Earnings Slump And Junk Spreads Blow Out

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

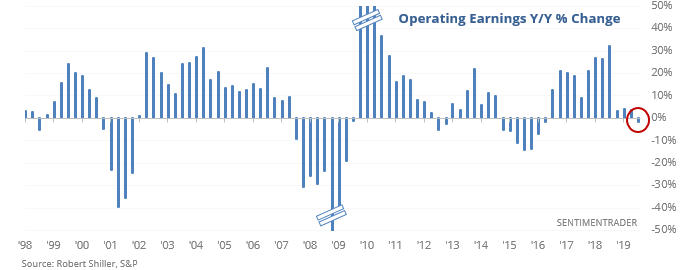

Earnings slump

Standard & Poor’s is estimating that operating earnings among the 505 companies in the S&P 500 index will decline from where they were a year ago, the worst result in several years.

Stocks have seemingly not priced in that possibility. When we filter the signals for those quarters when the S&P was within 5% of a new high (using quarterly closes), then returns suffered quite a bit, with an especially ugly risk/reward profile over the next year.

It didn’t lead to anything nasty in 2012, and even 2014 wasn’t that bad, so that dents the bearish argument somewhat.

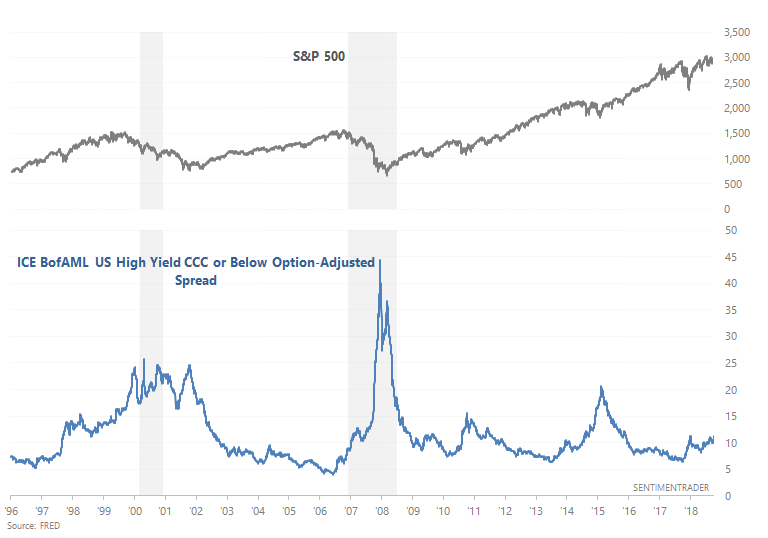

High yield spreads

High yield spreads are rising, and recently made a new high relative to its high in December/January:

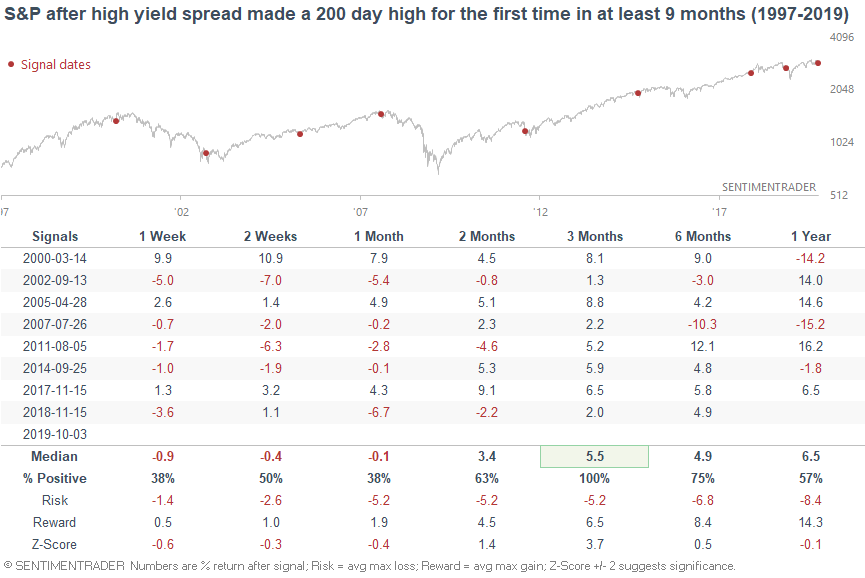

When the high yield spread broke out to a 200 day high in the past, the S&P's returns over the next year were random. This preceded the 2000 and 2007 bull market tops, and gave advance warning of the 2018 and 2015 selloffs.

When the high yield spread broke out to a 200 day high in the past, the S&P's returns over the next year were random. This preceded the 2000 and 2007 bull market tops, and gave advance warning of the 2018 and 2015 selloffs.