Dumb money's comeback

Depending on which group you ask and what you ask, sentiment is all over the place. However, there are some common themes across the board.

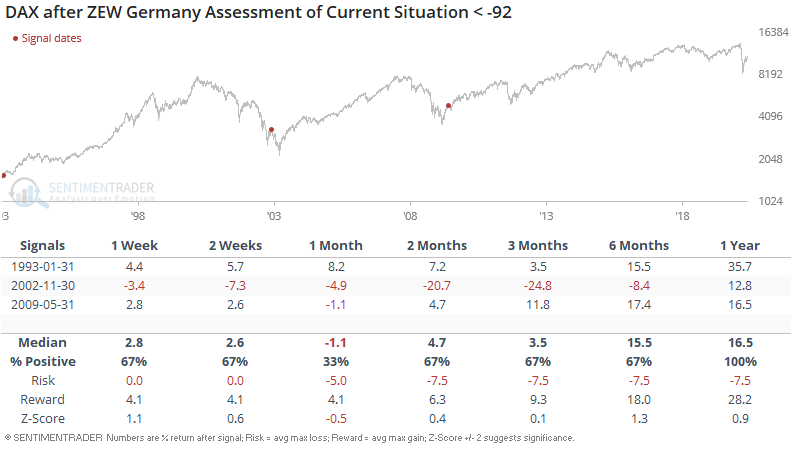

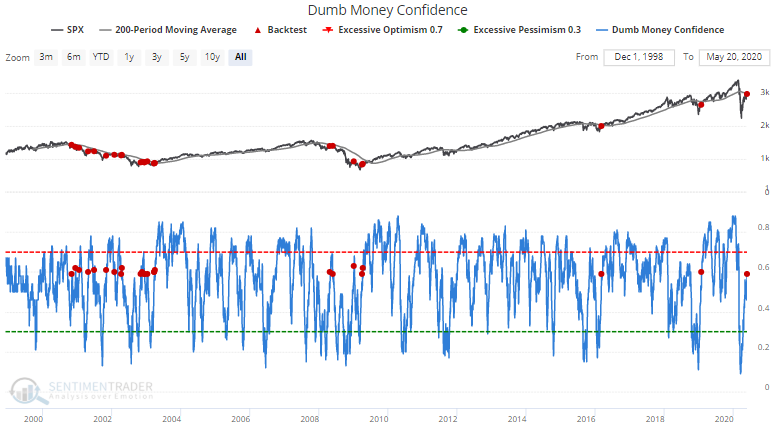

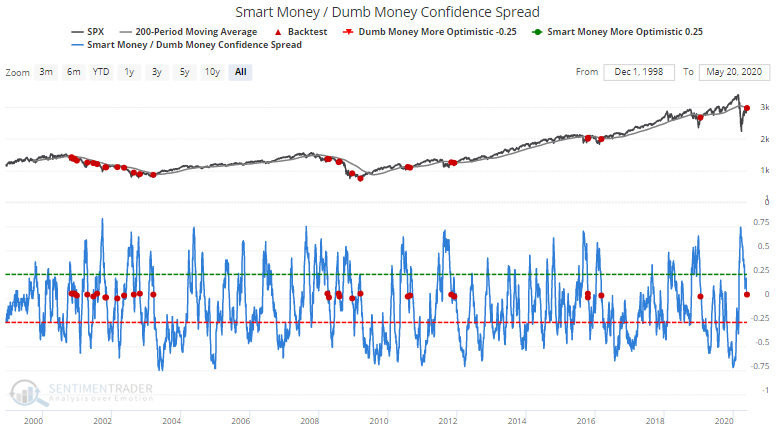

Short and medium term sentiment is getting more and more optimistic, particularly in the tech and healthcare sectors. Our Dumb Money Confidence Spread is now at 0.59. While this is nowhere near as extreme in January/February, this is typically where a lot of bear market rallies stall.

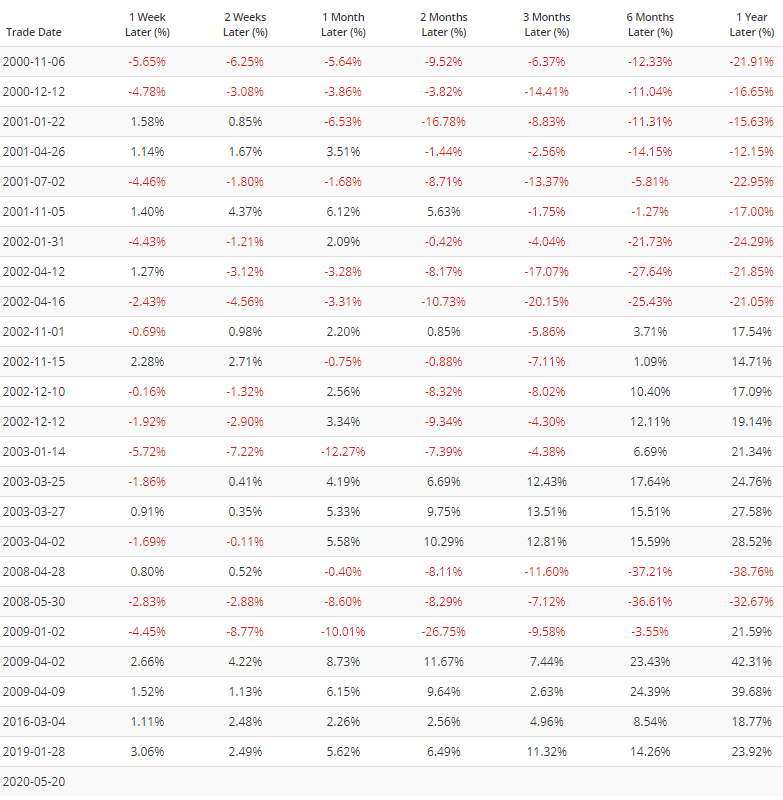

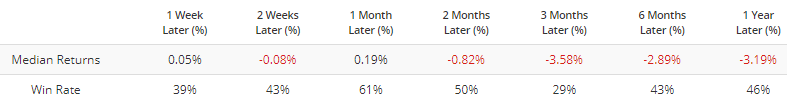

When sentiment reached this level while the S&P was under its 200 dma, the S&P 500's returns over the next 2-3 months were quite poor. This was a consistently bearish sign for stocks pre-2009, although post-2009 it often led to more gains before stocks could pullback:

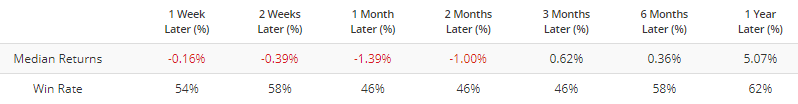

In a similar vein, the Smart Money / Dumb Money Confidence Spread is now at a level where during a downtrend (S&P under 200 dma), the S&P's returns over the next 3 months were bearish:

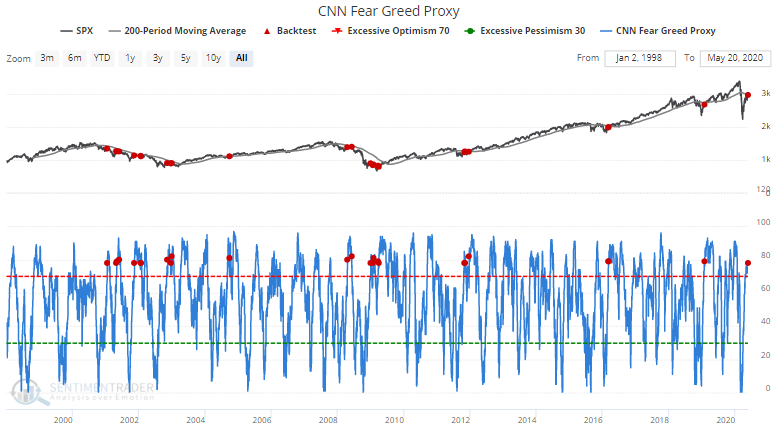

Using a different calculation, our CNN Fear Greed indicator is also unfavorable for stocks going forward. When CNN Fear Greed reached 78 while the S&P was under its 200 dma, the S&P's returns over the next 2 months were worse than average:

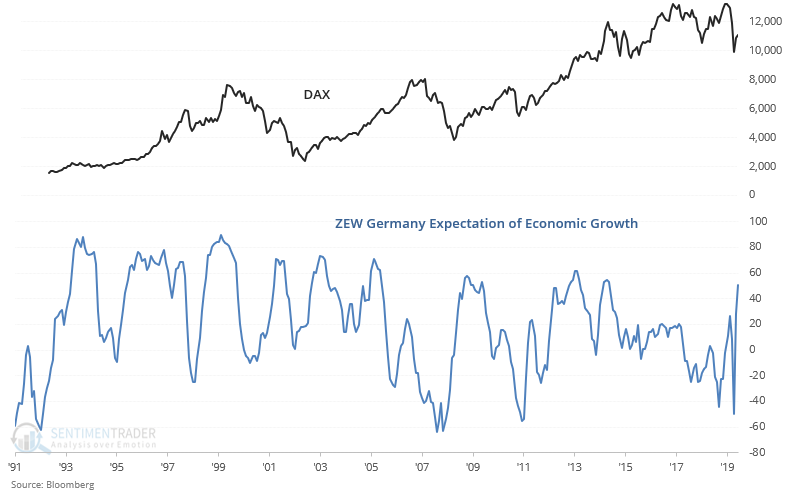

Long term sentiment is showing what you would expect: the economy right now is extremely weak, but the global economy is expected to rebound as lockdowns ease/end.

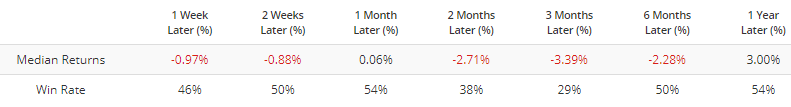

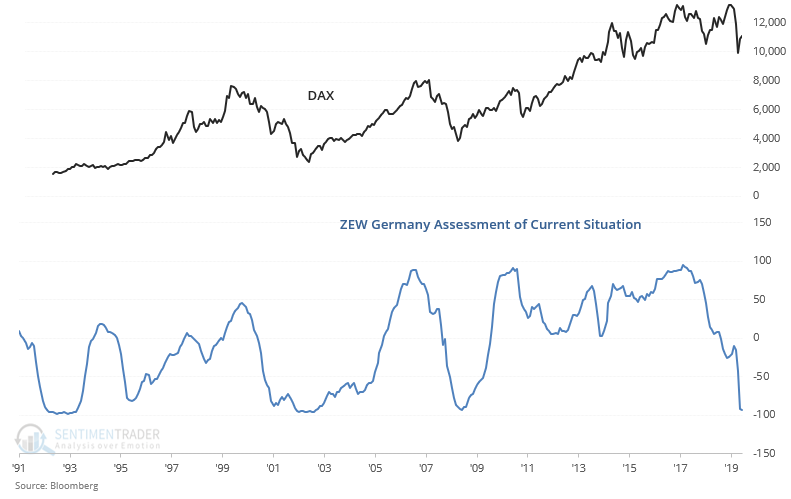

For example, the ZEW Germany Assessment of Current Situation is extremely negative...

While expectations for economic growth jumped...

Such extreme pessimism regarding the current situation led to gains for German equities over the next year: