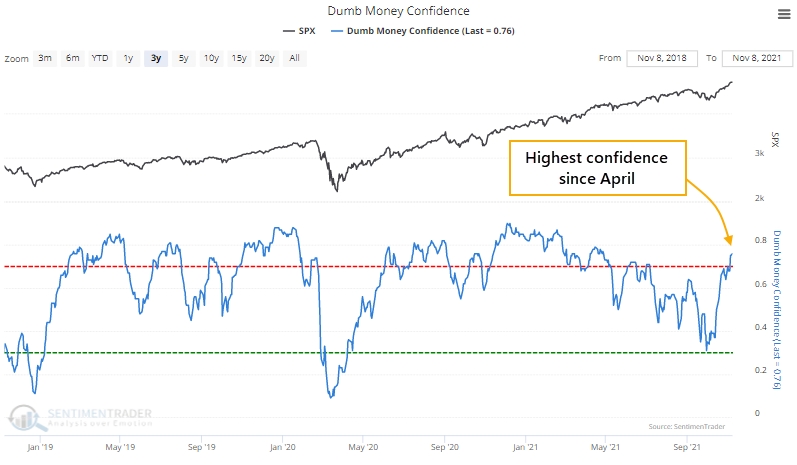

Dumb Money Confidence has made a furious comeback

The dumb money is confident again.

After a streak of optimism, Dumb Money Confidence turned pessimistic at the end of September. The ends of other long streaks of optimism led to higher prices, as buyers finally saw a good chance to step in.

The lack of optimism didn't last long, and now it's back to an extreme. On the lower end of that threshold, but still.

We update several other models of sentiment based on public information released by other sources. And each of them is showing similarly high levels of optimism among those who tend to be wrong at extremes.

- The Fear & Greed Model, based on similar inputs and methodology to the one published by CNN, has also made a furious comeback and is now pushing well into Greed.

- The Panic/Euphoria Model, constructed using a methodology described by Citigroup in public posts, has rebounded and is once again above its Euphoria threshold.

- And the Bear Market Probability Model, described in interviews by Goldman Sachs, has soared to one of the highest levels in 50 years.

If we combine all four models into one, we can see how a broad cross-section of sentiment-related measures compares versus other periods. And there are almost no precedents.

This composite model never got above 90% since we have data starting in 1998...until this year.

What else we're looking at

- What a composite sentiment model suggests about future returns in the S&P 500

- The percentage of Nasdaq 100 stocks in a correction has plunged

- Why transportation stocks may continue to move over the next 9 months

| Stat box The TLT 7-10 year Treasury bond fund pulled in more than $900 million in assets on Wednesday, the 5th-highest inflow in the fund's history. |

Etcetera

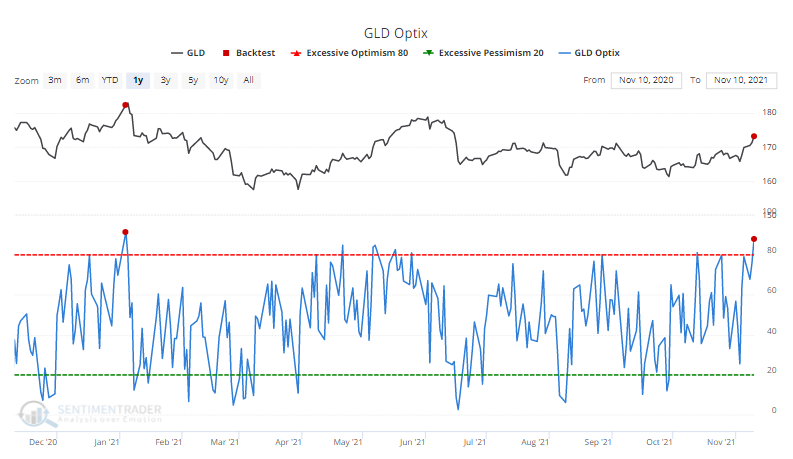

Yellow metal is white hot. The Optimism Index (Optix) for the GLD gold fund soared to 88% as traders rushed in after a high CPI print. This is only the 2nd time it's been so high this year, the other marking gold's peak. Gold bugs need to hope this time is different.

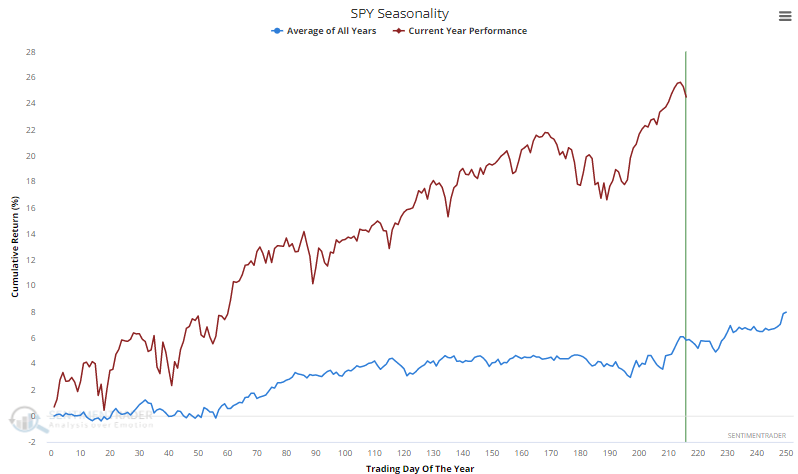

Seasonality spy. Taking a peek at seasonal gyrations in the most important ETF in the world, we can see that SPY has closely followed its typical yearly pattern (its path, not its magnitude). If it continues, then SPY might be in for a couple more weeks of choppiness.

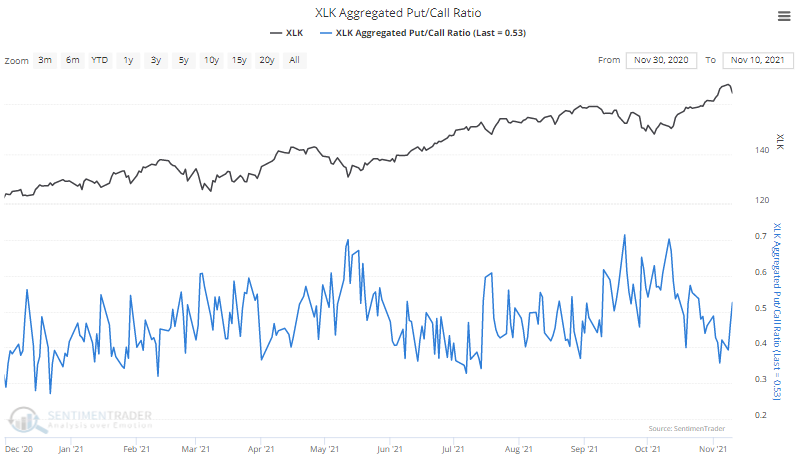

Not hedging their bets. Options traders on stocks included in the XLK Technology fund increased their put activity a bit. But activity in call options is still about twice as heavy as put options, among the lowest levels of the past year.