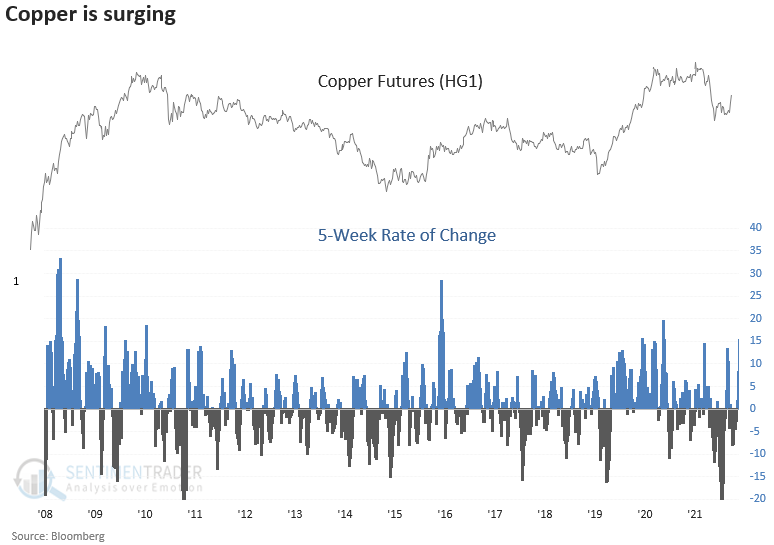

Dr. Copper is surging

Key points:

- Copper Futures rallied more than 14% over five weeks

- The surge occurred after the metal contracted by more than 20% over the last year

- After similar conditions, the industrial metal was higher 80% of the time a year later

- Stocks struggled over the next few months, and commodities showed impressive results

The Industrial metal with a Ph.D. in economics is surging

Copper has been one of the beneficiaries of the recent plunge in the Dollar Index. The metal with a Ph.D. in economics surged more than 14% over five weeks. The rally in copper occurred after the commodity fell more than 20% over 52 weeks.

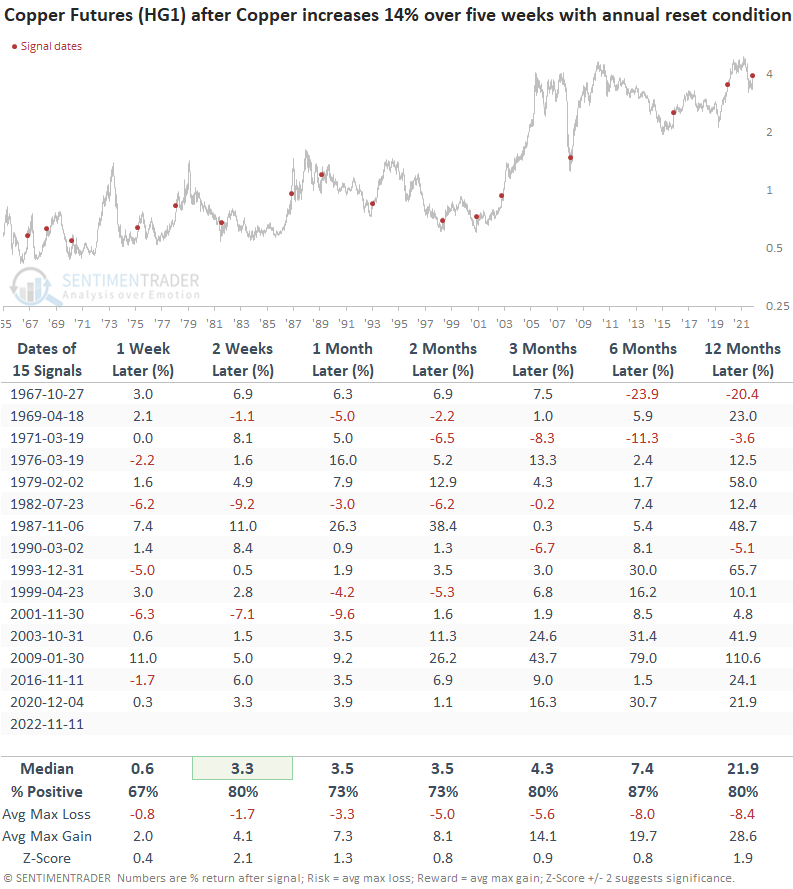

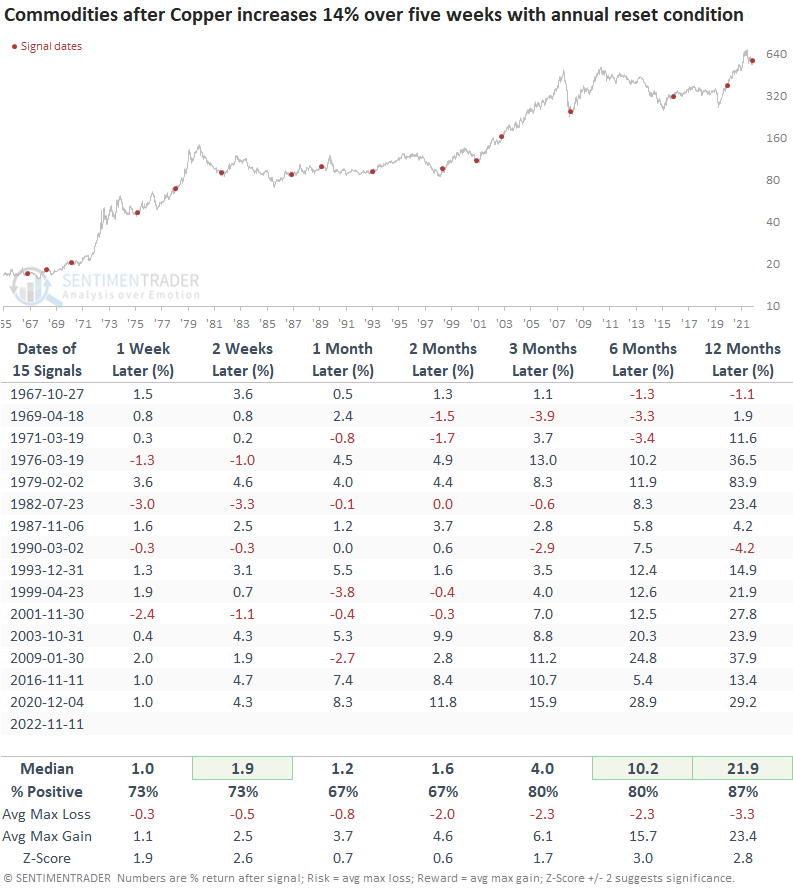

Similar surges in copper preceded positive returns for the industrial metal

The surge in Copper bodes well for the commodity across all time frames, especially 6 and 12 months later. The signal shows a positive return in every case at some point in the first six months.

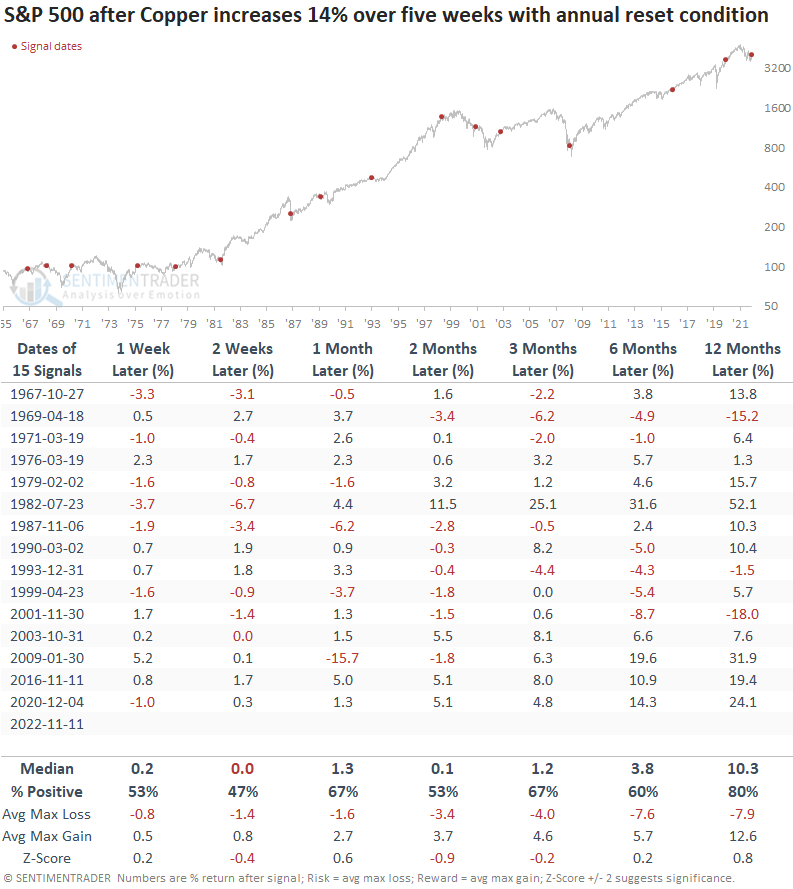

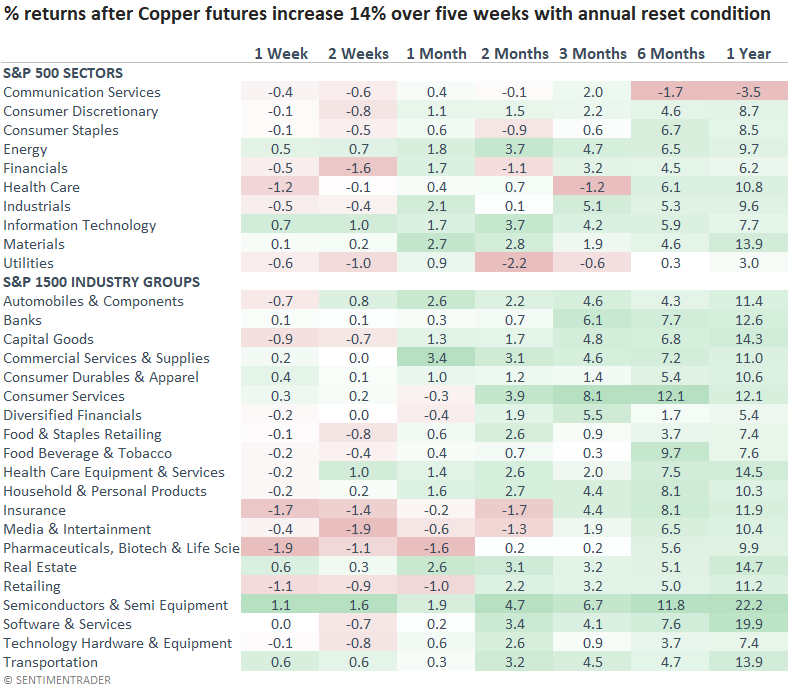

The surge in copper does not provide an all-clear sign for stocks

While results are constructive a year later, the S&P 500 tends to struggle over the next few months after a sharp rise in Copper. Interestingly, the signal rarely aligns with a bear market bottom. The 1982 signal is the only one that occurred near the tail end of a bear market accompanied by a recession.

Sector and industry performance confirms the lackluster outlook over the next few months, with a few exceptions. Similar to what we've seen in other recent studies, Energy and Materials look constructive.

Commodities tend to benefit after a surge in copper

What's good for Copper is good for a broad basket of commodities. The Bloomberg Spot Commodity Index shows solid results across all time frames, especially a year later.

What the research tells us...

The surge in Copper is a new and fascinating development. While it could be due to the recent plunge in the dollar or excitement about easing Covid restrictions in China, the historical market message for the industrial metal is clear. The outlook for Copper looks good. The newfound strength in Copper also bodes well for a broad basket of commodities. Unfortunately, the same can't be said for stocks, as they tend to struggle over the next few months.