Don't be worried about inflation until this happens

Inflation is very much on the minds of investors as government spending and debt, and deficits soar. Many are experiencing that gnawing feeling that they should "do something" to protect themselves.

But is now the right time? And what about the old saw that stocks are a good hedge against inflation?

This piece will detail one simple approach to keeping inflation from acting as a detriment to your stock market performance. To see the full post with more details and charts, click here.

HOW TO MEASURE INFLATION

The standard measure of inflation is the 12-month change in the Consumer Price Index (CPI). The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is used to assess price changes associated with the cost of living and one of the most frequently used statistics for identifying periods of inflation or deflation.

WHEN TO MEASURE INFLATION

For testing purposes, at the end of each month, we will look at the latest reported 12-month rate of change in the Consumer Price Index.

HOW TO EVALUATE INFLATION

In generic terms, like Goldilocks, we want our inflation not too hot and not too cold.

- Too hot inflation is bad because it throws cost estimates out the window and can cause massive economic disruption - something the market rarely takes kindly to.

- Too cold inflation (or deflation, a trend of falling prices) can cause a downward economic spiral that is ugly for everyone.

The question then is...what is the right rate of inflation?

There is, of course, no such thing, partly because there are many other factors that affect the stock market beyond just inflation. Still, as far as deeming inflation "too high, too low or just right," we will use a straightforward method that can be referred to as "The 4% Inflation Solution."

THE 4% INFLATION SOLUTION

We will evaluate how the stock market has performed when inflation is:

- Greater than or equal to +4%

- Less than or equal to -4% (i.e., significant deflation)

- Greater than -4% but less than +4%

For our test, we will use monthly data from February 1914 through February 28 to determine the latest 12-month rate of change in the Consumer Price Index and the monthly closing price for the Dow Jones Industrial Average.

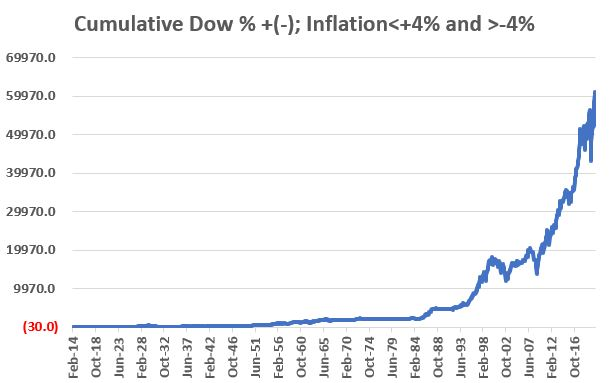

The chart below displays the cumulative price performance for the Dow during those times when inflation is in the "Not too hot, not too cold" range of above -4% but below +4%.

To see the full post with more details and charts, click here.

As you can see in the chart above, just because inflation is not running too hot or too cold does not mean that you can't have bear markets. Inflation is only one factor that can impact the stock market.

To see the full post with more details and charts, click here.

| Stat Box On an average day over the past month, 16% of Consumer Discretionary stocks have traded at a 52-week high. This is the 2nd-largest amount in the past 5 years, exceeded only by a few days in January 2018. |

What else we're looking at

- Returns in the Dow when inflation is in various modes

- What consumer confidence looks like now

- There is an extreme number of consumers that are very confident in stocks

- What the dollar looks like in May (the euro, too)

- Energy stocks just triggered a rare breadth signal