Dollar Positions Hit Highs As Investors Leave Equity Funds

This is an abridged version of our Daily Report.

Non-dollar pain hits year high

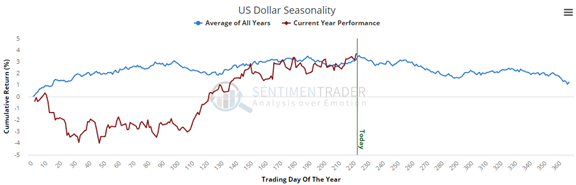

A measure of positioning in the dollar has reached an extreme level amid its highest level in a year just as it nears its seasonal peak.

Forward returns in the buck were weak, especially in the next 3-6 months, while better in gold and emerging markets.

Equities lose more assets

Investors pulled an average of $4 billion per week from equity funds since June. That’s on par with other extreme outflows over a 10-week period, leading to gains for stocks every time over the next 2-3 months.

A little fear

Volume in inverse ETFs spiked on Friday as traders rushed to protect their downside or bet on some follow through next week. There have been 62 days when it reached Friday’s level according to the Backtest Engine, leading to a rebound in the S&P over the next week 71% of the time.

The latest Commitments of Traders report was released, covering positions through Tuesday

“Smart money” hedgers continue to be net long more than 20% of the open interest in 10-year Treasuries. The only two other times that happened, April 2010 and January 2017, led to rallies in TLT over the next six months.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |