Dollar is falling in a risk-on environment

The global stock market rally has shrugged off economic and geopolitical fears. Stock trading is all the rage among young adults right now, many of whom no doubt were hooked on trading while staying at home during the lockdown (if you believe the anecdotes on Twitter). As a result, risk-assets are being bid up and the USD is losing its safe haven appeal. The past 11 days have seen the S&P rally more than 8% while the USD Index fell more than 3%:

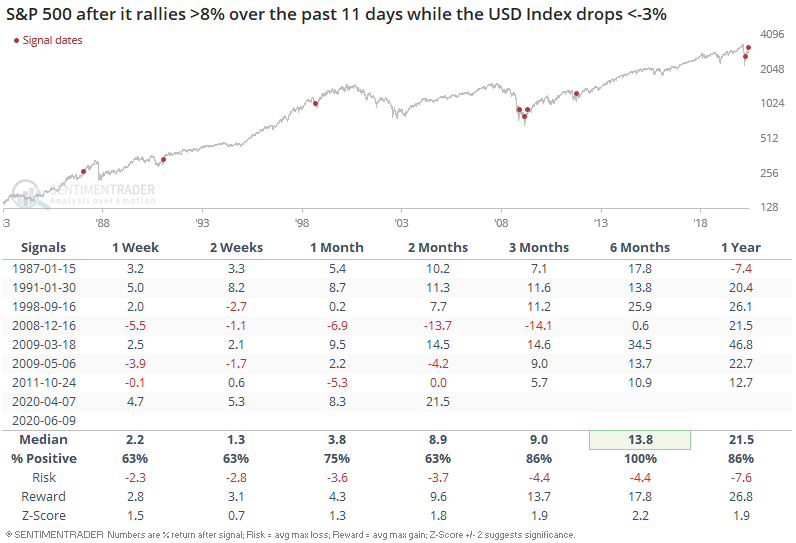

When this happened in the past, it often marked the recover stage after a major market crash (see 2011, 2009, 1998 etc). As a result, the S&P could pullback in the short term, but usually pushed higher over the next 6-12 months:

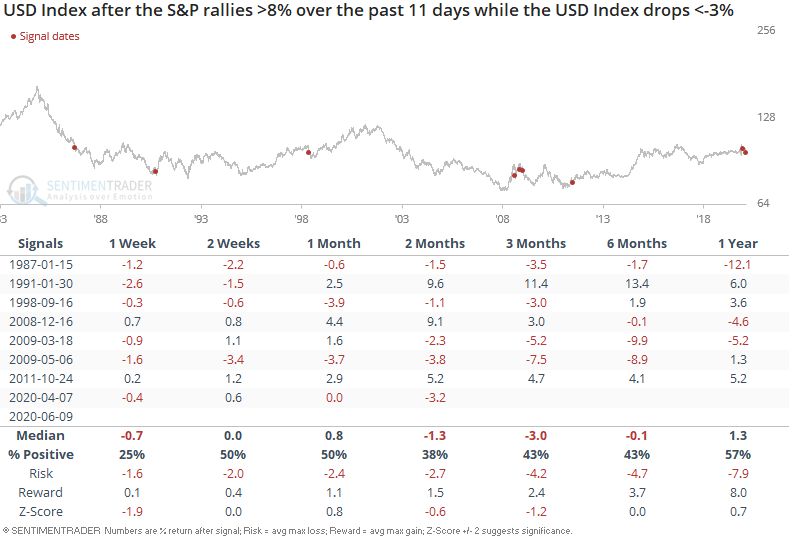

As for the USD Index, this wasn't a good sign in the coming weeks and months. Regardless of whether the next big move was up or down, the USD Index usually fell in the short/medium term:

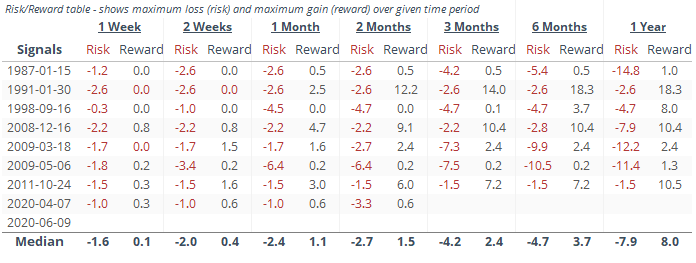

Here's the accompanying risk:reward table:

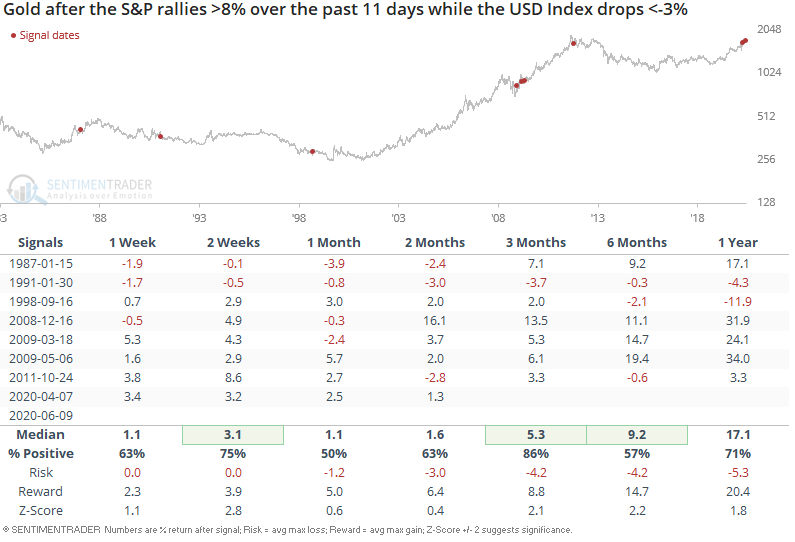

Since gold and the USD Index tend to have an inverse correlation, this has usually been a good sign for gold:

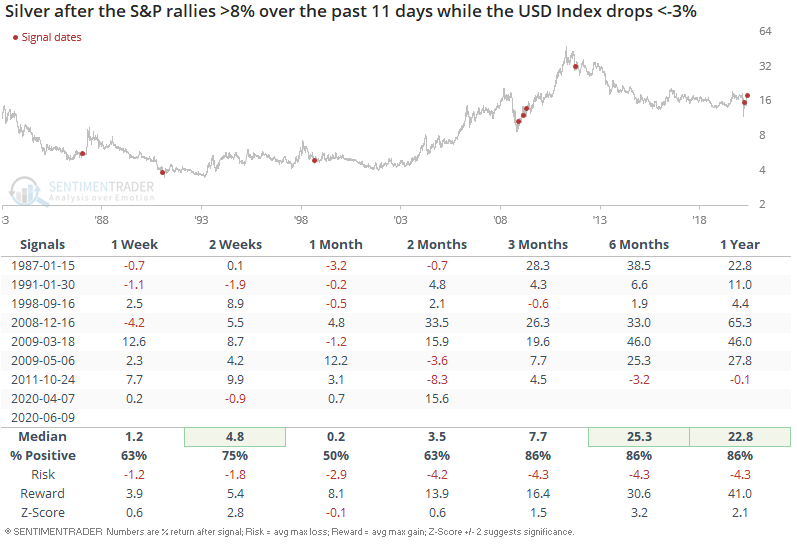

And has been a bullish factor for silver: