Dollar Index (DXY) Surge on Fed Decision Day - Part 2

In an intraday update on Thursday, I shared a study to assess the Dollar Index (DXY) outlook when it surged by 90 bps or more on an FOMC decision day. The results returned a minimal sample size, so I relaxed the 1-day rate of change level from 90 to 50 bps to capture more instances.

Let's continue with the same study and assess the potential outlook for stocks, commodities, and bonds when the DXY surges by 50 bps or more on an FOMC decision day.

While one day does not make a trend, the potential implications of a continuation from the FOMC decision day surge could be meaningful, as the data will show.

HOW THE SIGNALS PERFORMED

The results suggest that the Dollar Index (DXY) could be on the cusp of a potential trend change.

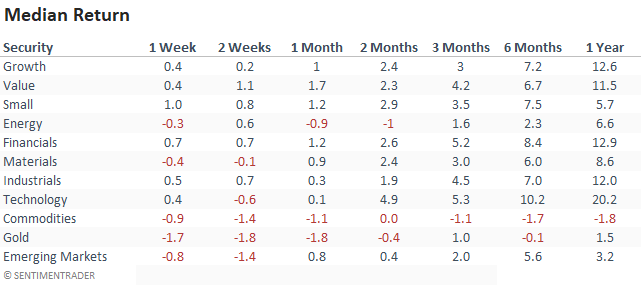

HOW THE SIGNALS PERFORMED - GROWTH

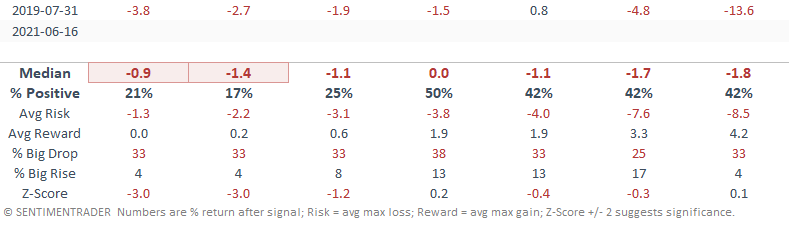

Growth stocks look slightly weak in the short term, with results that get a little better in the 3-12 month timeframe.

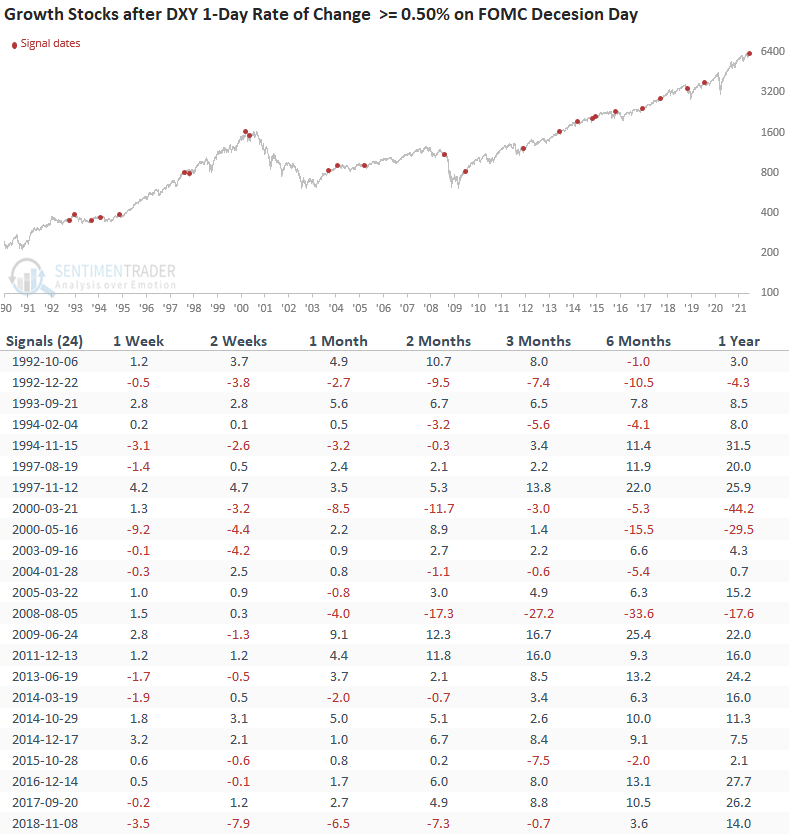

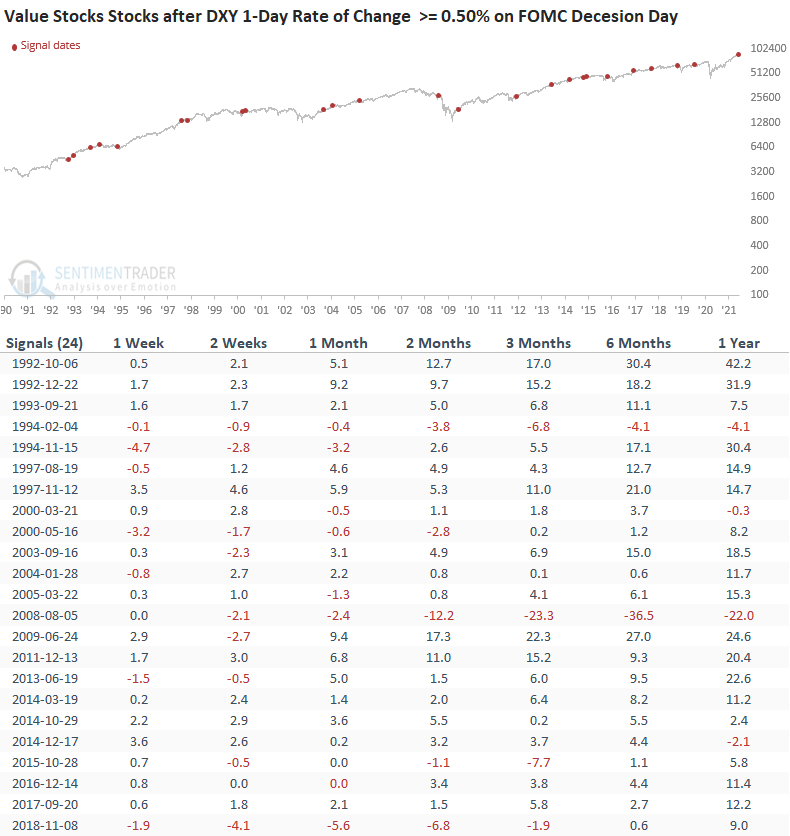

HOW THE SIGNALS PERFORMED - VALUE

Value stocks look solid across all timeframes. I would also note the consistency in the 6-month forward returns.

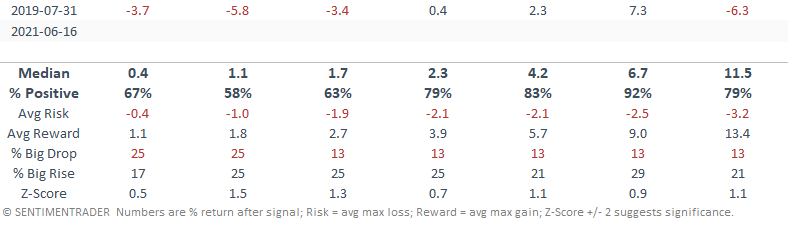

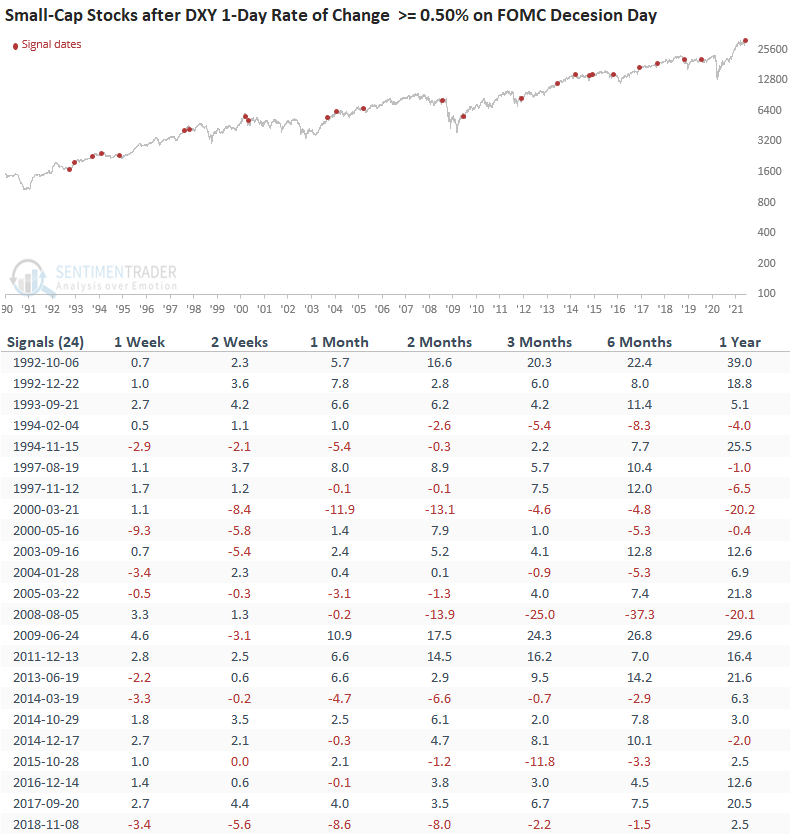

HOW THE SIGNALS PERFORMED - SMALL-CAP

Small-cap stocks are somewhat of a mixed bag. I don't see anything that stands out.

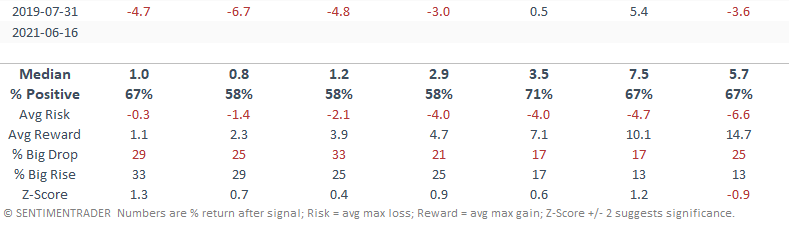

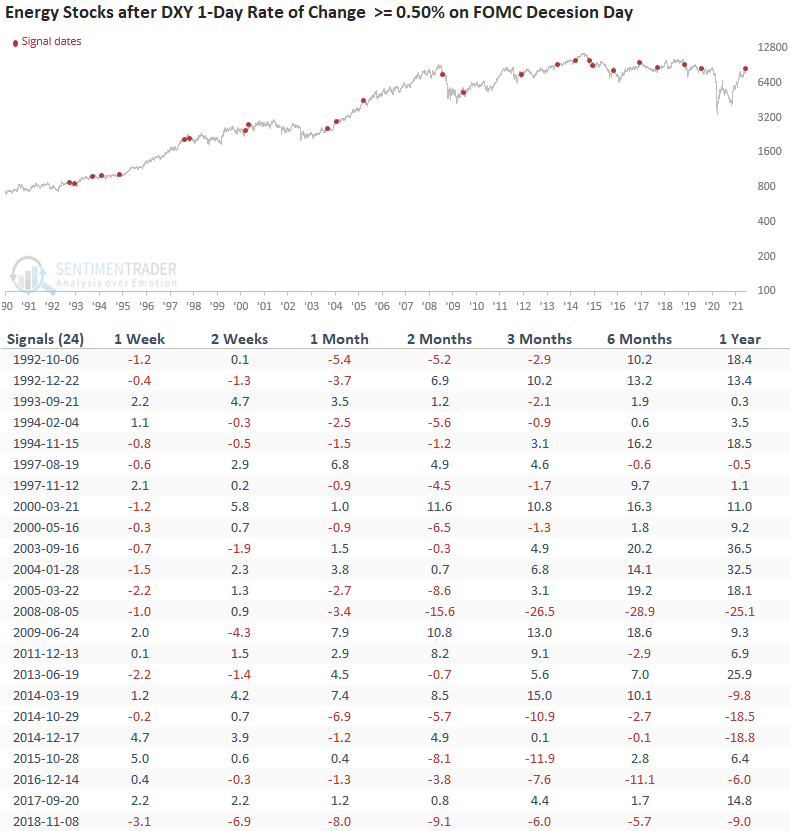

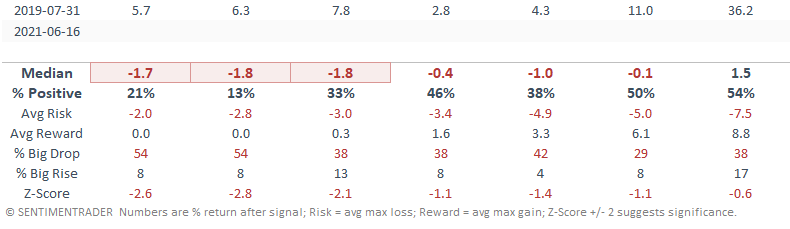

HOW THE SIGNALS PERFORMED - ENERGY

Energy is consistently weak across all timeframes. If the dollar is transitioning to a bullish trend, energy stocks could struggle.

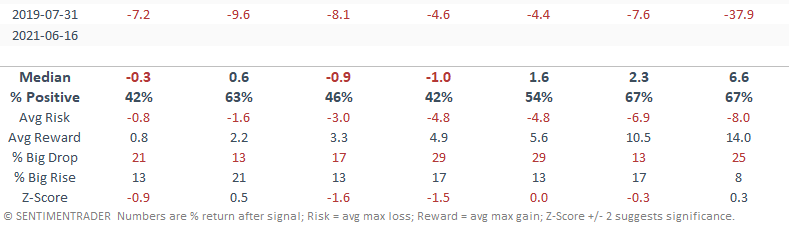

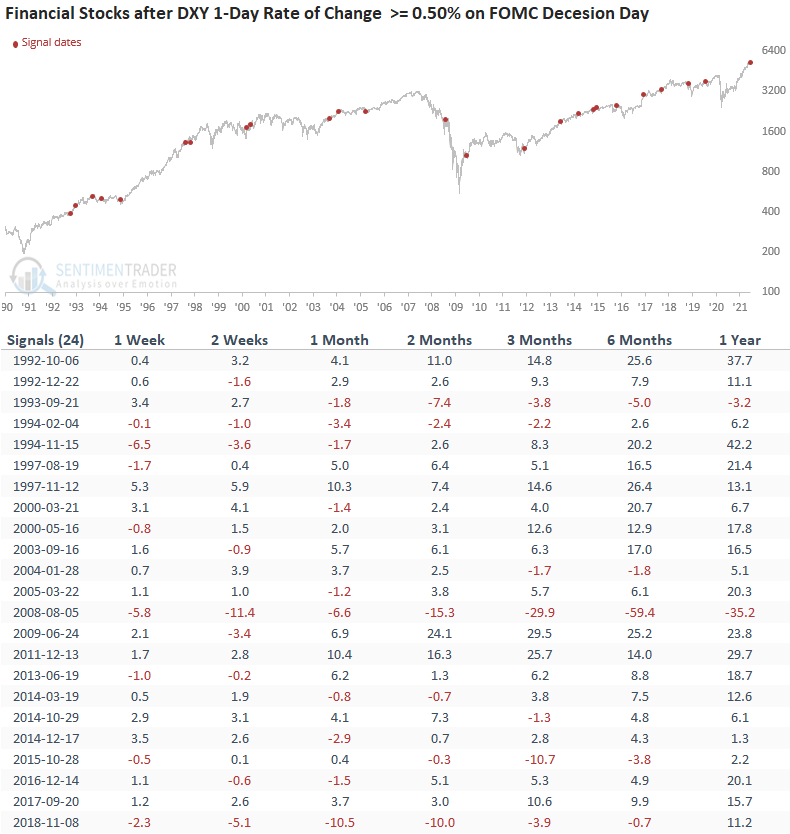

HOW THE SIGNALS PERFORMED - Financials

Financials look pretty good, especially in the 3-12 month timeframes.

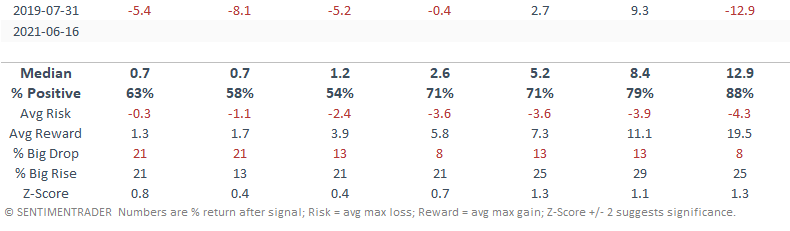

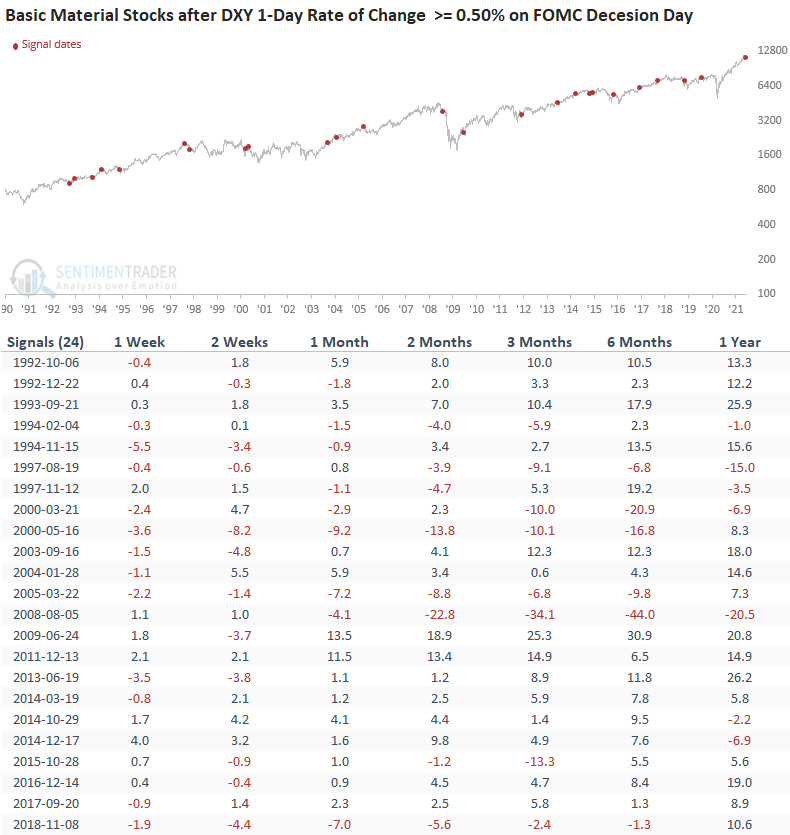

HOW THE SIGNALS PERFORMED - BASIC MATERIALS

Materials look slightly weak in the short term, with results that get a little better in the 2-12 month timeframe.

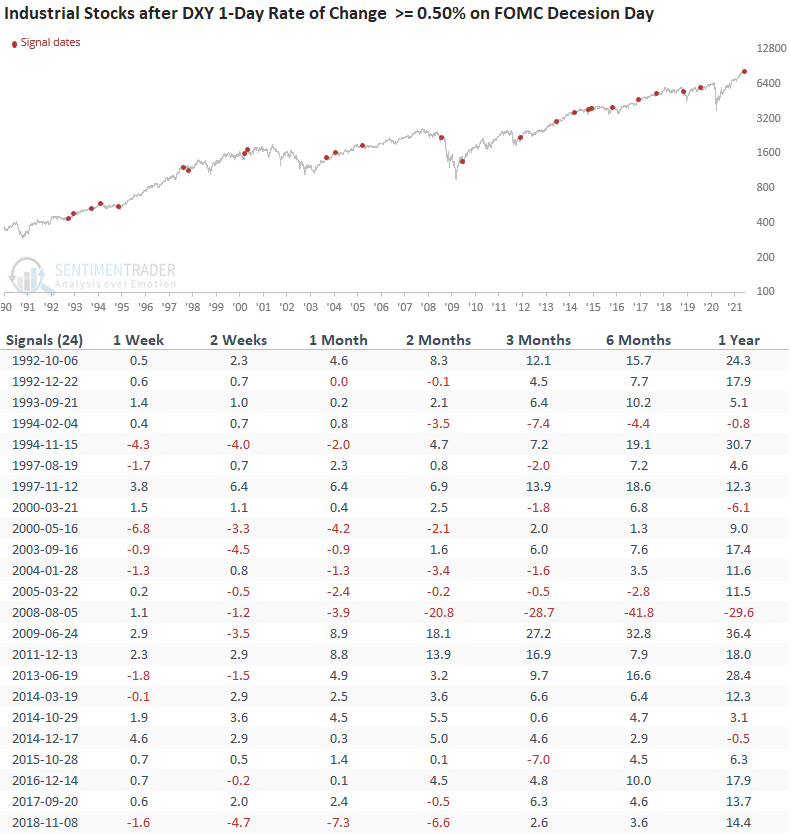

HOW THE SIGNALS PERFORMED - Industrial

Industrials look slightly better to inline in the short term with much better results in the 3-12 timeframe.

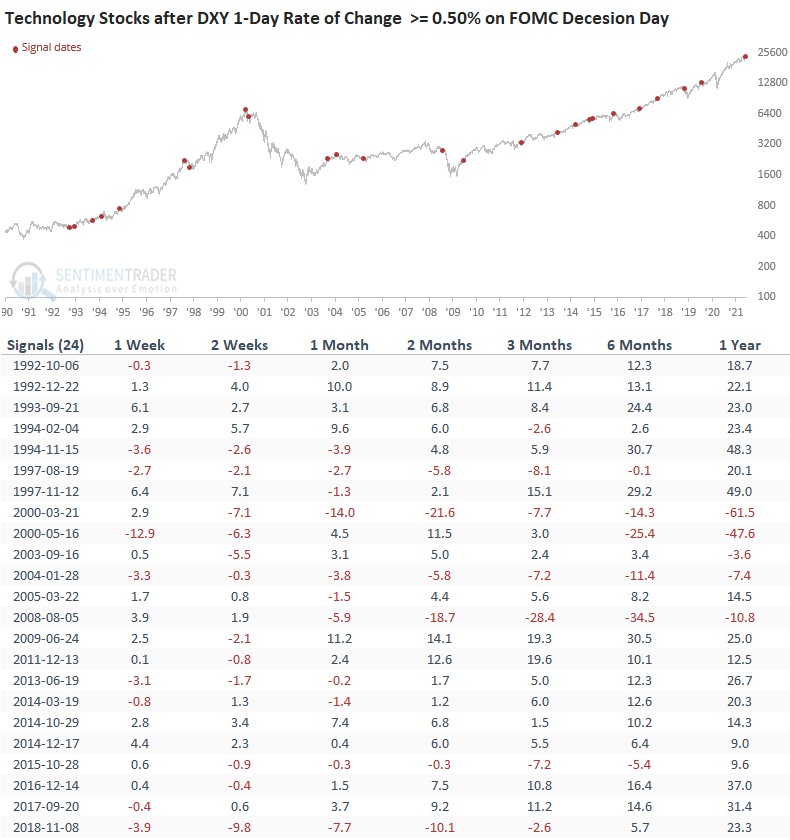

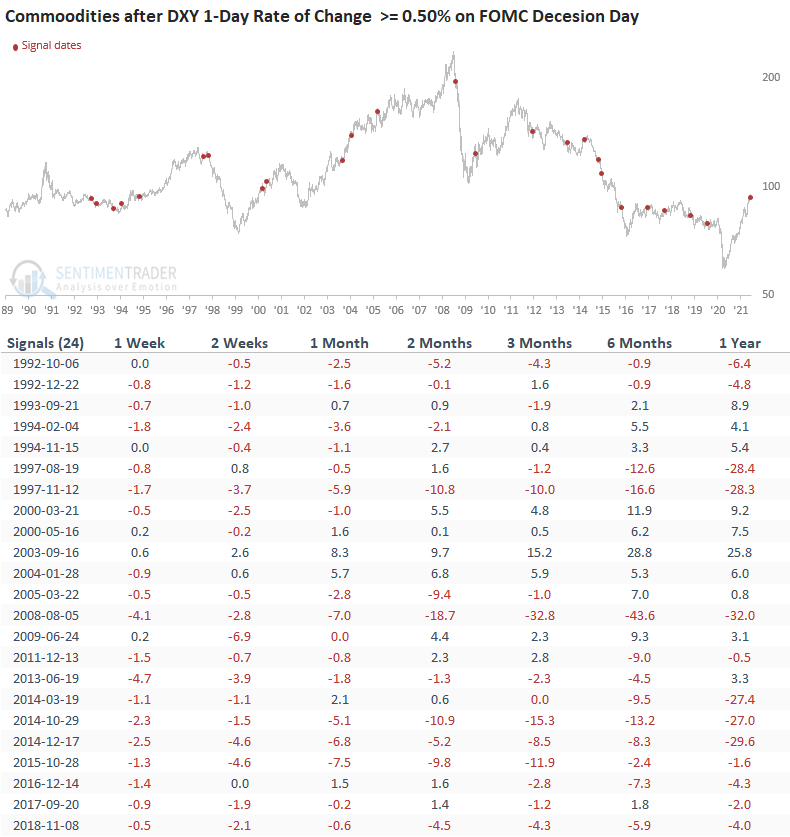

HOW THE SIGNALS PERFORMED - Technology

Technology looks weak in the short term, with much better results in the 2-12 timeframe.

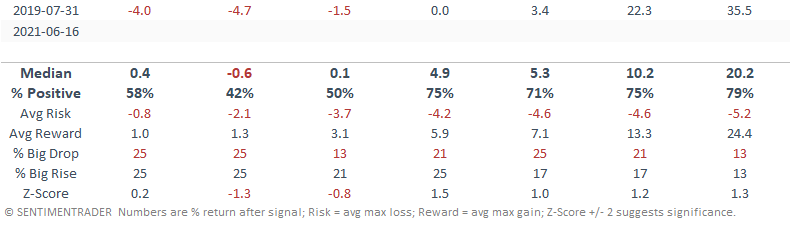

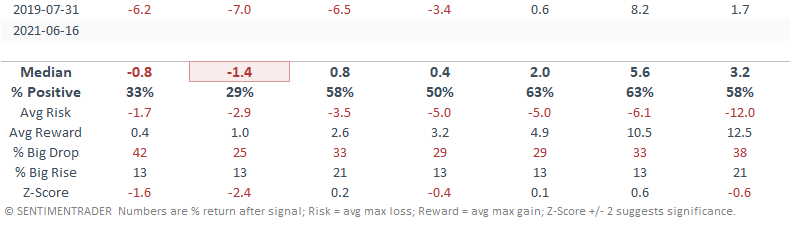

HOW THE SIGNALS PERFORMED - COMMODITIES

Commodities look weak across all timeframes as a strong dollar is unfriendly to the asset class.

HOW THE SIGNALS PERFORMED - GOLD

As expected, Gold's results are abysmal.

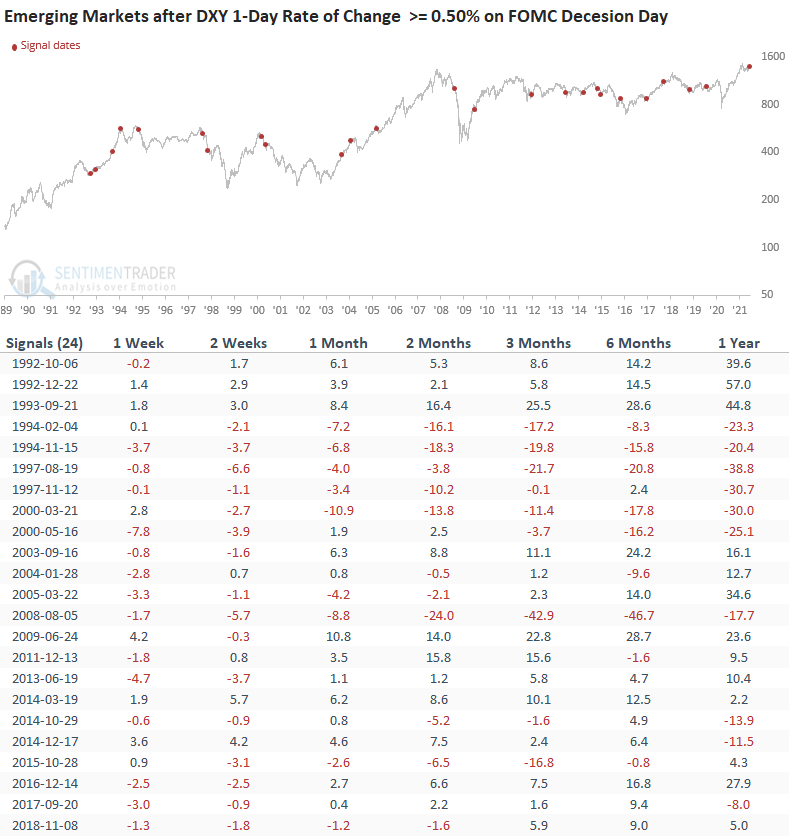

HOW THE SIGNALS PERFORMED - EMERGING MARKETS

Emerging markets look weak across all timeframes, especially in the short term. A strong dollar is a problem for EM.

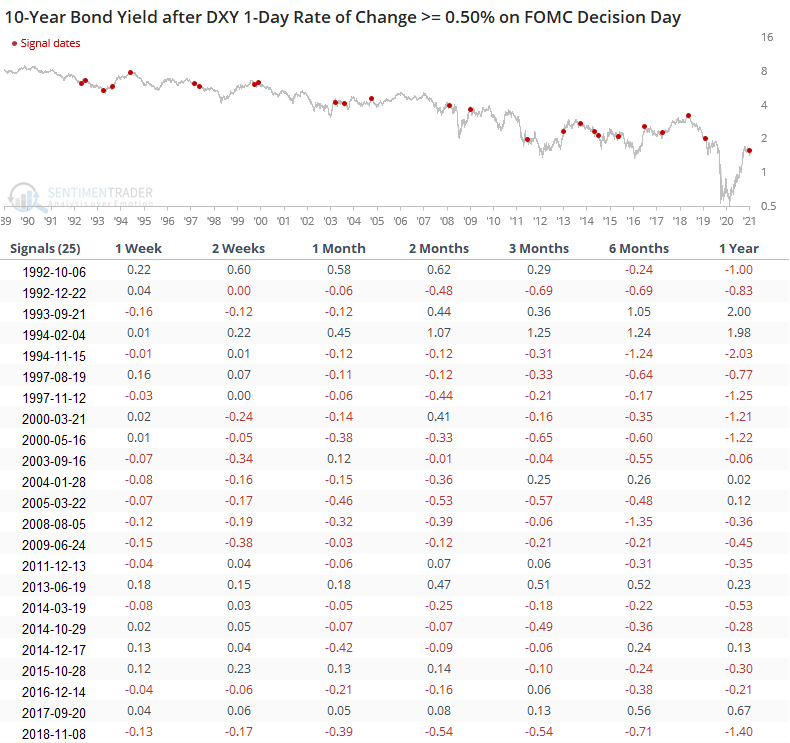

HOW THE SIGNALS PERFORMED - 10-YEAR BOND YIELD

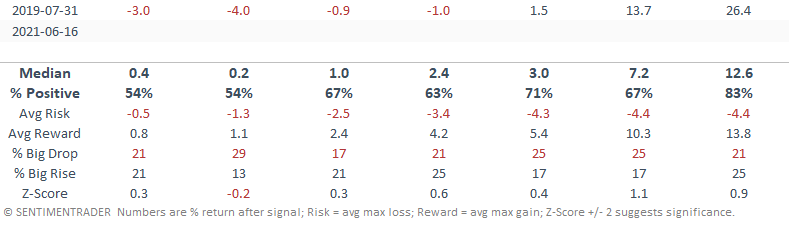

PERFORMANCE SUMMARY

The 1-4 week results suggest that the market could struggle a little in the short term as investors grapple with the potential of a stronger dollar. I would keep an eye on the DXY and the critical resistance area just above $93. A break above that level would suggest that a new uptrend is unfolding.