Dollar Index Breakout

The trend following system that I use for the Dollar Index (DXY) is a straightforward one. It's the price channel breakout system created by Richard Donchian, the father of trend following. The original concept became the foundation on which later trend followers like Richard Dennis and the turtles used to capture significant price trends.

How did I determine the best price channel breakout duration for the Dollar Index? I conducted an optimization process to identify the optimal number of bars with a range between 100 and 200 days. The optimization returned 133 days as the ideal price channel duration. So, when the closing price of the Dollar Index increases above the highest close in the previous 133 days, the system buys the Dollar Index. Conversely, when the Dollar Index falls below the lowest close in the last 133 days, the system sells or shorts the Dollar Index.

A new uptrend was established on 8/19/21 when the Dollar Index closed above the 133-day price channel high.

Let's assess the forward return outlook for the Dollar Index, commodities, and stocks.

CURRENT DAY CHART

HOW THE SIGNALS PERFORMED

Results look solid across all timeframes with several notable z-scores.

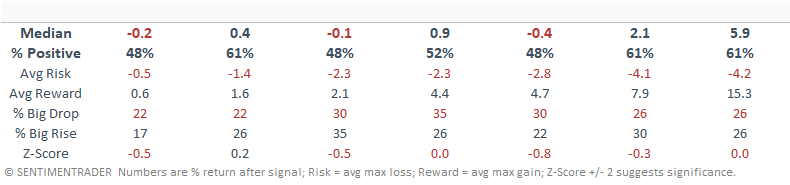

HOW THE SIGNALS PERFORMED

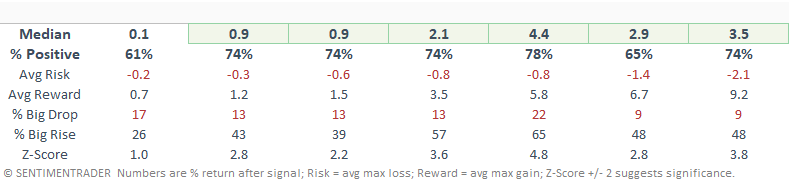

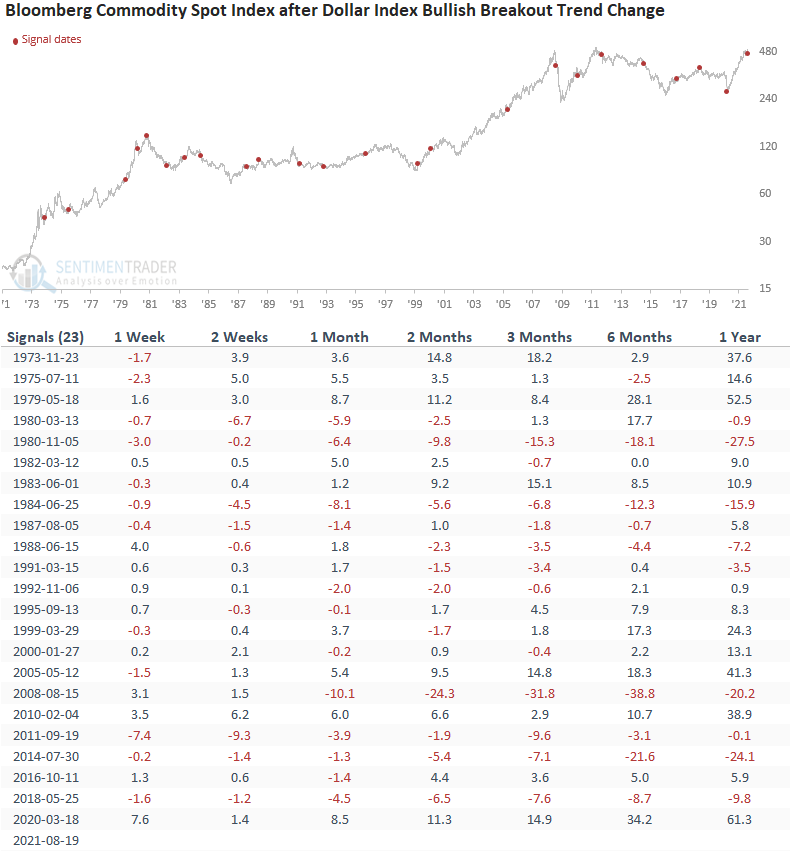

Commodity returns look anemic. When the dollar strengthens, commodities generally struggle.

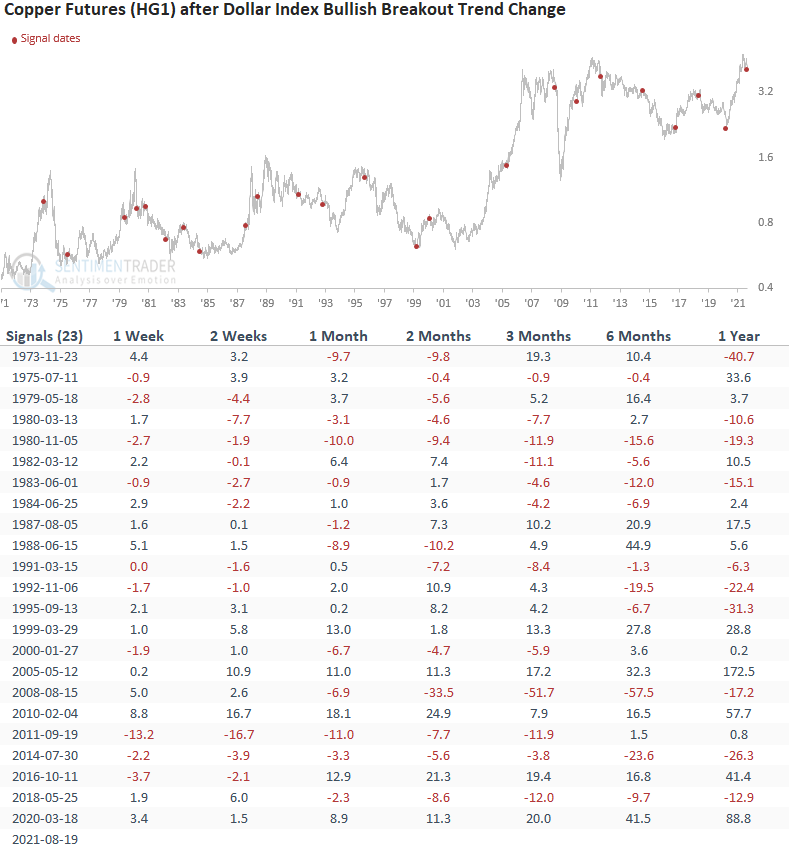

HOW THE SIGNALS PERFORMED

Copper returns look flat to weak with a few exceptions like the 2005 signal.

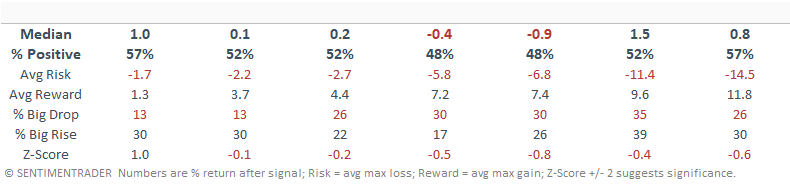

HOW THE SIGNALS PERFORMED

Gold returns look weak across the board.

HOW THE SIGNALS PERFORMED

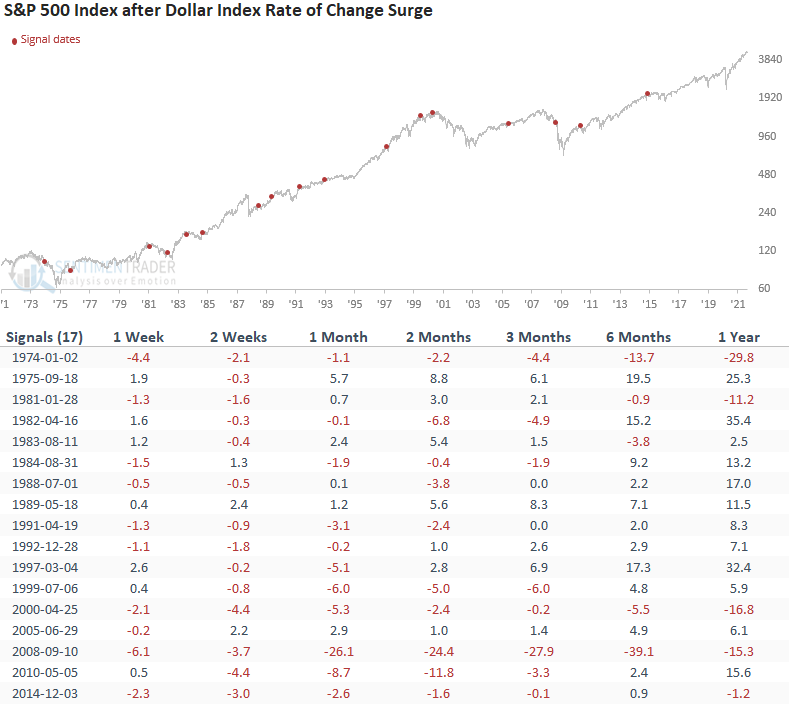

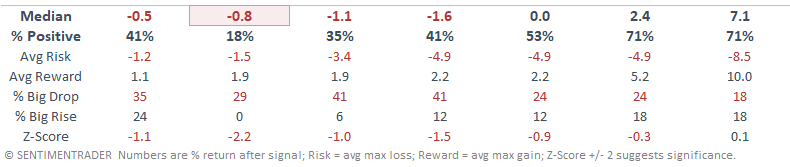

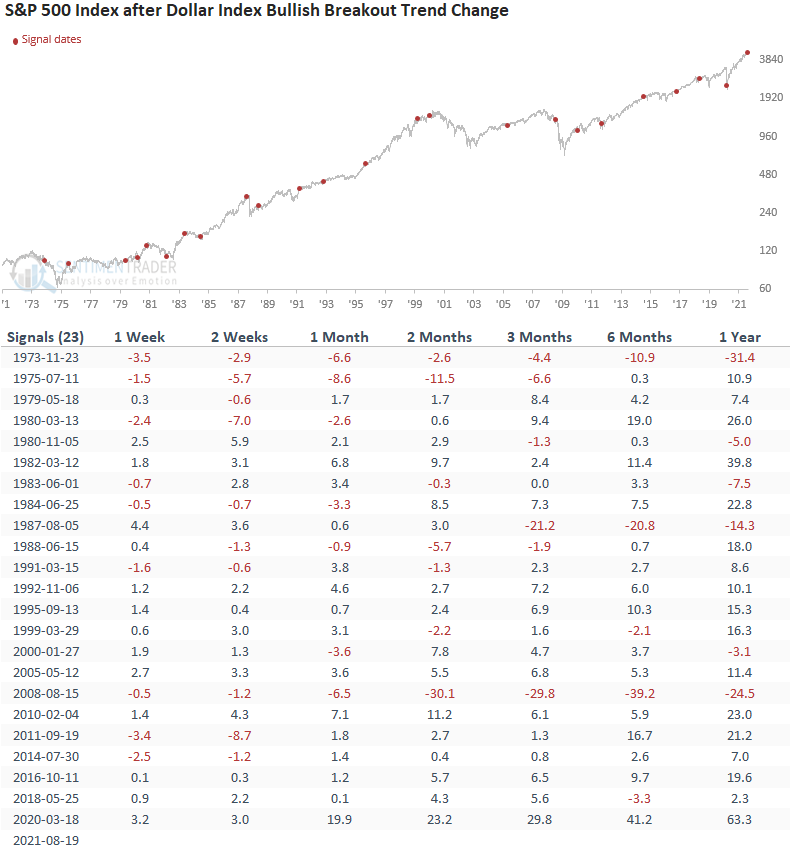

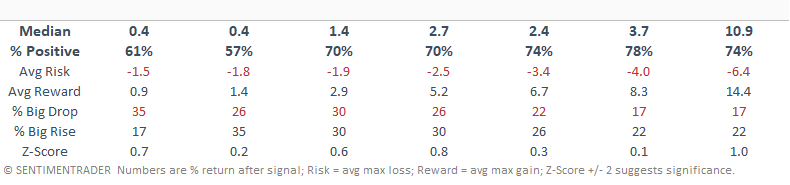

The S&P 500 returns look fine. Typically, when the dollar rallies, the economy is strong, and that benefits corporate earnings.

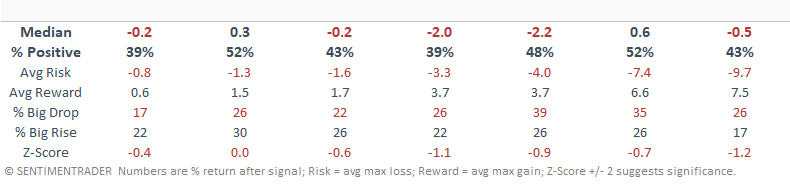

HOW THE SIGNALS PERFORMED

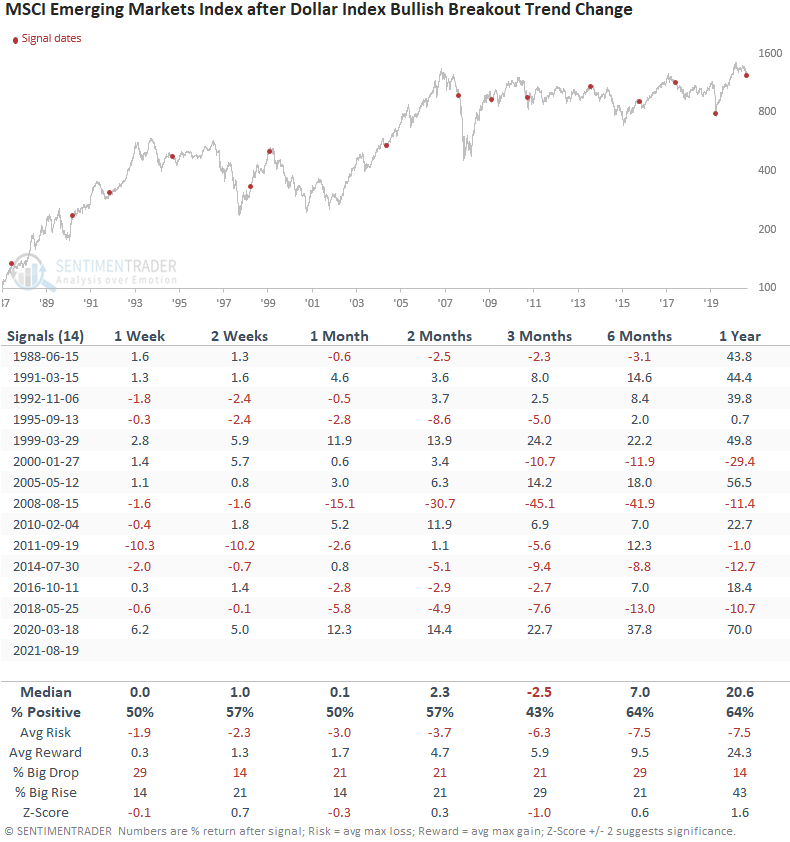

Emerging market returns are anemic, except for the 1-year window.

HOW THE SIGNALS PERFORMED - TOTAL RETURN

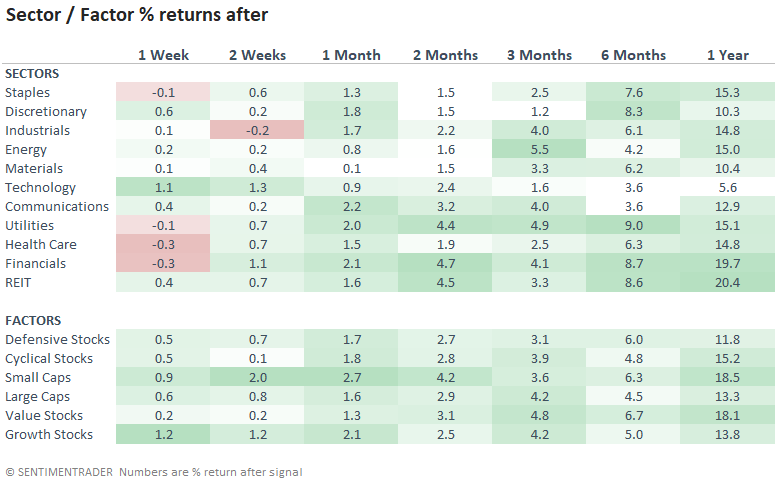

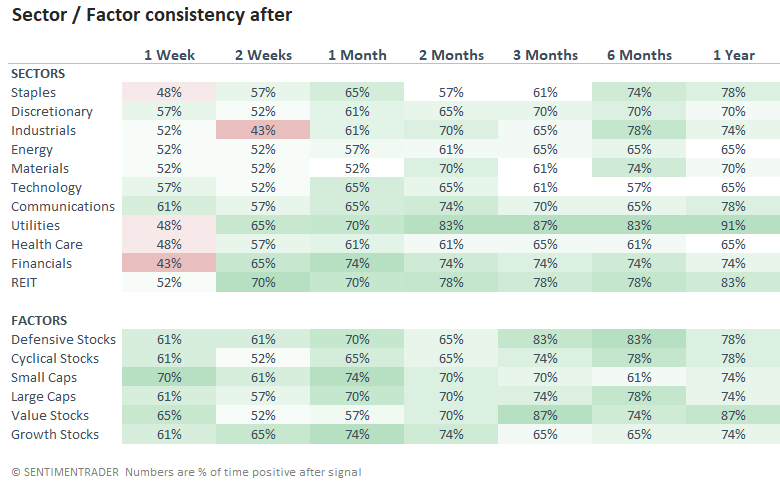

The returns in the first couple of weeks for sectors and factors are slightly weak to inline. I suspect the market is adjusting to the new dollar trend. The intermediate to long-term results look okay.

The consistency trends look somewhat similar to the returns grid. Sectors ad factors can struggle in the short term. I would note the energy looks weak on a comparable basis.

While stocks can struggle in the short term, a positive trend change is not a game-changer. However, now that the dollar index is rising, we need to monitor the rate of change. Historically, a 126-day rate of change surge in the Dollar Index above 10.5% creates a problem for stocks, but even more so for commodities.

HOW THE SIGNAL PERFORMED