Dollar Ignores Rates As S&P Shows Exhaustion

This is an abridged version of our Daily Report.

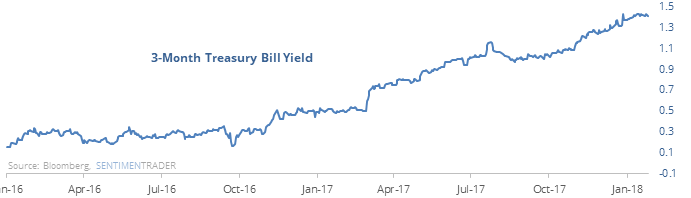

Ignoring the rise in rates

Despite a steady rise in interest rates, the U.S. dollar has declined more than 10% over the past year.

That’s unusual, especially given the magnitude of the fall in the dollar and the rise in rates. The other times it happened, the dollar continued to decline, stocks did okay, while gold and commodities did best.

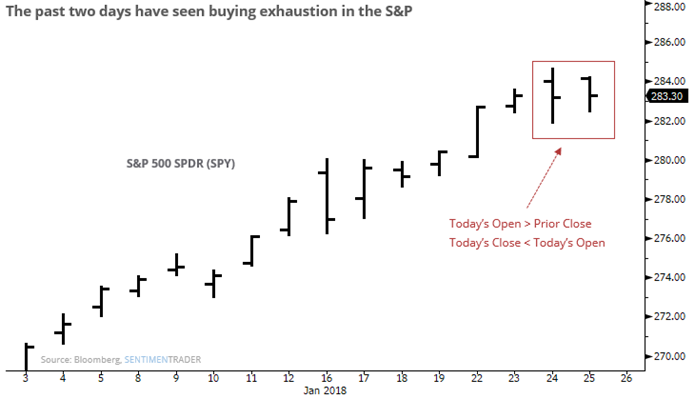

Signs of buying exhaustion

For the past two days, stocks have opened higher but weren’t able to sustain buyers’ initial enthusiasm.

When occurring at a high, such days tend to lead to short-term weakness.

Dow divergence

The Dow Industrials closed at a new high on Thursday, while the Dow Transports have lost more than 1% on each of the past two days. Incredibly, that has happened only 4 other times since 1930.

Bad breadth, again

Not sure this matters anymore, but the Dow managed its back-to-back new highs with more declining issues than advancing ones on the NYSE both days. That has happened four times over the past couple of years.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.