Dollar falls into correction for the first time in years

In March, all the talk was about demand for dollars, the safest reserve currency in the world. Now it has swung to the idea that the buck may lose its reserve status. Sentiment is a funny thing.

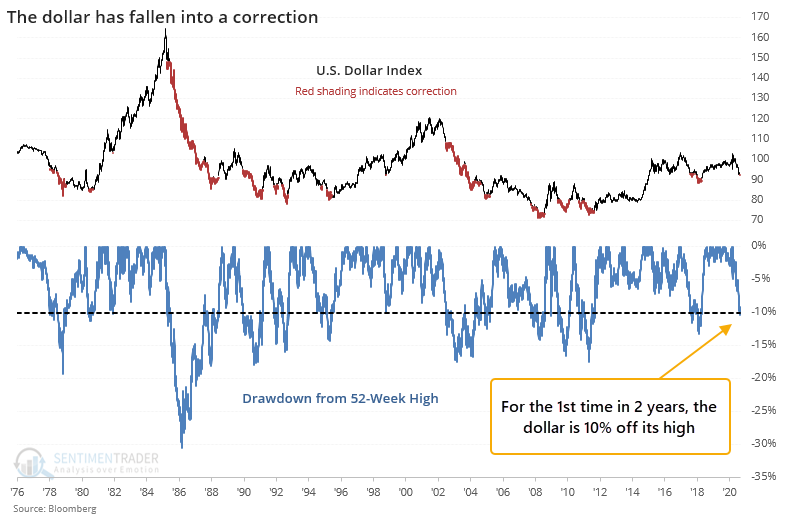

For the first time in over two years, the dollar has dropped more than 10% below its prior 52-week high. That may not seem like a lot given how much markets have been swinging in recent months, but it's a fairly rough drawdown historically.

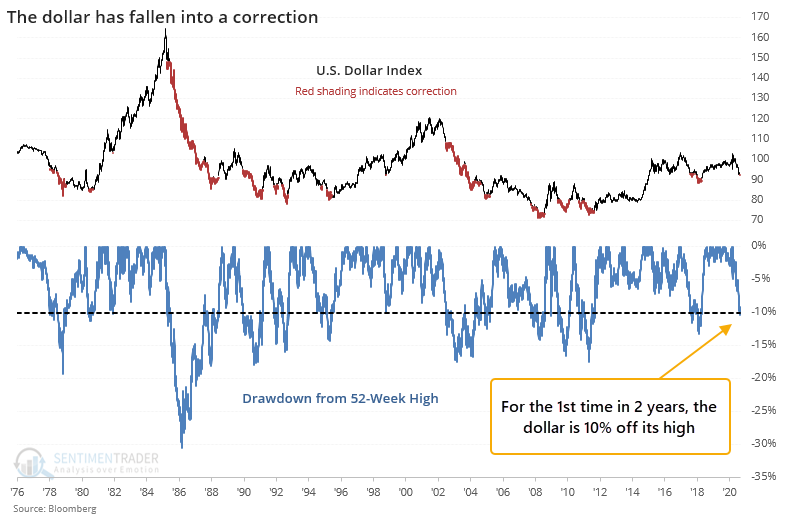

This ends the dollar's 6th-longest streak without being more than 10% below its high.

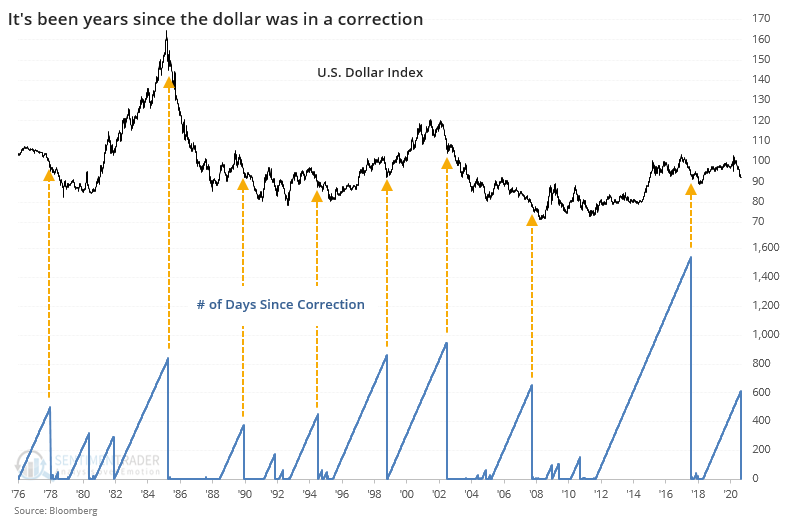

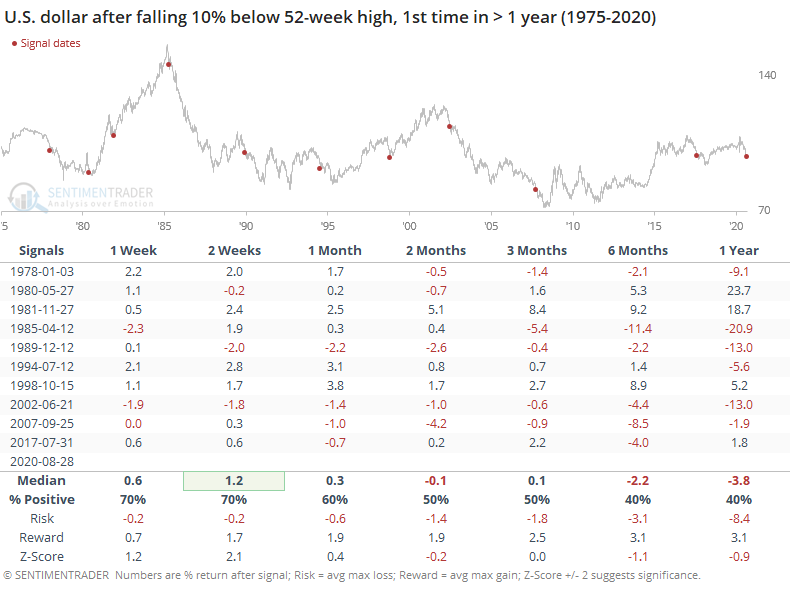

In past notes, we've seen that negative momentum in the dollar tends to persist. That's the case here as well. Other than a modest tendency for positive returns over the next couple of weeks, when the dollar fist falls into a correction, its forward returns were mostly below average.

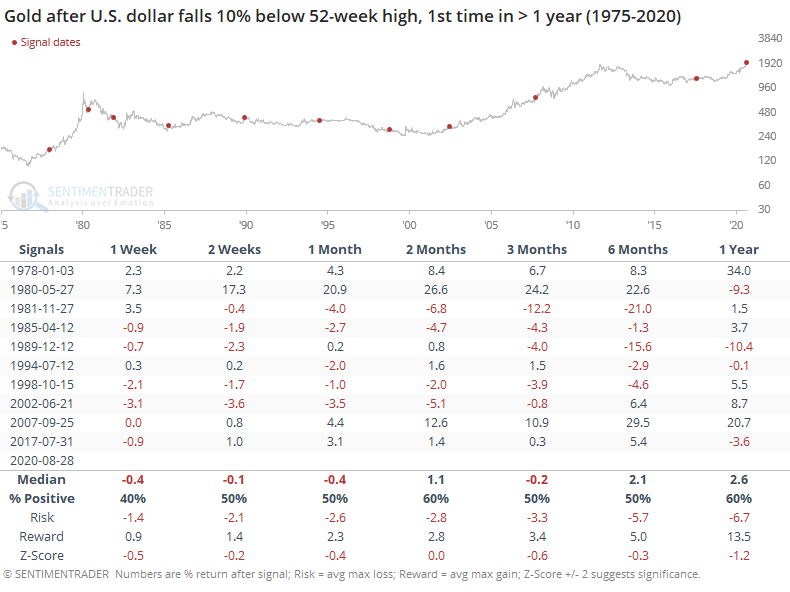

Though they generally have a negative correlation, this bias in the dollar didn't help gold too much.

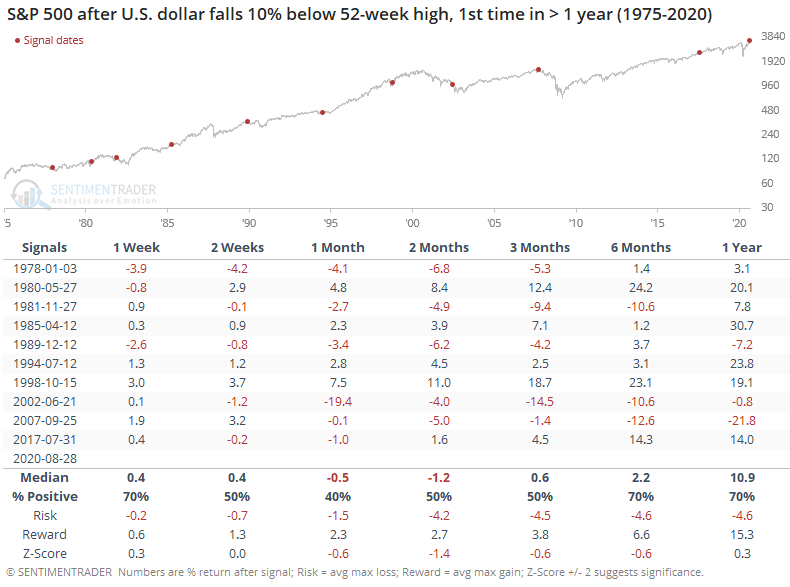

Or stocks.

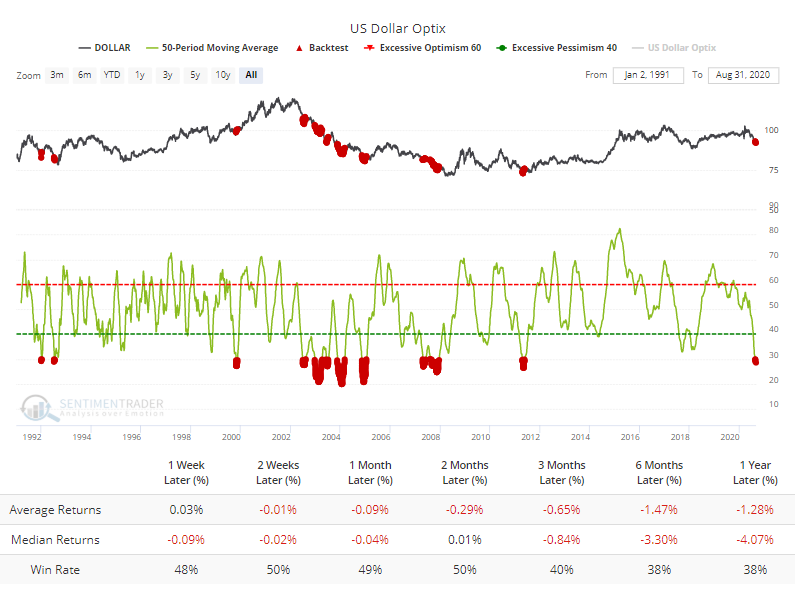

The prolonged decline has pushed the 50-day average of the Optimism Index below 30 for only the 2nd time in the past decade. The only other time sentiment got this low was in April 2011 which proved to be a turning point. But currencies have more of a tendency to trend against sentiment extremes, and this happened through much of the 2000s for the dollar according to the Backtest Engine.

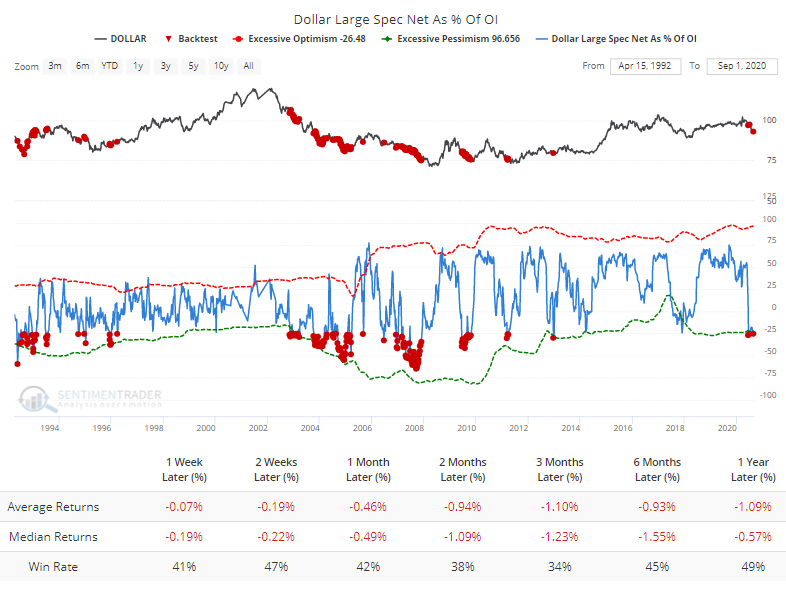

The Optimism Index is driven in part by futures positioning, and large speculators in dollar futures are holding more than 25% of the open interest net short. This is typically a reliable contrary indicator in most markets, but the Backtest Engine shows it has not been for the dollar.

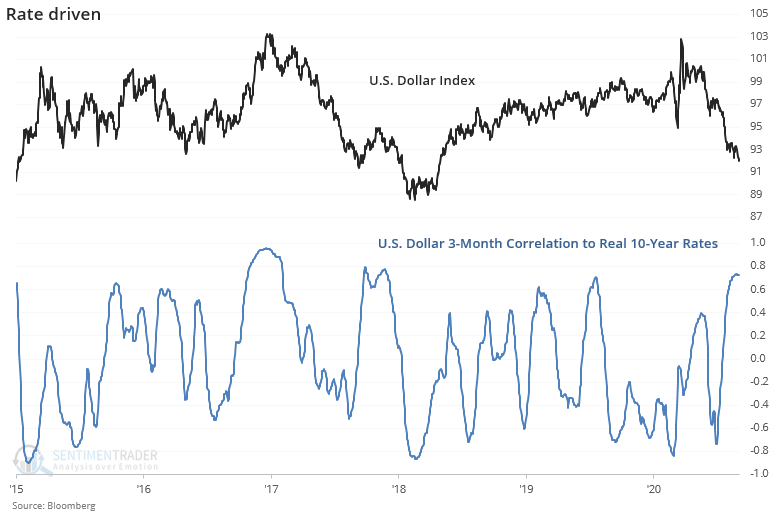

Pessimism has been driven lower on an almost tick-for-tick basis by the fall in real 10-year interest rates. The 3-month correlation between the dollar and real rates is now among the highest in years.

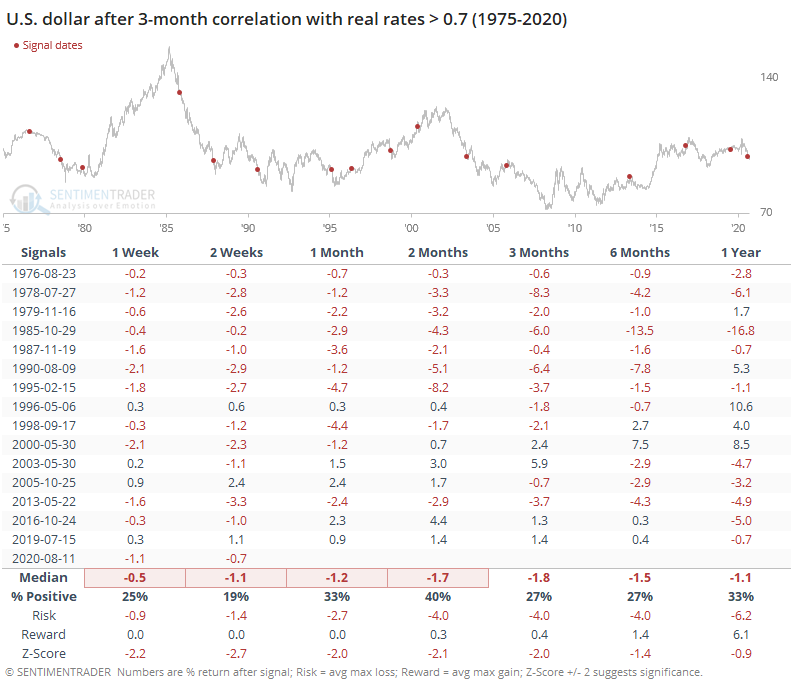

High correlations have not been a good reason to expect the dollar's downward trend to reverse any time soon.

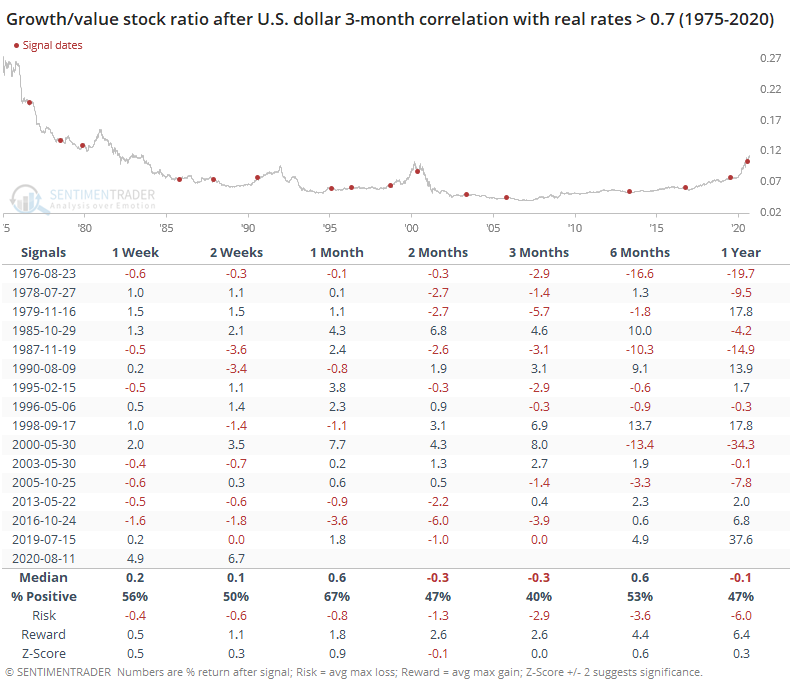

One interesting wrinkle with this is that when markets have been driven so much by the trend in real rates, growth stocks had a tendency to underperform value over the next several months.

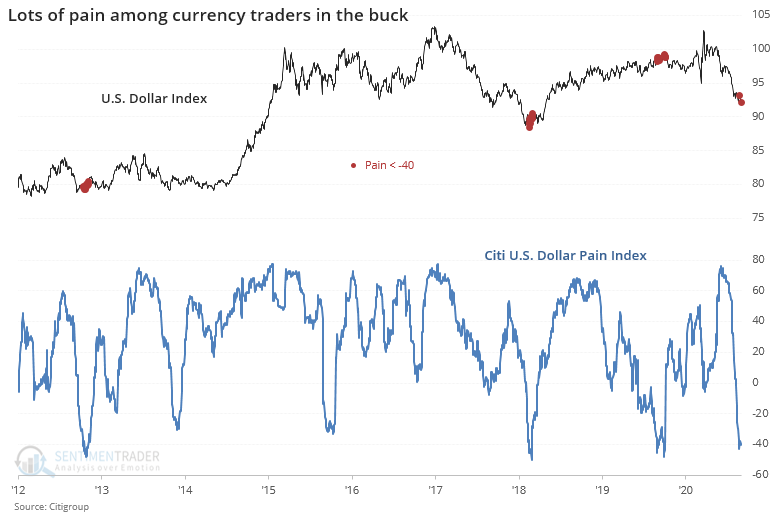

Another measure showing an extreme in the dollar is the Pain Index from Citigroup.

"The Citi FX Positioning Alert Indicators infer positioning of active currency traders from relationships between exchange rates and currency managers' returns. A positive reading suggests that currency traders have been net long the currency and a negative reading suggests that currency traders have been net short the currency."

That index just fell below -40 for the first time in almost a year.

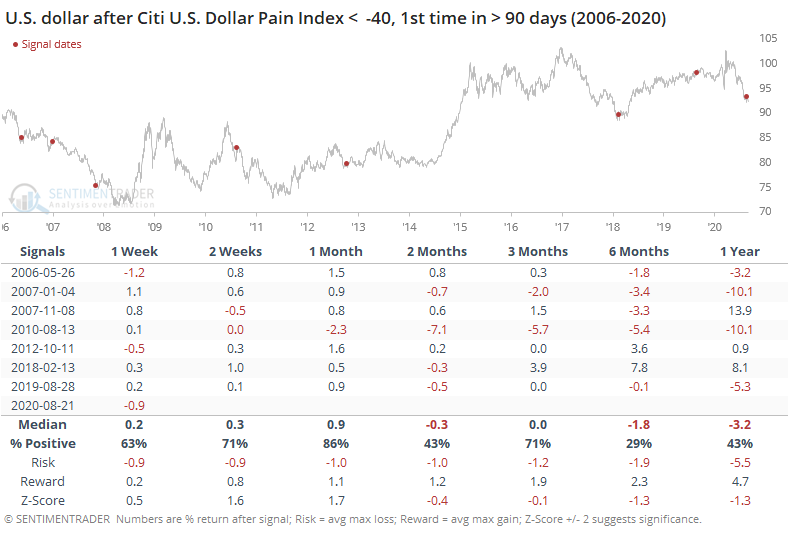

There isn't a long history here, but other times it fell below -40 for the first time in months, the dollar snapped back short-term but usually wasn't able to hold those gains.

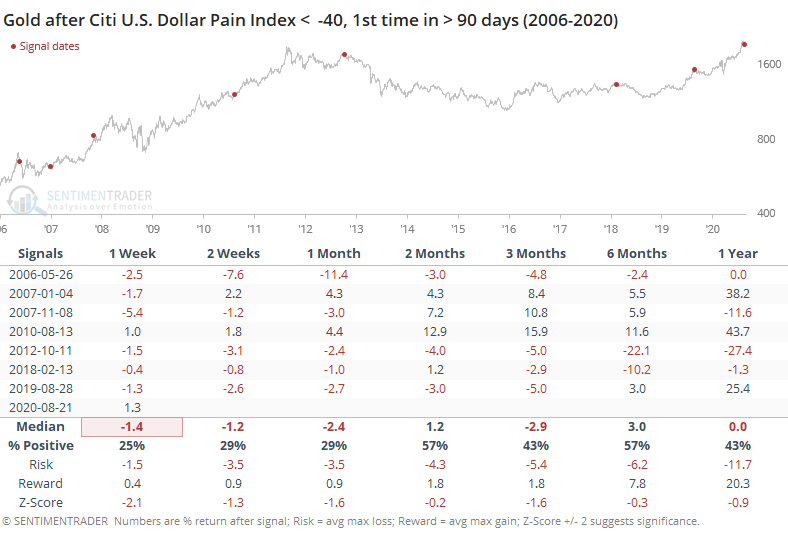

It was not a great sign for gold, either.

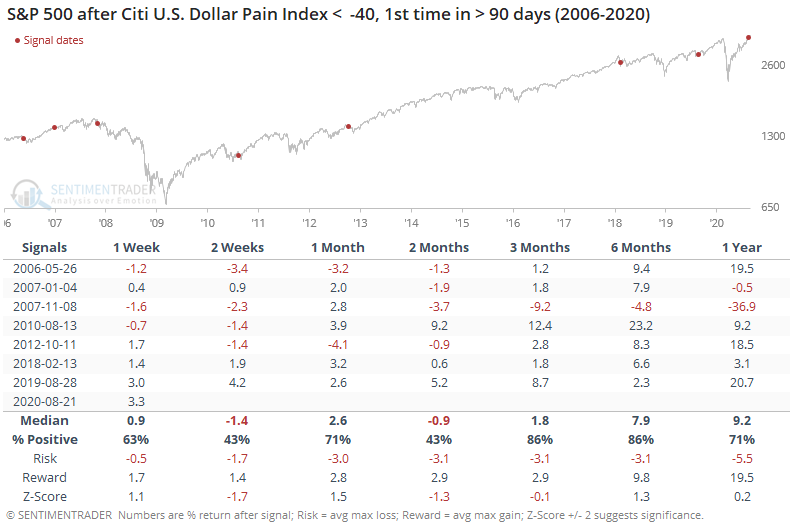

Stocks had very mixed returns depending on the time frame.

There remains little in the studies we've looked at in recent weeks giving a high probability that the risk/reward in the dollar is positive. When a trendy currency gets moving like this, it's hard for it to turn, even when sentiment is sour.