Dollar Fails As S&P Momentum Stalls

This is an abridged version of our Daily Report.

A dollar failure

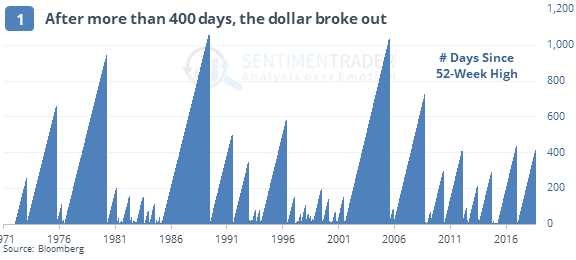

The U.S. dollar ended a long streak without a new high in early August by closing at its first 52-week extreme in more than 400 sessions.

Since then, it rallied more than 1%, then failed by closing below its breakout price, which has usually preceded more weakness.

Good vs bad overbought

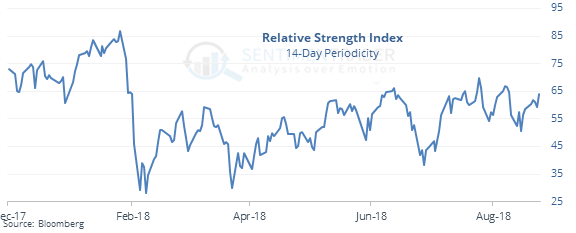

The S&P is breaking to new highs, but its Relative Strength Index is lower than it was in January. Breakouts accompanied by very high RSI readings tend to do better than ones with low readings, showing impressive momentum from buyers.

Breakouts also do (slightly) better when more of the S&P’s component stocks hit new highs along with the index.

Silver streak

According to Bloomberg, silver is on track to end its streak of 10 straight weekly declines, the longest since 1950. The only times it even reached 8 straight weekly declines were January 4, 1985, and May 29, 1998.

The latest Commitments of Traders report was released, covering positions through Tuesday

The 3-Year Min/Max Screen shows that “smart money” hedgers keeping adding aggressively to coffee, where they’re now net long a record 26% of total open interest.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |