Does weak breadth cancel an 'almost' thrust?

An "almost" breadth thrust

Last week, stocks witnessed one of the most powerful three-day thrusts in history. Probably the most powerful.

There's always a "but," and this time the "but" is that it wasn't actually a breadth thrust. That's based on preconceived notions about what a thrust is. It's assuming there are rules when it comes to these kinds of signals.

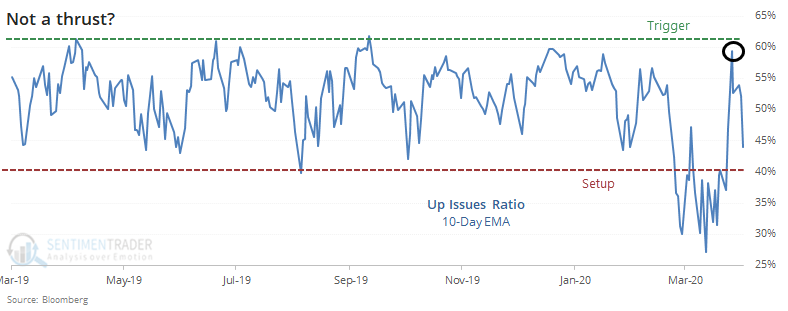

The most popular definition of a thrust is the one popularized by Marty Zweig, which looked for the 10-day exponential moving average of the Up Issues Ratio, which needs to cycle from below 40% to above 61.5% within 10 days. Because of a bad day on Friday, it didn't quite trigger.

But this is ignoring a potentially important point - it's coming from one of the most severe oversold signals in history.

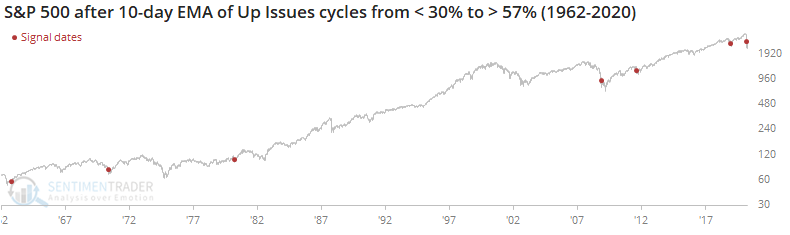

The setup requires the ratio to drop below 40%, but last month it plunged below 30%. If we look for "almost" thrusts that had a setup below 30%, then the precedents become much more interesting.

Weak even on up days

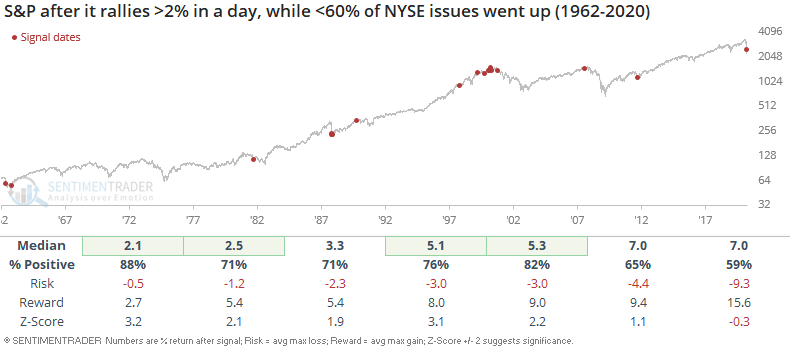

The S&P 500 rallied more than 2% on Thursday, which is a decently large 1 day rally that usually elicits stronger breadth. Instead, only 59% of NYSE issues rallied along with the S&P. Is this a sign of weak breadth?

Not entirely. When this happened in the past, the S&P had a greater than average tendency to rally over the next few weeks and months. On a longer term basis, this wasn't always bullish since many of the historical cases occurred at the market's peak in 2000.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- More looks at last week's thrust, as well as this week's bad day cancelling the signal

- Our Aggregate Signal Model has turned negative

- Energy stocks have gone two weeks without a lower low

- Ratings agencies have been busy downgrading energy company debt

- Price/sales valuations for various sectors are showing some values

- The probability of a "double top" in the VIX

- Recent economic data has been shocking