Do new lows suggest capitulation

Key points:

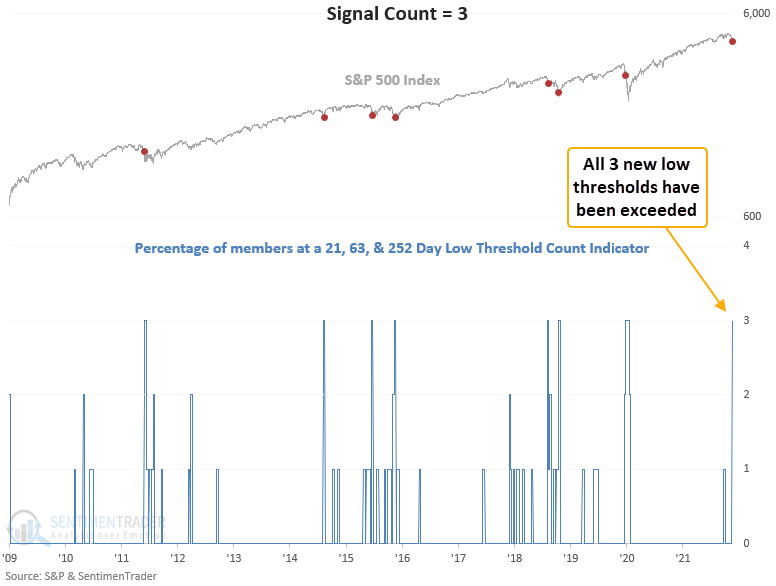

- The percentage of 21, 63, & 252-day lows for S&P 500 members surged on Monday

- Our data shows 73.51%, 38.45%, and 5.38%, respectively, for the 3 duration lengths

- The S&P 500 index has rallied 68% of the time over the next 2 months after other signals

Measuring capitulation with new lows

Let's conduct a study to assess the outlook for the S&P 500 when the percentage of 21, 63 & 252-day lows exceed similar threshold levels to Monday's session. New lows must exceed 73%, 38%, and 5%. I will use a composite indicator that uses a 5-day lookback to count when each series achieves its respective threshold. The study will include a condition that requires the composite to return to zero before a new signal can trigger again to screen out repeats.

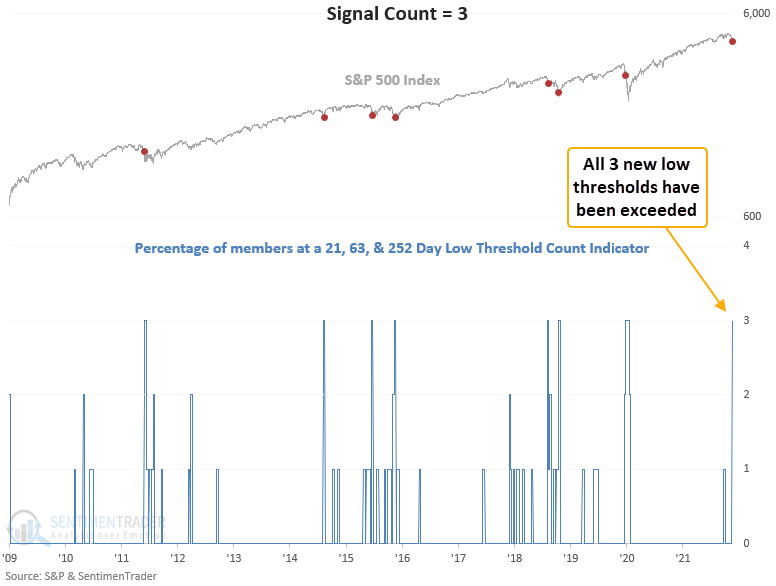

The S&P 500 rallied 68% of the time after other signals

This signal has triggered 50 other times over the past 94 years. After the others, S&P 500 future returns were positive across all time frames, with the best risk/reward profiles coming in the 2 & 6-month windows. However, none of the time frames show a risk/reward profile that looks overwhelmingly appealing, especially given the current level of market volatility.

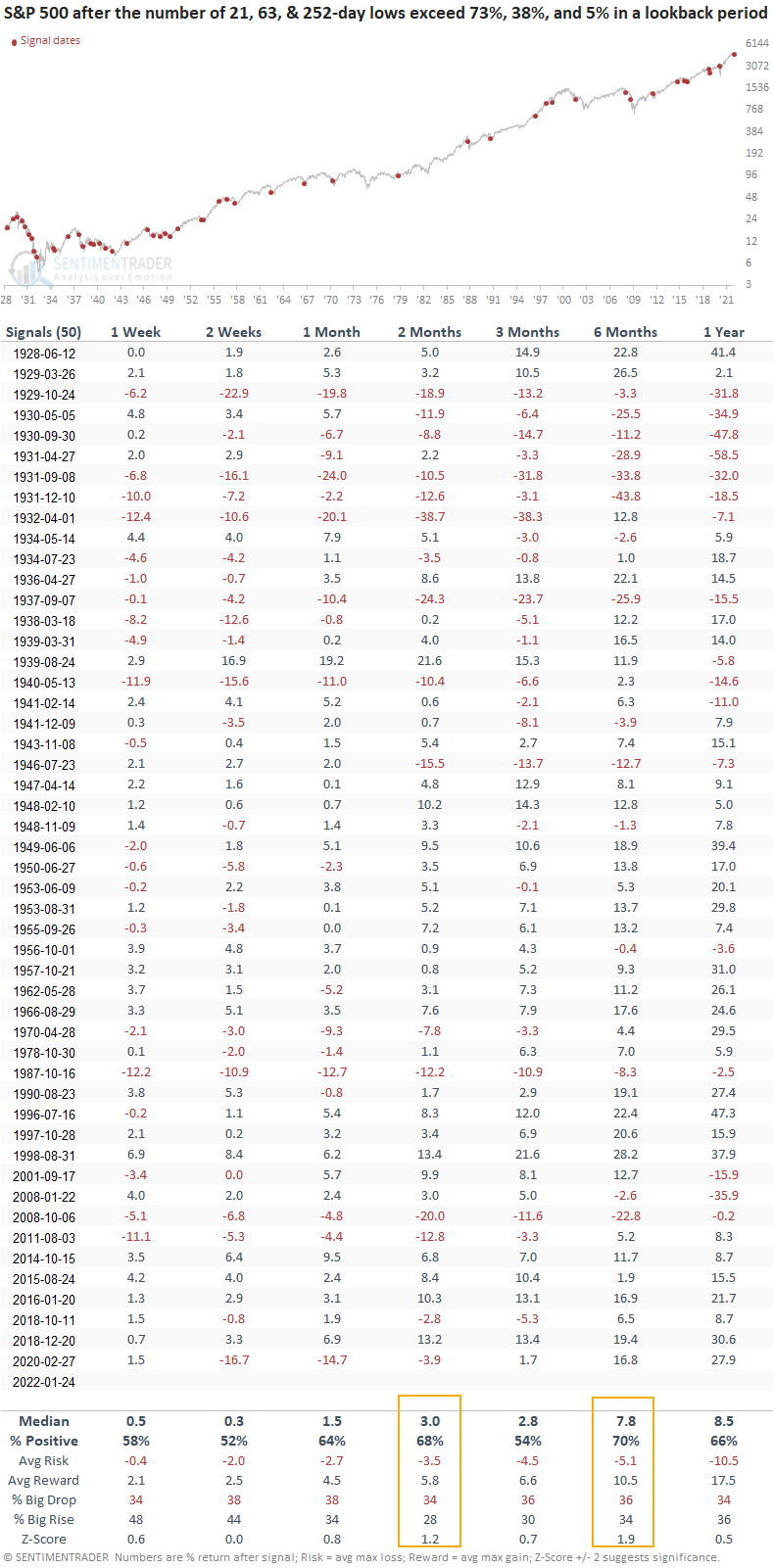

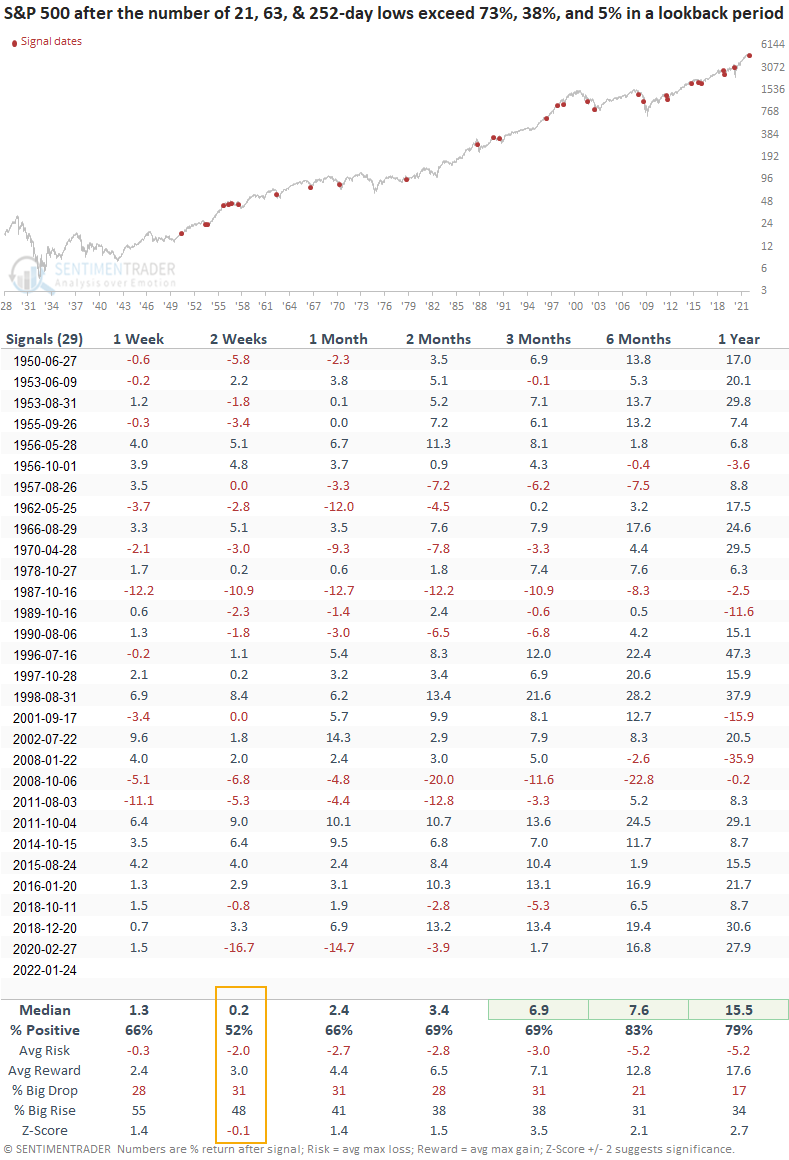

Signals since 1950

When we exclude the volatile 1929-49 period, results look better across the board except for the 2-week window. It looks about the same, which suggests we need to be mindful that the market might not respond to the spike in new lows in the near term. And, I would also be aware of potential failures like 2011, 2018, and 2020.  What the research tells us...

What the research tells us...

When news lows surge to a high level, a market capitulation event can set the stage for a potential market bottom. Similar setups to what we're seeing now have preceded rising stock prices with okay, but not eye-opening risk-reward profiles in the 2 and 6-month time frames. If we assess more recent history, the returns, win rates, and risk/reward profiles look better, especially in the 3-12 month windows. The 2-week time frame suggests that the market may not respond in the near term.