Did We Just Start a New Secular Commodity Bull Market

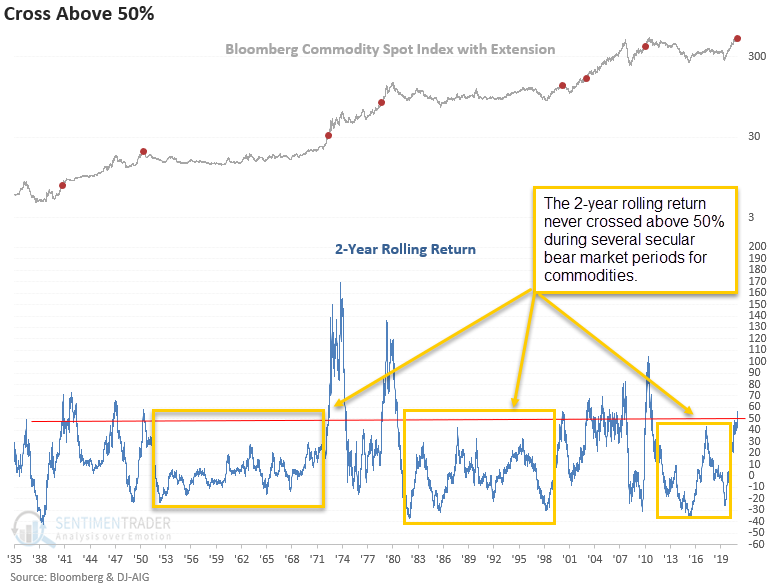

The 2-year rolling return for the Bloomberg Commodity Spot Index recently crossed above the 50% level. If we use history as a guide, should we expect a new secular commodity bull market?

Let's assess the outlook for commodities when the 2-year rolling return for the Bloomberg Commodity Spot Index exceeds 50% for the first time. I used a reset below 0% to identify the first cross above 50%.

HISTORICAL CHART

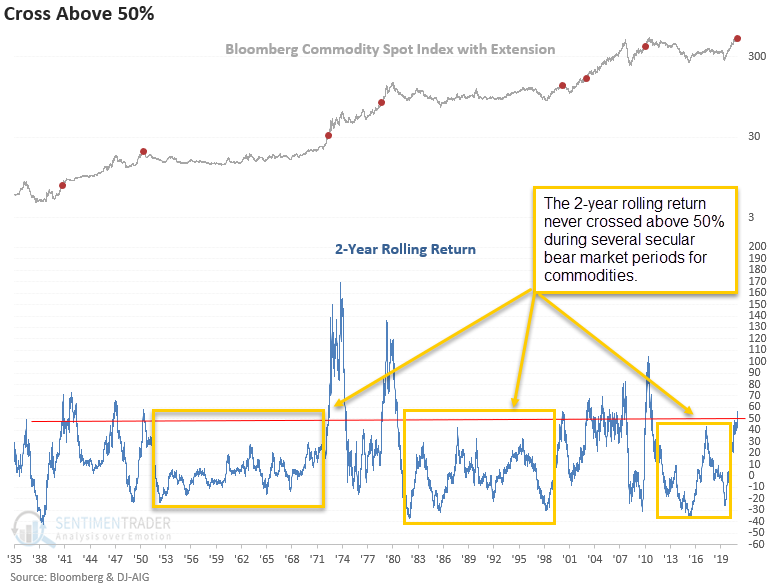

HOW THE SIGNALS PERFORMED

While the sample size is small, the outlook suggests commodities have entered a new secular uptrend. I would note that the 1951 signal came at the tail end of the WW2 commodity cycle. The instance shows up in the table because the rolling return crossed back below 0% in the 1946-49 drawdown.

THE EVERYTHING COMMODITY RALLY

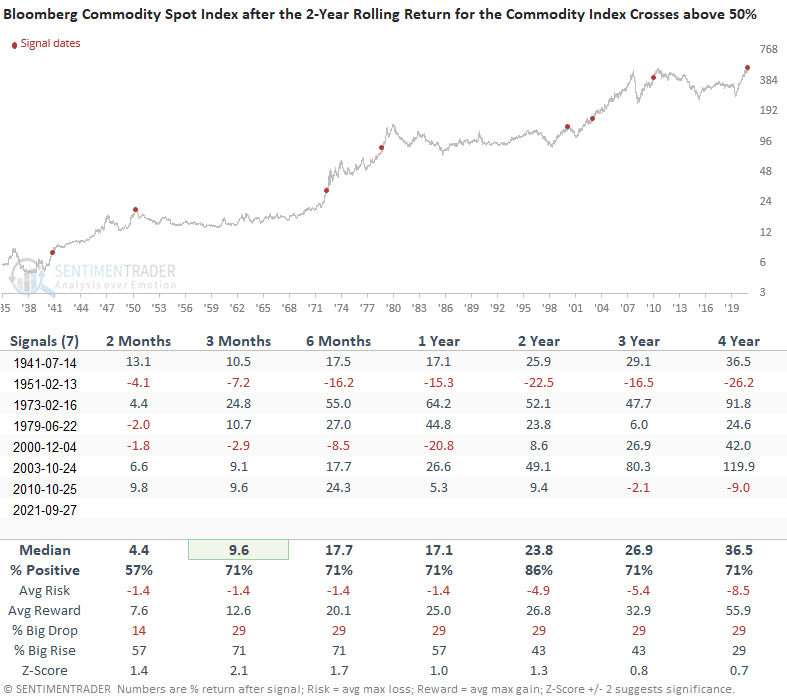

Whenever you assess a commodity index, it's essential to understand the component weightings. My favorite index used to be the old Continuous Commodity Index (CCI) because it was equal-weighted and had a long history. Unfortunately, it is no longer available. I mention the equal-weighted index because certain commodities like energy can heavily influence other indexes.

The following table provides the rolling returns for the S&P GSCI Commodity Spot Indexes. The current uptrend in commodities is an everything rally. Each component has a positive two and three-year rolling return, and only two maintain a negative one and five-year return.

The rank measures the current rolling return relative to all other values in history-100 highest to 0 lowest.

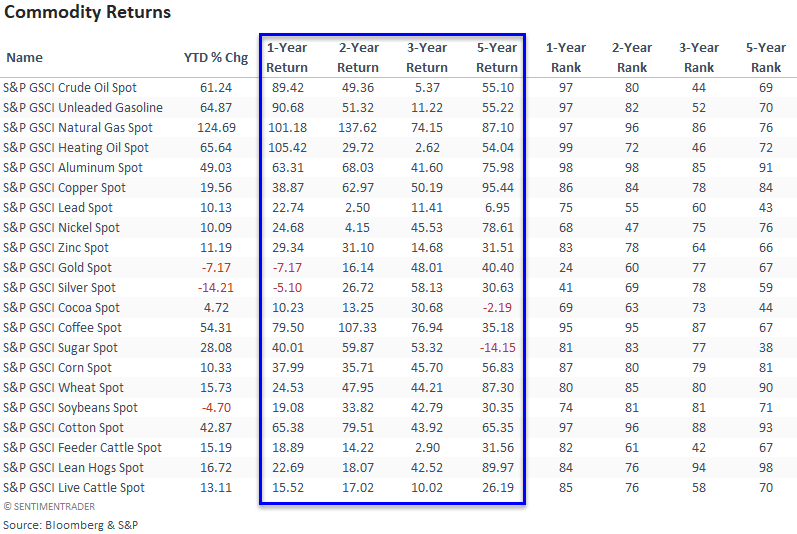

THE EVERYTHING COMMODITY RALLY

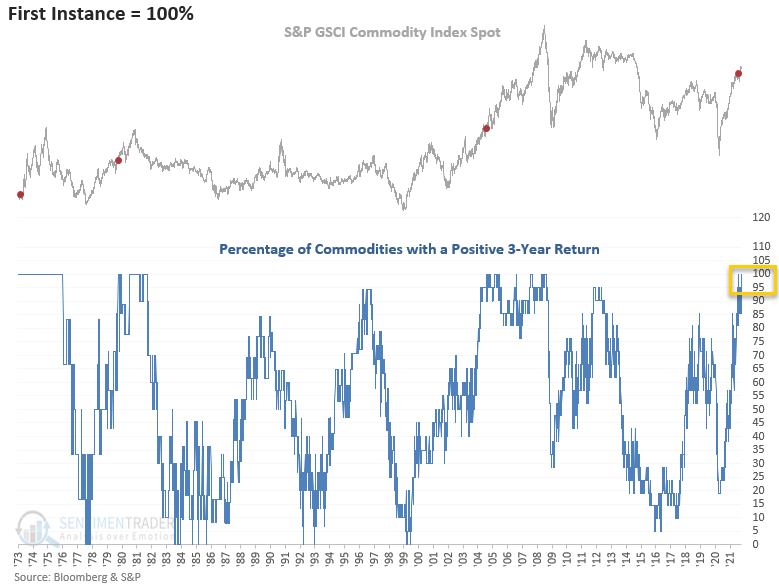

Suppose we plot the percentage of commodities with a positive 3-year rolling return. In that case, we see that the indicator reached a level of 100% on 7/29/21. Before the current signal, the most recent instance occurred in October 2004. Commodities subsequently continued higher for almost four more years.

The weight-of-the-evidence is building to suggest that we should be mindful that the current uptrend in commodities may not be a cyclical phenomenon but rather a new secular trend.

If commodities are indeed in a new secular uptrend, the implications for portfolio positioning are at a critical juncture. Mind the opportunity.