Did mom and pop really leave?

There seems to be a growing narrative that retail traders have left the market, or at least pulled back greatly, and stocks have held up just fine. The latest stimmy hasn't engaged new investors like the prior rounds did since there's more to do now than sit in the basement and click on tickers that seem to generate profits every day.

It's not really true, and likely to be even less true if stocks continue to surge like they have the past few sessions.

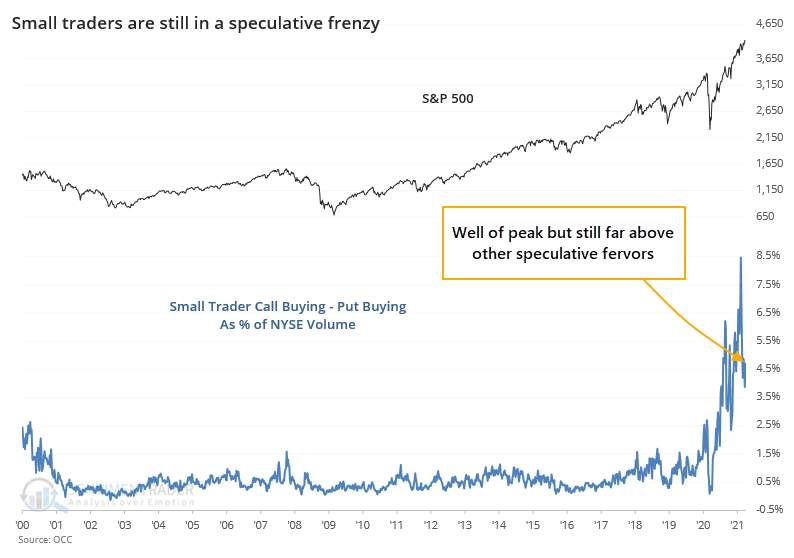

Activity has definitely pulled back from the peak in January when it reached jaw-dropping levels. It almost had to, and a correction in many of the highest-flying names hastened their exit.

But in many respects, small trader behavior is still more aggressive than many of the speculative fervors that popped up over the past 20 years, in the most leveraged instruments.

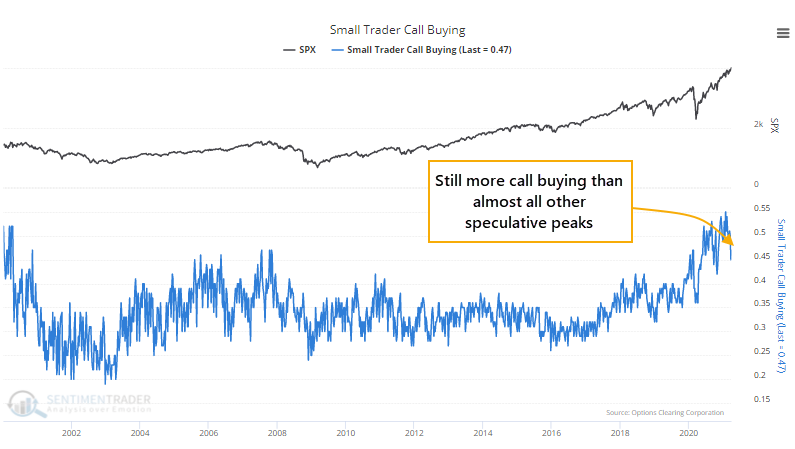

During last week's holiday-shortened stretch, the smallest of traders spent 47% of their volume on speculative call buying. Sure, that's down from 55% in January but it's still higher than any other pre-2020 week in 20 years other than (barely) the peak in 2000.

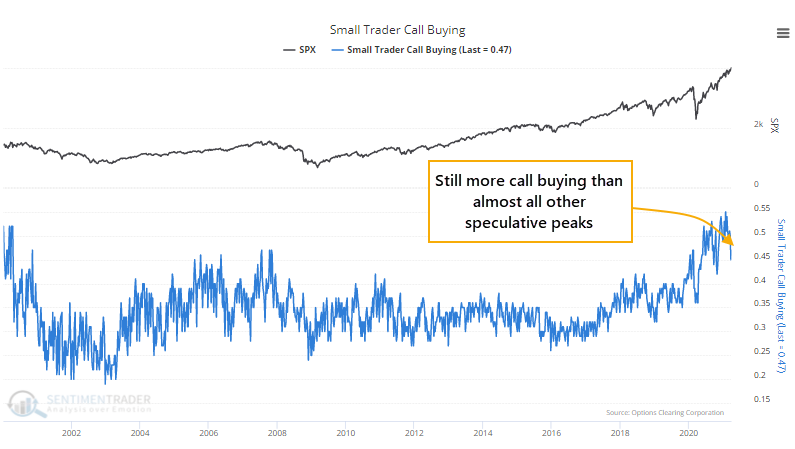

It's not like they suddenly bought a bunch of protective puts as an offset. The ROBO Put/Call Ratio dropped last week and remains mired among the lowest readings in history.

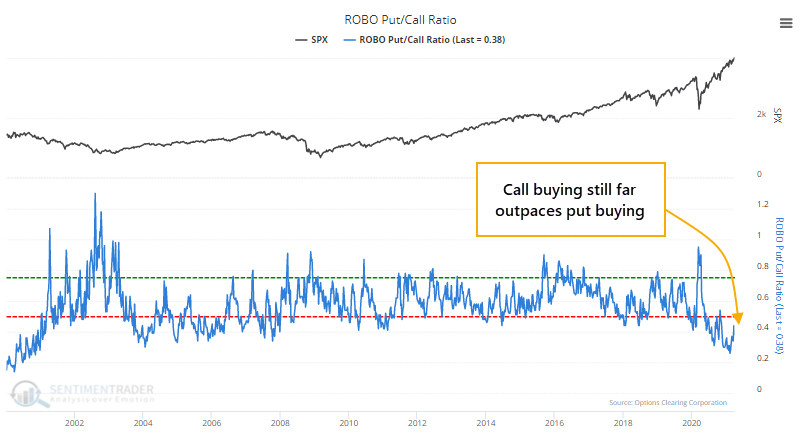

Okay, so maybe they started moving to some less offensive strategies like selling calls? No, not at all. The Option Speculation Index, but looking at only the activity of the smallest traders, rose last week. Looking only at trades for 10 contracts or fewer, there were 59% more bullish options strategies executed than bearish ones.

Prior to the last 6 months, the only weeks that showed more aggressive small-trader behavior were during the peak of the bubble in 2000, again in October 2007, and for a few weeks in January-February 2020.

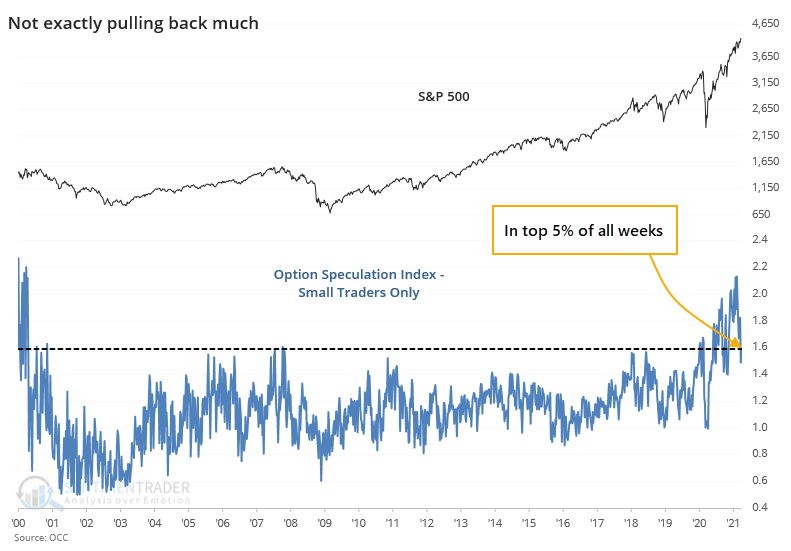

If we look at the total number of speculative call options they bought minus protective put options, expressed as a percentage of NYSE volume, then we can see that it continues to far surpass other speculative peaks, more than double what was seen even in the year 2000.

This looks troubling, but it's looked this way for months and yet the S&P 500 just closed at a record high. There has been more churn in many of the most-exposed names, so a rotation to more defensive positioning after the latest surge in speculative activity was beneficial. It just seems premature to declare that "the market" has emerged victorious from a vicious bout of speculative fervor. It has diminished somewhat, no doubt. But it's still raging to a degree unlike almost any other in a generation.