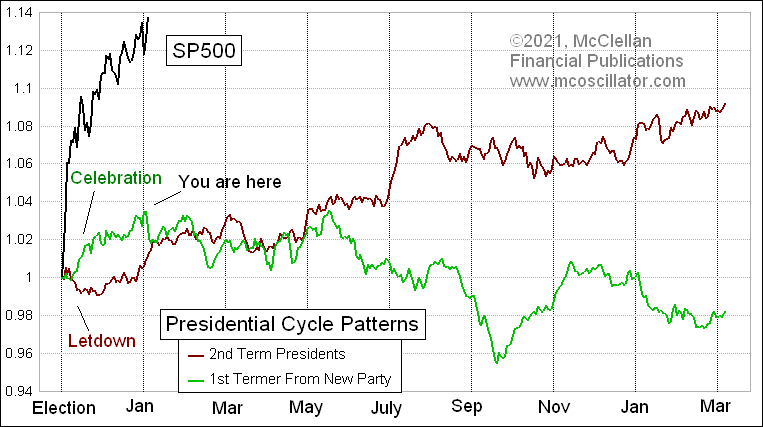

Despite the "reflation trade," fewer Industrials are trending higher

Industrial stocks have been one of the bright lights of the re-opening crowd, with investors focusing on them to potentially signal that the engine of commerce is really steaming.

They suffered a hiccup to start the New Year. After months with an overwhelming majority of industrials holding above their medium-term trends, that dropped quite a bit as the calendar turned. For the first time in nearly 2 months, fewer than 70% of industrial stocks traded above their 50-day moving averages.

The last time the sector enjoyed an extended run with more than 70% of stocks above their 50-days, when it first dropped below 70%, the sector turned immediately and headed higher. Historically, it hasn't been quite so easy.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- Forward returns when the percentage of industrial stocks above their 50-day averages drops below 70%

- Returns in XLI when Twitter users are optimistic (like now) versus pessimistic

- Corporate insiders aren't buying a lot of shares in industrial companies

- A look at the seasonal window in XLI

- What happens to industrial stocks when the ISM Manufacturing survey rises above 60

- The Russell 2000 fund, IWM, gapped up almost the most-ever when at a new high

- Financials had a big spike versus tech

- What seasonality says about prospects for the British pound

- Returns since 1926 when small-cap stocks see a big jump to a new high

| Stat Box On Wednesday, the Russell 2000 rose more than 3% to an all-time high. Since the index's inception in 1979, the only other day that can claim such a good performance was February 29, 2000. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

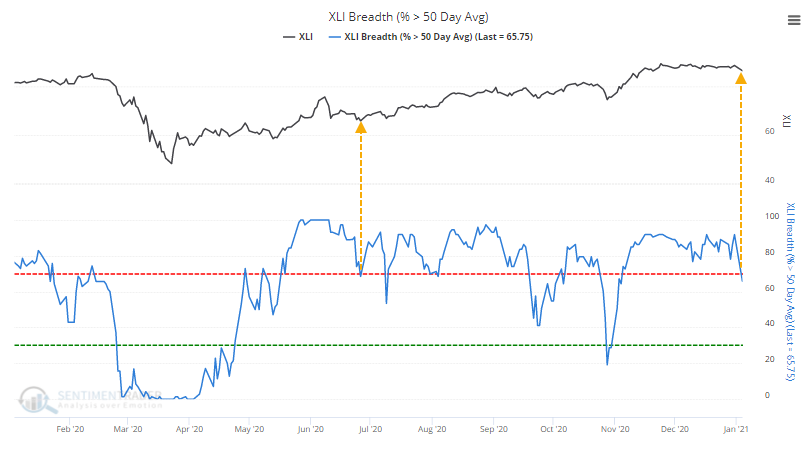

1. Retail traders have gone heavily short the FTSE 100, and they have a pretty good record at actually being correct. [DailyFX]

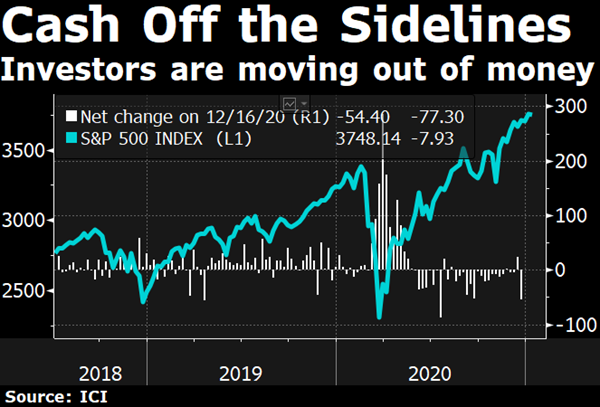

2. With stocks doing well and neighbors getting rich, it gets harder and harder to justify holding cash, so investors are deciding to hold less of it. [Bloomberg TV]

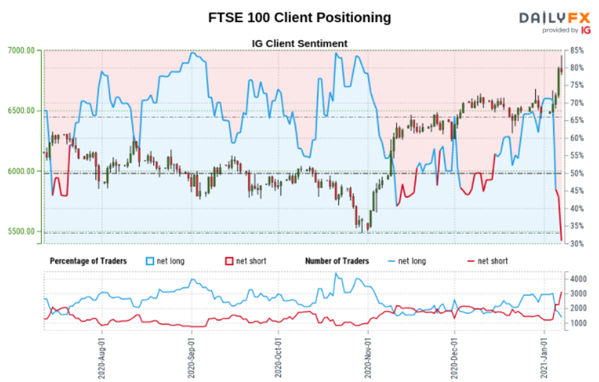

3. Investors have enjoyed the "celebration" part of the cycle when a new president gets elected, and if history is any kind of a guide then the hangover is about to begin. [Tom McClellan]