Defensive Stocks Dominate The New High List - Does It Matter?

A defensive new high list

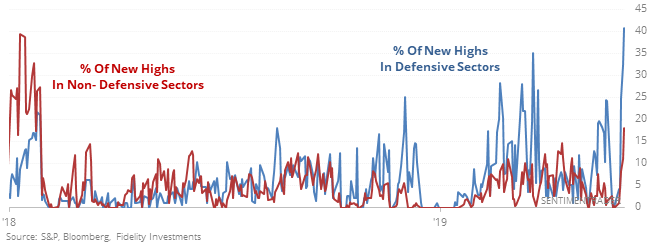

Across the equity market, securities at a 52-week high have expanded. Same goes for companies within the S&P 500. And within that index, it’s been more of the defensive sectors that have seen the best participation.

While that suggests a potentially worrisome risk-off mentality, it has not been a bad sign. The S&P 500's forward returns were good, and generally better than times when non-defensive sectors dominated the new highs.

As far as the sectors themselves go, there wasn’t a clear bias toward either one. When defensive sectors dominated the new-high list, those sectors tended to outperform non-defensive sectors, but it was mixed.

A week to remember

The tech sector was languishing at a multi-month low a week ago and has since put in its best week in years.

Since 1928, this kind of rapid change in sentiment has been a good kick-start, especially in recent decades. It was better when it triggered during healthy markets, like this one, depending on how we define "healthy."

Housing pattern

According to the ETF Seasonality list, the worst performing fund in June is the XHB housing fund, with an average return of -4.3%. It has followed its typical seasonal path almost perfectly so far this year, potentially an issue as its 3-day Optimism Index climbed above 70.

Bond hedges

As bonds have rallied, options traders in the TLT fund have built up an inventory of put options. The Put/Call Open Interest Ratio is showing they’re now holding 200 puts for every 100 calls. Since the financial crisis, TLT has struggled to hold gains when this many puts were outstanding. When the OI ratio was below 0.75, however, TLT was higher 3 months later after 87 out of 88 days per the Backtest Engine.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.