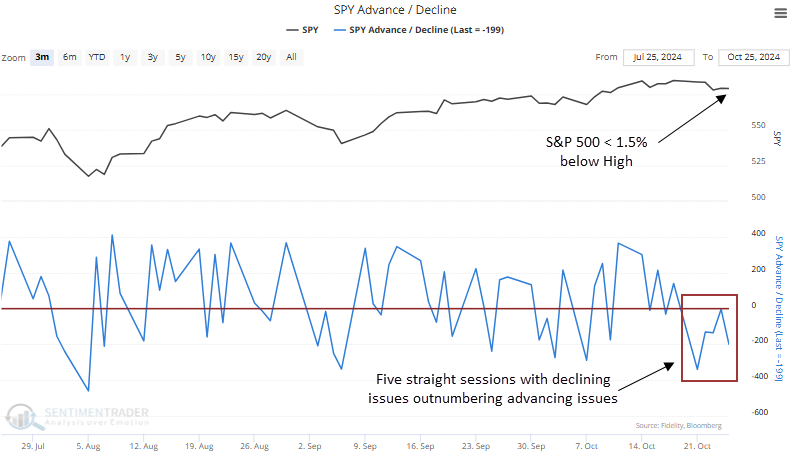

Decliners in the S&P 500 have topped advancers for five straight days

Key points:

- Each trading session over the last week saw more S&P 500 stocks fall than rise

- Similar breadth conditions near a high tended to precede a multi-week consolidation

- Calendar and election-year seasonality trends are poised to turn favorable

A negative skew in the advance-decline differential suggests a short-term pause

Stocks have rallied with impressive breadth, demonstrating resilience by ignoring the typically weak seasonal periods of August and September. However, last week's market breadth was poor, as the number of declining stocks in the S&P 500 exceeded advancing issues in each trading session.

While the negative skew in participation is likely due to investors' hesitation surrounding the upcoming election, it's always best to take an evidence-based approach to market analysis rather than speculating on possible interpretations.

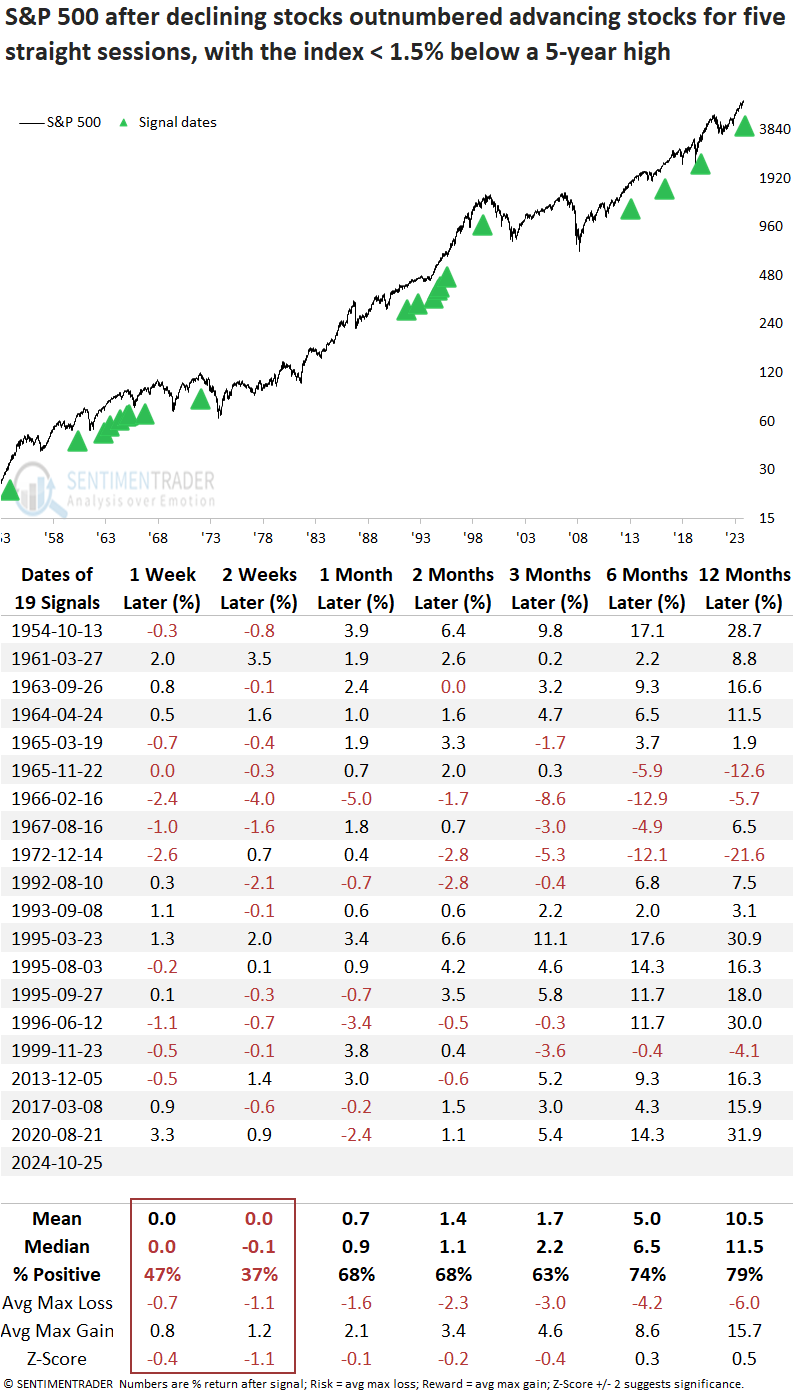

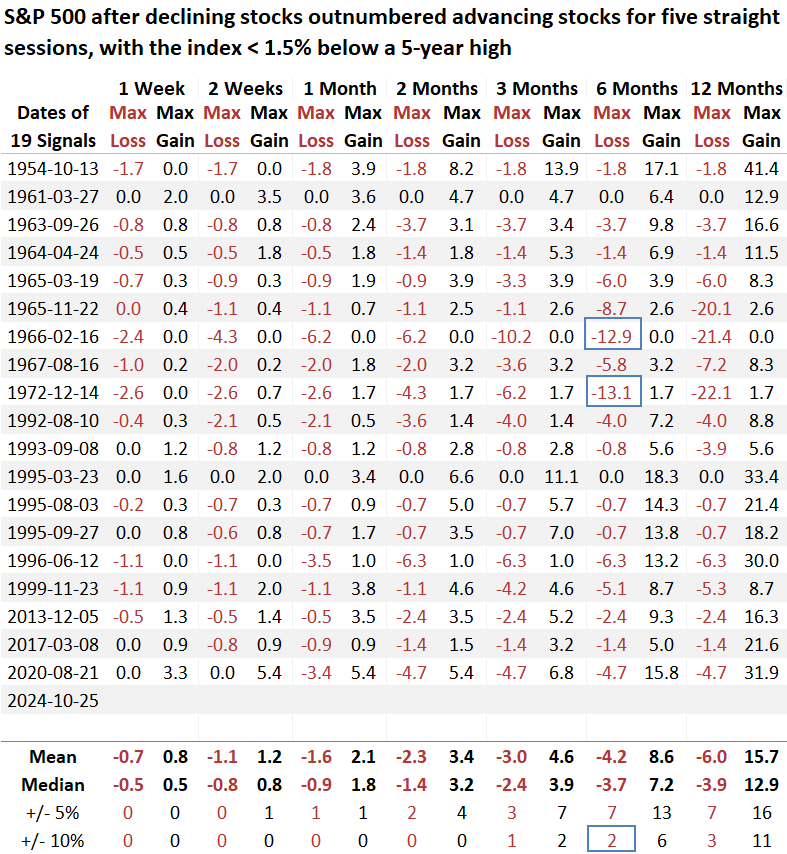

Comparable market breadth conditions preceded a short-term consolidation

Whenever declining issues for the S&P 500 exceeded advancing issues for five straight sessions, with the index hovering less than 1.5% below a 5-year high, the world's most benchmarked index tended to undergo a multi-week consolidation. At some point over this time frame, the index displayed a loss in 15 out of 19 instances.

Any pullback or consolidation should be viewed as a buying opportunity as returns and win rates over the next six and twelve months exceeded historical norms, especially since 1992.

Over the subsequent six months, the S&P 500 sustained just two instances of a maximum loss exceeding 10%, a threshold that has not been breached since before 1973. Consequently, the chances of last week's negative breadth developing into something more significant appears less probable.

Seasonality

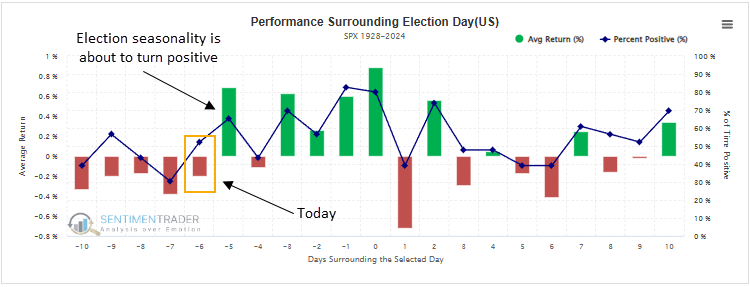

As illustrated in the table below, today's trading session marks the last day of a seasonally weak period ahead of the presidential election. If you're seeking an explanation for last week's negative breadth, the typical jitters associated with pre-election periods might be the cause.

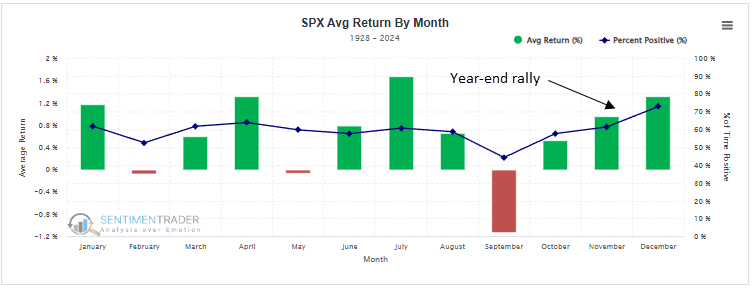

Although today's analysis suggests the broad market could drift sideways for a few weeks, investors should keep sight of the big picture, given that stocks are set to enter the advantageous seasonal period from November to May.

What the research tells us...

Last week, the S&P 500 saw a consistent pattern of declining issues outpacing advancing ones each day, a dynamic that may partly stem from seasonal trends typically observed ahead of a presidential election. Historically, such patterns often lead to a period of consolidation for the index over several weeks. However, with favorable seasonal trends on the horizon, investors might view any short-term weakness as an opportunity to buy the dip, positioning for potential upside ahead of the November to May period.