Dark clouds for t-bonds

Key Points

- Bonds are extremely oversold on a short-term basis and may be due to bounce

However:

- 30-year treasury bonds are in a weak seasonal period

- With high inflation and much talk of a tightening by the Fed, the prospects for lower bond prices are exceptionally high

Seasonality

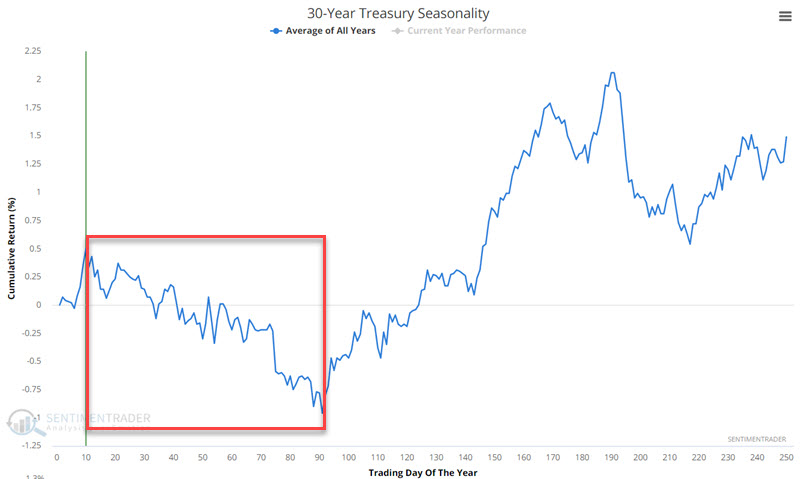

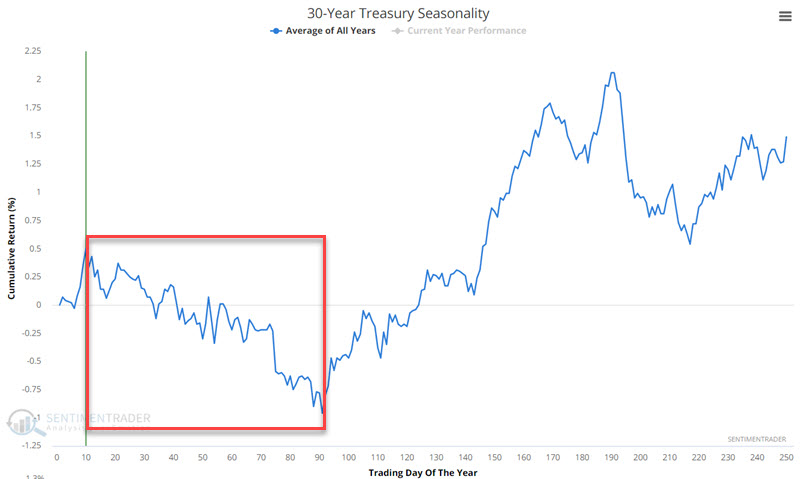

The chart below displays the annual seasonal trend for 30-year treasury bonds.

As you can see, long-term treasuries have entered a particularly seasonally weak period that lasts until roughly the middle of May 2022.

The history

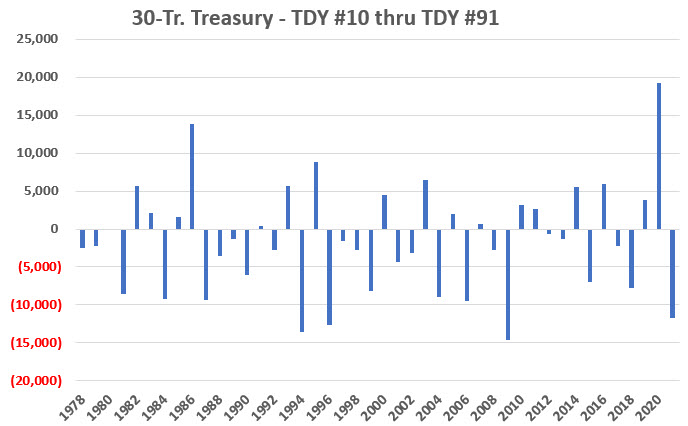

For our test, we will look at the price changes for treasury bond futures during the seasonally unfavorable period that extends from Trading Day of the Year (TDY) #10 through TDY #91. Each one-point movement in the futures contract price represents $1,000 gained or lost.

The chart below displays the year-by-year performance for t-bond futures during this seasonally unfavorable period.

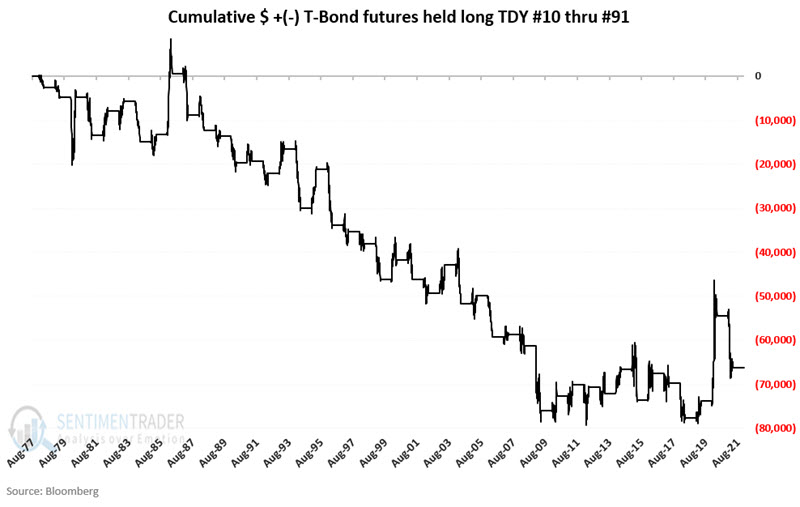

The chart below displays the cumulative $ gain or loss if t-bond futures were held long every year during the seasonally unfavorable period.

From the mid-1980s through 2009, the results were consistently quite bearish. Since then, results have been mixed, with a substantial gain during the Covid-panic of 2020 and a significant decline in 2021.

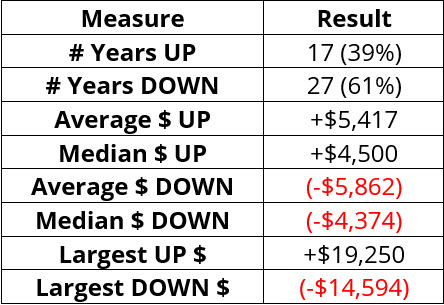

The table below displays a summary of the results.

What the research tells us…

Long-term treasury bonds tend to weakness in the first part of the calendar year. As we saw in the results above, year-to-year performance can vary greatly. Likewise, on a technical basis, bonds are quite oversold at the moment. Nevertheless, with inflation running high, interest rates well below inflation, and sounds from the Fed that they are willing to raise interest rates soon, there appear to be several good reasons to be wary of playing the long side of bonds right now.