Headlines

|

|

The Nasdaq Is Split, Again:

As the Nasdaq Composite hangs near a 52-week high, there has been a lot of internal turmoil. Its Summation Index is deeply negative, with more 52-week lows than highs. That has triggered a cluster of technical warning signs.

Bottom Line:

See the Outlook & Allocations page for more details on these summaries STOCKS: Hold

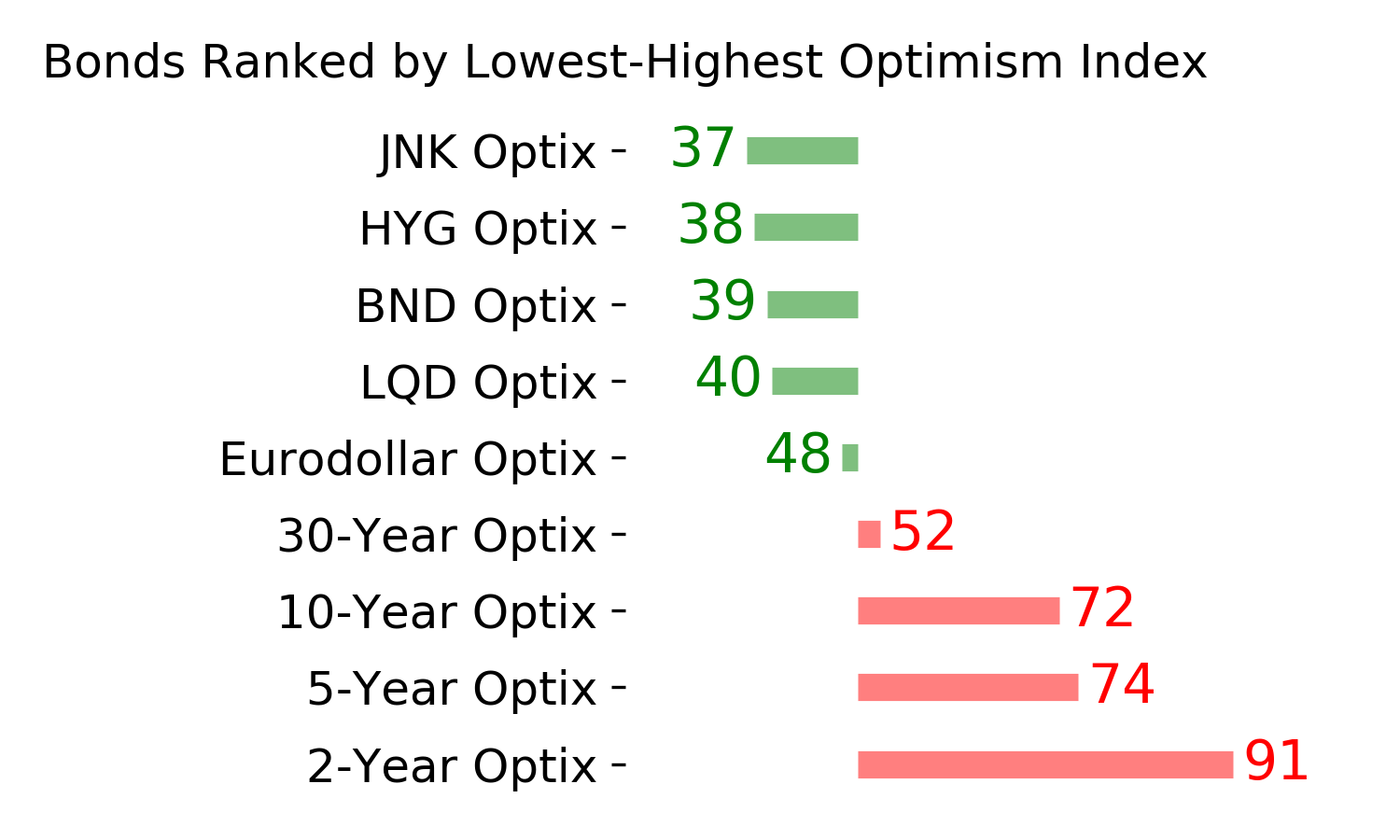

The speculative frenzy in February is wrung out. Internal dynamics have mostly held up, with some exceptions. Many of our studies still show a mixed to poor short-term view, with medium- and long-term ones turning more positive. BONDS: Hold

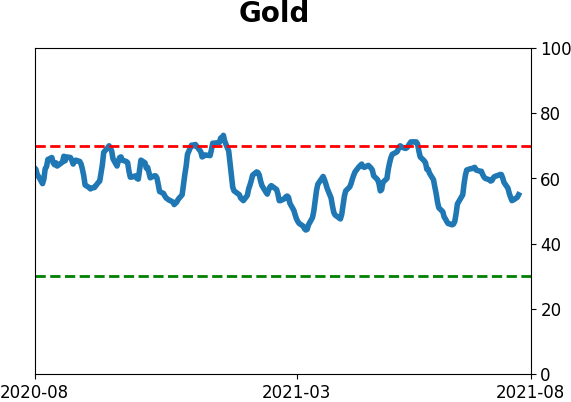

Various parts of the market got hit in March, with the lowest Bond Optimism Index we usually see during healthy environments. After a shaky couple of weeks, the broad bond market has modestly recovered. Not a big edge here either way. GOLD: Hold

Gold and miners have done very well, recovering above long-term trend lines. The issue is that both have tended to perform poorly after similar situations - will have to wait and see how it plays out.

|

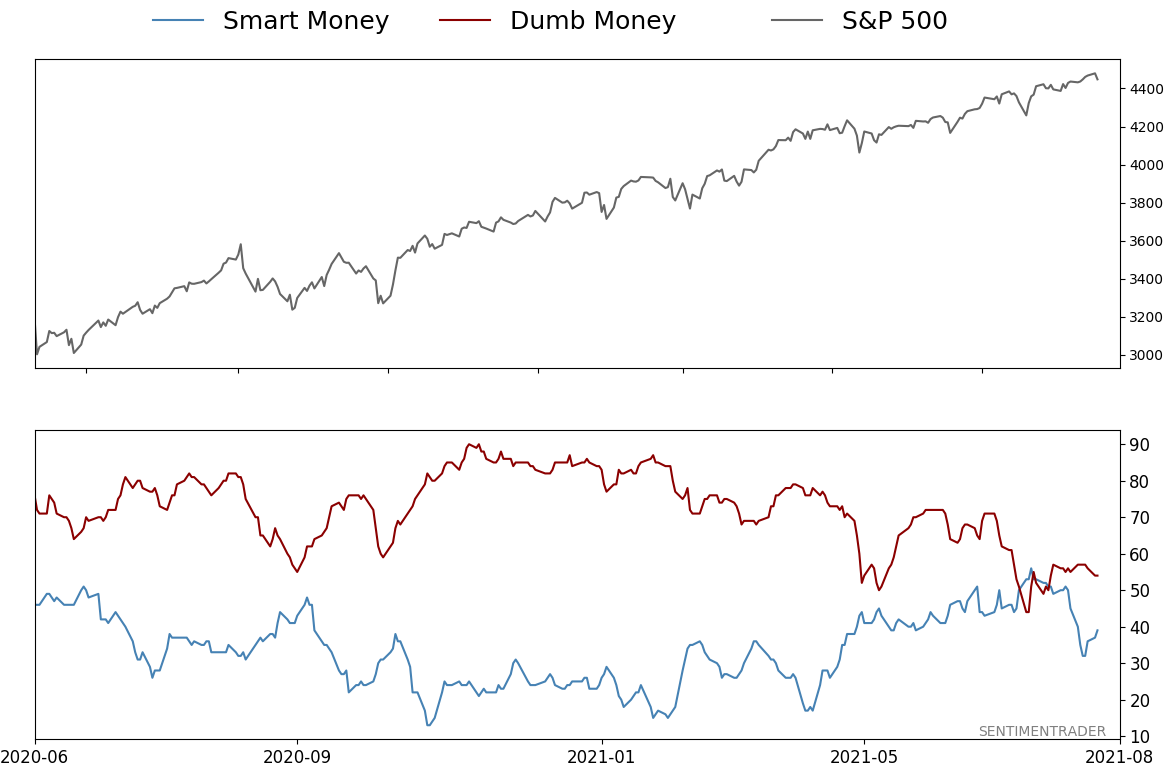

Smart / Dumb Money Confidence

|

Smart Money Confidence: 39%

Dumb Money Confidence: 54%

|

|

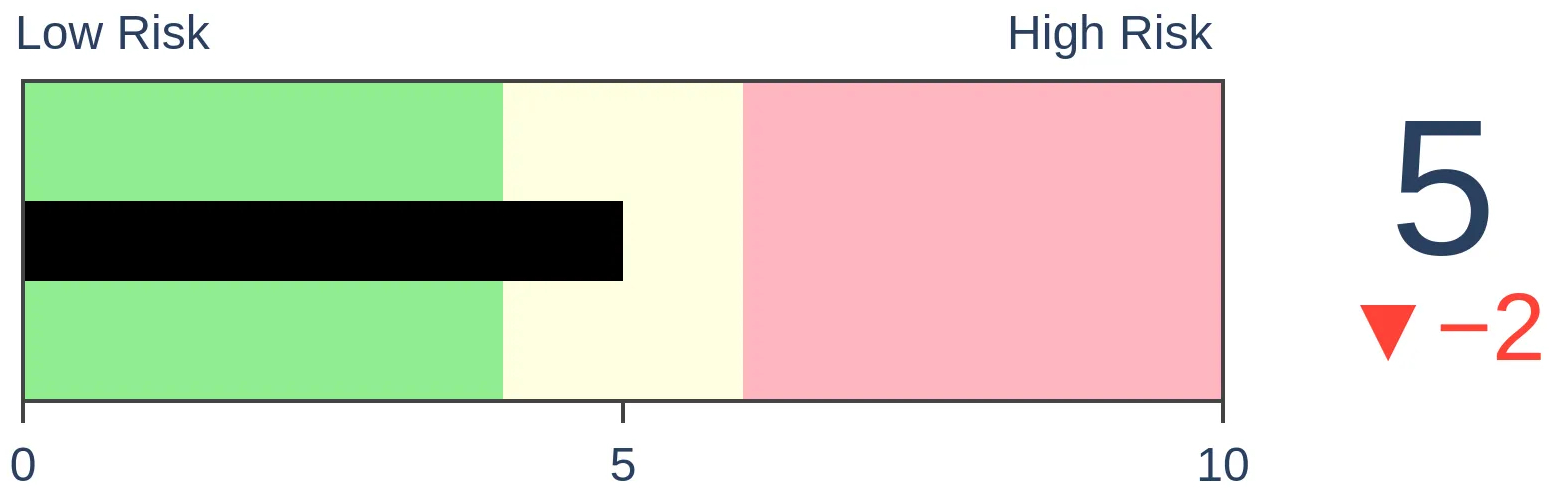

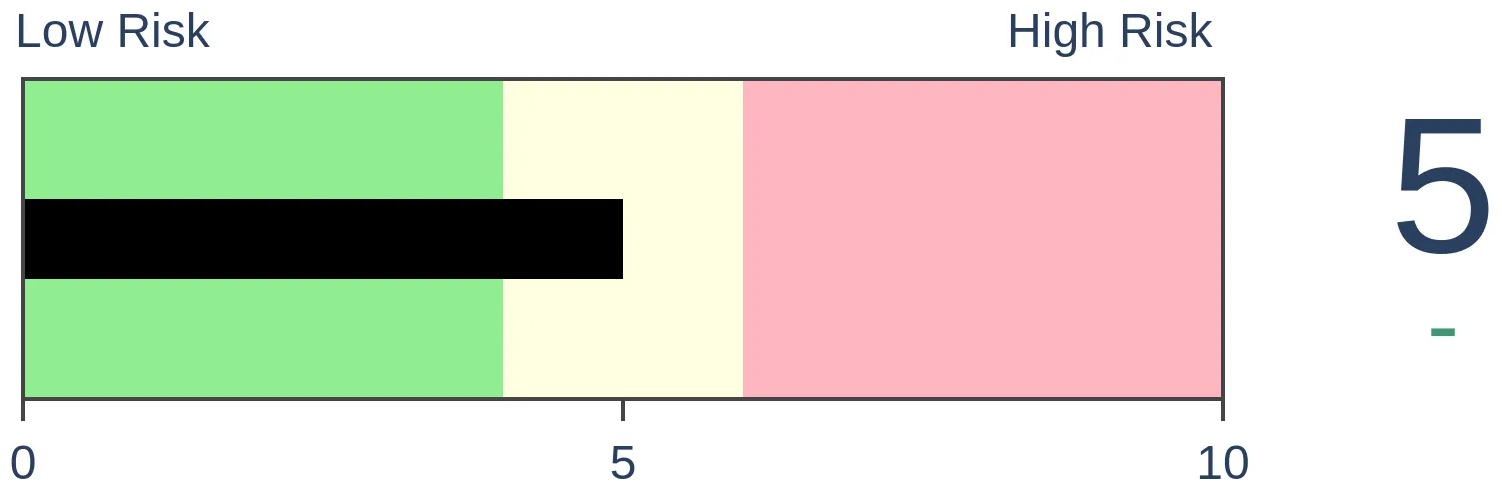

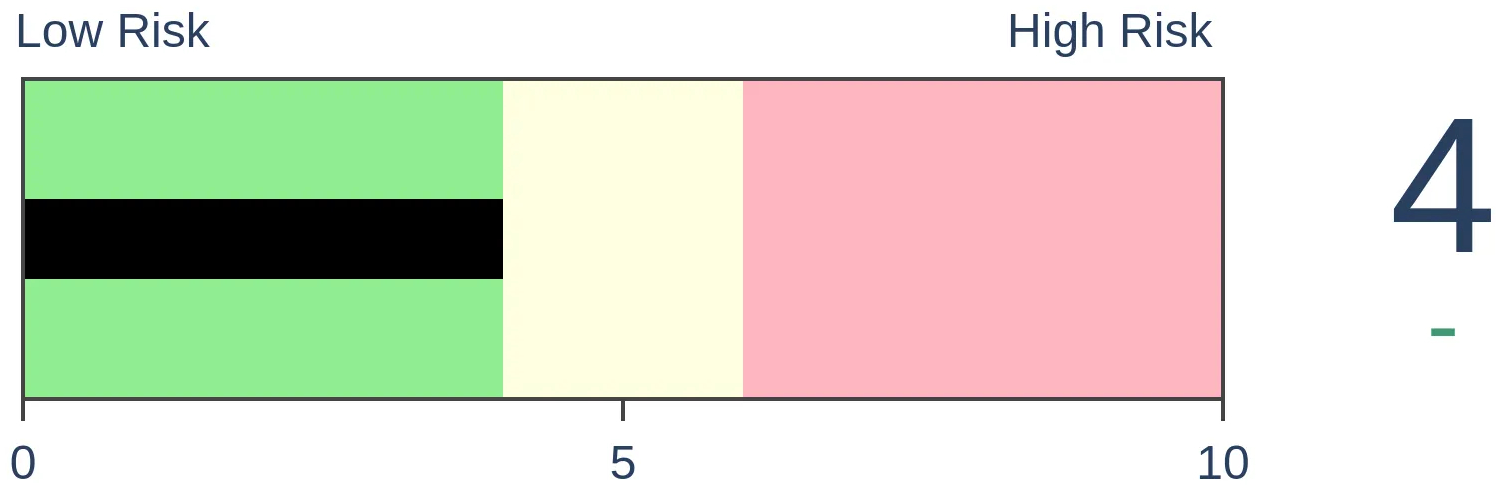

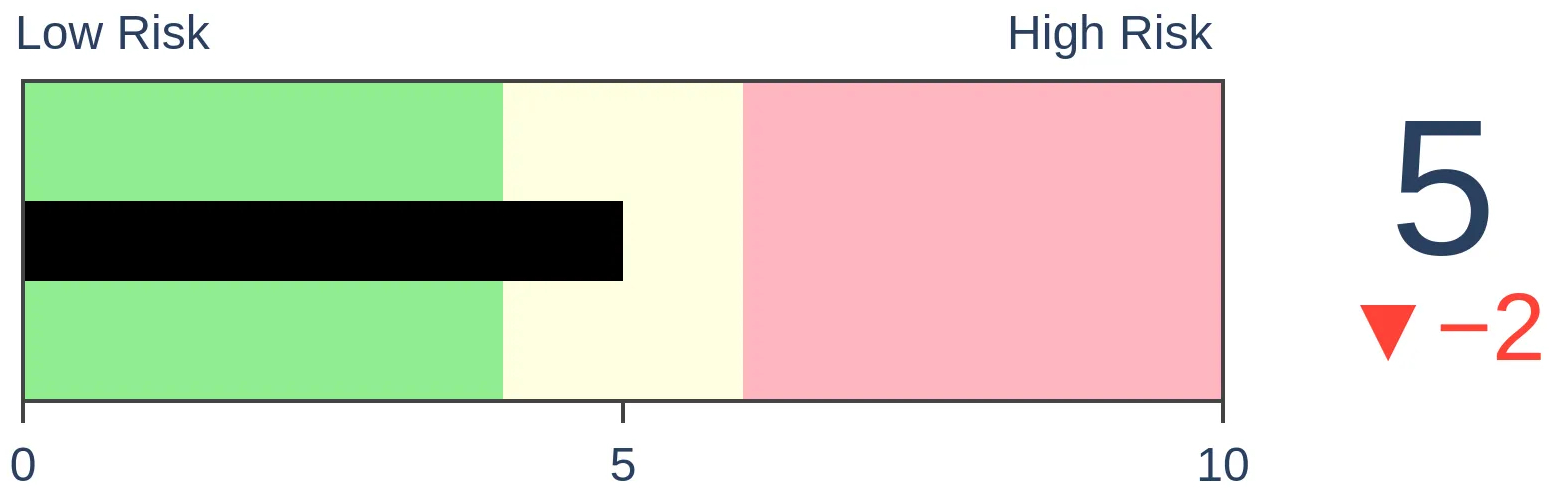

Risk Levels

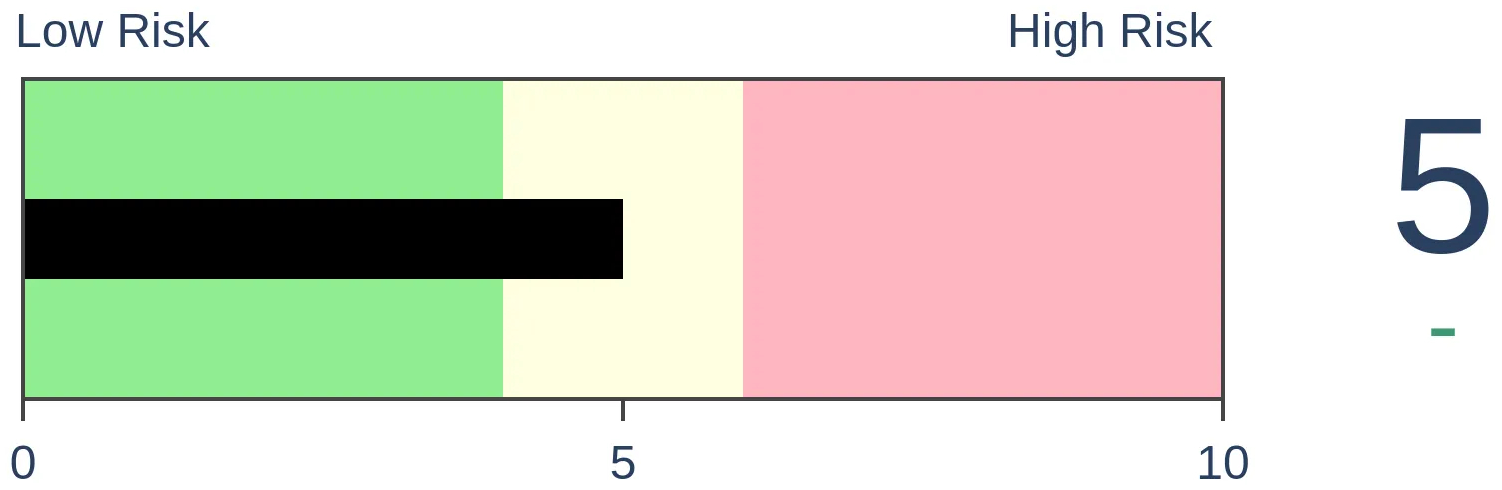

Stocks Short-Term

|

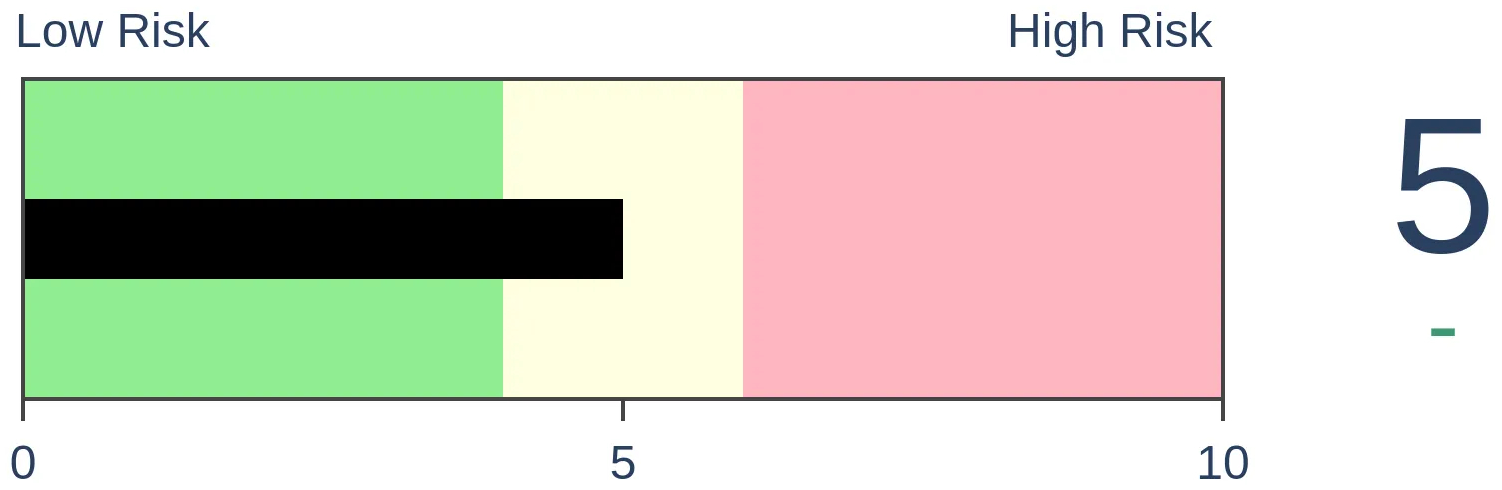

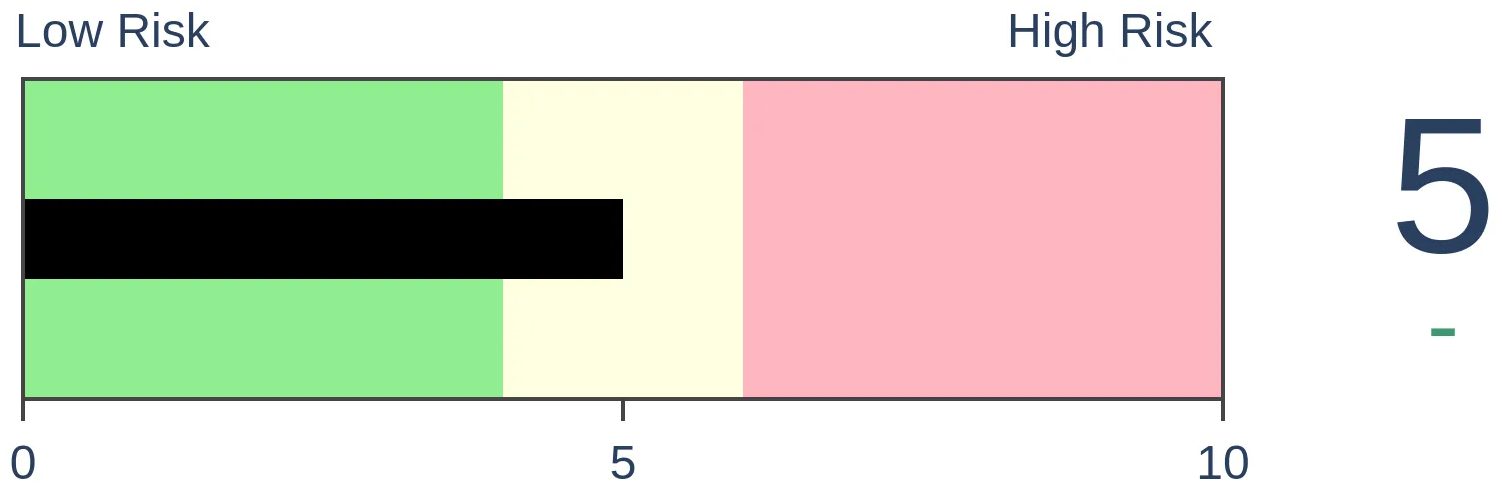

Stocks Medium-Term

|

|

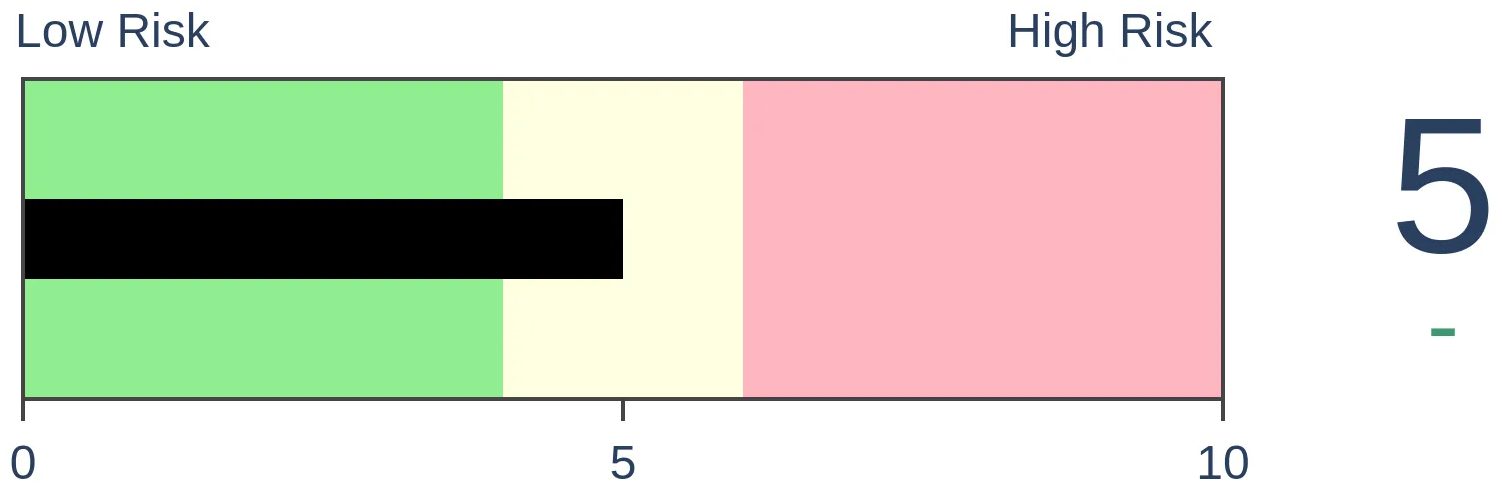

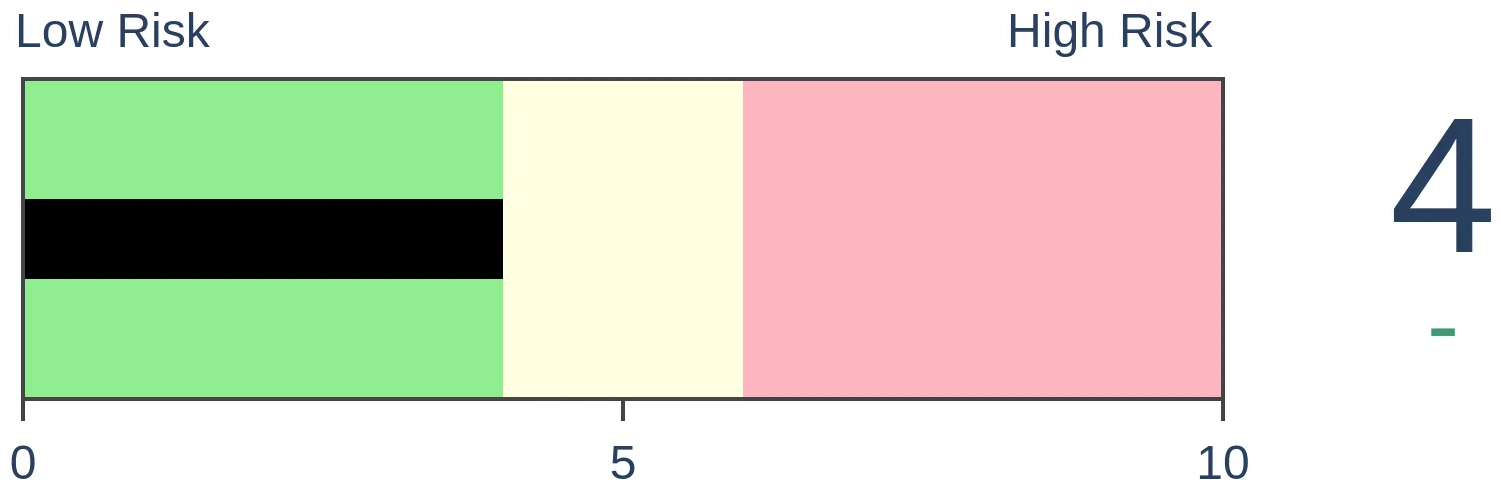

Bonds

|

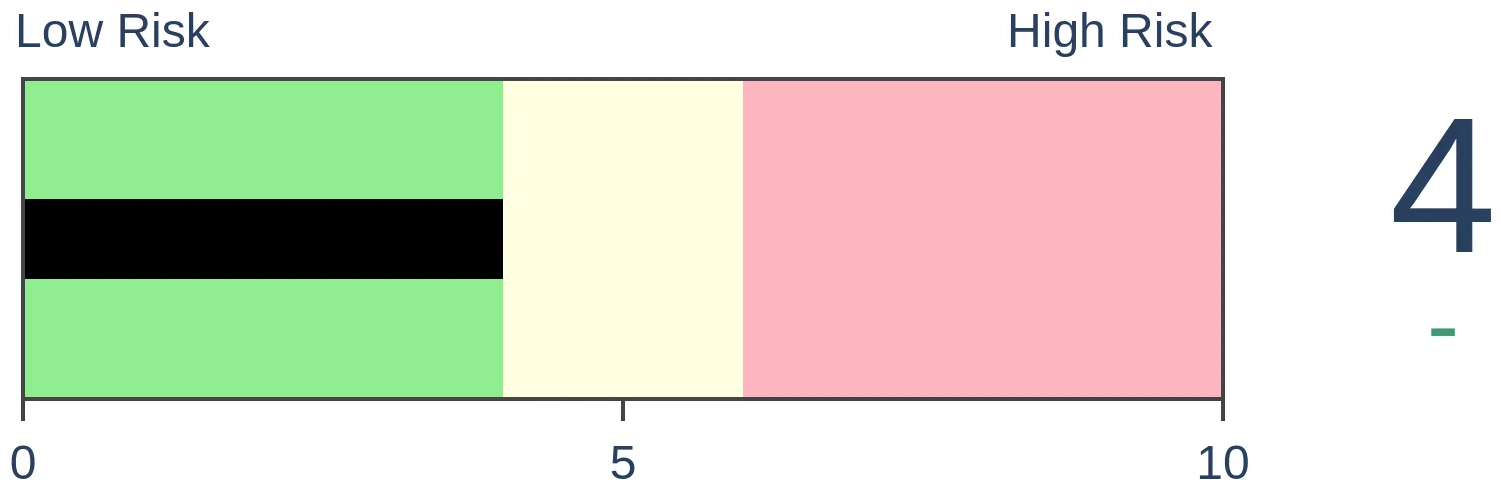

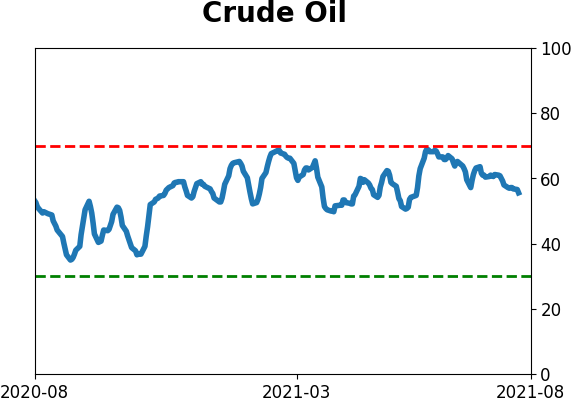

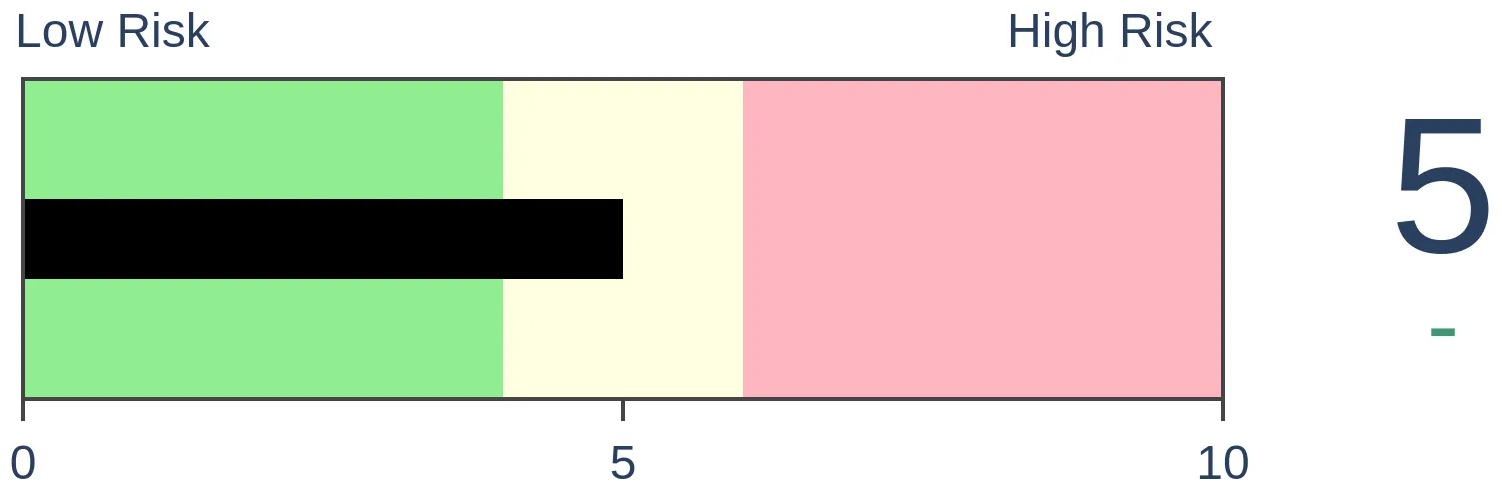

Crude Oil

|

|

Gold

|

Agriculture

|

|

Research

By Jason Goepfert

BOTTOM LINE

As the Nasdaq Composite hangs near a 52-week high, there has been a lot of internal turmoil. Its Summation Index is deeply negative, with more 52-week lows than highs. That has triggered a cluster of technical warning signs.

FORECAST / TIMEFRAME

None

|

On Monday, we saw that despite new highs in many of the major U.S. equity indexes, the old school NYSE Advance/Decline Line hadn't made a fresh high for over two months.

It's worse on the Nasdaq.

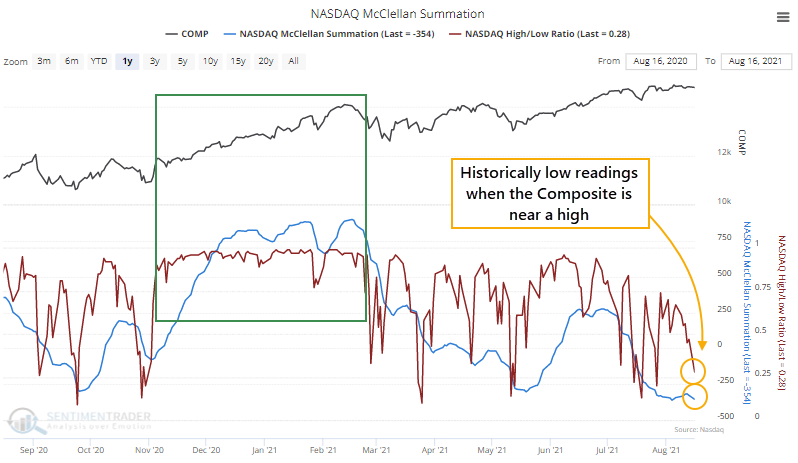

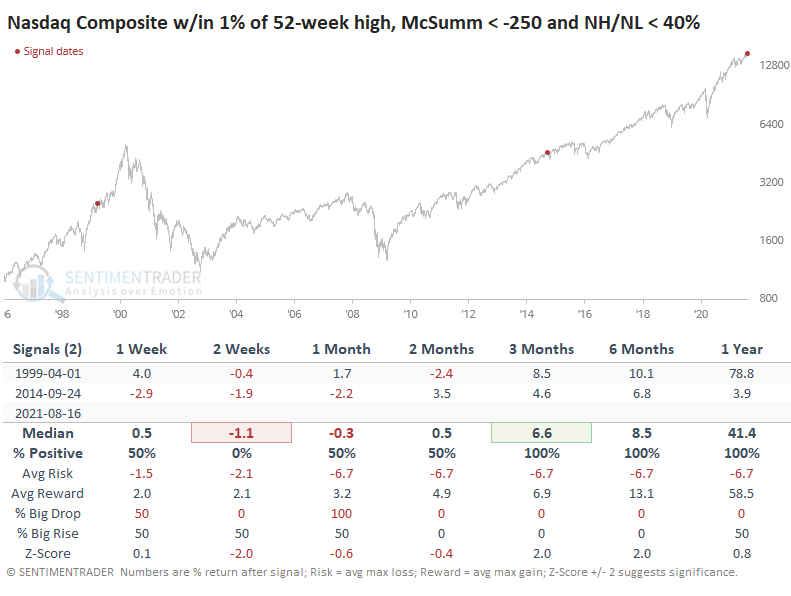

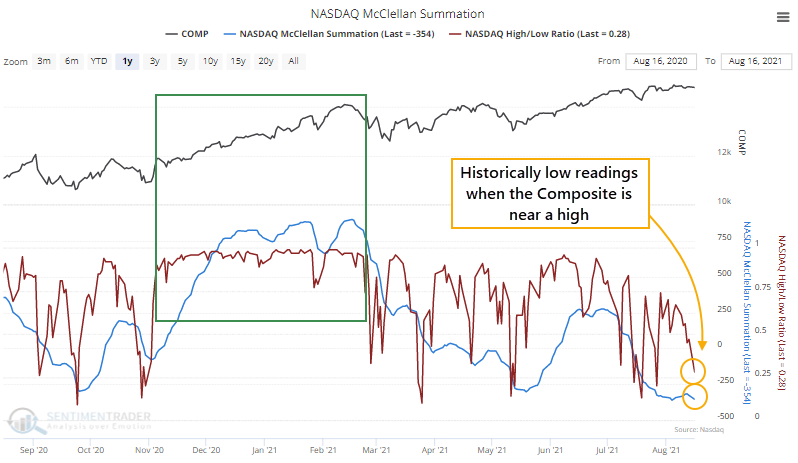

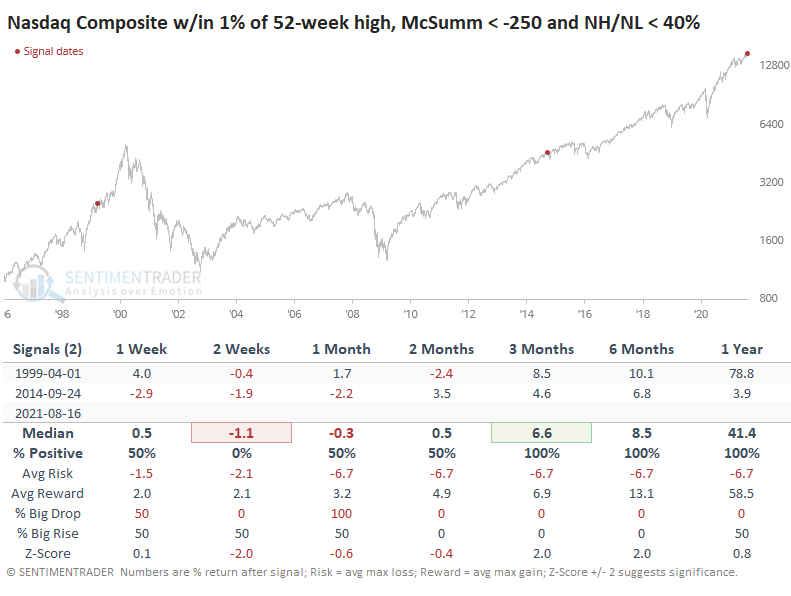

On Monday, the Nasdaq Composite closed within 1% of a 52-week high, and yet two long-term measures of breadth on that exchange fell to very low levels. The McClellan Summation Index closed below -350, and the New High / New Low Ratio was below 30%.

Those are the worst figures in history, dating back to 1986, for a day when the Composite was so near a high. It's in stark contrast to the huge positive momentum thrust from November through February.

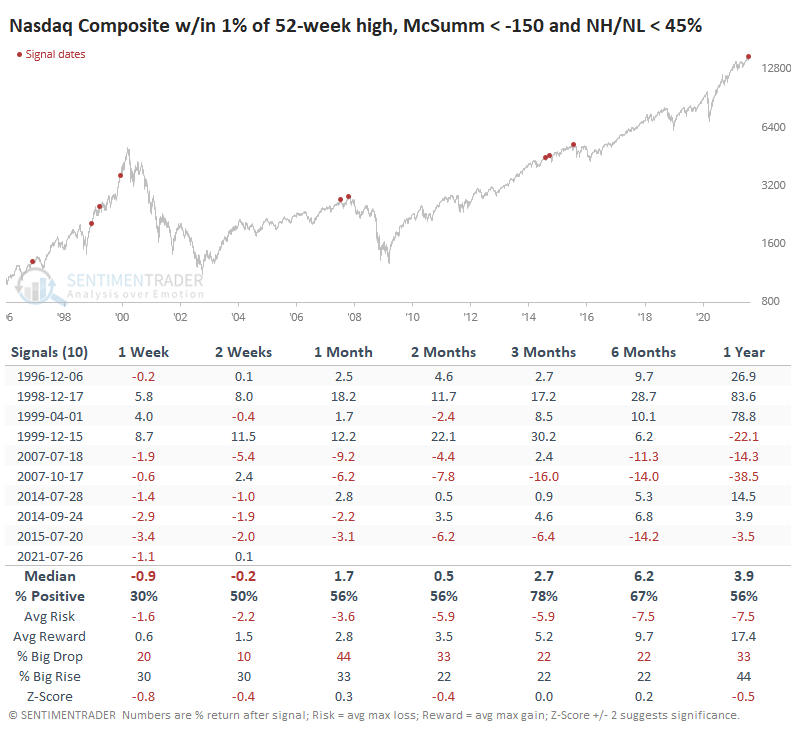

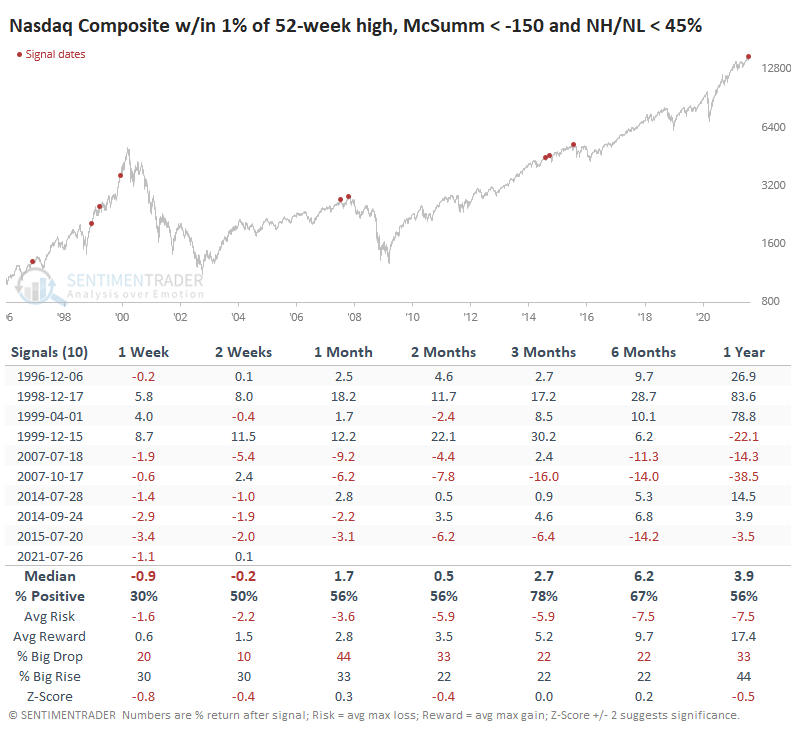

There are only two dates that come close to the current divergences in those indicators. Both times, the Nasdaq took a short-term tumble, with a poor risk/reward ratio, but both times the Nasdaq also recovered in the months ahead.

Looking at lesser extremes, there was still a tendency to see a short-term shakeout. Every signal since 2007 has led to short-term losses in the Composite.

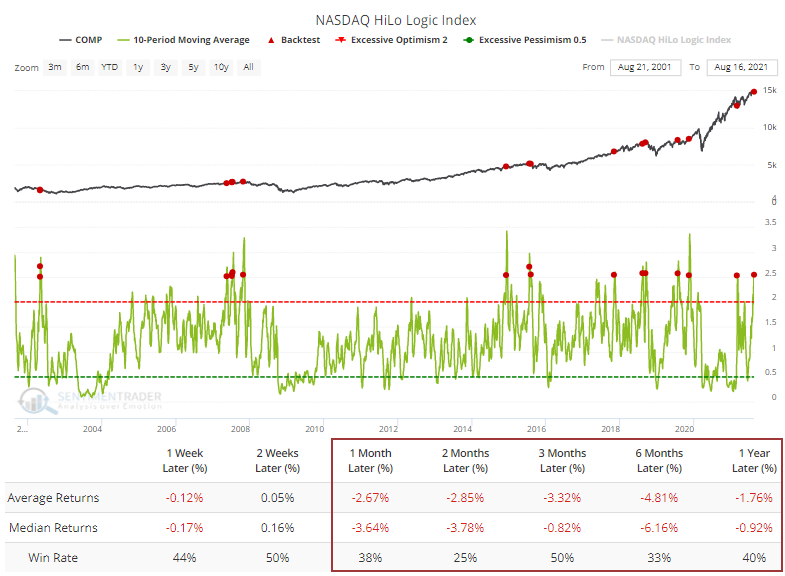

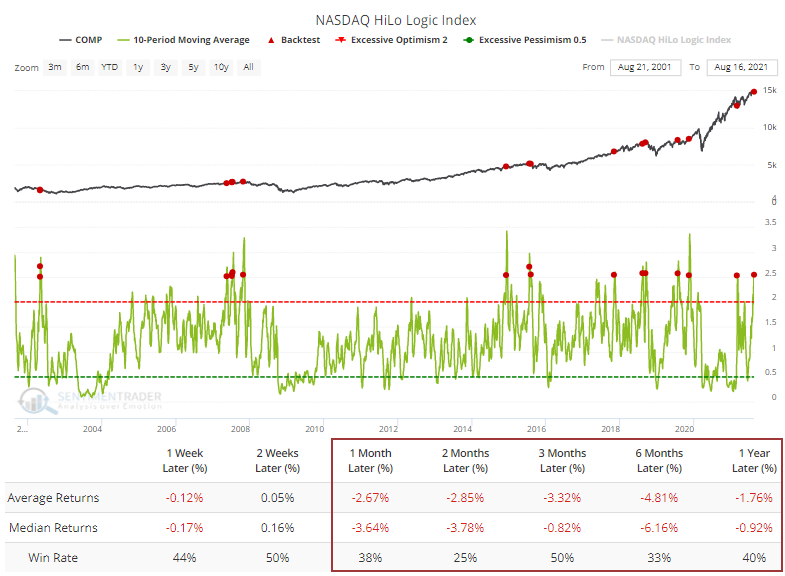

The fact that there are so many 52-week highs and 52-week lows simultaneously means that the HiLo Logic Index has spiked. The 10-day average moved above 2.5, which the Backtest Engine shows has been a terrible sign during the past 20 years.

Only 4 of the 16 dates showed a positive return over the next two months. Bulls could argue that two of those dates were the most recent ones, which somewhat reduces the bearish argument.

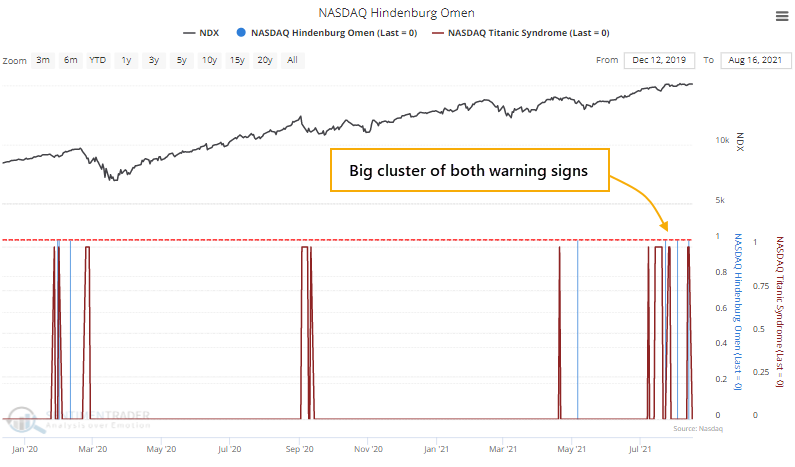

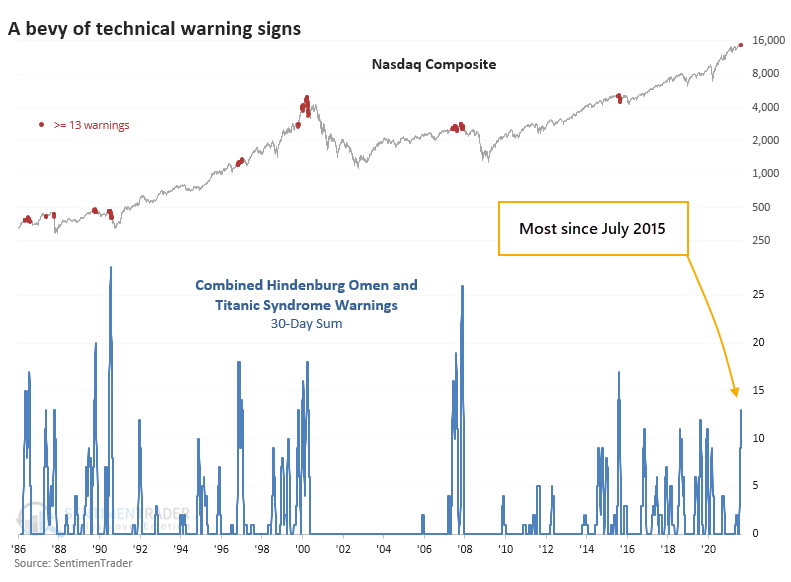

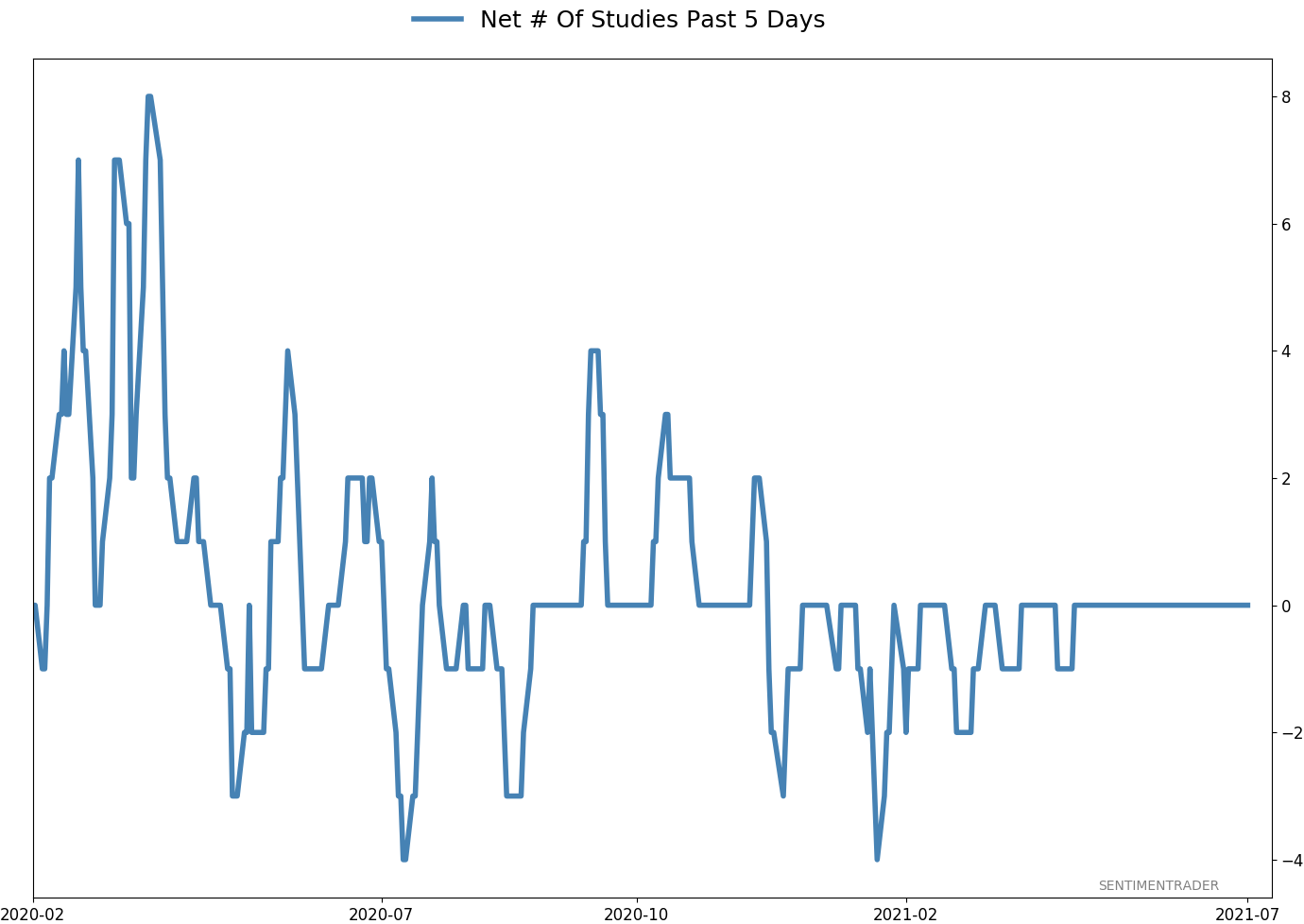

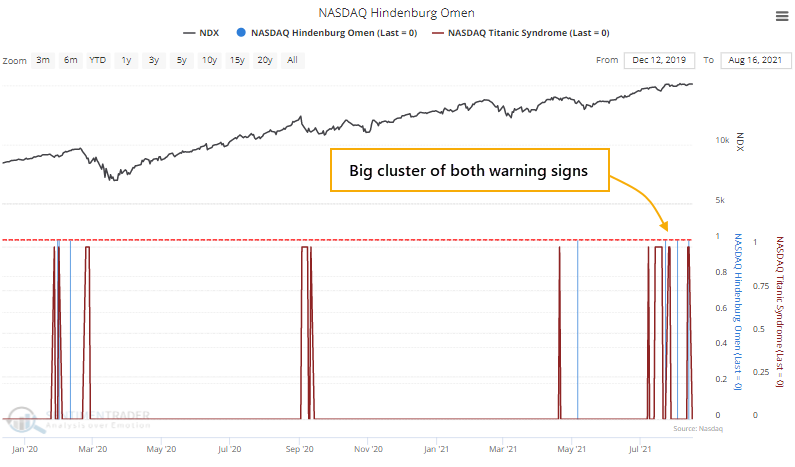

This internal tumult has been triggering some technical warning signs, such as the Hindenburg Omen and Titanic Syndrome for the Nasdaq exchange.

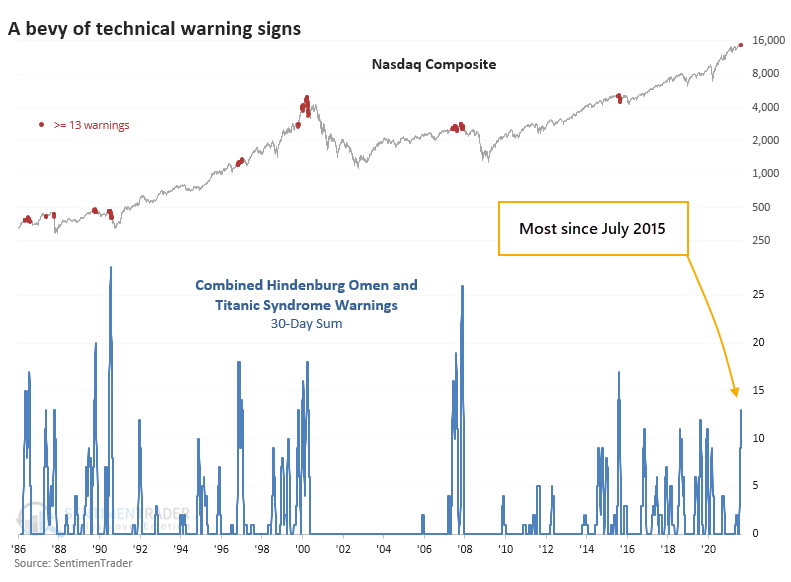

Over the past 30 sessions, a combined 13 signals have been triggered, the most in six years.

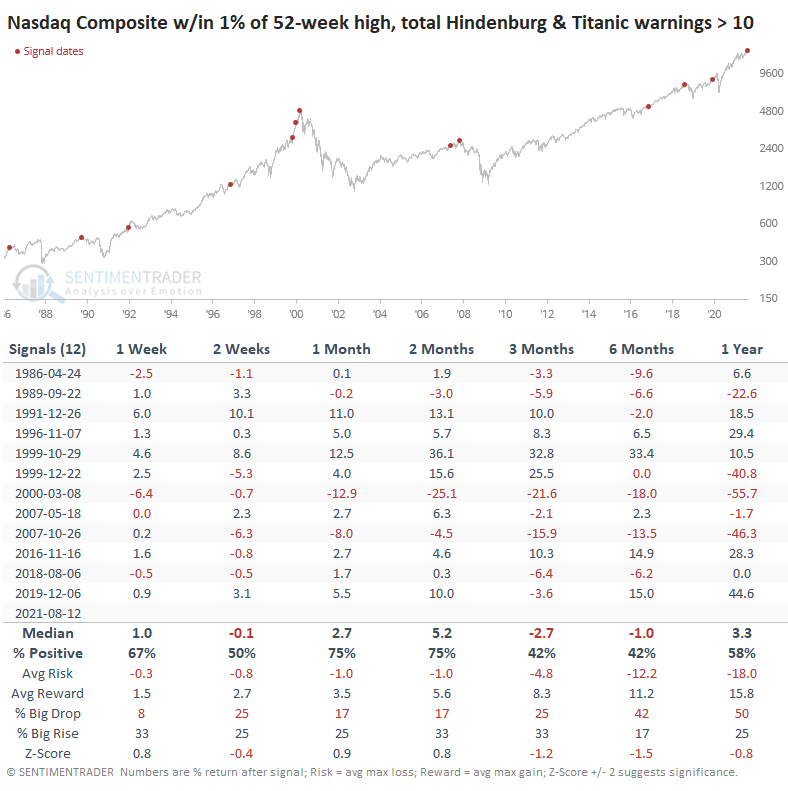

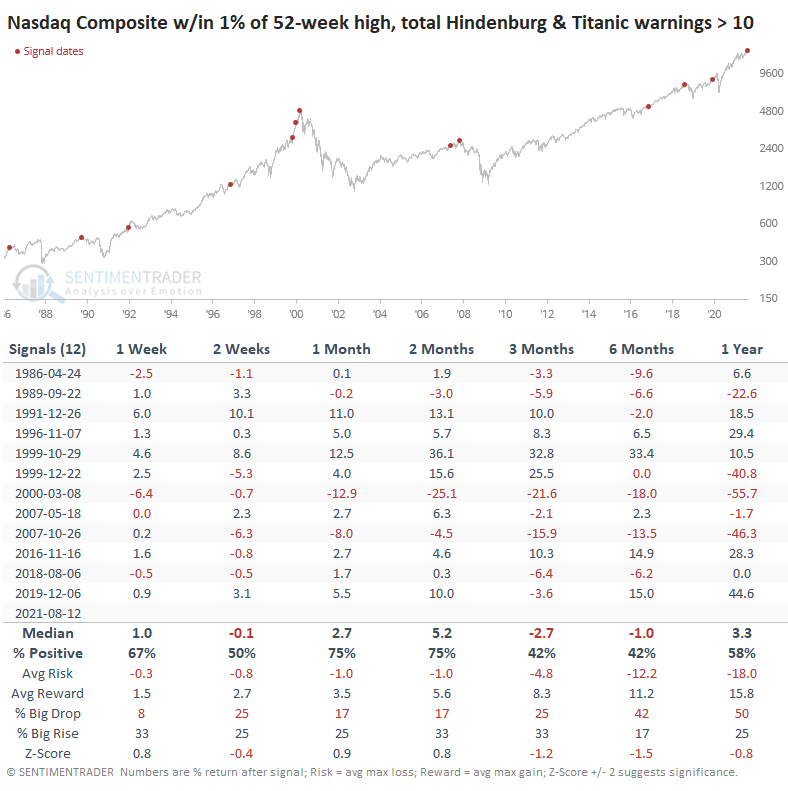

When there has been such a cluster of signals with the Composite within spitting distance of a new high, trouble was brewing most of the time. The Nasdaq escaped any damage in 1996, 1999 (for a while), and 2016 but otherwise witnessed high volatility and negative returns.

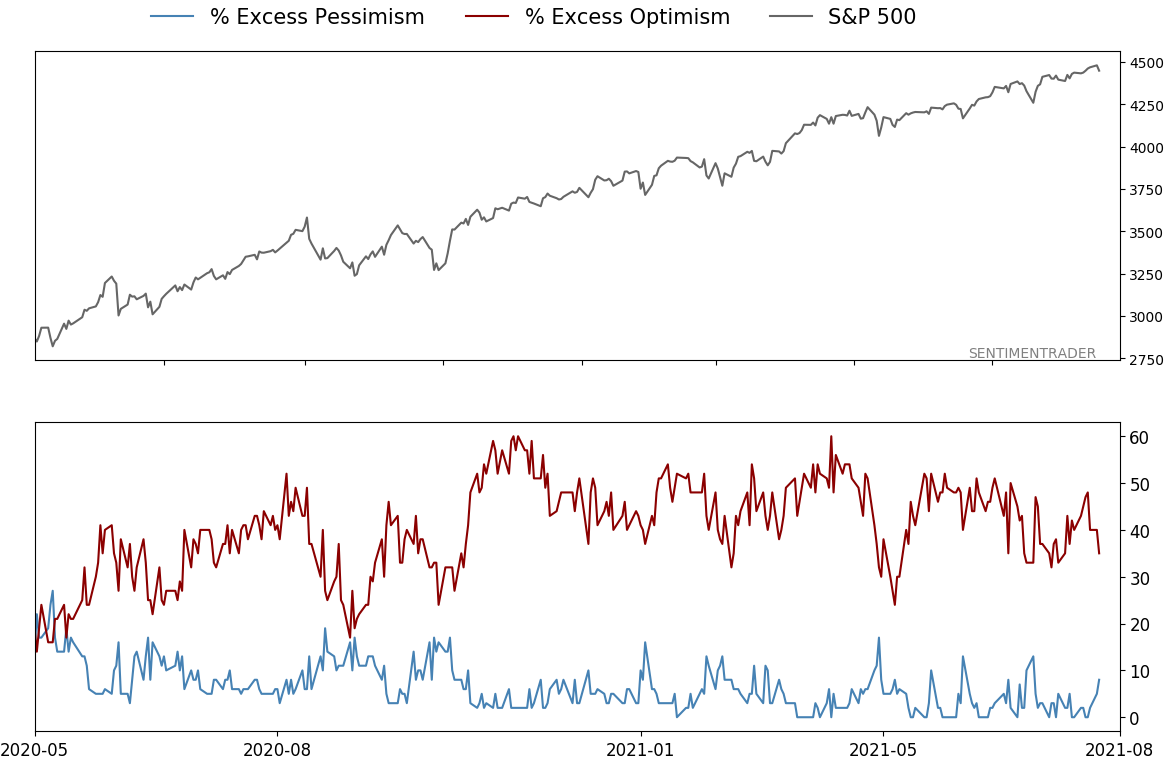

This year has been one for the record books on several different fronts. It's frustrating that one of those fronts is the number of methods that have failed to precede the kind of price action that they normally do. Sentiment extremes, breadth divergences, price patterns, seasonality - all have gone by the wayside as the creeper trend prevails.

This happened in 2013-14, which led to a choppy 2015. And it happened in 2017, which led to a rocky 2018. After the speculative blow-off in late January - early February of this year, we've been on the lookout for major deterioration under the surface of the indexes. There have been periodic bouts of that since then, and the indexes have almost immediately recovered. We'll have to see if this is yet another episode.

Active Studies

| Time Frame | Bullish | Bearish | | Short-Term | 0 | 4 | | Medium-Term | 4 | 3 | | Long-Term | 10 | 5 |

|

Indicators at Extremes

Portfolio

| Position | Description | Weight % | Added / Reduced | Date | | Stocks | RSP | 4.1 | Added 4.1% | 2021-05-19 | | Bonds | 23.9% BND, 6.9% SCHP | 30.7 | Reduced 7.1% | 2021-05-19 | | Commodities | GCC | 2.6 | Reduced 2.1%

| 2020-09-04 | | Precious Metals | GDX | 5.6 | Reduced 4.2% | 2021-05-19 | | Special Situations | 4.3% XLE, 2.2% PSCE | 7.6 | Reduced 5.6% | 2021-04-22 | | Cash | | 49.4 | | |

|

Updates (Changes made today are underlined)

Much of our momentum and trend work has remained positive for several months, with some scattered exceptions. Almost all sentiment-related work has shown a poor risk/reward ratio for stocks, especially as speculation drove to record highs in exuberance in February. Much of that has worn off, and most of our models are back toward neutral levels. There isn't much to be excited about here. The same goes for bonds and even gold. Gold has been performing well lately and is back above long-term trend lines. The issue is that it has a poor record of holding onto gains when attempting a long-term trend change like this, so we'll take a wait-and-see approach. RETURN YTD: 8.2% 2020: 8.1%, 2019: 12.6%, 2018: 0.6%, 2017: 3.8%, 2016: 17.1%, 2015: 9.2%, 2014: 14.5%, 2013: 2.2%, 2012: 10.8%, 2011: 16.5%, 2010: 15.3%, 2009: 23.9%, 2008: 16.2%, 2007: 7.8%

|

|

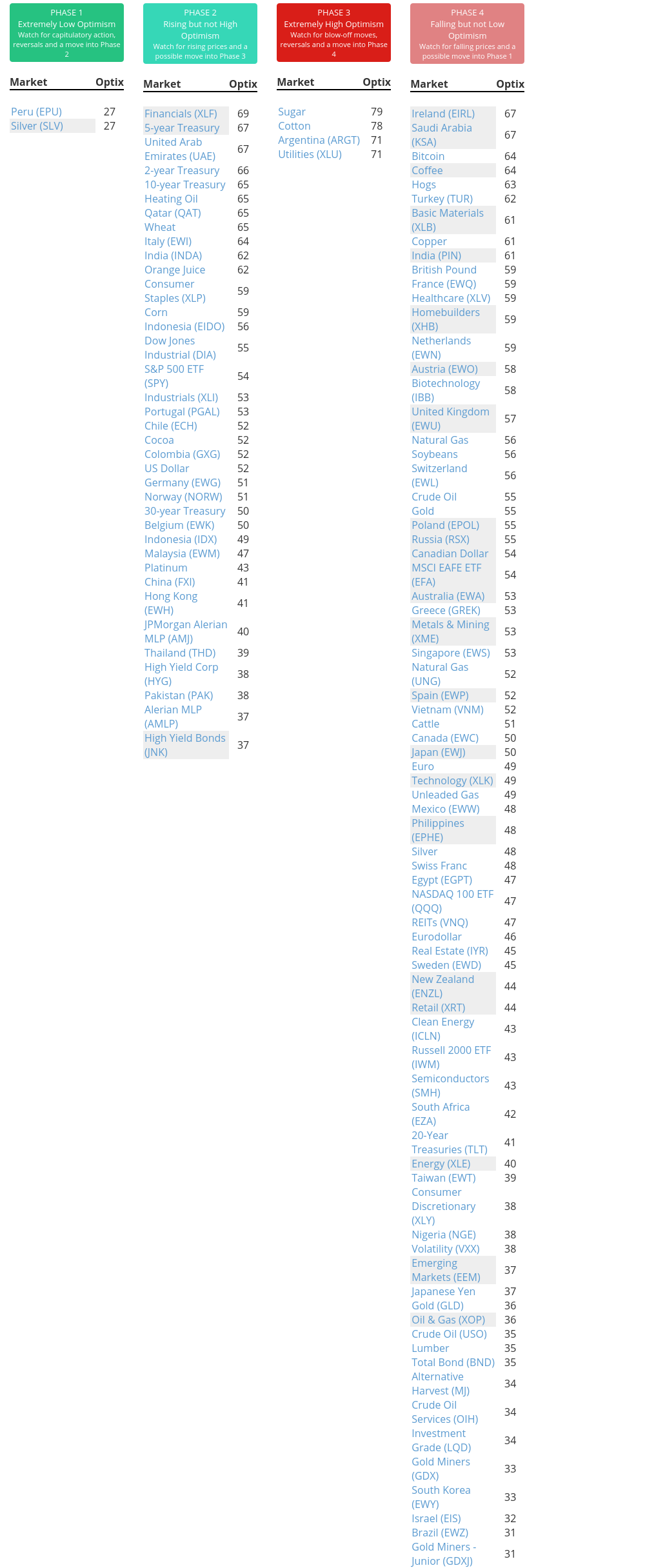

Phase Table

Ranks

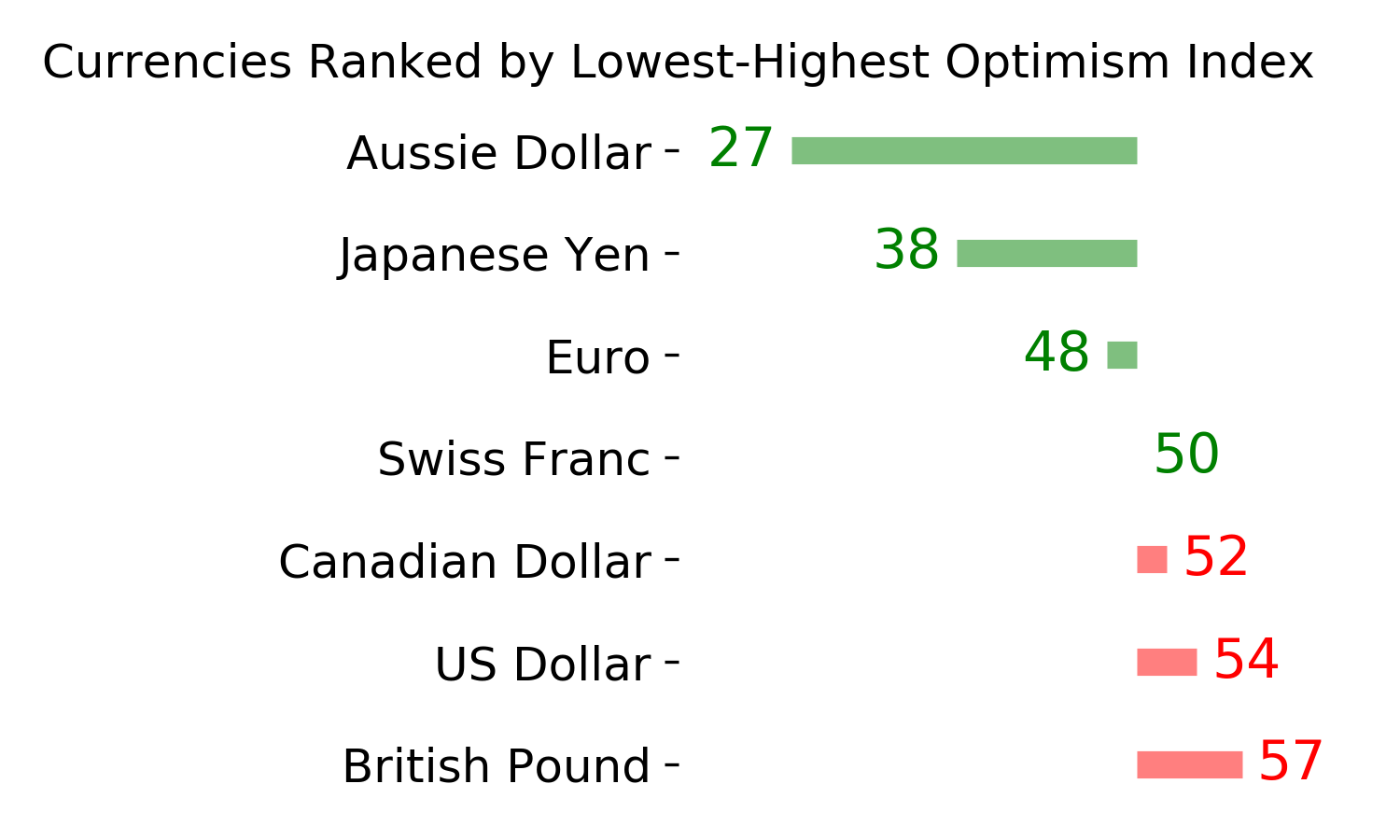

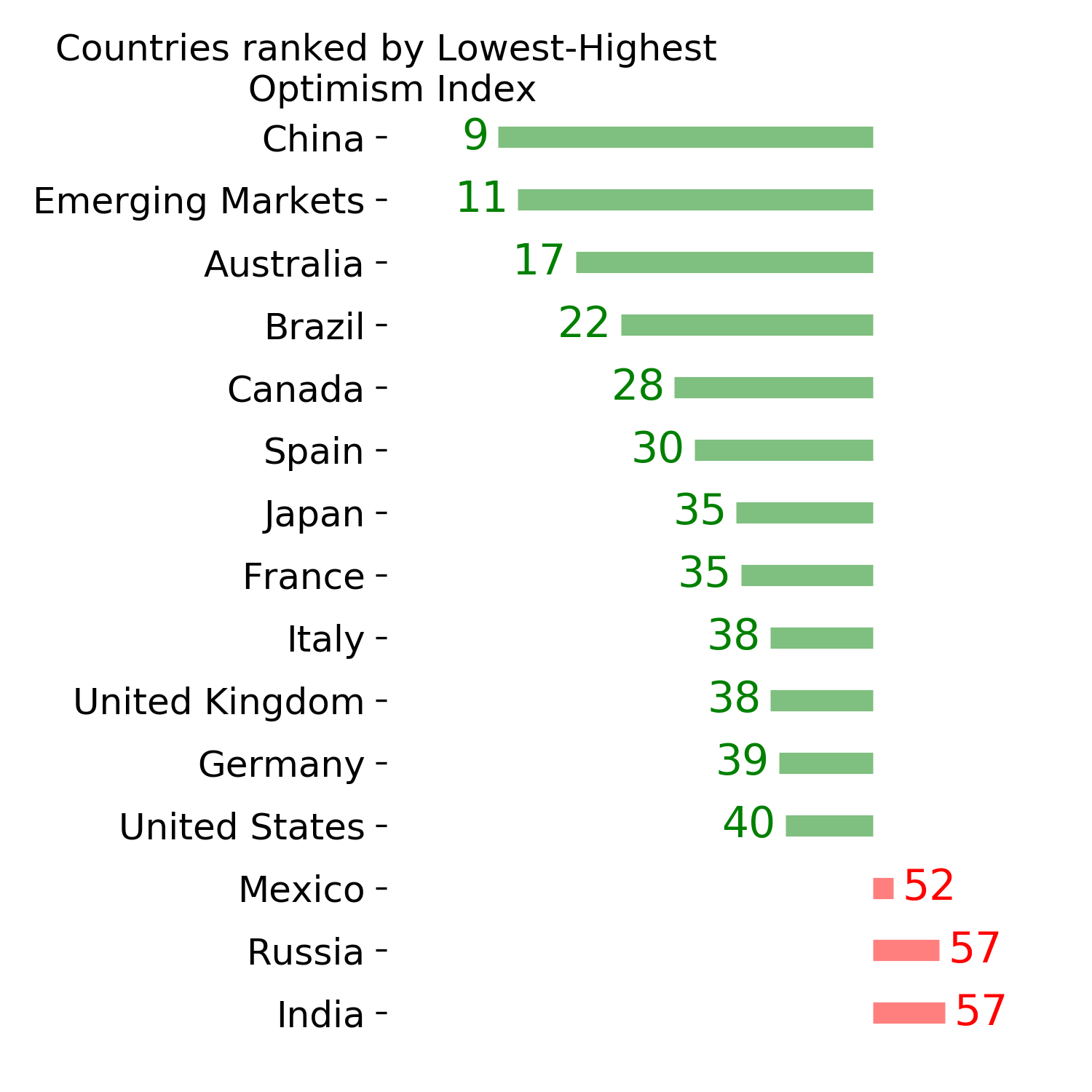

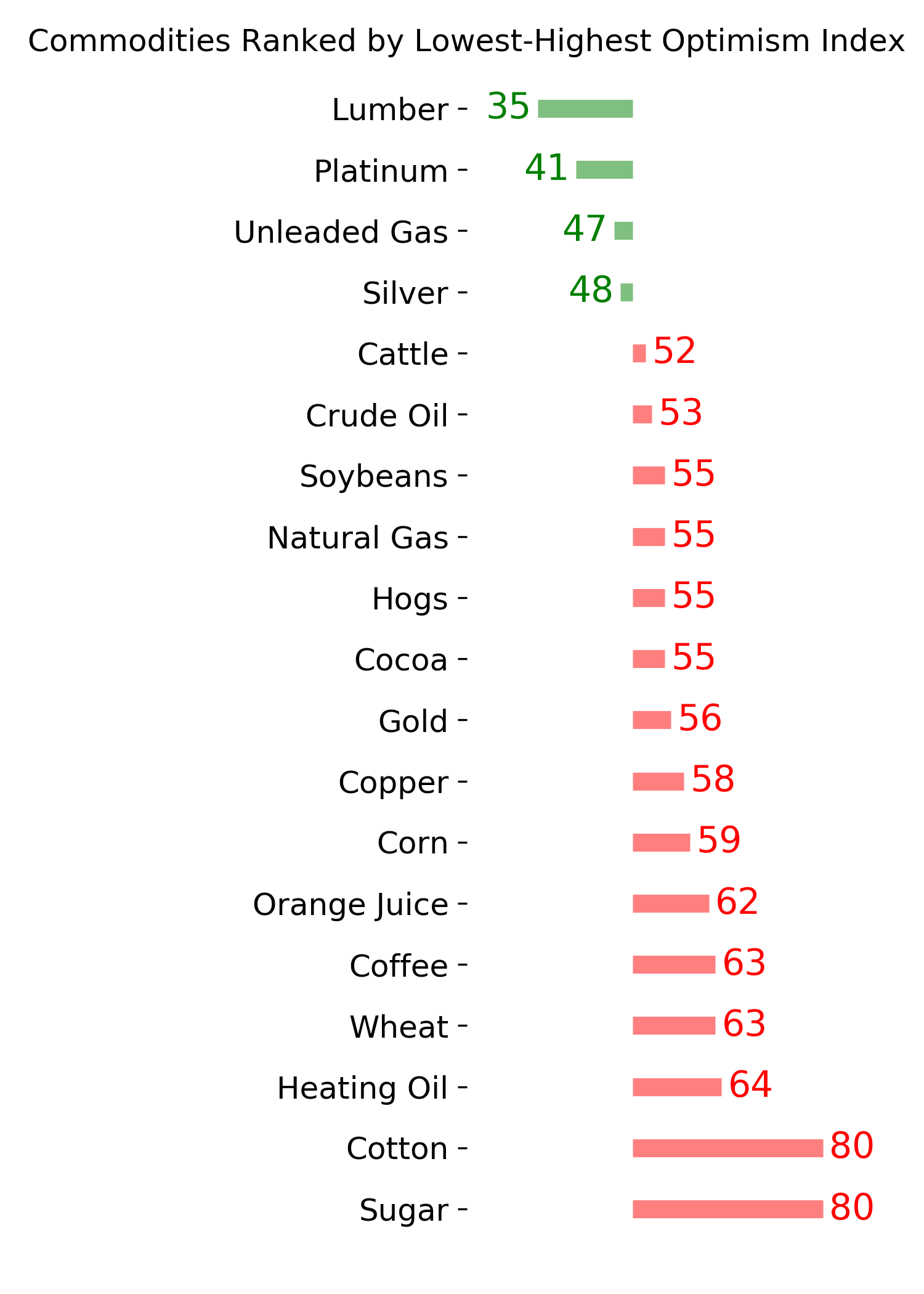

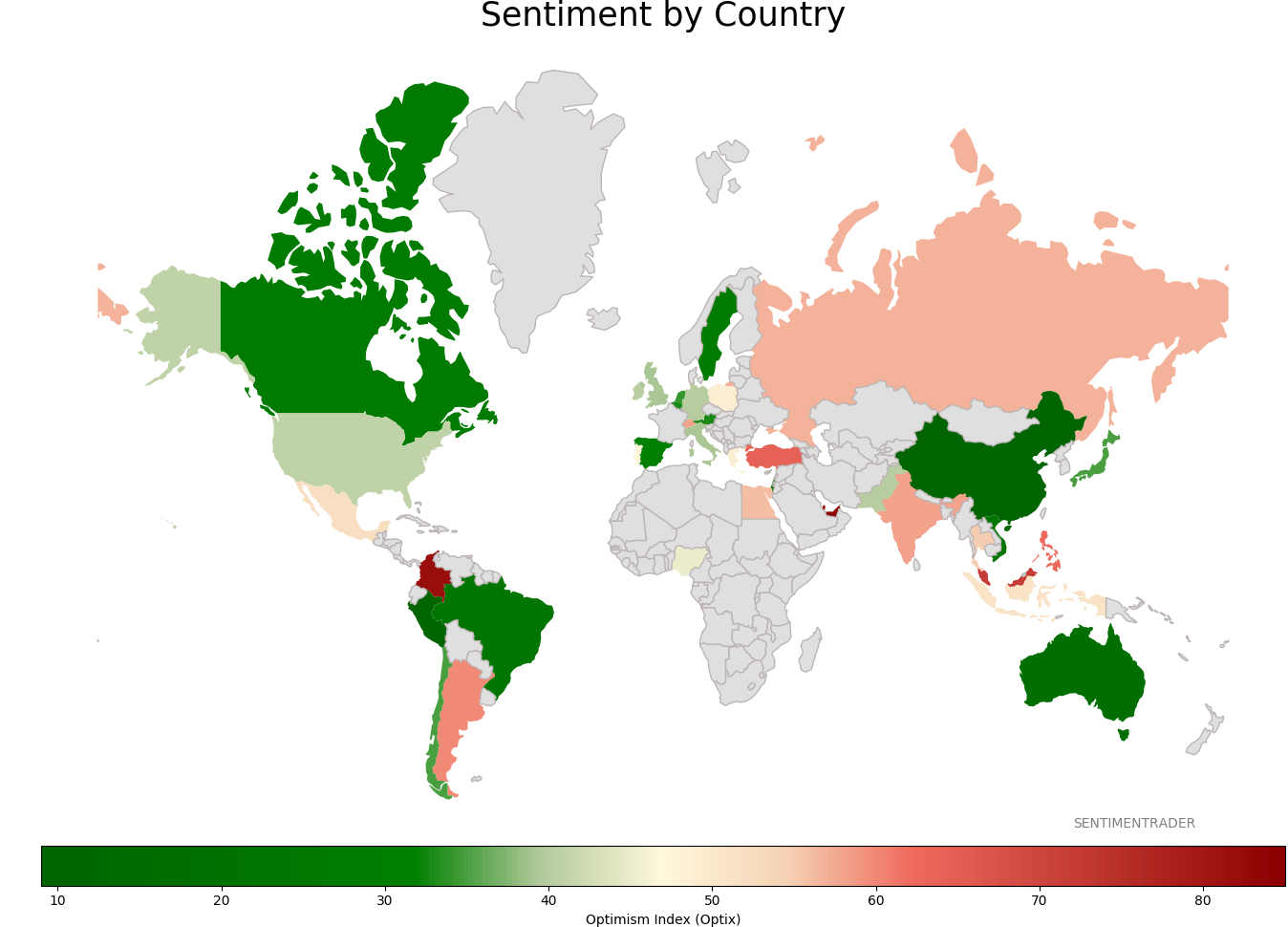

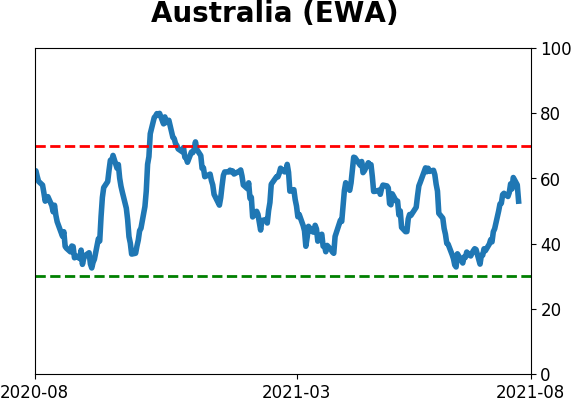

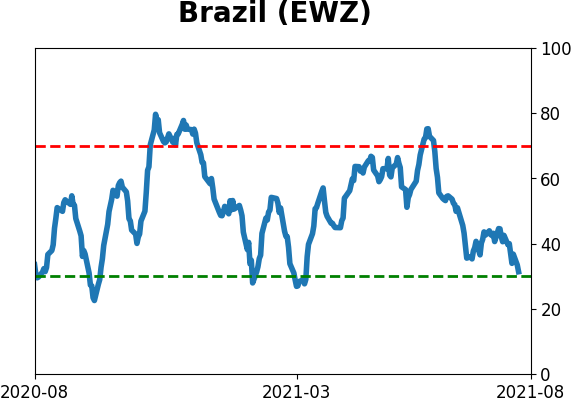

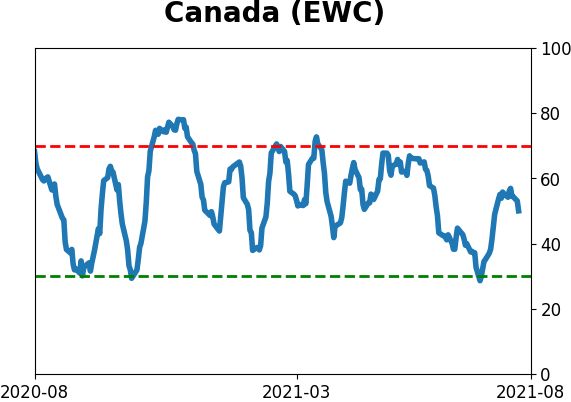

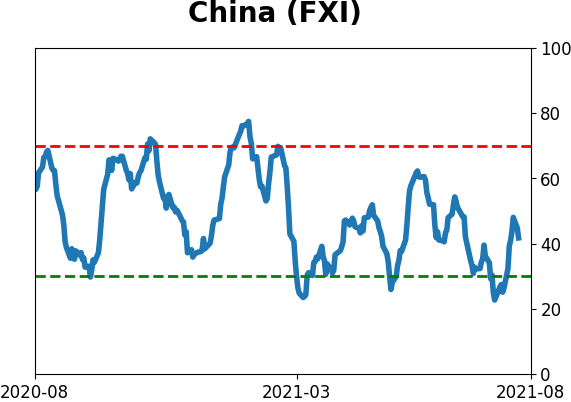

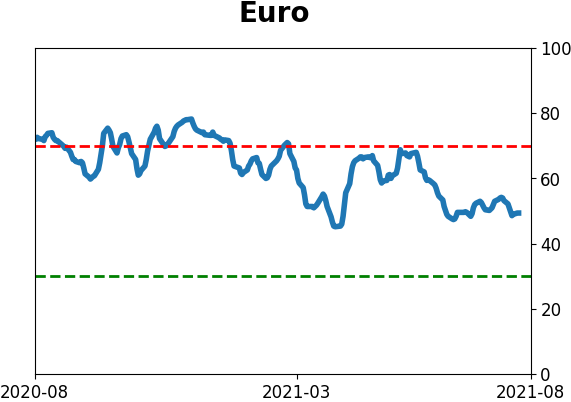

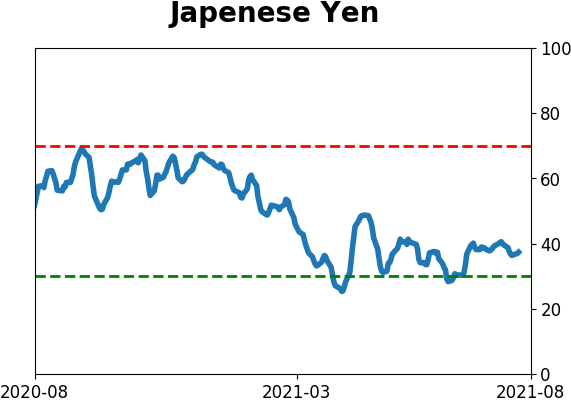

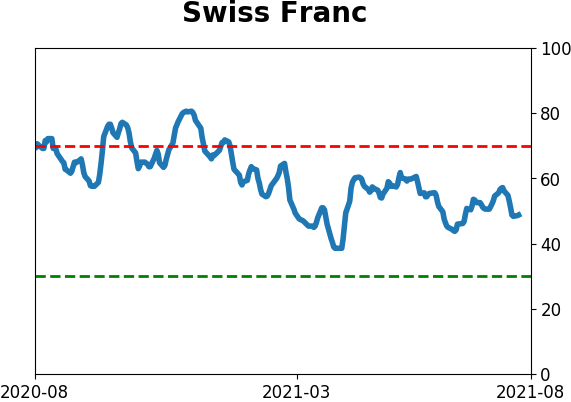

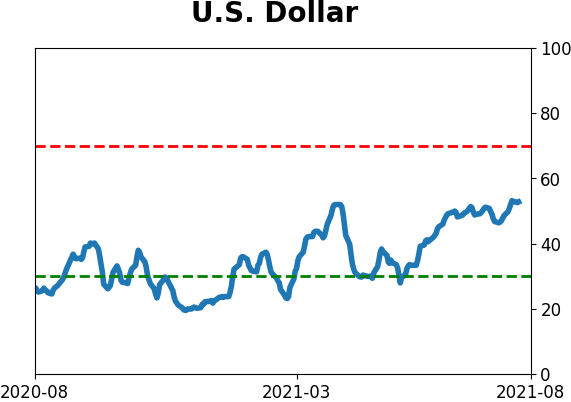

Sentiment Around The World

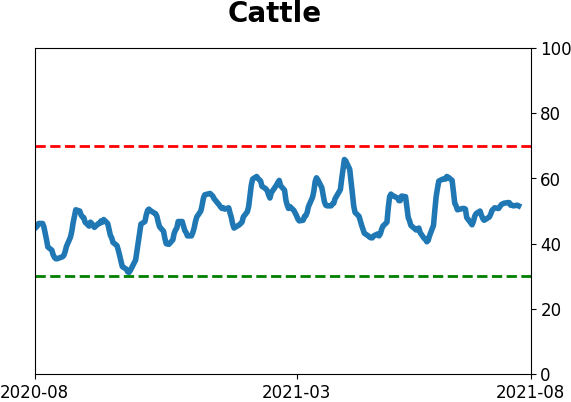

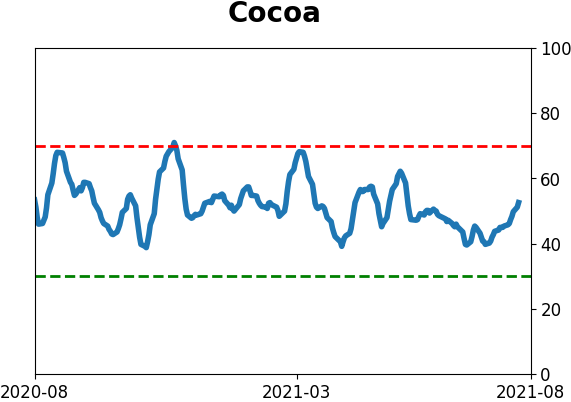

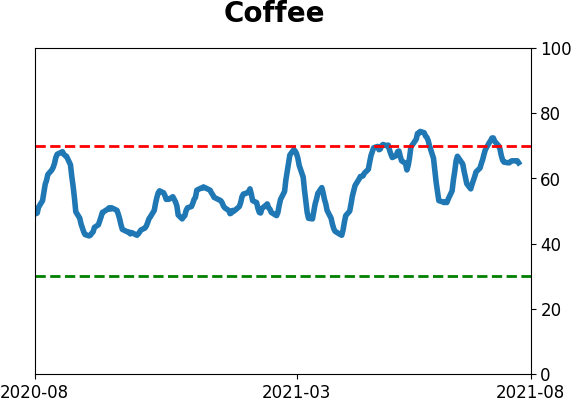

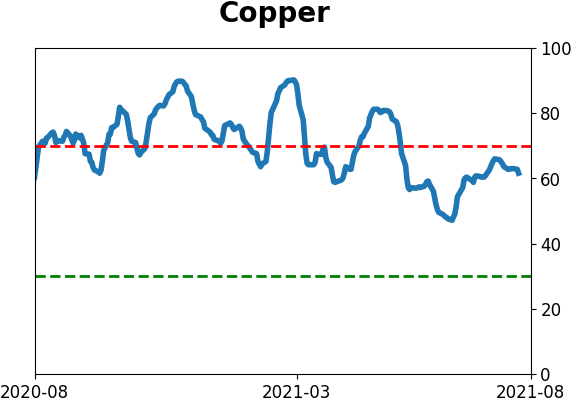

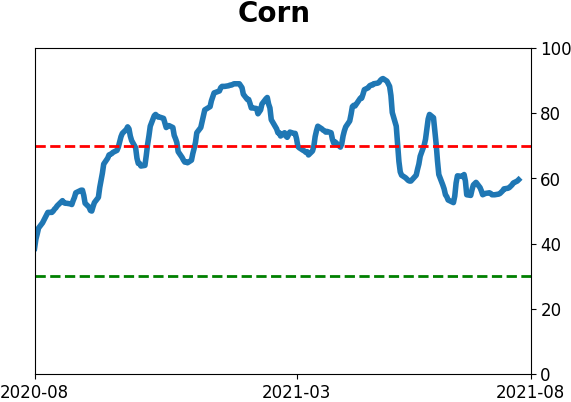

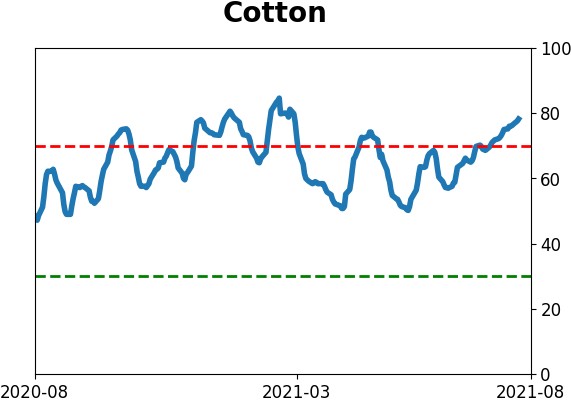

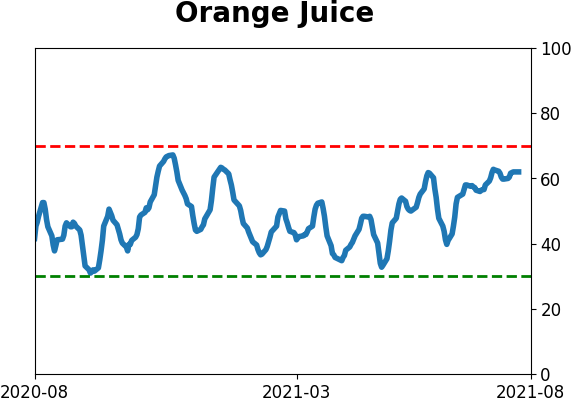

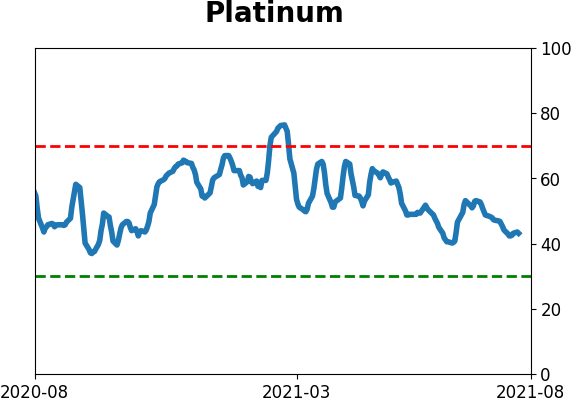

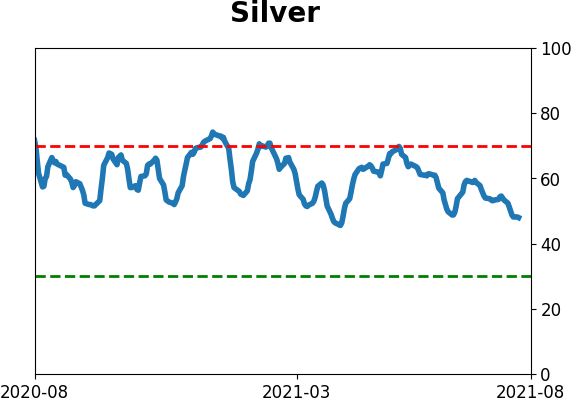

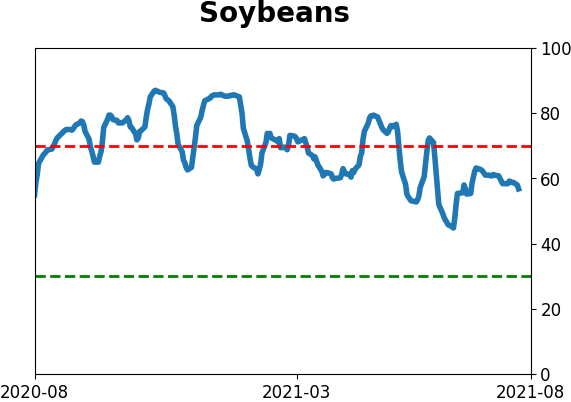

Optimism Index Thumbnails

|

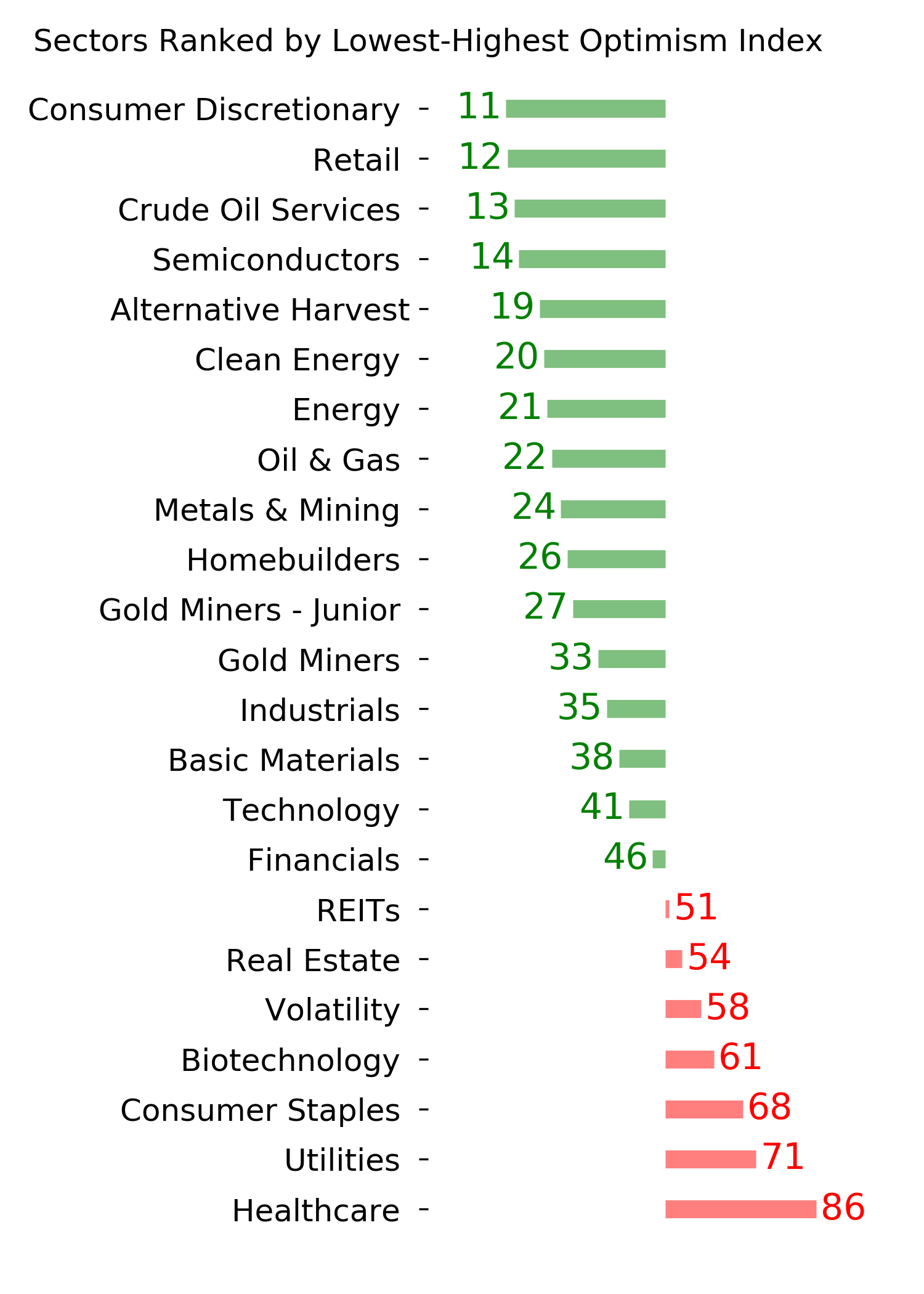

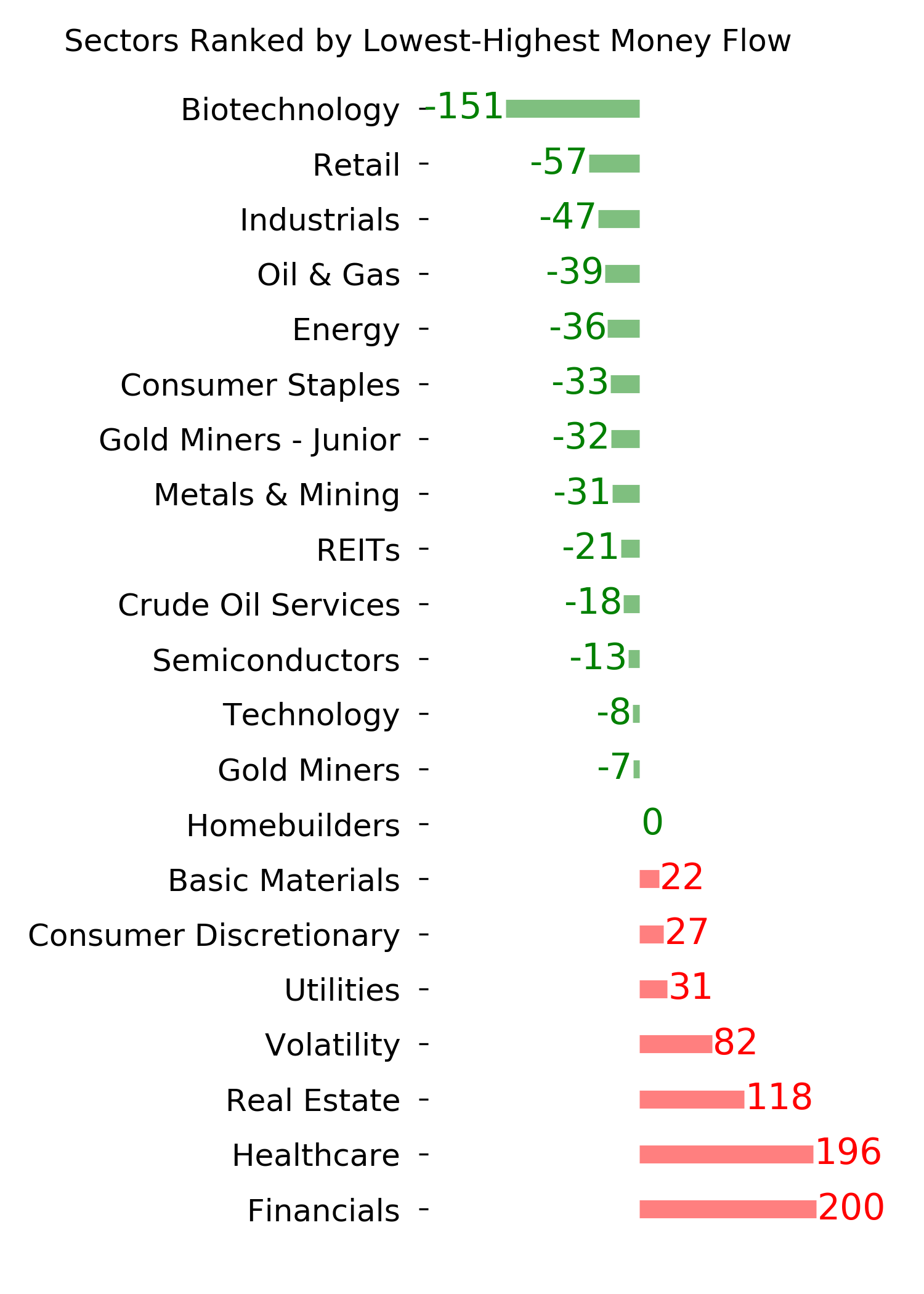

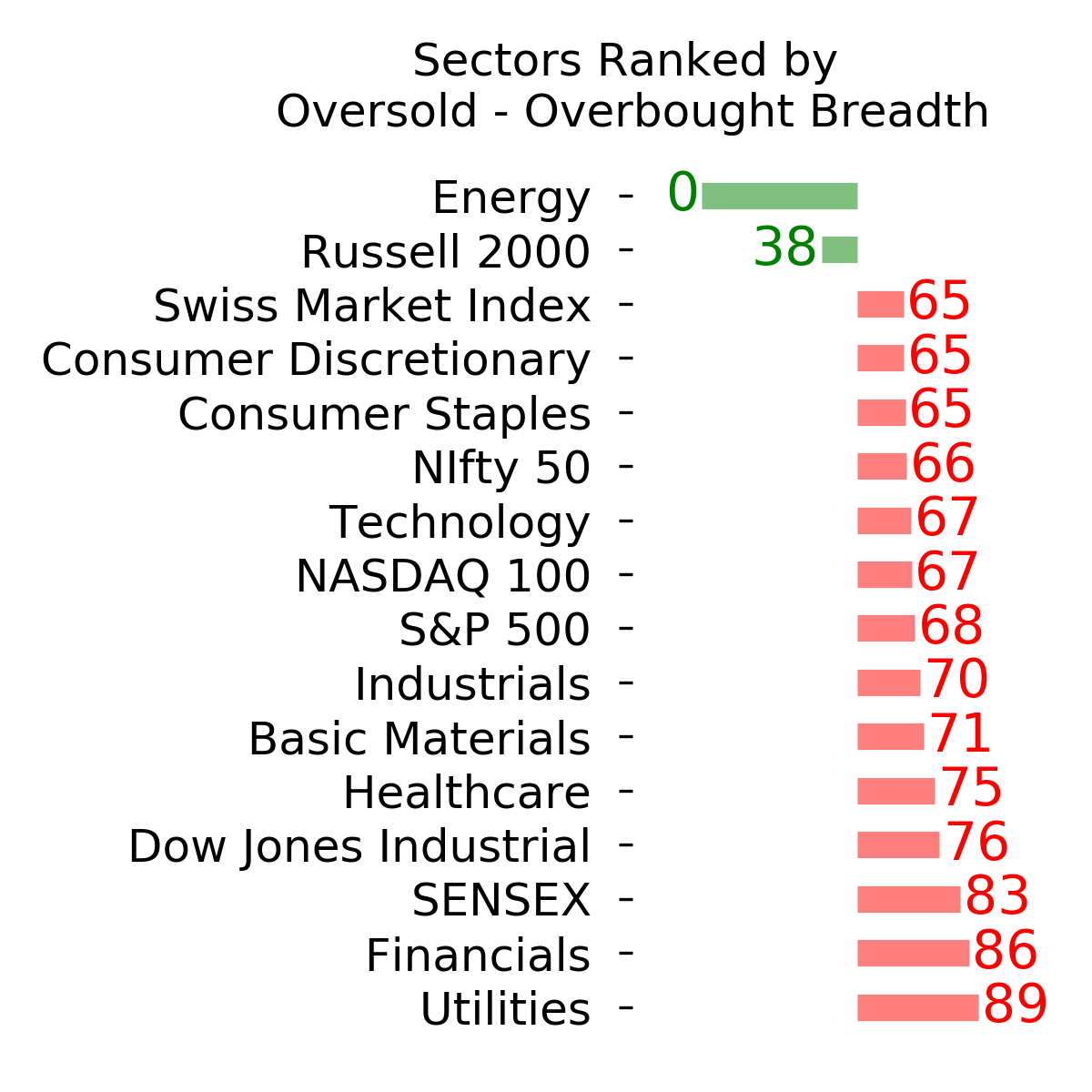

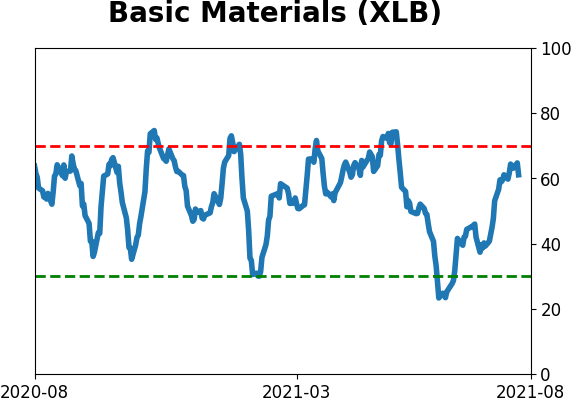

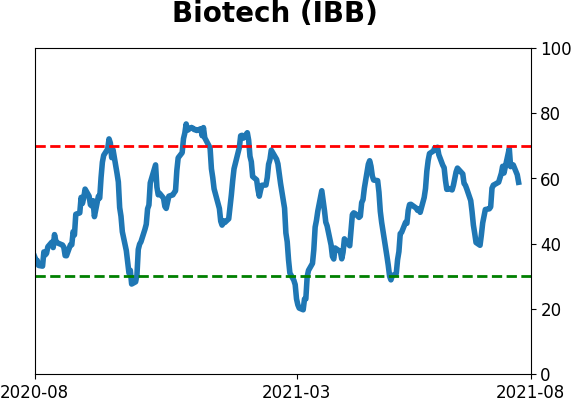

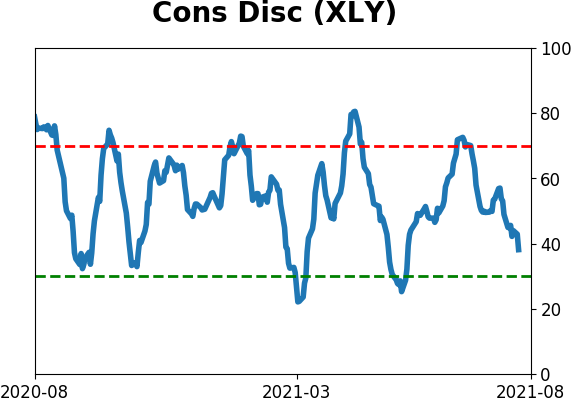

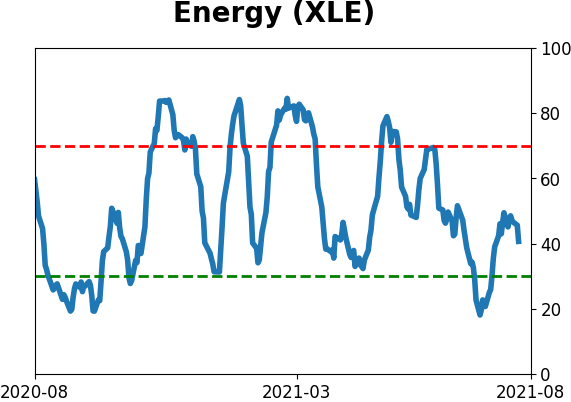

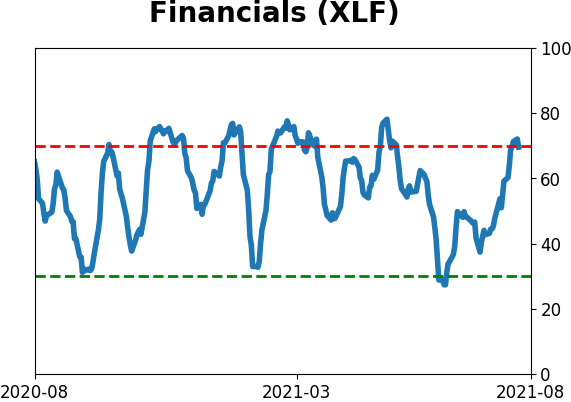

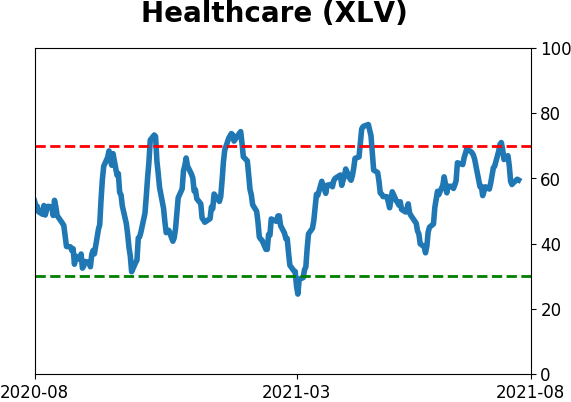

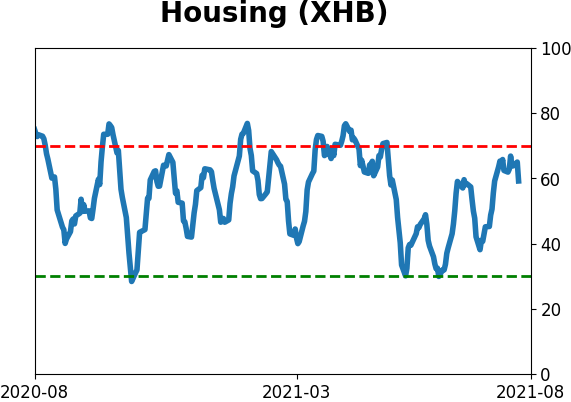

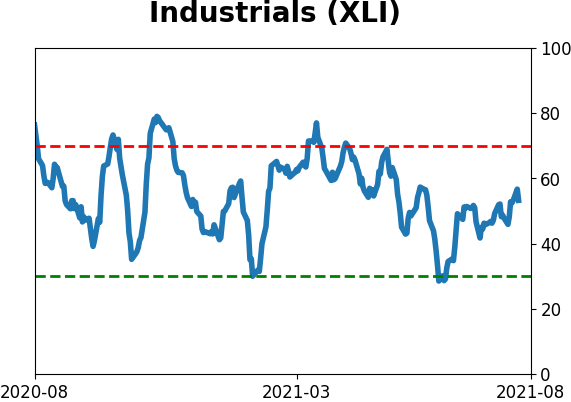

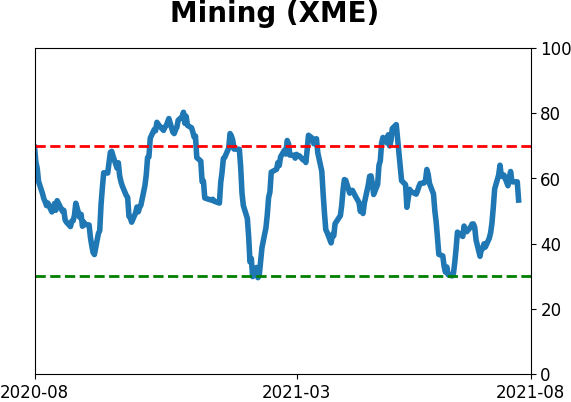

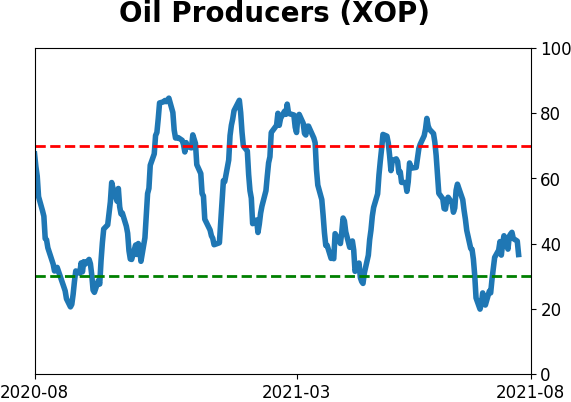

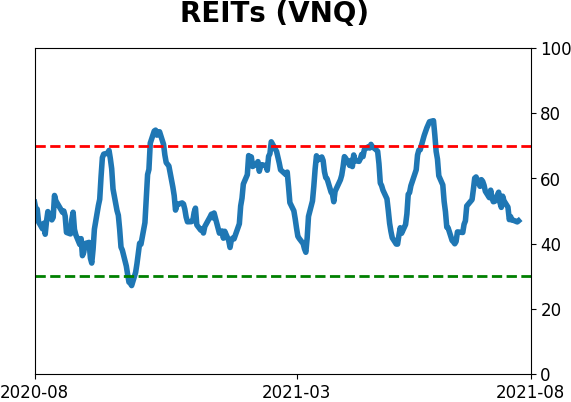

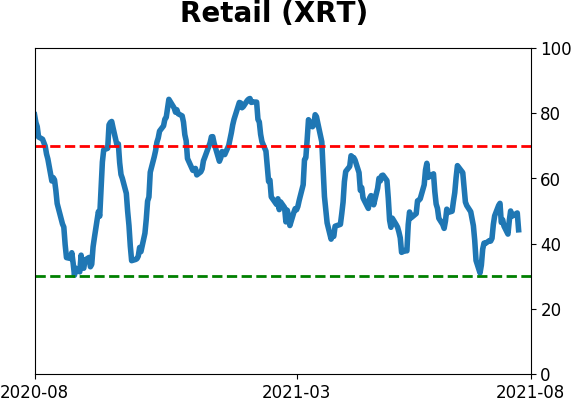

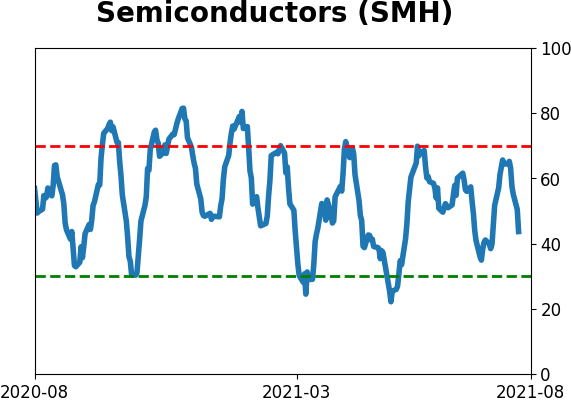

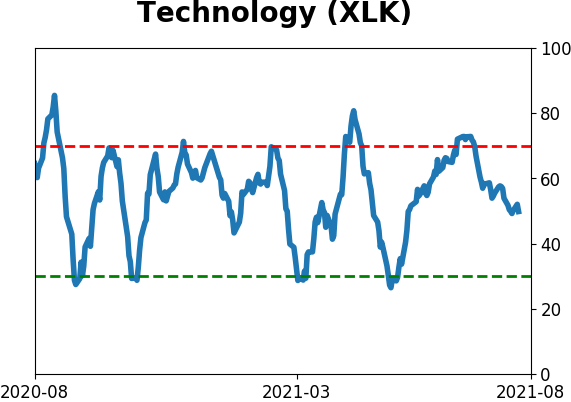

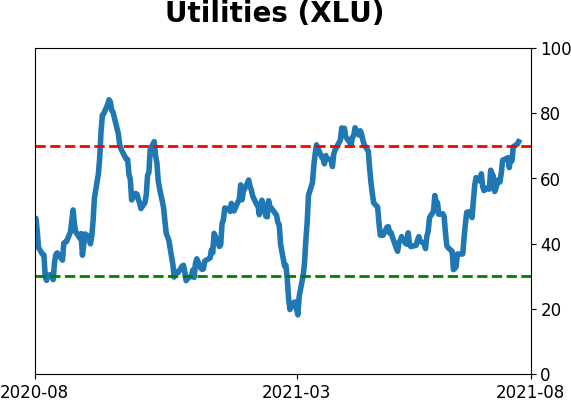

Sector ETF's - 10-Day Moving Average

|

|

|

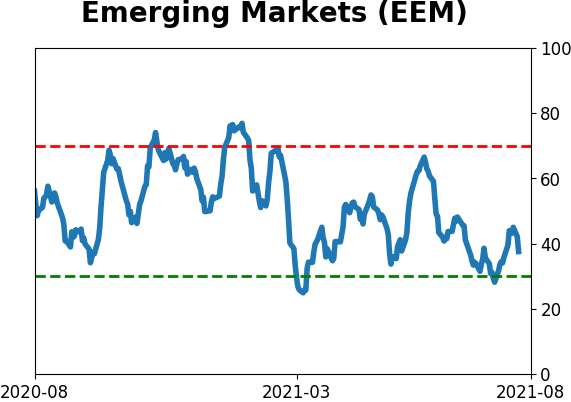

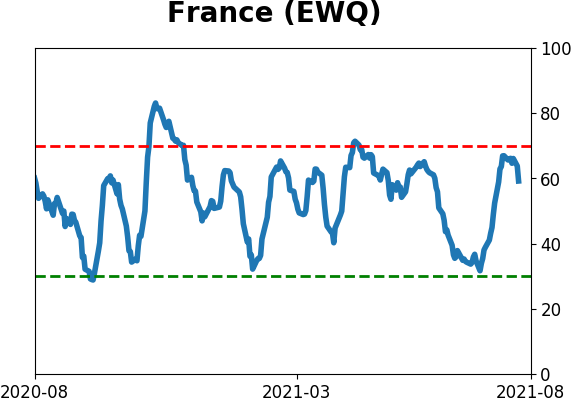

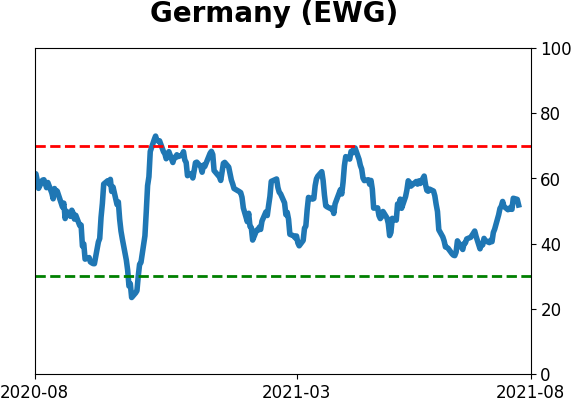

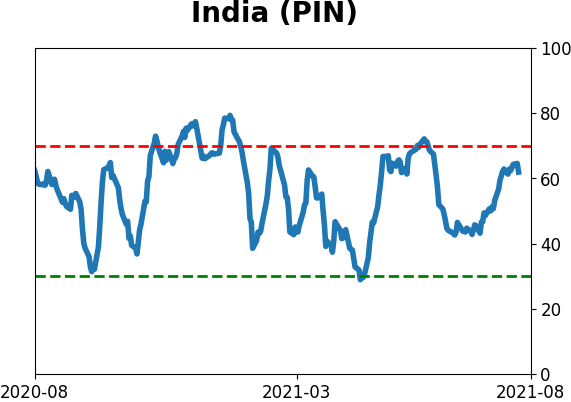

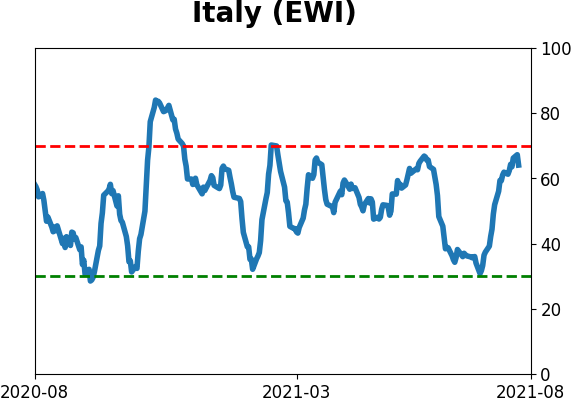

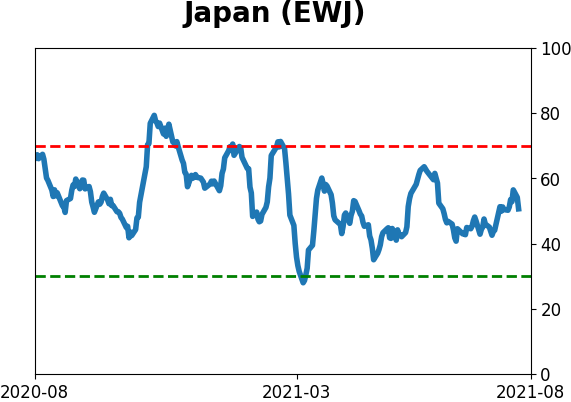

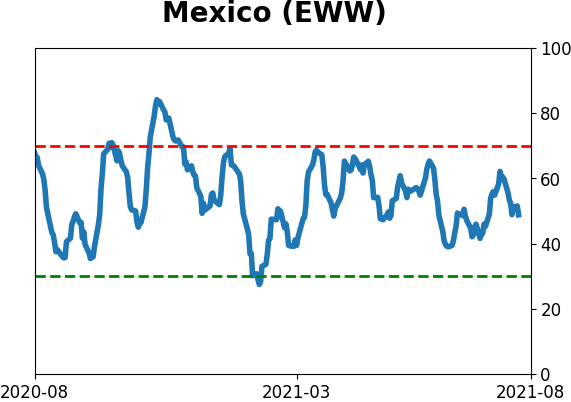

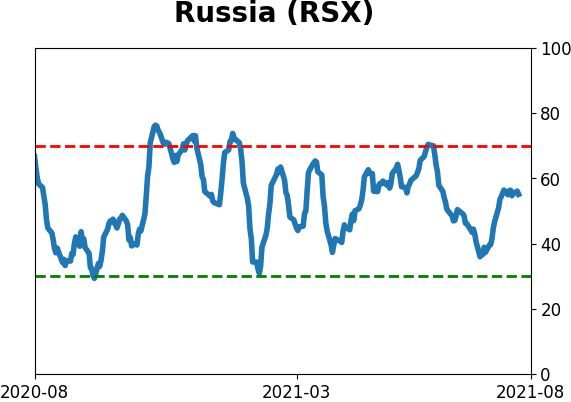

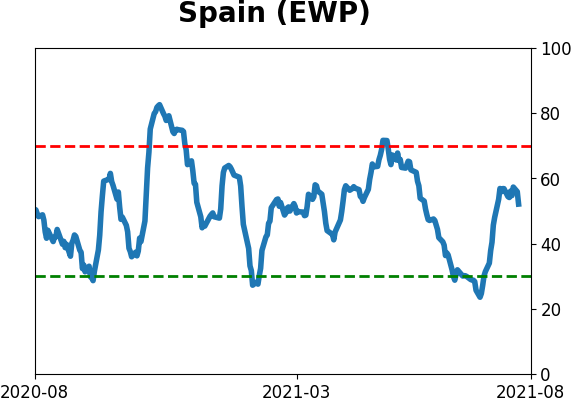

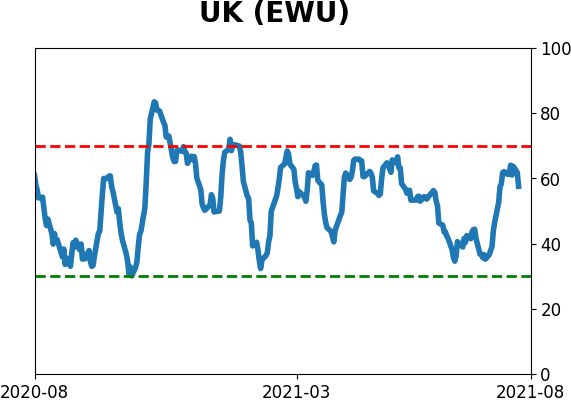

Country ETF's - 10-Day Moving Average

|

|

|

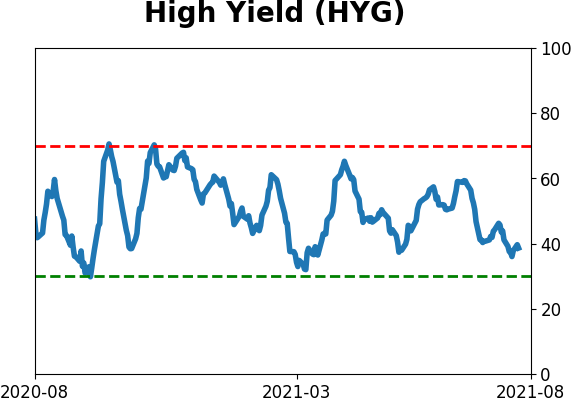

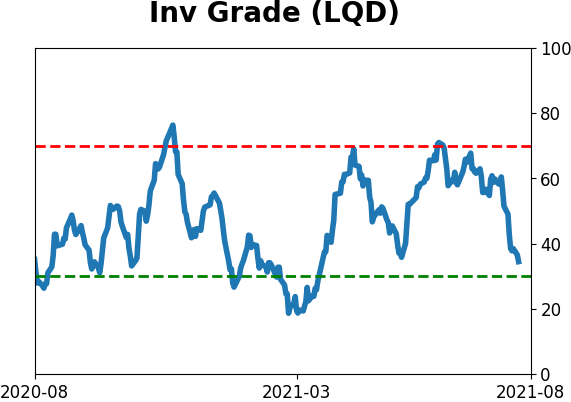

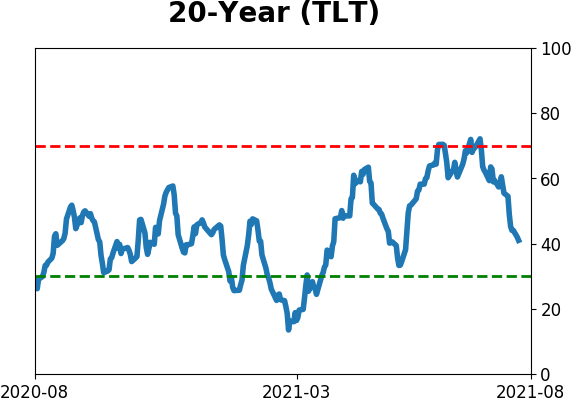

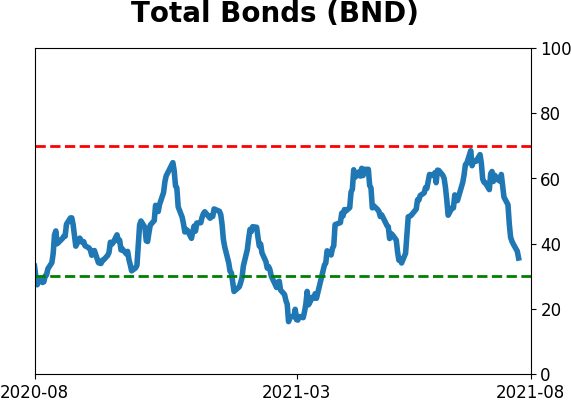

Bond ETF's - 10-Day Moving Average

|

|

|

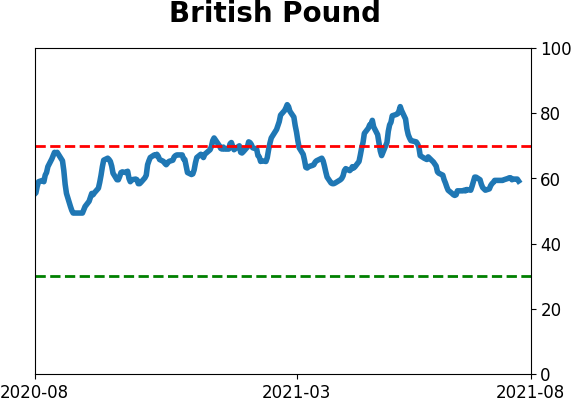

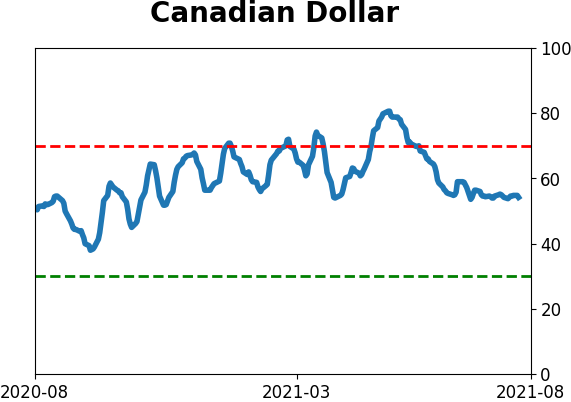

Currency ETF's - 5-Day Moving Average

|

|

|

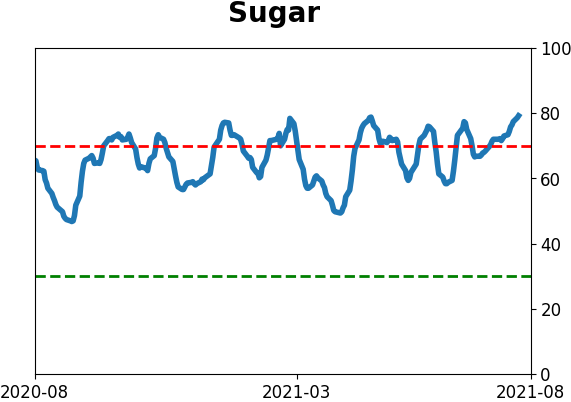

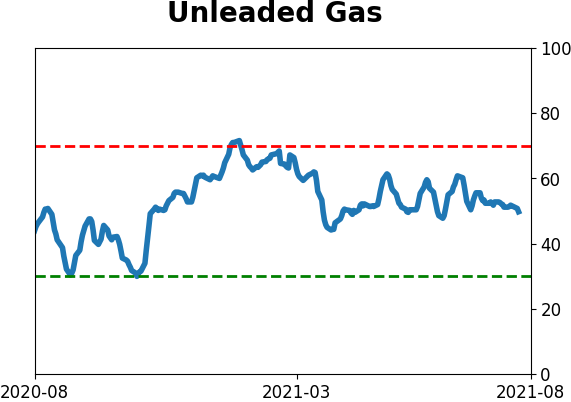

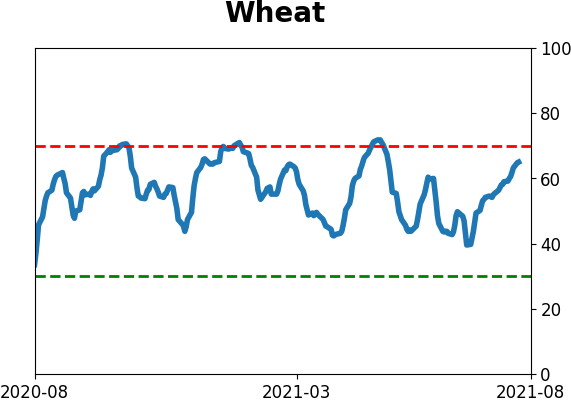

Commodity ETF's - 5-Day Moving Average

|

|