Headlines

|

|

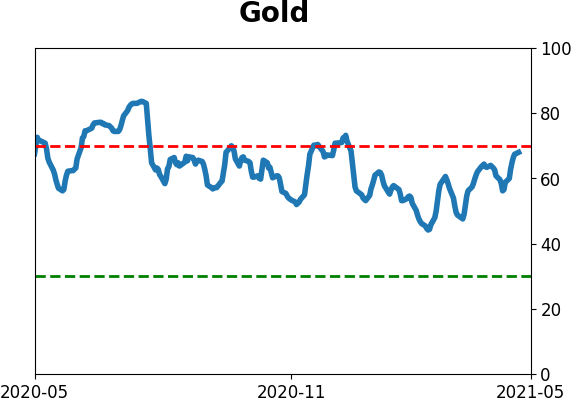

An Important Window for Gold's Attempted Trend Change:

Gold finally poked above its 200-day moving average for the first time in several months. Other times it ended a multi-month downtrend, it was tough for gold to maintain the upside momentum, and miners tended to suffer too.

Bottom Line:

See the Outlook & Allocations page for more details on these summaries STOCKS: Weak sell

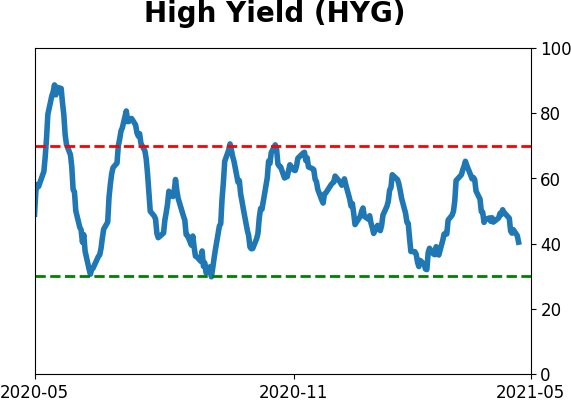

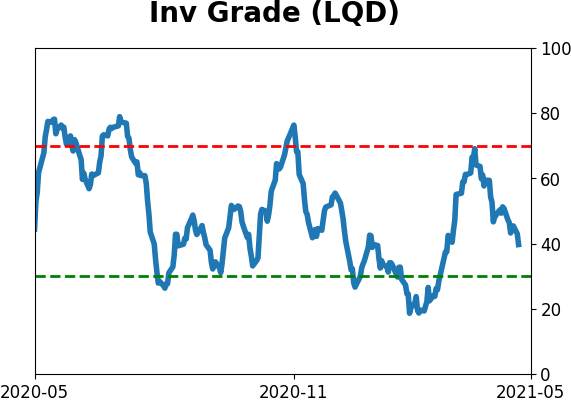

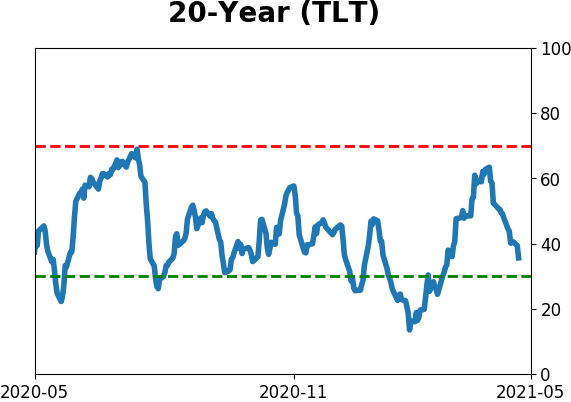

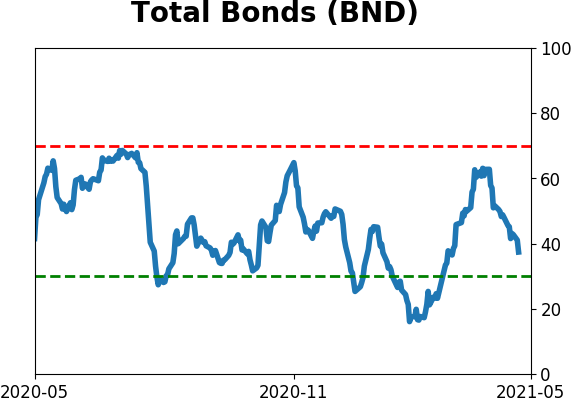

The speculative frenzy in February is getting wrung out. Internal dynamics have mostly held up, with some recent exceptions. Most of our studies show a poor risk/reward over the short- to medium-term, with a more positive skew longer-term. BONDS: Hold

Various parts of the market got hit in March, with the lowest Bond Optimism Index we usually see during healthy environments. After a shaky couple of weeks, the broad bond market has modestly recovered. Not a big edge here either way. GOLD: Weak buy

The dollar keeps failing on bulls' hopes that it's finally going to turn a corner, so that's been good for gold and miners. Studies from recent months remain in effect, with a modest positive bias.

|

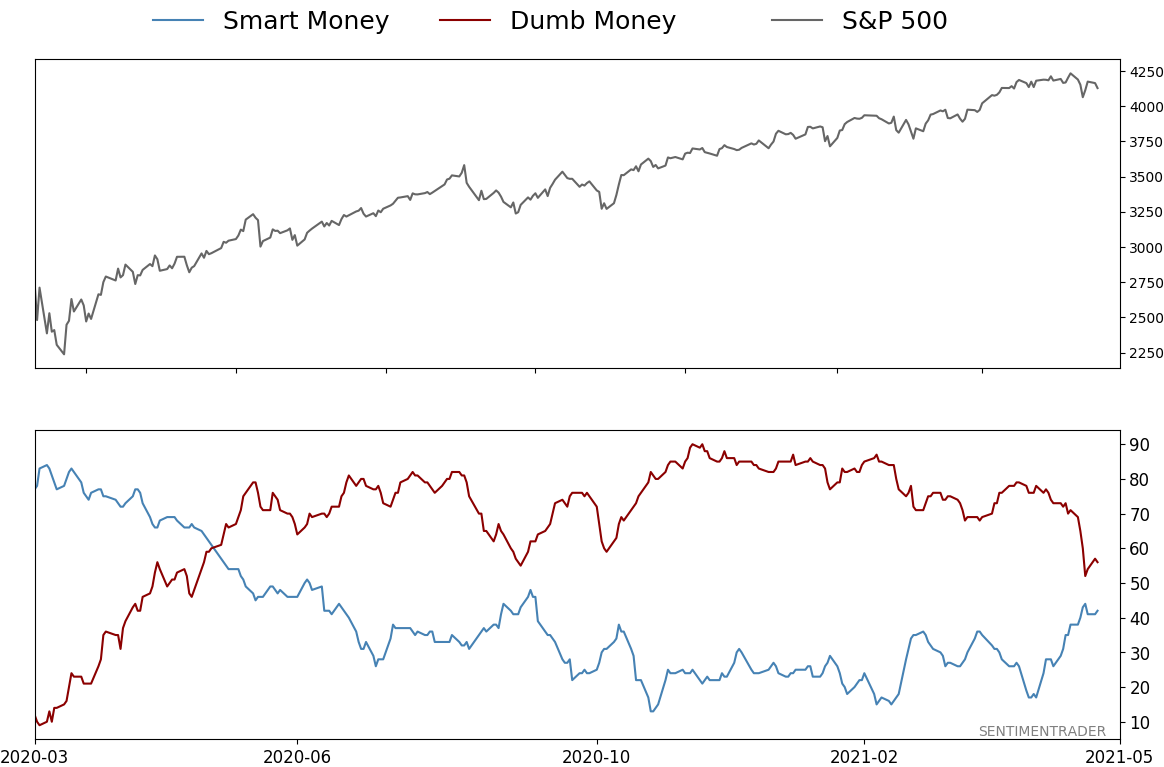

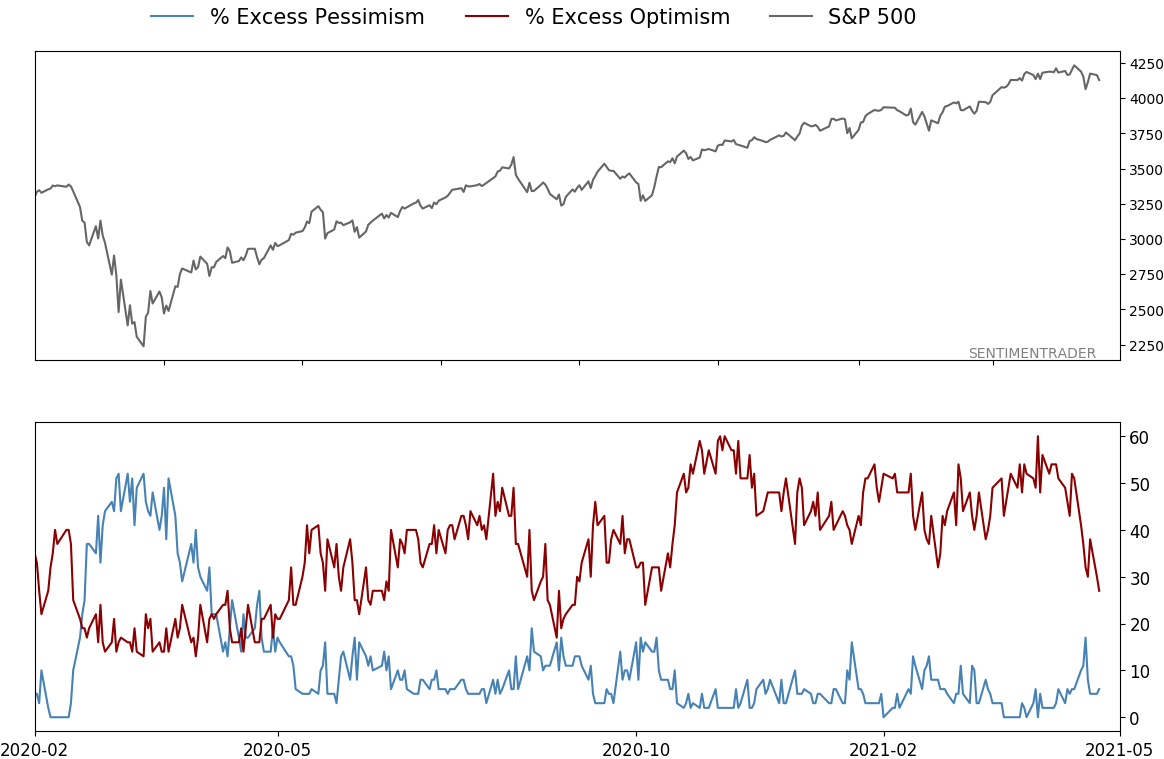

Smart / Dumb Money Confidence

|

Smart Money Confidence: 42%

Dumb Money Confidence: 56%

|

|

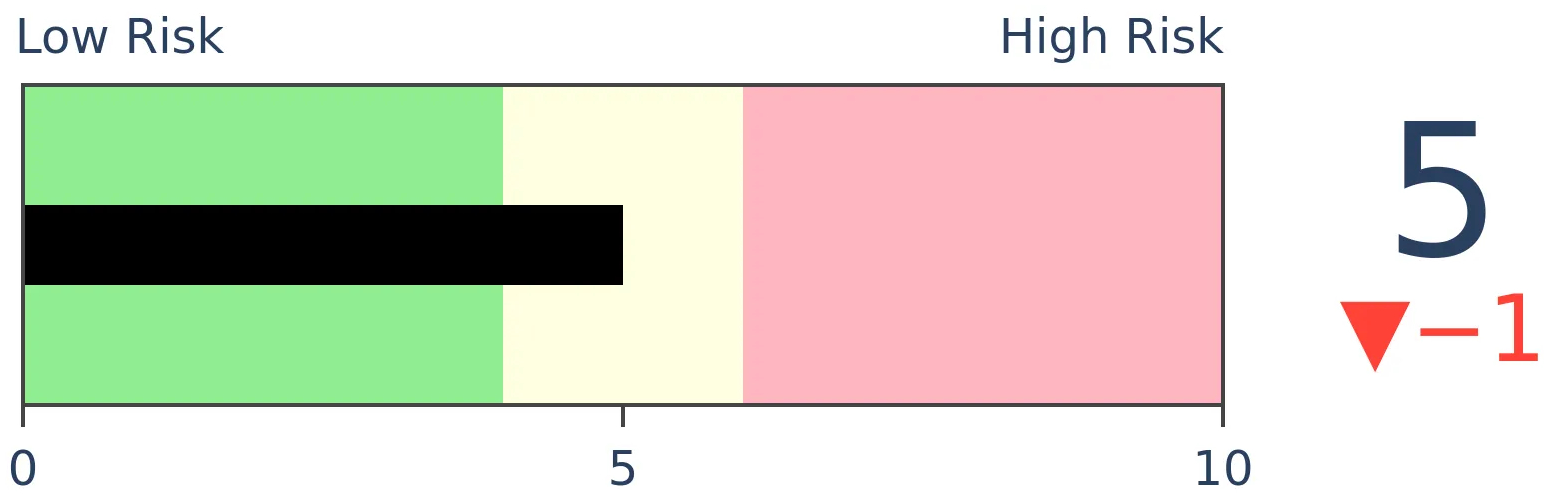

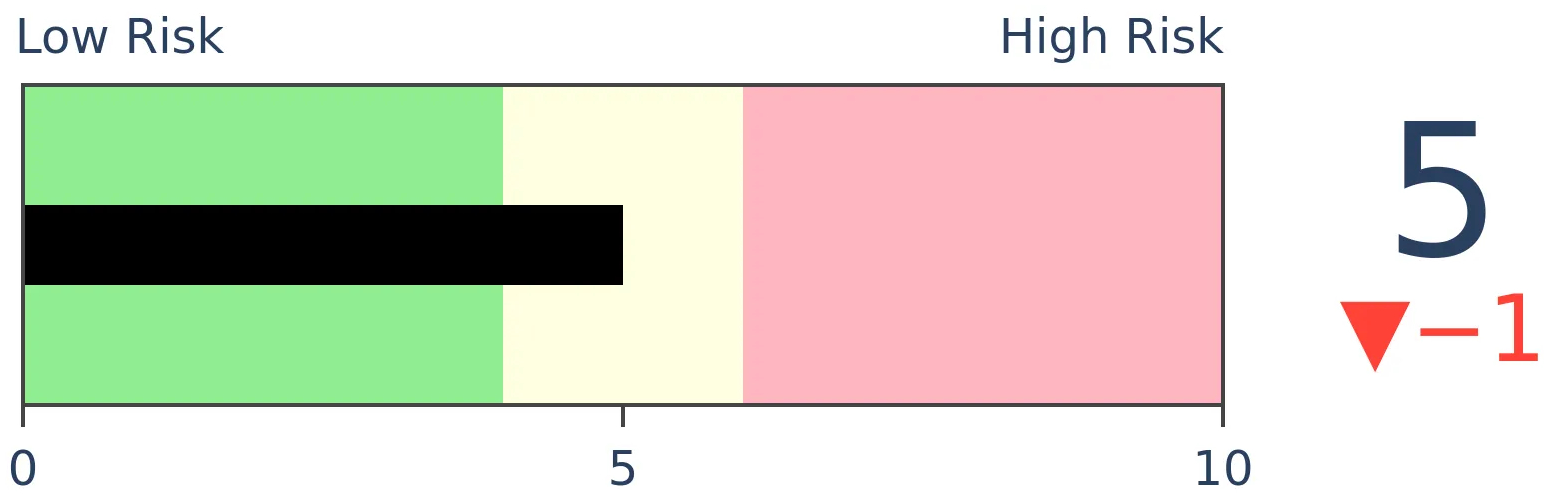

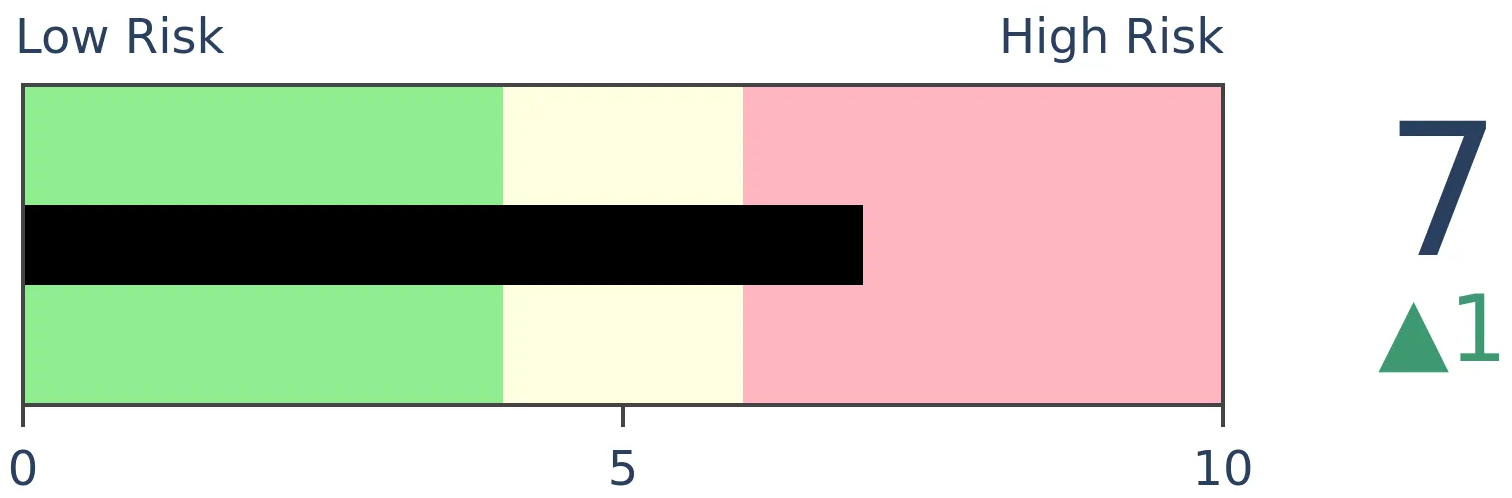

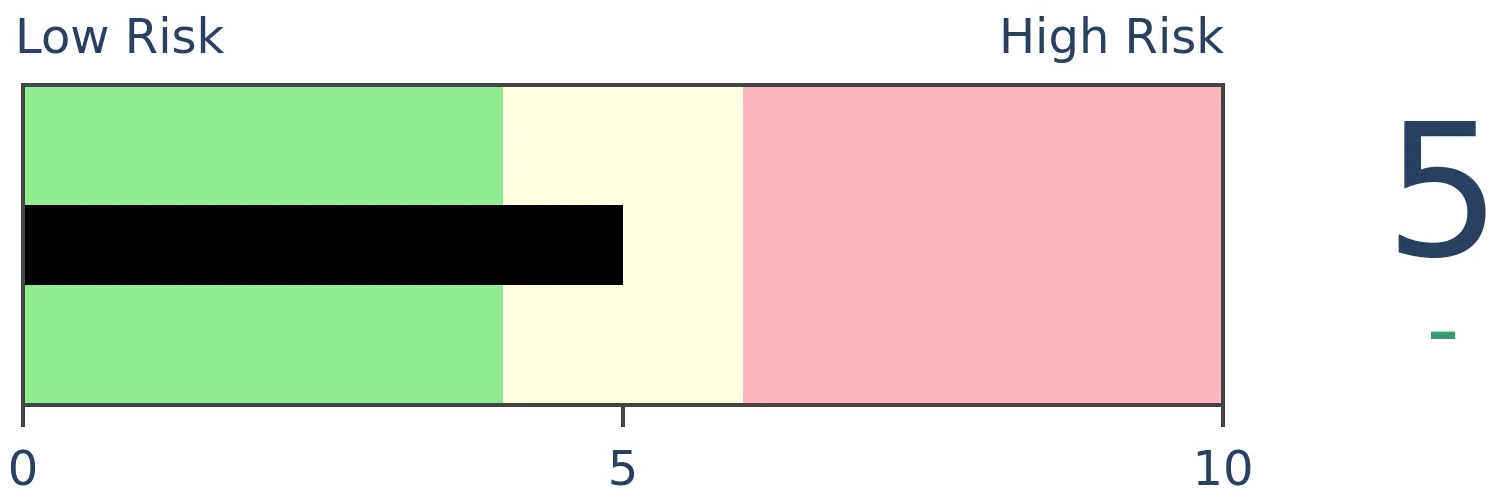

Risk Levels

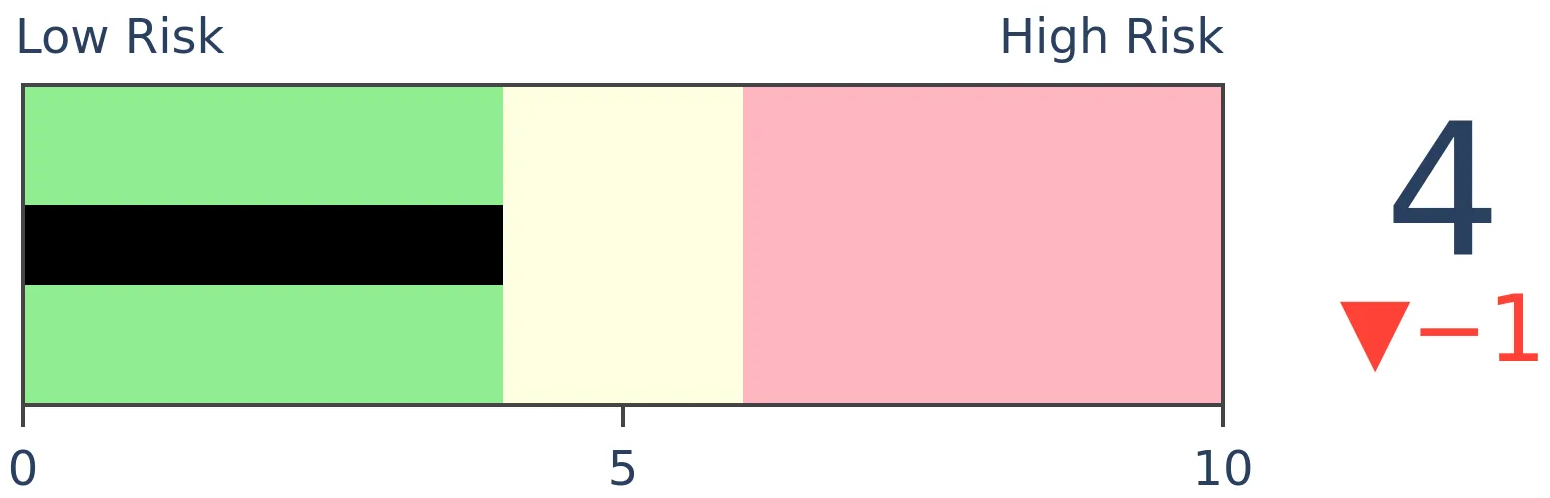

Stocks Short-Term

|

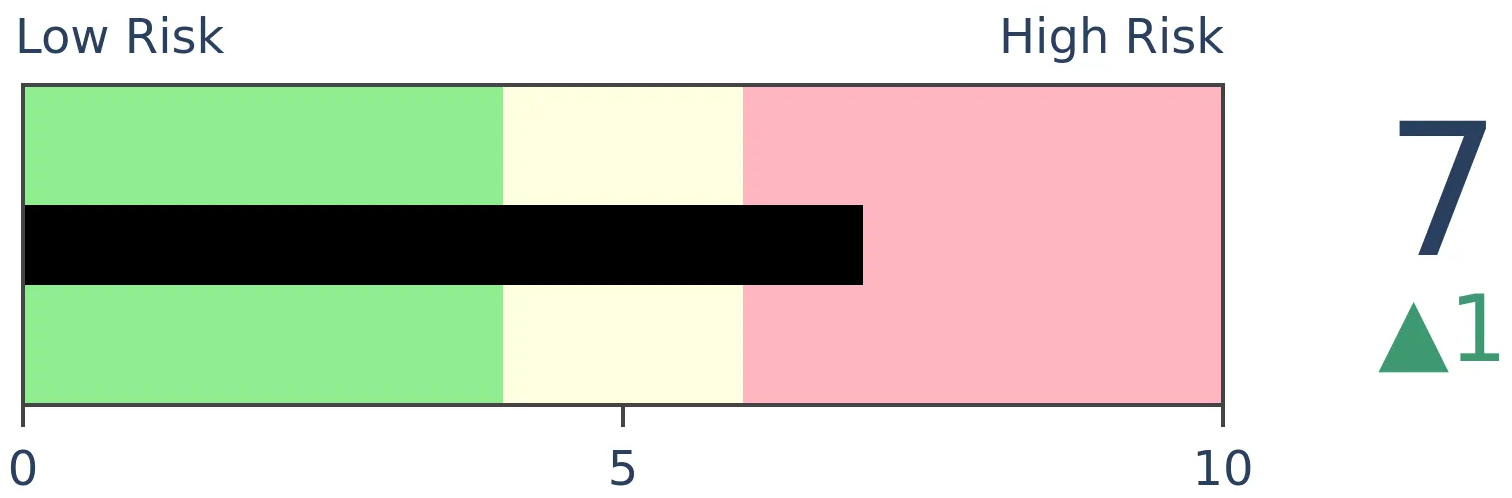

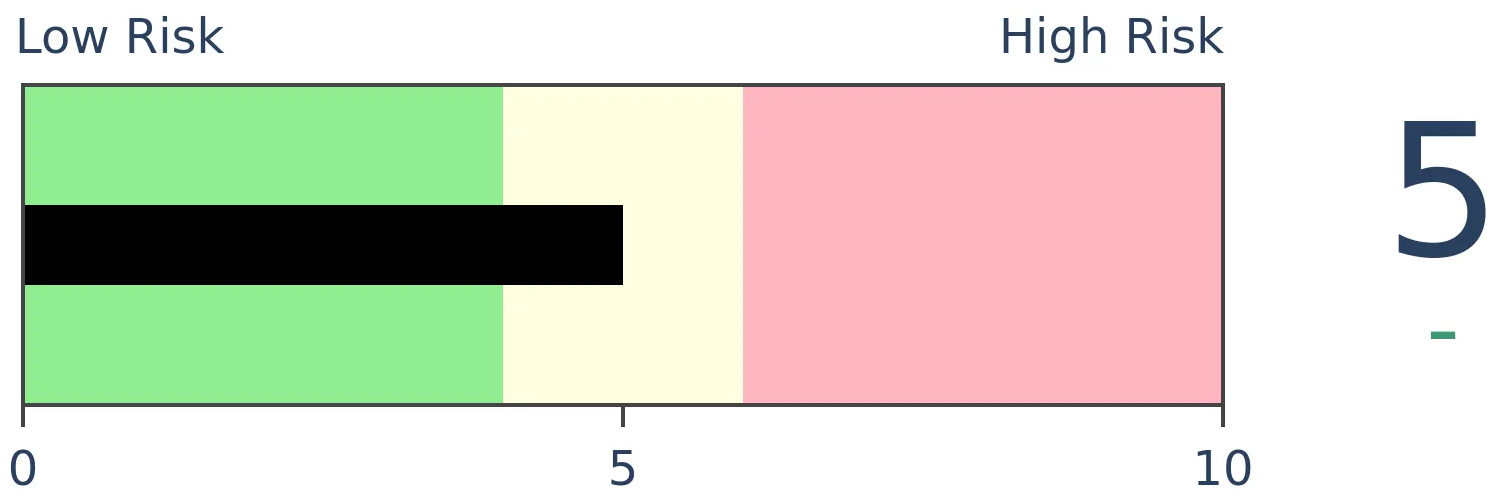

Stocks Medium-Term

|

|

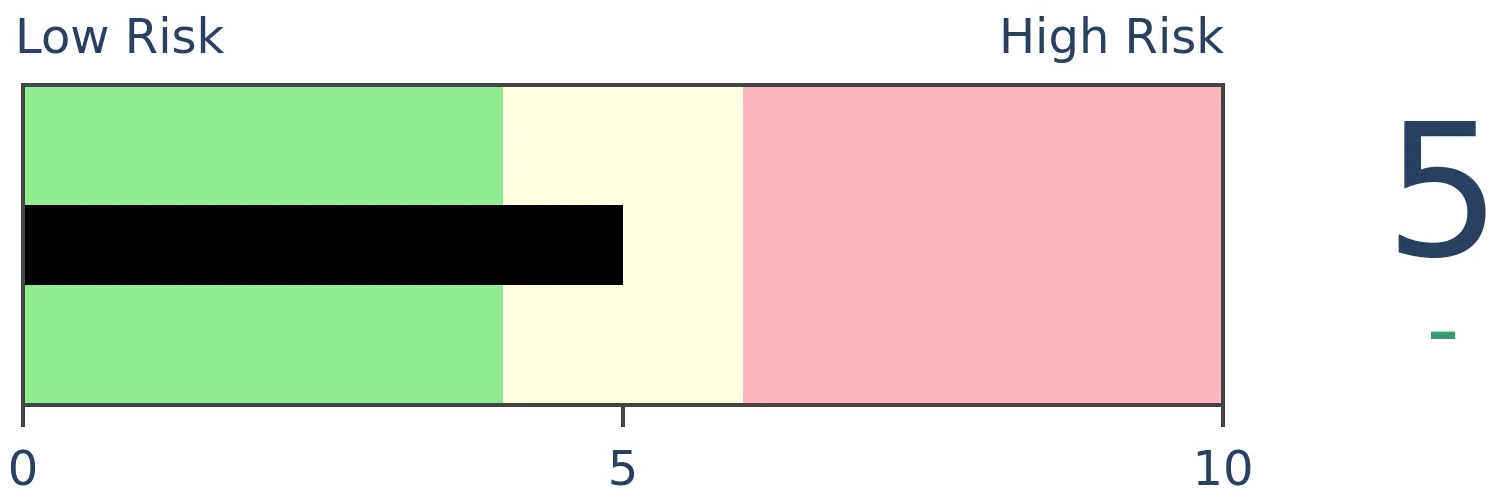

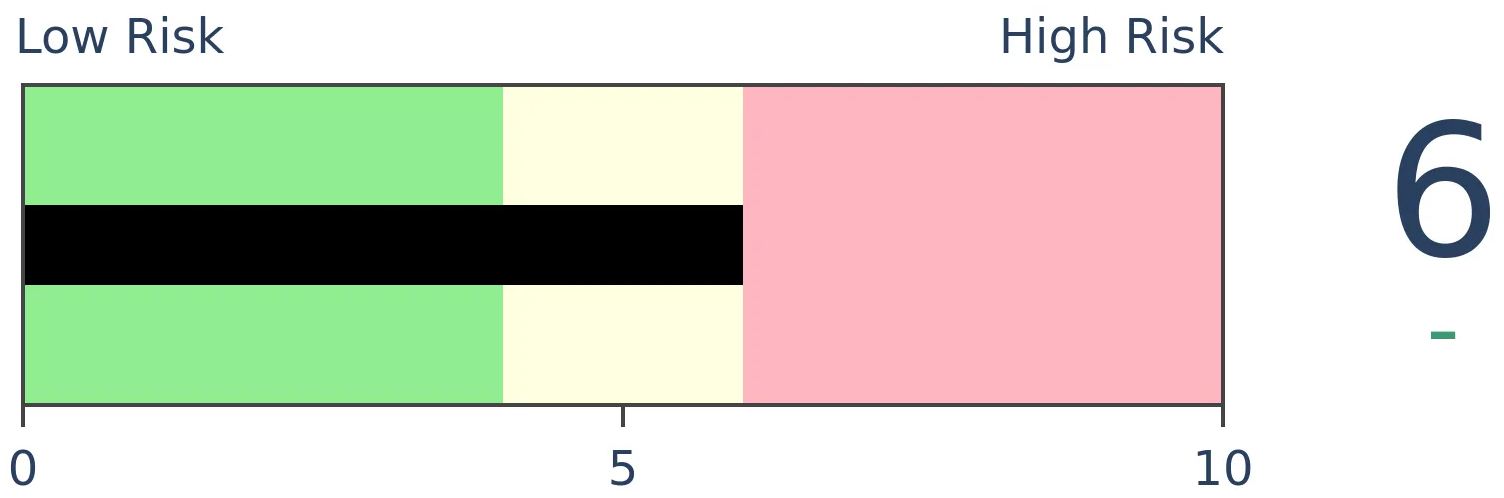

Bonds

|

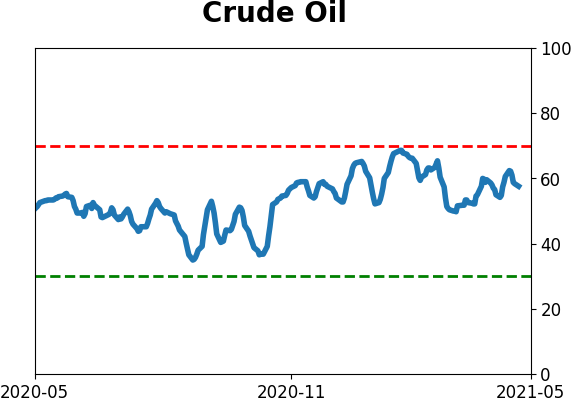

Crude Oil

|

|

Gold

|

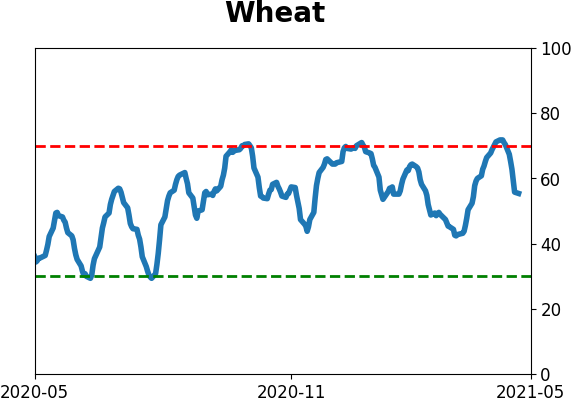

Agriculture

|

|

Research

BOTTOM LINE

Gold finally poked above its 200-day moving average for the first time in several months. Other times it ended a multi-month downtrend, it was tough for gold to maintain the upside momentum, and miners tended to suffer too.

FORECAST / TIMEFRAME

None

|

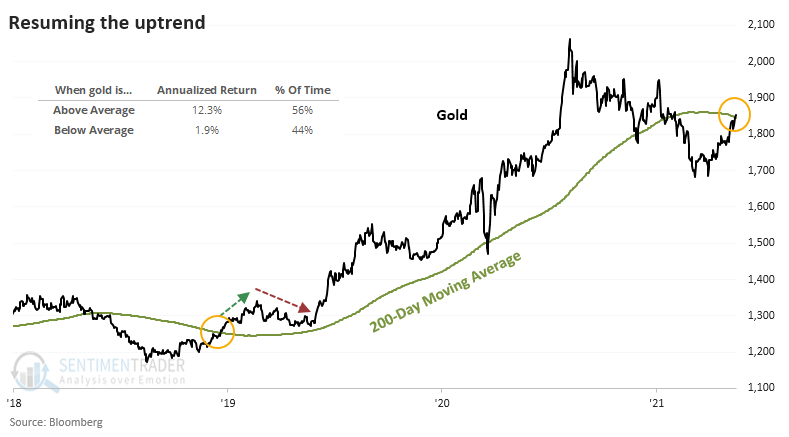

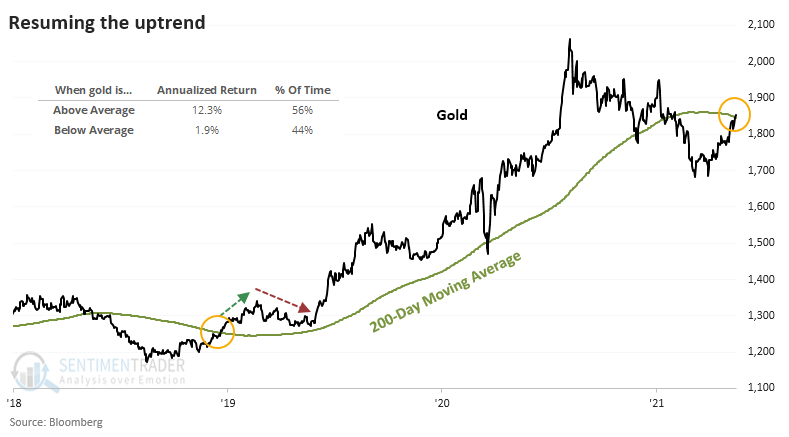

For the first time in months, gold is back in an uptrend.

Using intraday prices, gold finally punched above its 200-day average for the first time since the start of February. That ends the longest stretch below the 200-day since late 2018. After it regained its average then, it rallied for another couple of months before giving almost all of those gains back, and then finally managed to roar ahead.

It's certainly better to be holding gold when it's above-trend than not - since 1975, the metal showed an annualized return of +12.3% when above the 200-day average versus only +1.9% when below.

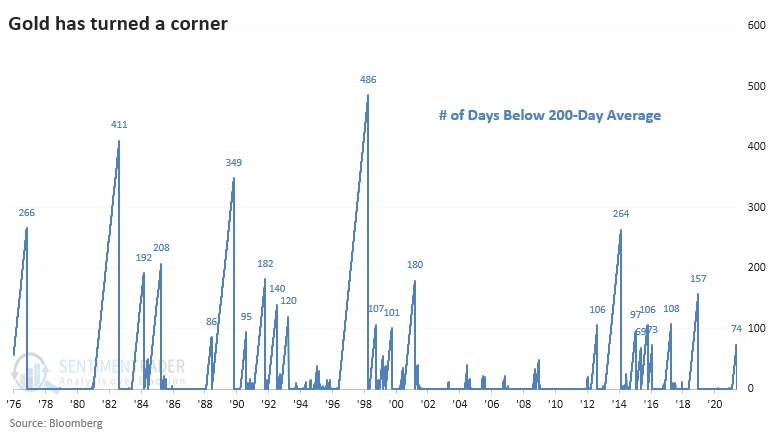

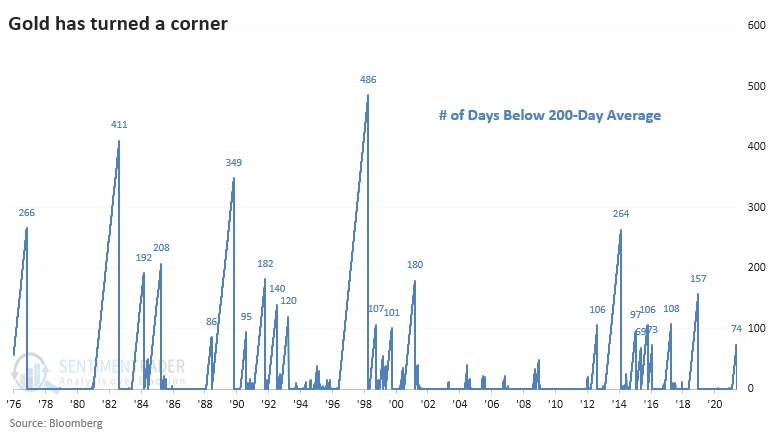

The several months below its 200-day wasn't gold's longest stretch in a downtrend by any means, but it was one of the longer trends in the past 20 years.

TREND CHANGES ARE HARD

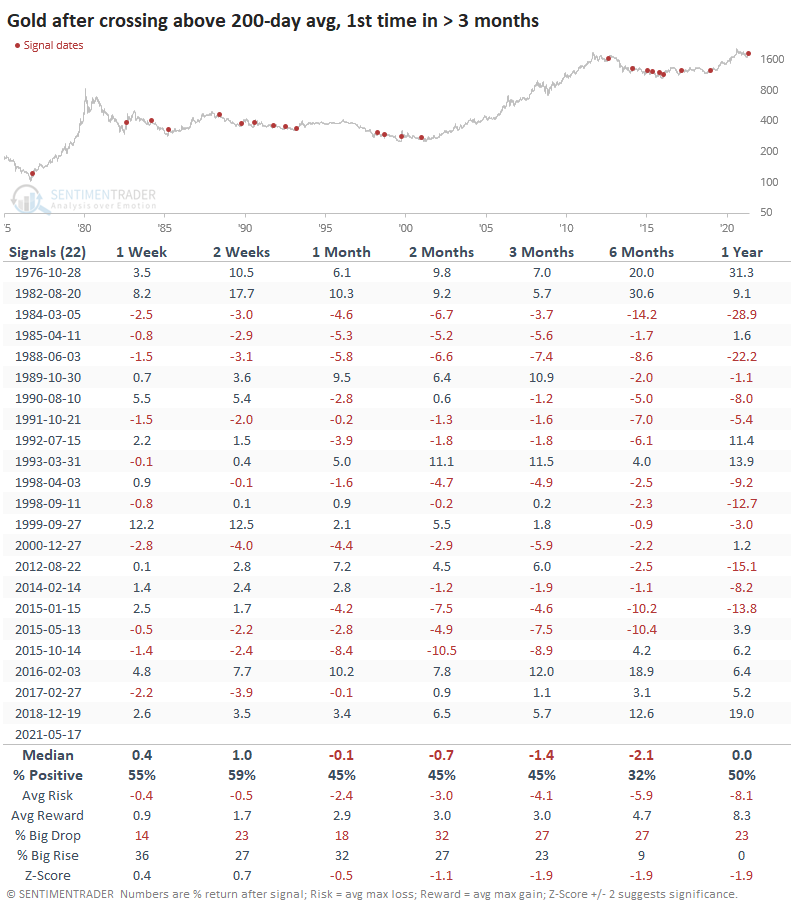

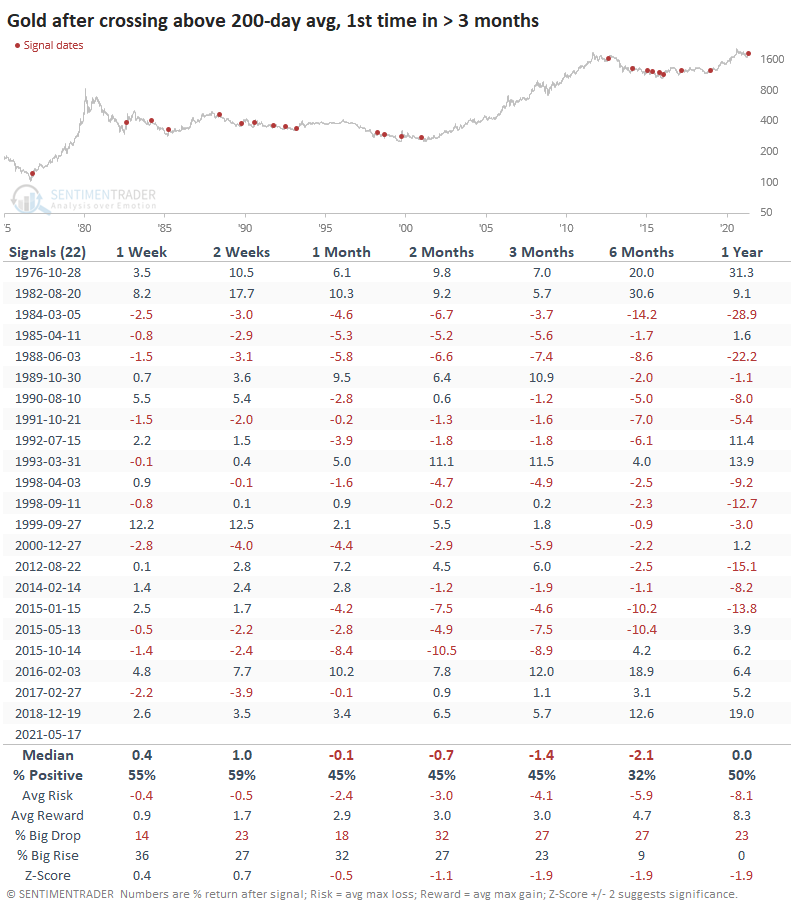

We've seen before that gold has a tendency to be trendy, and attempted reversals in long-term trends aren't very sticky. The table below shows what happened to gold after it ended other multi-month streaks below its 200-day. Medium-term returns weren't kind.

Over the next 6 months, gold showed a positive return only 32% of the time, and all the other stats were poor. We place more weight on recent occurrences, though, and there's some solace there for gold bulls. Each of the last four signals led to more gains for gold.

There was a +0.36 correlation (from a scale of -1.0 to +1.0) between the return on gold over the next 2 weeks and the return over the next year. That suggests that if gold bugs are especially eager and willing to keep buying gold at higher prices, then it bodes well longer-term.

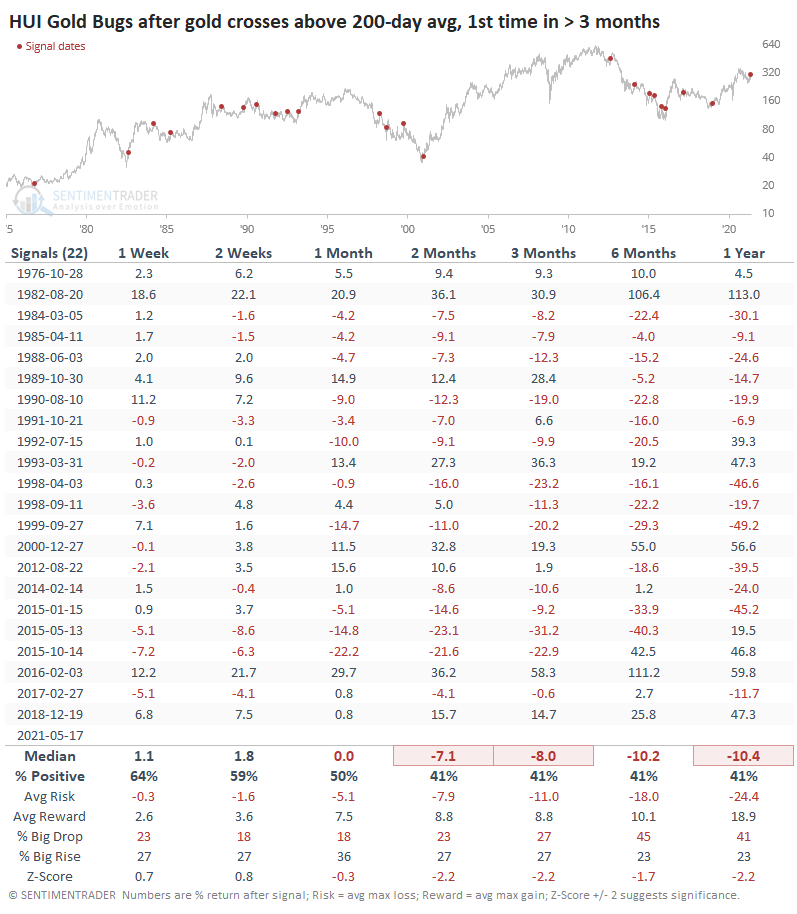

MINERS STRUGGLED TO BENEFIT FROM POTENTIAL CHANGES

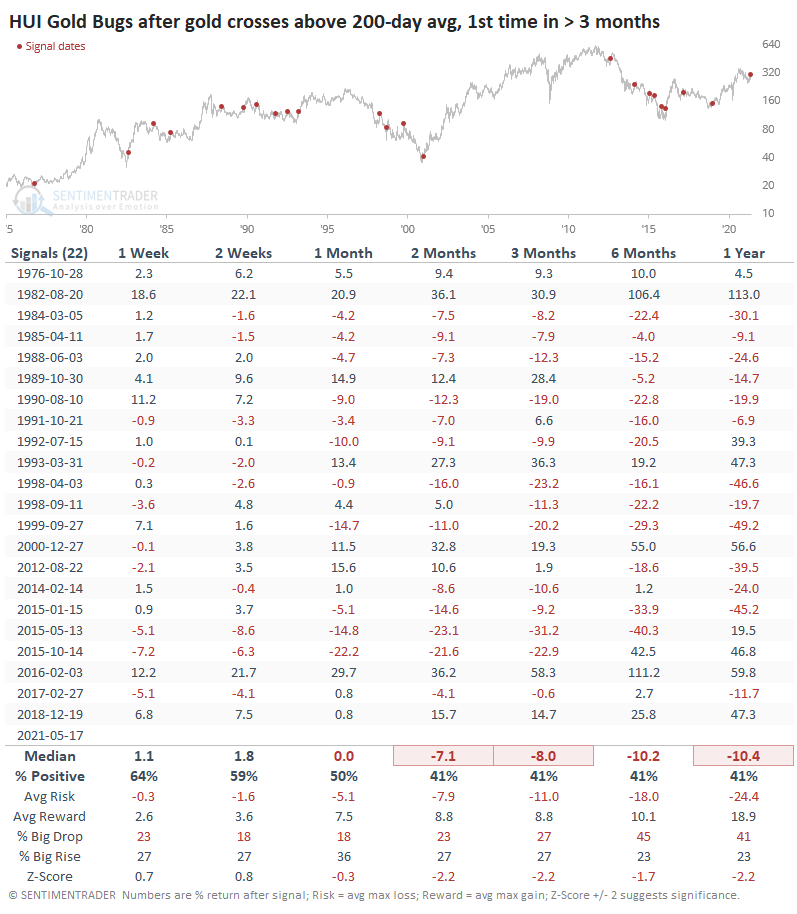

These attempted trend changes in gold were just as bad a sign for miners.

From 2-12 months later, miners had a lot of trouble holding gains. But when they did, they REALLY did. There were 6 signals that preceded gains of nearly 20% or more over the next 6 months.

For miners, there was a +0.43 correlation between returns over the next 2 weeks and the return over 12 months. If buyers are even more interested in miners in the short-term, the probability increases that we could see one of those double-digit 6-month gains.

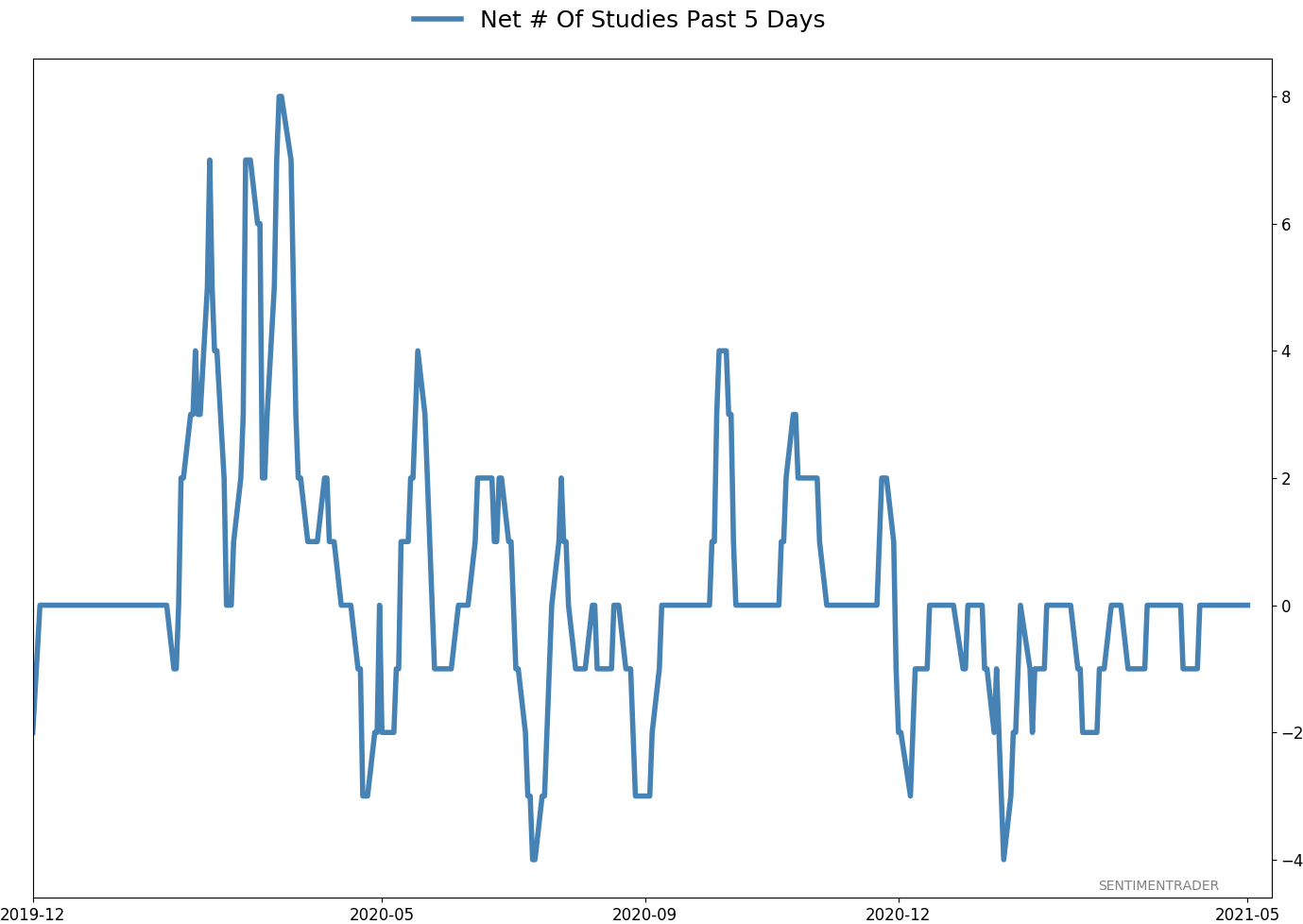

Active Studies

| Time Frame | Bullish | Bearish | | Short-Term | 0 | 0 | | Medium-Term | 1 | 11 | | Long-Term | 11 | 4 |

|

Indicators at Extremes

Portfolio

| Position | Description | Weight % | Added / Reduced | Date | | Stocks | RSP | 0.0 | Reduced 4.9% | 2021-04-22 | | Bonds | 30.0% BND, 8.8% SCHP | 37.9 | Added 15.1% | 2021-02-18 | | Commodities | GCC | 2.5 | Reduced 2.1%

| 2020-09-04 | | Precious Metals | GDX | 9.8 | Added 0.1% | 2021-02-18 | | Special Situations | 4.3% XLE, 2.2% PSCE | 6.5 | Reduced 5.6% | 2021-04-22 | | Cash | | 43.3 | | |

|

Updates (Changes made today are underlined)

I've made no adjustments for months, as the situation remained essentially stuck - energy was doing what it should, sentiment in the broader market was ridiculously stretched but with no major warning signs, and sentiment toward gold and bonds appeared overdone on the pessimistic side. Those conditions have started to reverse a bit, so I further reduced my risk. There are still no major warning signs, but I'm getting increasingly uncomfortable and would prefer to sit safely in cash and wait for better risk/reward opportunities. RETURN YTD: 9.3% 2020: 8.1%, 2019: 12.6%, 2018: 0.6%, 2017: 3.8%, 2016: 17.1%, 2015: 9.2%, 2014: 14.5%, 2013: 2.2%, 2012: 10.8%, 2011: 16.5%, 2010: 15.3%, 2009: 23.9%, 2008: 16.2%, 2007: 7.8%

|

|

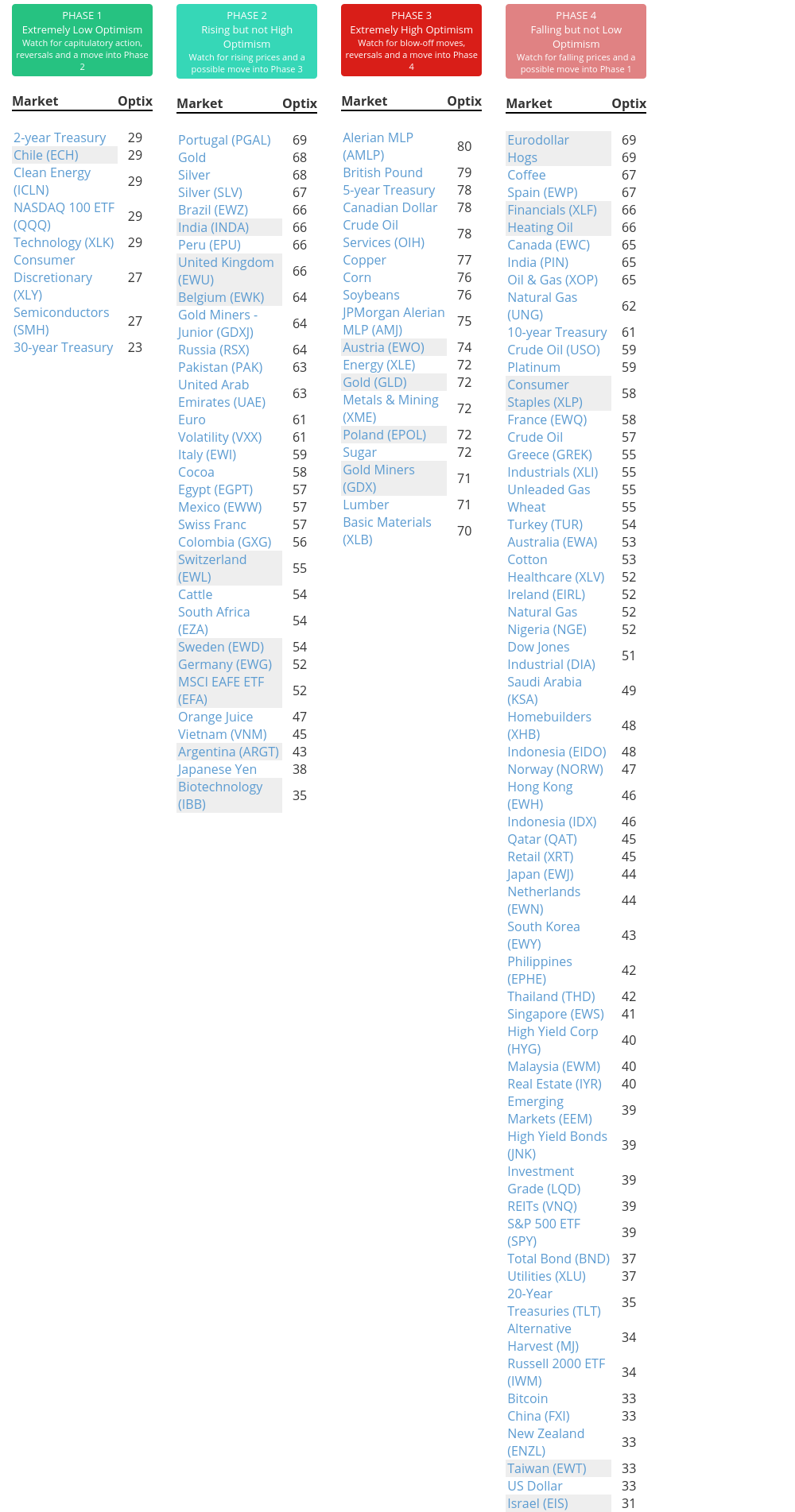

Phase Table

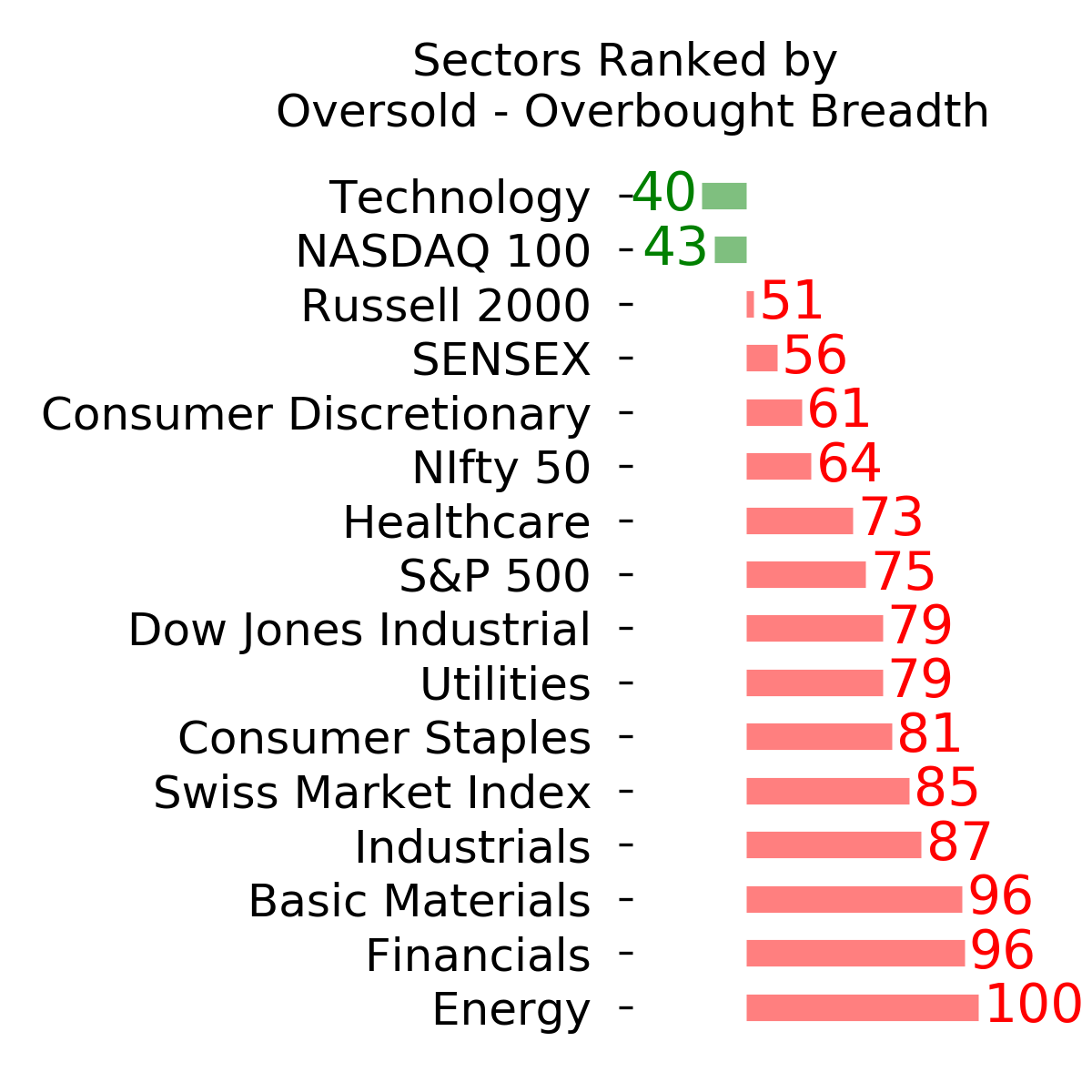

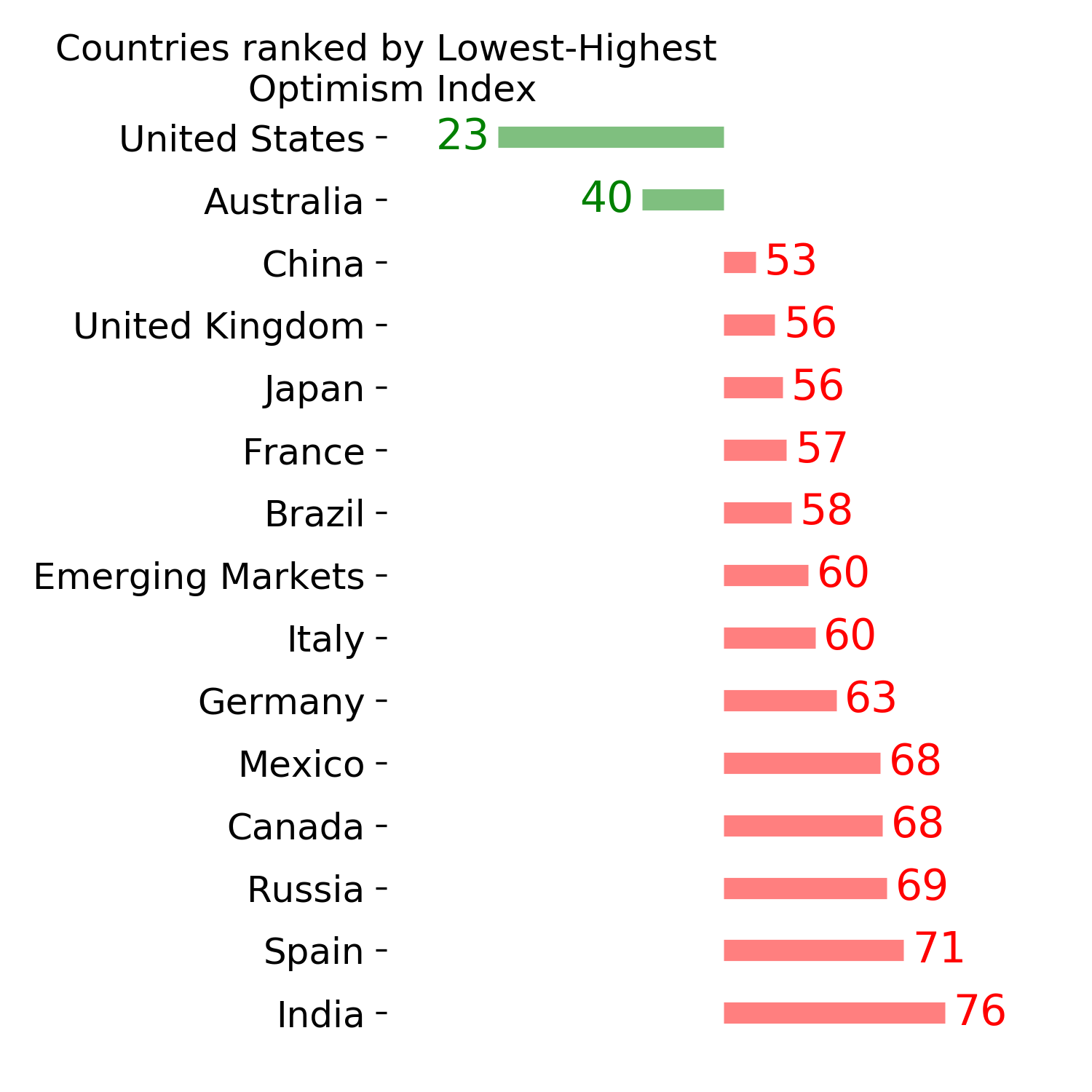

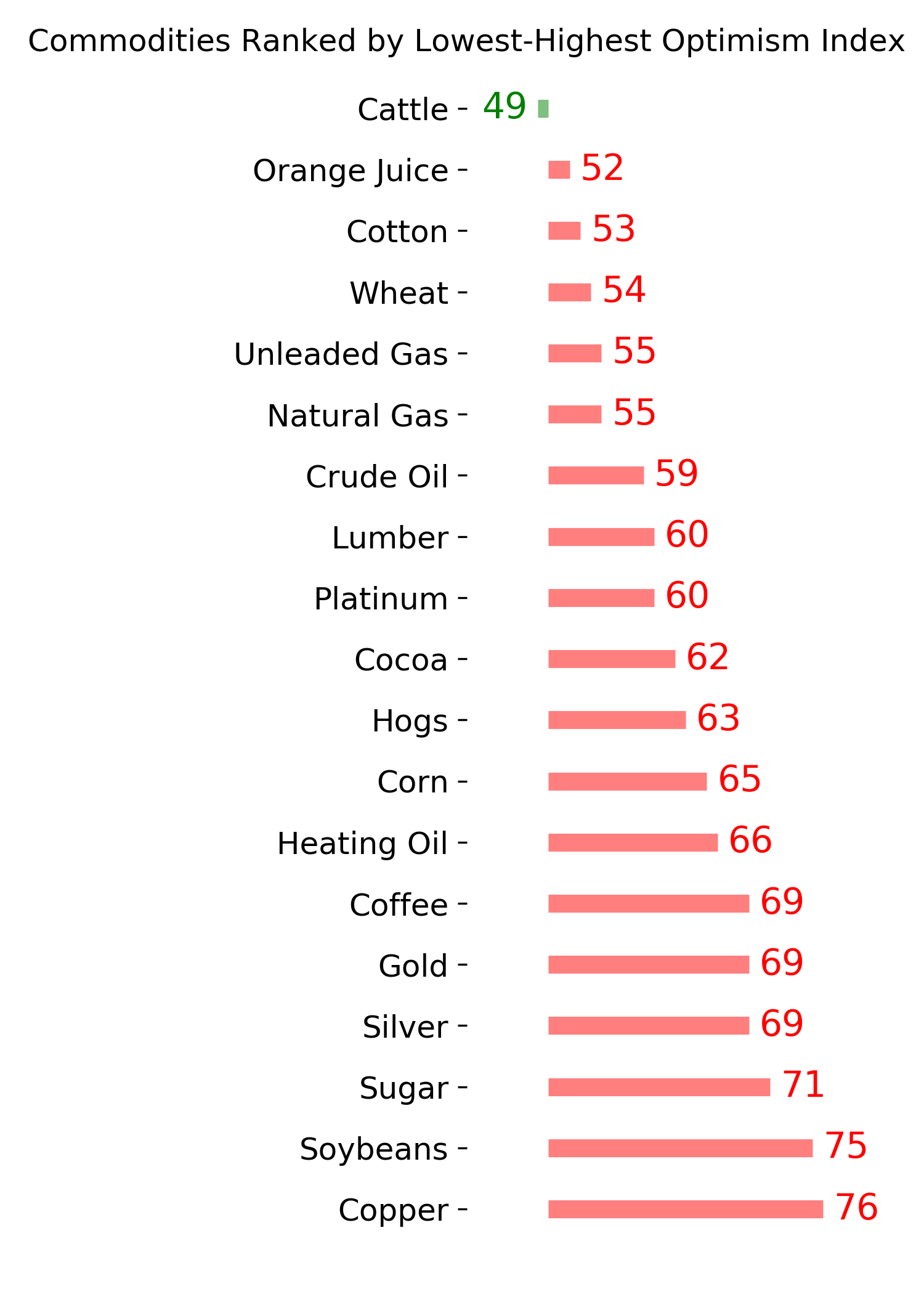

Ranks

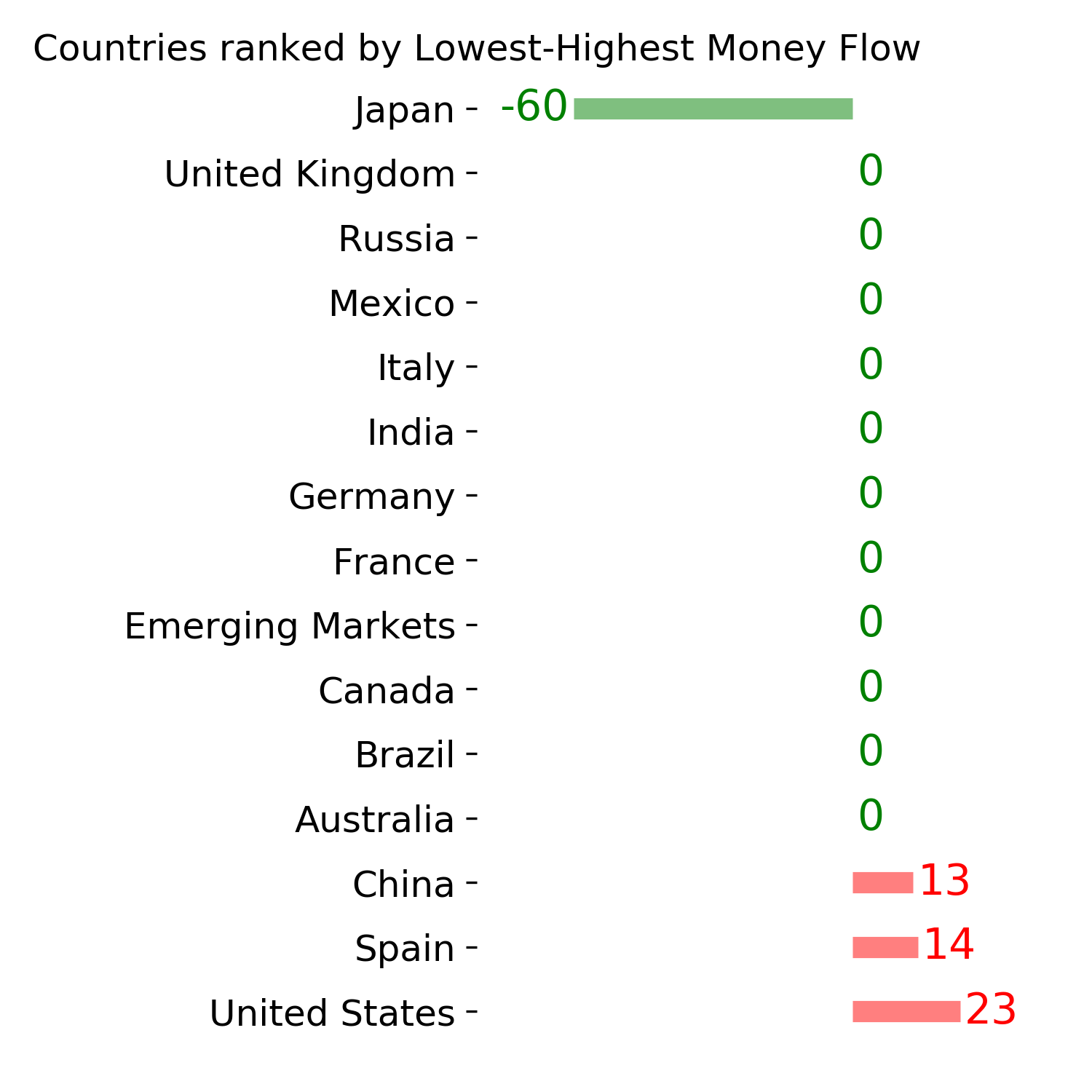

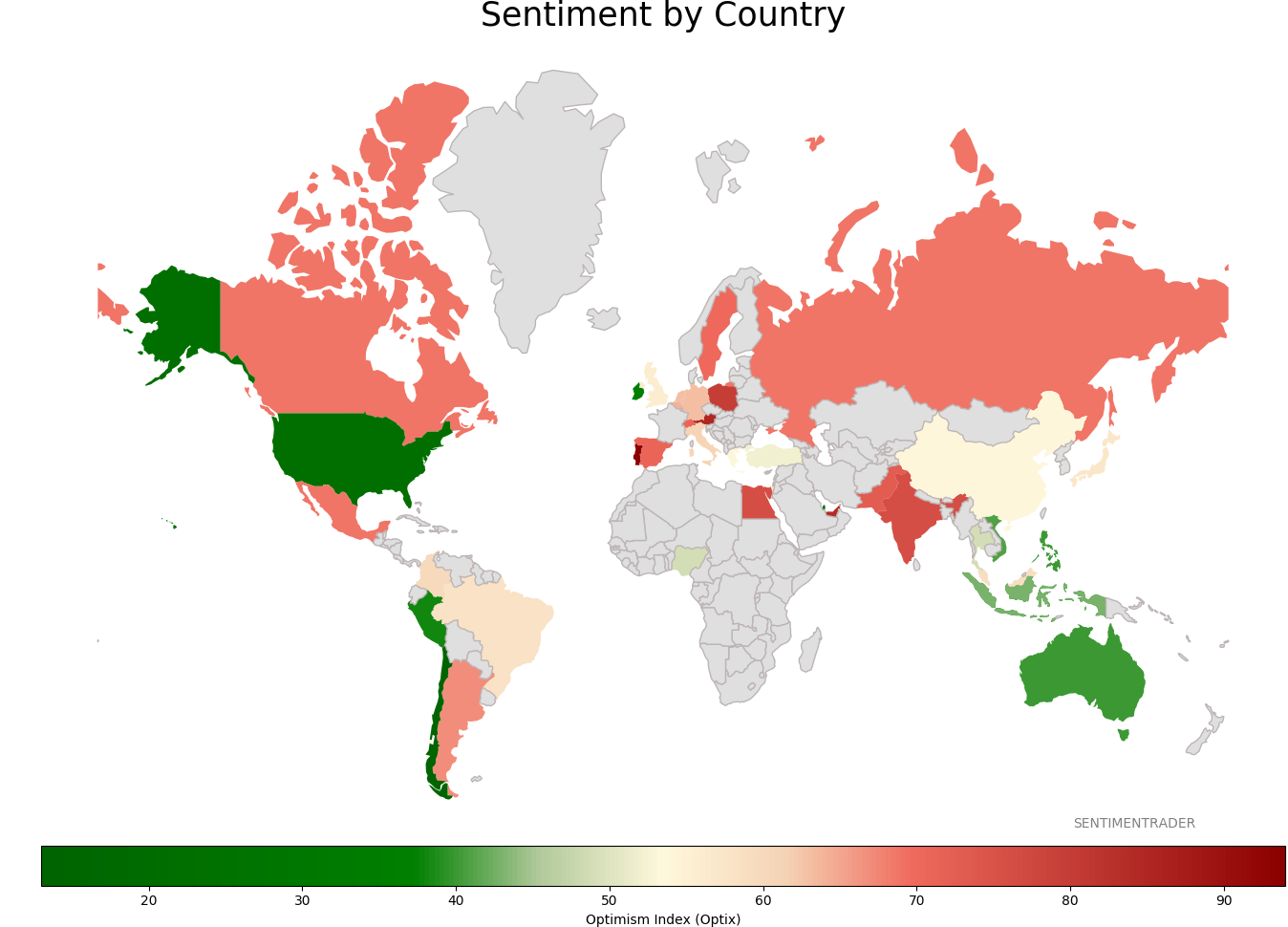

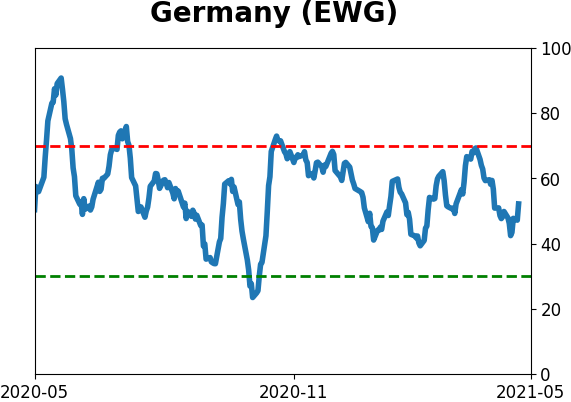

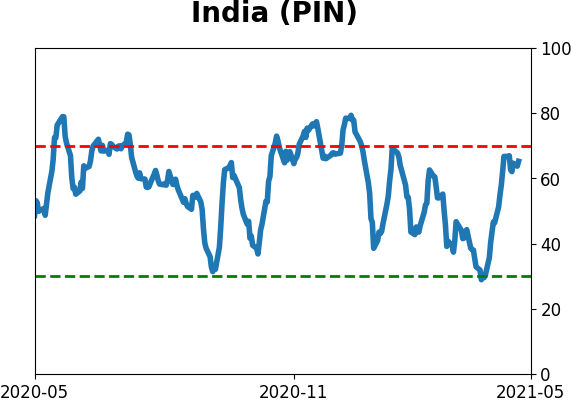

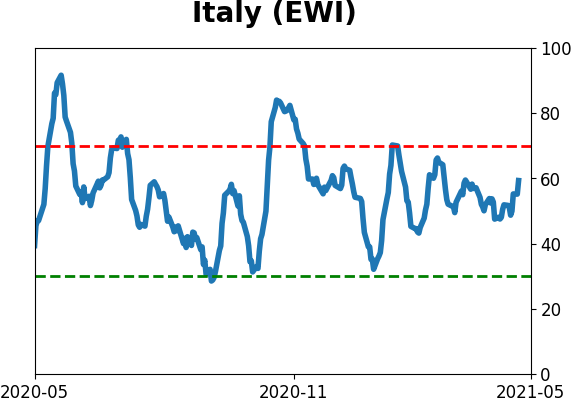

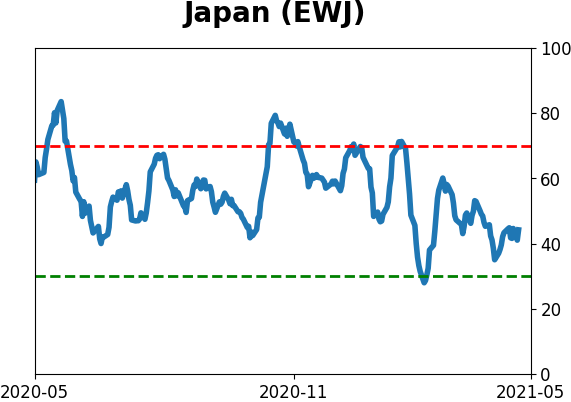

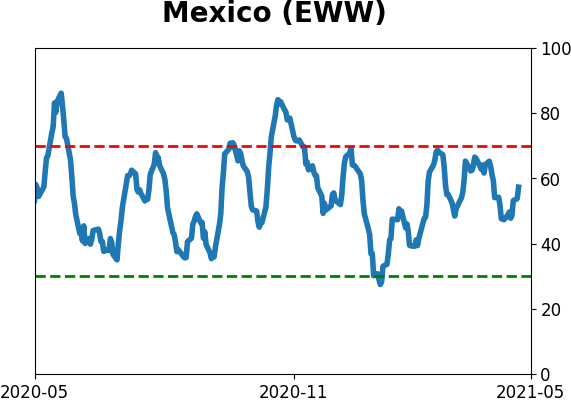

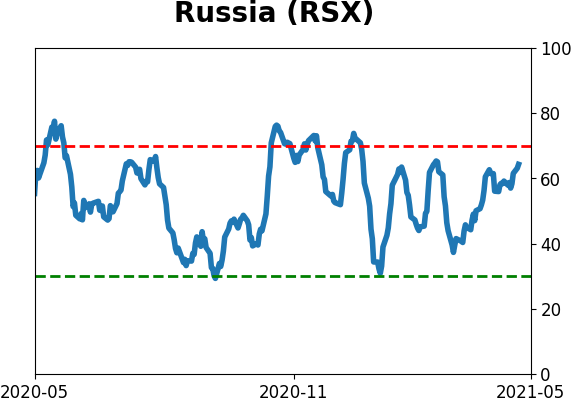

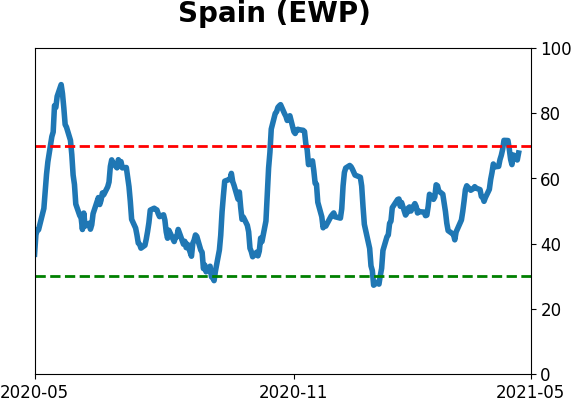

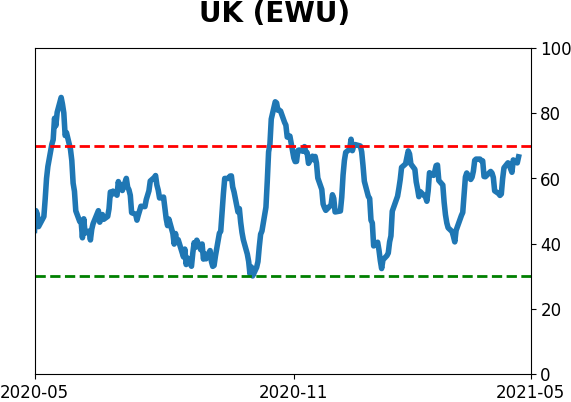

Sentiment Around The World

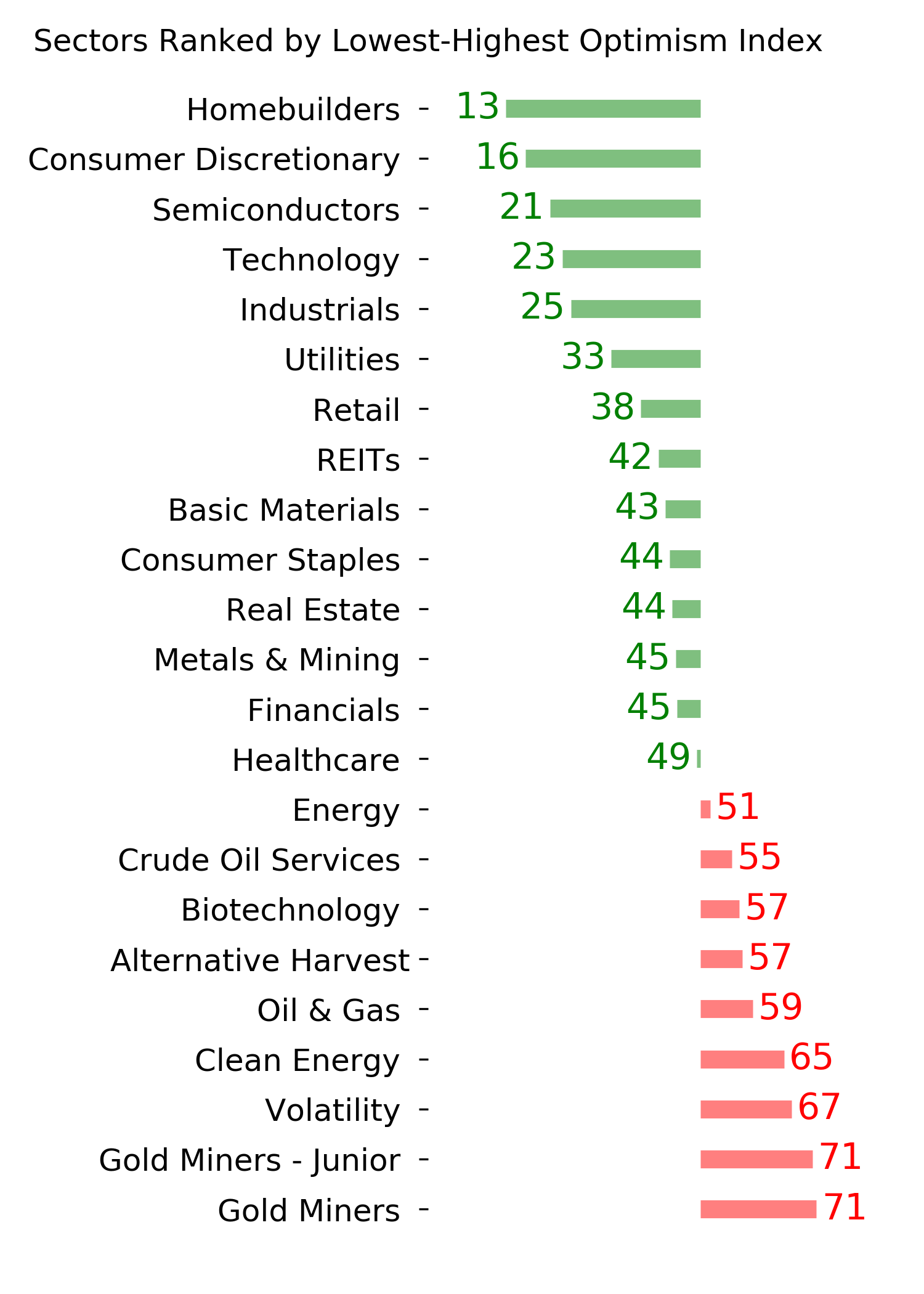

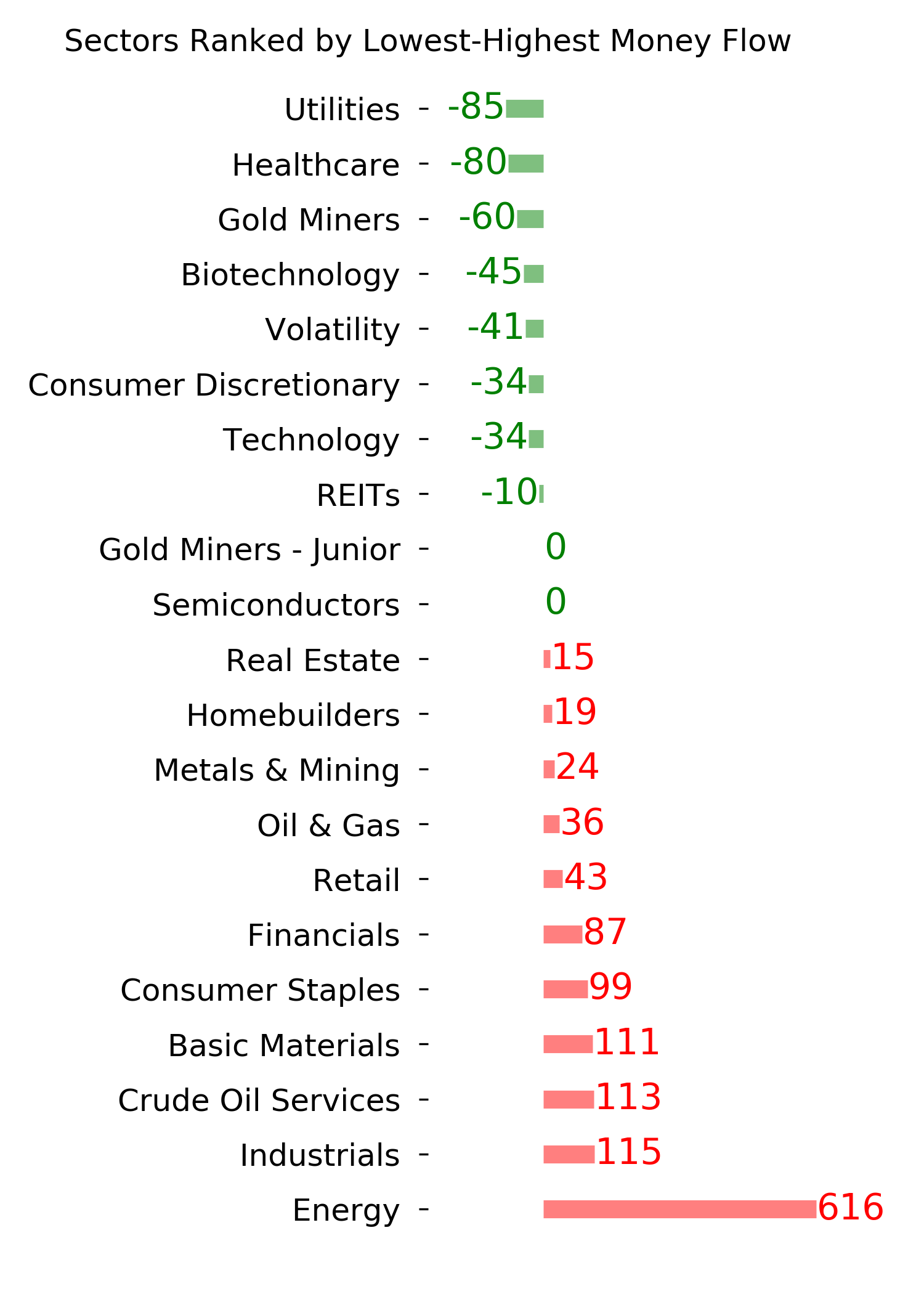

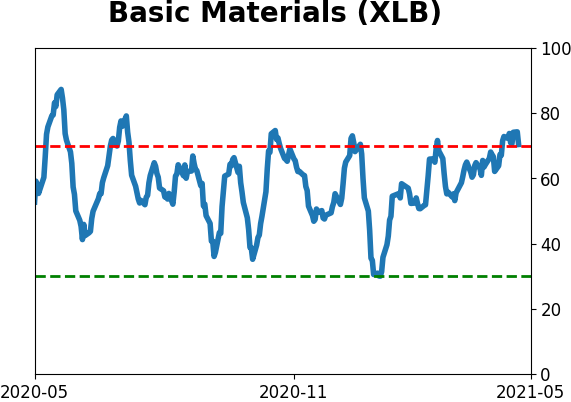

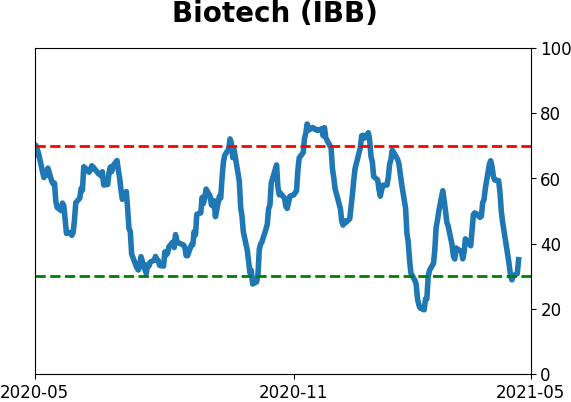

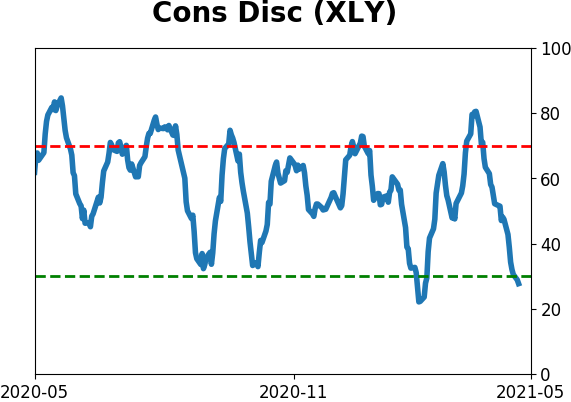

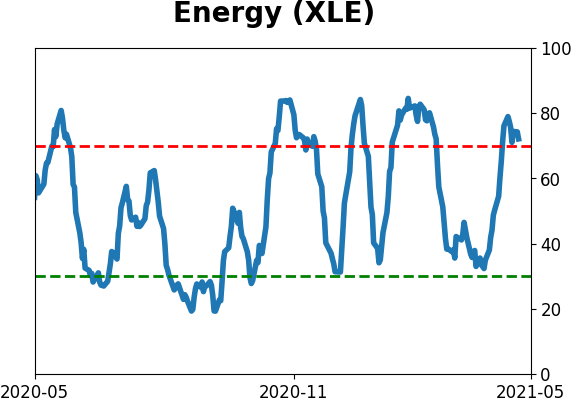

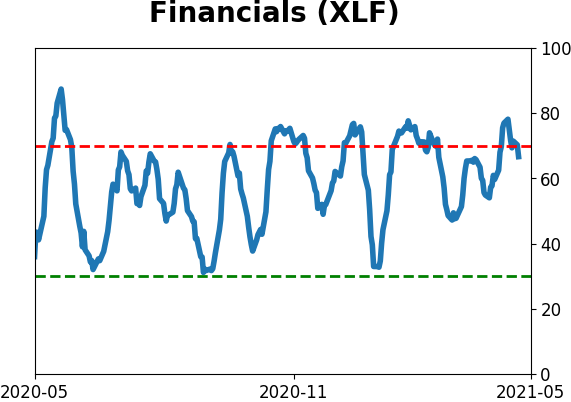

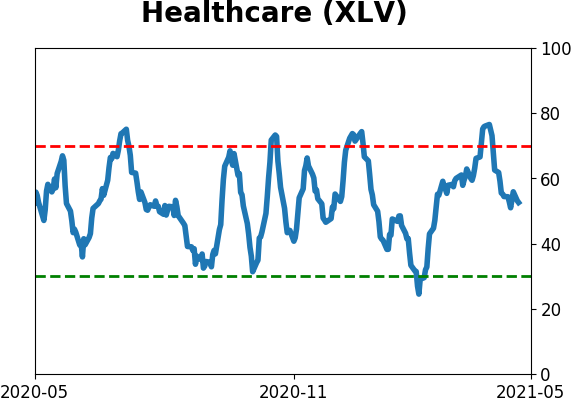

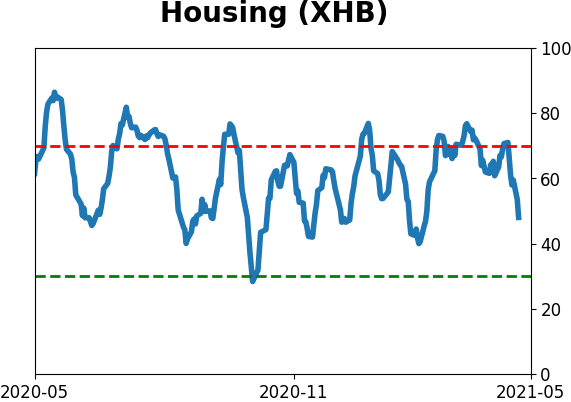

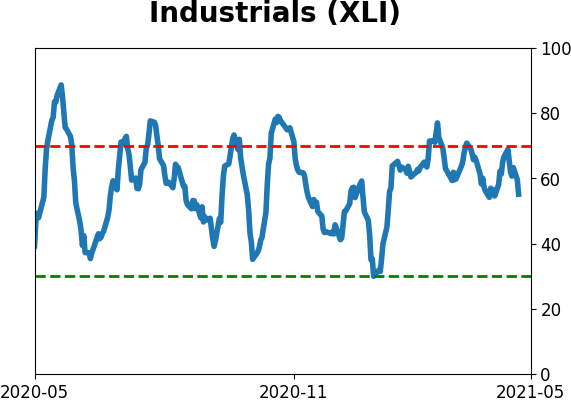

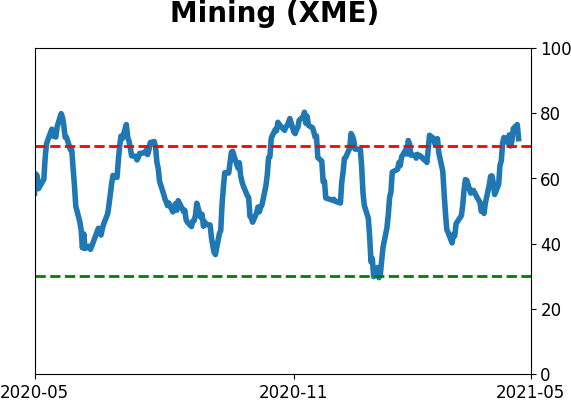

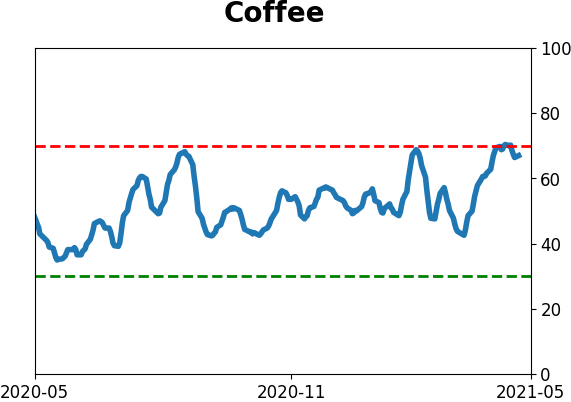

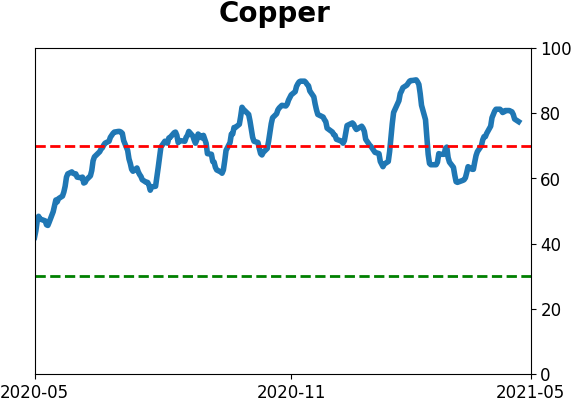

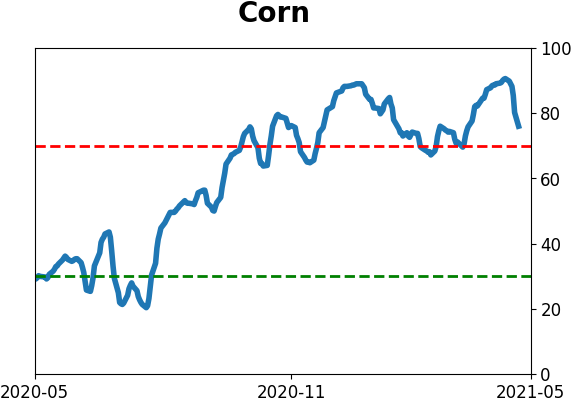

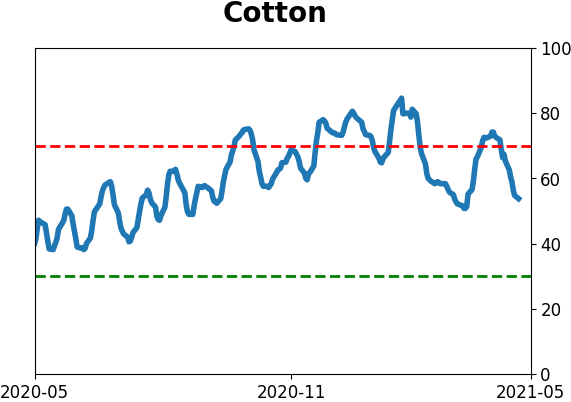

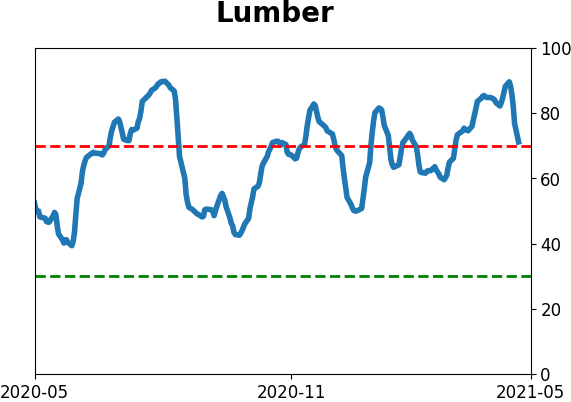

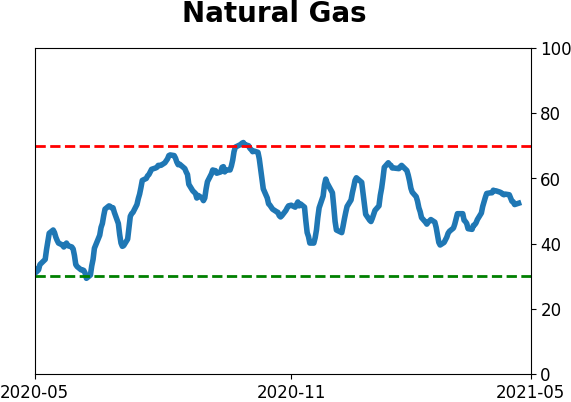

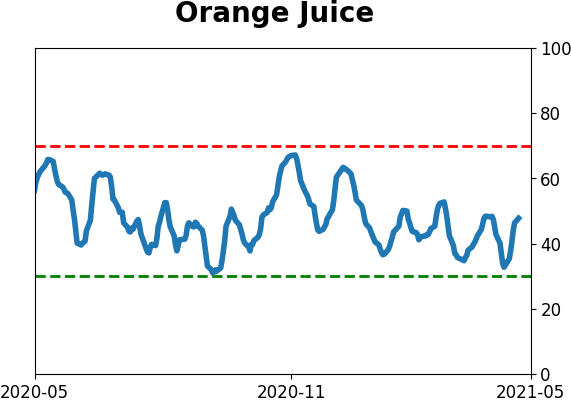

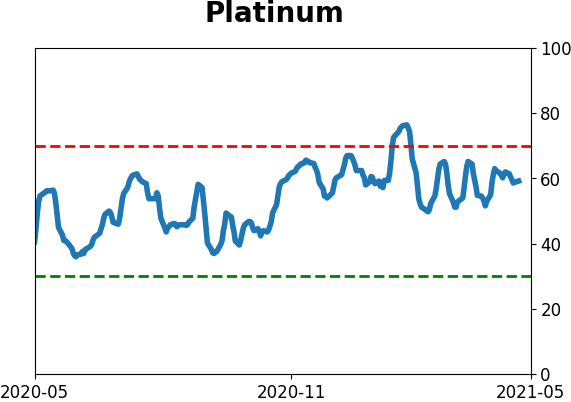

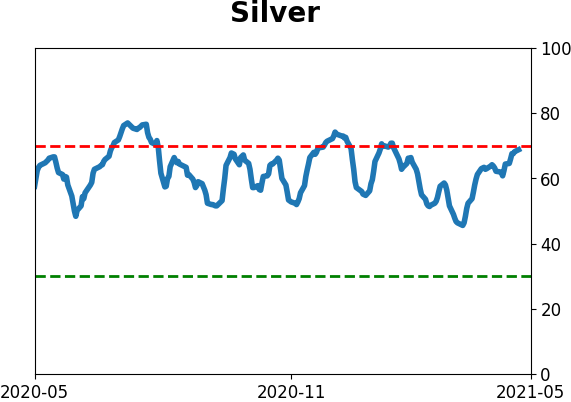

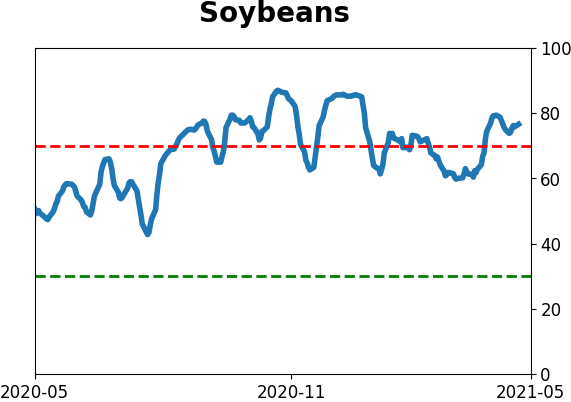

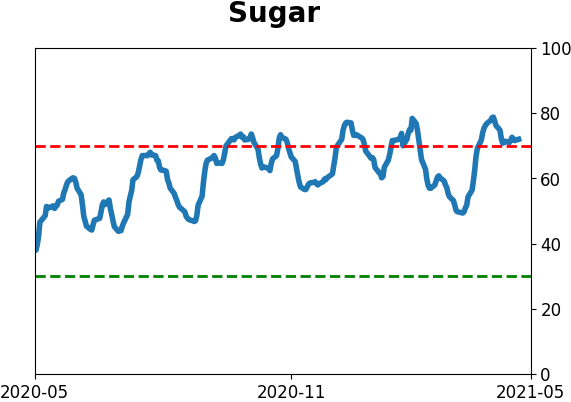

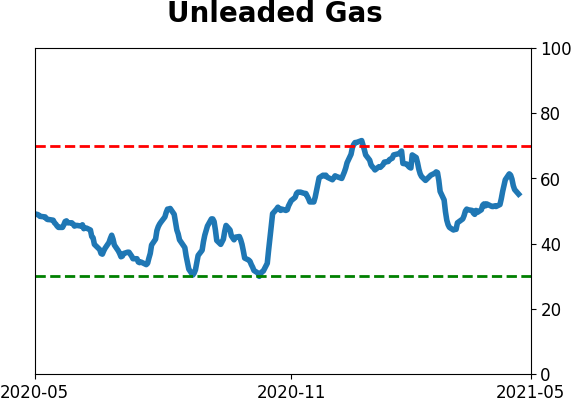

Optimism Index Thumbnails

|

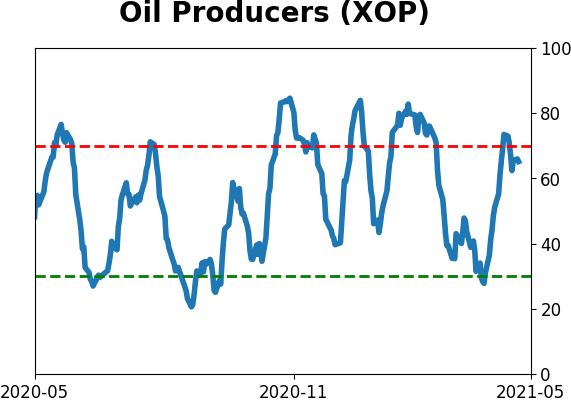

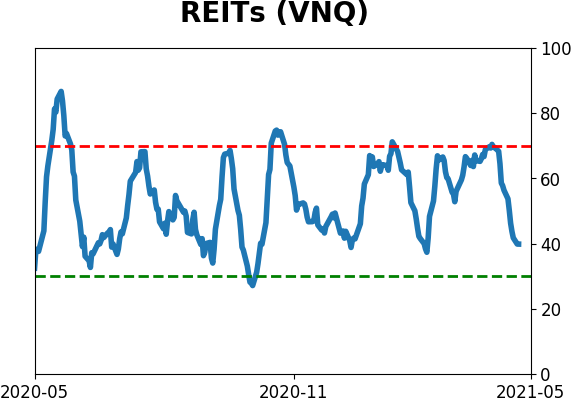

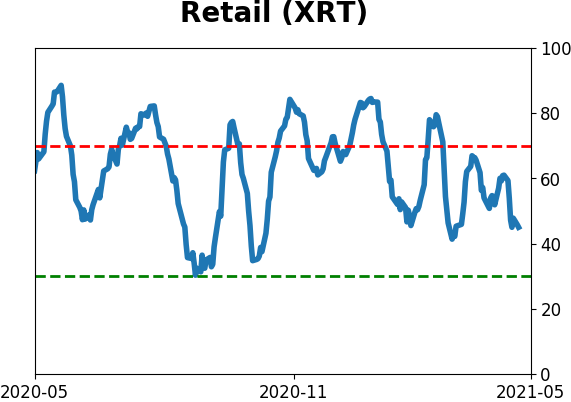

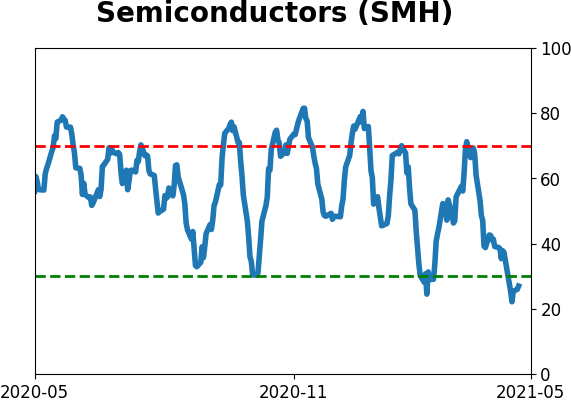

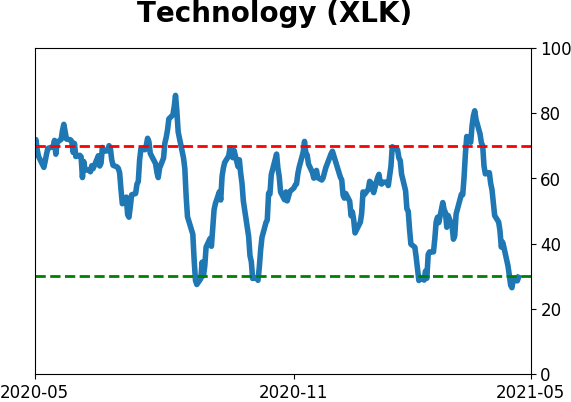

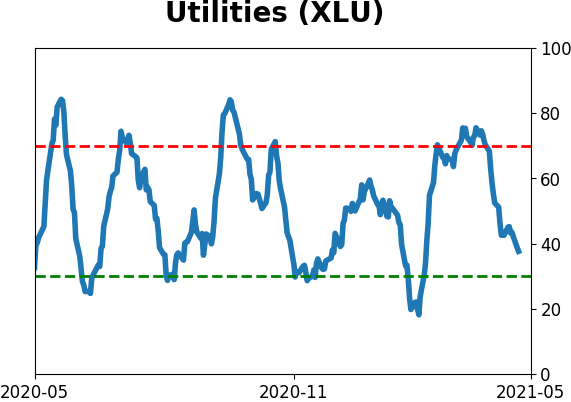

Sector ETF's - 10-Day Moving Average

|

|

|

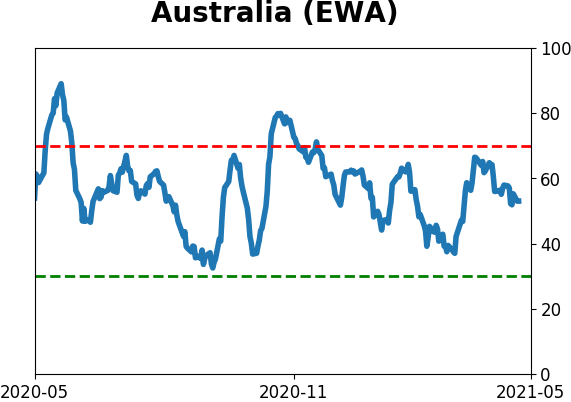

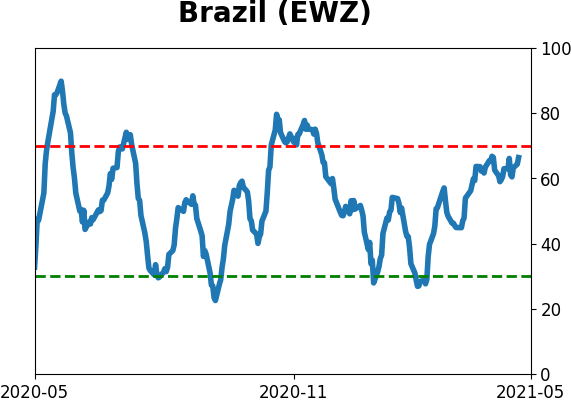

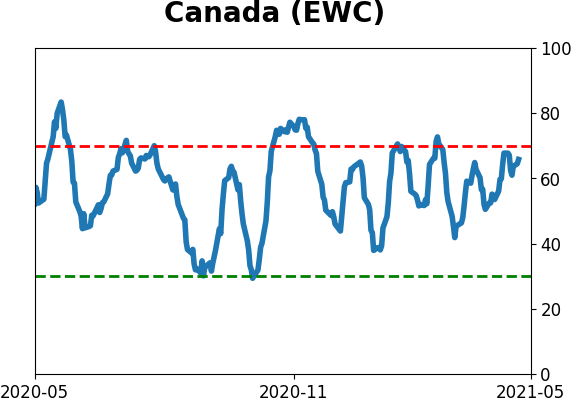

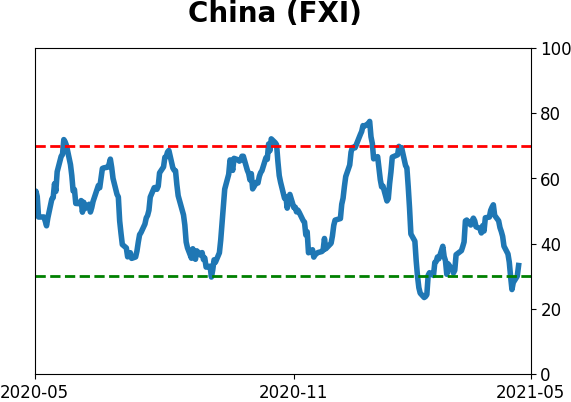

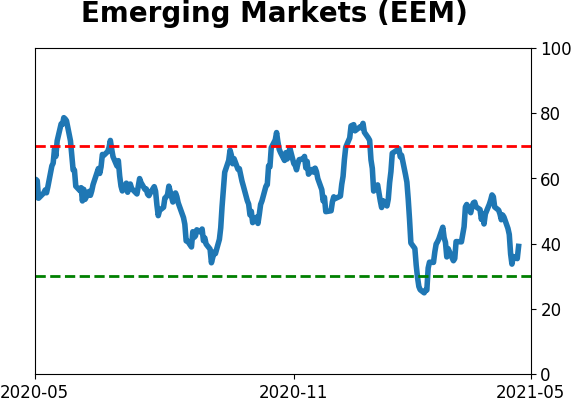

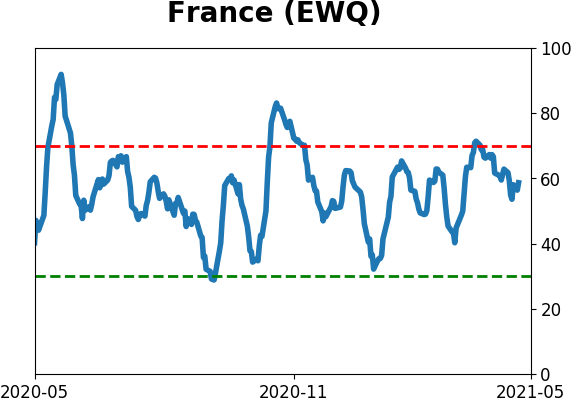

Country ETF's - 10-Day Moving Average

|

|

|

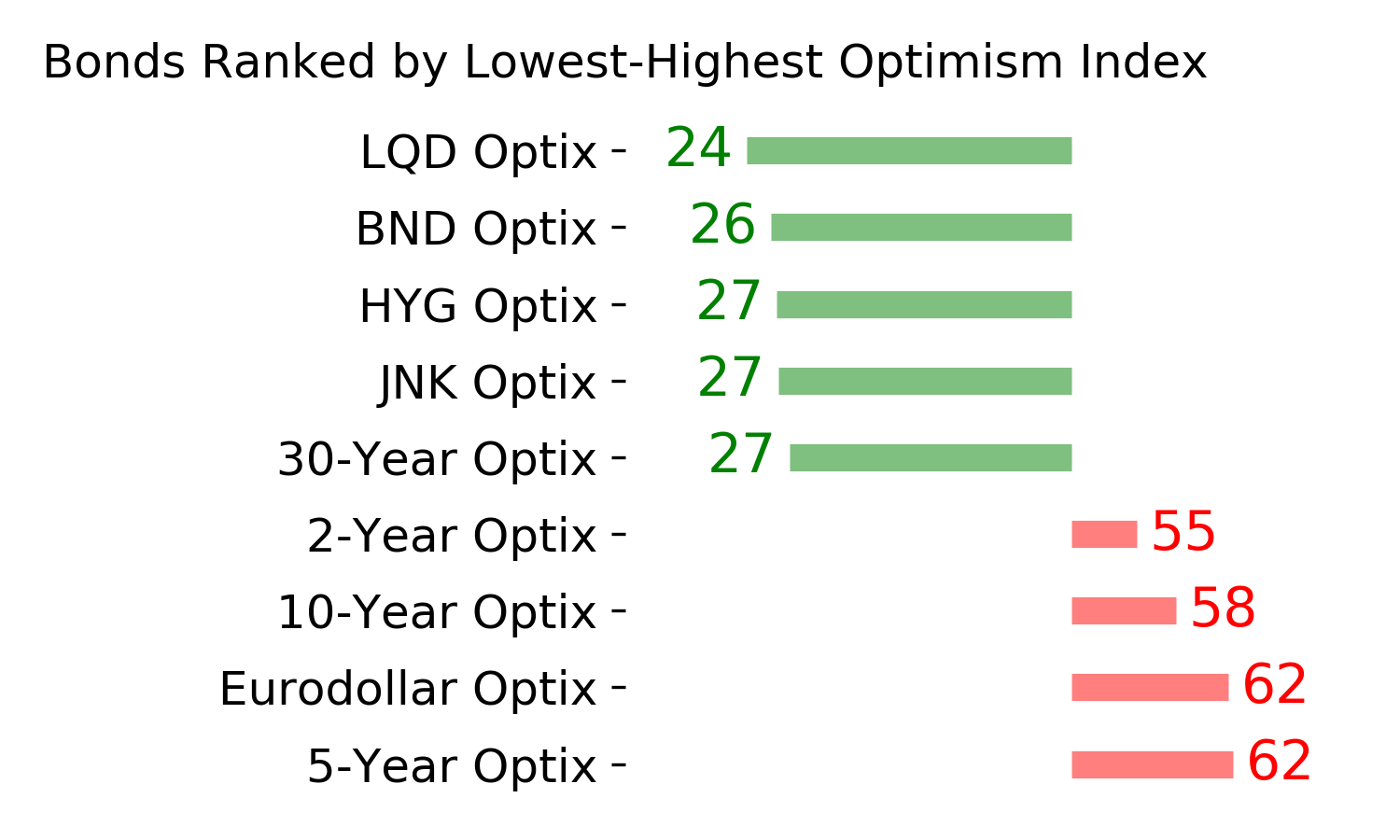

Bond ETF's - 10-Day Moving Average

|

|

|

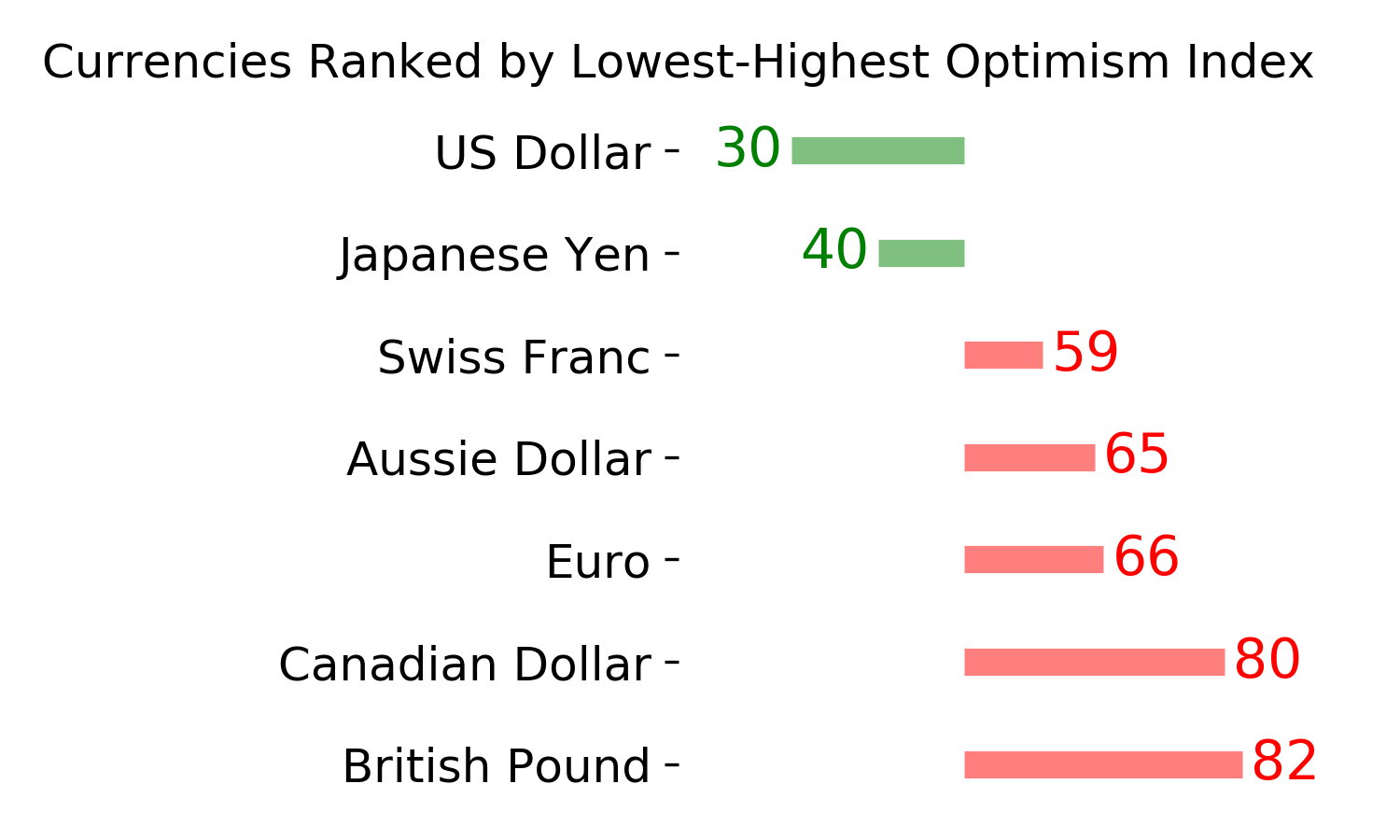

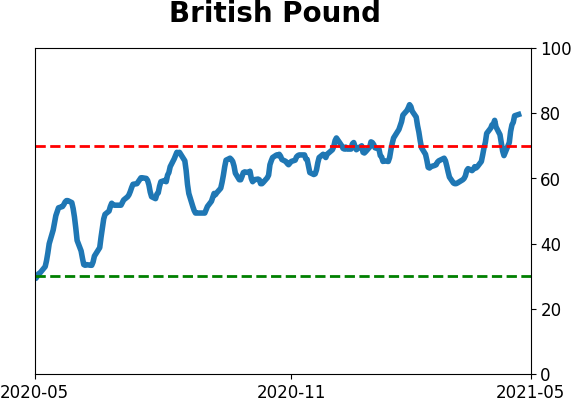

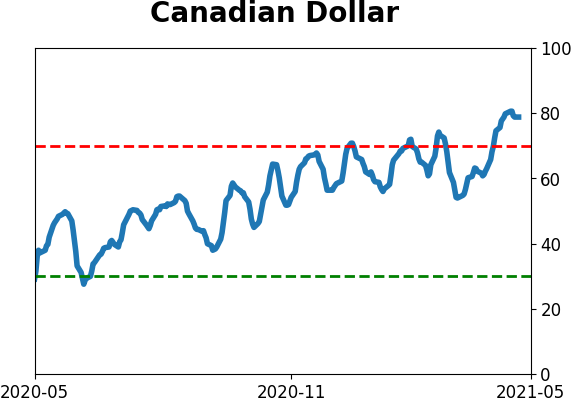

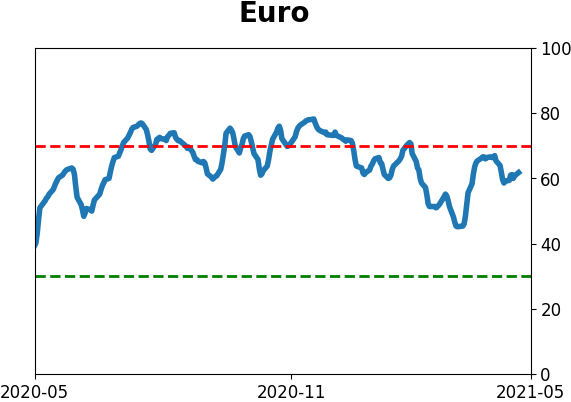

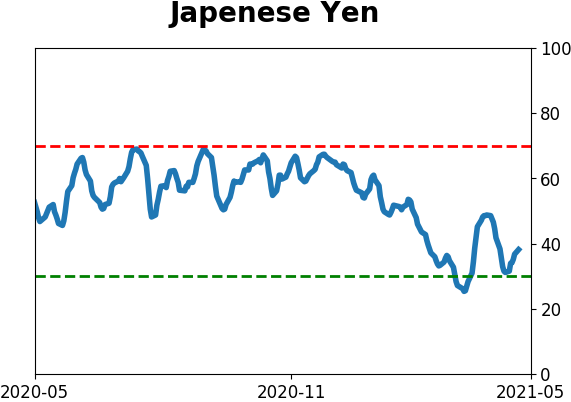

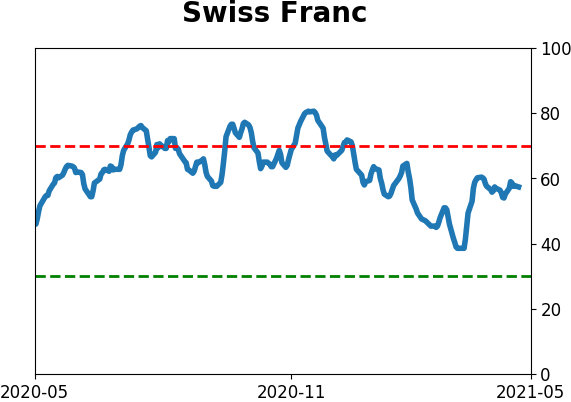

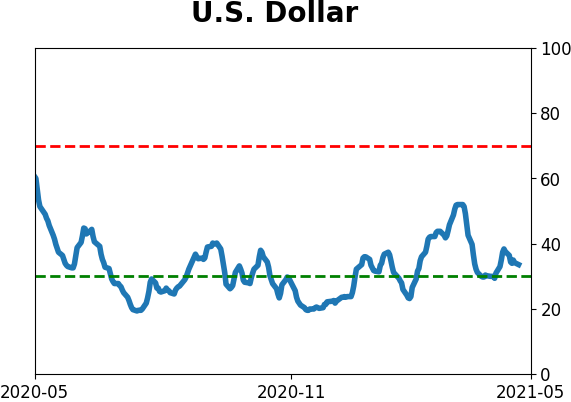

Currency ETF's - 5-Day Moving Average

|

|

|

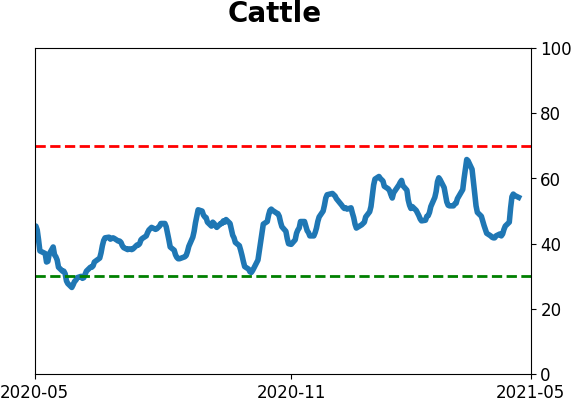

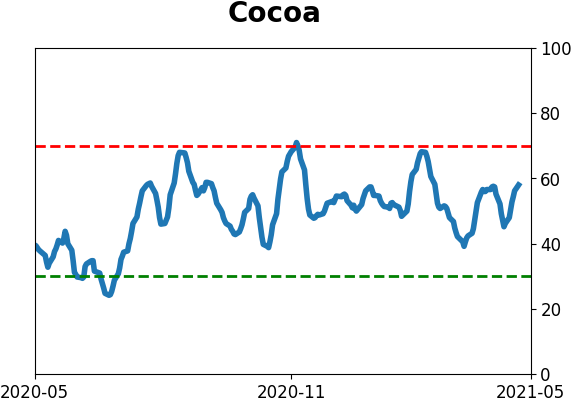

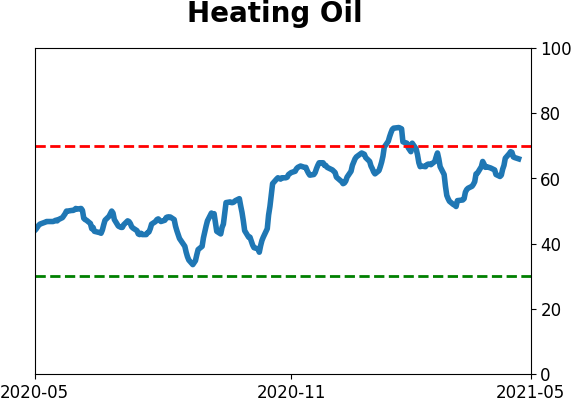

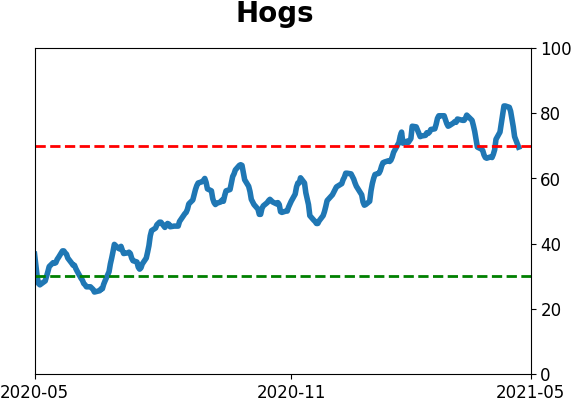

Commodity ETF's - 5-Day Moving Average

|

|