Headlines

|

|

The worst year ever for trading:

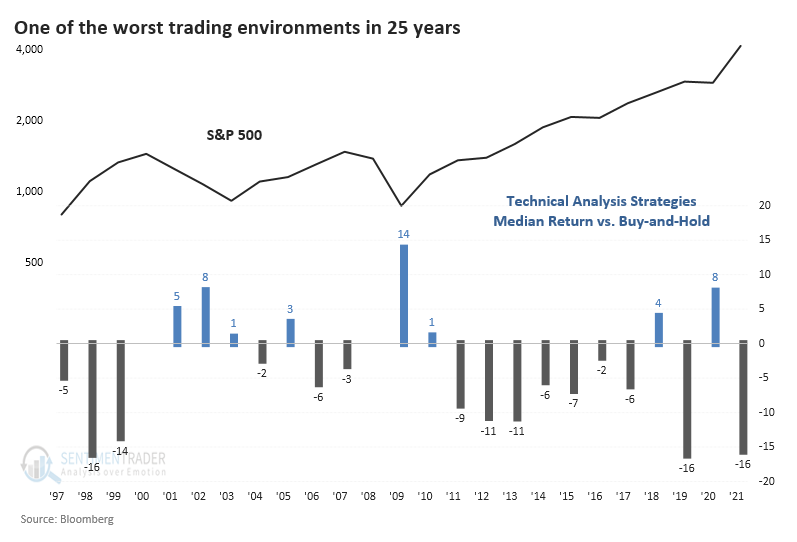

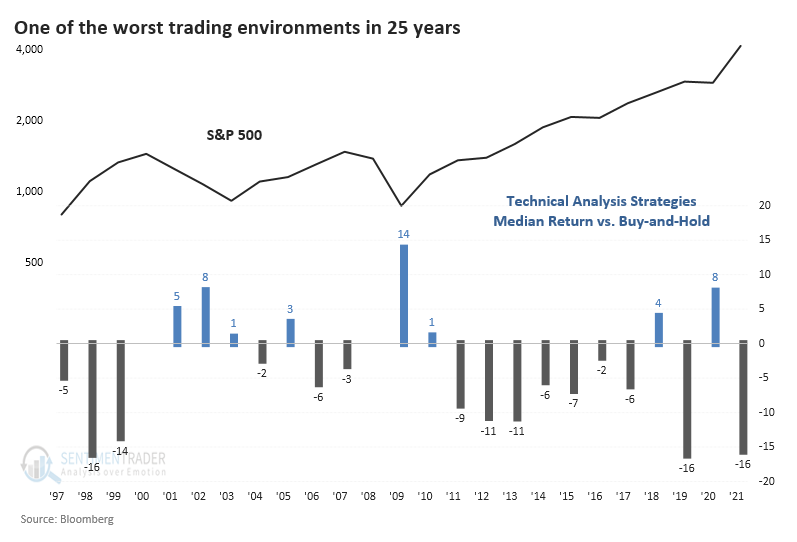

So far in 2021, most trading systems using technical indicators have lost money. As a group, they have lagged the S&P 500's buy-and-hold return by 16%, tied for the worst performance in 25 years.

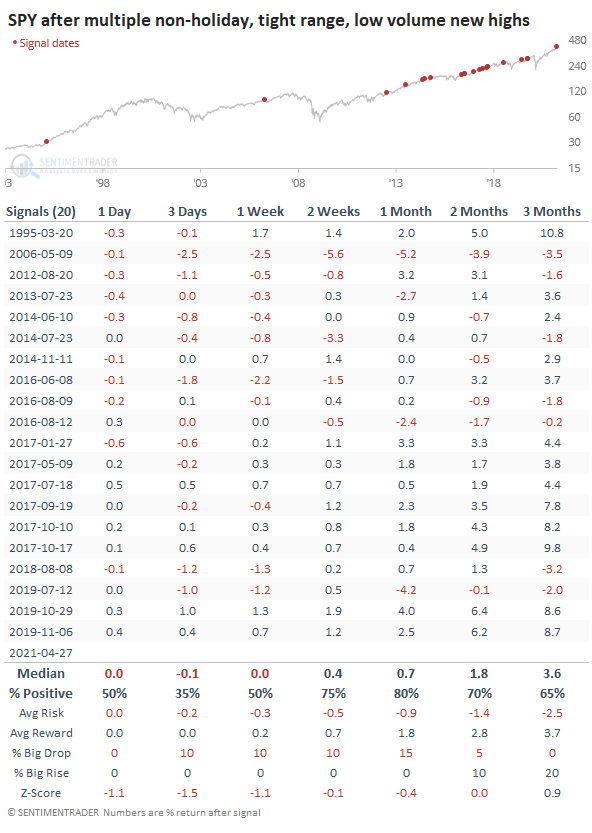

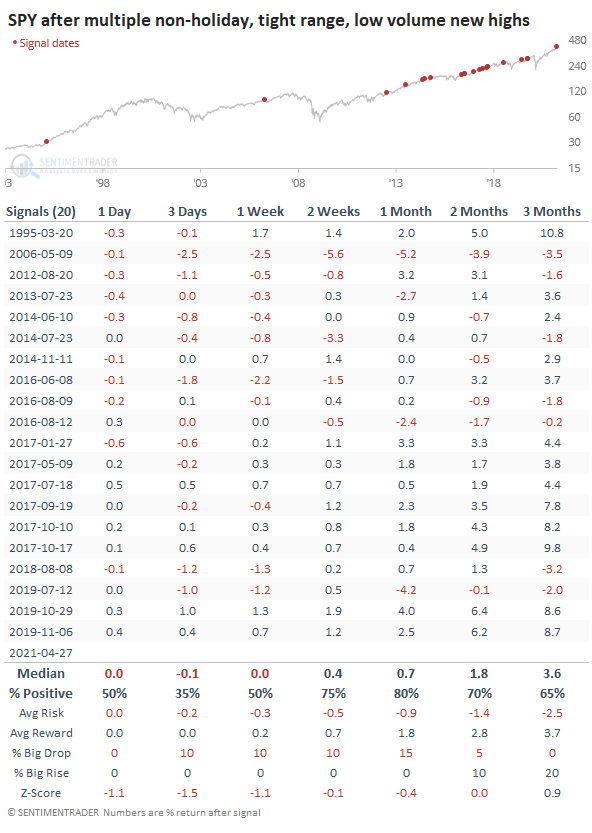

Don't short a dull market. Don't short a dull market. Don't short...: This particular market clichè has some historical support. When stocks do nothing at new highs, it's more often a pause than a reversal. The S&P 500 fund, SPY, has had an intraday range less than 0.5%, with volume more than 33% below average, while exceeding its previous high, for consecutive sessions. Excluding holiday periods, SPY tended to dip in the very short-term but rally afterward. This is likely due to the looming deluge of earnings and FOMC decision, so FWIW.

Bottom Line:

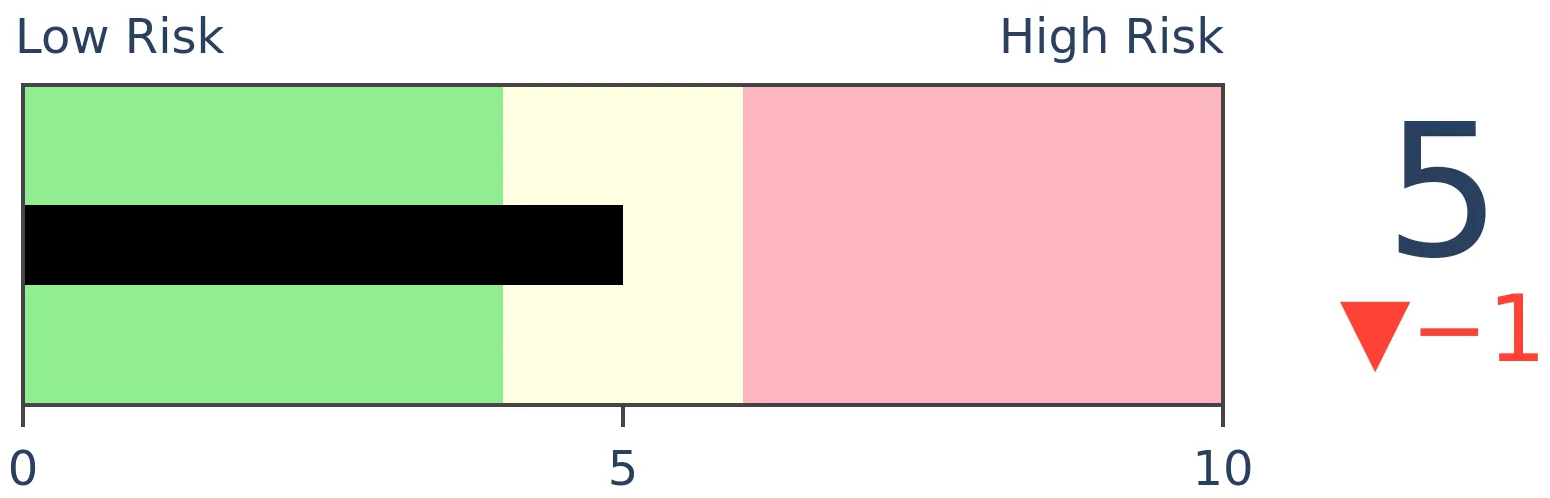

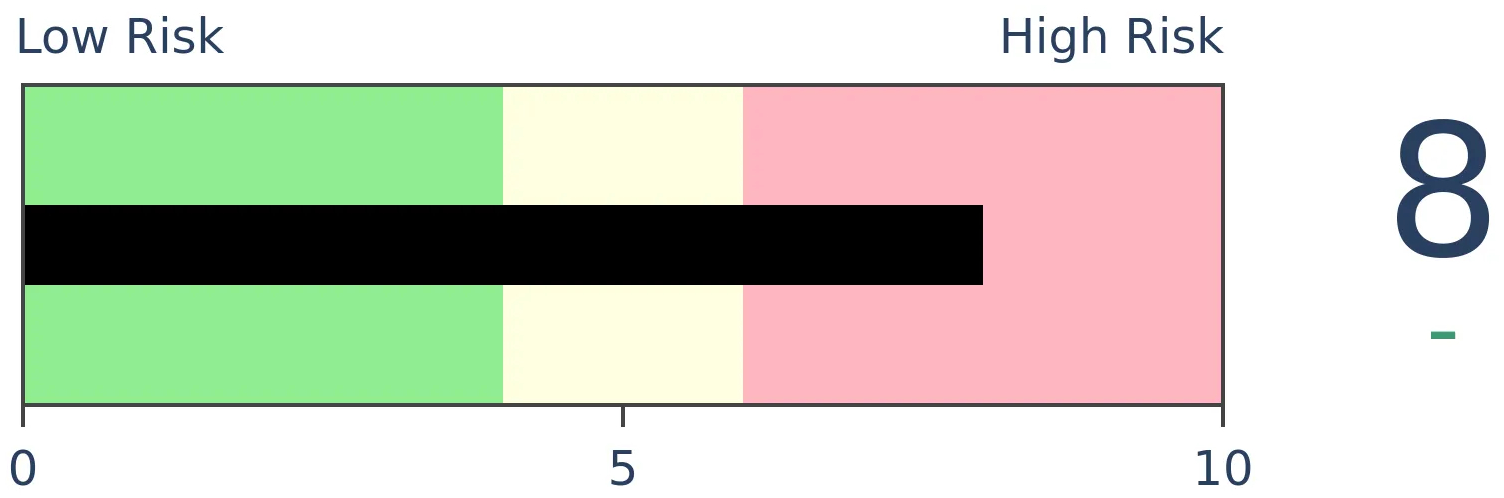

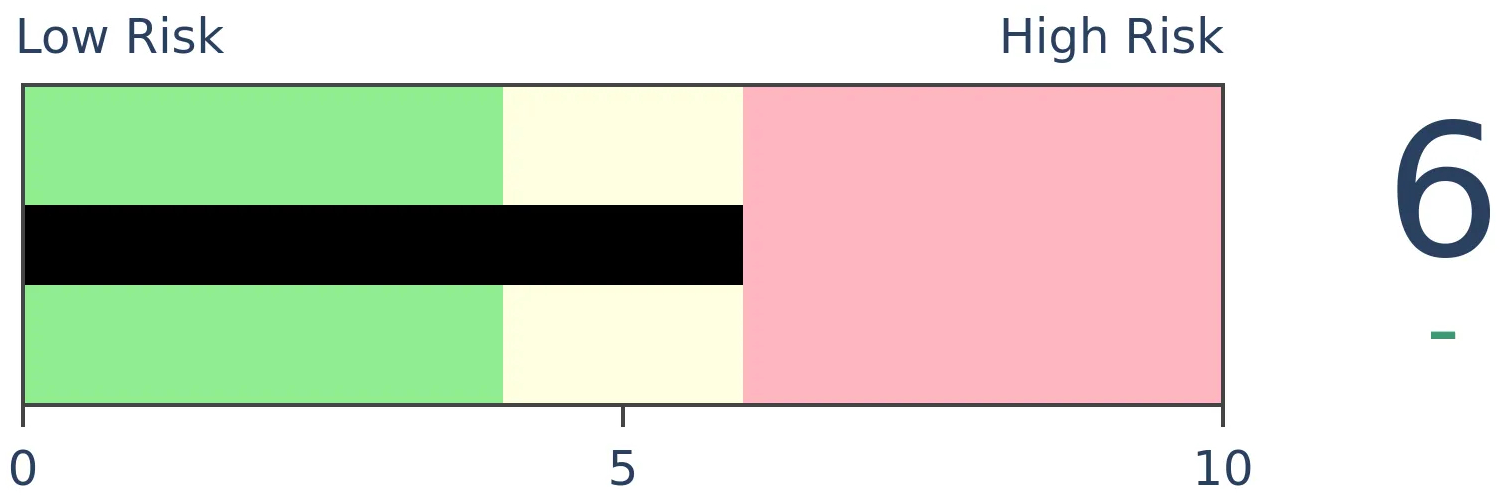

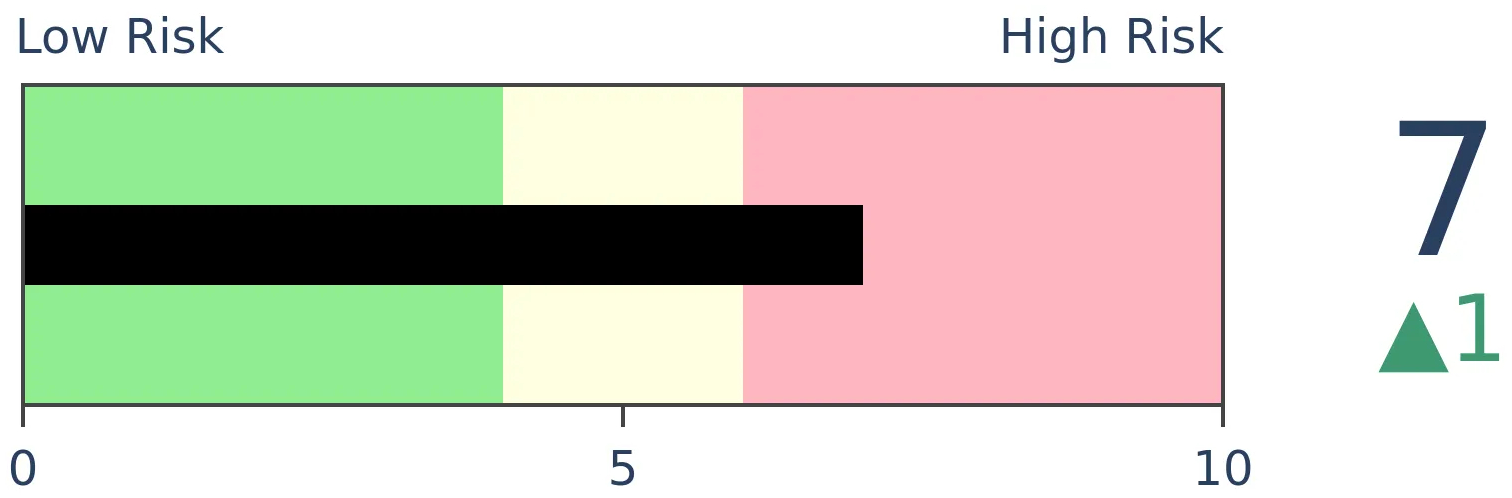

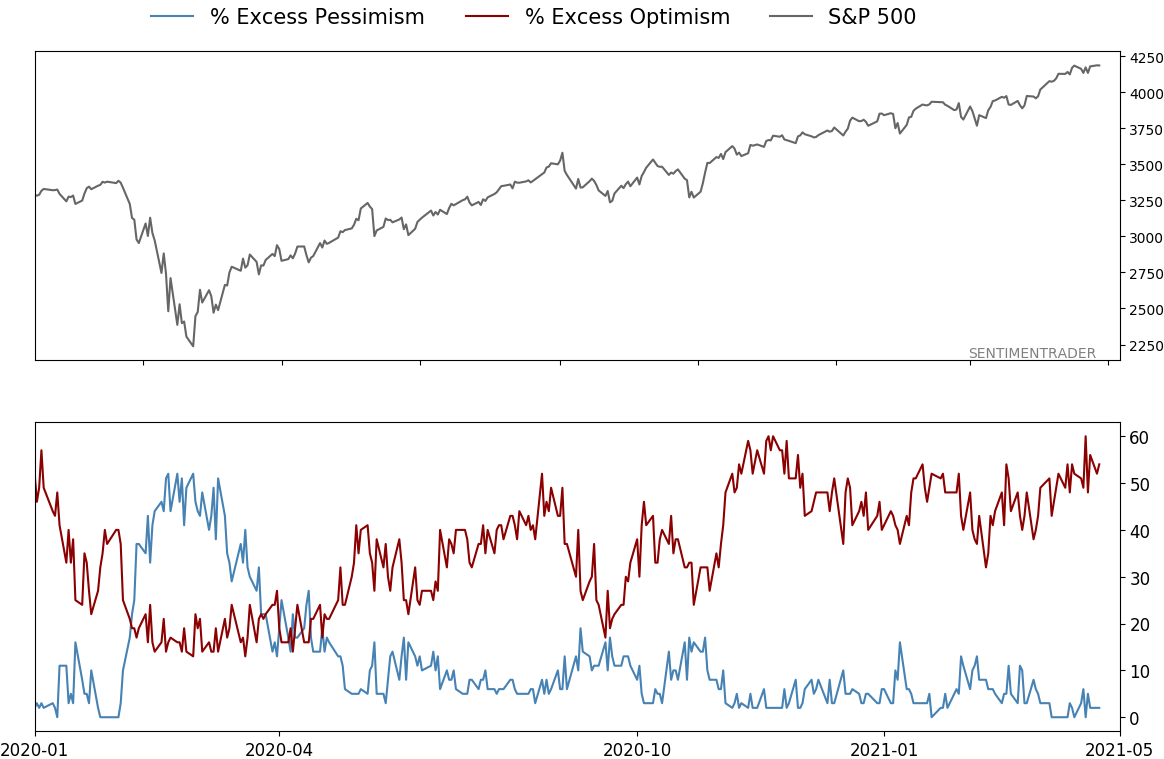

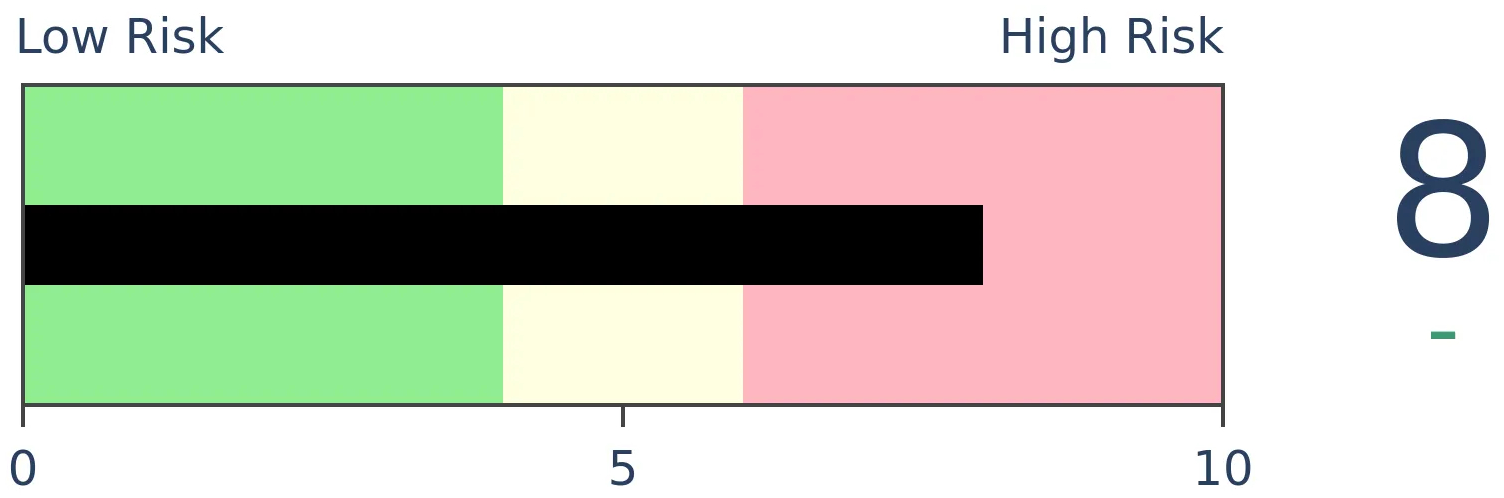

See the Outlook & Allocations page for more details on these summaries STOCKS: Weak sell

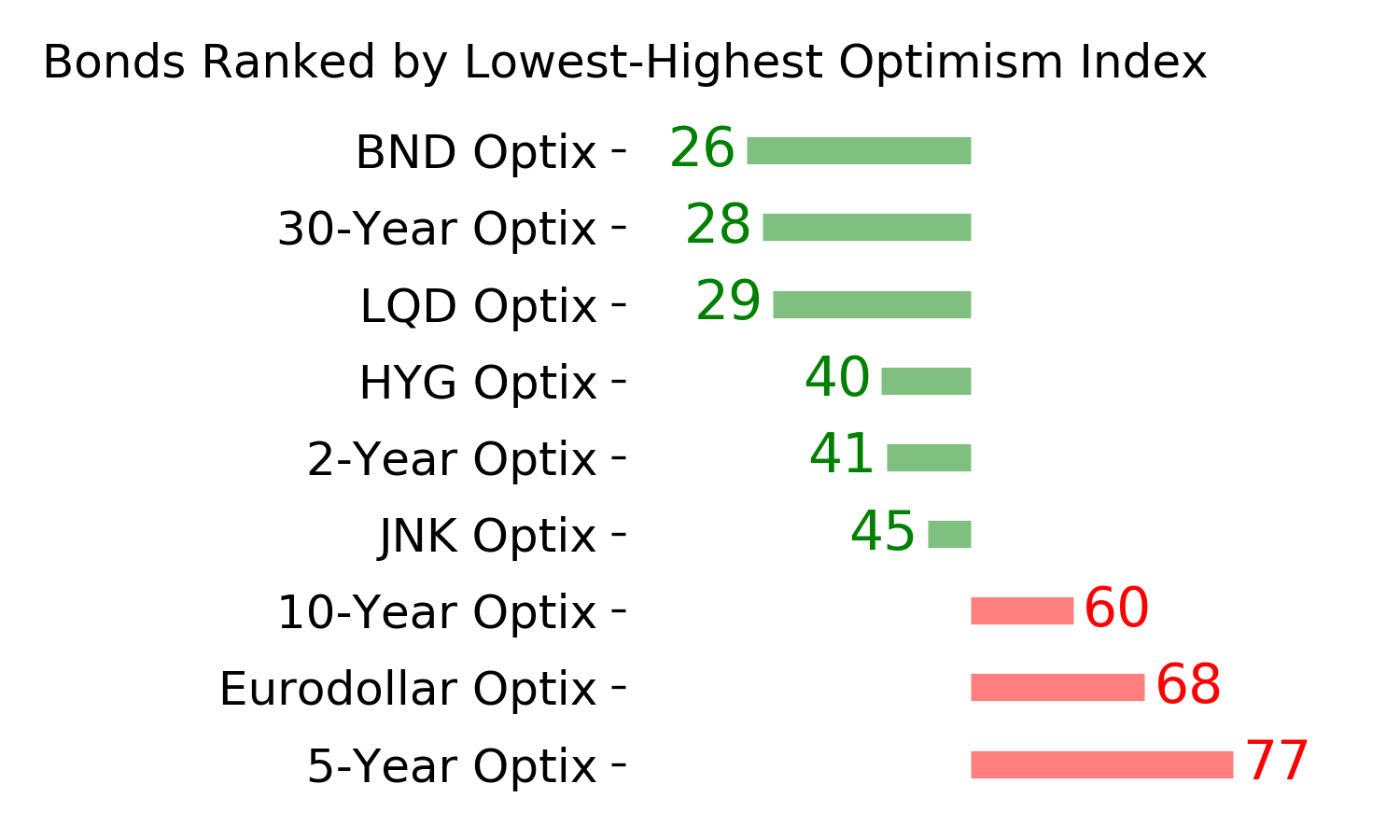

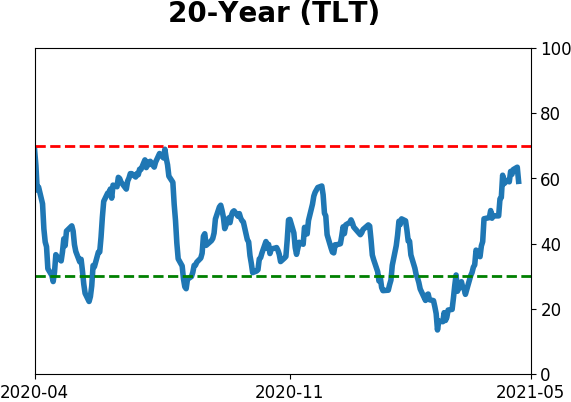

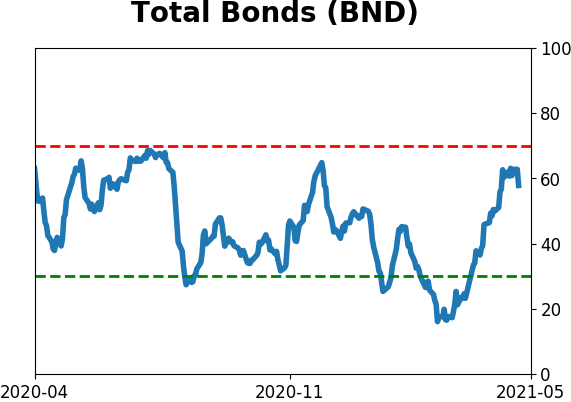

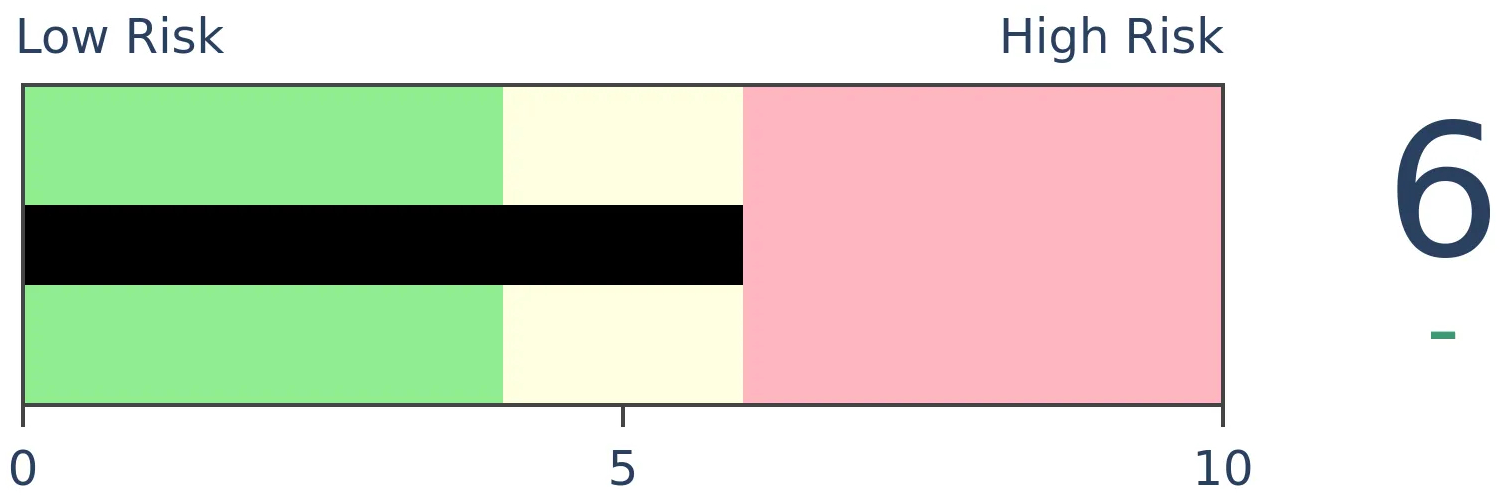

The extreme speculation registered in January and February is starting to get wrung out. Internal dynamics have mostly held up, so a return to neutral sentiment conditions would improve the forward risk/reward profile substantially. We're still a ways off from that. BONDS: Weak buy

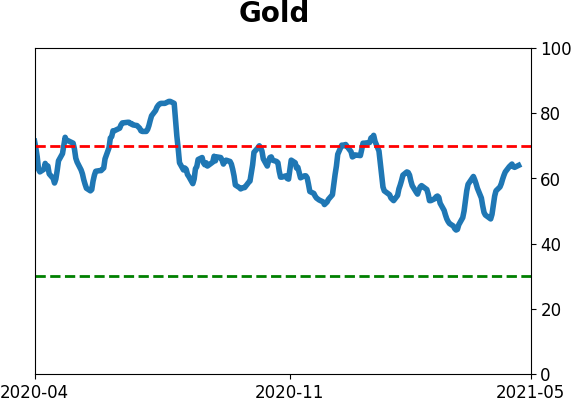

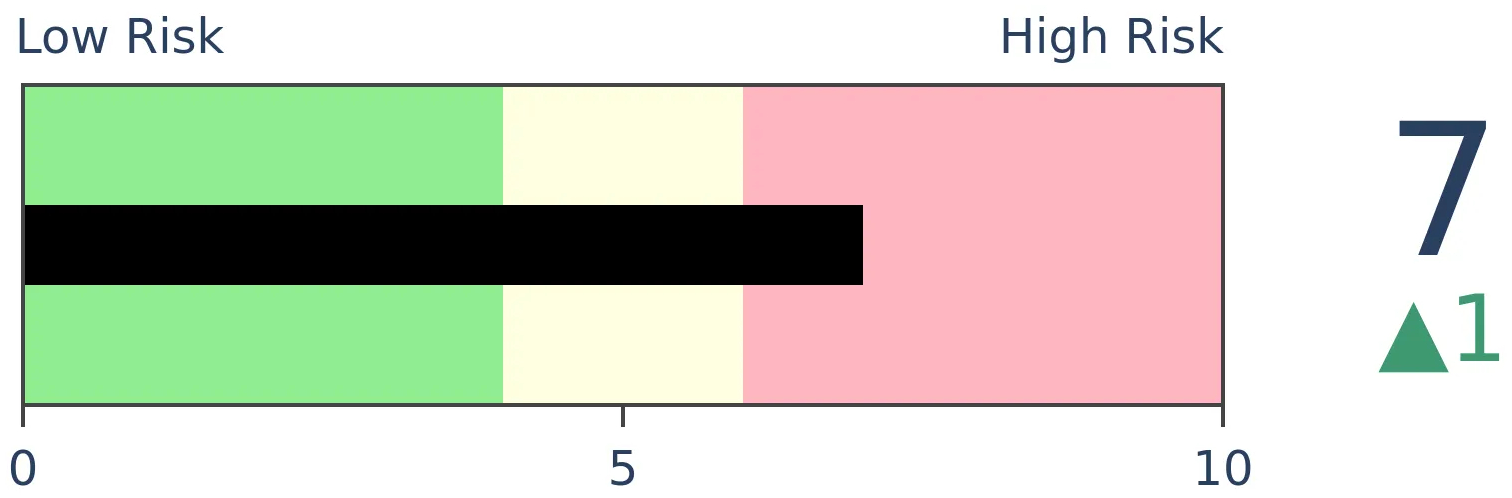

Various parts of the market have been hit in recent weeks, with mild oversold conditions. The Bond Optimism Index is now about as low as it gets during healthy bond market environments. Fixed income isn't responding well, so that needs to be monitored in case it's transitioning to a longer-term negative market environment. GOLD: Weak buy

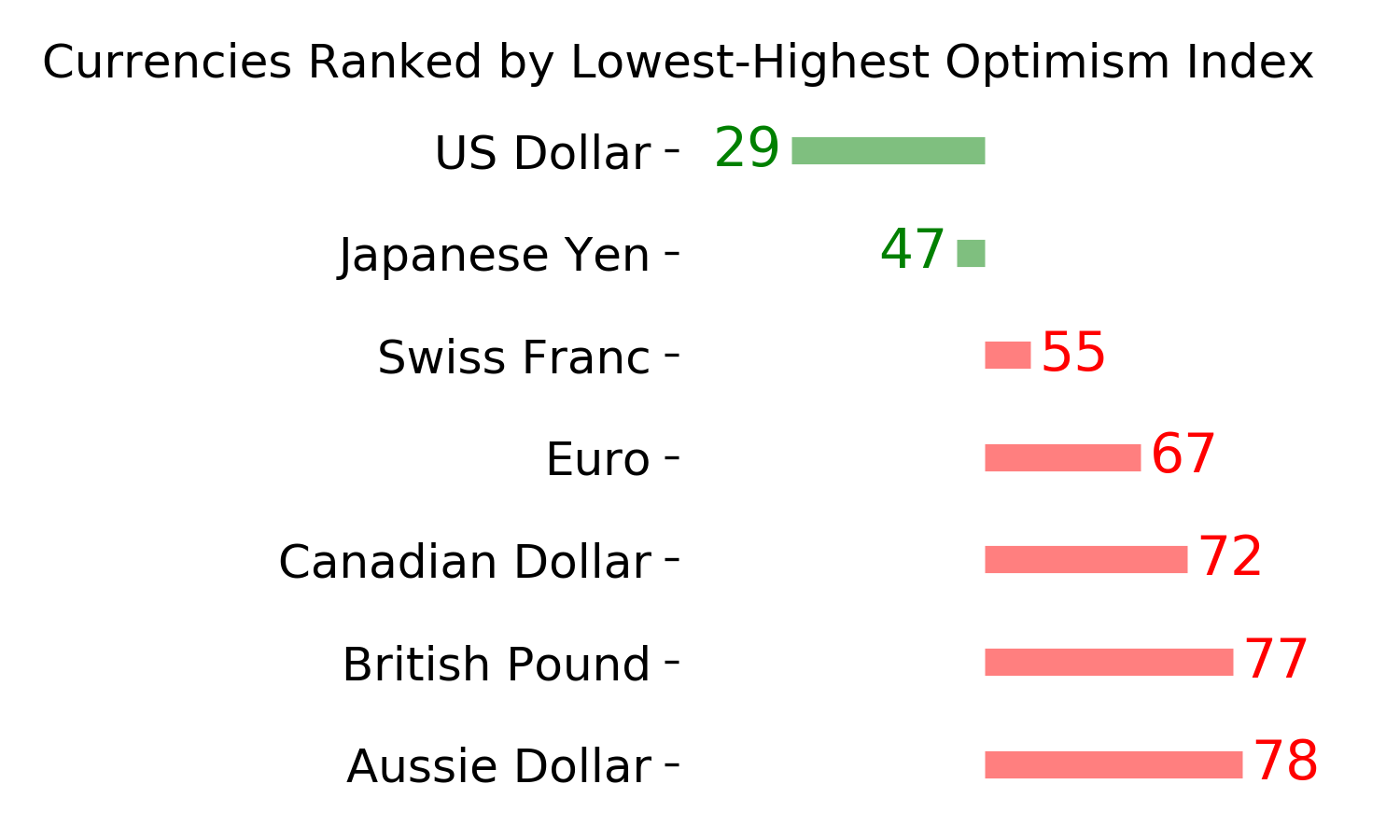

A dollar trying to rebound from a severe short position has weighed on gold and miners. The types of signals they've given in recent weeks, within the context of their recent surge, have usually resulted in higher prices over a medium- to long-term time frame. Like bonds, gold and miners aren't responding very well, and this needs to be monitored.

|

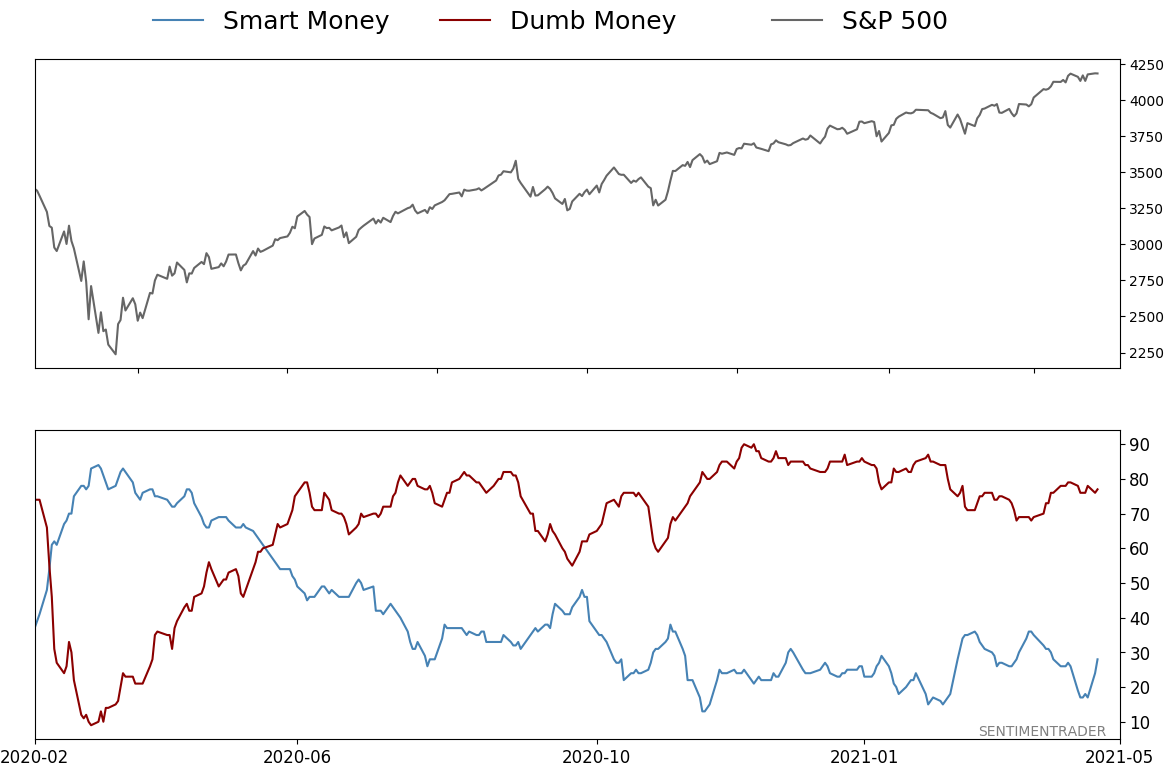

Smart / Dumb Money Confidence

|

Smart Money Confidence: 28%

Dumb Money Confidence: 77%

|

|

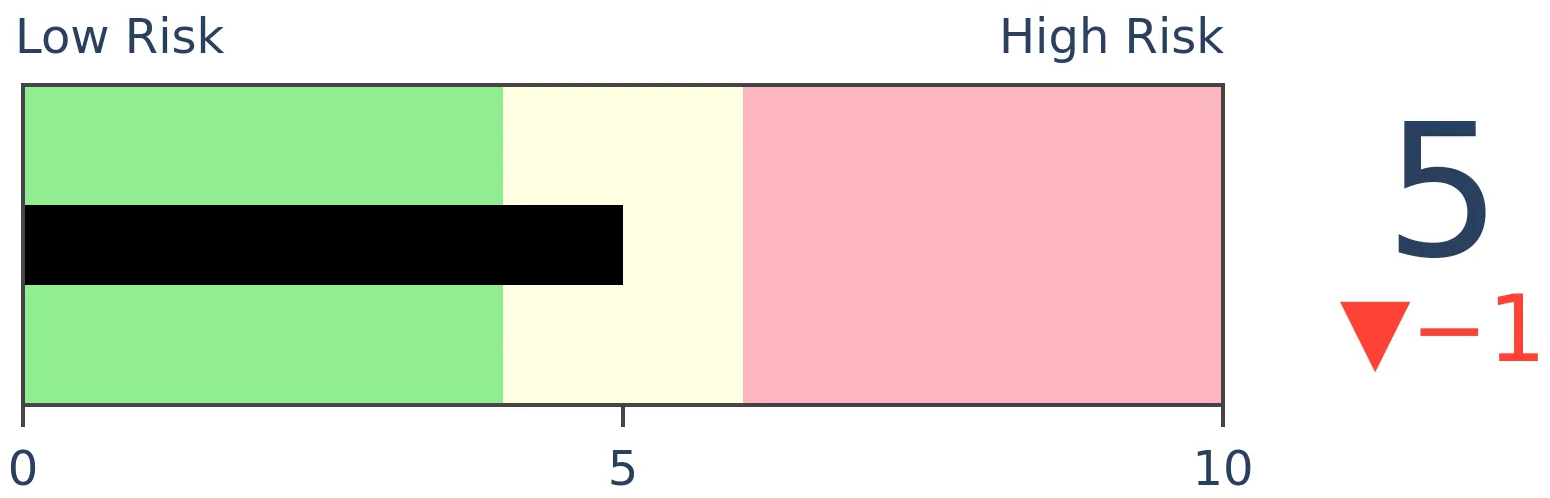

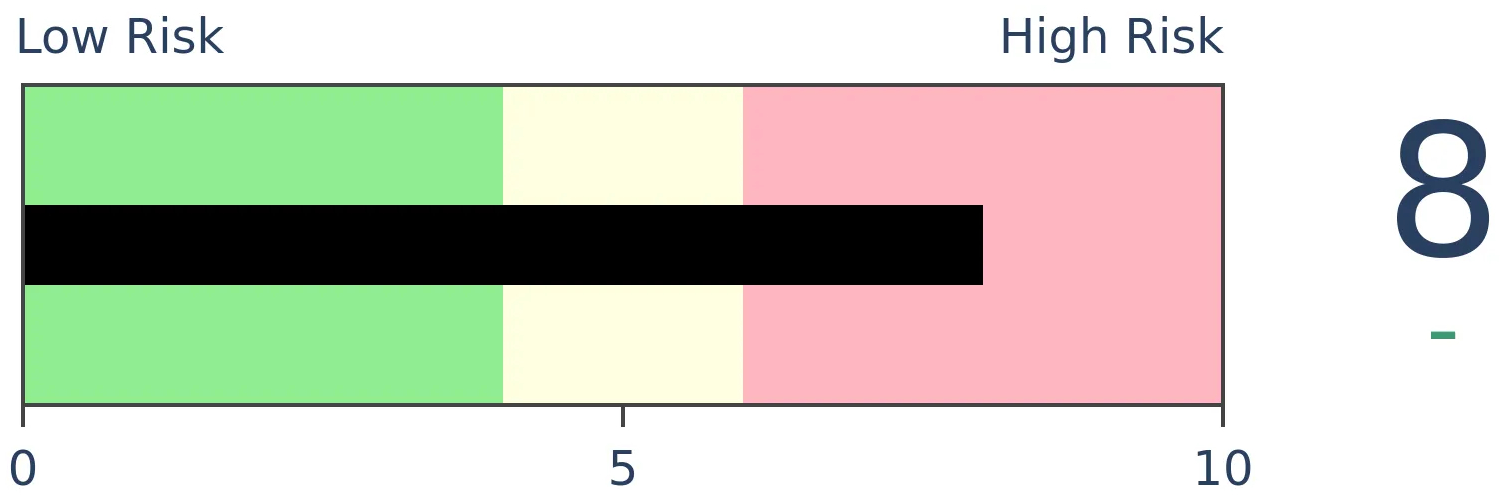

Risk Levels

Stocks Short-Term

|

Stocks Medium-Term

|

|

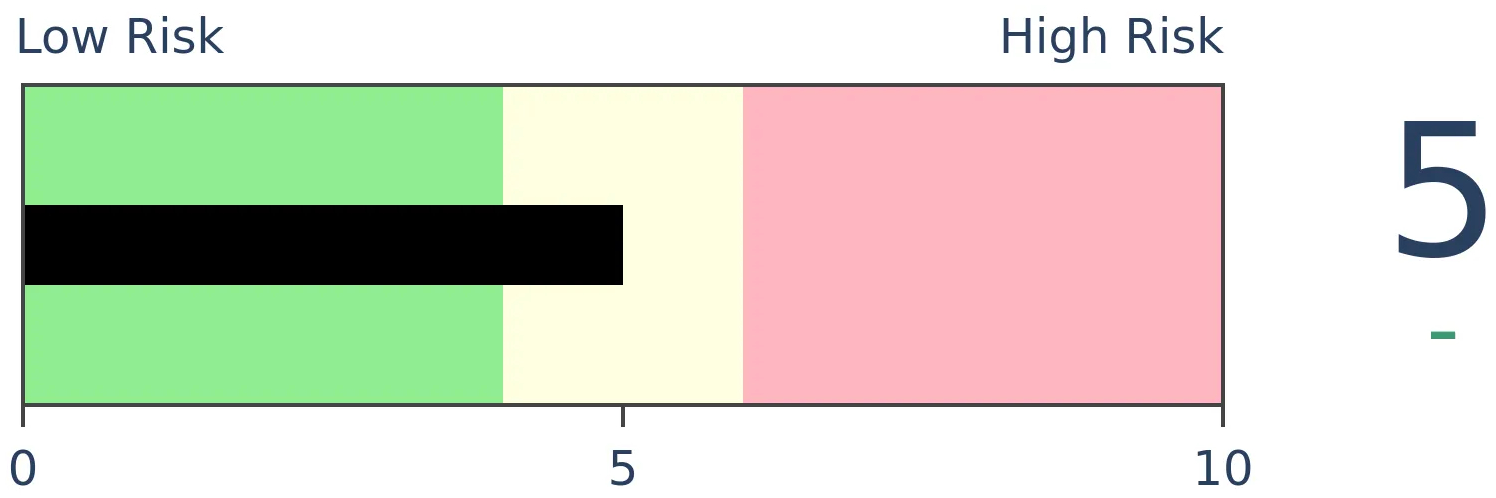

Bonds

|

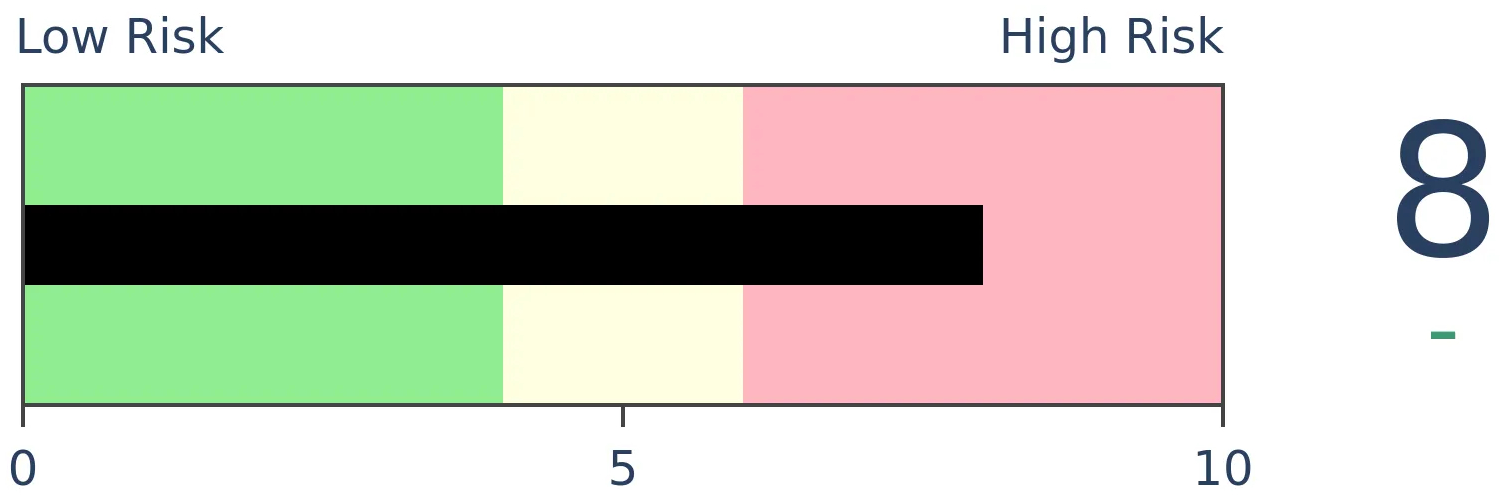

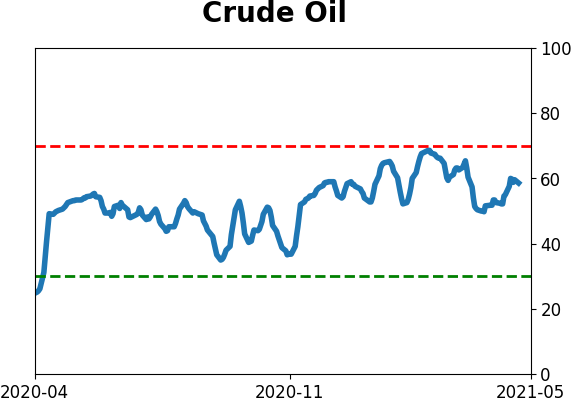

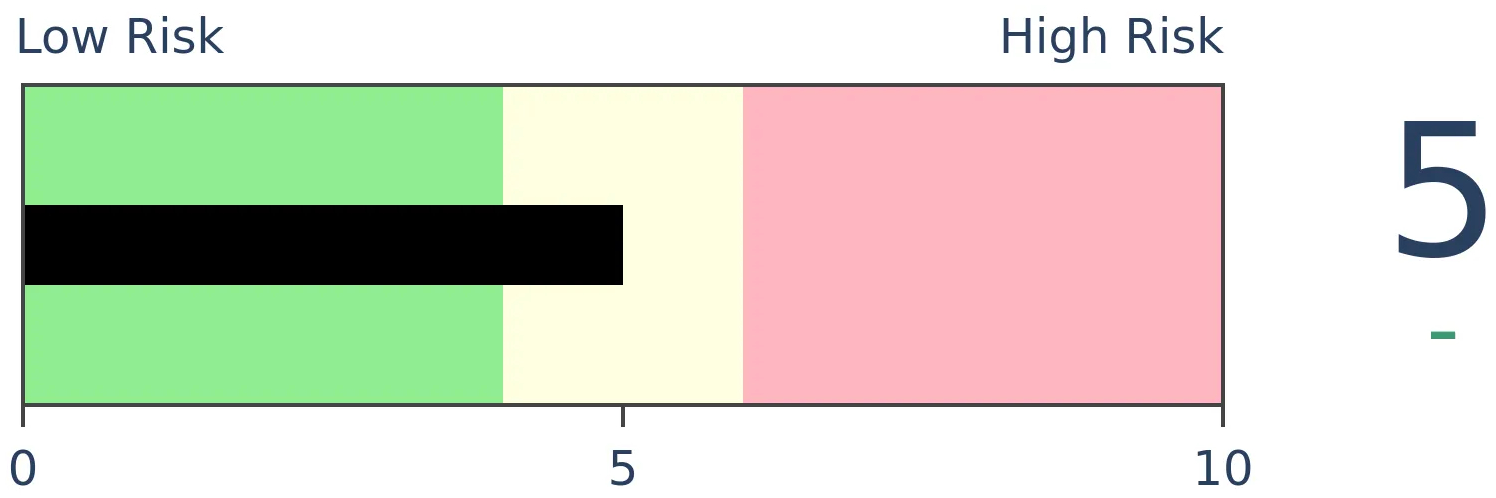

Crude Oil

|

|

Gold

|

Agriculture

|

|

Research

BOTTOM LINE

So far in 2021, most trading systems using technical indicators have lost money. As a group, they have lagged the S&P 500's buy-and-hold return by 16%, tied for the worst performance in 25 years.

FORECAST / TIMEFRAME

None

|

There has never been a worse time to be a technician.

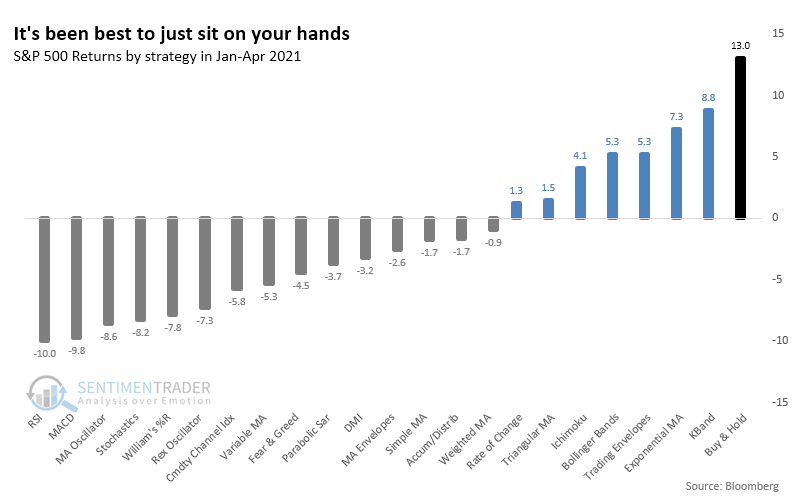

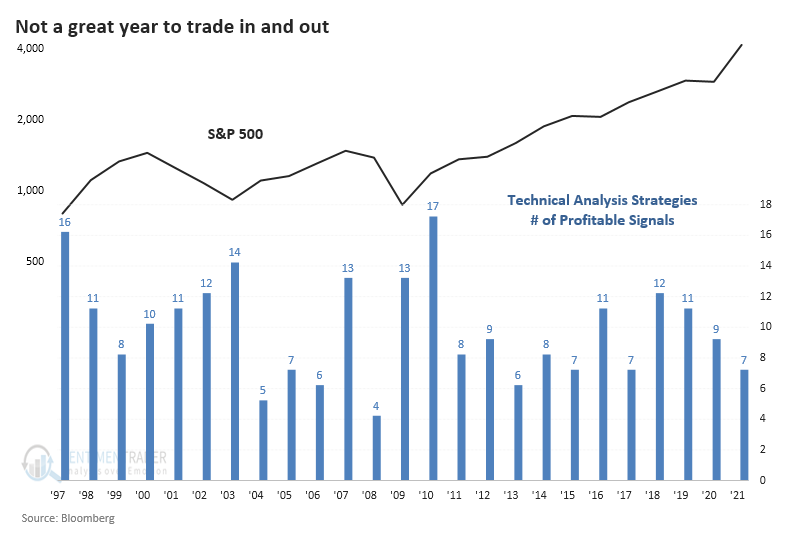

Out of 22 technical trading strategies followed by Bloomberg, only 7 have shown a profit in 2021. That's among the fewest in 25 years.

As Bloomberg notes:

"It's testament to the straight-up trajectory of stocks that virtually all signals that told investors to do anything but buy have done them a disservice this year. In fact, when applied to the S&P 500, 15 of 22 chart-based indicators tracked by Bloomberg have actually lost money..."

Granted, there is no wiggle room for interpretation here. Backtests require rules, and the rules use default settings. That doesn't allow for optimization or experience.

Backtests might show that using the Relative Strength Index (RSI) was a money-loser this year - indeed, it was the worst indicator - but in the hands of an experienced technician, it could have been wonderfully useful. And adjusting the length of some moving average strategies could have had a trader invested all year as momentum ruled, instead of being whipsawed on shorter-term moves.

With that said...

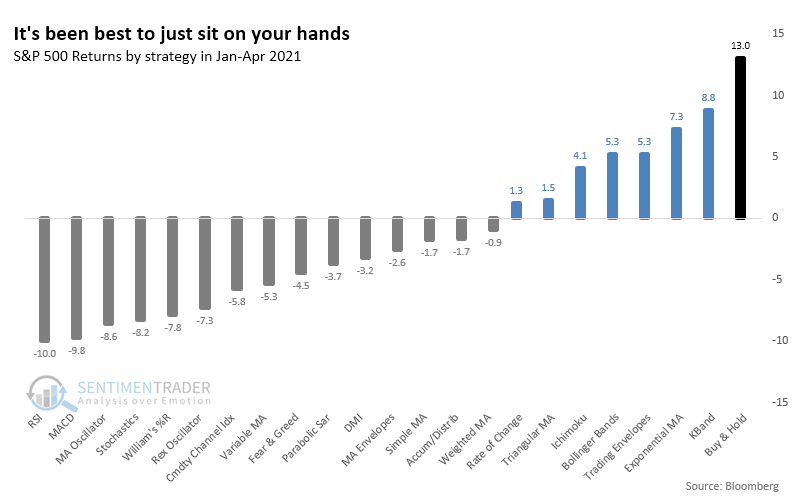

NOTHING WORKED

The list of strategies shows how few have shown a positive return, with none beating buy-and-hold.

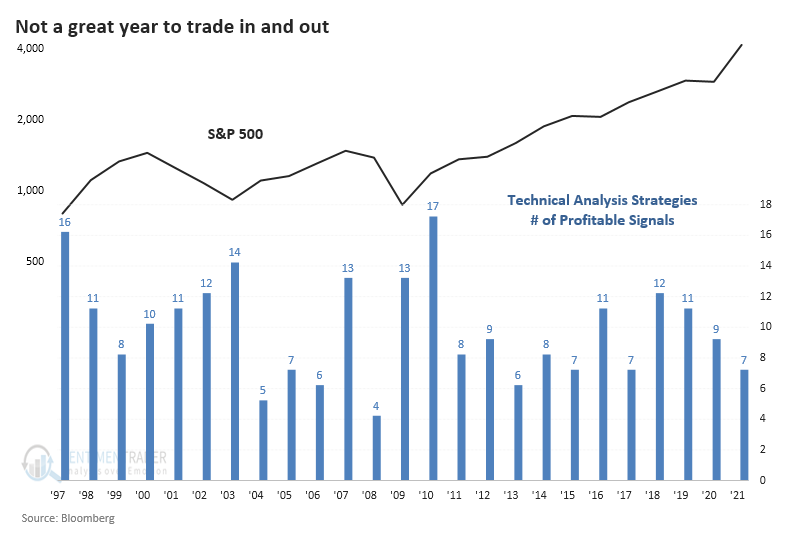

Going back as far as we can using daily backtesting data, this year is among the worst for using technical trading strategies through April. In 2008, only 4 strategies showed a YTD gain through April, while in 2010, almost all of them did.

We could assume that when the trading environment is poor, then it likely means that the S&P 500 showed heavy momentum one way or the other. So the beginnings of years when it didn't pay to trade in-and-out might show some mean-reversion going forward.

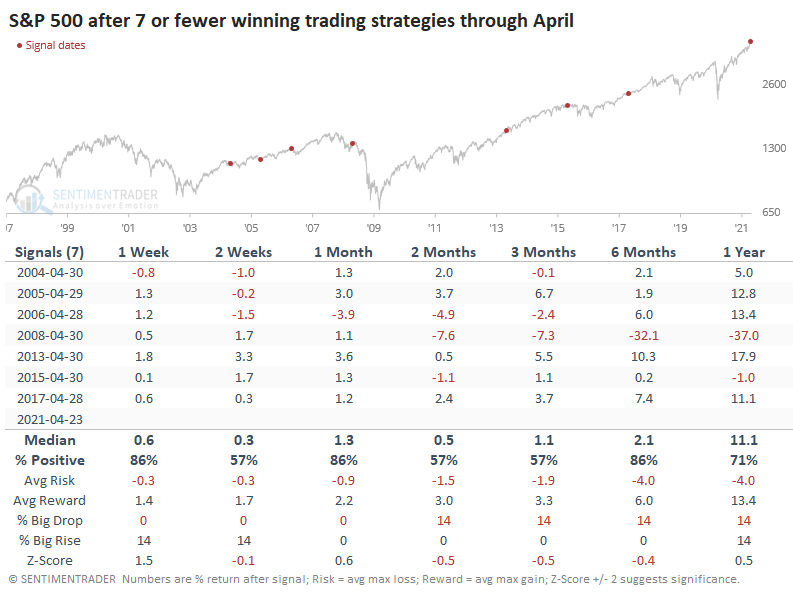

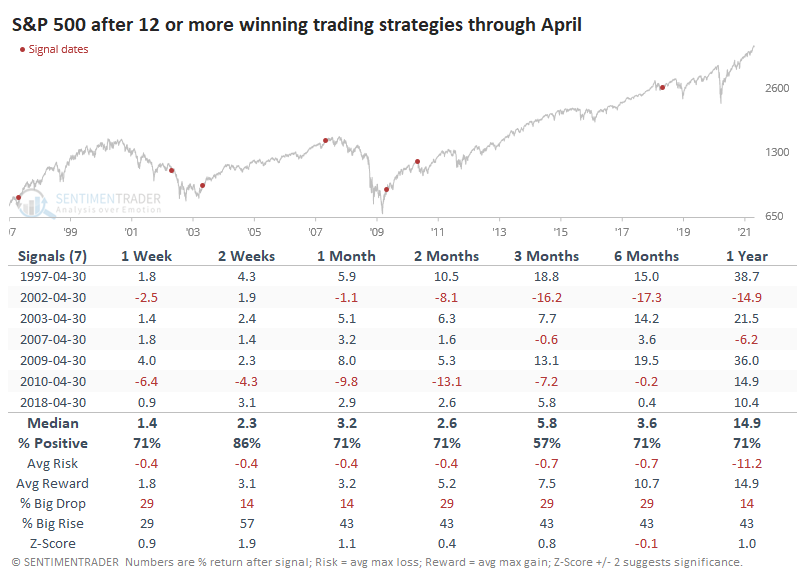

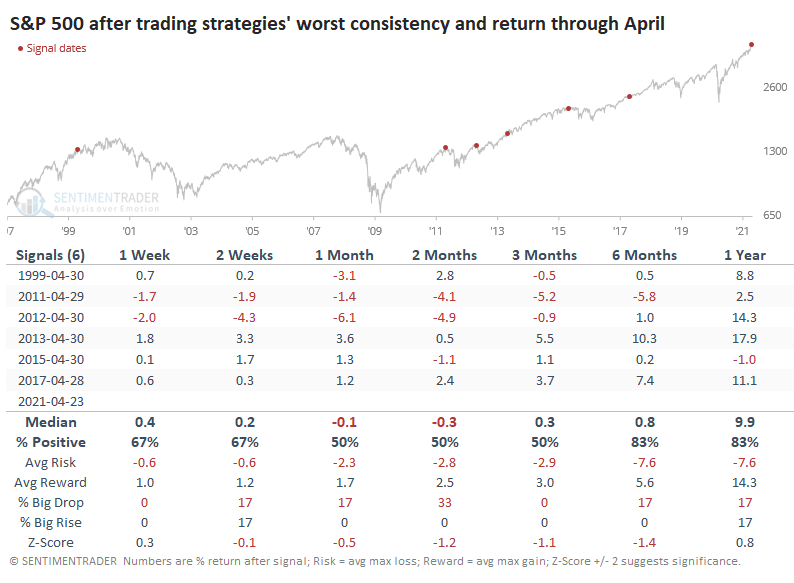

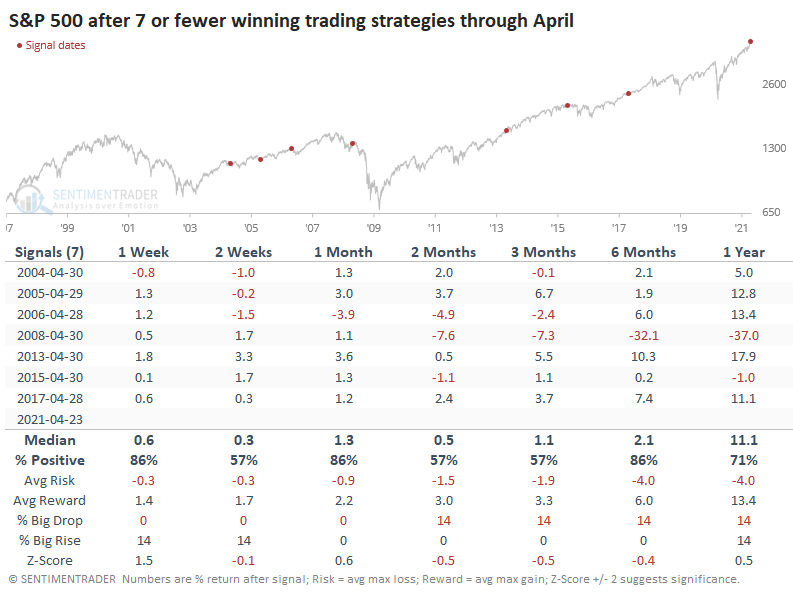

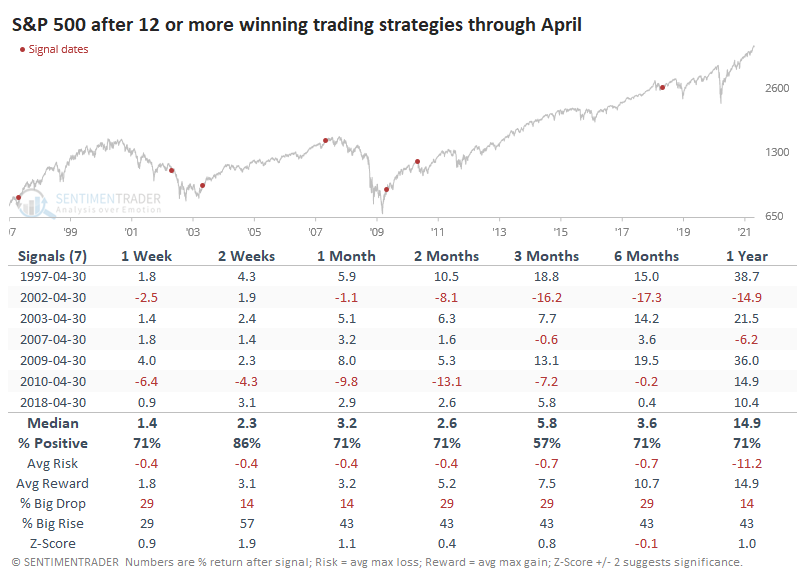

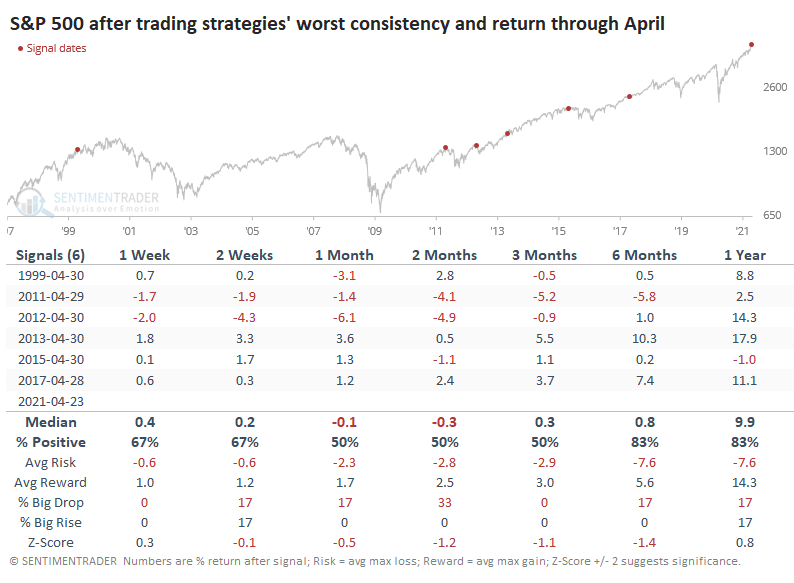

To check, the table below shows the years with the worst records for technical indicators from January through April. These are years when 7 or fewer strategies showed a profit.

Meh. Out of the 7 years, 4 of them showed a negative return either 2 or 3 months later, 2 of the others sported only meager or temporary gains, while the last one, in 2017, preceded the nothing-matters market that ran over everything.

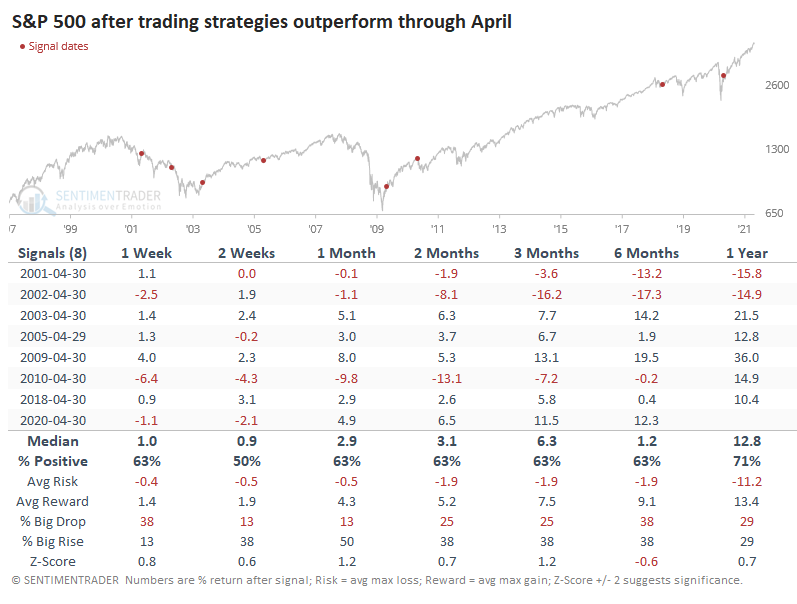

Contrast that to years when trading was more advantageous. In those years, forward returns were quite a bit better in the months ahead. Over the next 3 months, the S&P averaged a return of +5.8%, versus the +1.1% from the prior table. There were a couple of large losses among them, though.

THE WORST UNDERPERFORMANCE EVER

Not only have few strategies shown a profit, but their median return has been horrendous. The median return across all 22 strategies has lagged buy-and-hold by 16% so far this year, tied for the worst ever.

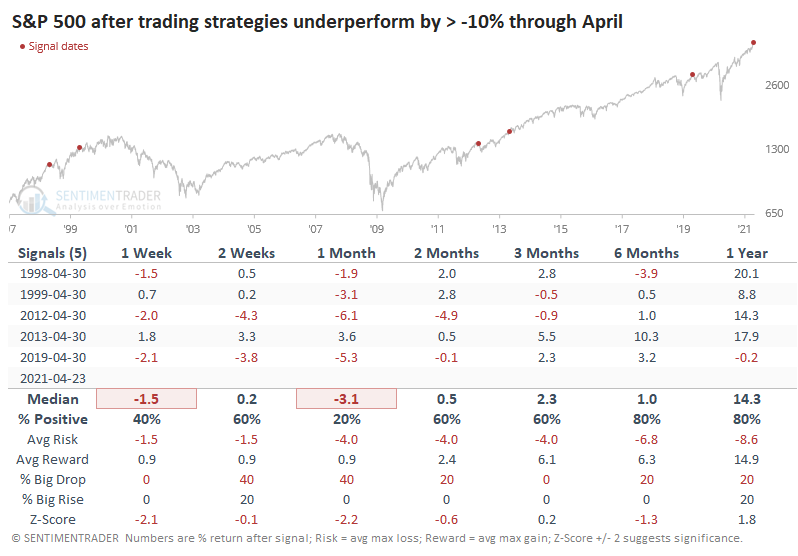

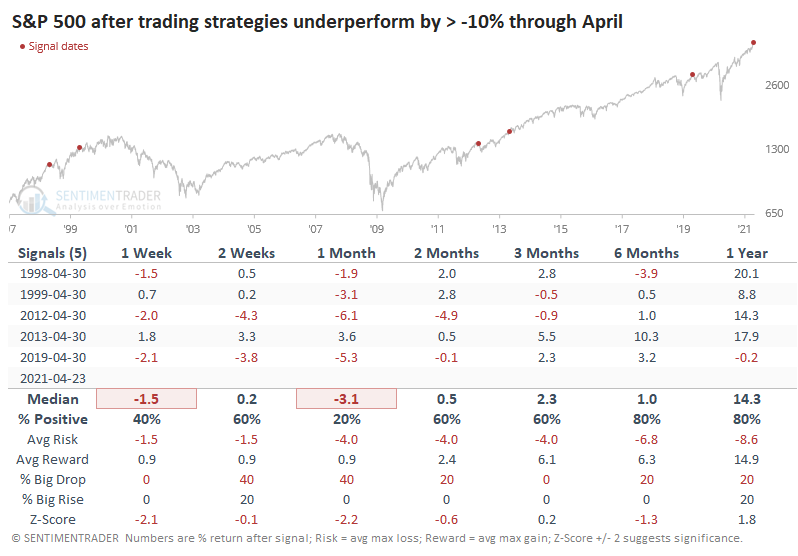

There have been 5 other years when the strategies' median return lagged the market by 10% or more. Each one of them triggered during big run-ups in the S&P, and again, forward returns were poor.

When we look at years that were more amenable to trading, then returns improved significantly over the short-term.

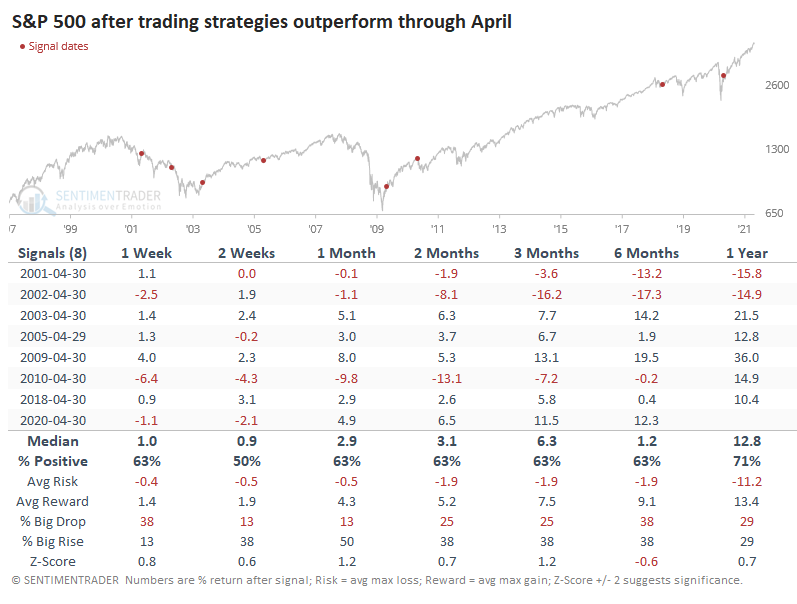

YEARS WITH THE WORST TECHNICAL TRADING ENVIRONMENTS

If we combine the consistency of the trading strategies and their median returns, then 2021 ranks among the very bottom. Other years with poor trading environments showed that the S&P struggled in the months ahead.

Out of the 6 years with the worst trading environments through April, 5 of them showed either a negative or barely positive return in the months ahead, again with 2017 being the only real exception.

We wouldn't put a lot of weight on this data, but it is an interesting way to look at the mostly one-way trend in stocks this year. Momentum has overwhelmed everything, which is great if you're that kind of trader. And it can persist for a long time. The biggest issue is that when we see data like this, it means the momentum is likely to wane. Of course, we've seen data like this for a couple of months, at least, and here we are at record highs. What a market.

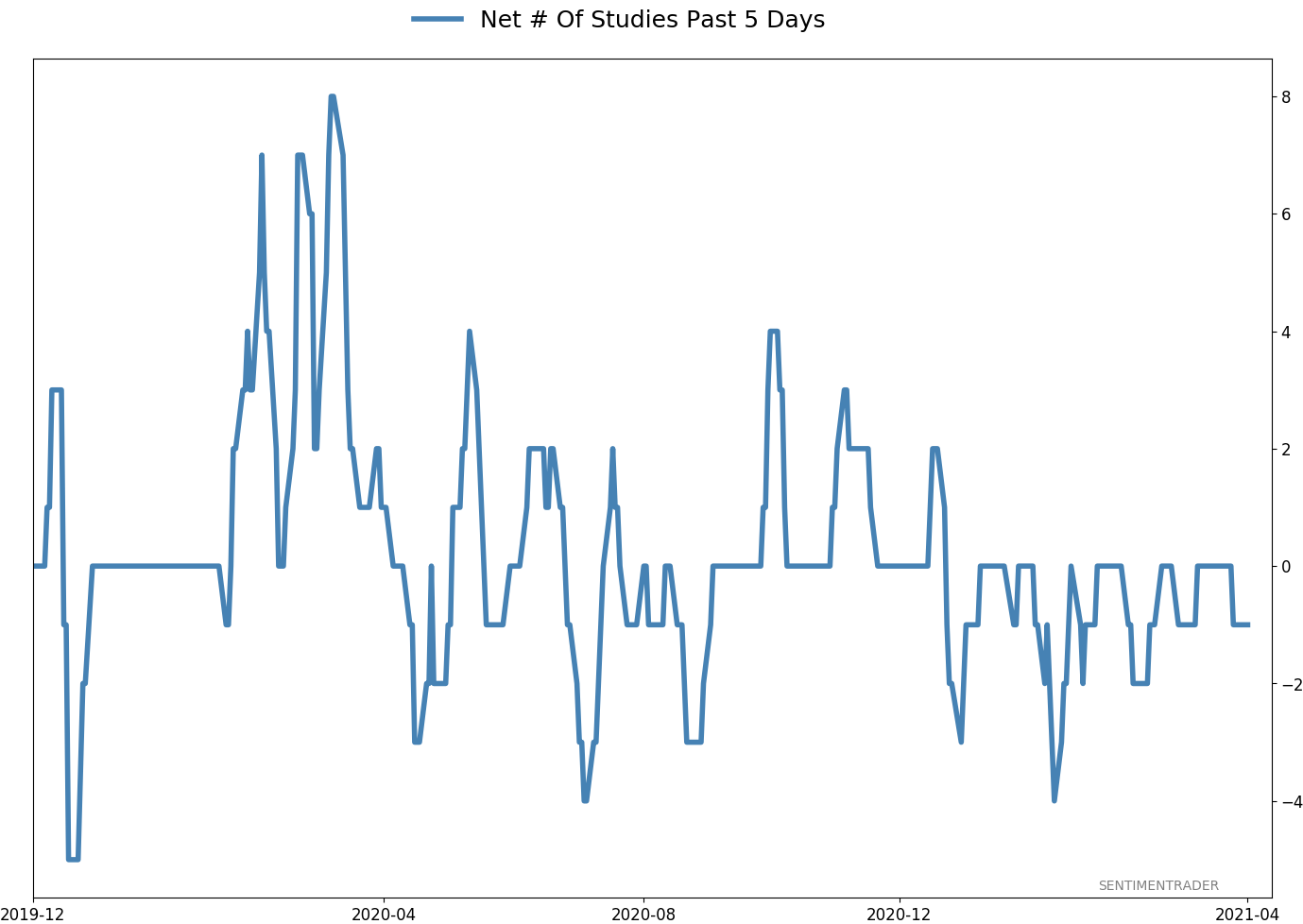

Active Studies

| Time Frame | Bullish | Bearish | | Short-Term | 0 | 0 | | Medium-Term | 0 | 11 | | Long-Term | 11 | 4 |

|

Indicators at Extremes

|

% Showing Pessimism: 2%

Bullish for Stocks

|

|

Portfolio

| Position | Description | Weight % | Added / Reduced | Date | | Stocks | RSP | 0.0 | Reduced 4.9% | 2021-04-22 | | Bonds | 30.0% BND, 8.8% SCHP | 37.9 | Added 15.1% | 2021-02-18 | | Commodities | GCC | 2.5 | Reduced 2.1%

| 2020-09-04 | | Precious Metals | GDX | 9.8 | Added 0.1% | 2021-02-18 | | Special Situations | 4.3% XLE, 2.2% PSCE | 6.5 | Reduced 5.6% | 2021-04-22 | | Cash | | 43.3 | | |

|

Updates (Changes made today are underlined)

I've made no adjustments for months, as the situation remained essentially stuck - energy was doing what it should, sentiment in the broader market was ridiculously stretched but with no major warning signs, and sentiment toward gold and bonds appeared overdone on the pessimistic side. Those conditions have started to reverse a bit, so I further reduced my risk. There are still no major warning signs, but I'm getting increasingly uncomfortable and would prefer to sit safely in cash and wait for better risk/reward opportunities. RETURN YTD: 7.0% 2020: 8.1%, 2019: 12.6%, 2018: 0.6%, 2017: 3.8%, 2016: 17.1%, 2015: 9.2%, 2014: 14.5%, 2013: 2.2%, 2012: 10.8%, 2011: 16.5%, 2010: 15.3%, 2009: 23.9%, 2008: 16.2%, 2007: 7.8%

|

|

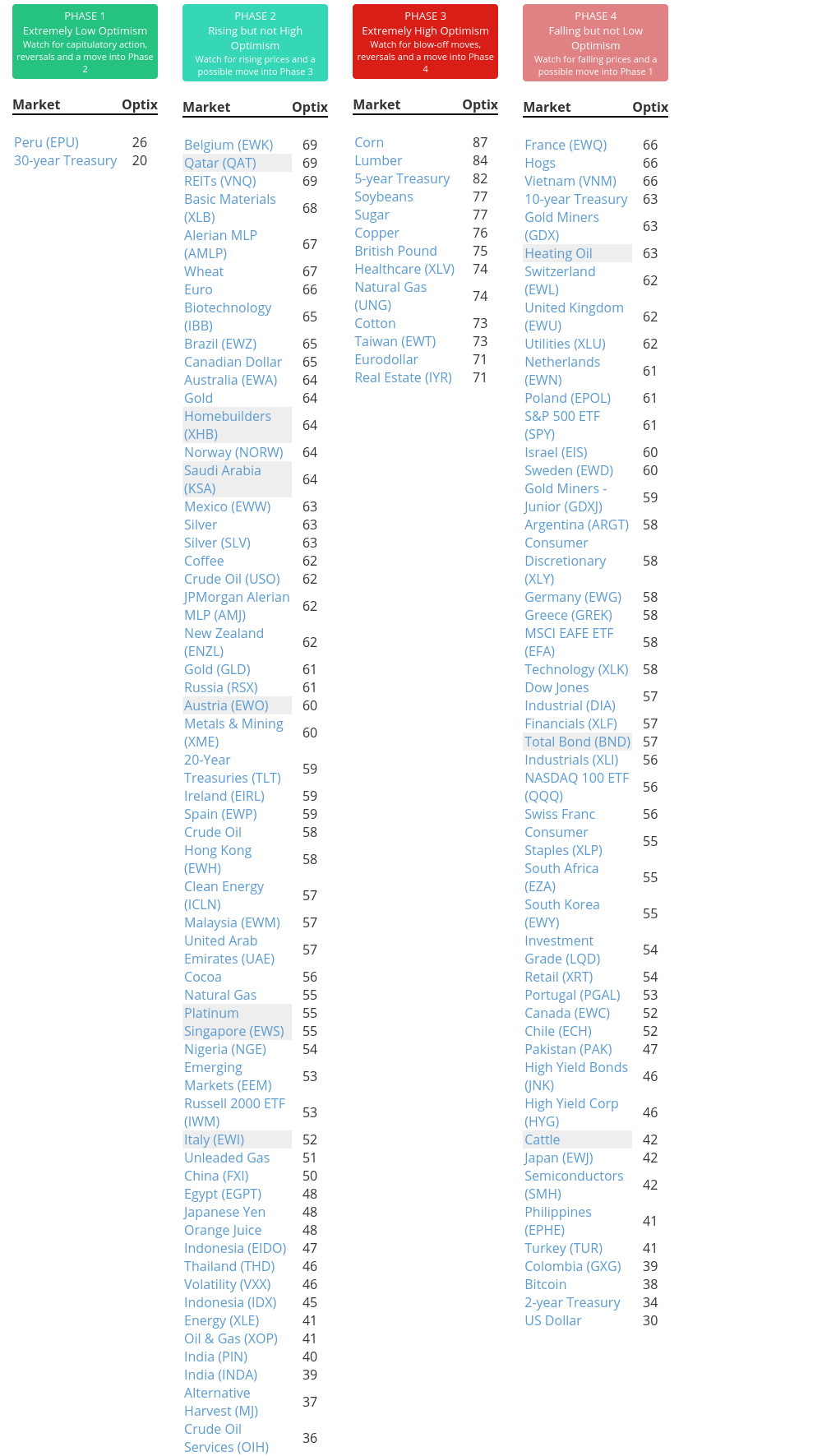

Phase Table

Ranks

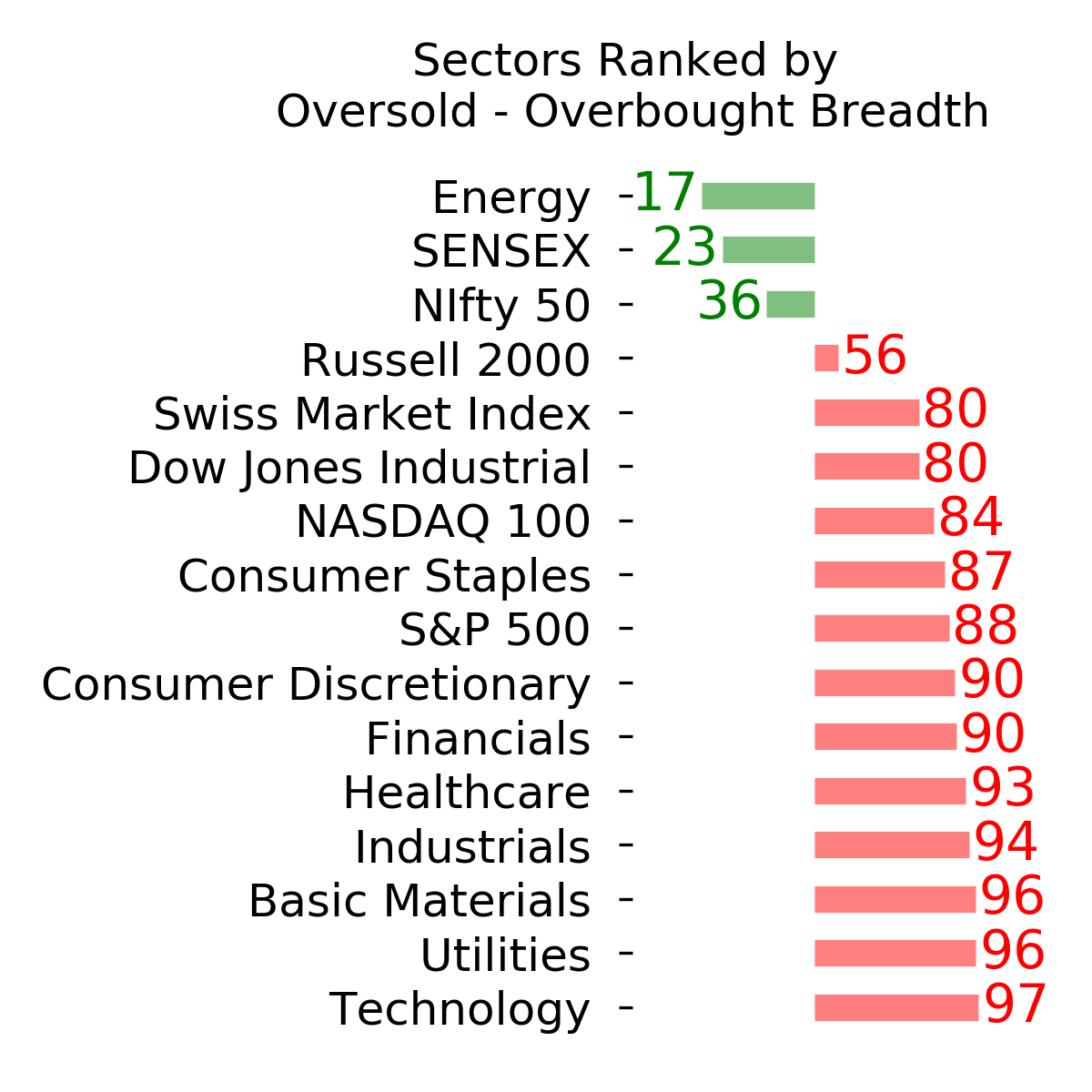

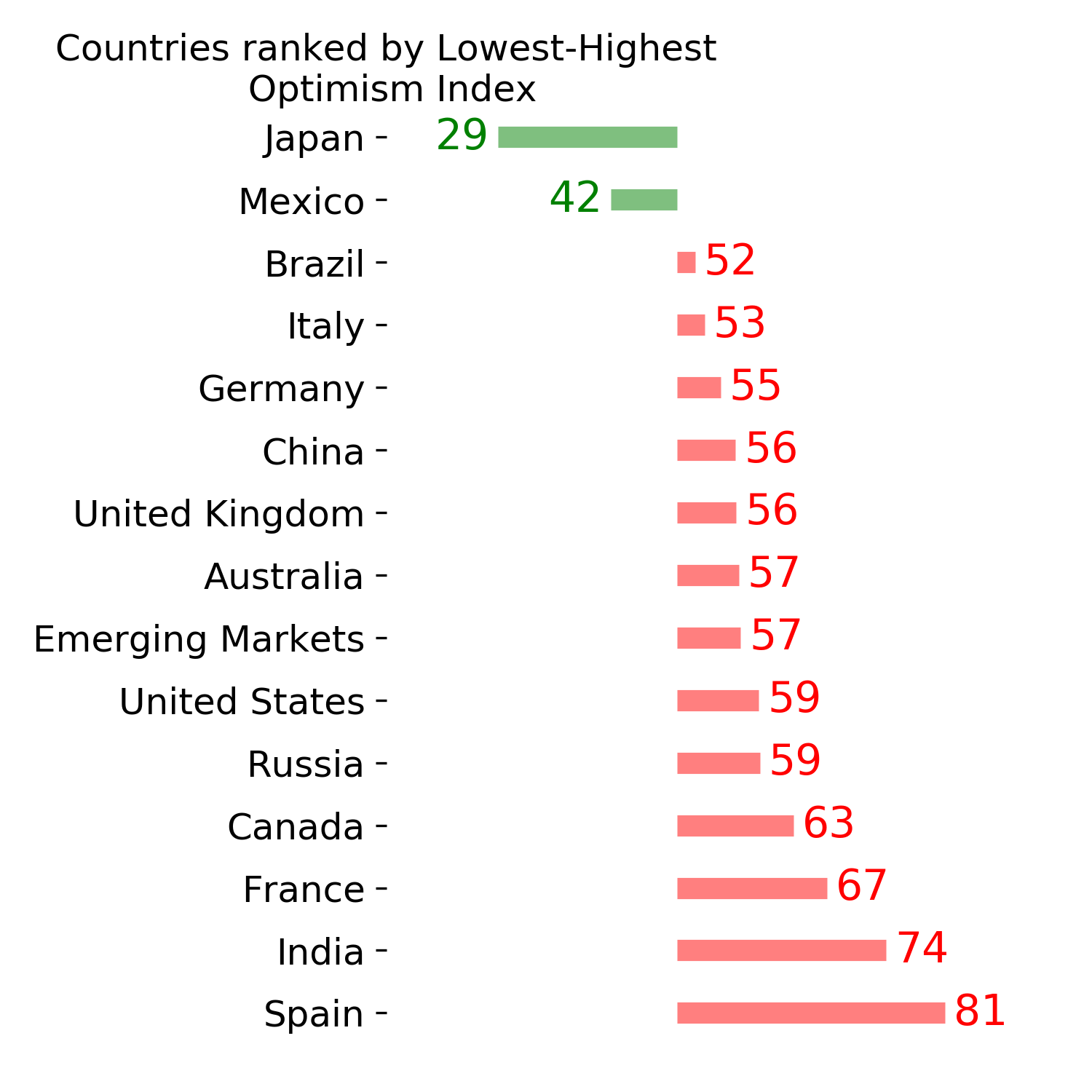

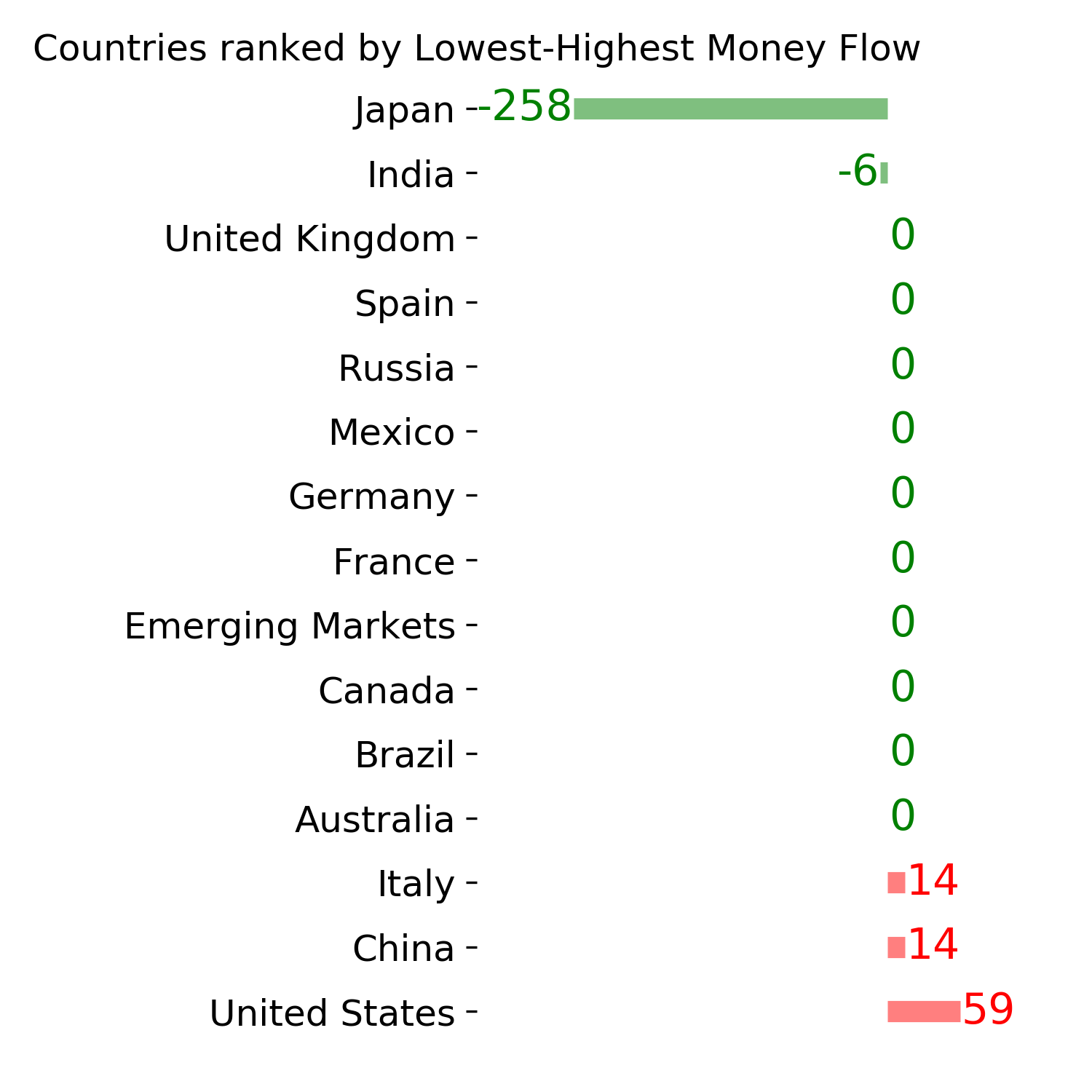

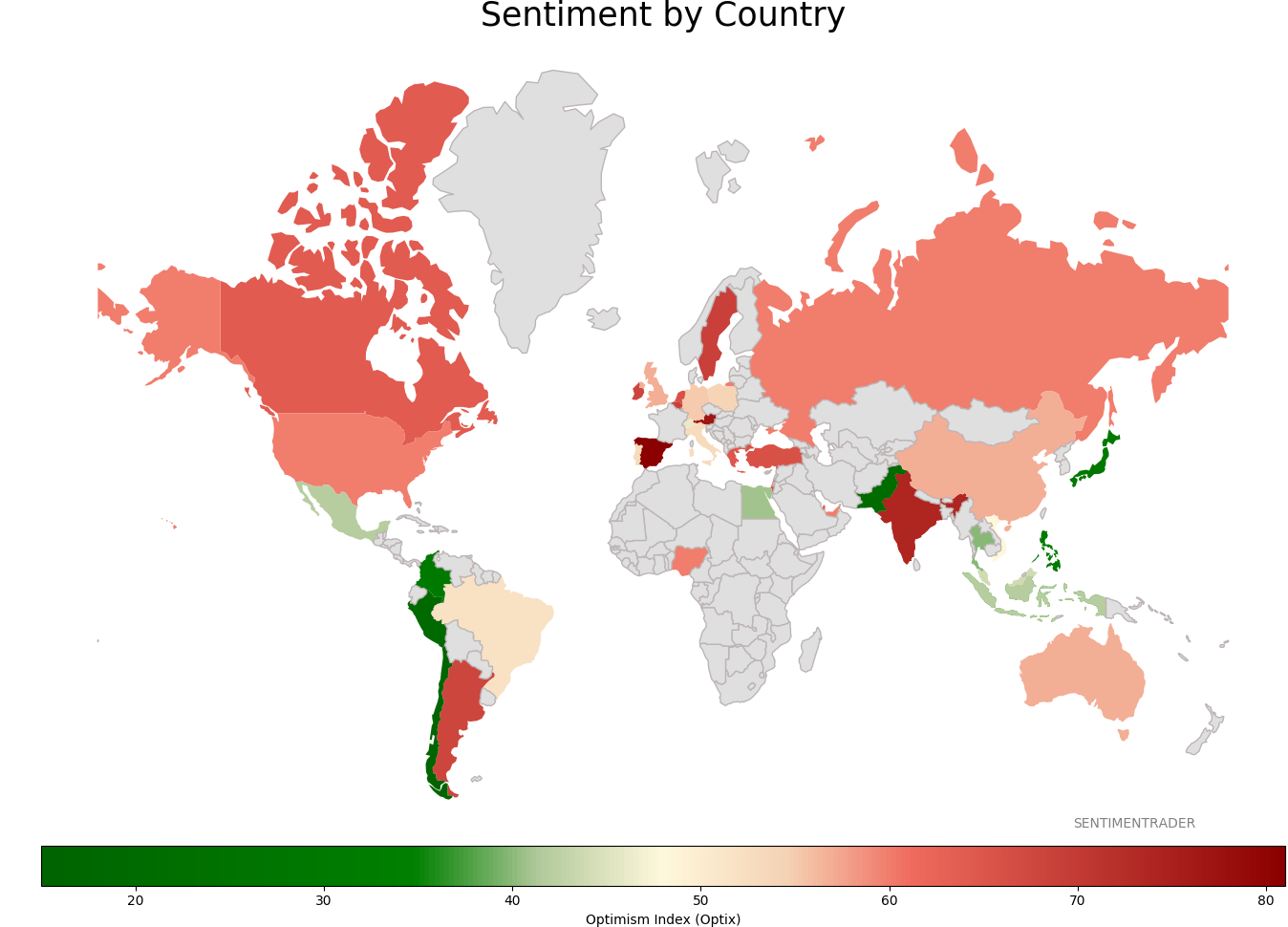

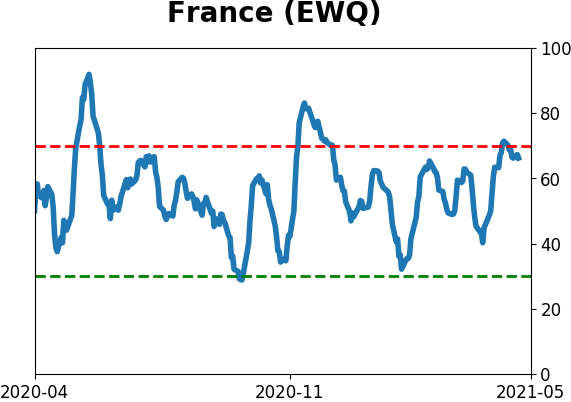

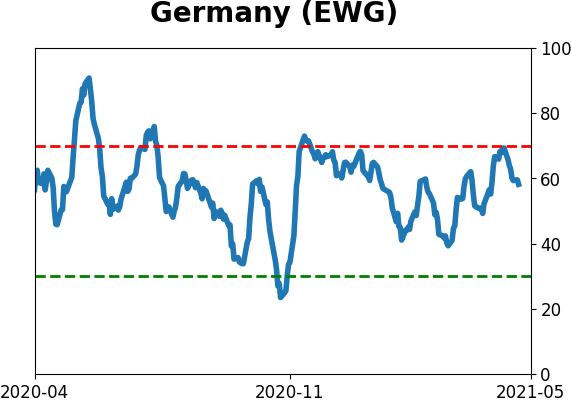

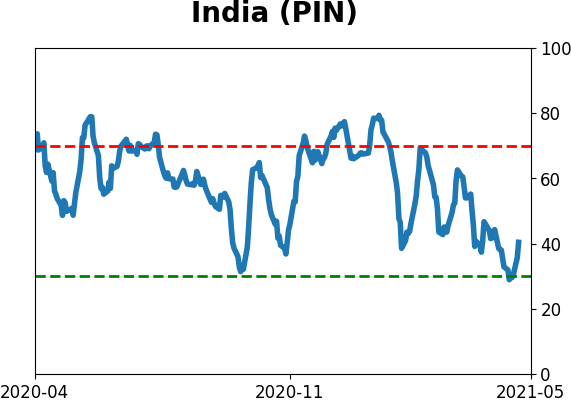

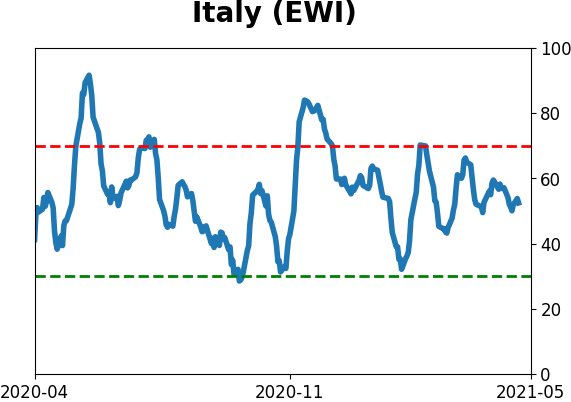

Sentiment Around The World

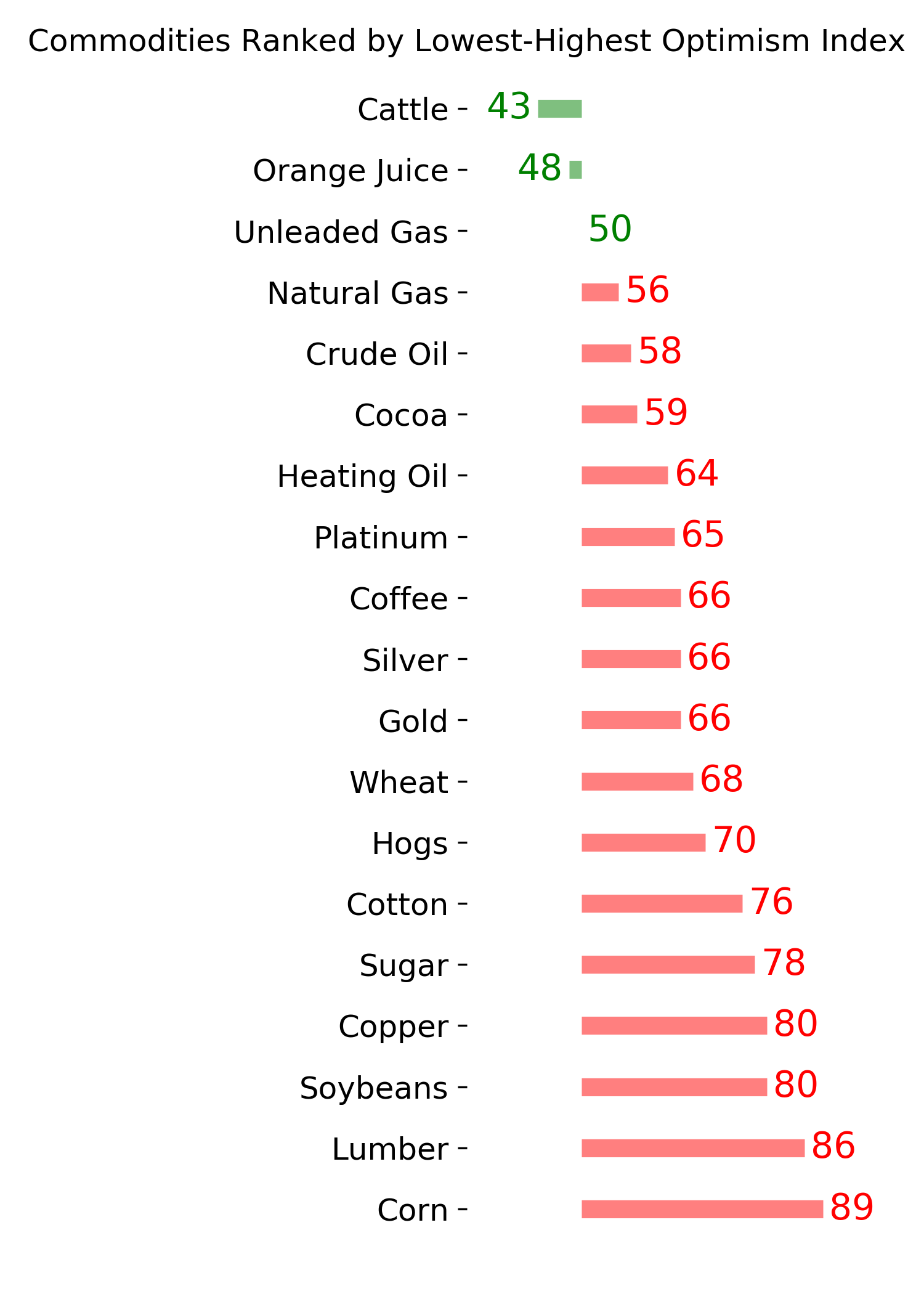

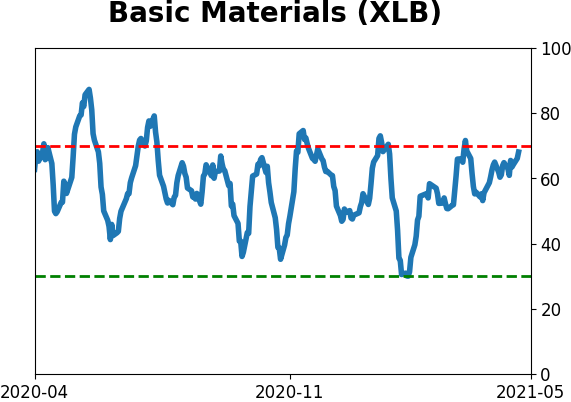

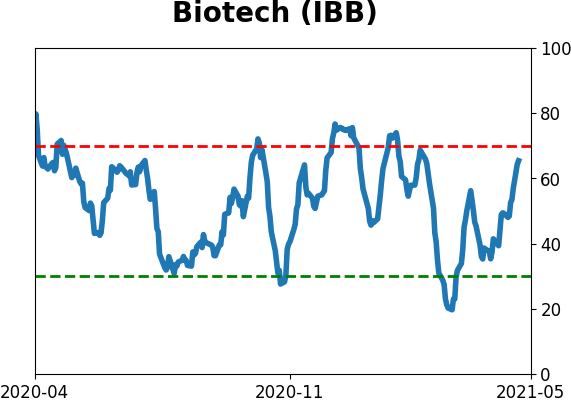

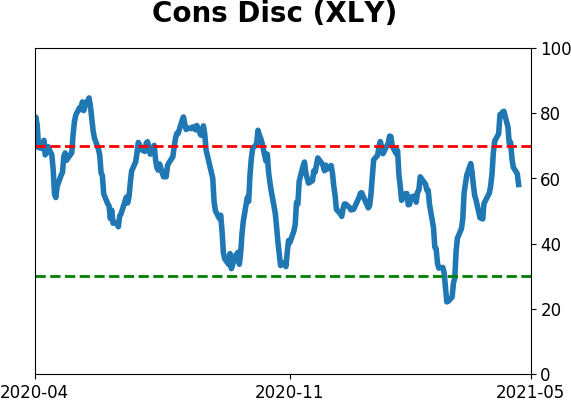

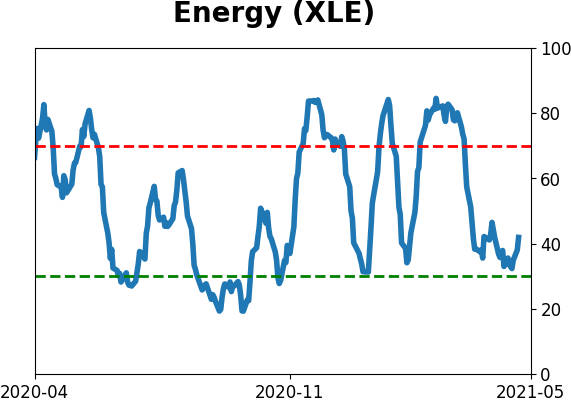

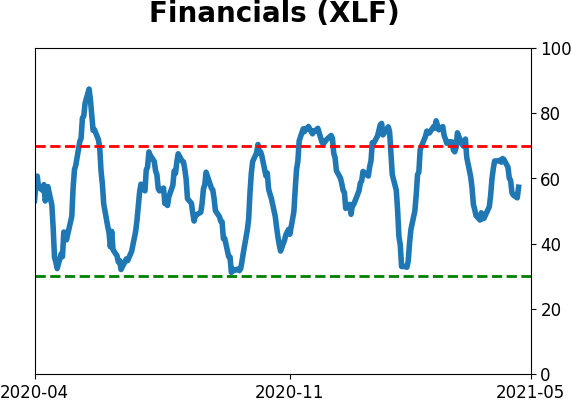

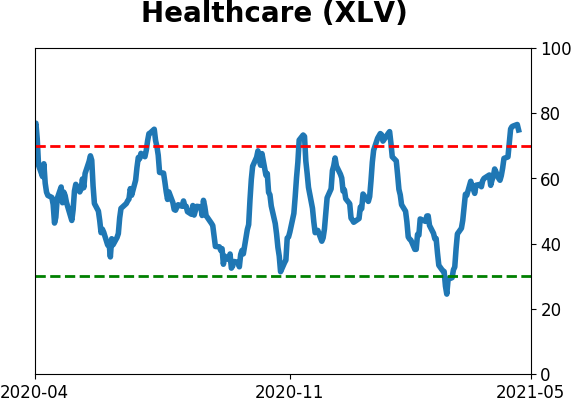

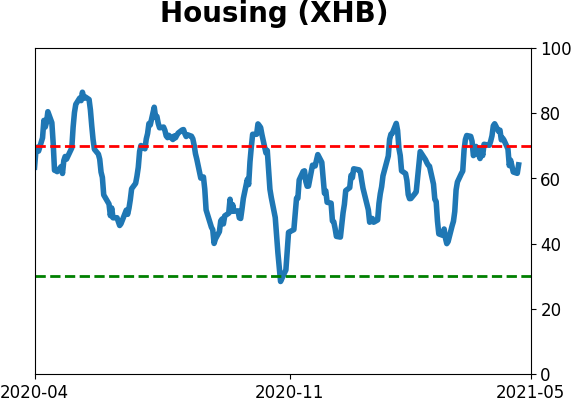

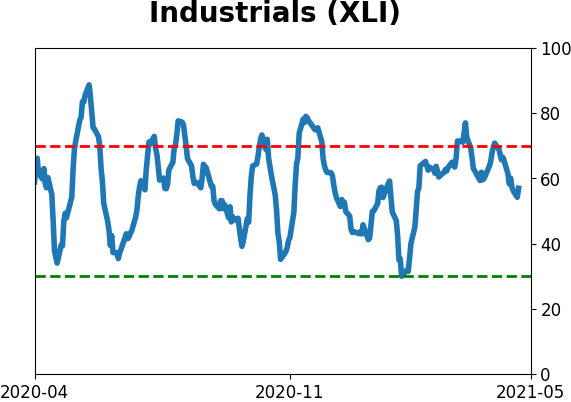

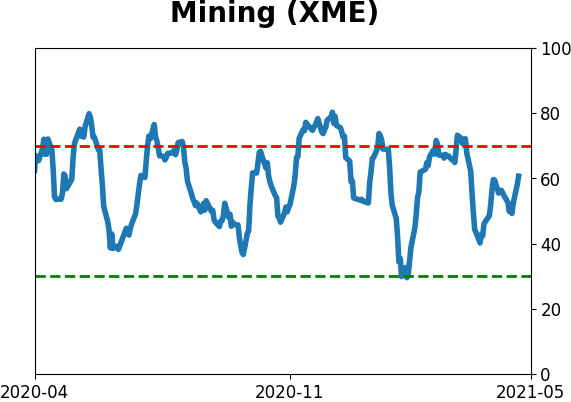

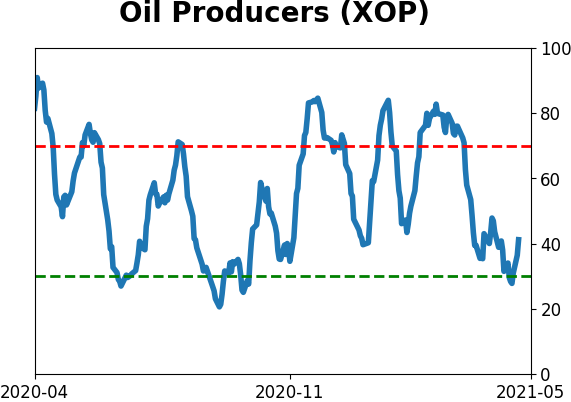

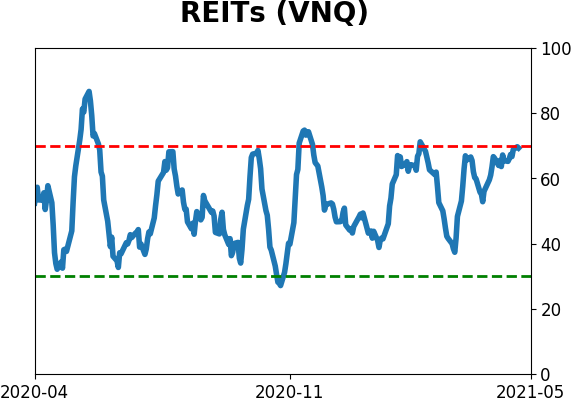

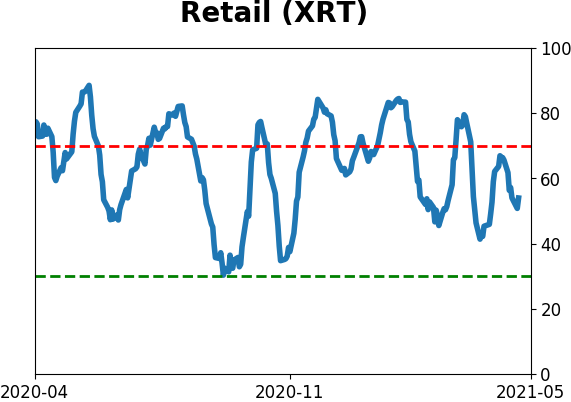

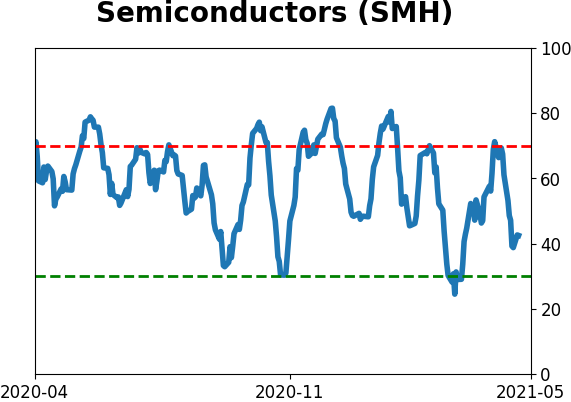

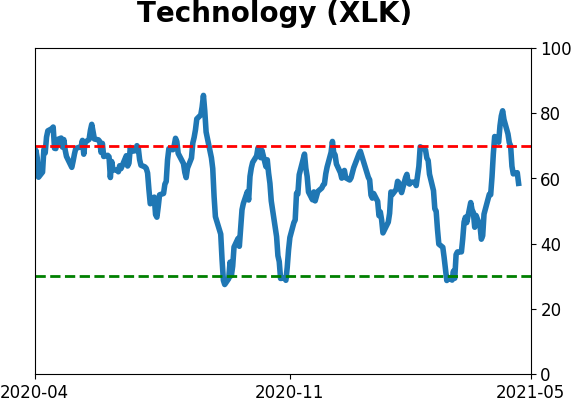

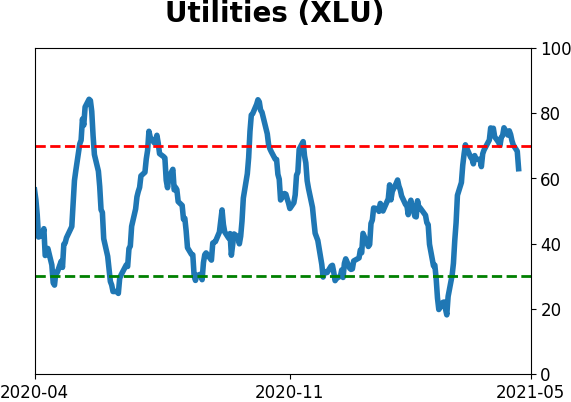

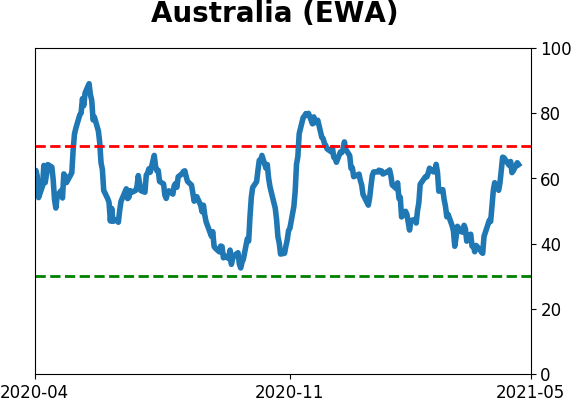

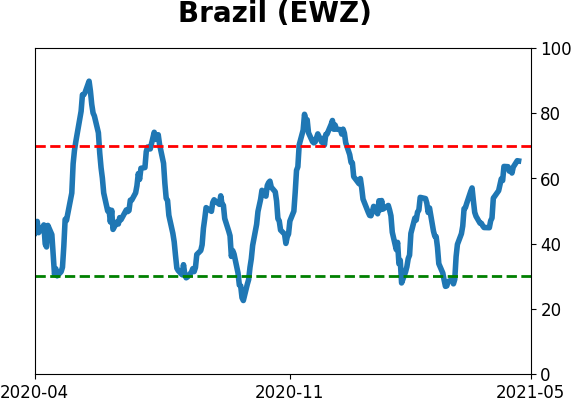

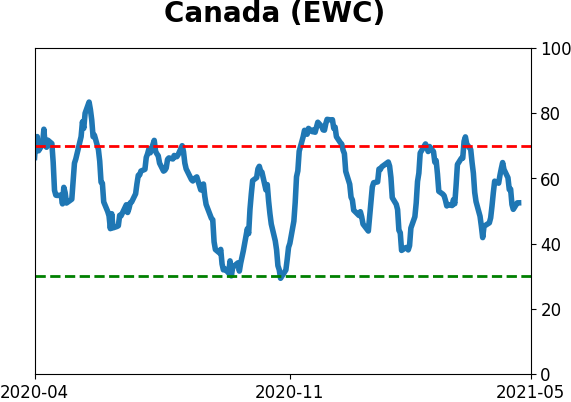

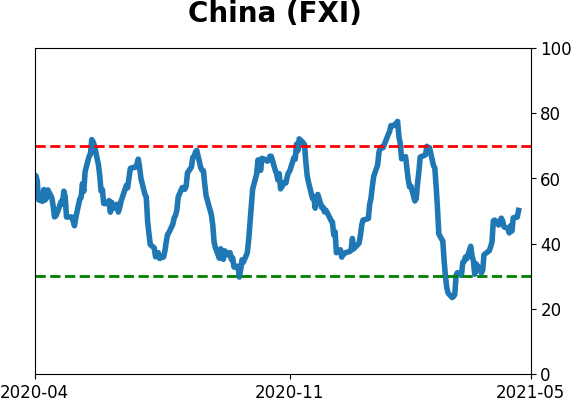

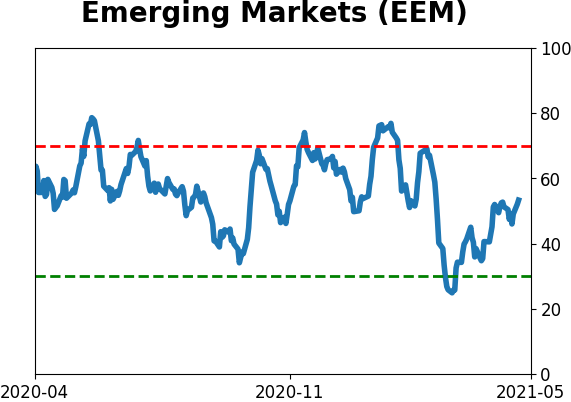

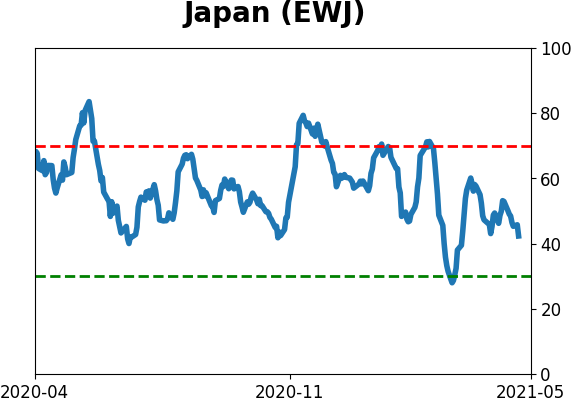

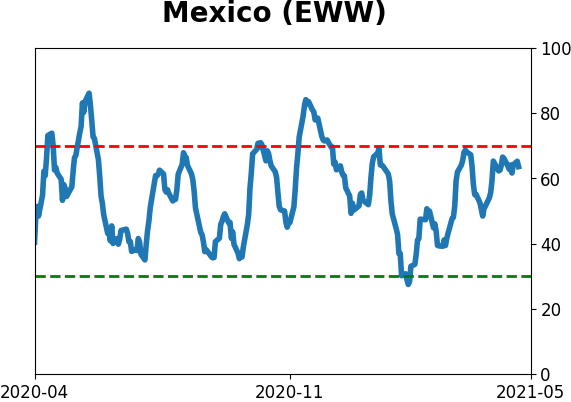

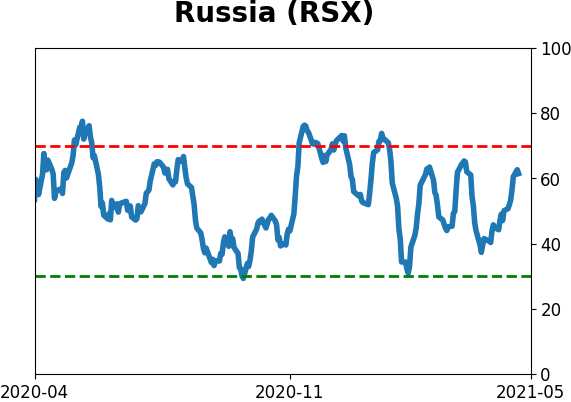

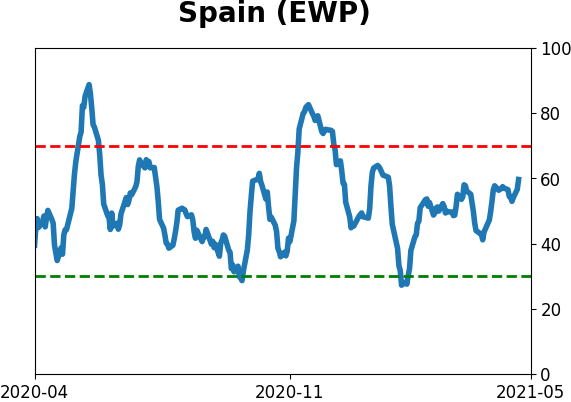

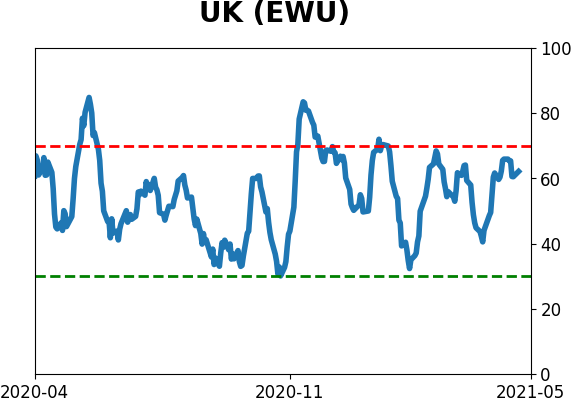

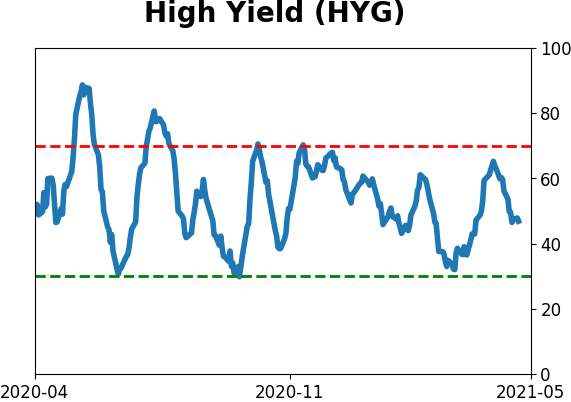

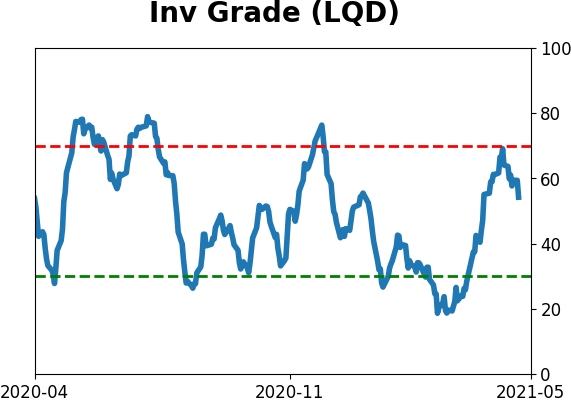

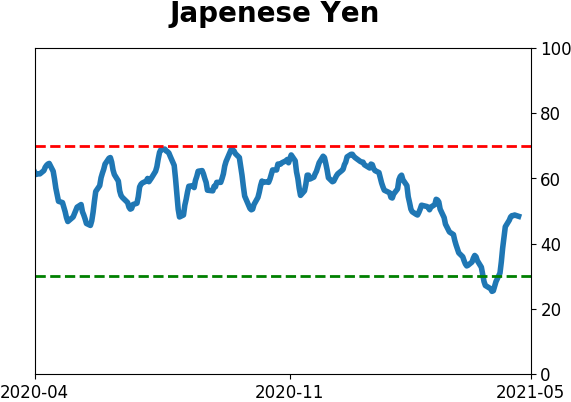

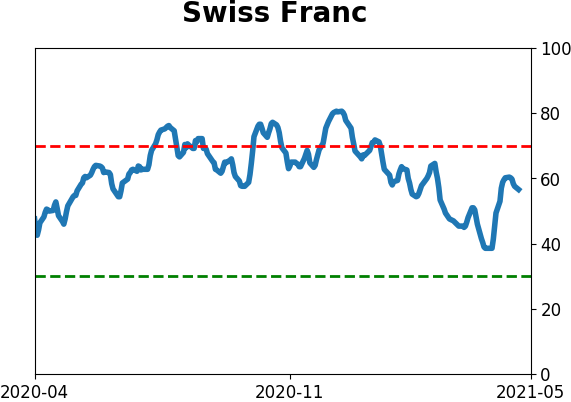

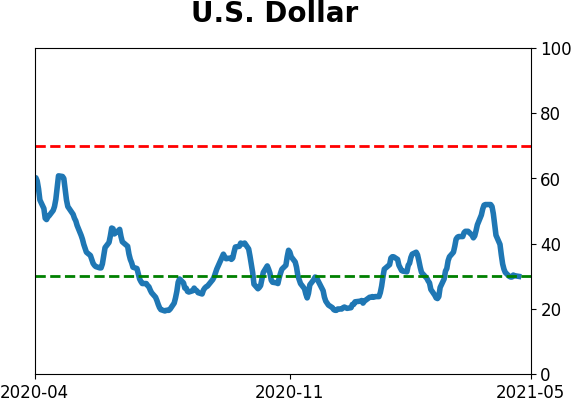

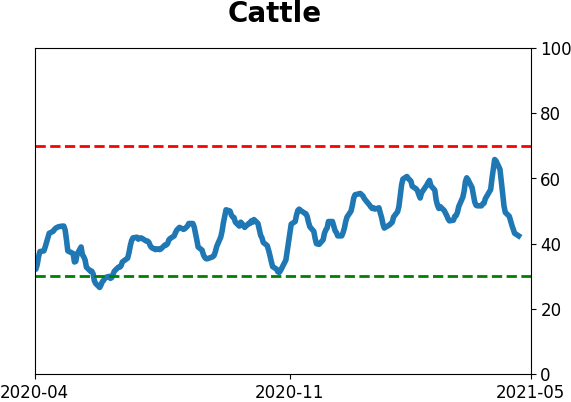

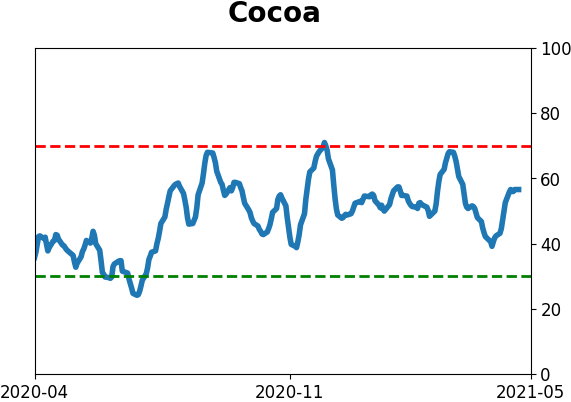

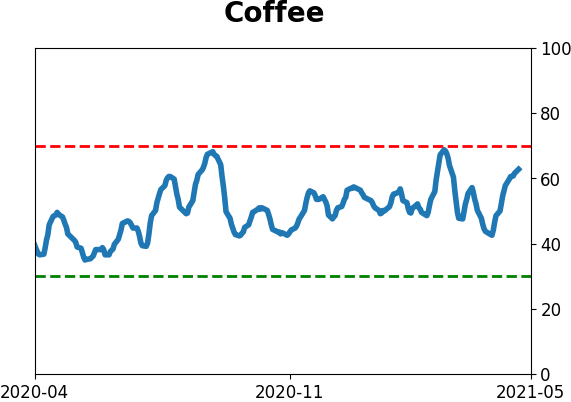

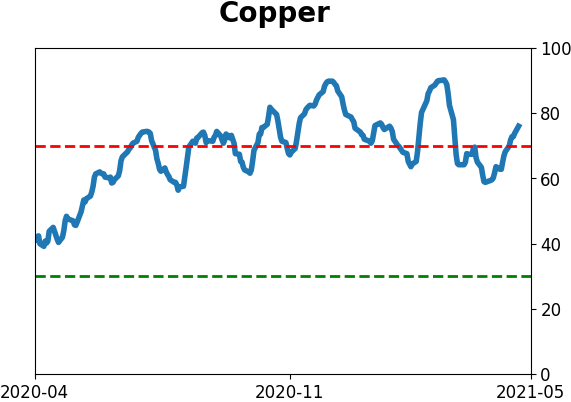

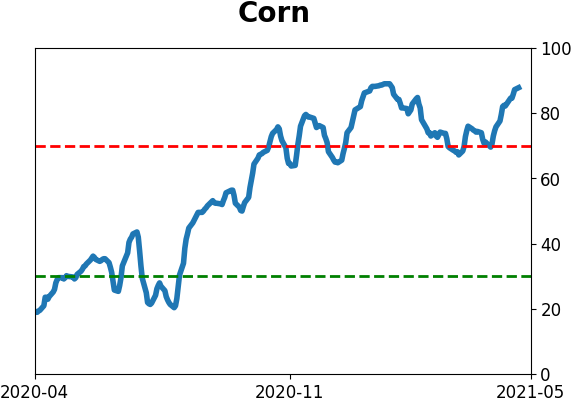

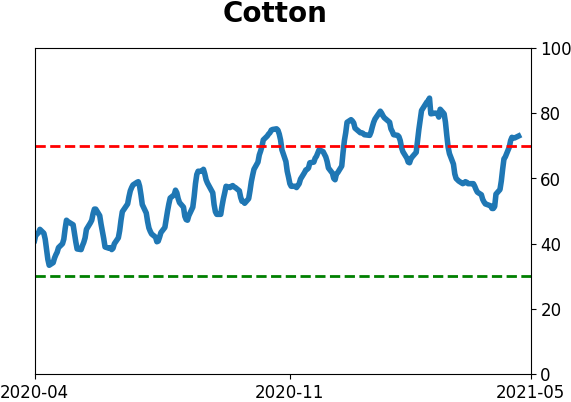

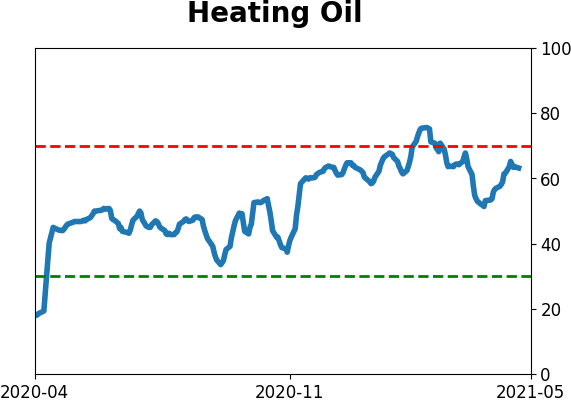

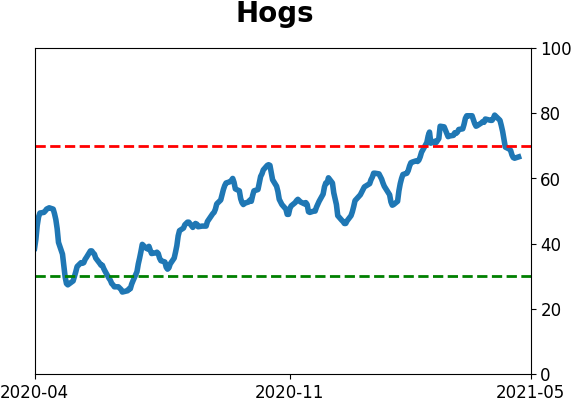

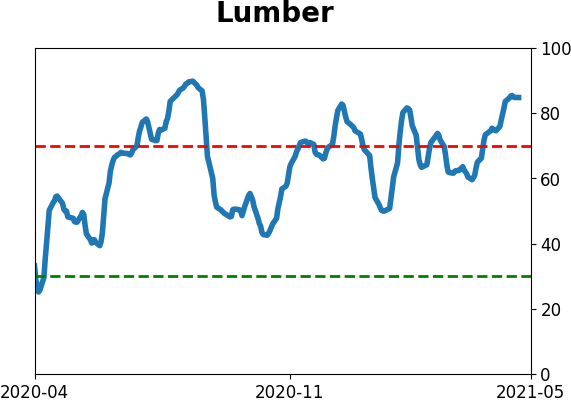

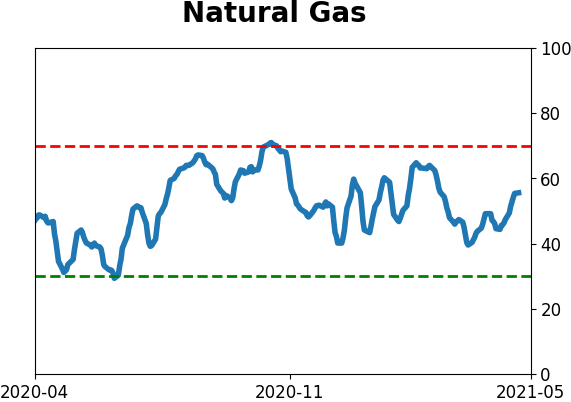

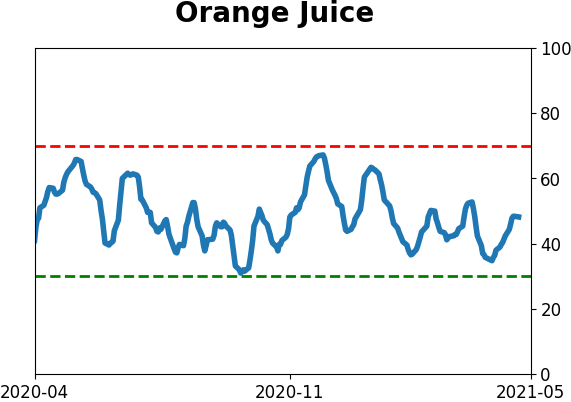

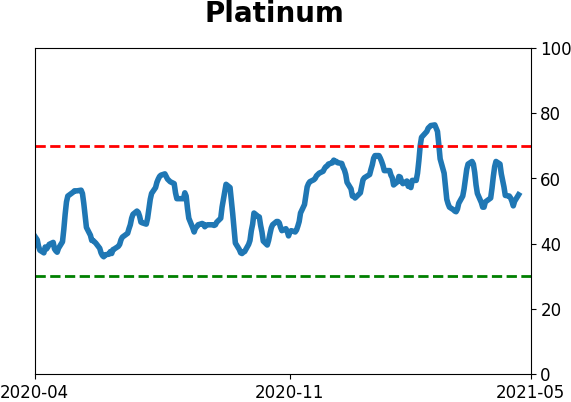

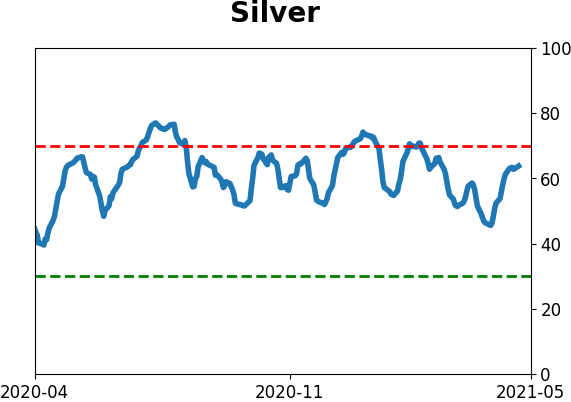

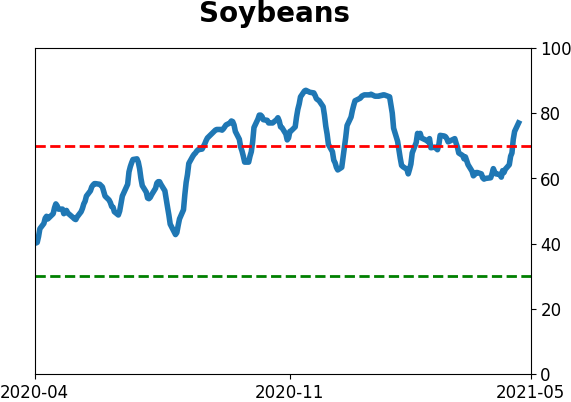

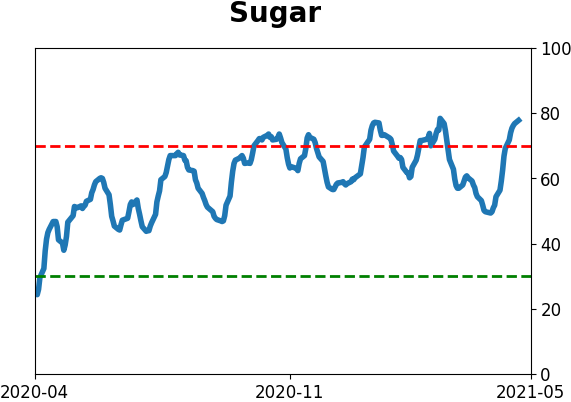

Optimism Index Thumbnails

|

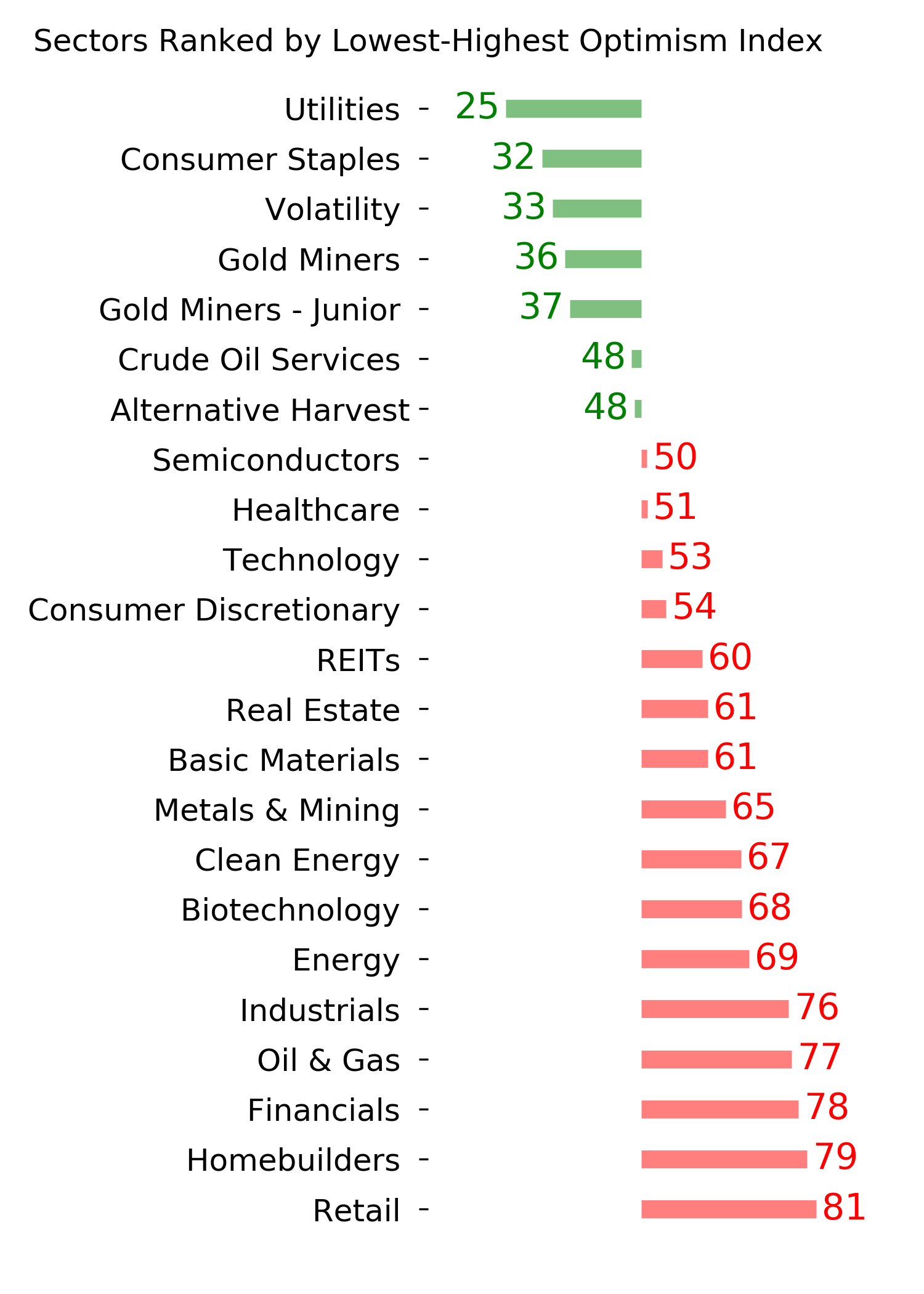

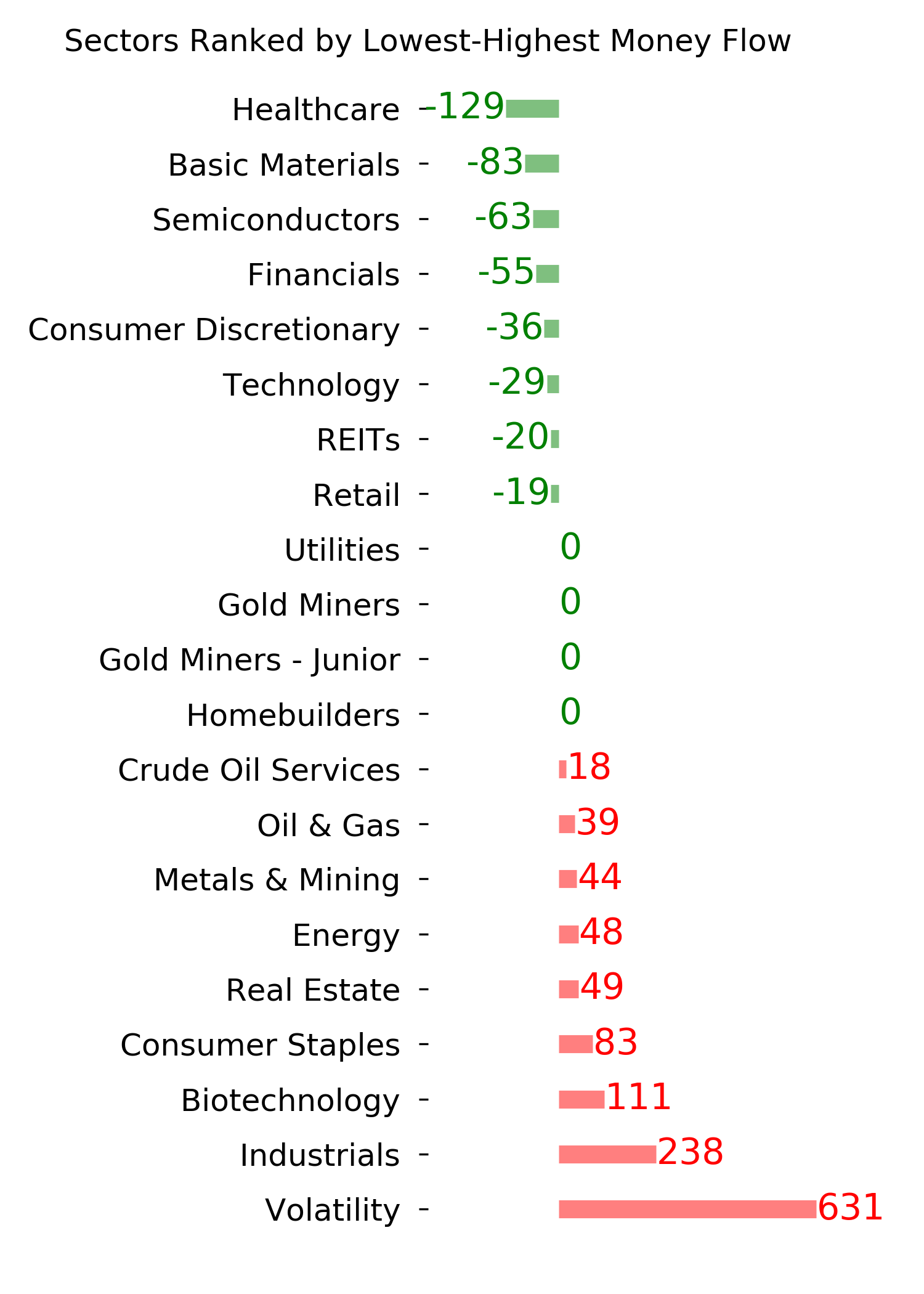

Sector ETF's - 10-Day Moving Average

|

|

|

Country ETF's - 10-Day Moving Average

|

|

|

Bond ETF's - 10-Day Moving Average

|

|

|

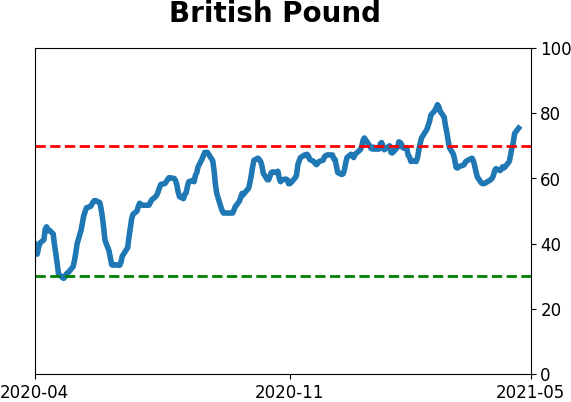

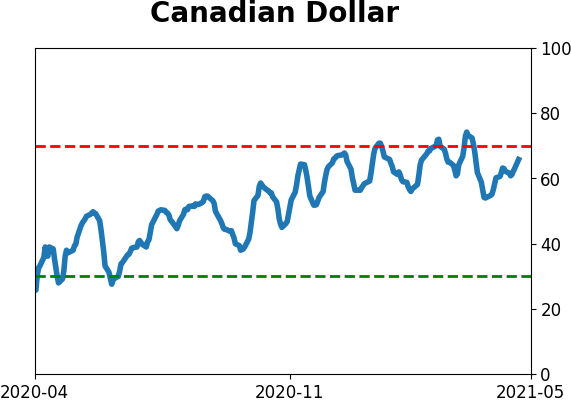

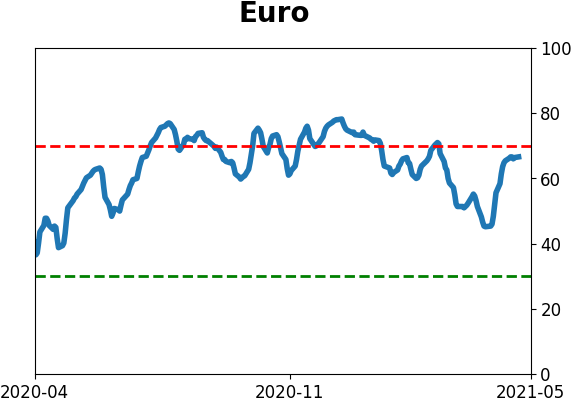

Currency ETF's - 5-Day Moving Average

|

|

|

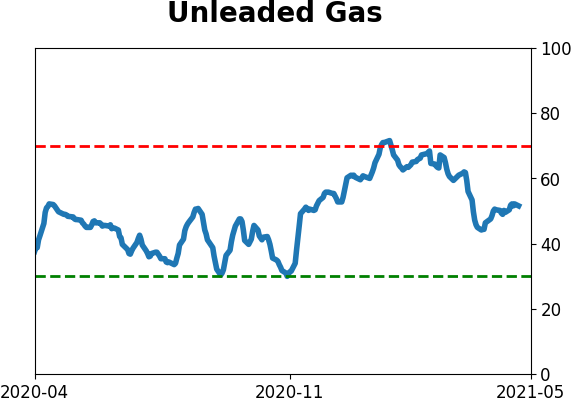

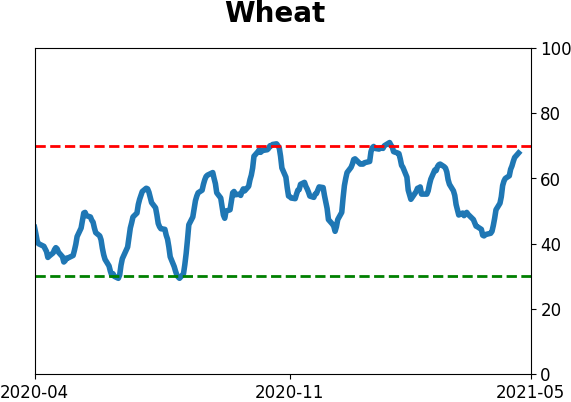

Commodity ETF's - 5-Day Moving Average

|

|