Headlines

|

|

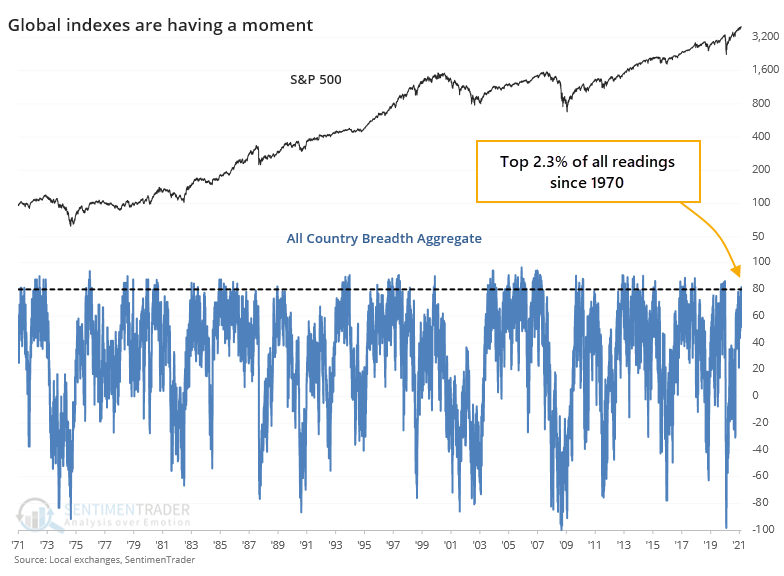

A global recovery that's almost unmatched:

Among industries, sectors, and countries, there has been a remarkable continued recovery. To one of the largest degrees on record, they are seeing impressive internal participation, with indexes trading above moving averages and at new highs, with few exceptions.

Bottom Line:

See the Outlook & Allocations page for more details on these summaries STOCKS: Weak sell

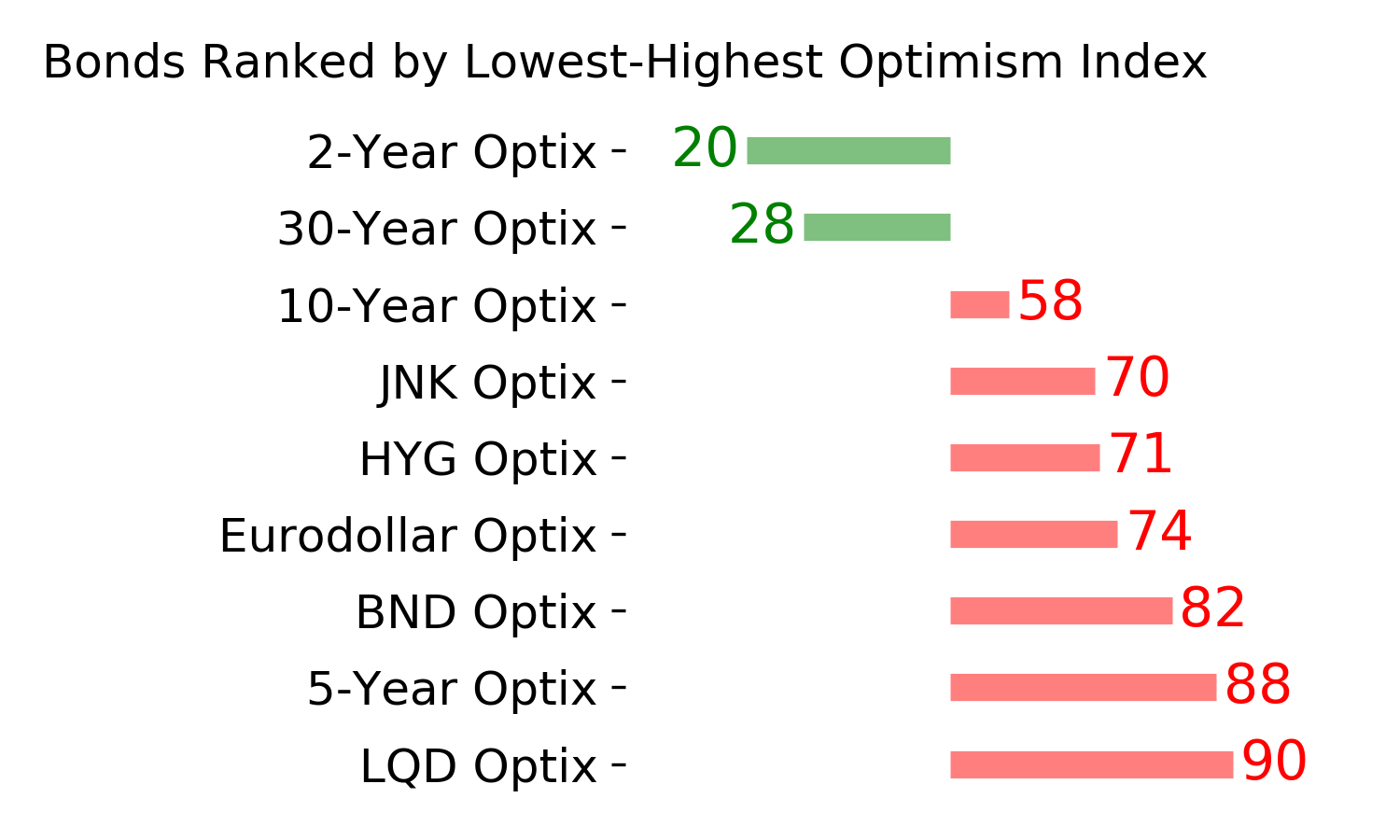

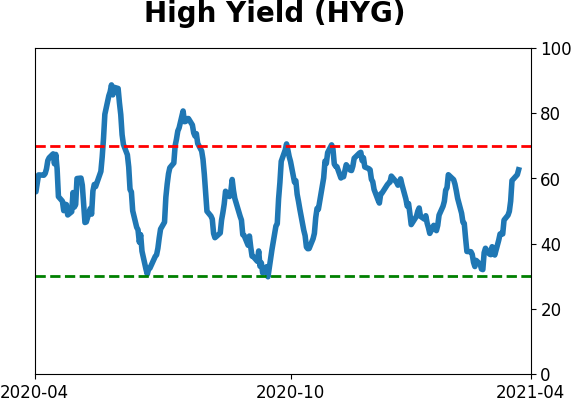

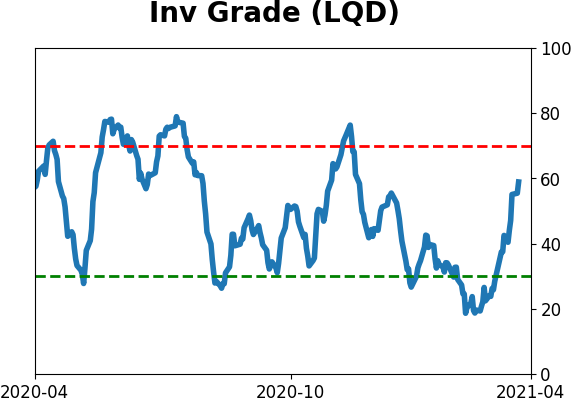

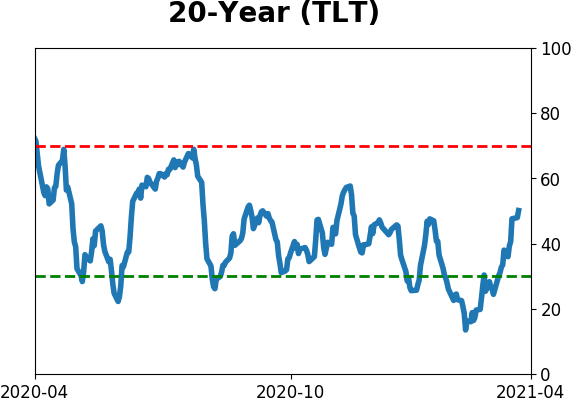

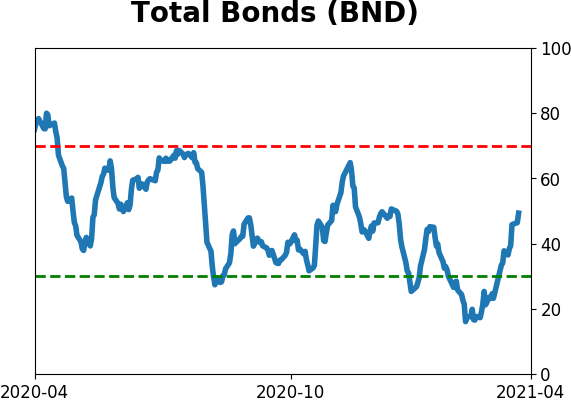

The extreme speculation registered in January and February is starting to get wrung out. Internal dynamics have mostly held up, so a return to neutral sentiment conditions would improve the forward risk/reward profile substantially. We're still a ways off from that. BONDS: Weak buy

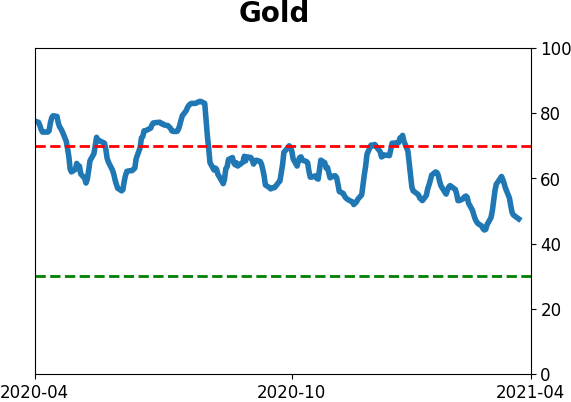

Various parts of the market have been hit in recent weeks, with mild oversold conditions. The Bond Optimism Index is now about as low as it gets during healthy bond market environments. Fixed income isn't responding well, so that needs to be monitored in case it's transitioning to a longer-term negative market environment. GOLD: Weak buy

A dollar trying to rebound from a severe short position has weighed on gold and miners. The types of signals they've given in recent weeks, within the context of their recent surge, have usually resulted in higher prices over a medium- to long-term time frame. Like bonds, gold and miners aren't responding very well, and this needs to be monitored.

|

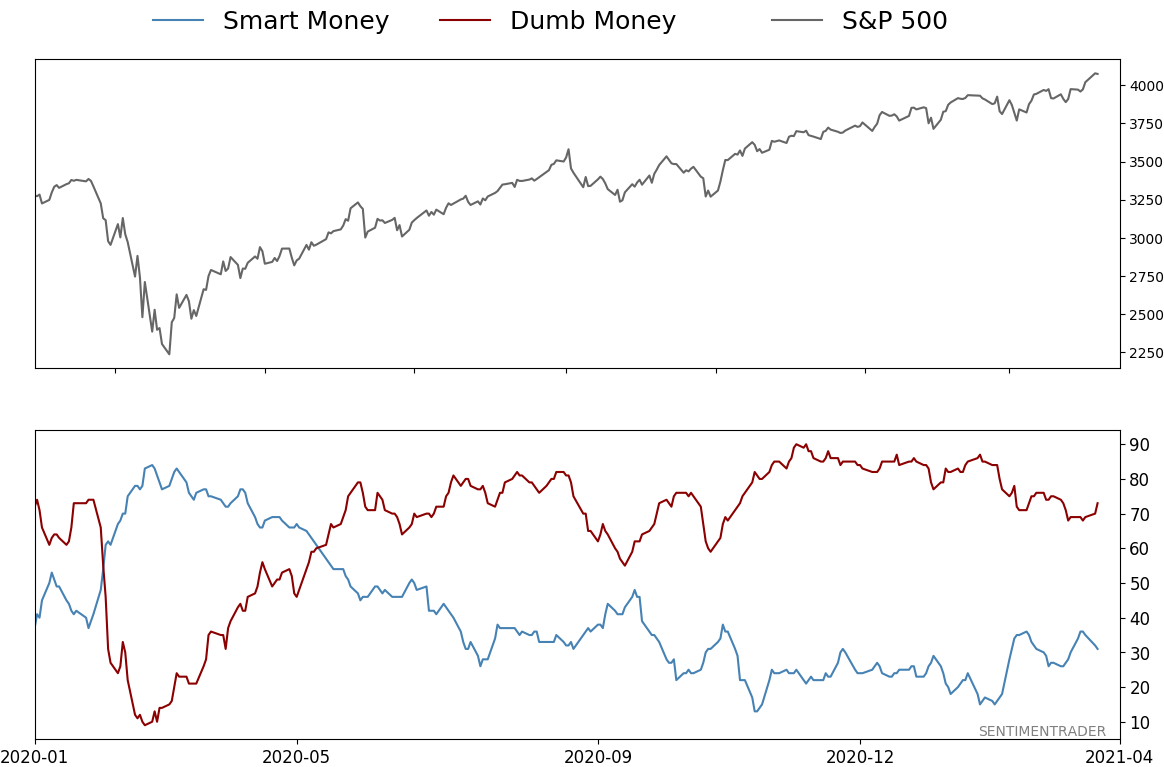

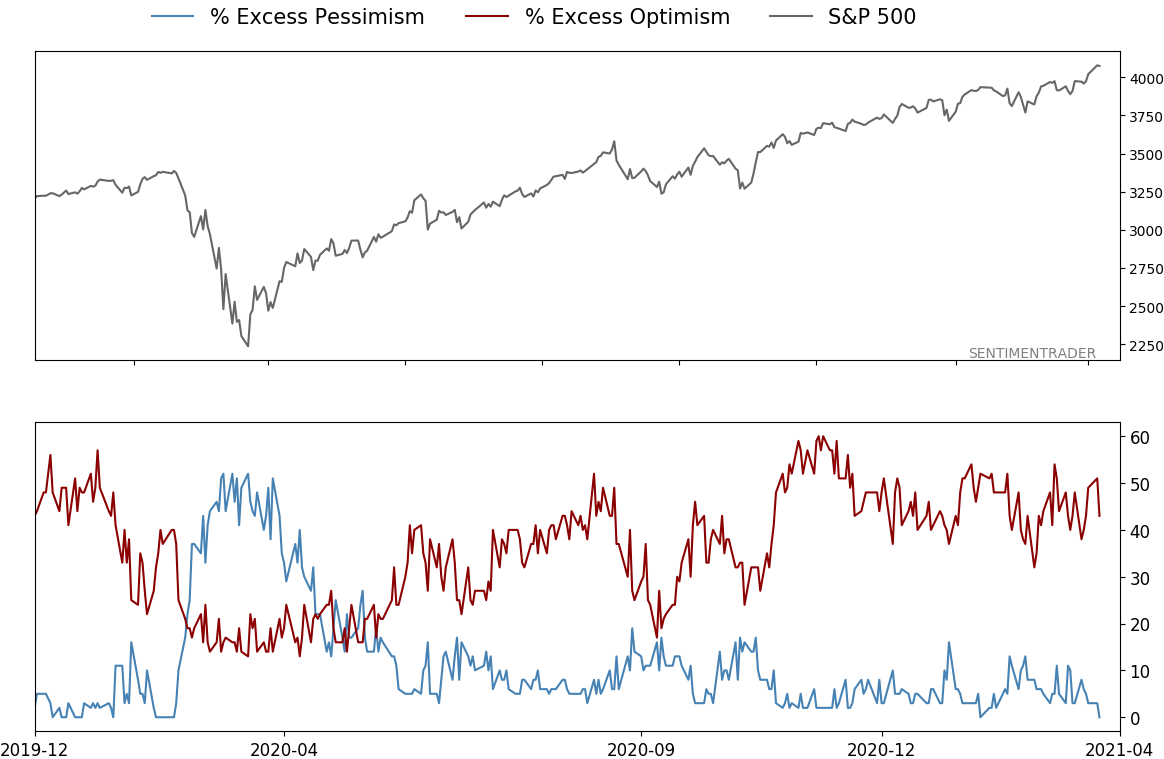

Smart / Dumb Money Confidence

|

Smart Money Confidence: 31%

Dumb Money Confidence: 73%

|

|

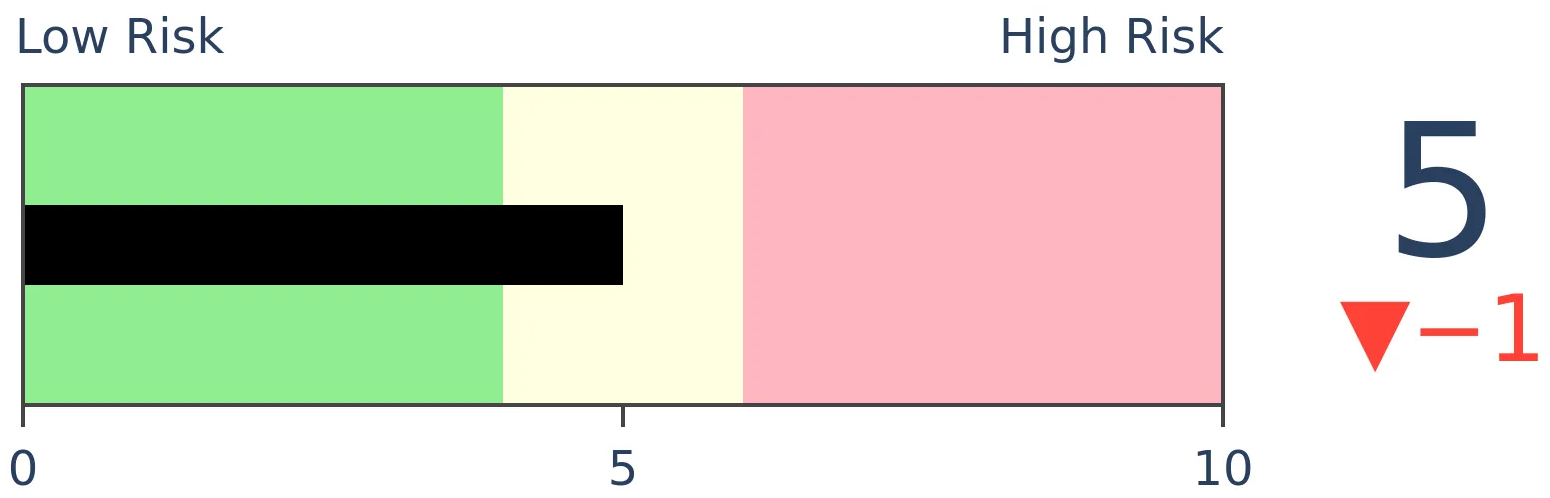

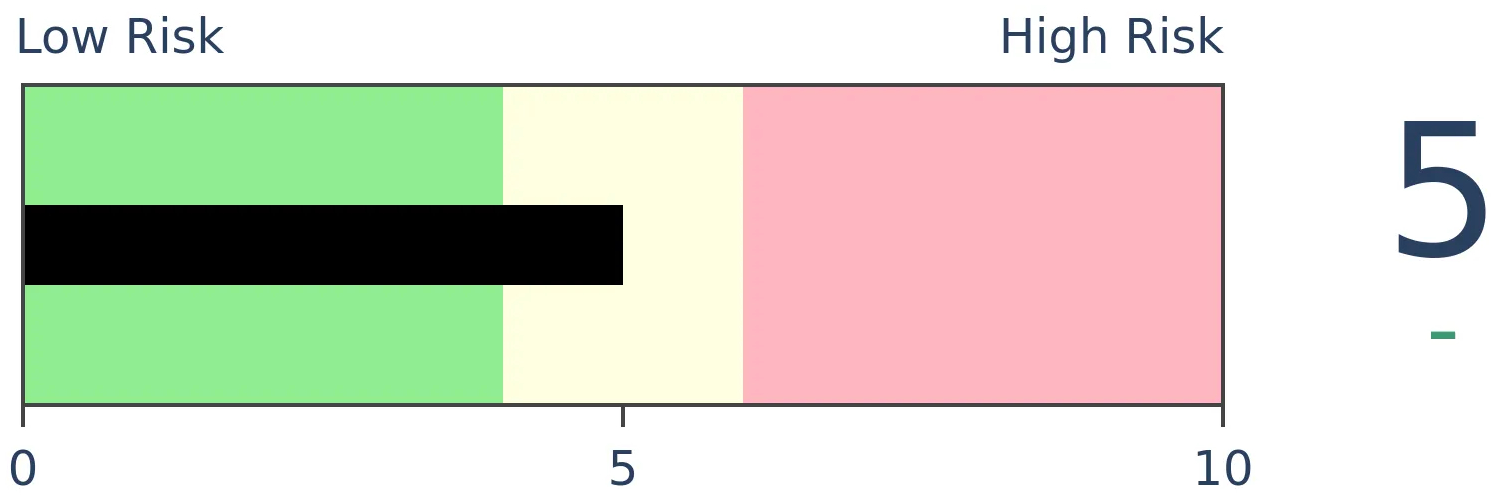

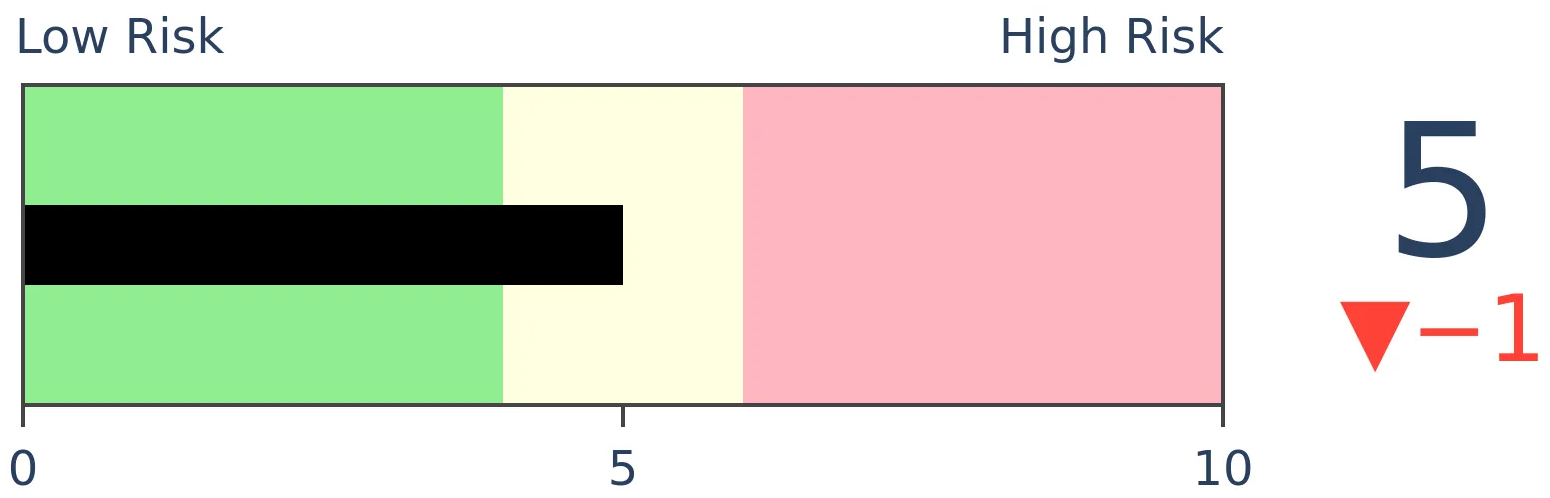

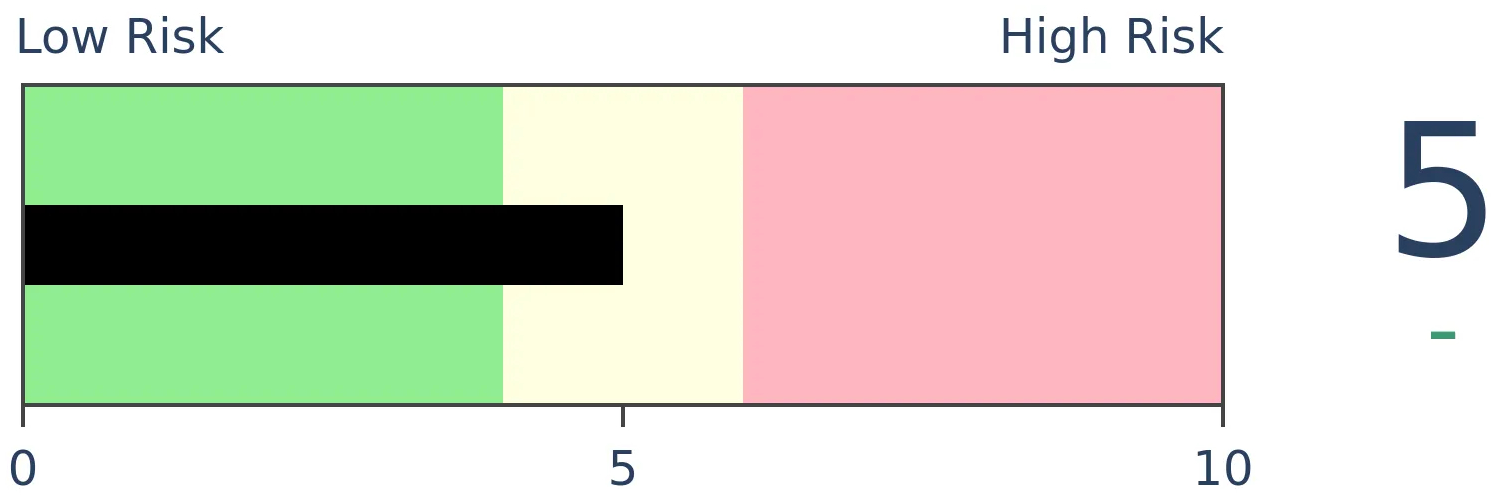

Risk Levels

Stocks Short-Term

|

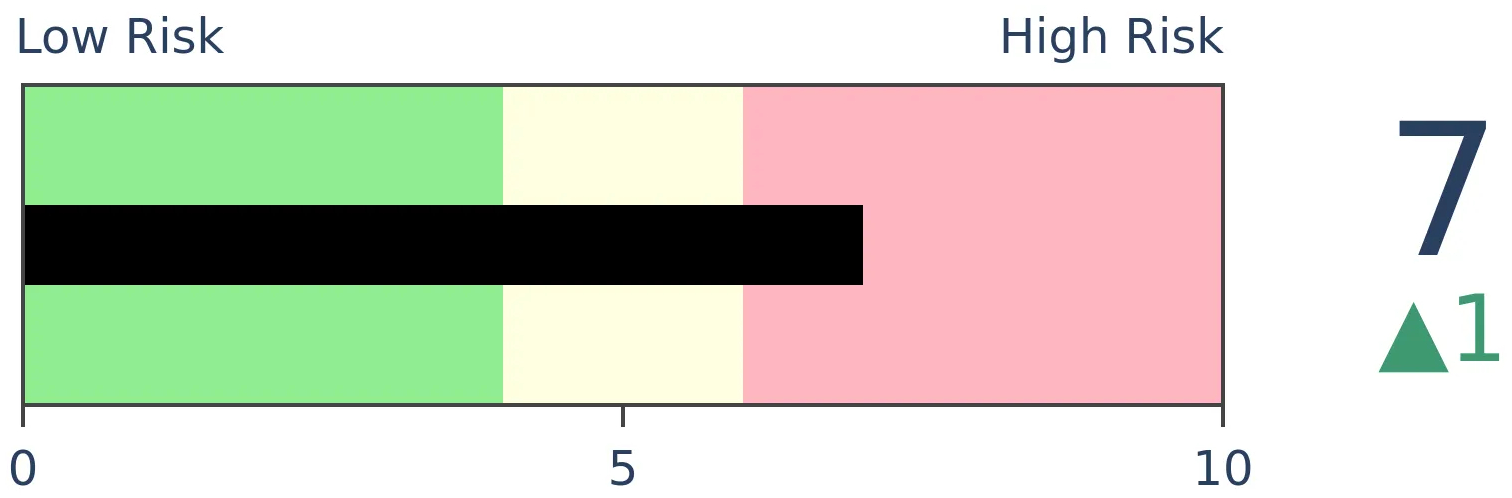

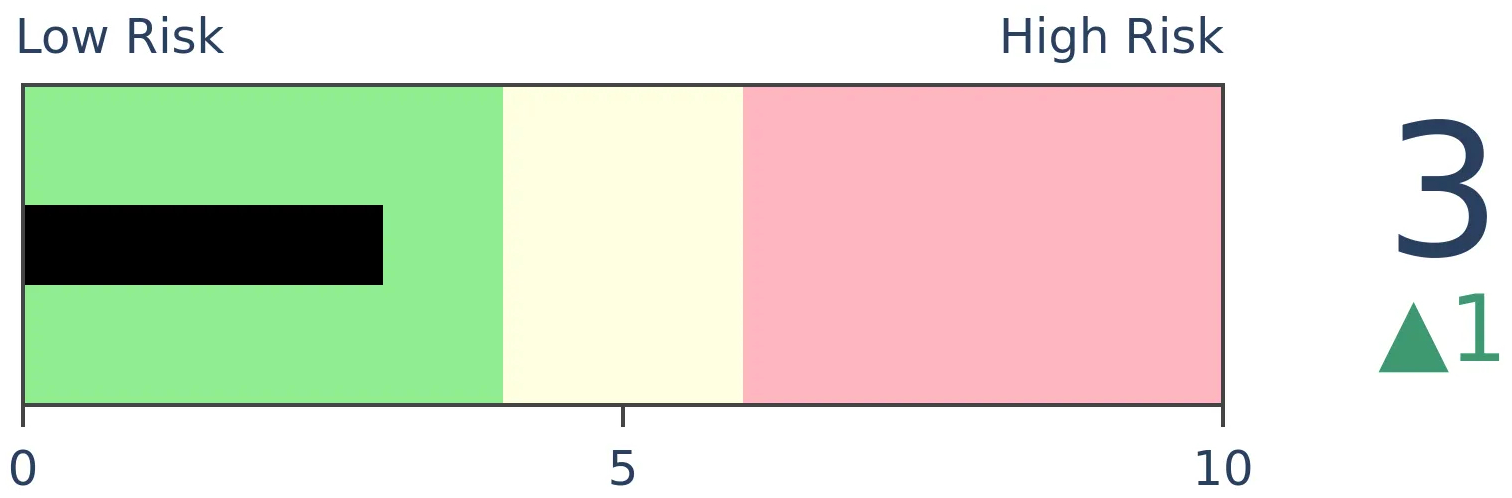

Stocks Medium-Term

|

|

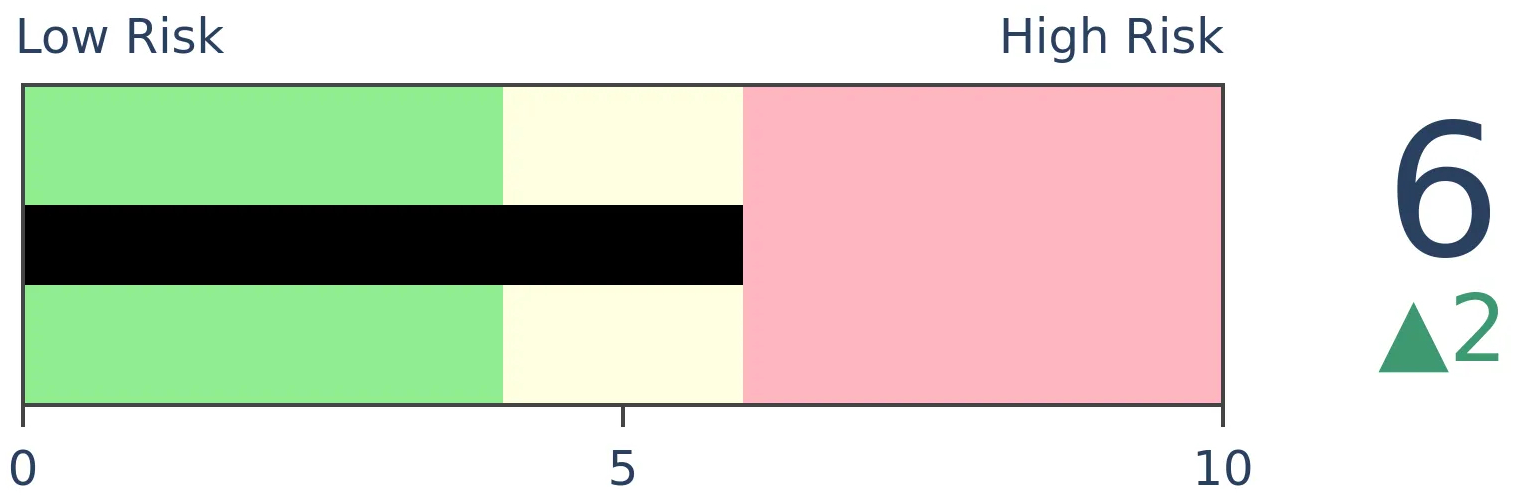

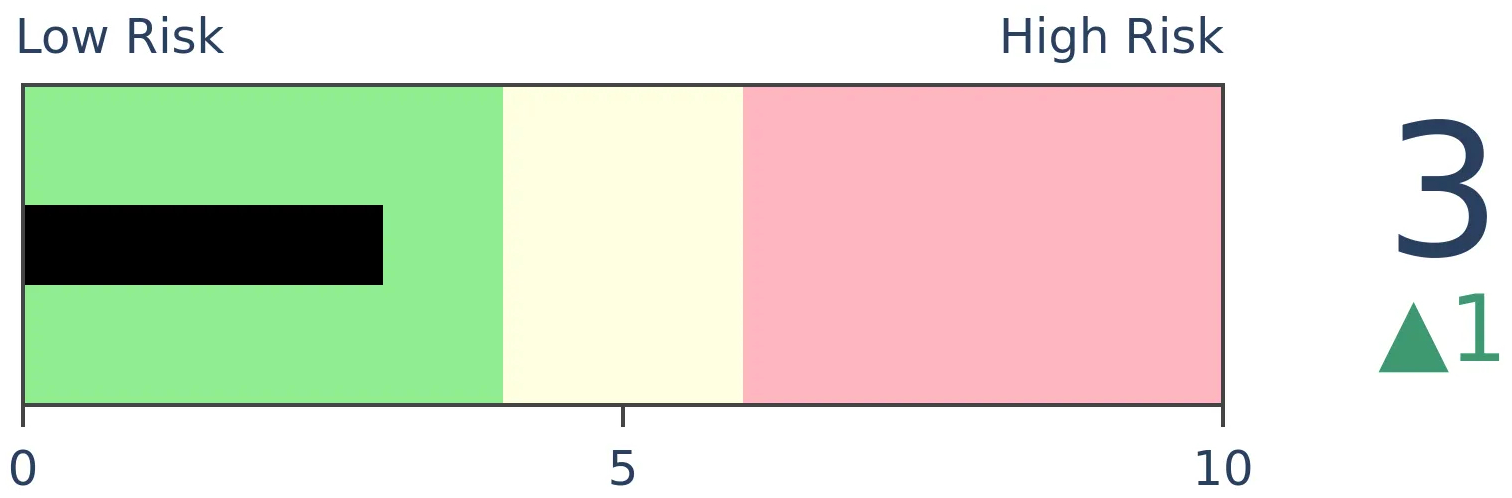

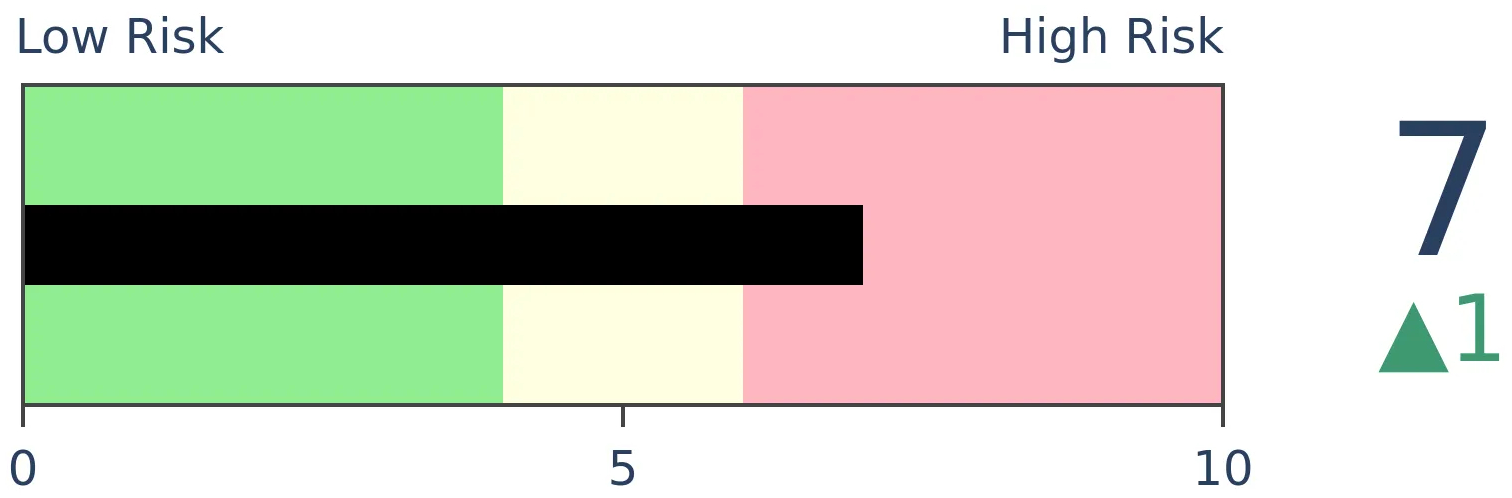

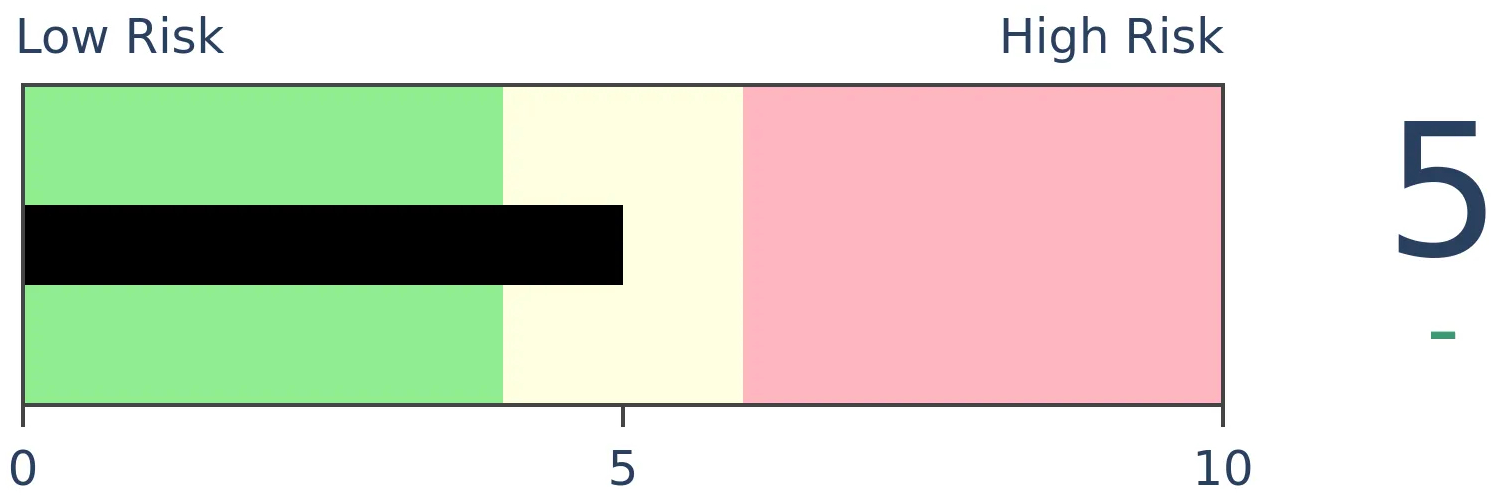

Bonds

|

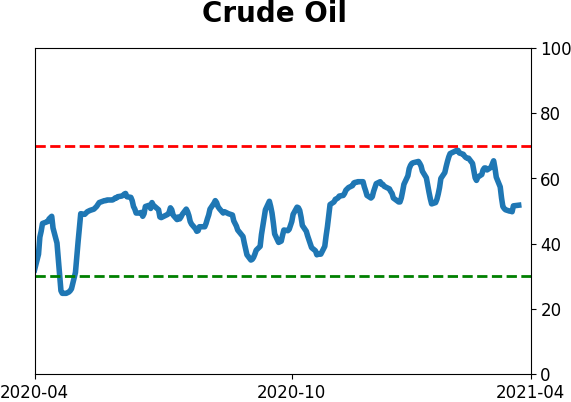

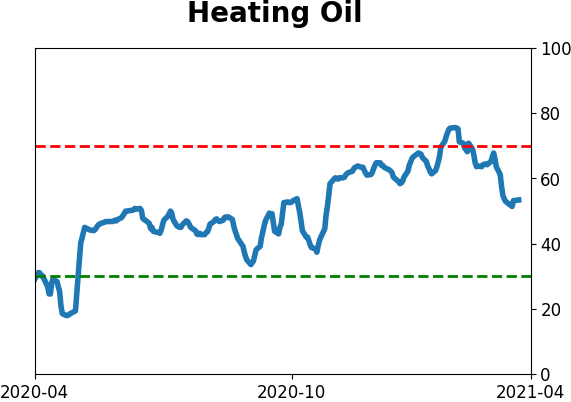

Crude Oil

|

|

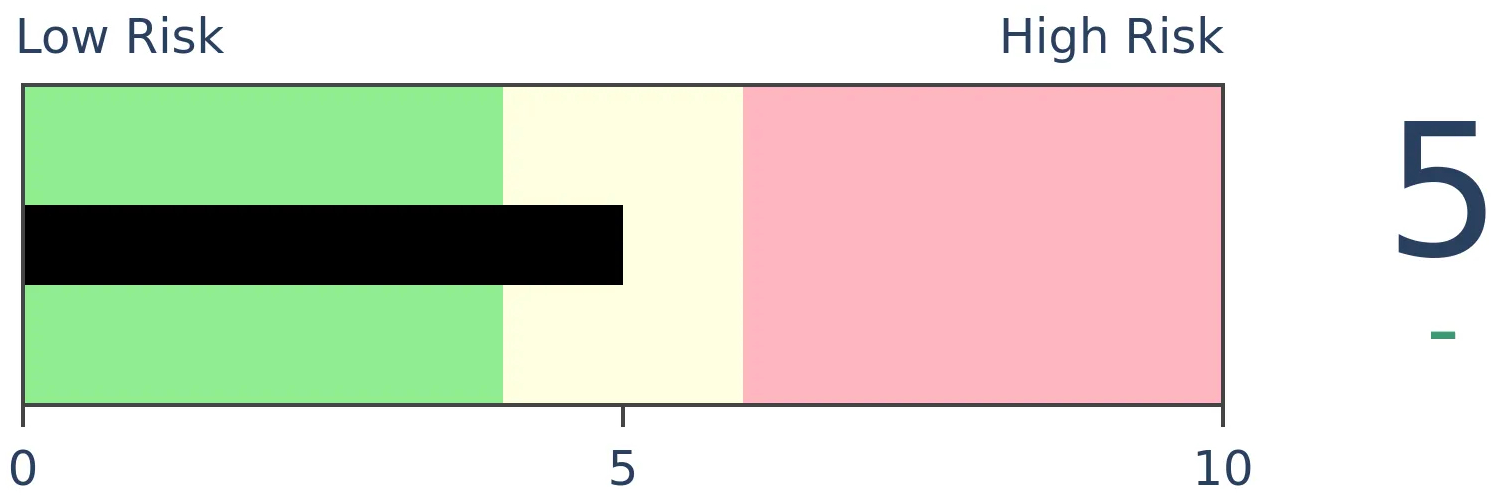

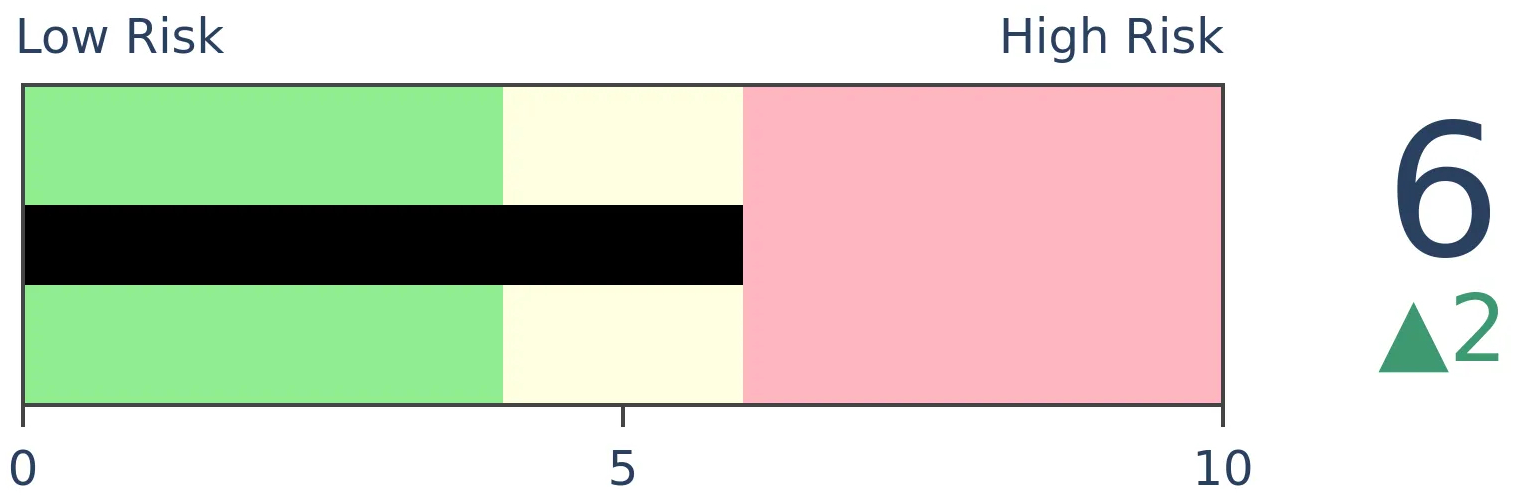

Gold

|

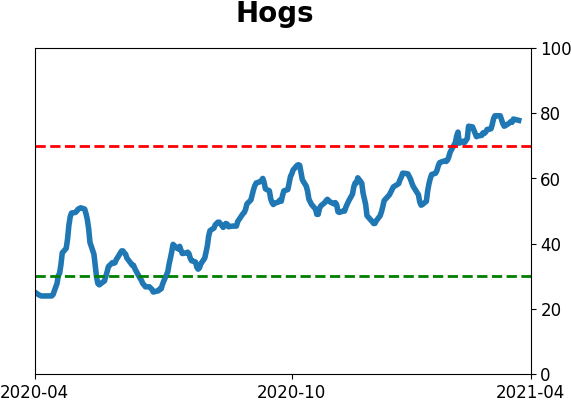

Agriculture

|

|

Research

BOTTOM LINE

Among industries, sectors, and countries, there has been a remarkable continued recovery. To one of the largest degrees on record, they are seeing impressive internal participation, with indexes trading above moving averages and at new highs, with few exceptions.

FORECAST / TIMEFRAME

ACWI -- Up, Medium-Term

|

There has been tension between the main focal points of our work for months now. In almost 20 years of publishing, this tension has never been so pronounced, or so prolonged.

Our main focus is sentiment. While there are always odd outlier indicators, there is little question that starting in December and arguably continuing today, we're seeing some of the most speculative behavior we have in a generation.

Another main focus is breadth and momentum. Those two forces are the main opposition to sentiment extremes, and when they are of high quality, they can swamp sentiment extremes for long stretches.

We've been watching carefully for months to see if the extremes in sentiment would lead to a deterioration in participation among stocks and bonds underlying the main indexes. So far, there have been only isolated pockets, and just when it seems like we would get major warning bells, the market recovered.

And how.

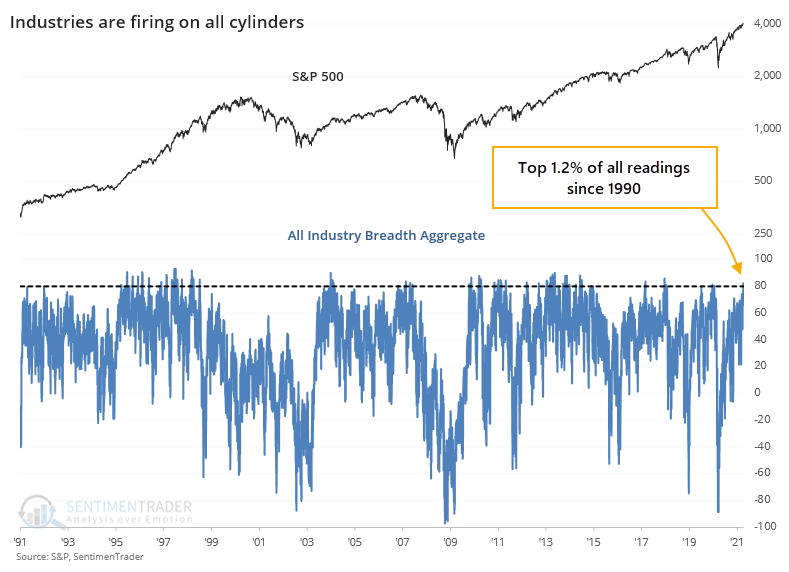

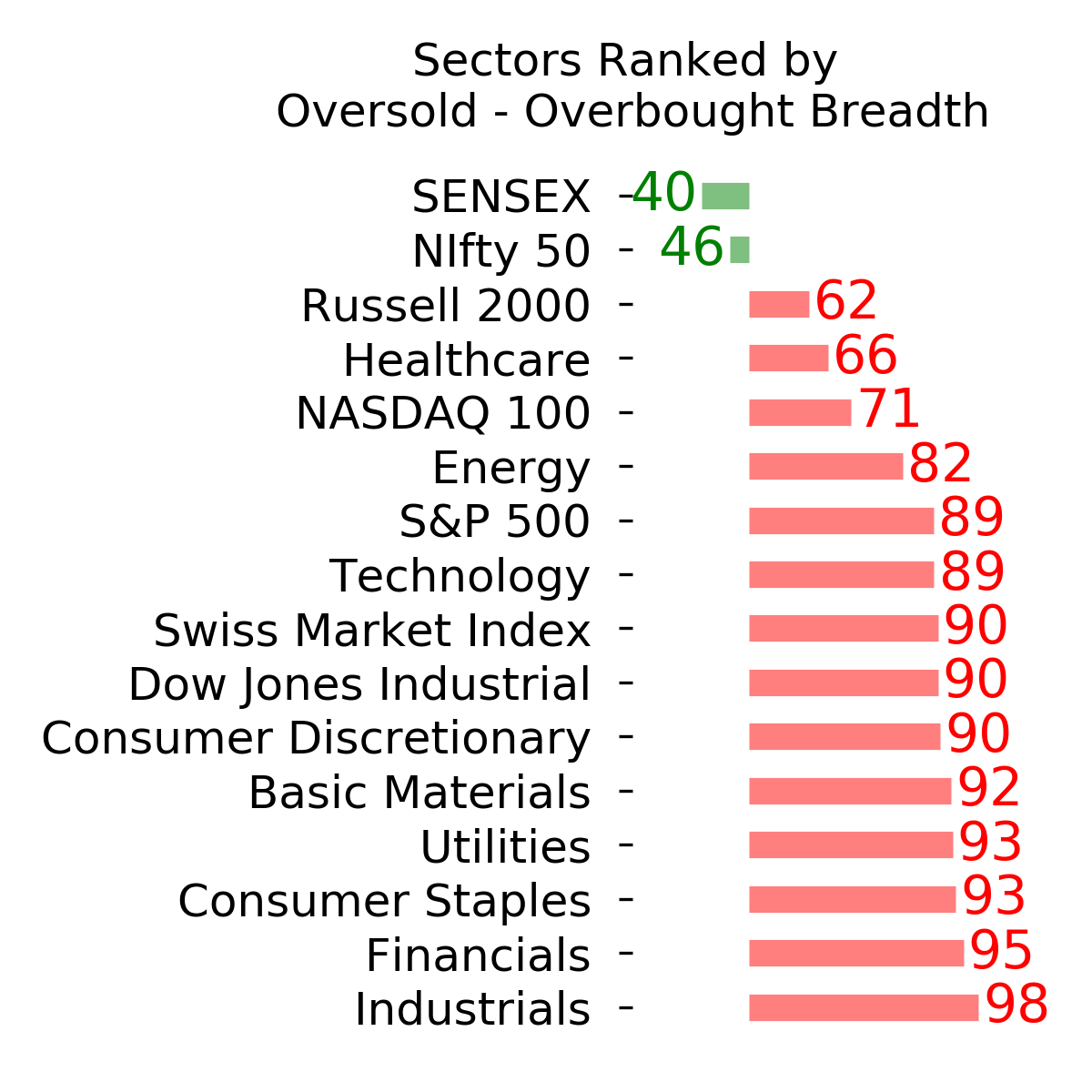

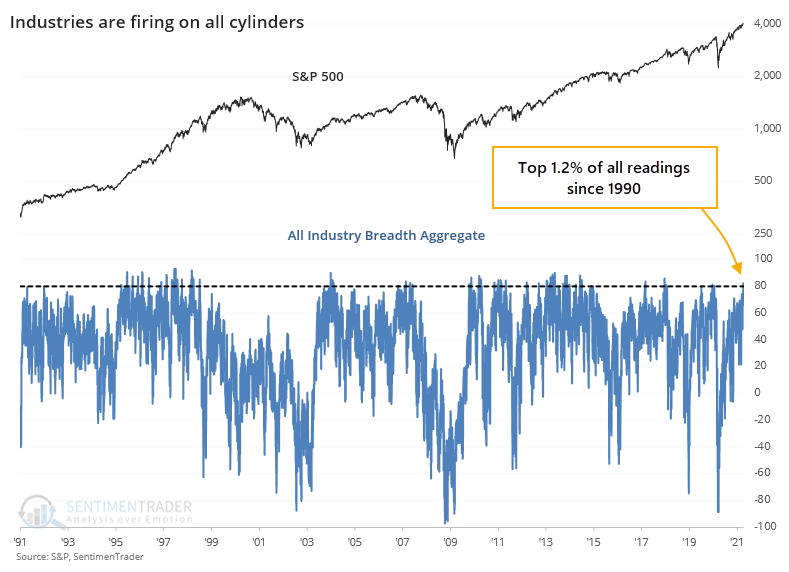

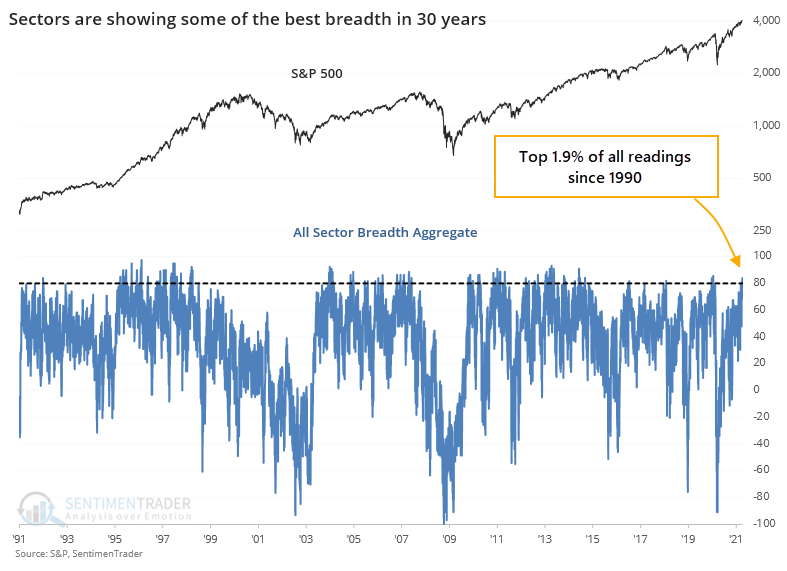

We track some unique breath measures, not only looking at stocks within indexes but also indexes within groups. And in the past couple of days, those have reached near-record impressiveness. Among industries, sectors, and global indexes, we are now seeing among the best participation on record.

This is judged by "positive" metrics:

And by "negative" ones:

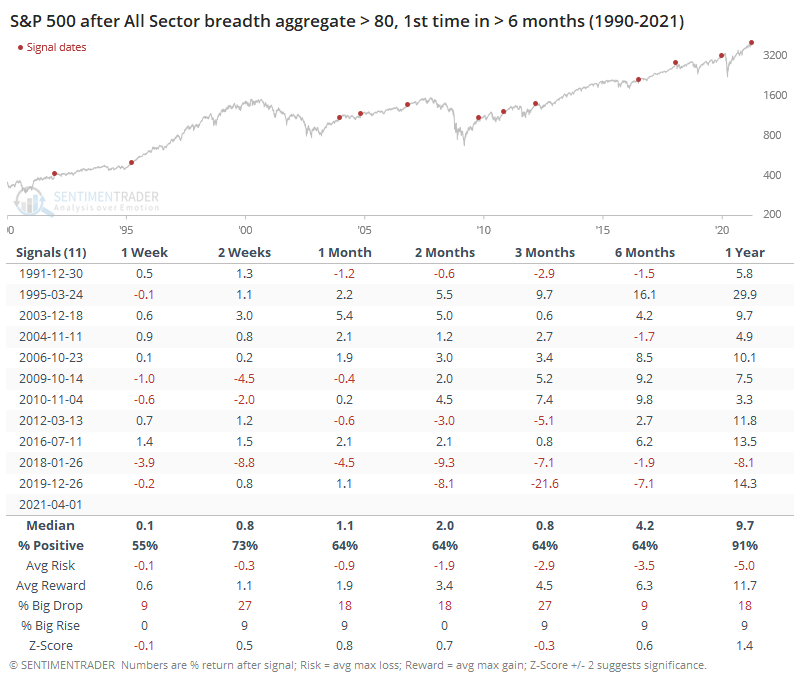

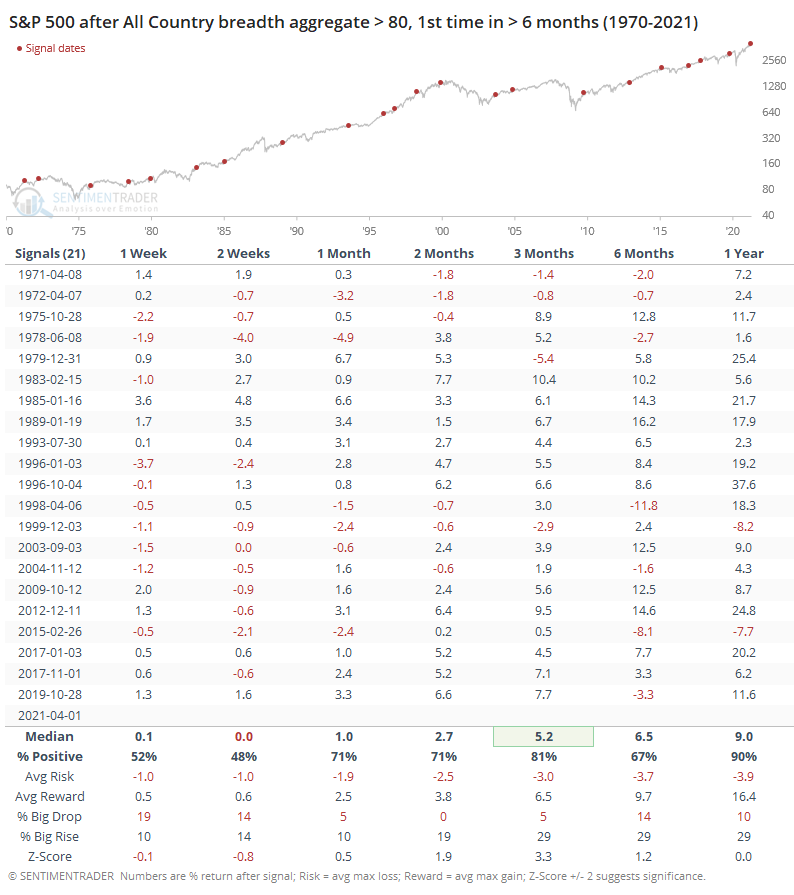

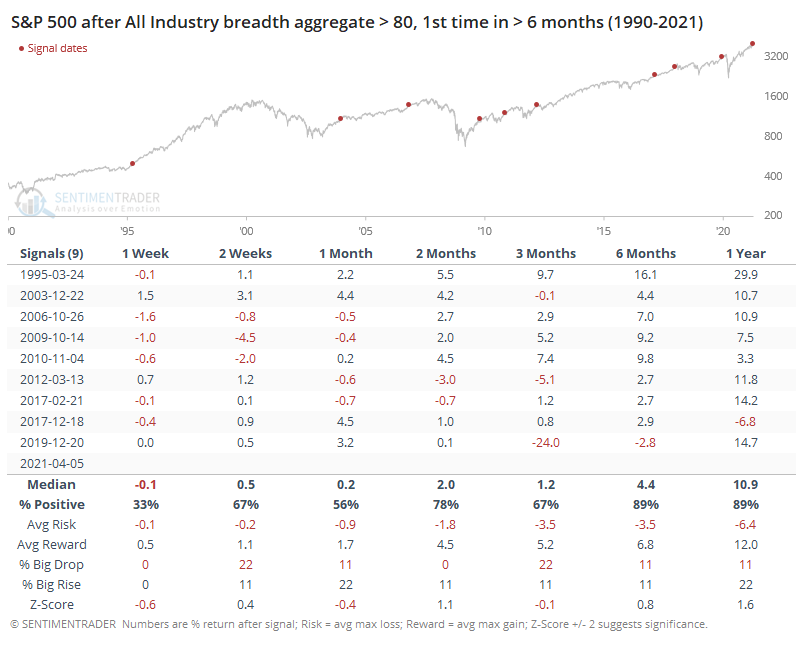

If we average all the positive metrics and subtract the negative ones, then we can get a breadth aggregate. For the 20+ major industries in the U.S., this aggregate just hit +80, among the highest readings in 30 years.

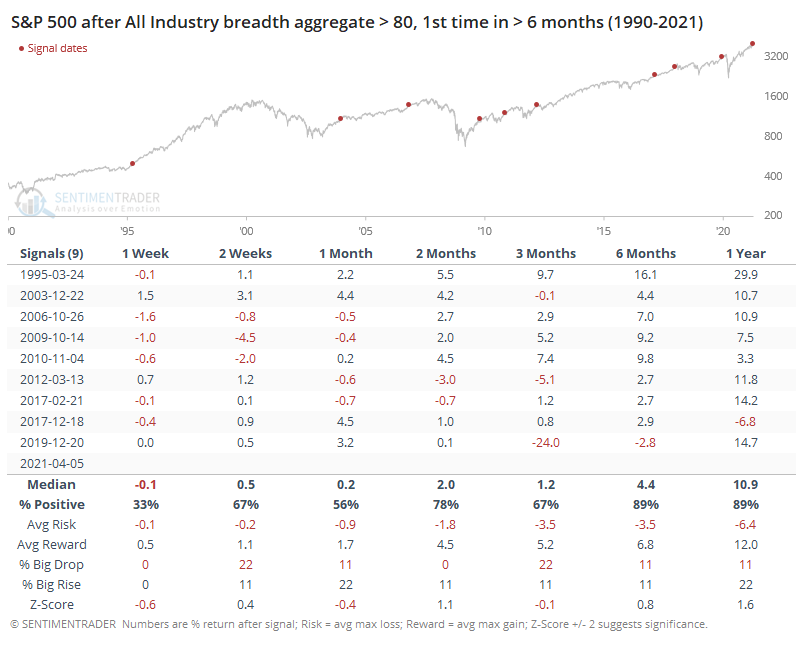

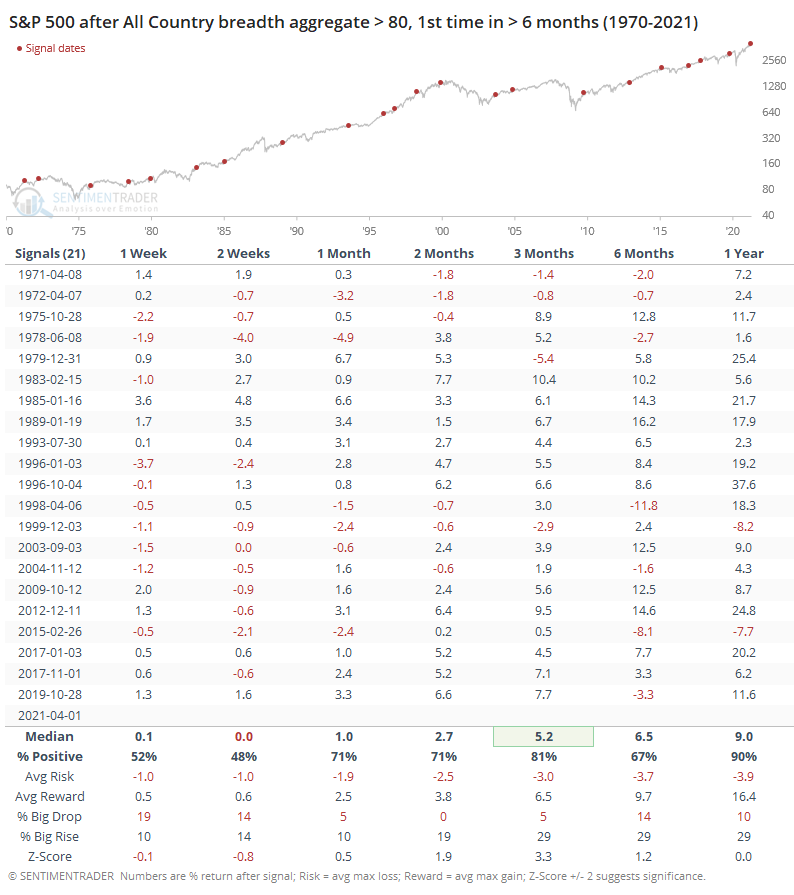

When this figure first exceeded +80 for the 1st time in at least 6 months, forward returns in the S&P 500 were very good over the medium- to long-term. The shorter-term saw some of the gains digested first, and the ones that triggered in the past decade saw more questionable returns than prior signals.

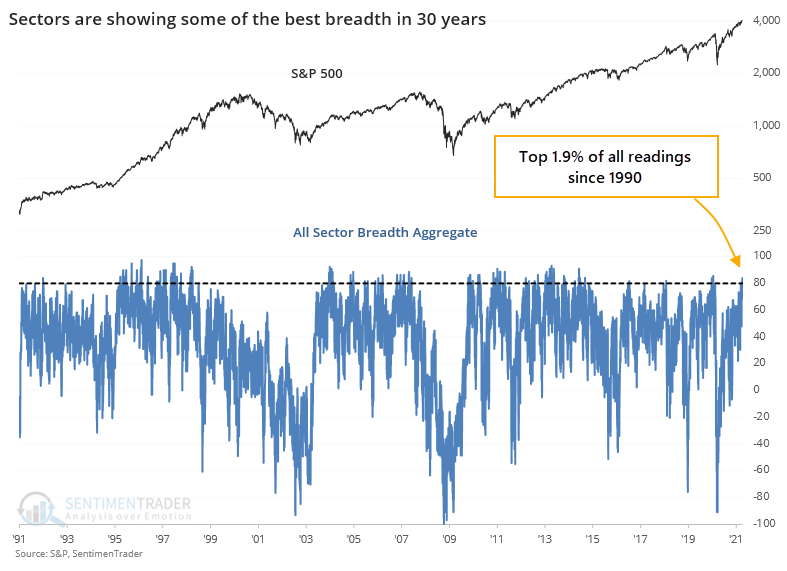

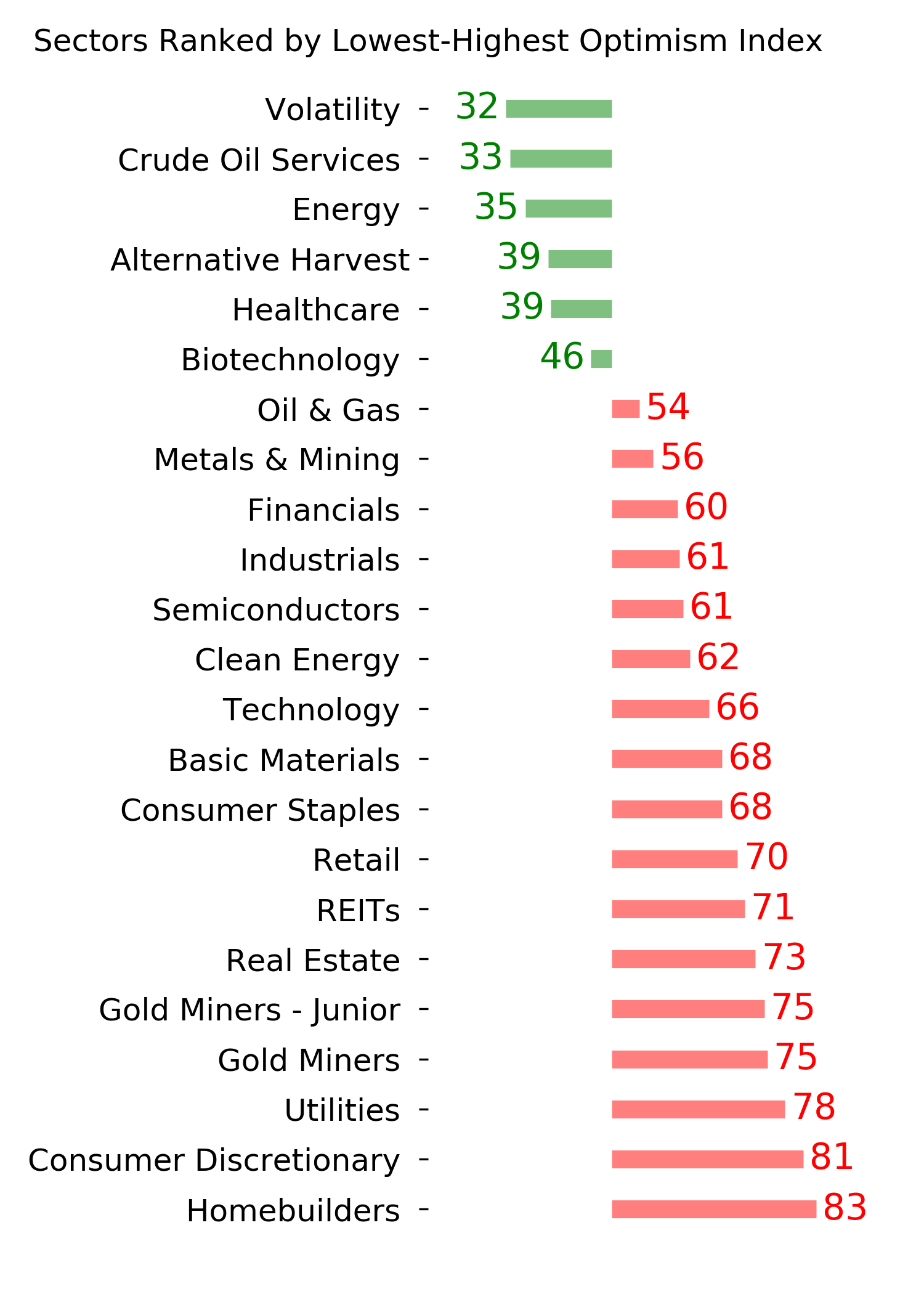

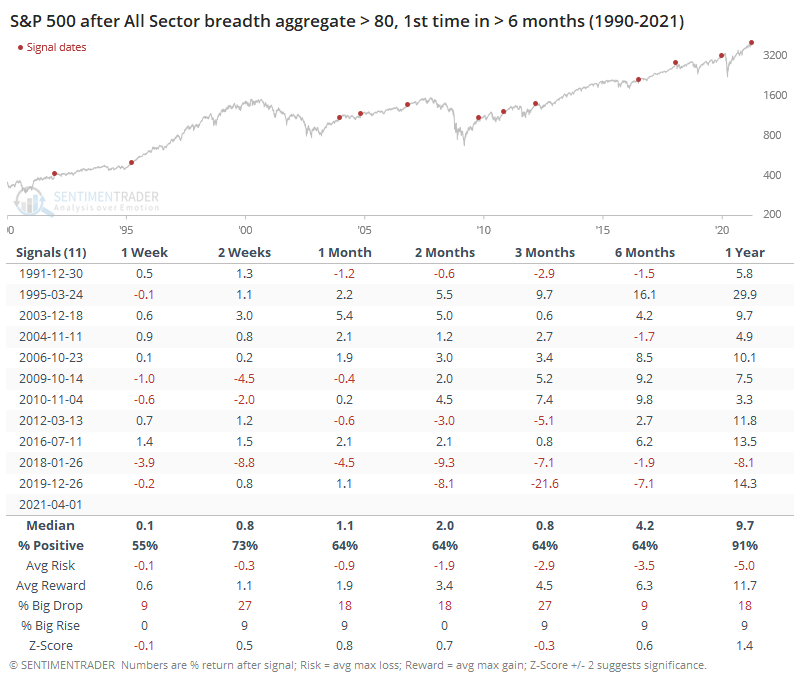

It stands to reason that if most industry indexes are performing well, then the 10 major sectors (excluding REITs) are as well. It's almost the same graph, but not quite.

There were a couple more dates when this aggregate exceeded +80, and forward returns were good but only modestly above random.

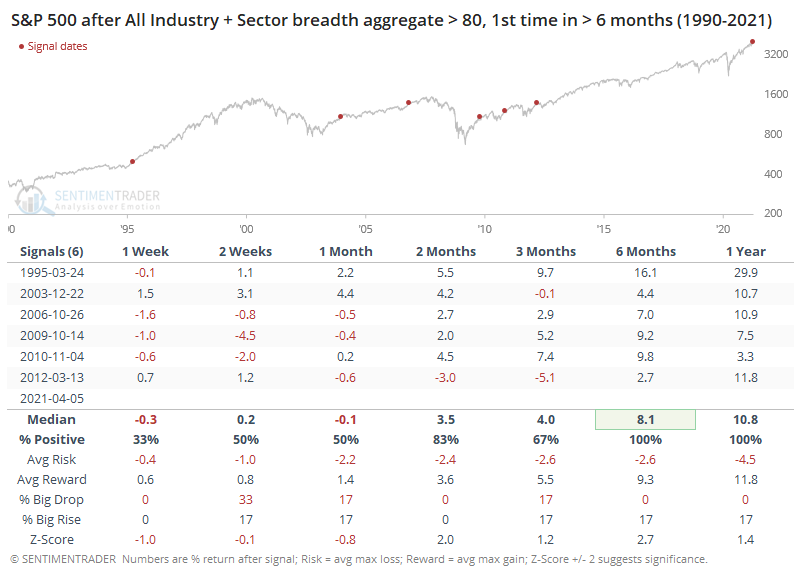

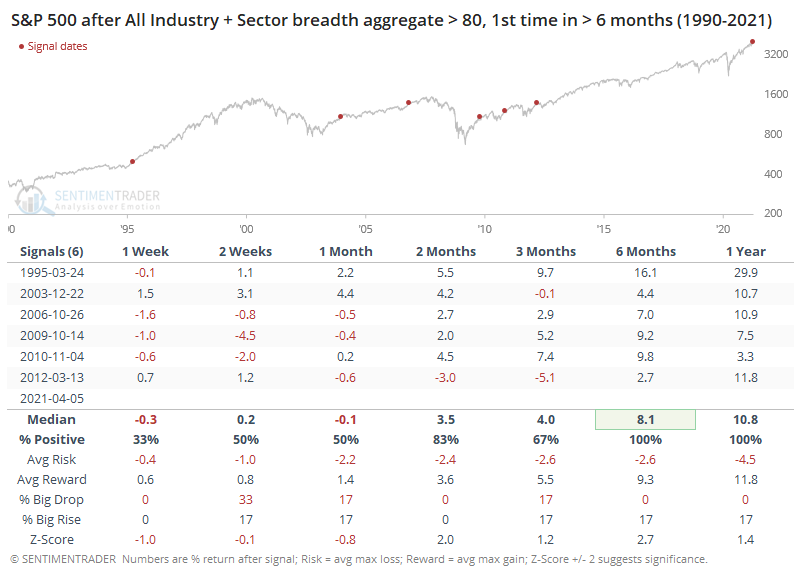

When we combine these signals, looking for times when both the All Industry and All Sector breadth aggregates exceeded +80, then we saw impressive returns going forward. The S&P showed no losses over the next 6-12 months, though again there was digestion in the near-term for 5 out of the 6 signals.

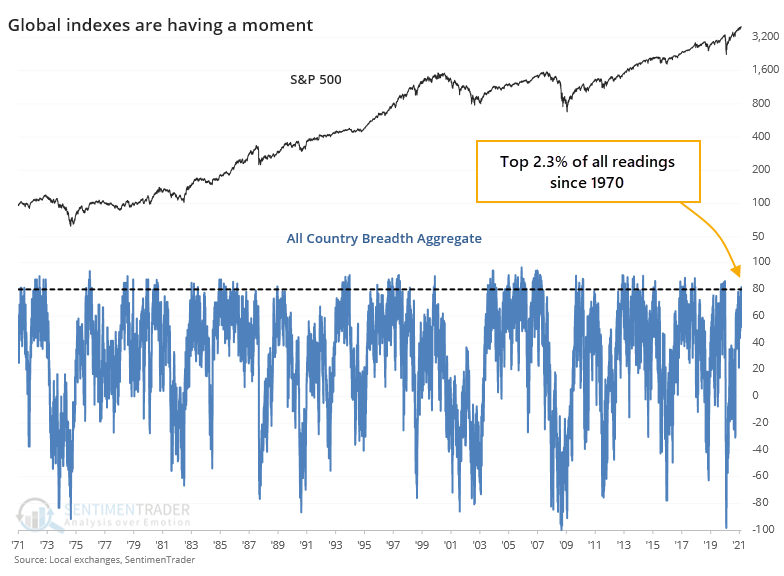

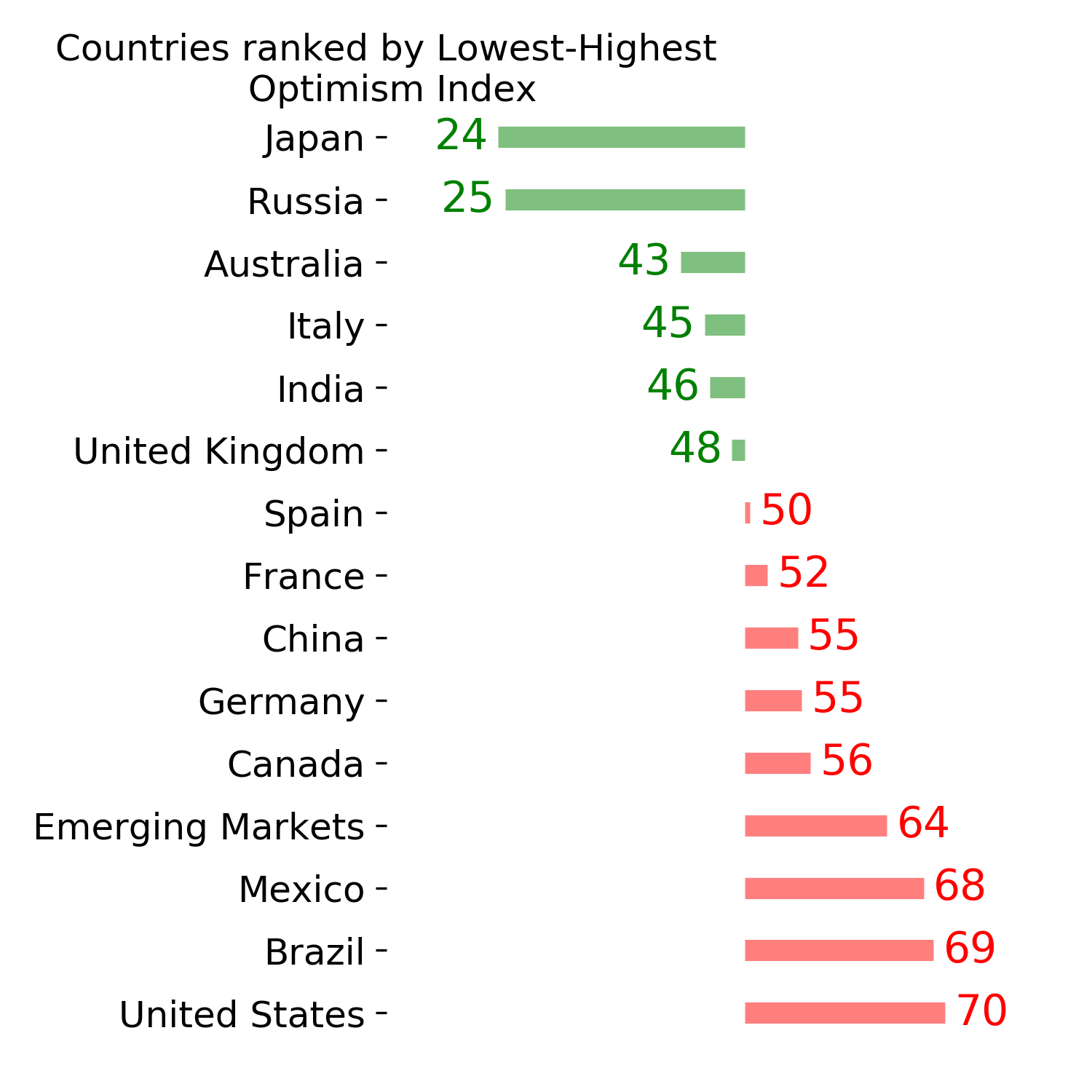

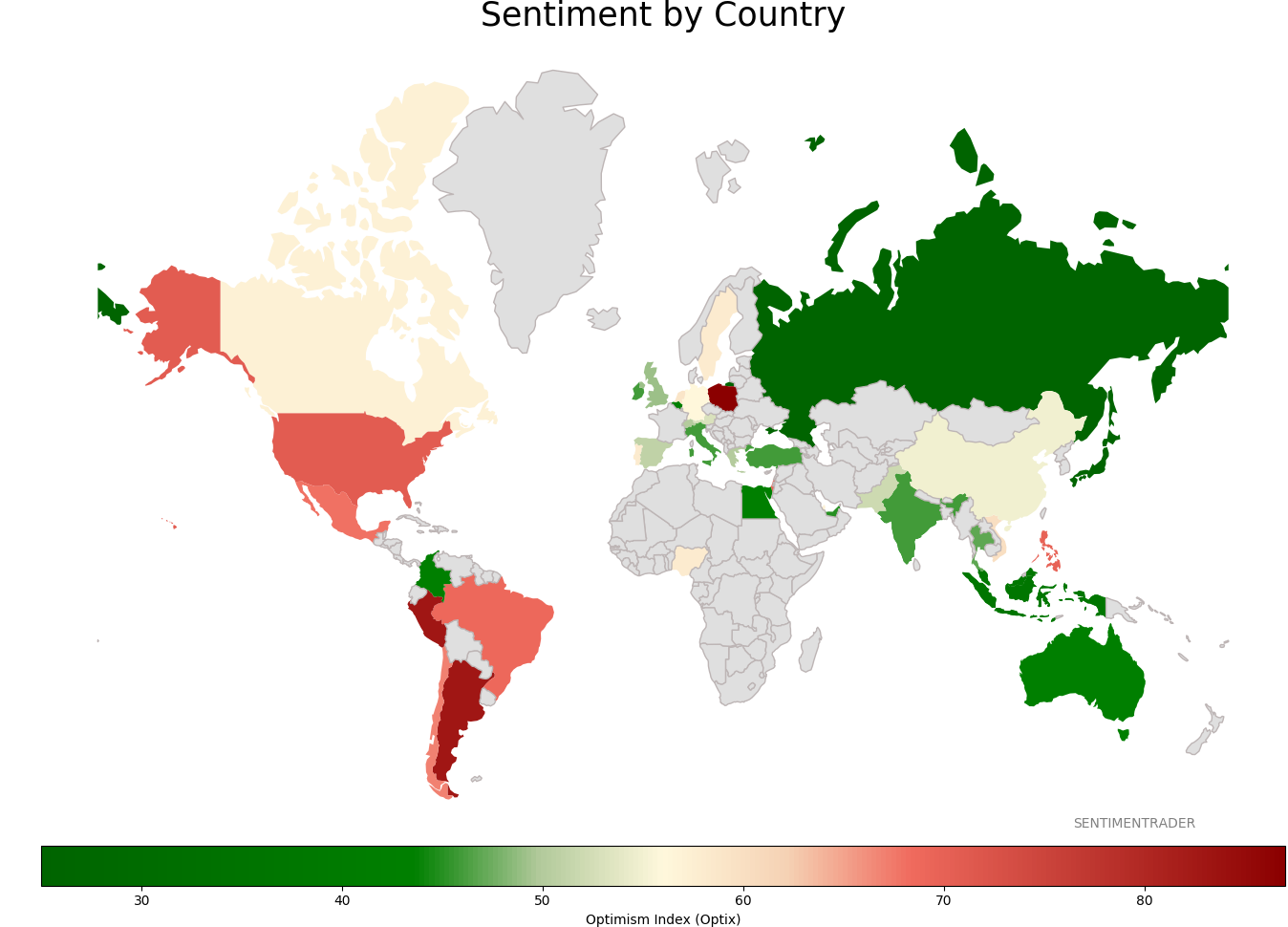

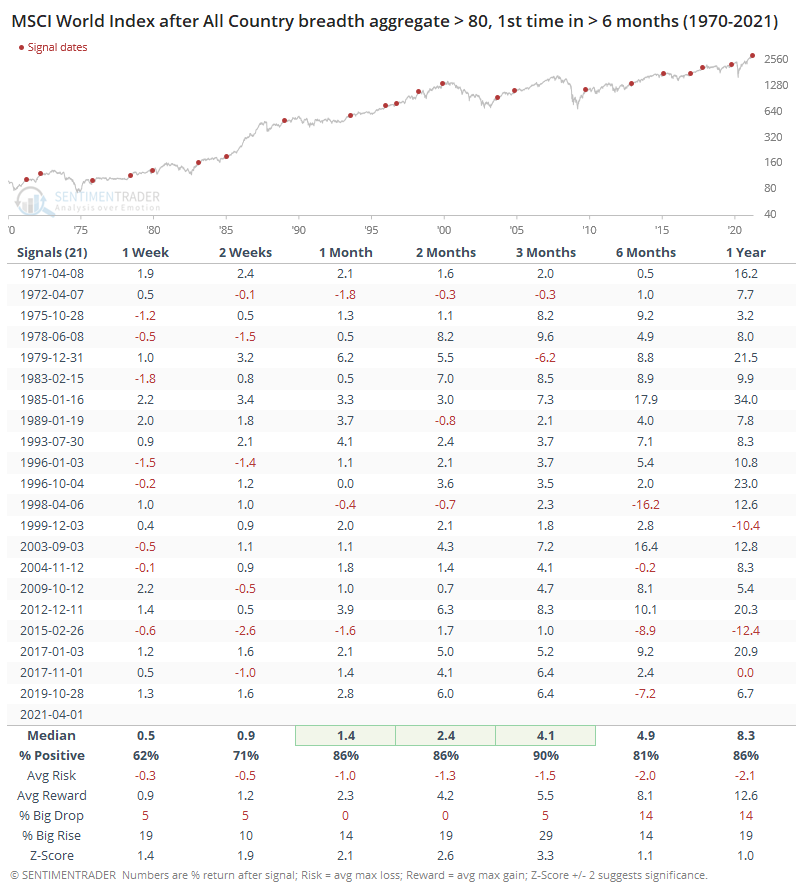

It's not just the U.S. that's participating. Among major global indexes, we're also seeing one of the most impressive thrusts in breadth, this time going back more than 50 years.

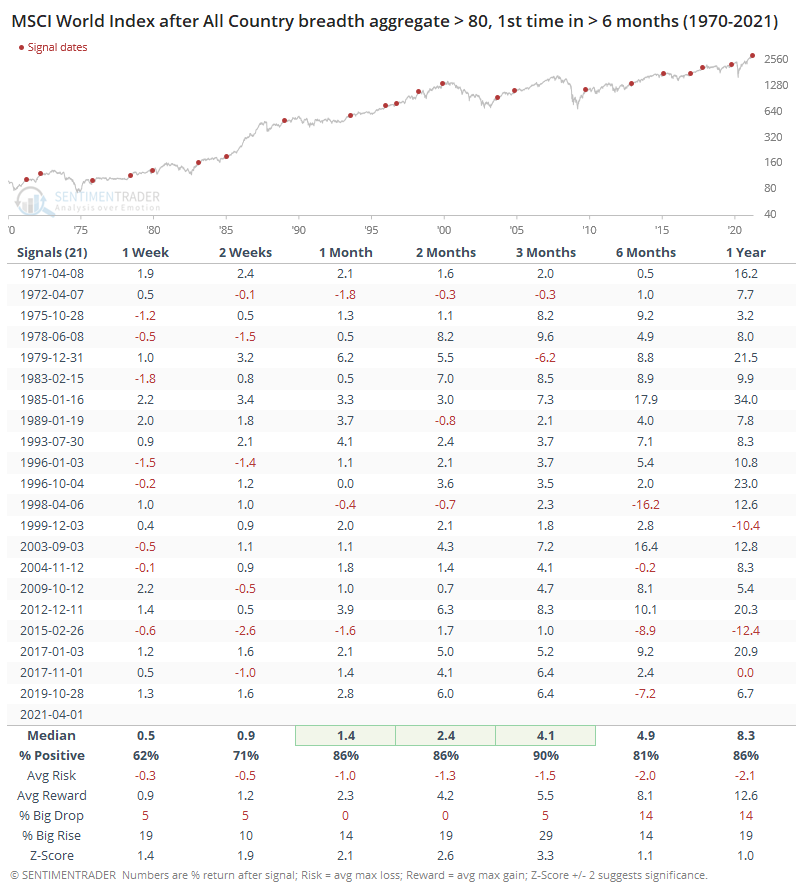

For the MSCI World Index, that preceded further gains over the next 1-3 months almost every time, and those rare losses were extremely small. It's hard to note anything negative about this at all, other than a few of them gave up the gains over the longer-term.

For the S&P 500, these periods of global health also led to mostly positive returns.

The biggest conundrum with our current environment is how quickly we went from one extreme (in March 2020) to the other. There hasn't really been another time in history when we've seen a recovery from a bear market like that, while also being at new all-time highs.

So, we're seeing a type of conflict that really hasn't happened before, at least not that we can find. Many of the measures related to thrusts, momentum, and breadth, are the types that only trigger during the first phase of a multi-year bear market recovery. But most of the sentiment-related measures have generated signals that typically only trigger near the ends of multi-year bull markets.

It's hard, maybe impossible, to reconcile these conflicts. So far, the positives have been winning, though there has been quite a bit of under-the-surface rotation. That hasn't been enough to manifest in broad-based deterioration that would trigger some of the warning signs we watch for after investors become overly optimistic. That means there isn't much of a change in the dynamic we've had to wrestle with for months now - impressive, even historic, breadth and momentum that's being met with some of the most optimistic investor behavior on record.

A typical market response to lesser conflicts has been choppy conditions in major indexes, with further gains eventually given back. That's been the outlook for while and seems like it's continuing.

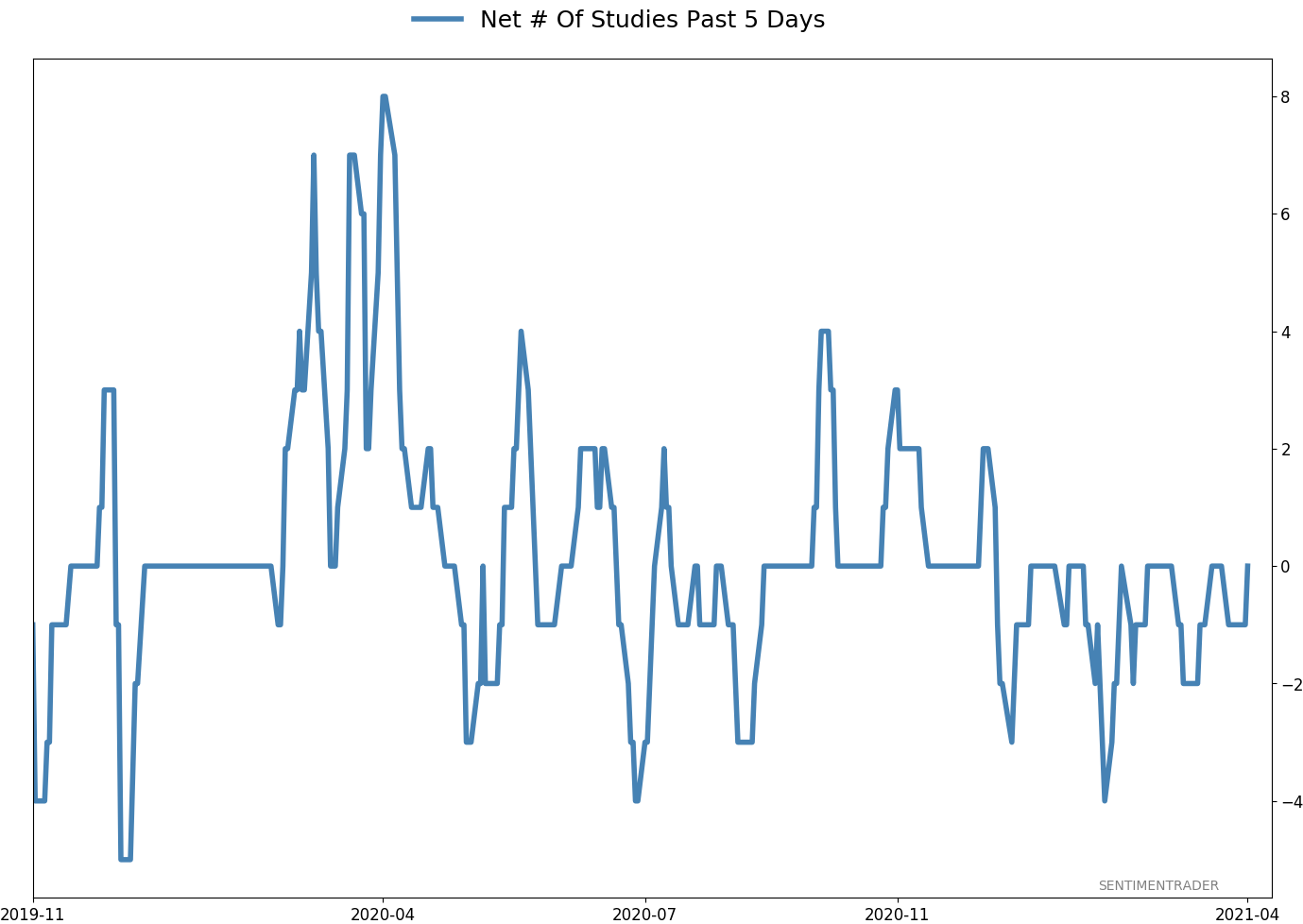

Active Studies

| Time Frame | Bullish | Bearish | | Short-Term | 0 | 0 | | Medium-Term | 0 | 10 | | Long-Term | 11 | 4 |

|

Indicators at Extremes

Portfolio

| Position | Description | Weight % | Added / Reduced | Date | | Stocks | RSP | 4.9 | Reduced 4% | 2021-02-09 | | Bonds | 30.0% BND, 8.8% SCHP | 38.8 | Added 15.1% | 2021-02-18 | | Commodities | GCC | 2.3 | Reduced 2.1%

| 2020-09-04 | | Precious Metals | GDX | 9.0 | Added 0.1% | 2021-02-18 | | Special Situations | 7.3% XLE, 4.8% PSCE | 12.1 | Reduced 5.6% | 2021-02-18 | | Cash | | 32.8 | | |

|

Updates (Changes made today are underlined)

With a market that has seen the kinds of broad participation and big breath thrusts like we did in the fall, it's hard to become too negative. Those kinds of conditions have consistently preceded higher returns over the next 6-12 months. It's the interim that's more of an issue. Even conditions like that haven't prevented some shorter-term pullbacks. And when we combine an environment where speculation is rampant and recent days have seen an increase in cracks under the surface of the indexes, it's enough to become more defensive over a short- to medium-term time frame. We still don't have much confirmation from the price action in the indexes, so those who are more conservative would likely wait before increasing cash levels. I've decreased risk exposure a bit more, mainly in terms of energy stocks and the ANGL fund, while adding more to the broader bond market. RETURN YTD: 6.7% 2020: 8.1%, 2019: 12.6%, 2018: 0.6%, 2017: 3.8%, 2016: 17.1%, 2015: 9.2%, 2014: 14.5%, 2013: 2.2%, 2012: 10.8%, 2011: 16.5%, 2010: 15.3%, 2009: 23.9%, 2008: 16.2%, 2007: 7.8%

|

|

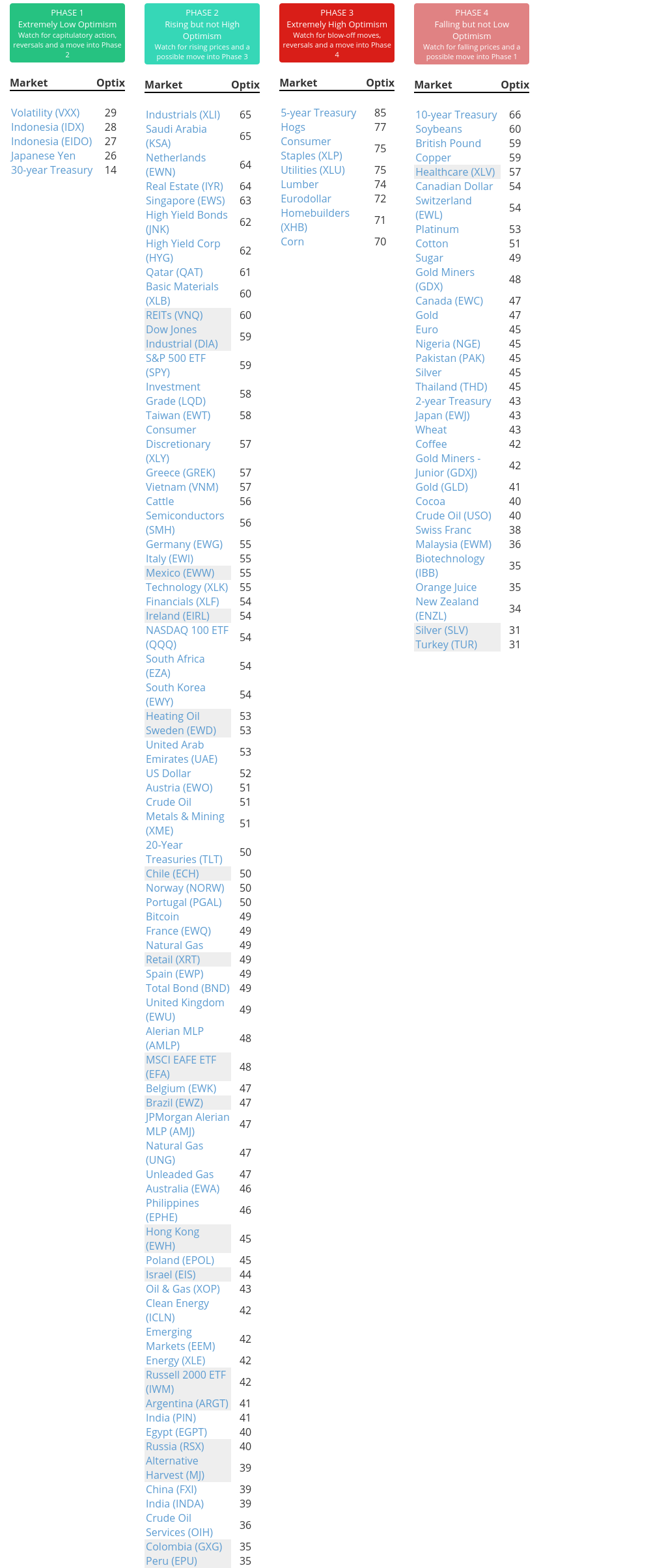

Phase Table

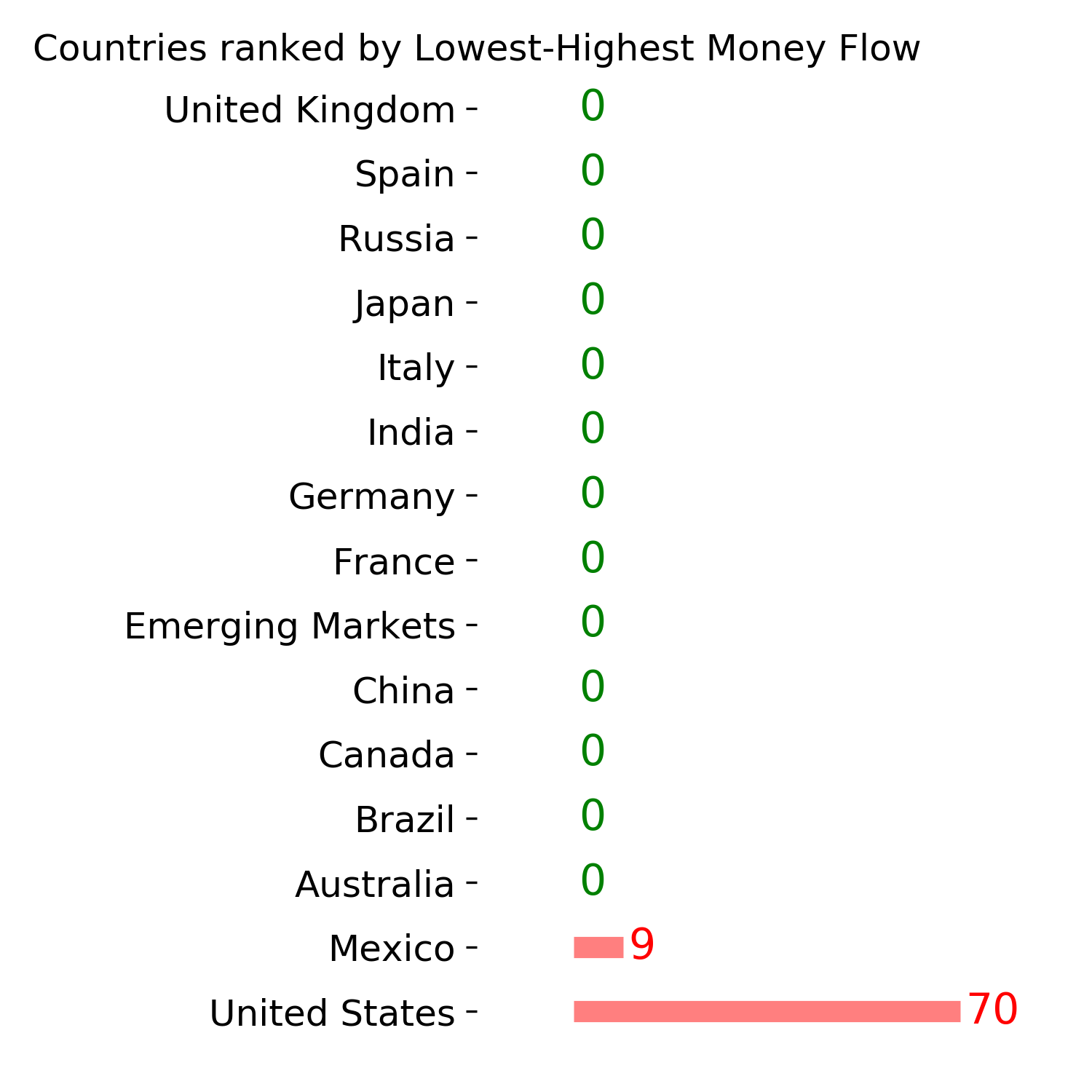

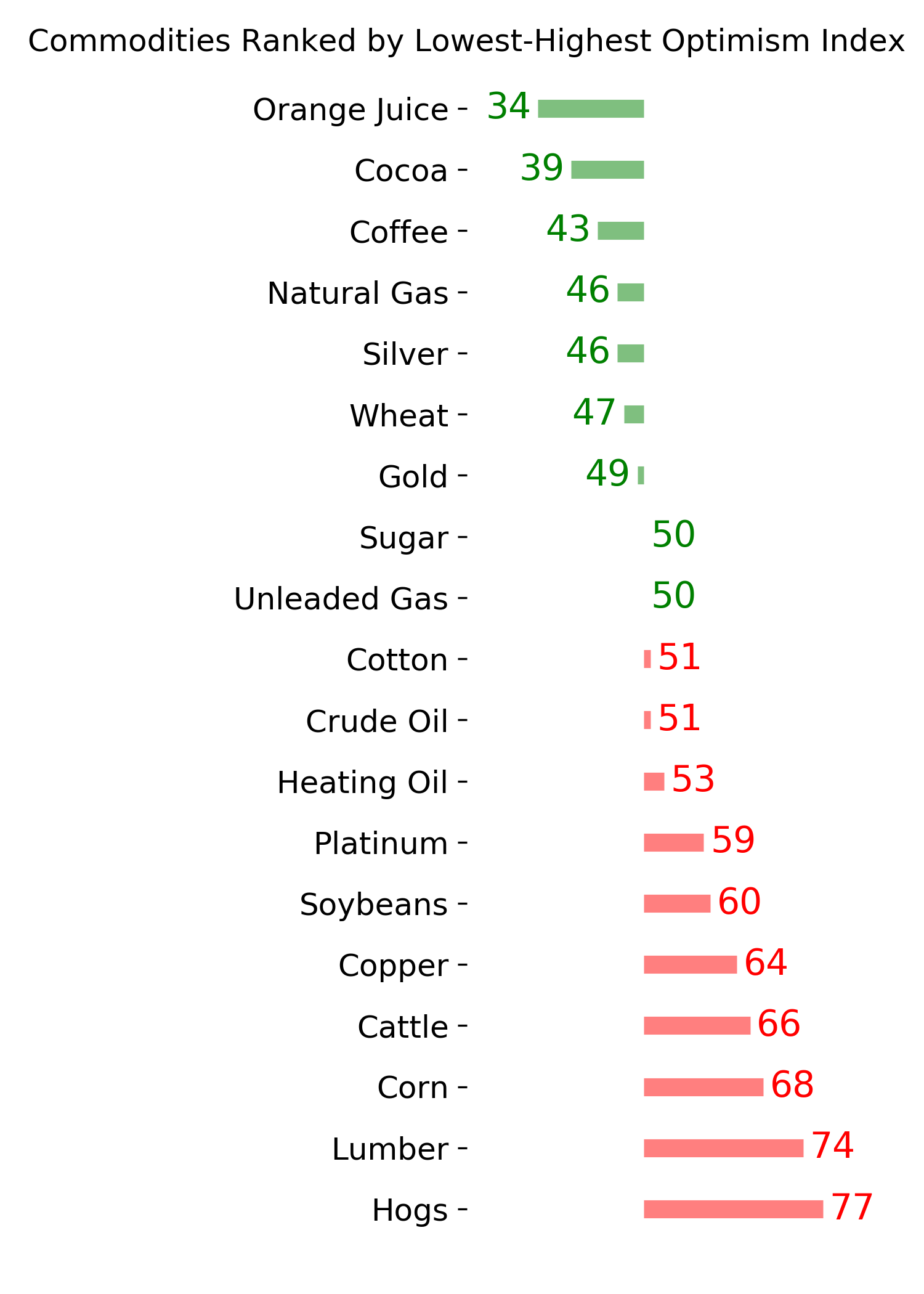

Ranks

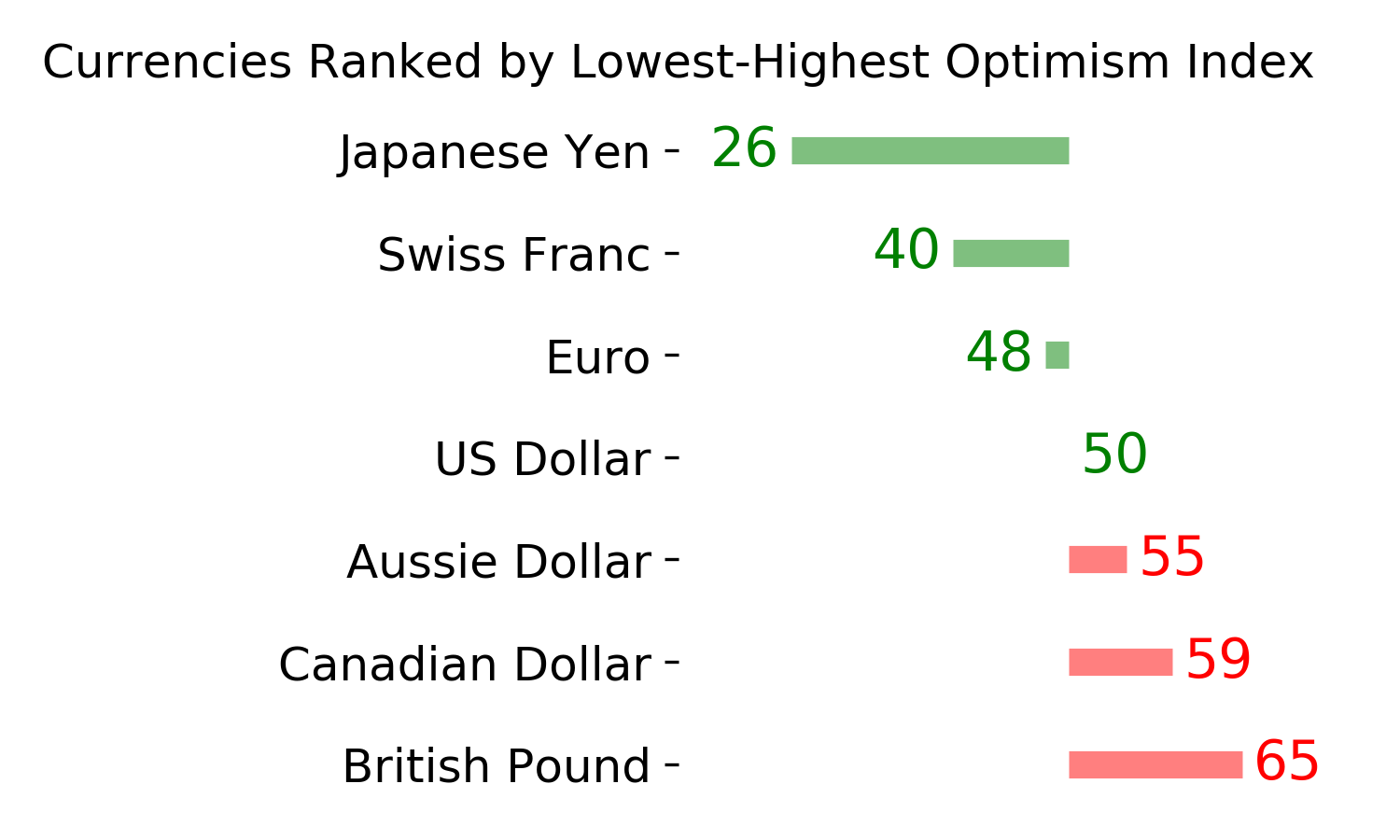

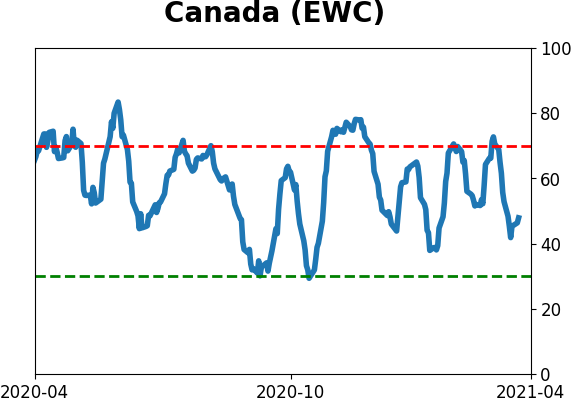

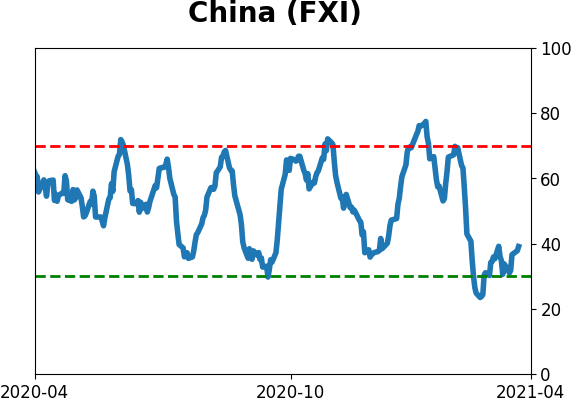

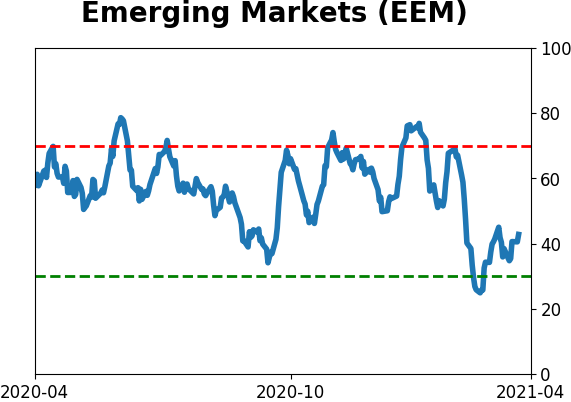

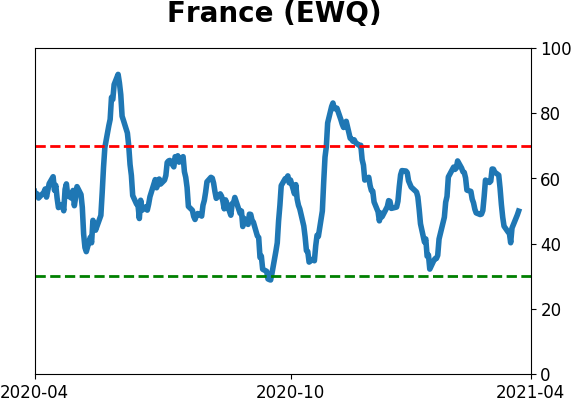

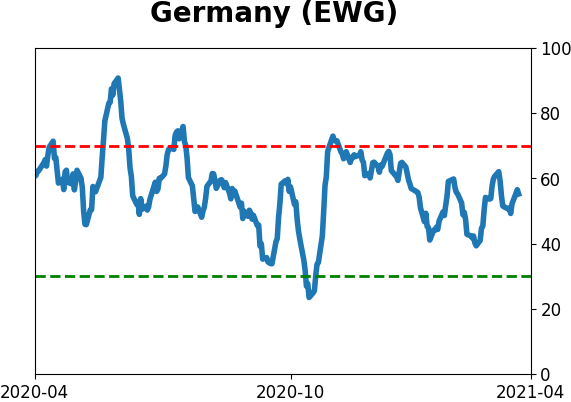

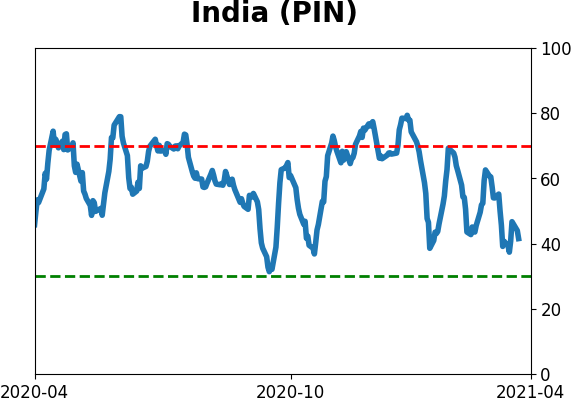

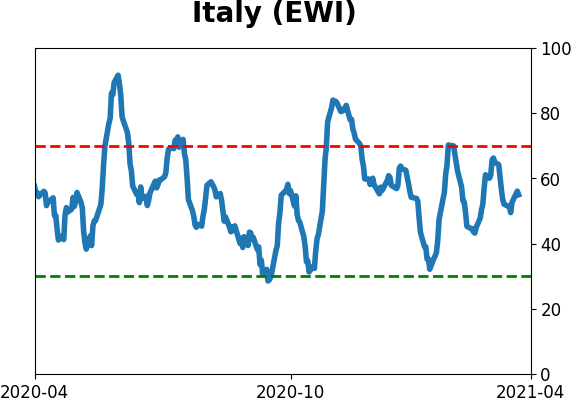

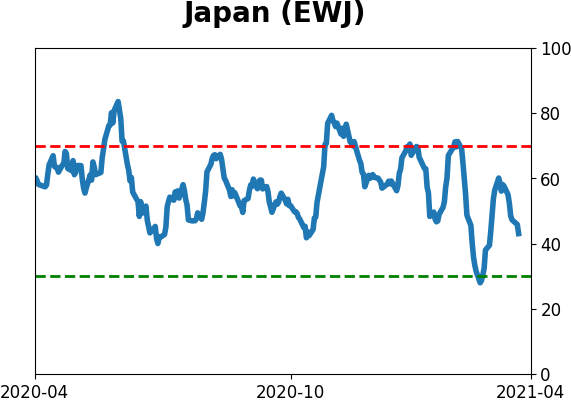

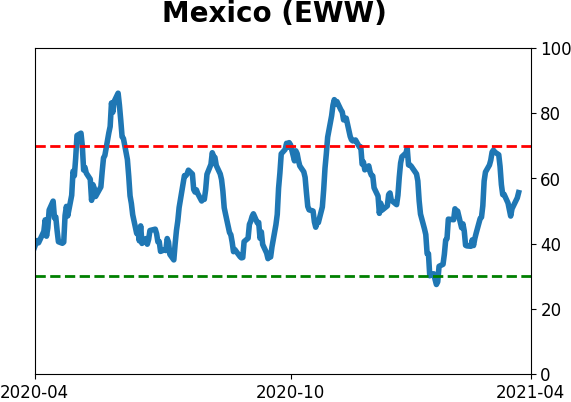

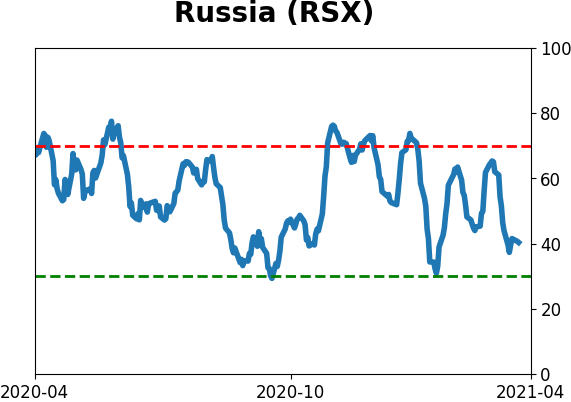

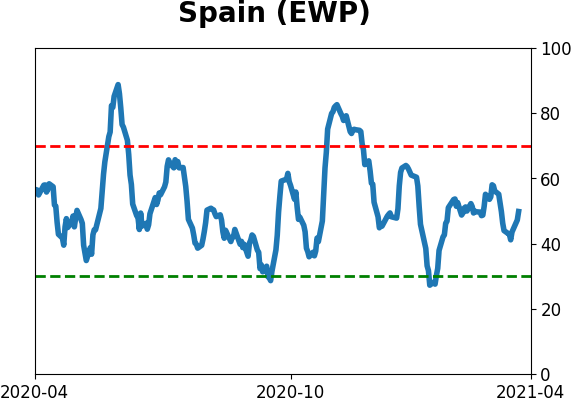

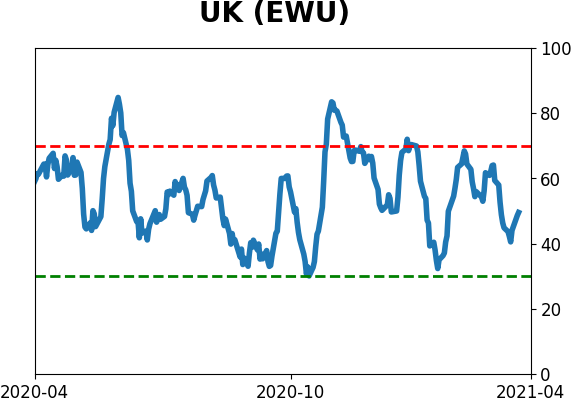

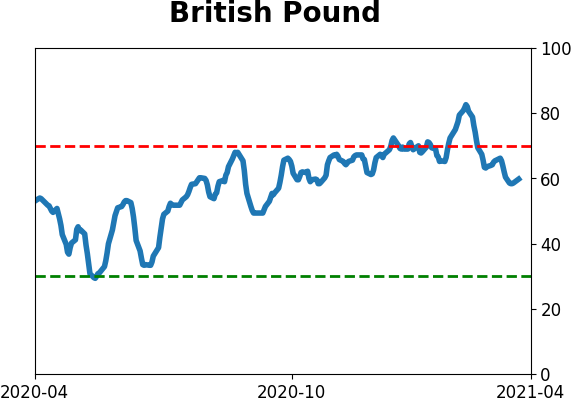

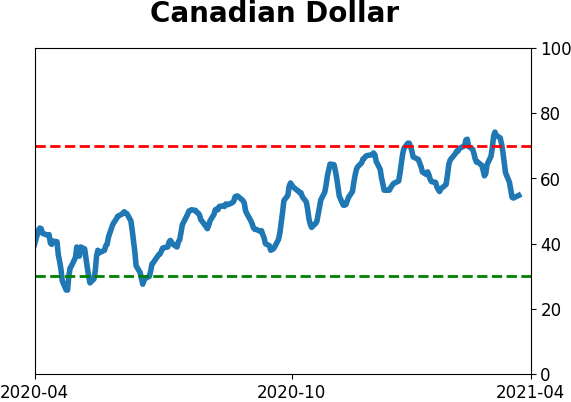

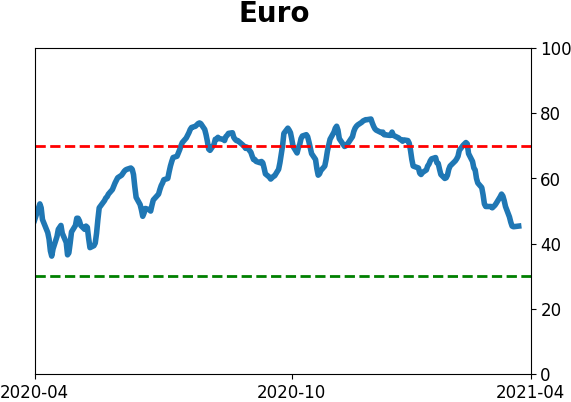

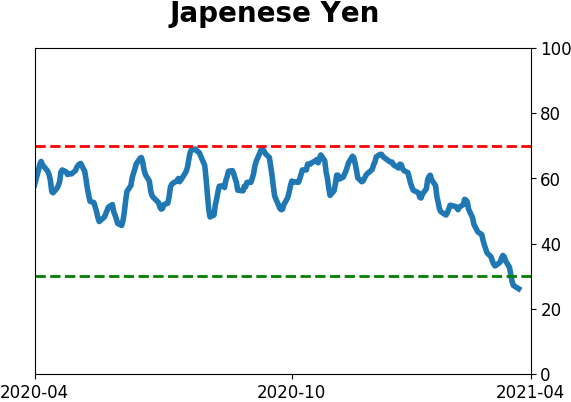

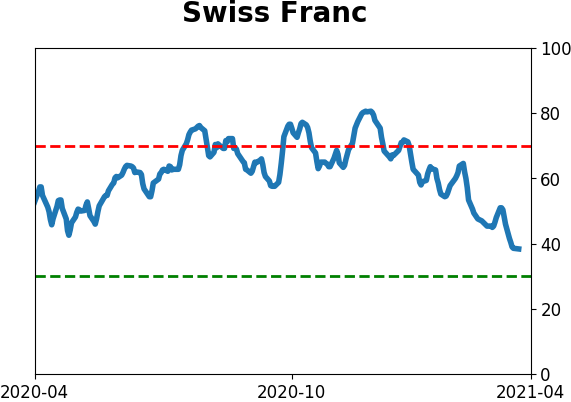

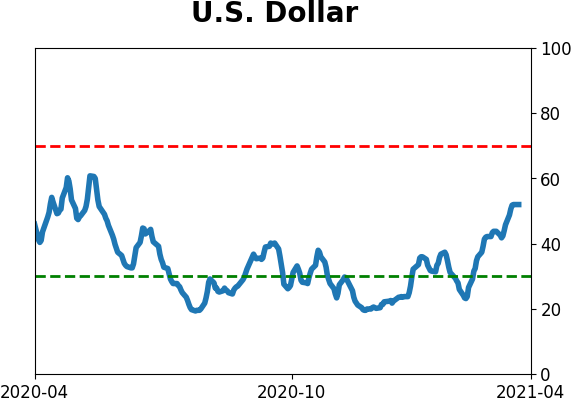

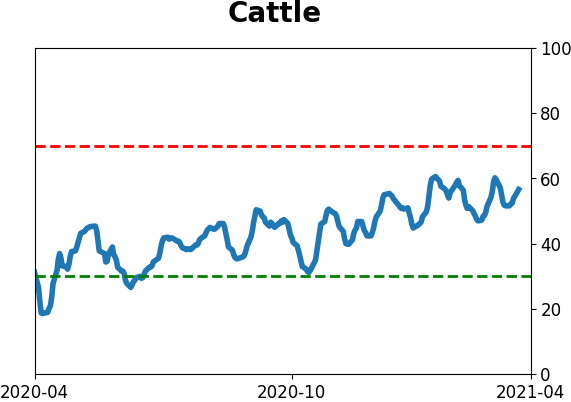

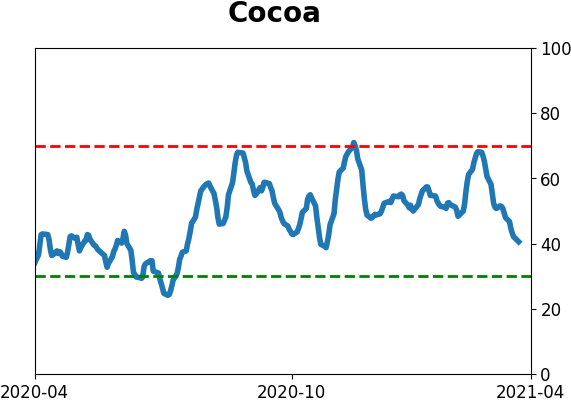

Sentiment Around The World

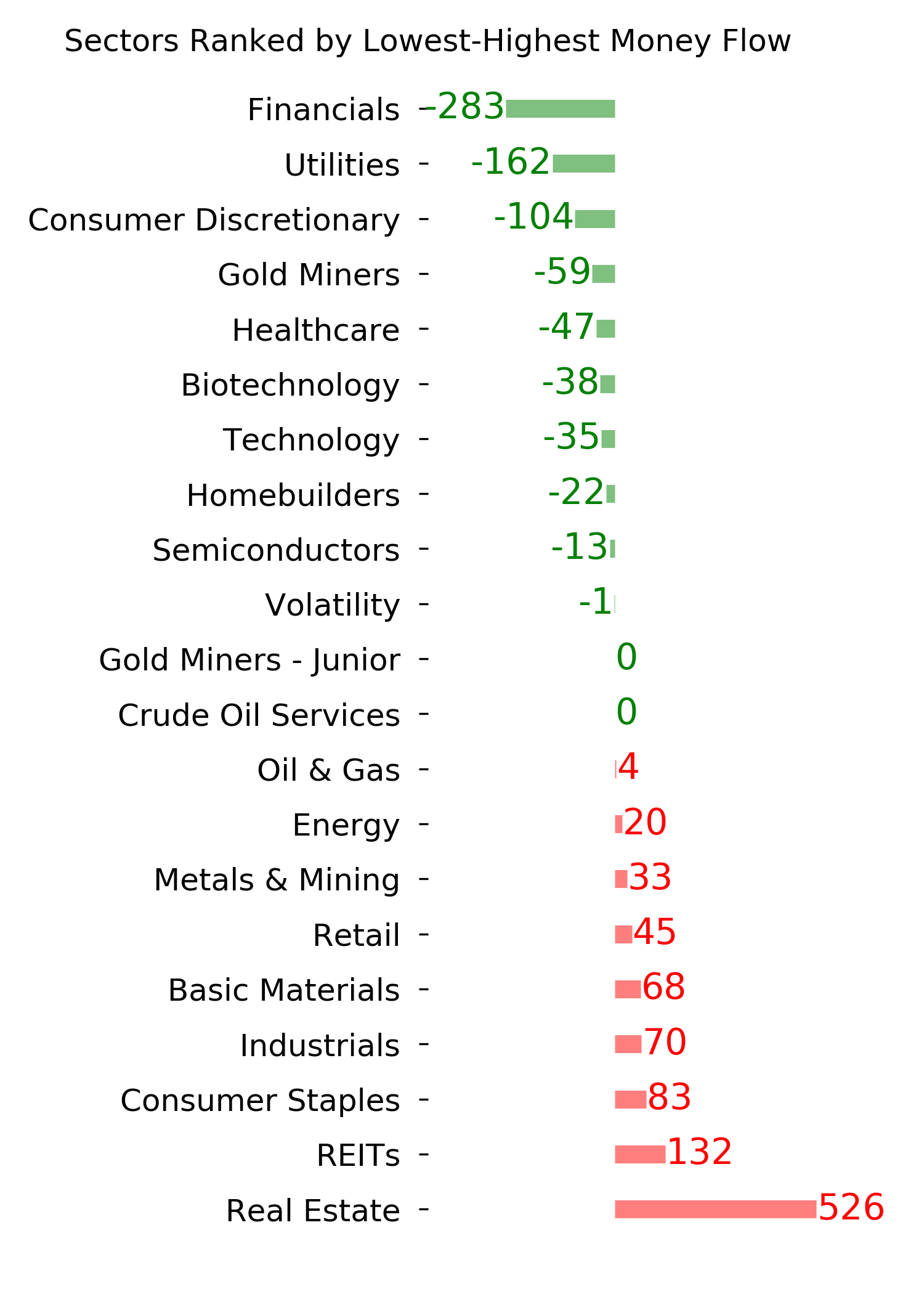

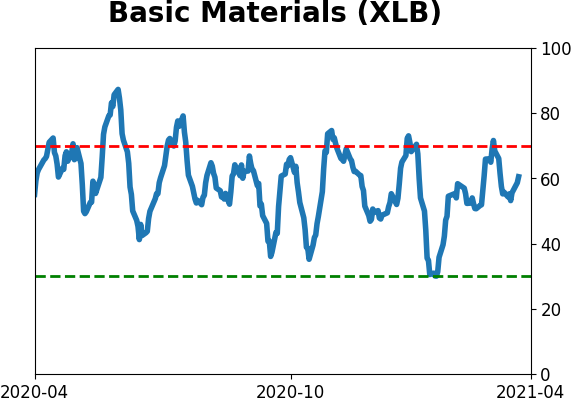

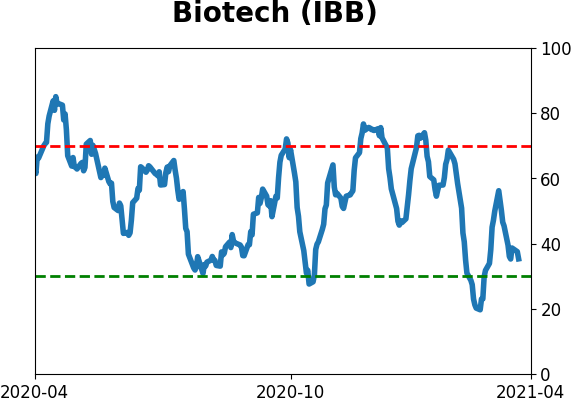

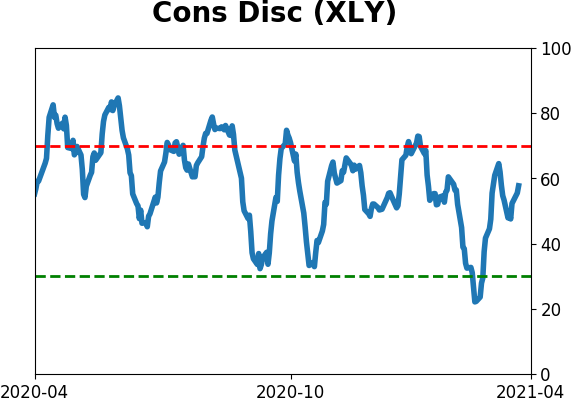

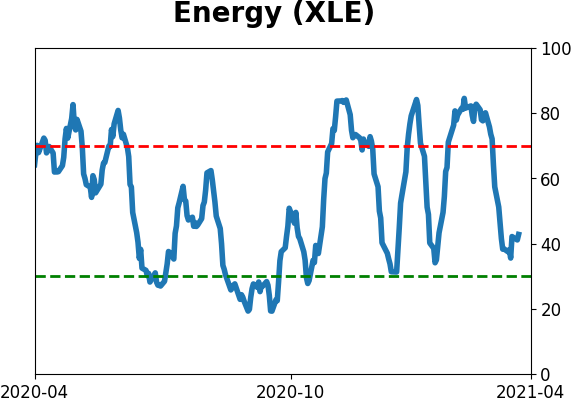

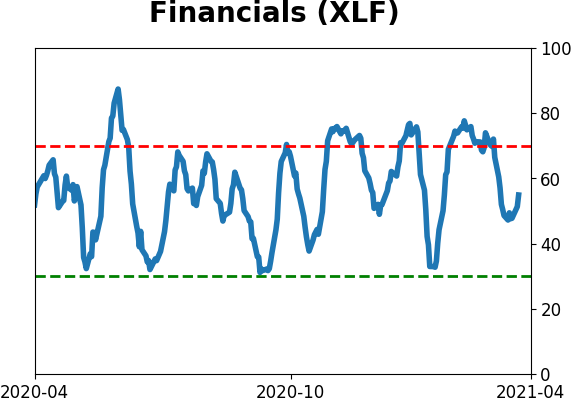

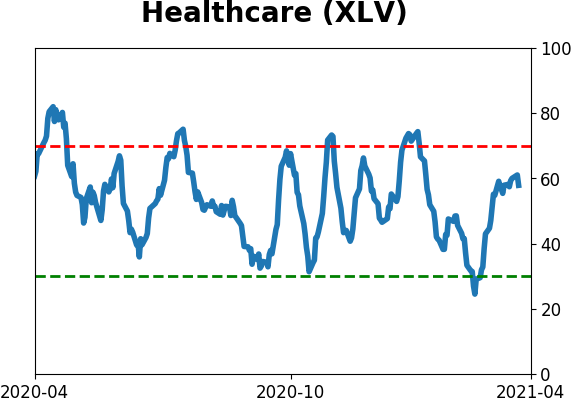

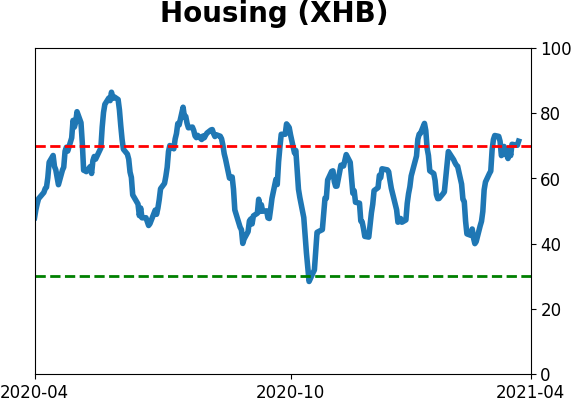

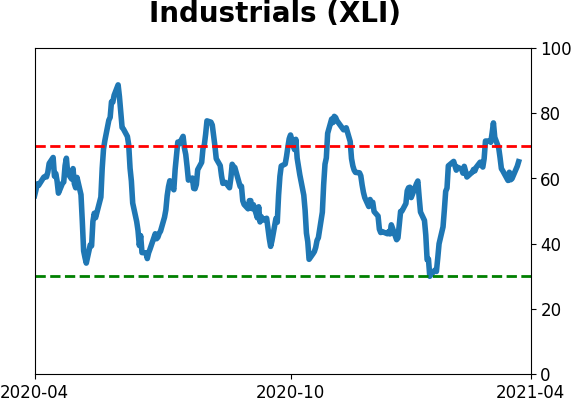

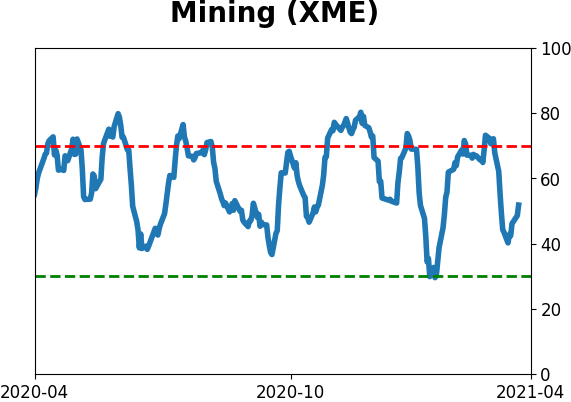

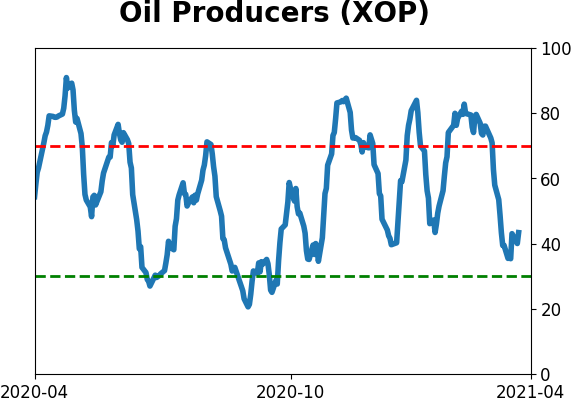

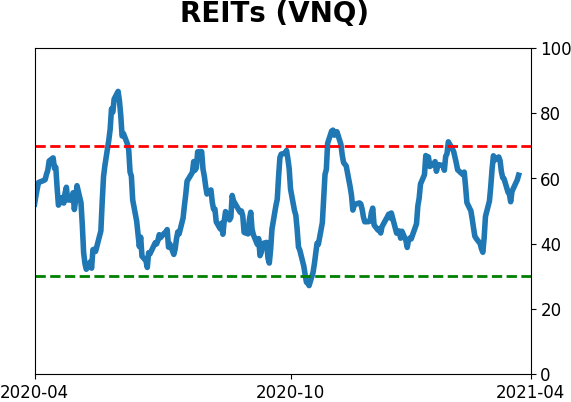

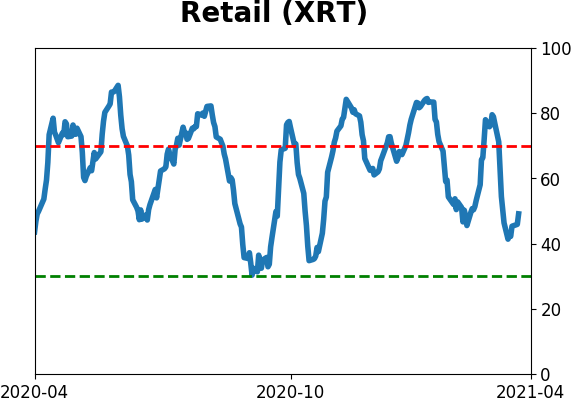

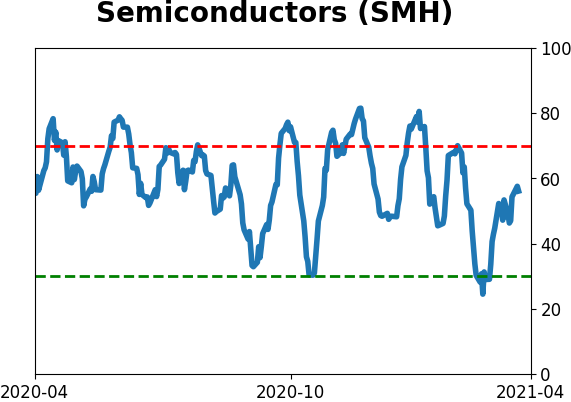

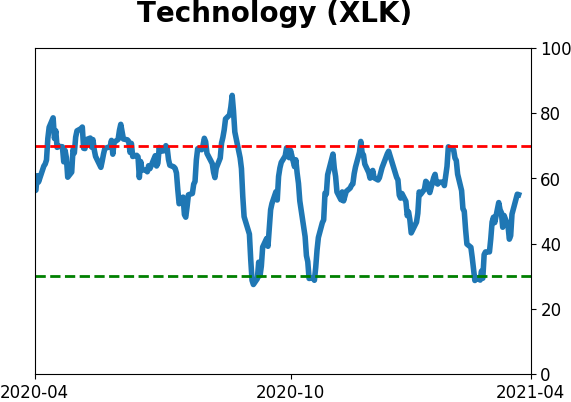

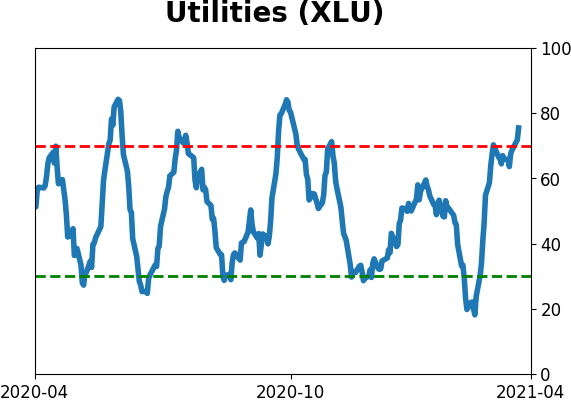

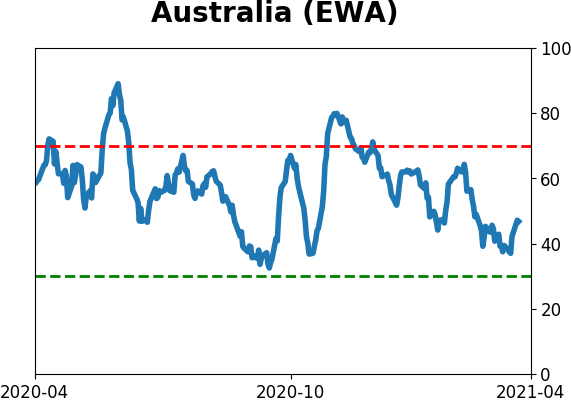

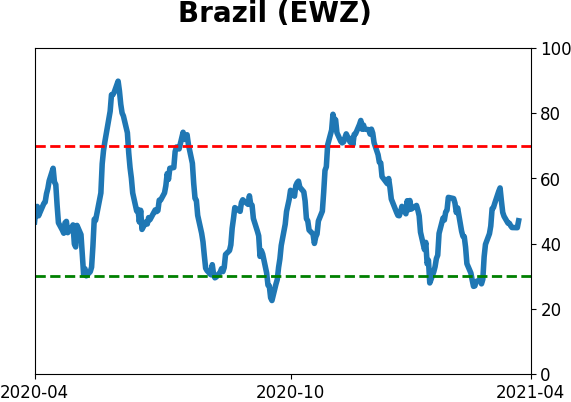

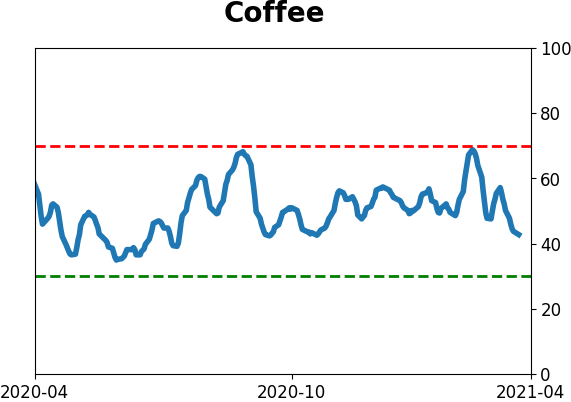

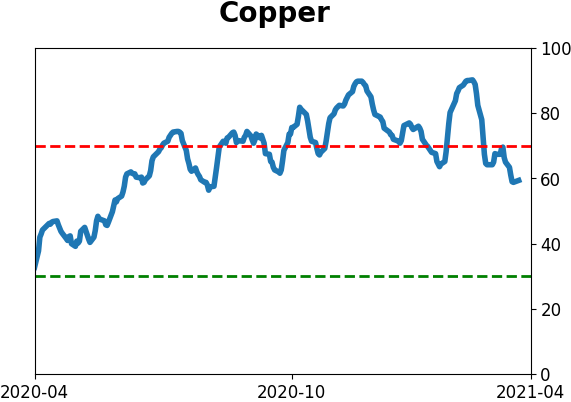

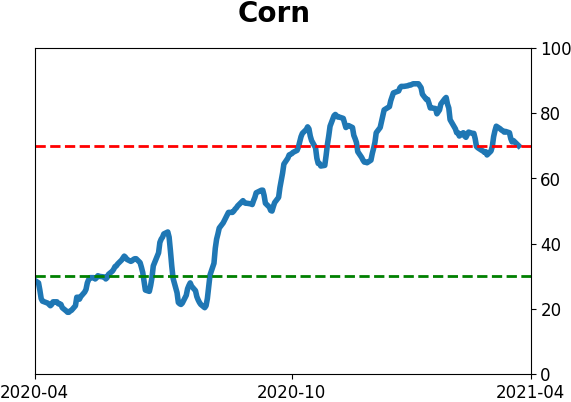

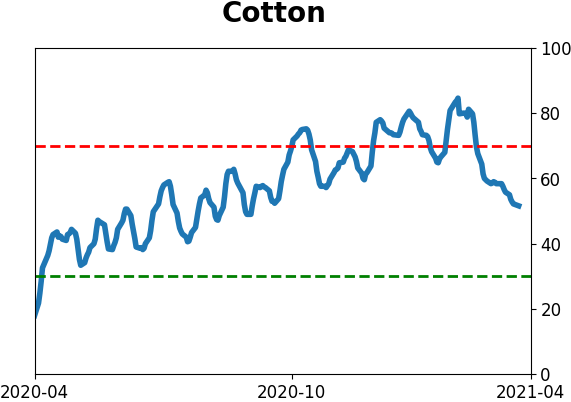

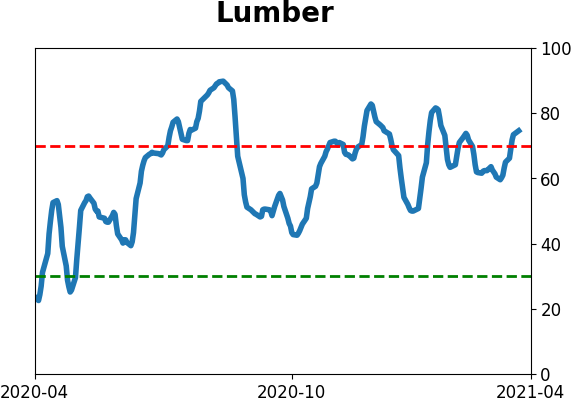

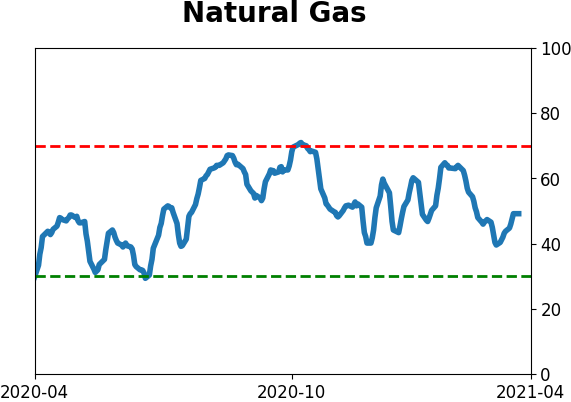

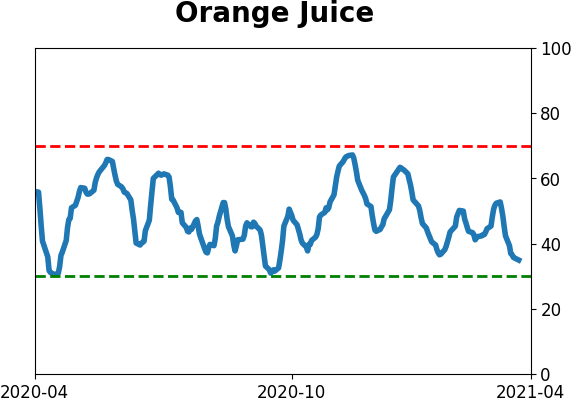

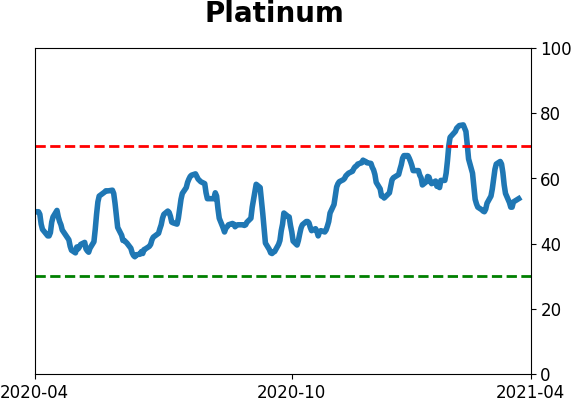

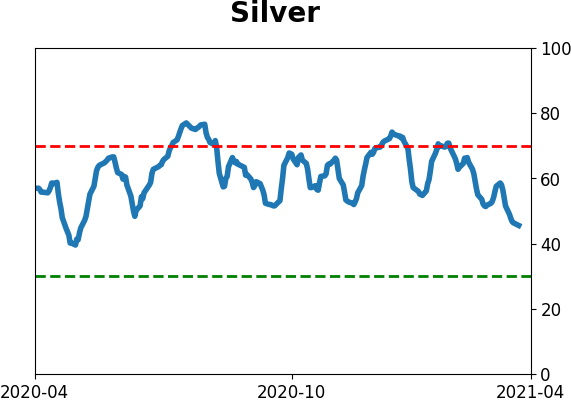

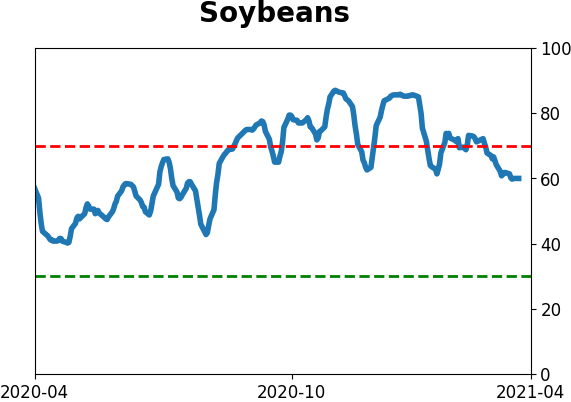

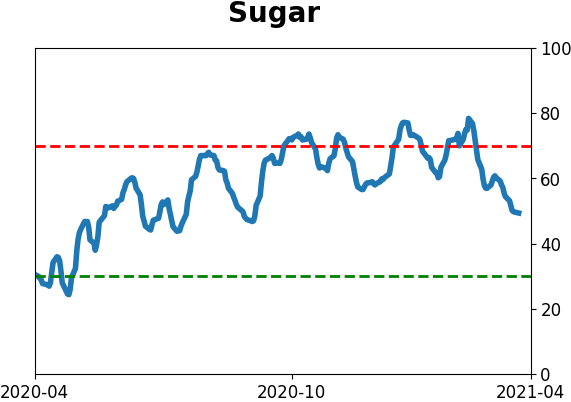

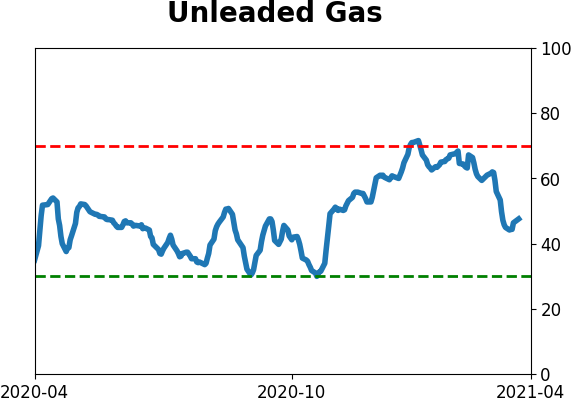

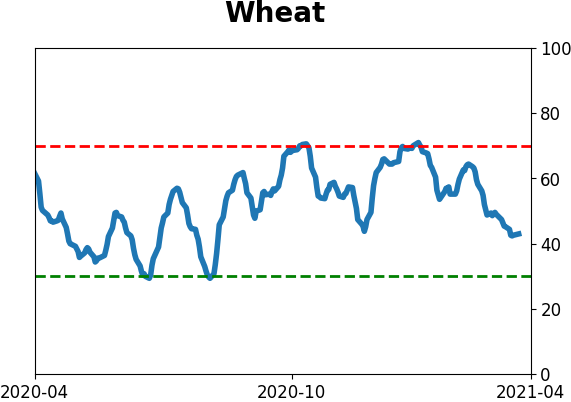

Optimism Index Thumbnails

|

Sector ETF's - 10-Day Moving Average

|

|

|

Country ETF's - 10-Day Moving Average

|

|

|

Bond ETF's - 10-Day Moving Average

|

|

|

Currency ETF's - 5-Day Moving Average

|

|

|

Commodity ETF's - 5-Day Moving Average

|

|