Headlines

|

|

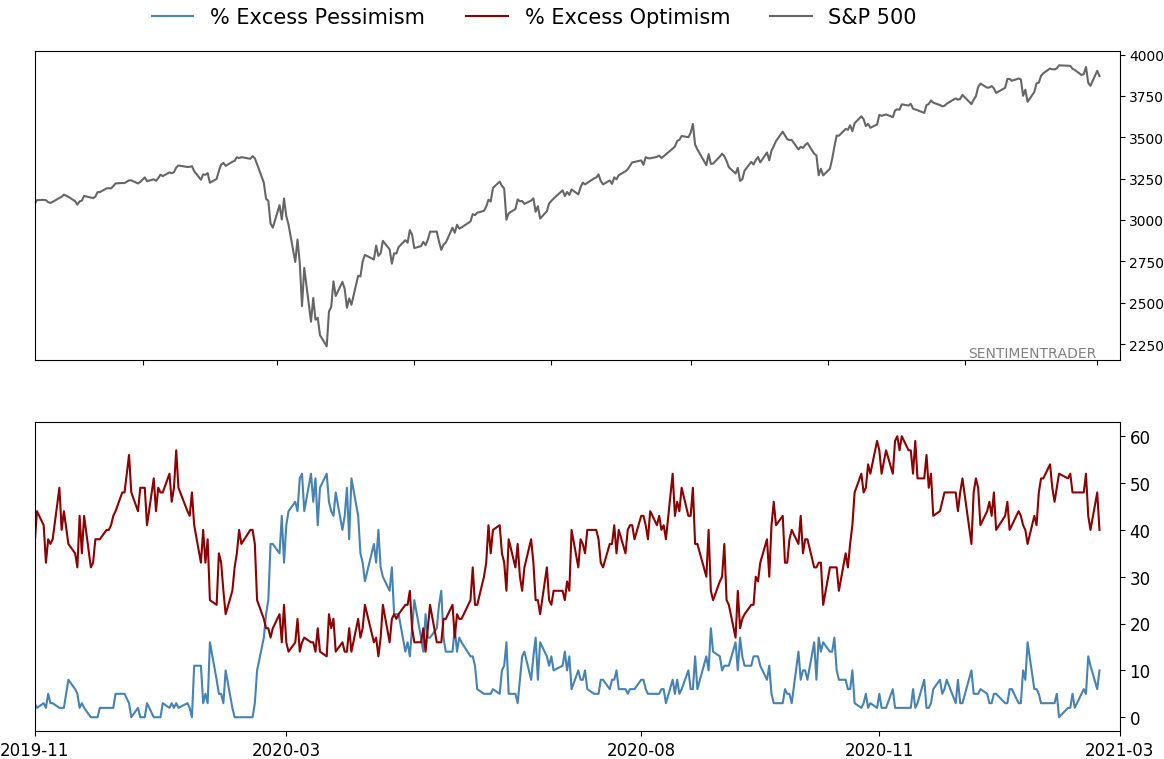

Despite records, consumers aren't very optimistic:

Despite a month in which the S&P 500 closed at a record monthly high, a survey of U.S. consumers shows that almost as many expect stocks to decline as rally in the year ahead. Similar attitudes didn't say much about the next few months, but long-term returns were good.

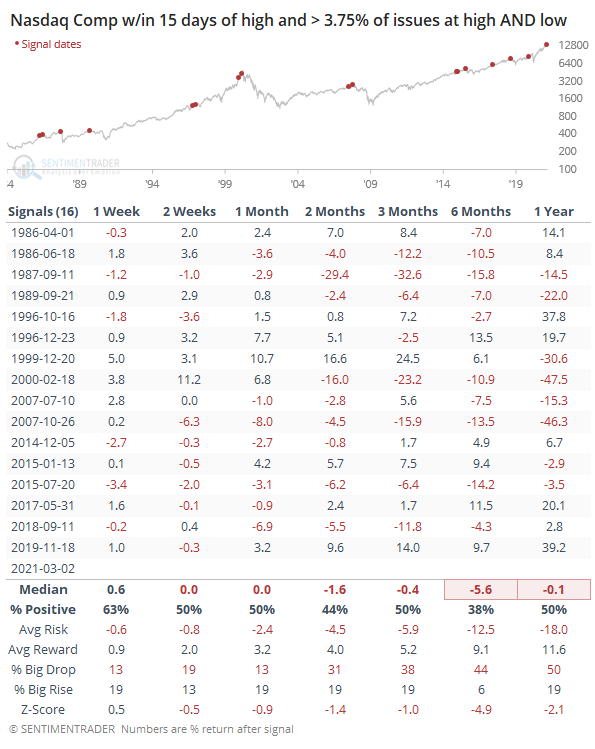

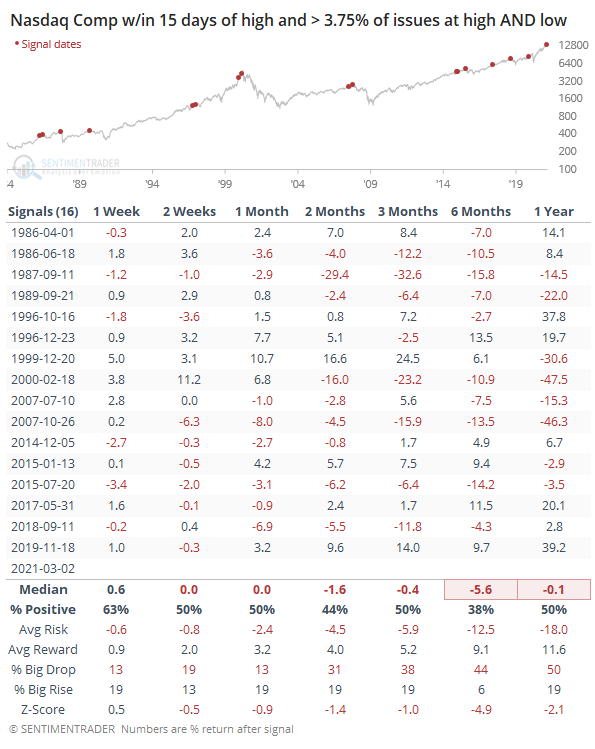

Doing the splits: Ever since signs of extreme speculation bubbled up, we've been hyper-focused on watching for internal deterioration. Other than some scattered days in January, there hasn't been much evidence of it. In recent days, there have been some more oddities, like Tuesday when more than 3.75% of securities on the Nasdaq reached a 52-week high. But more than 3.75% of issues also reached a 52-week low. This kind of split in the market, soon after the Composite had been sitting at a new high, has been a warning.

Bottom Line:

See the Outlook & Allocations page for more details on these summaries STOCKS: Weak sell

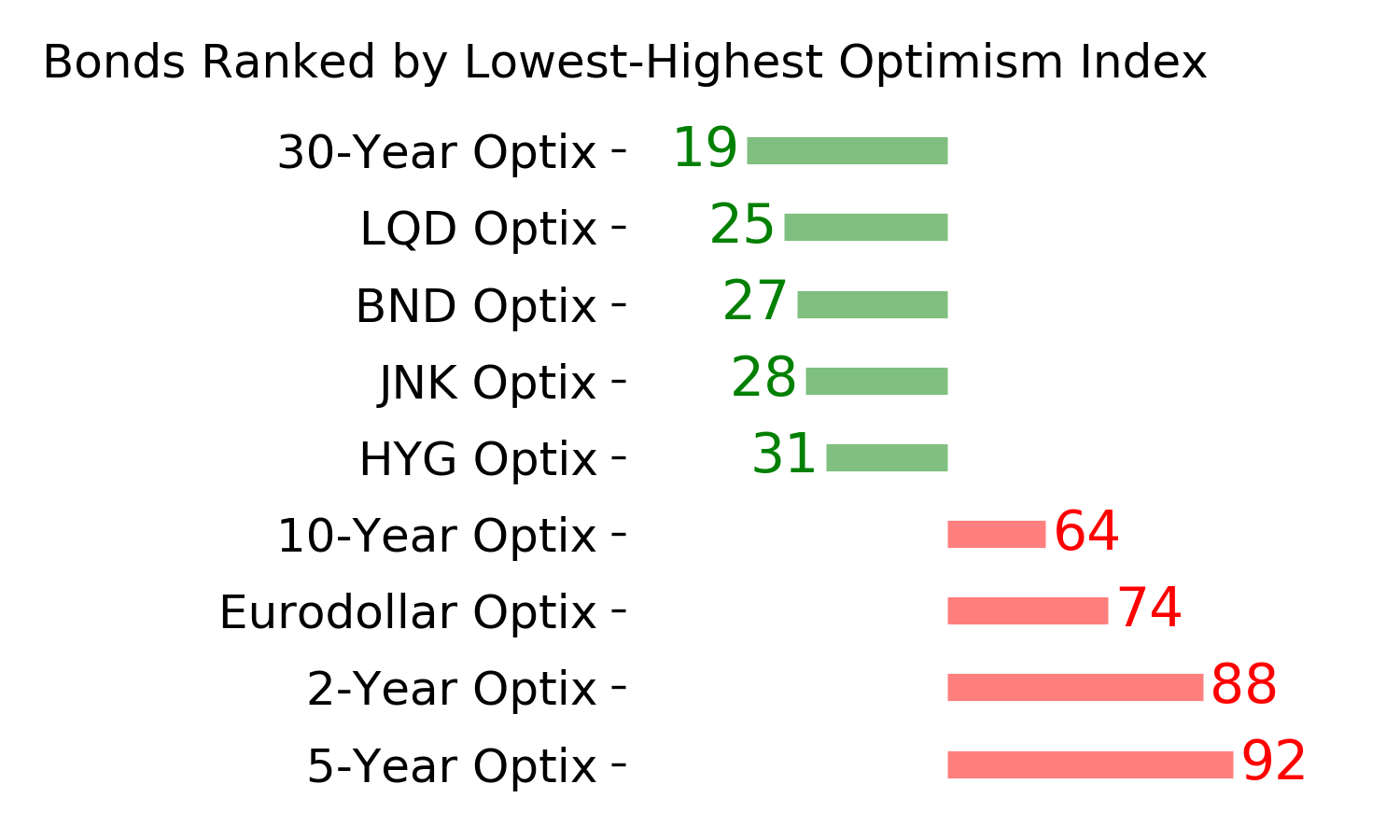

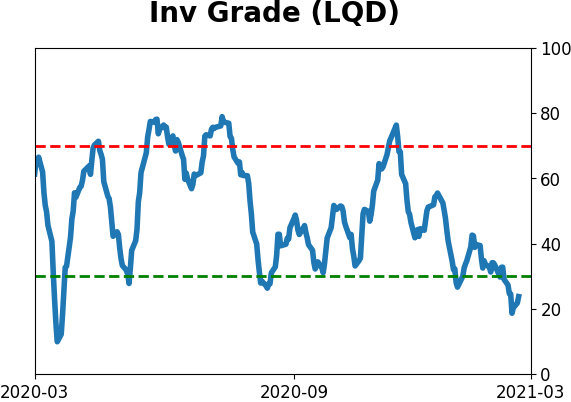

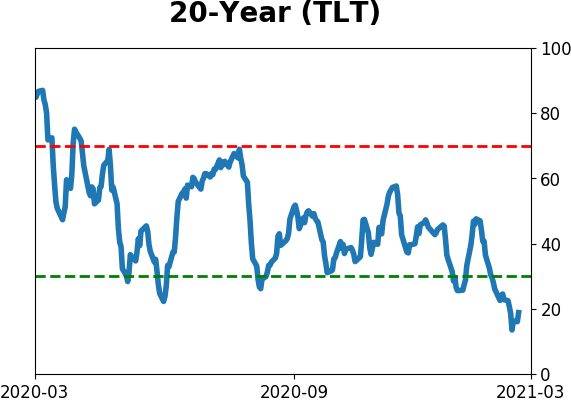

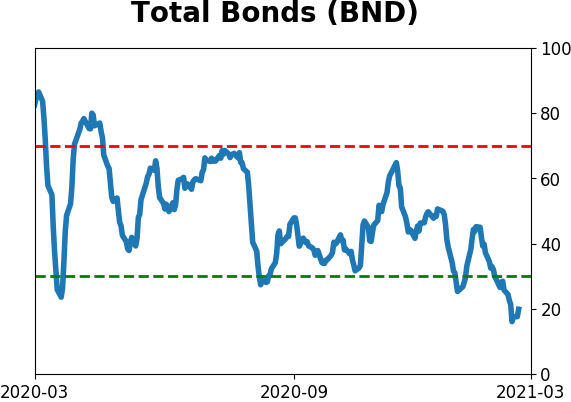

We're in an extremely speculative environment that is enough to suggest a defensive posture. Internal breadth and momentum have mostly remained positive, so a more strenuous sell wouldn't trigger unless that changed. BONDS: Weak buy

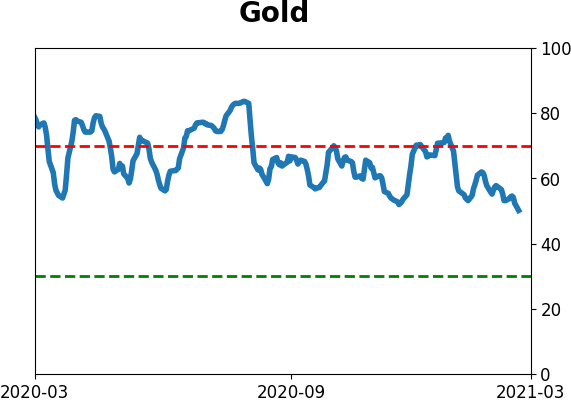

Various parts of the market have been hit in recent weeks, with mild oversold conditions. The Bond Optimism Index is now about as low as it gets during healthy bond market environments. GOLD: Weak buy

A dollar trying to rebound from a severe short position has weighed on gold and miners. The types of signals they've given in recent weeks, within the context of their recent surge, have usually resulted in higher prices over a medium- to long-term time frame.

|

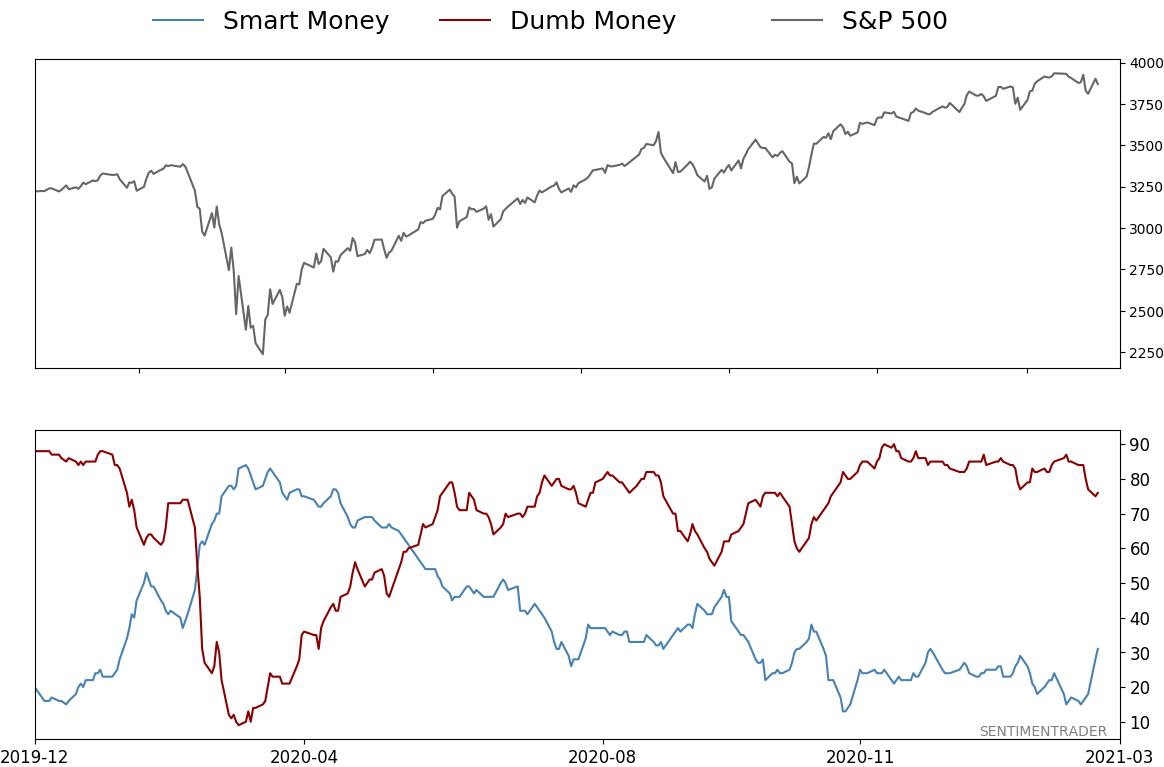

Smart / Dumb Money Confidence

|

Smart Money Confidence: 31%

Dumb Money Confidence: 76%

|

|

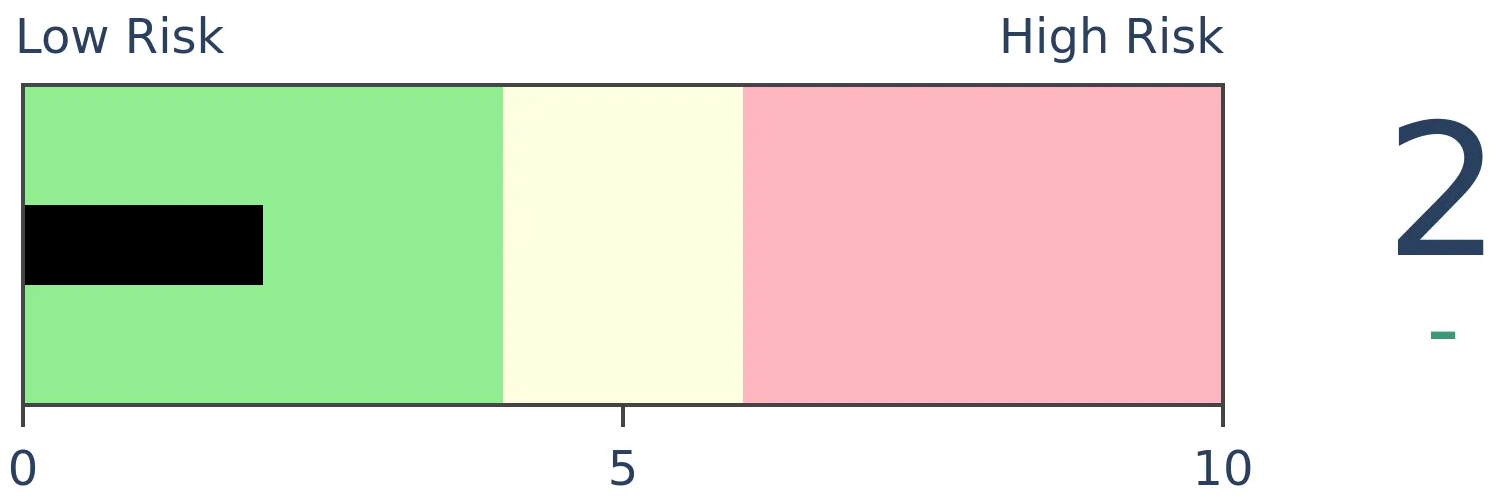

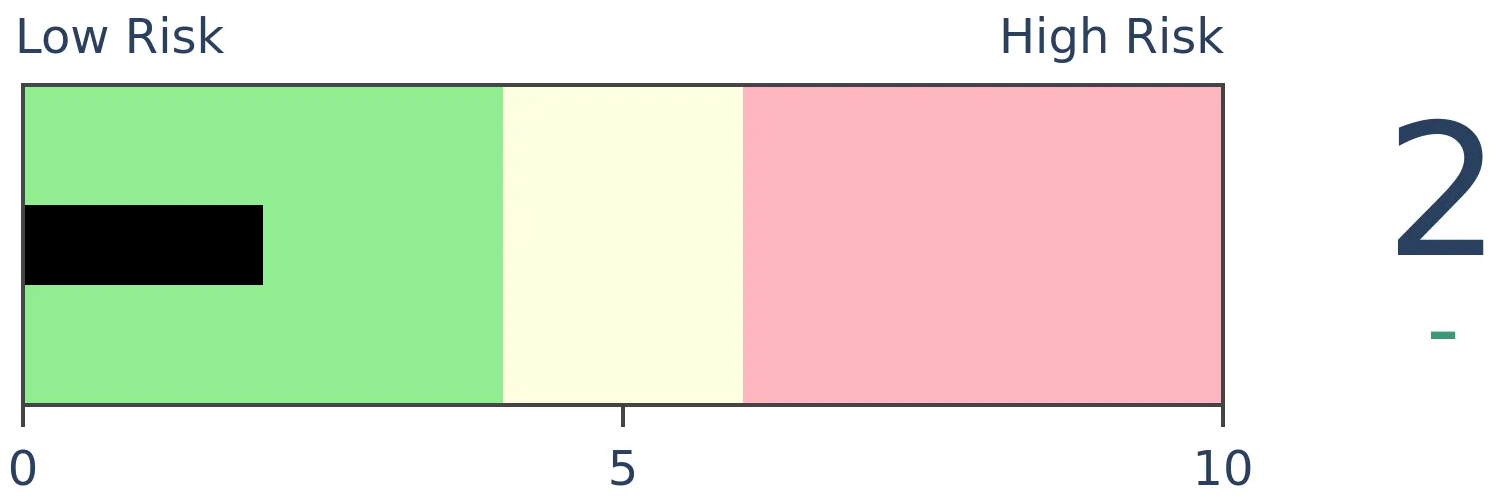

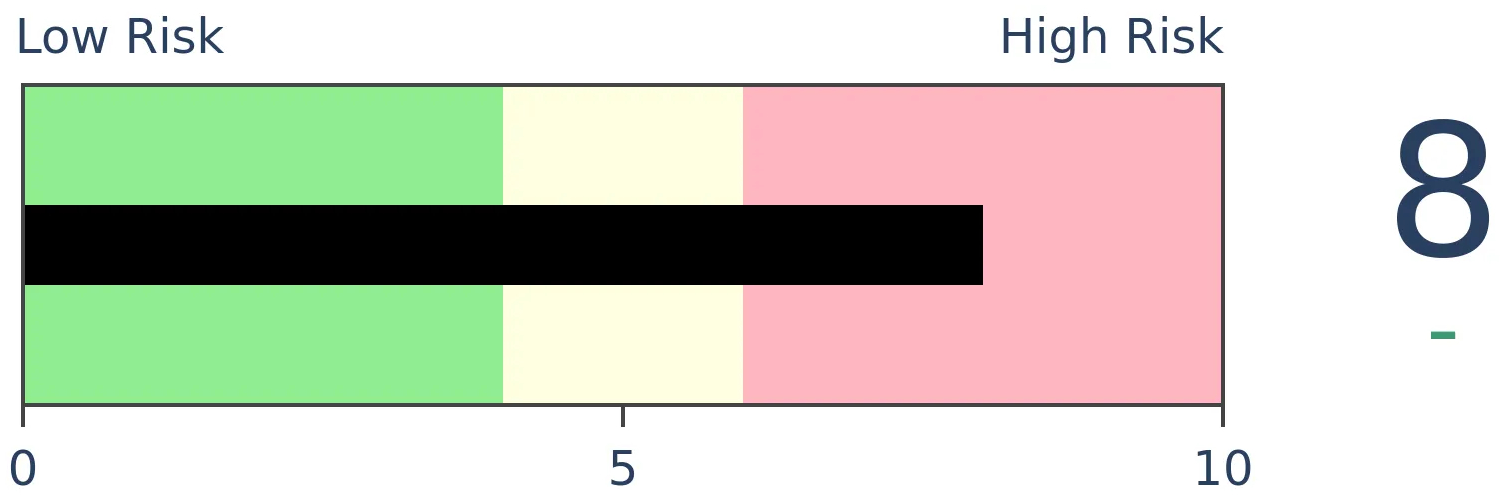

Risk Levels

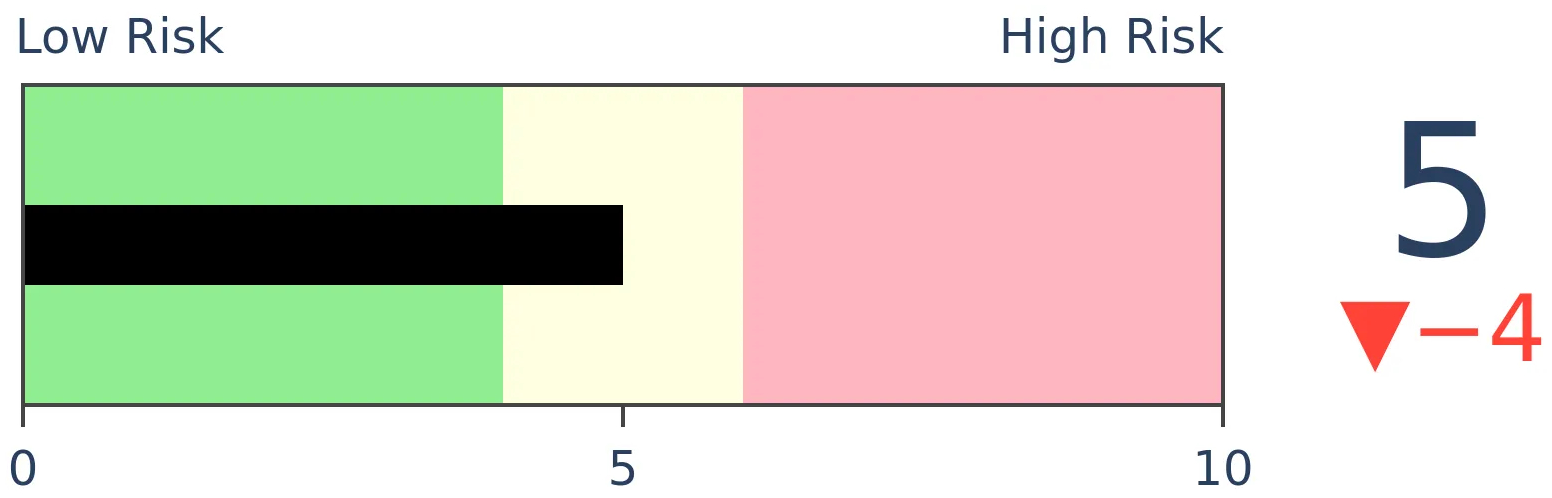

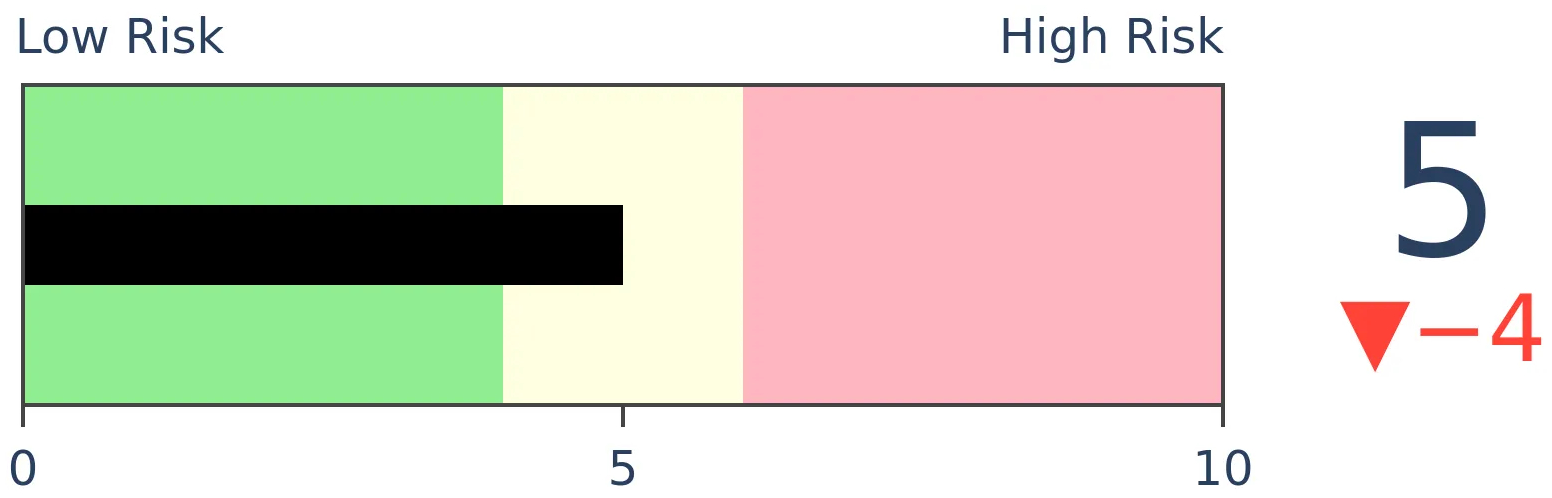

Stocks Short-Term

|

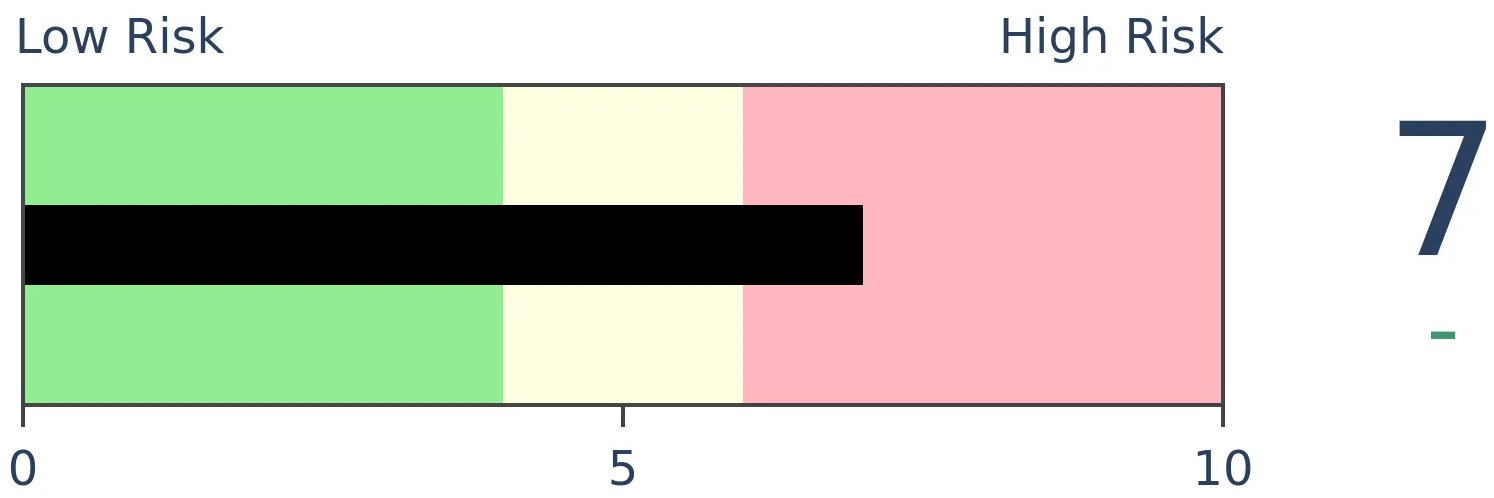

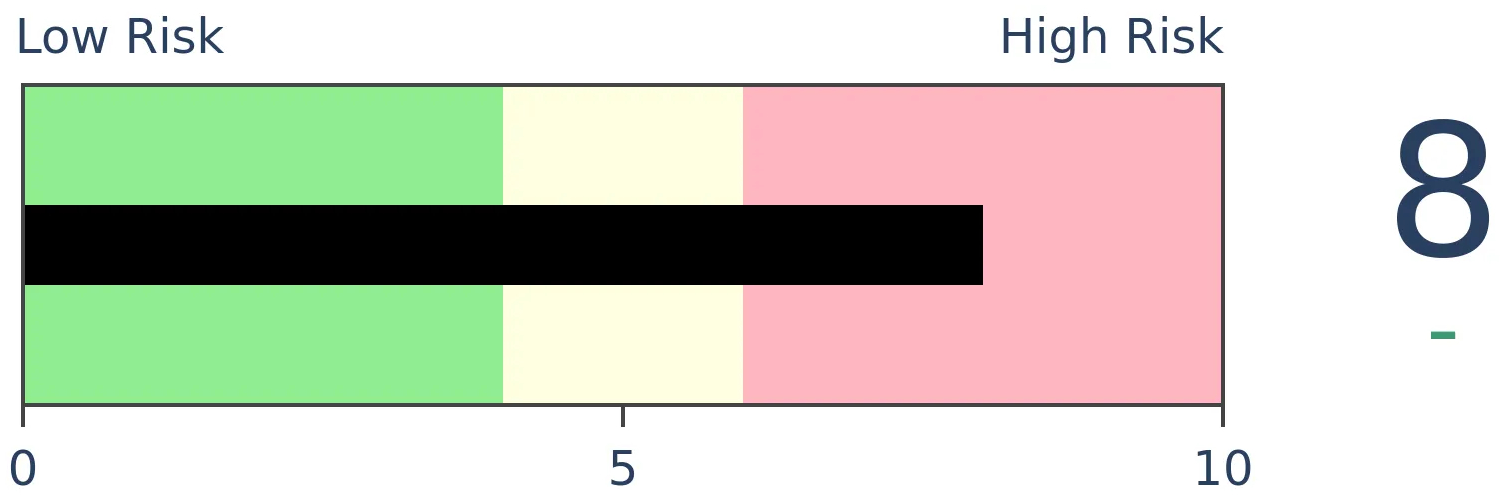

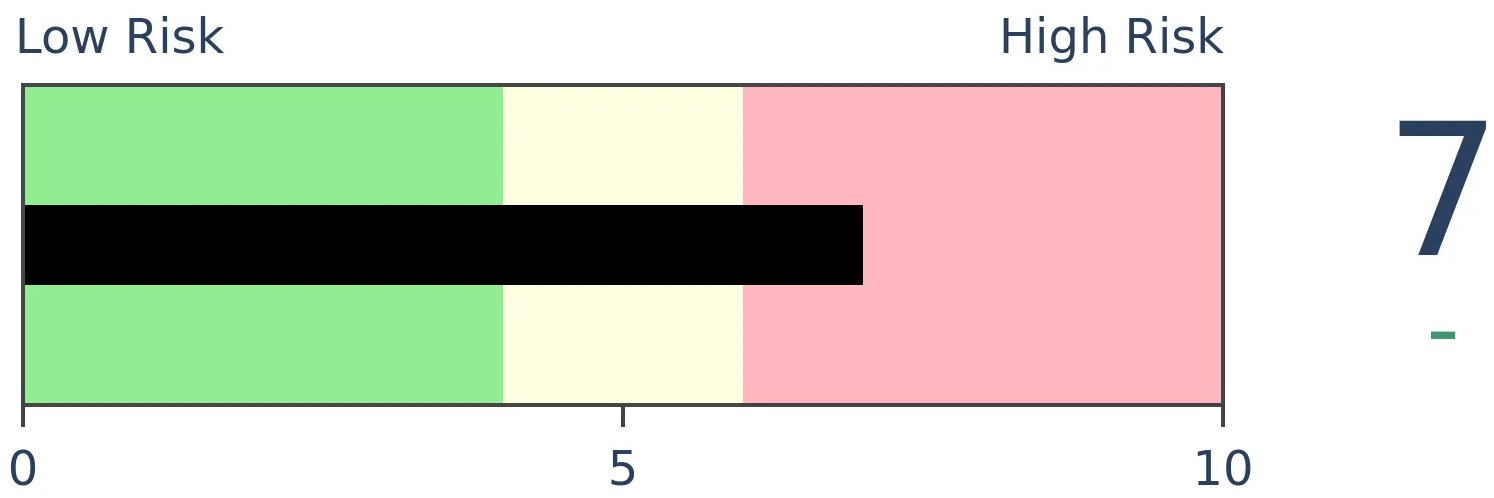

Stocks Medium-Term

|

|

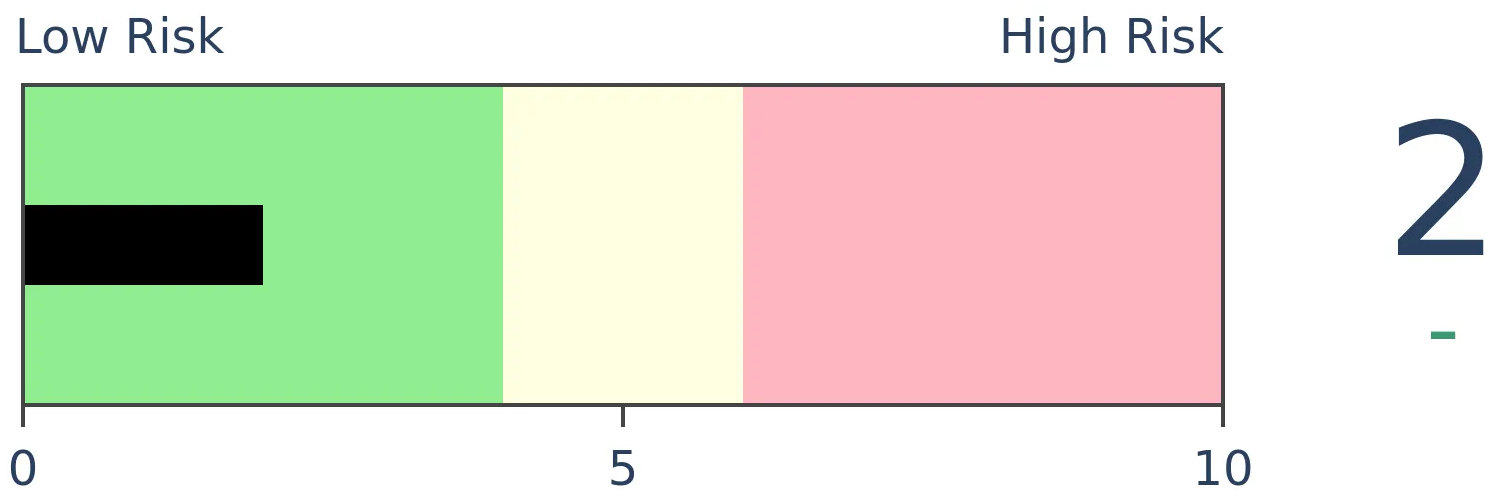

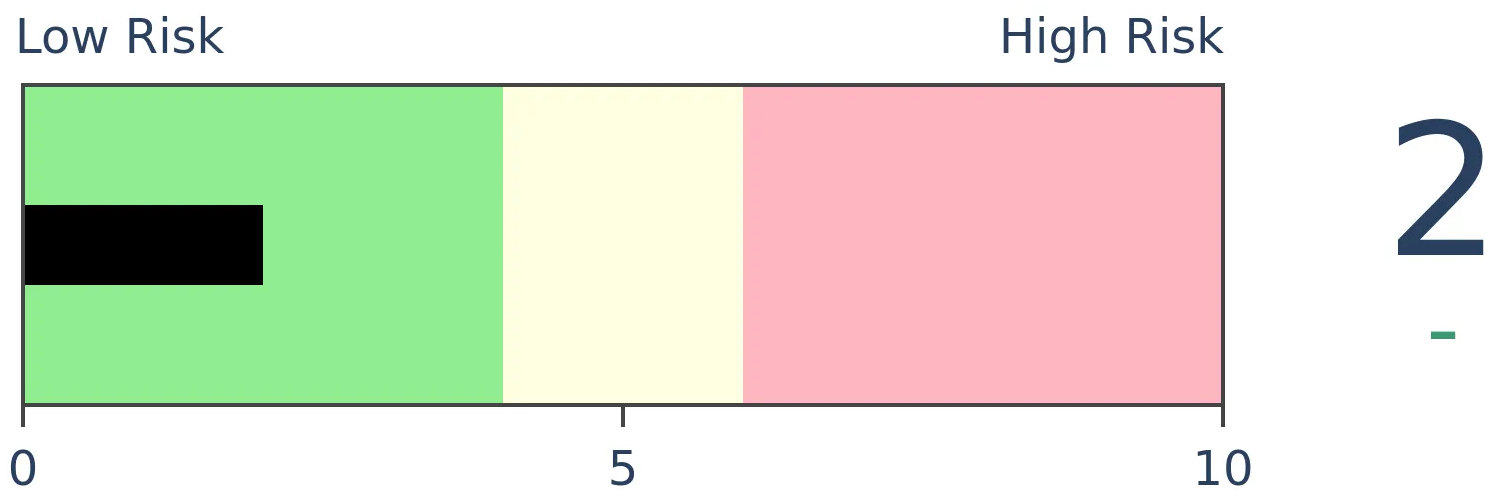

Bonds

|

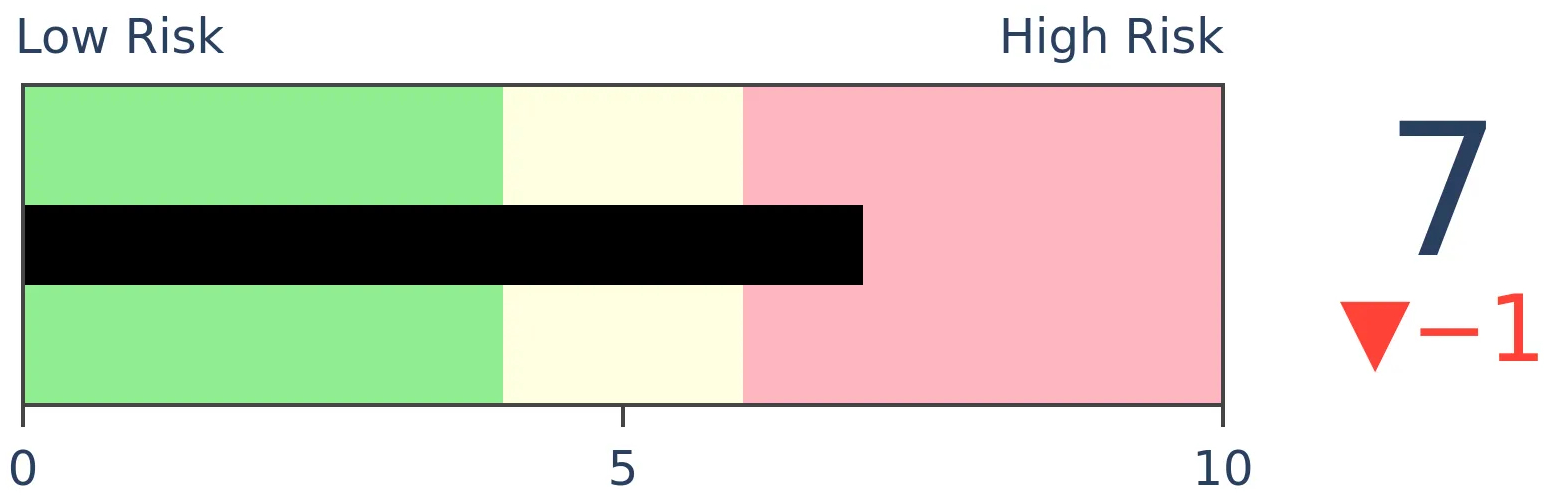

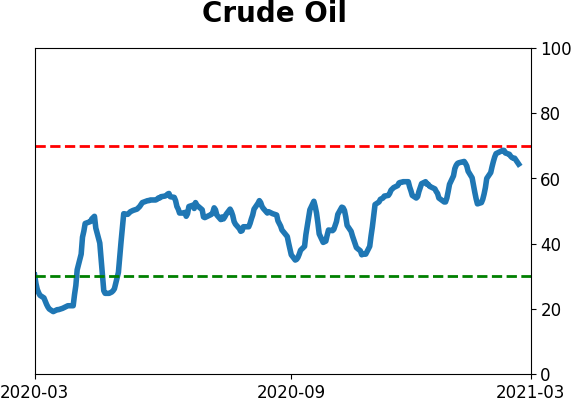

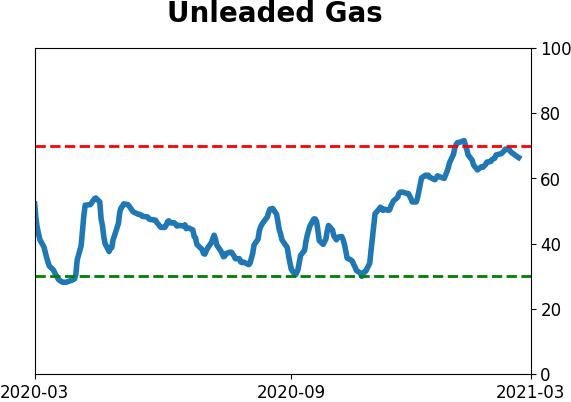

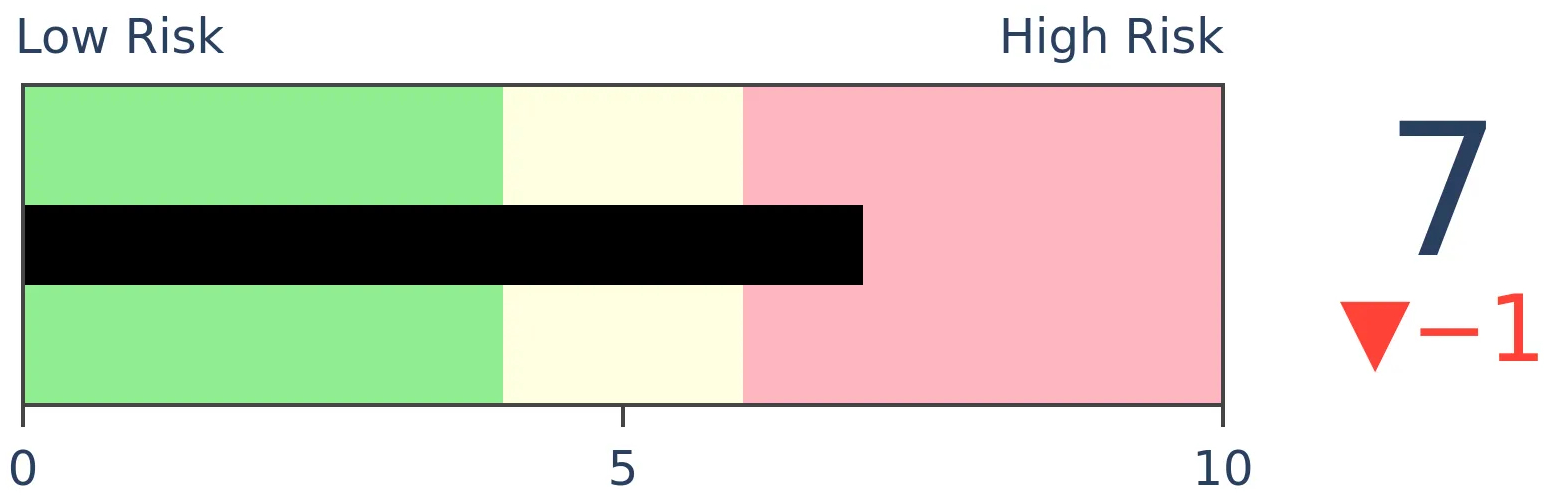

Crude Oil

|

|

Gold

|

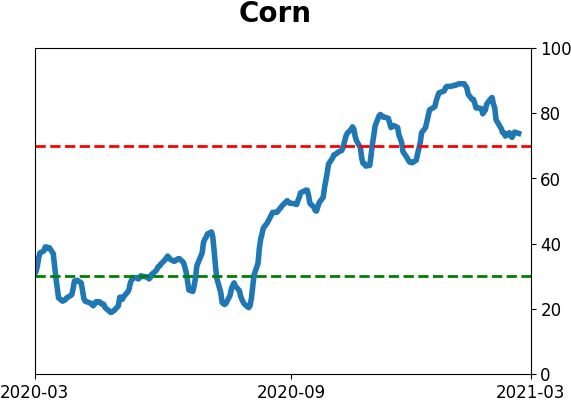

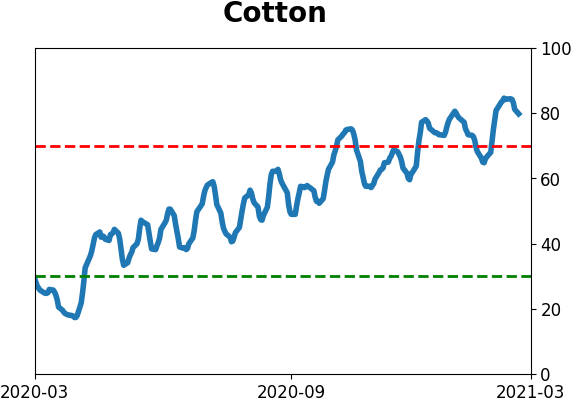

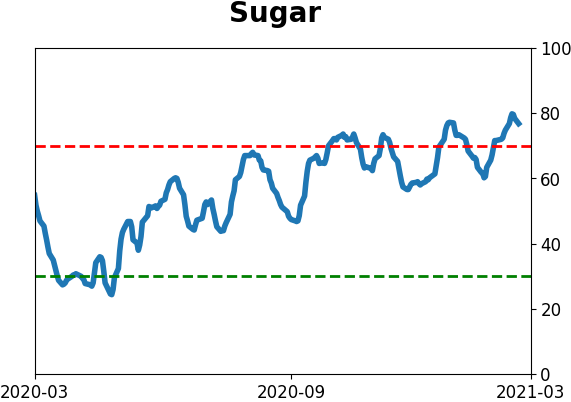

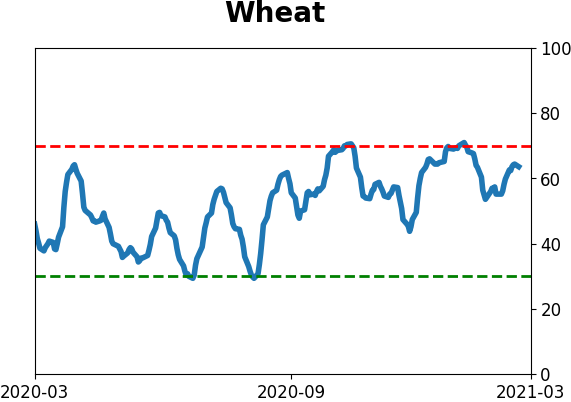

Agriculture

|

|

Research

BOTTOM LINE

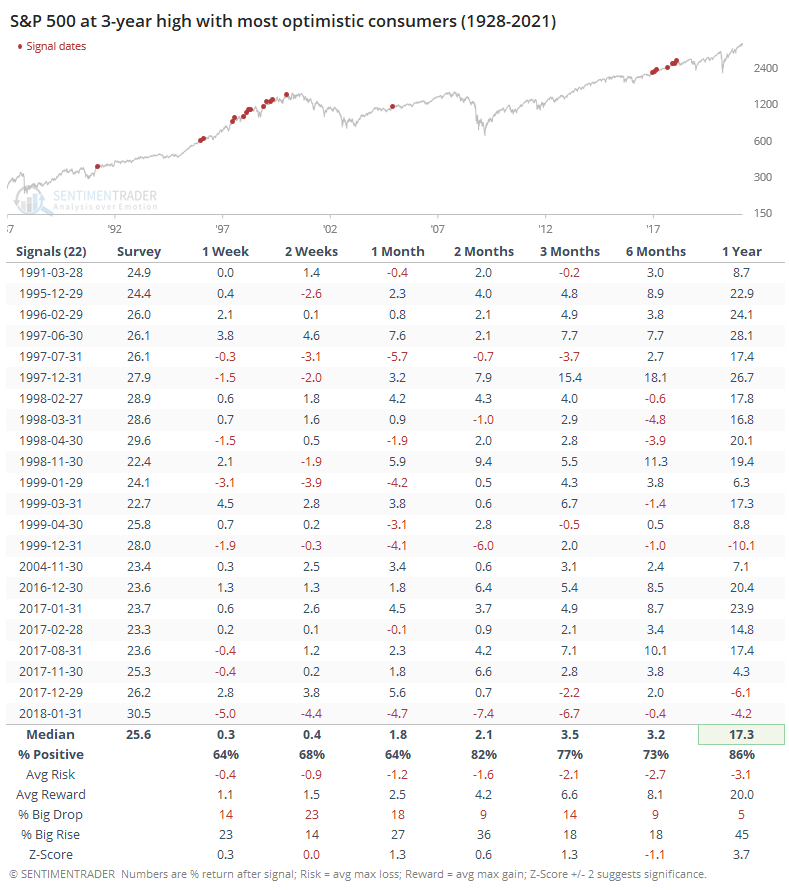

Despite a month in which the S&P 500 closed at a record monthly high, a survey of U.S. consumers shows that almost as many expect stocks to decline as rally in the year ahead. Similar attitudes didn't say much about the next few months, but long-term returns were good.

FORECAST / TIMEFRAME

None

|

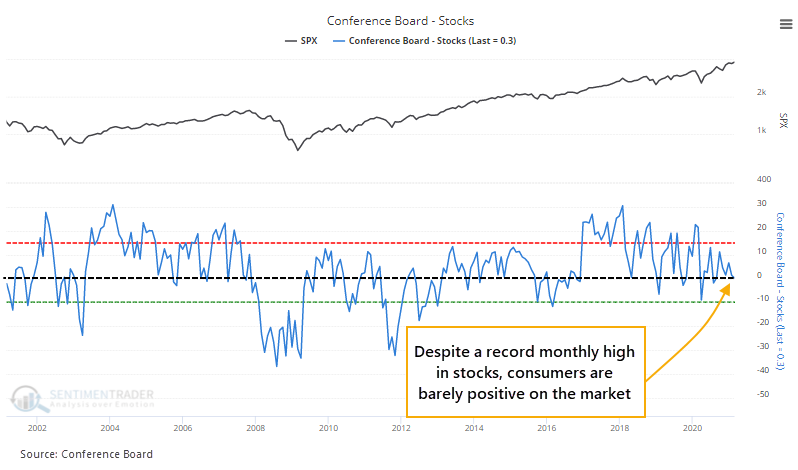

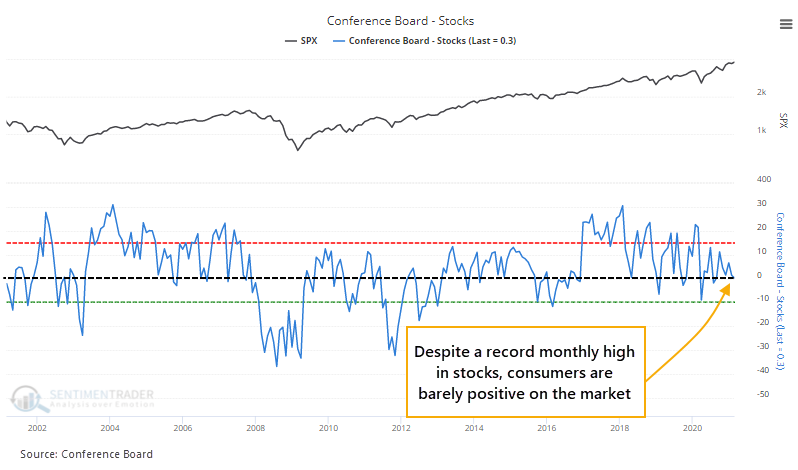

Despite a record monthly close in the S&P 500 and most other broad indexes in February, the average U.S. consumer isn't all that optimistic.

There are definite signs of speculative froth, even unbridled euphoria, among investors, but "investors" don't necessarily overlap with "consumers." The latest survey from the Conference Board shows that explicitly.

The latest results showed that almost as many consumers expect stocks to fall this year as to rise.

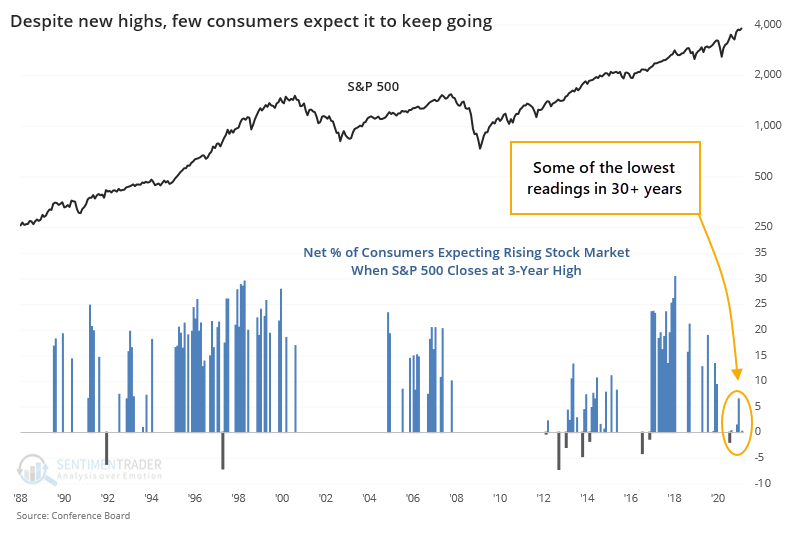

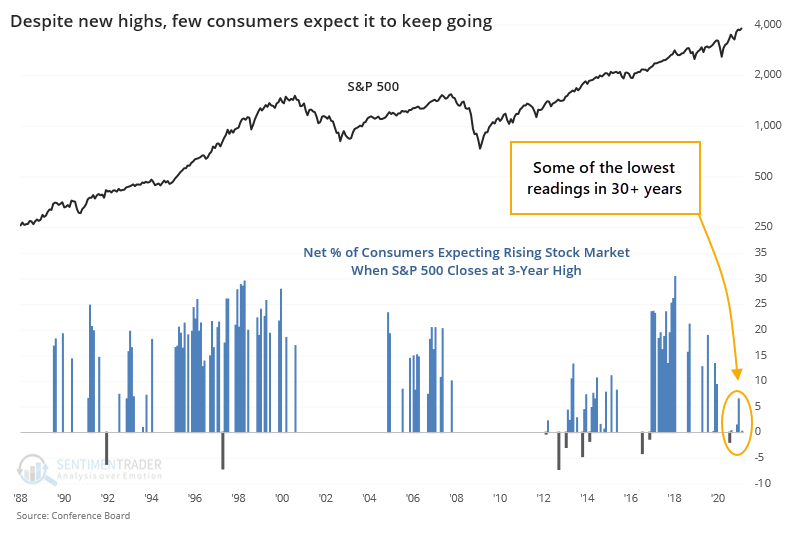

This is unusual. There is a 0.40 correlation (on a scale from -1.0 to +1.0) between the distance the S&P 500 is from a 3-year high and the net percentage of consumers that expect stocks to rise going forward. In other words, the closer the S&P is to a high, the more that consumers expect it to keep going.

Recent months are showing some of the least optimistic readings in more than 30 years.

This is supposed to be a good sign of the proverbial Wall of Worry, so let's check.

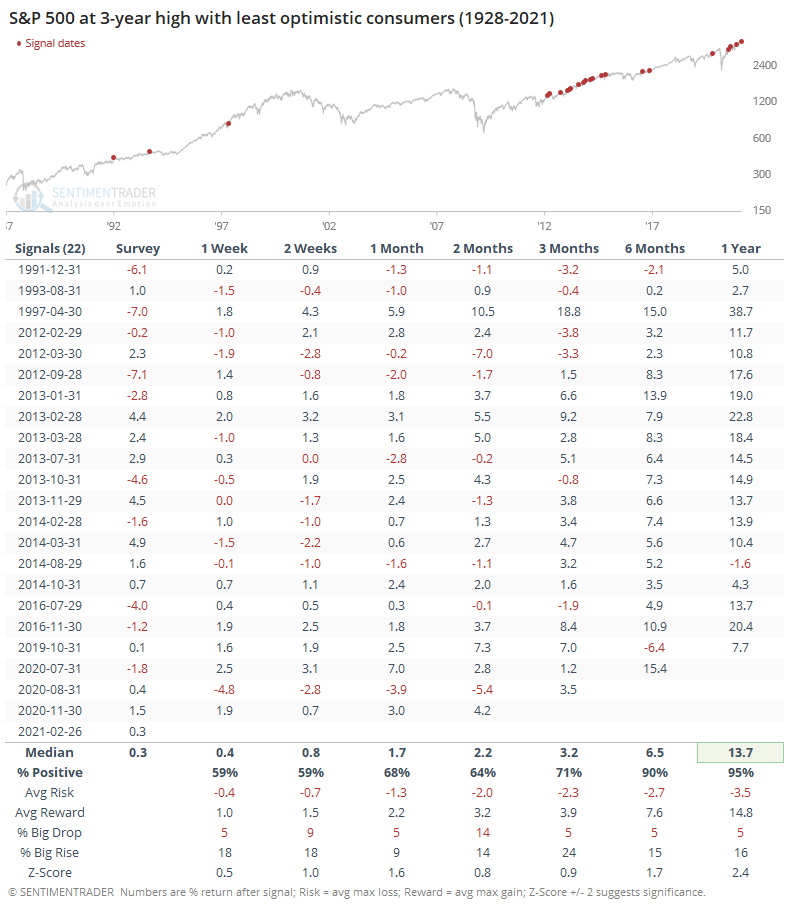

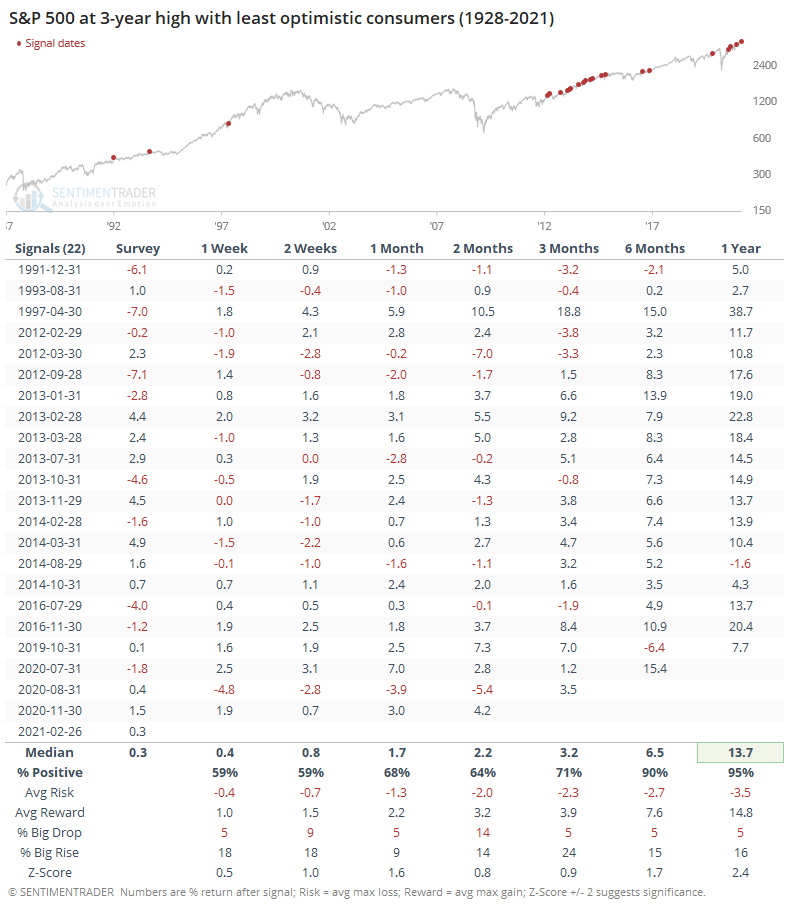

The table below shows every month when the S&P 500 closed at a 3-year high, while consumers were the least optimistic on the market's prospects going forward. On average for these signals, only 0.3% more consumers expected stocks to rise than fall, which is exactly what the spread was in February.

Overall, it proved to be a modest positive, thanks in large part to the cluster of readings since 2013-14. If we take out those two years, then the medium-term returns suffer quite a bit. Over the next 6-12 months, though, it was hard to find a negative return of any consequence.

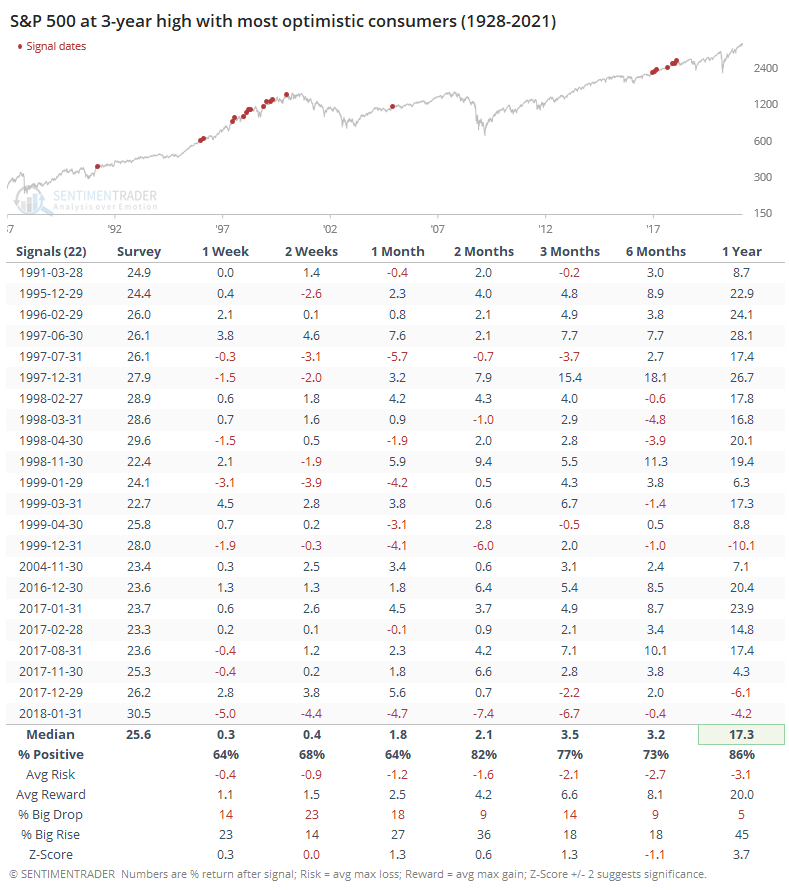

If we look at those months when consumers were most optimistic about future returns, then there wasn't much of a difference. While it preceded a couple of nasty falls, forward returns were in some respects even better than those months when consumers were pessimistic.

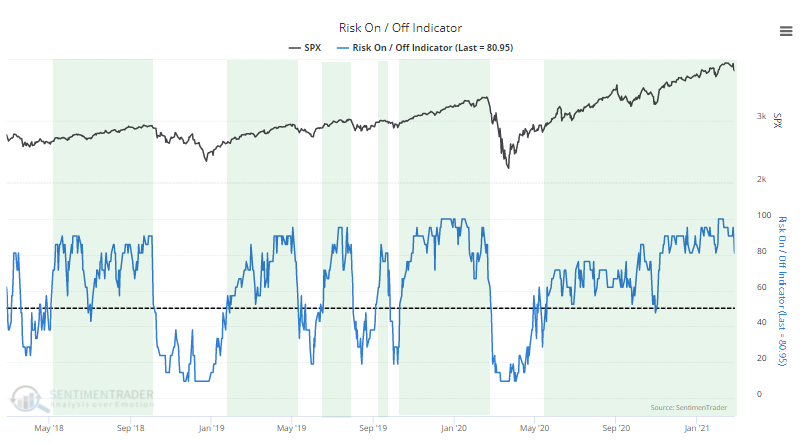

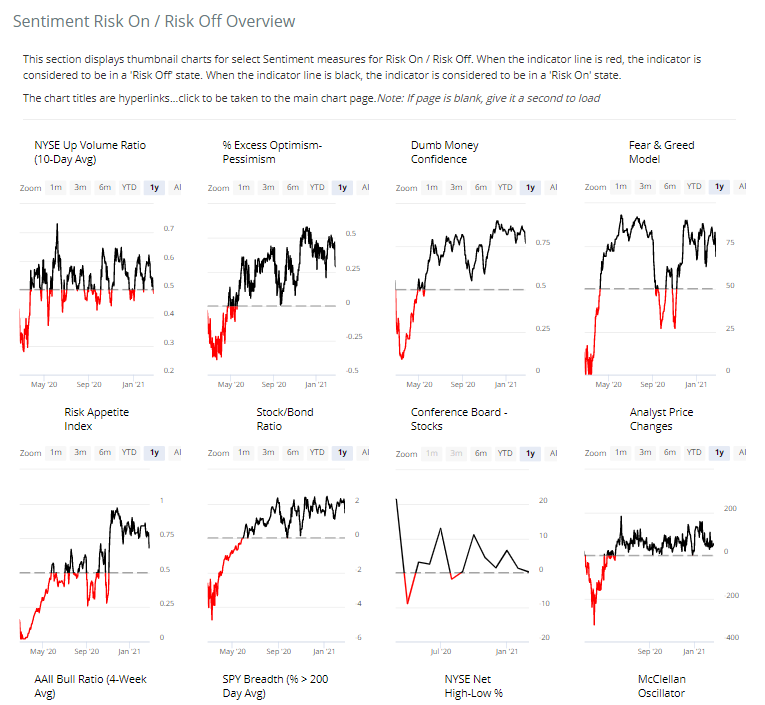

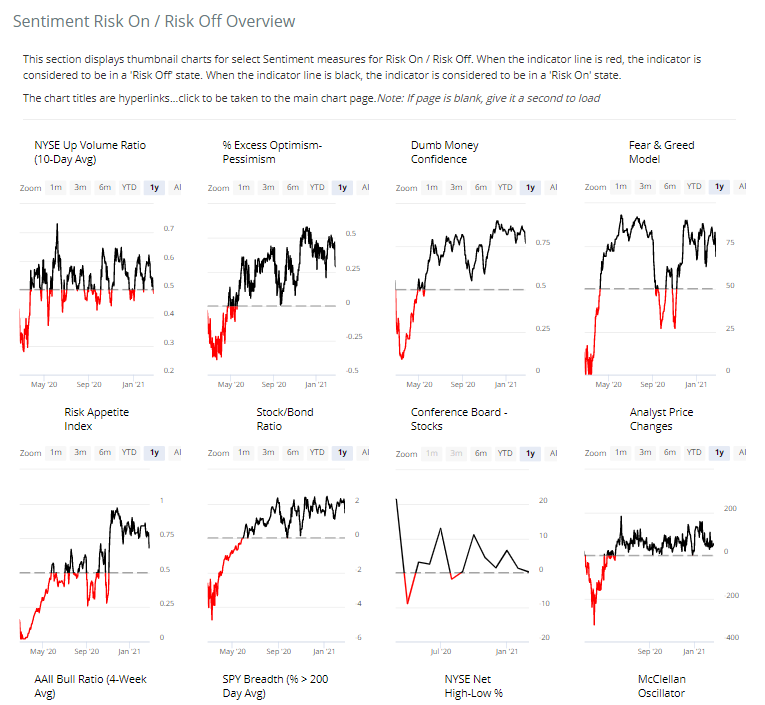

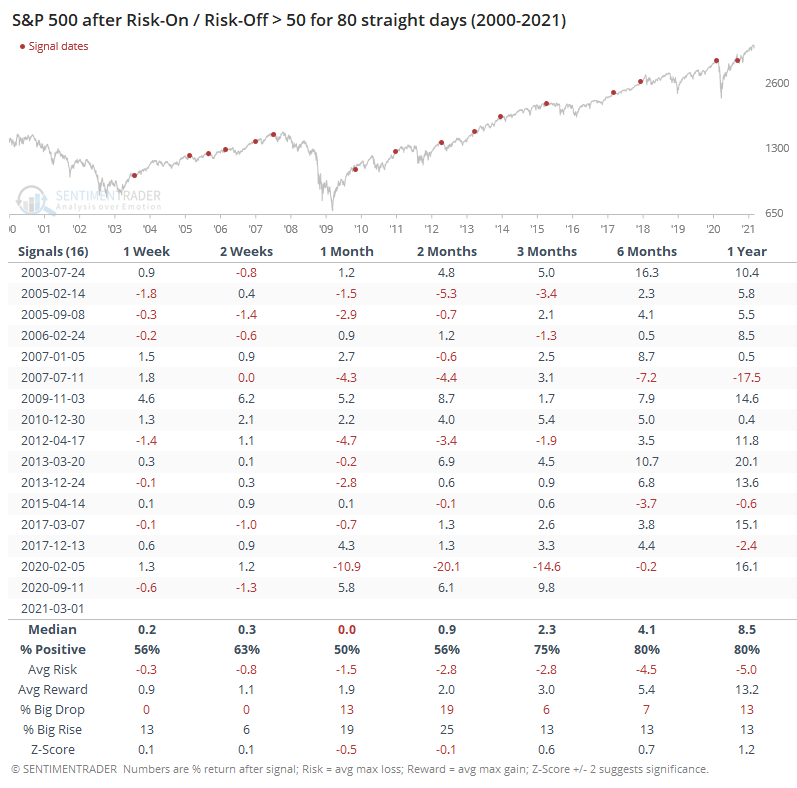

Consumers' preference for stocks is one of the gauges on a new page that Eric created. The Sentiment Risk-On / Risk-Off Overview is a single place to see a broad cross-section of indicators and how investors are positioning themselves. You can find it by going to Spotlights > Sentiment Risk-On / Risk-Off Overview.

Simple binary thresholds are used to determine whether sentiment is in risk-on (black) or risk-off (red) mode. The more indicators that are black, the more that we're in a risk-on mode, and more likely that dips will be bought. The more indicators are showing red, the more likely that rallies will be sold. It also gives a good overview of extremes either way.

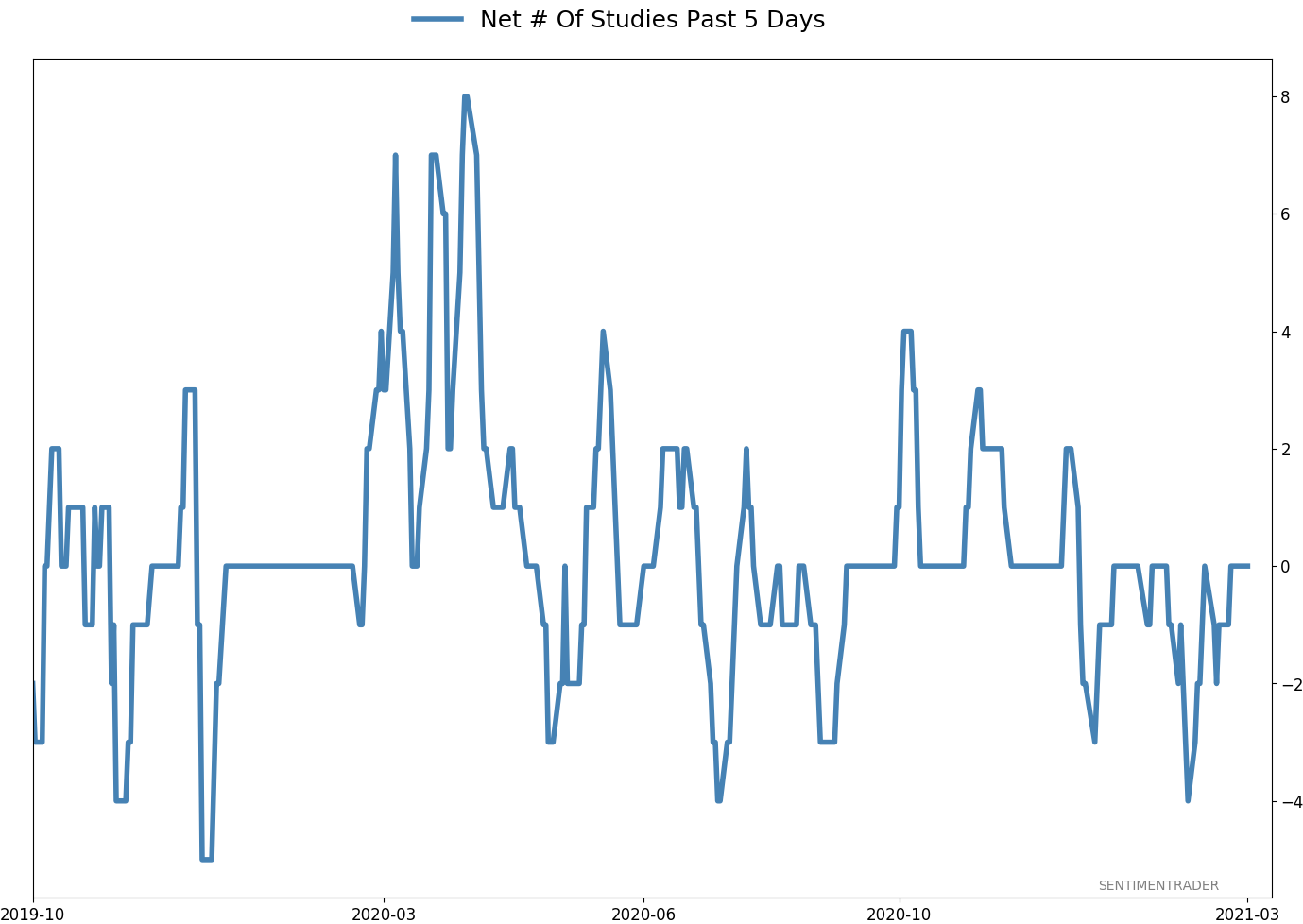

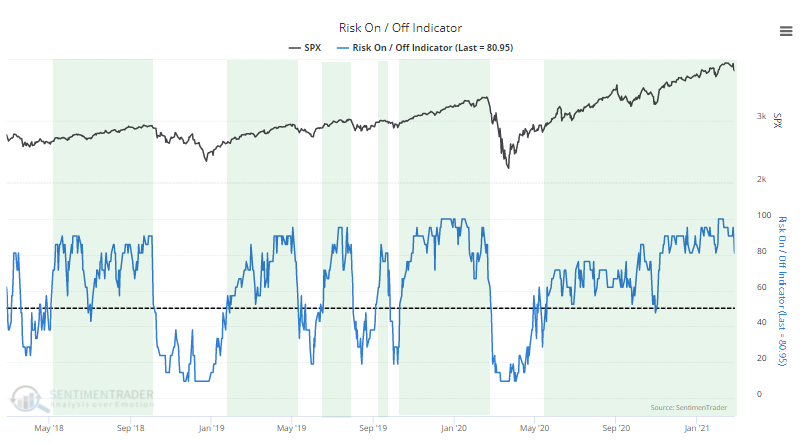

Eric also aggregated all of the measures into one master Risk-On / Risk-Off Indicator. This is simply the percentage of indicators on that page that are currently showing risk-on behavior. Anything above 50% tends to coincide with risk-taking behavior. When it drops below 50%, that's when stocks tend to consistently struggle.

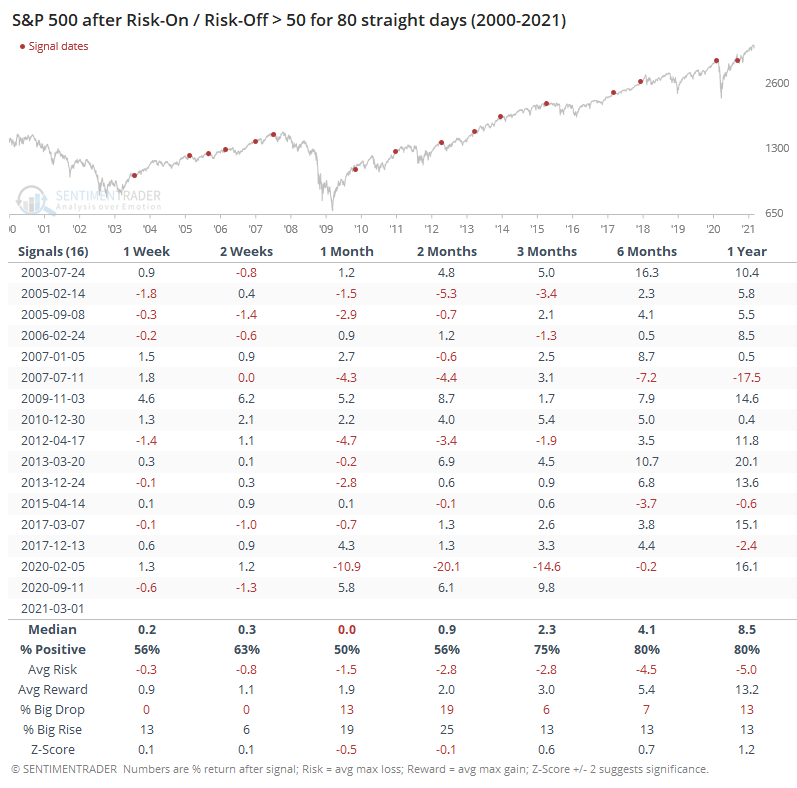

Like we've seen with so many measures lately, about the only negative here is that things have been so positive for so long, that they're less likely to lead to large, sustained gains. This aggregate has been in risk-on mode for 80 consecutive days, among the longest stretches in 20 years.

Returns after the others weren't terrible, but 11 out of the 16 showed a negative return sometime between 1-3 months later.

We have another half dozen or so indicators that should be added this week. If you're looking for a single place to check for a broad overview of how investors are behaving across time frames, this is it.

Some of them, like consumers' attitudes toward stocks, are at or near risk-off mode. Those are more of the exception than the rule, though, so it's safe to say that for now, investors will keep looking to buy the dip.

Active Studies

| Time Frame | Bullish | Bearish | | Short-Term | 0 | 0 | | Medium-Term | 2 | 8 | | Long-Term | 16 | 3 |

|

Indicators at Extremes

Portfolio

| Position | Description | Weight % | Added / Reduced | Date | | Stocks | RSP | 4.9 | Reduced 4% | 2021-02-09 | | Bonds | 30.0% BND, 8.8% SCHP | 38.8 | Added 15.1% | 2021-02-18 | | Commodities | GCC | 2.3 | Reduced 2.1%

| 2020-09-04 | | Precious Metals | GDX | 9.0 | Added 0.1% | 2021-02-18 | | Special Situations | 7.3% XLE, 4.8% PSCE | 12.1 | Reduced 5.6% | 2021-02-18 | | Cash | | 32.8 | | |

|

Updates (Changes made today are underlined)

With a market that has seen the kinds of broad participation and big breath thrusts like we did in the fall, it's hard to become too negative. Those kinds of conditions have consistently preceded higher returns over the next 6-12 months. It's the interim that's more of an issue. Even conditions like that haven't prevented some shorter-term pullbacks. And when we combine an environment where speculation is rampant and recent days have seen an increase in cracks under the surface of the indexes, it's enough to become more defensive over a short- to medium-term time frame. We still don't have much confirmation from the price action in the indexes, so those who are more conservative would likely wait before increasing cash levels. I've decreased risk exposure a bit more, mainly in terms of energy stocks and the ANGL fund, while adding more to the broader bond market. RETURN YTD: 5.7% 2020: 8.1%, 2019: 12.6%, 2018: 0.6%, 2017: 3.8%, 2016: 17.1%, 2015: 9.2%, 2014: 14.5%, 2013: 2.2%, 2012: 10.8%, 2011: 16.5%, 2010: 15.3%, 2009: 23.9%, 2008: 16.2%, 2007: 7.8%

|

|

Phase Table

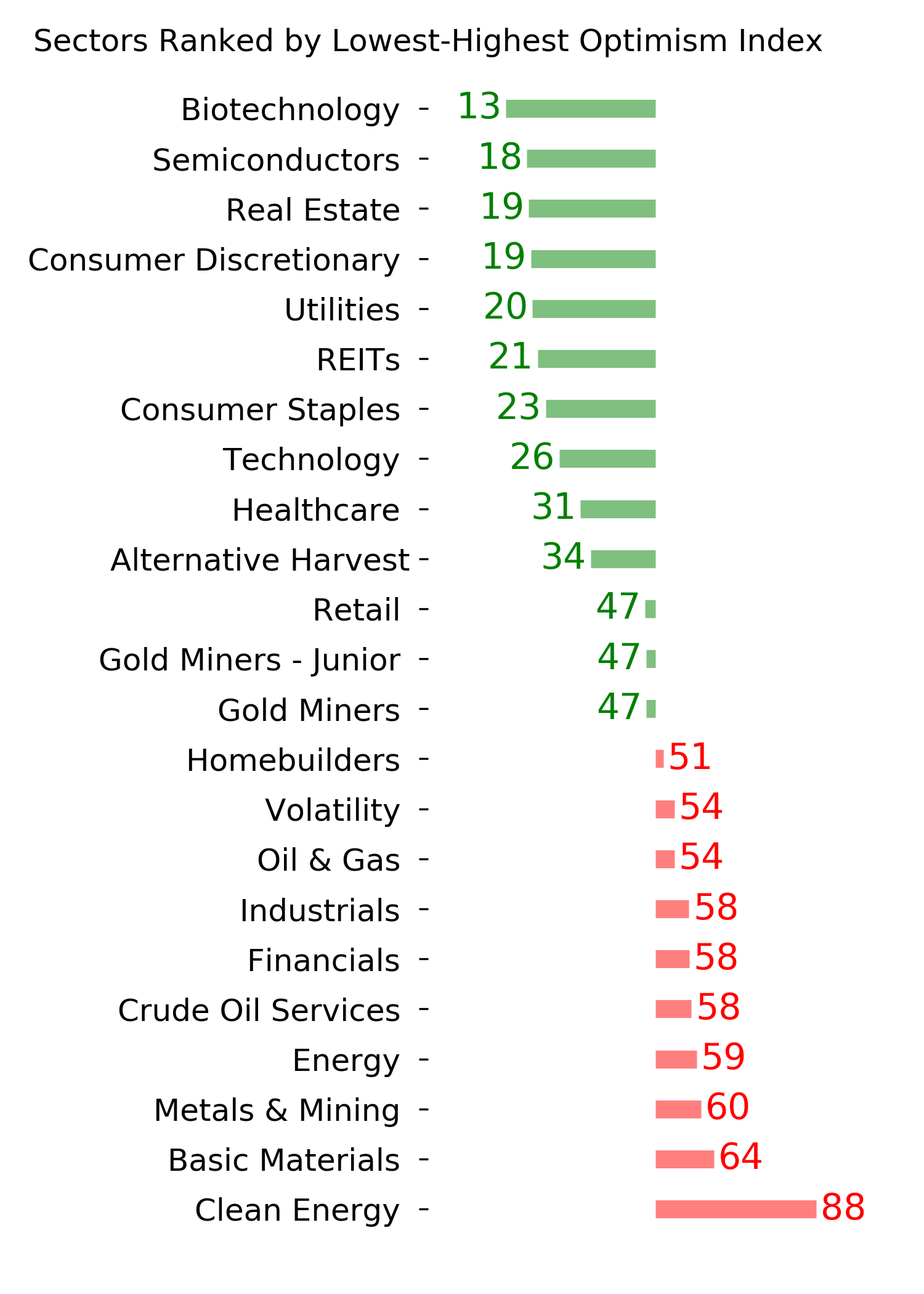

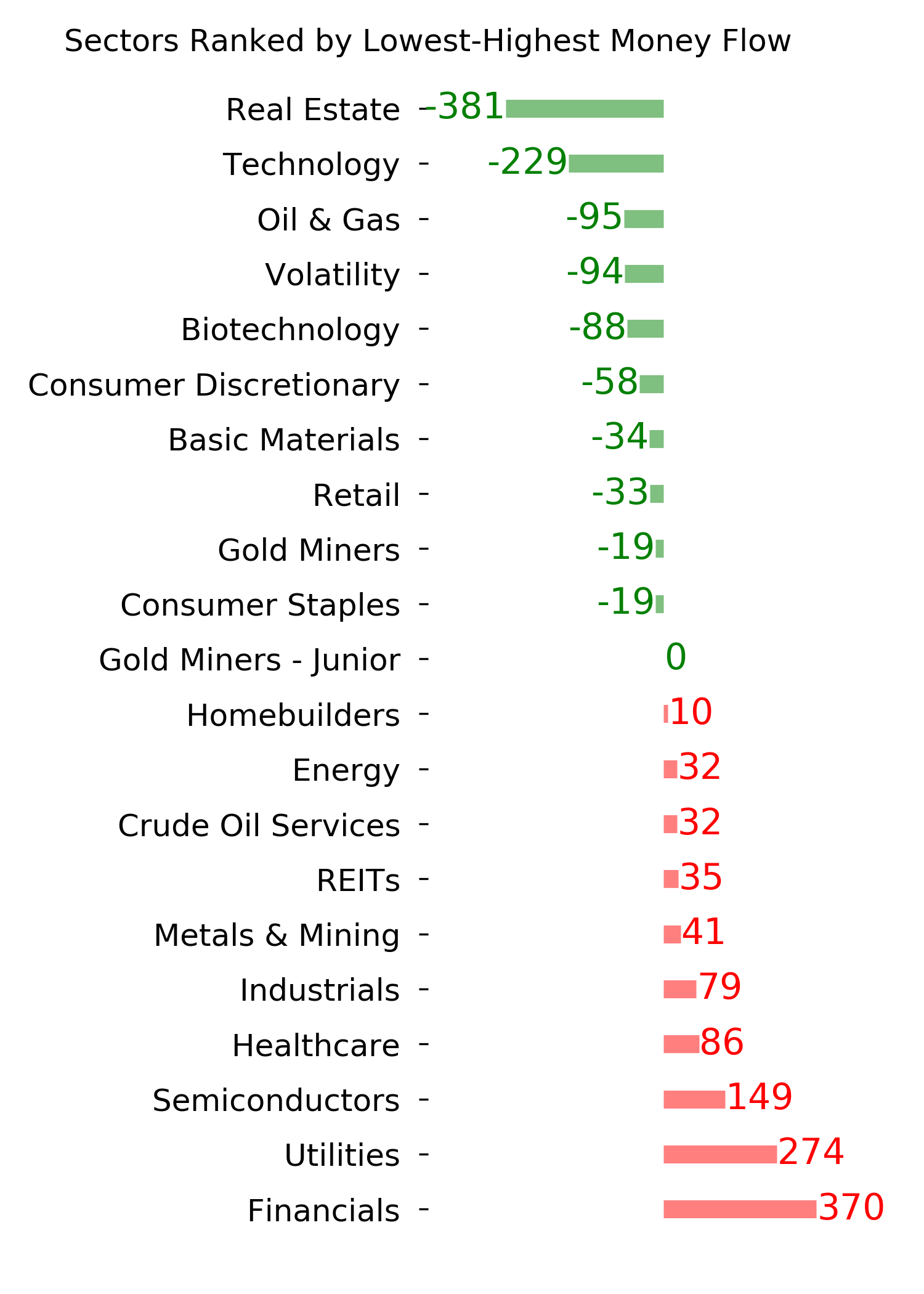

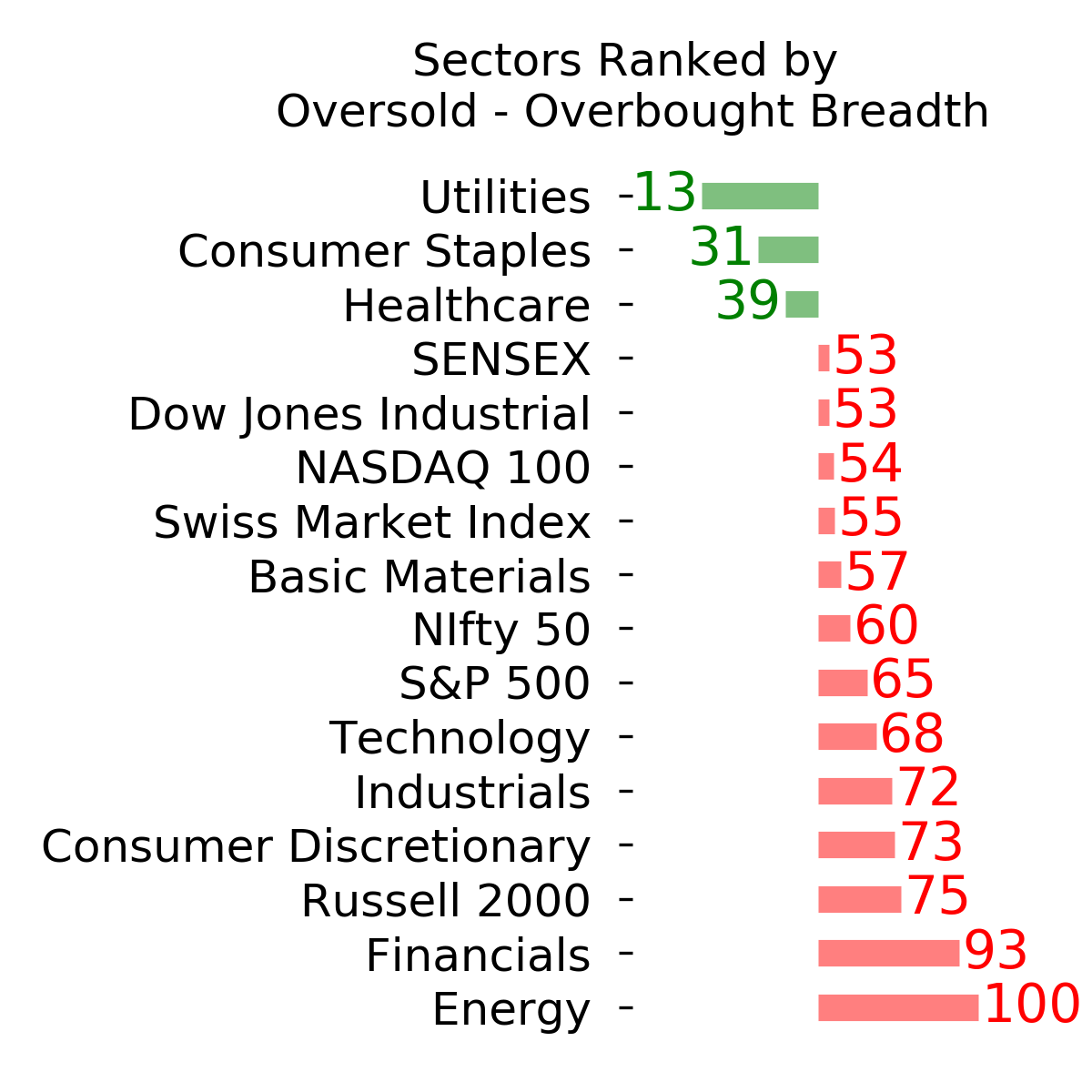

Ranks

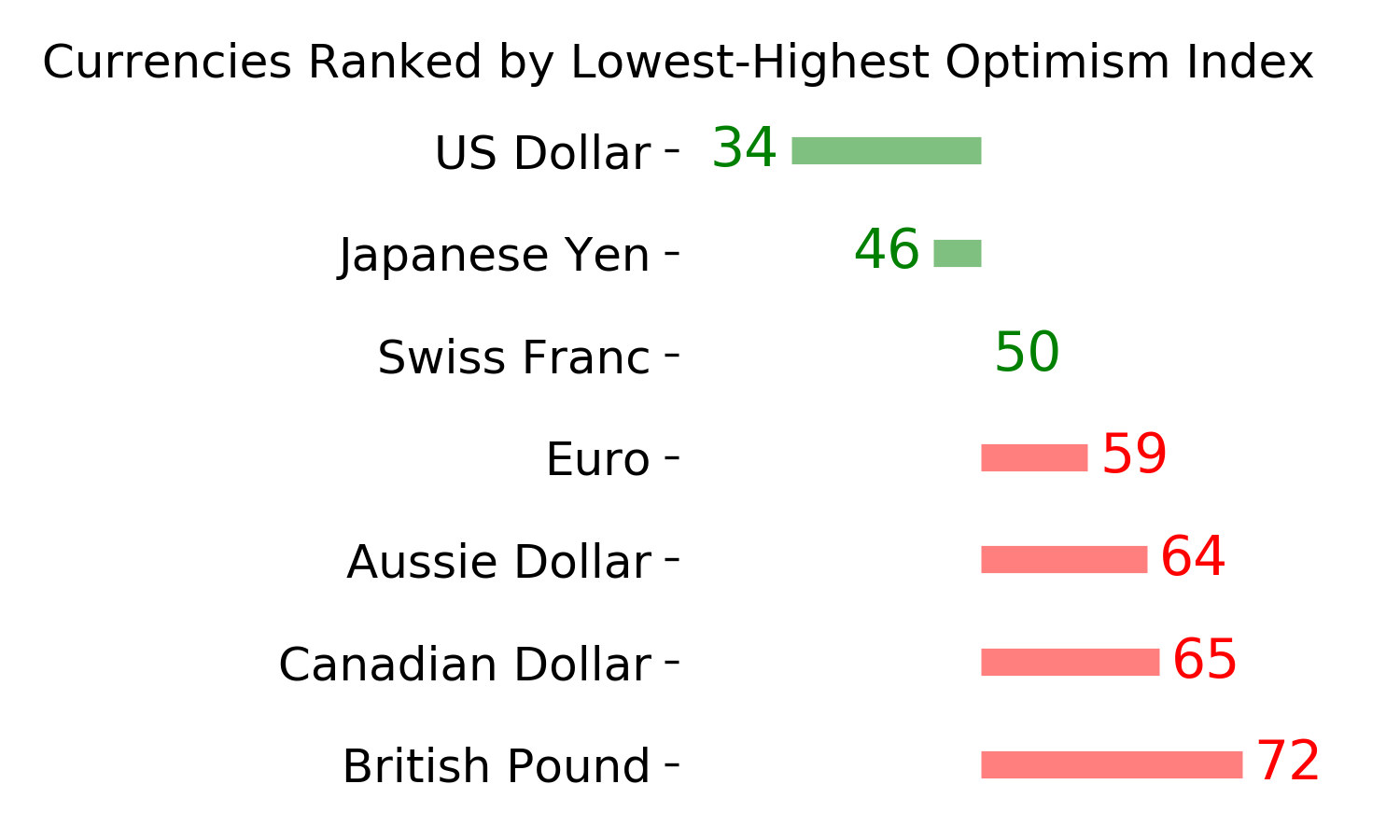

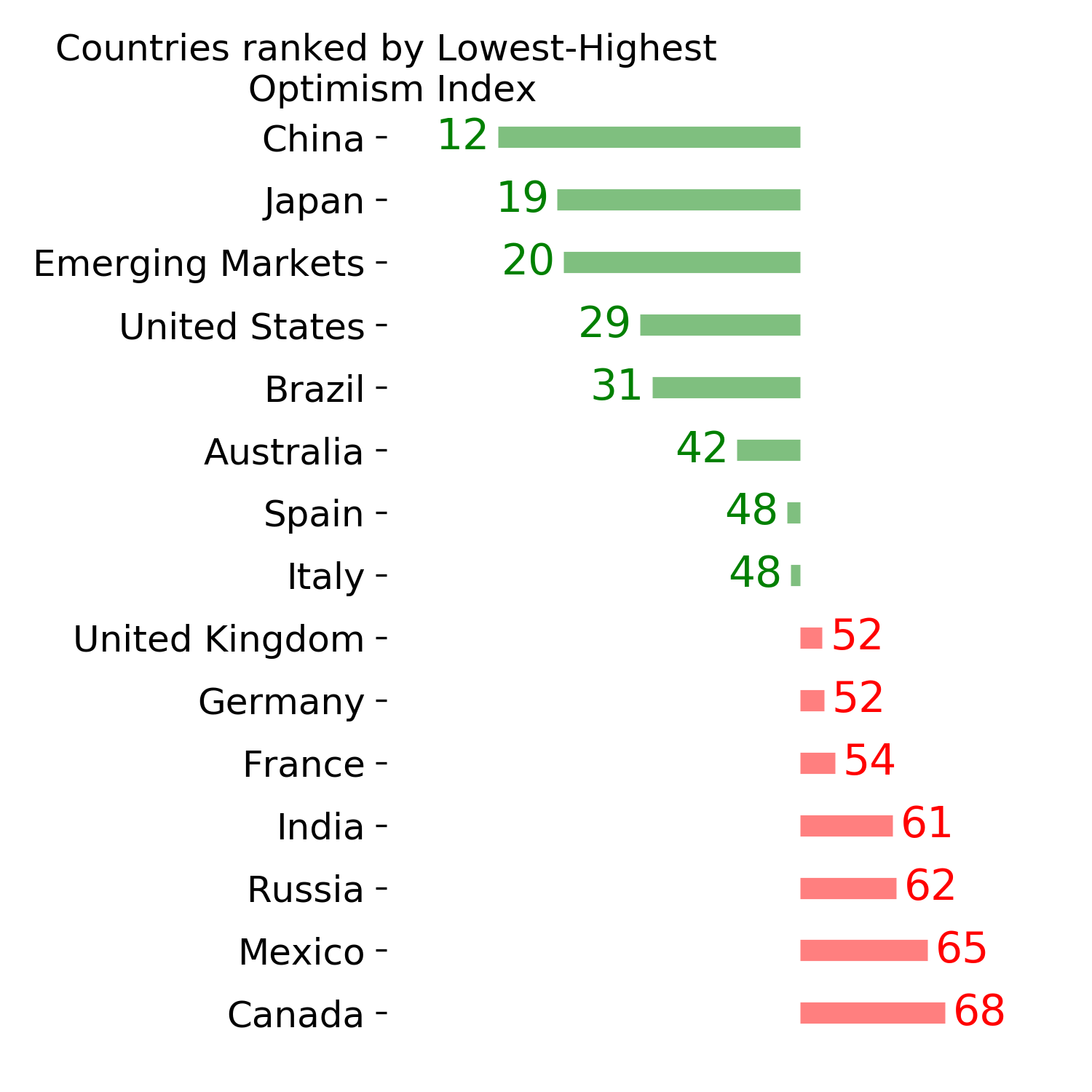

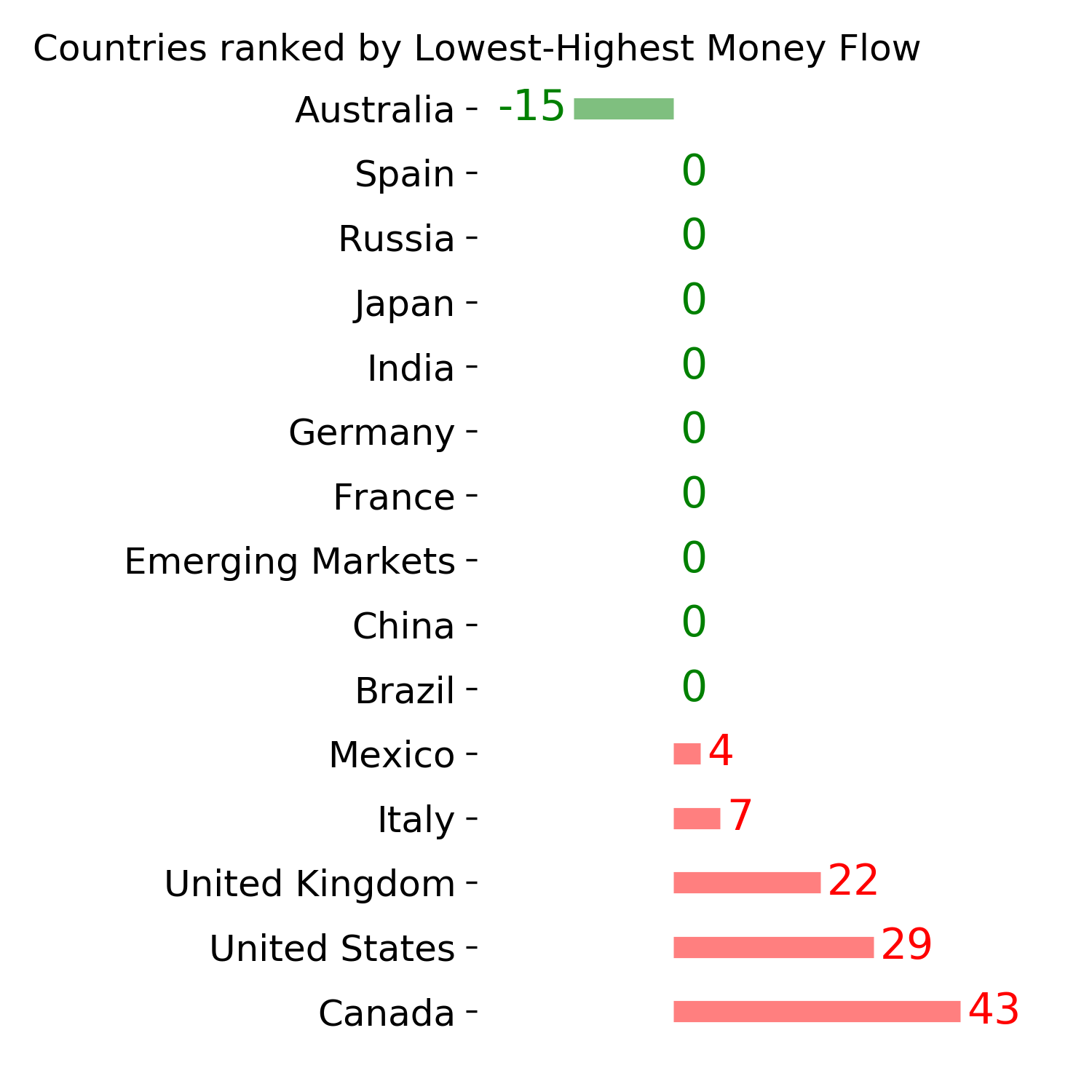

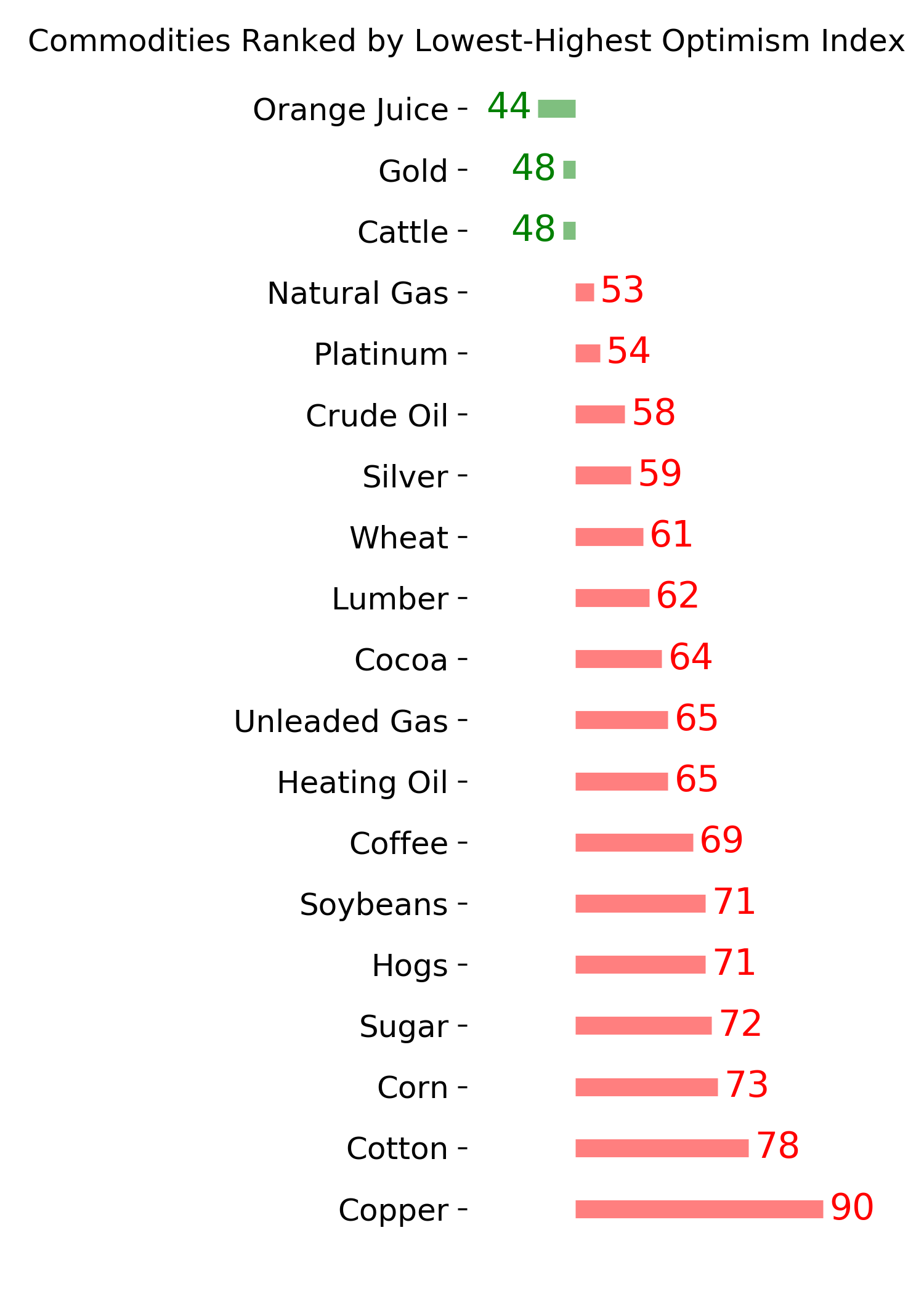

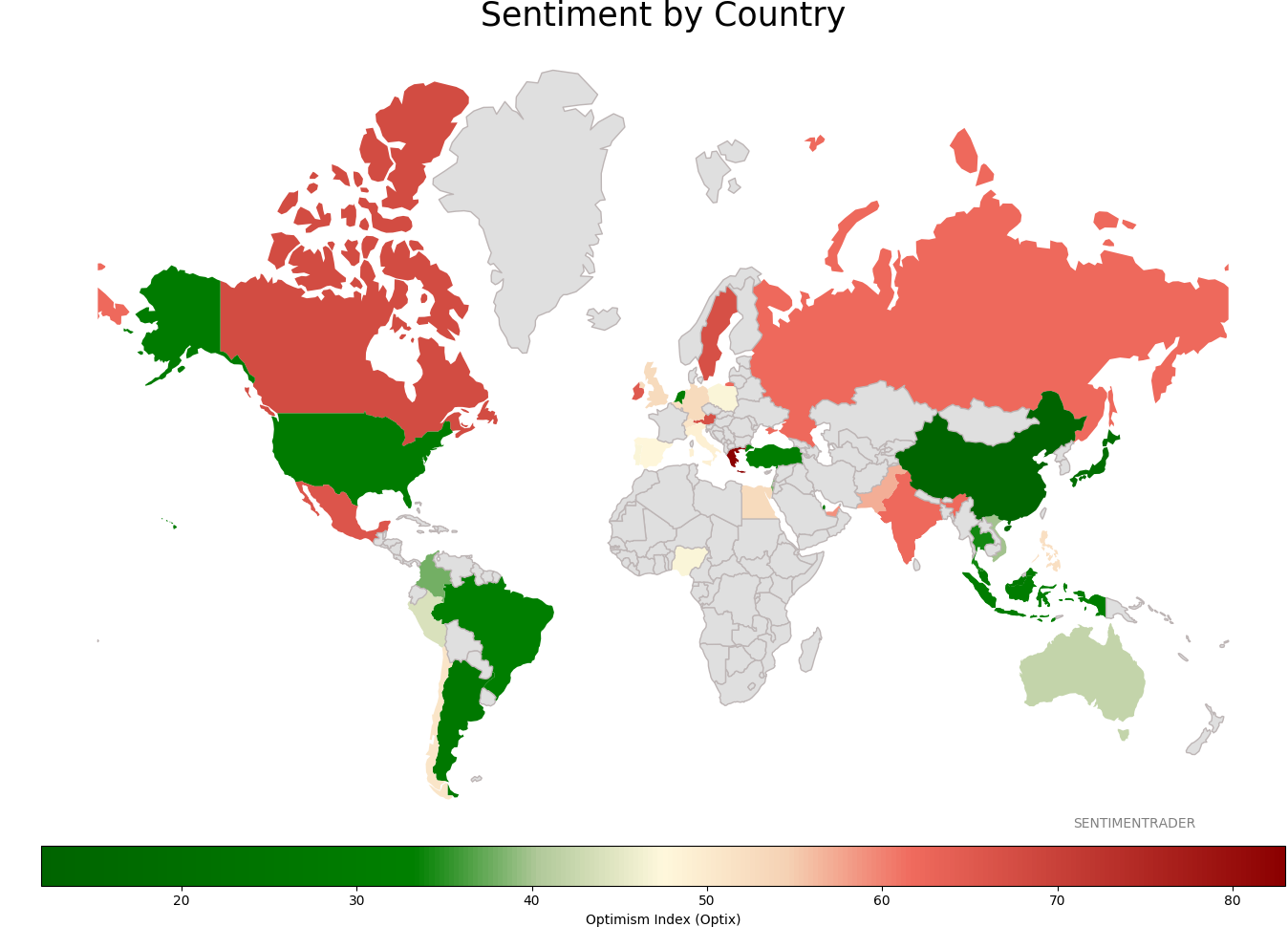

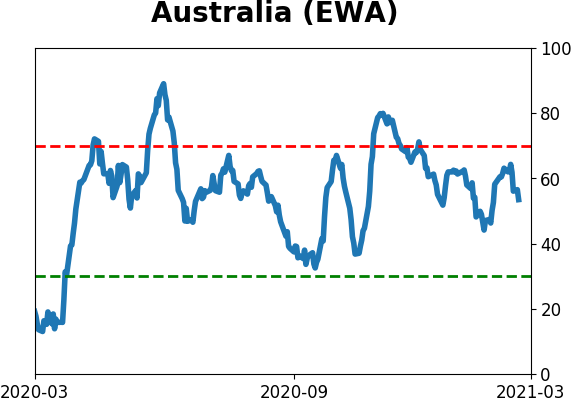

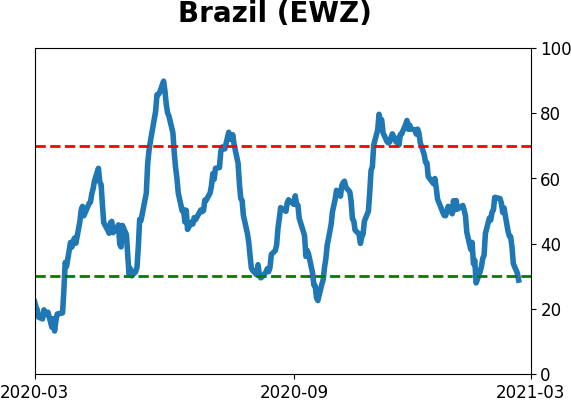

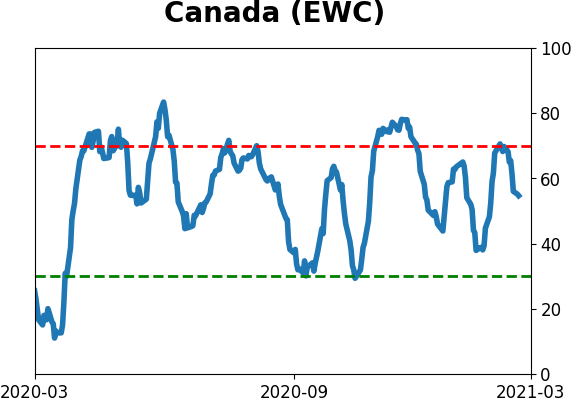

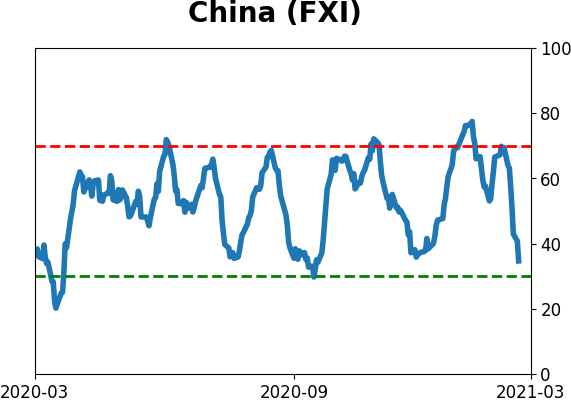

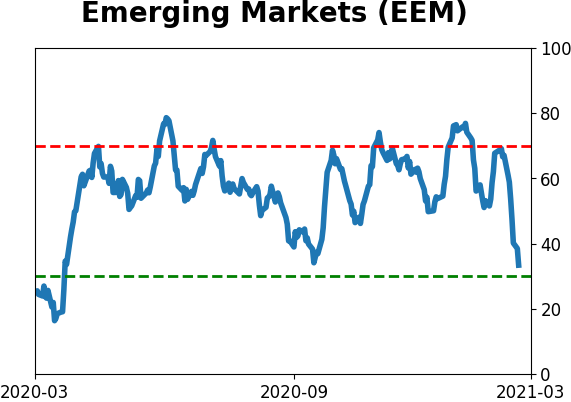

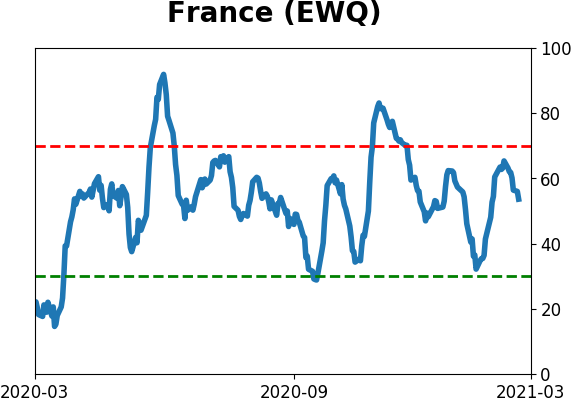

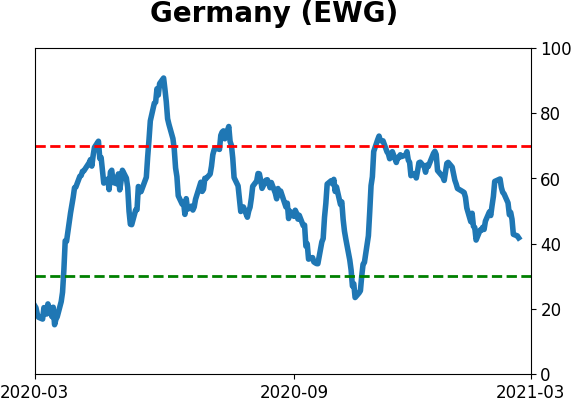

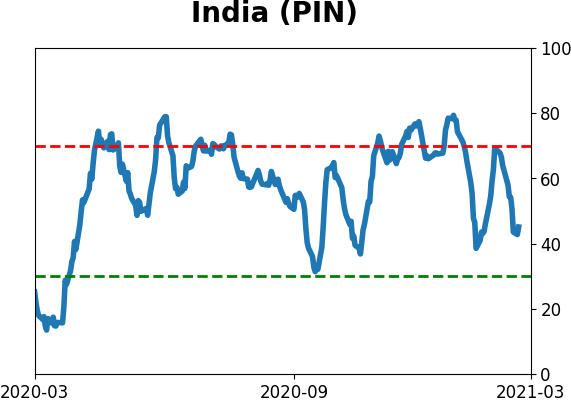

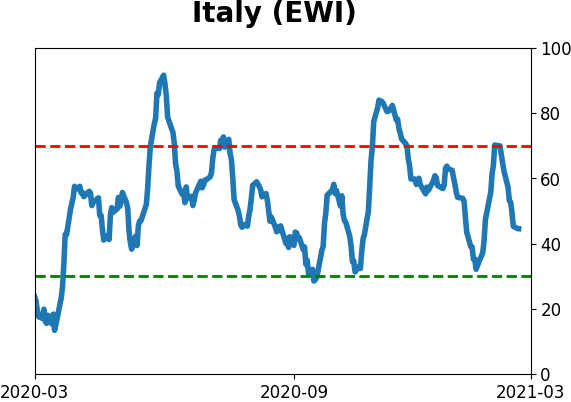

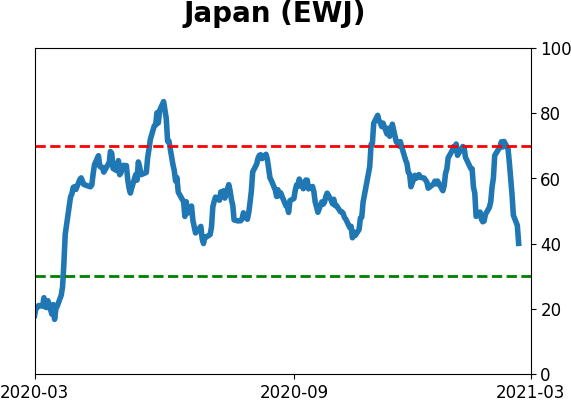

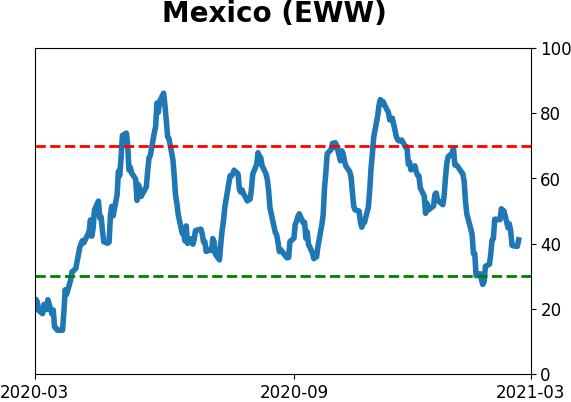

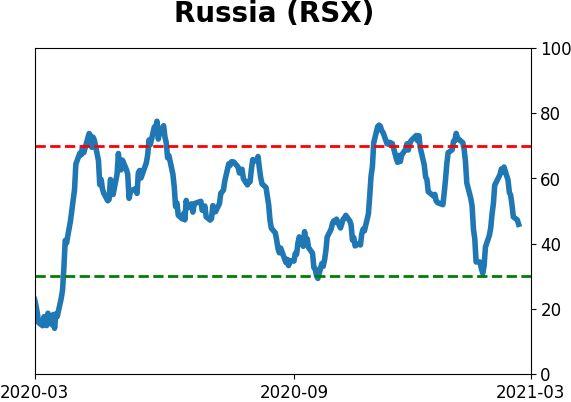

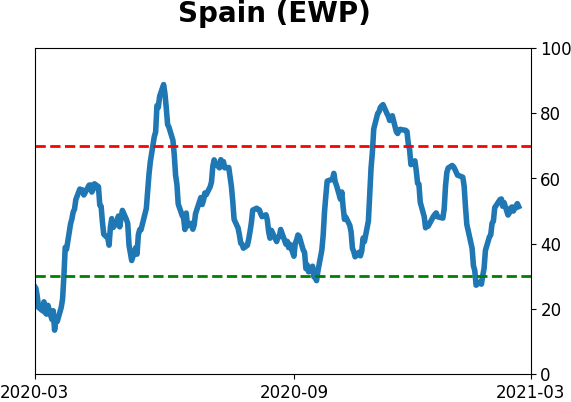

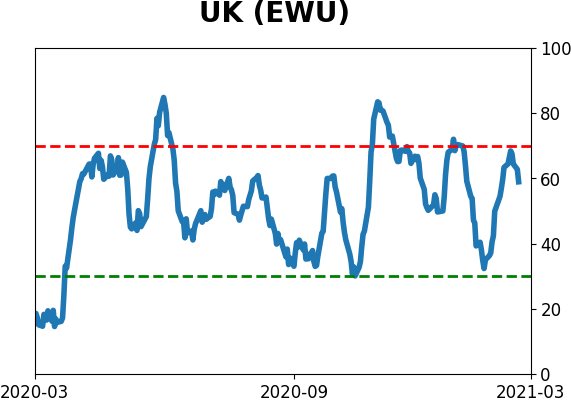

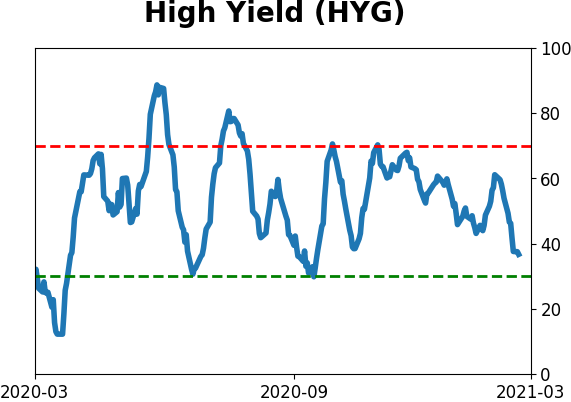

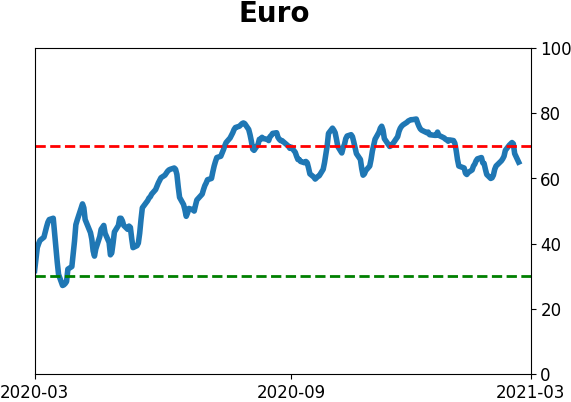

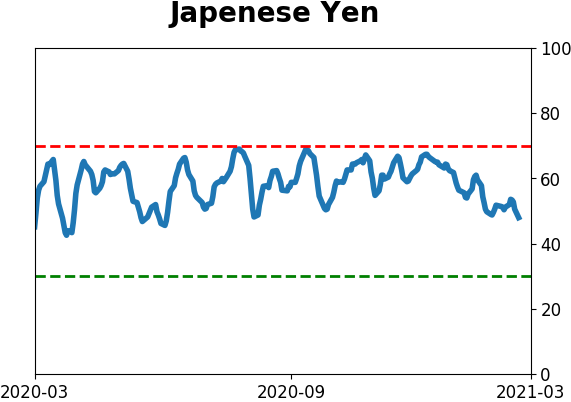

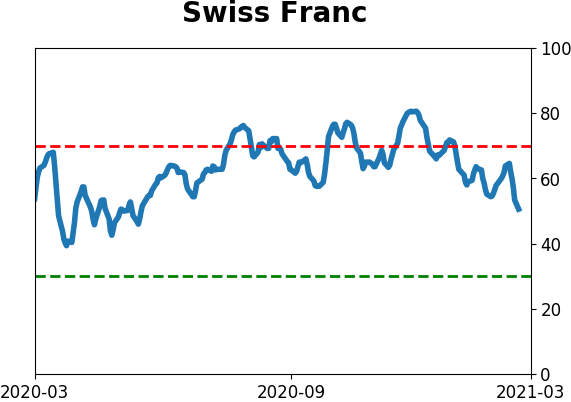

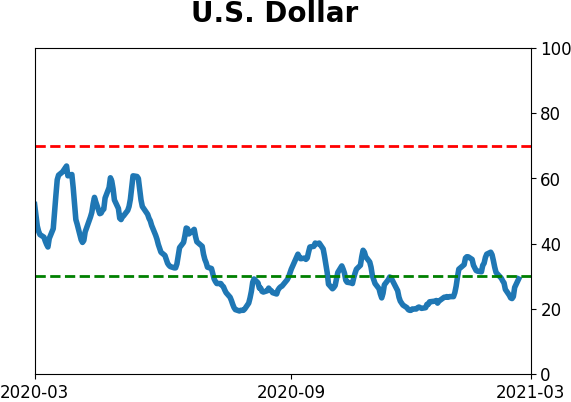

Sentiment Around The World

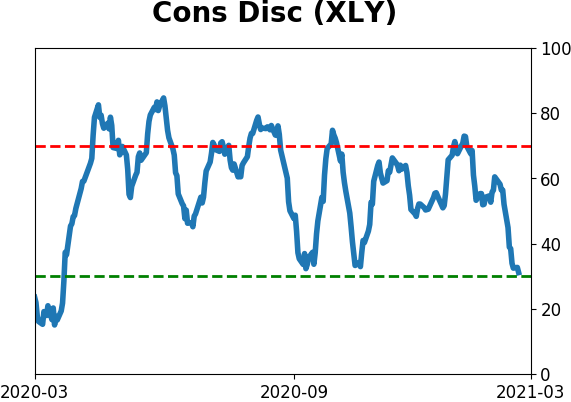

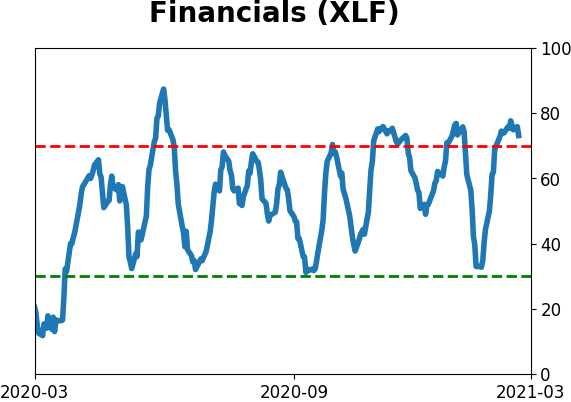

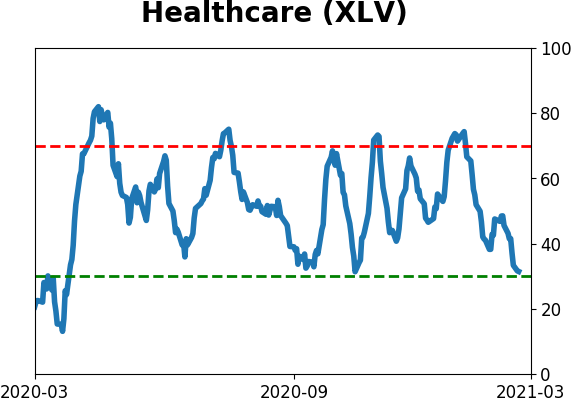

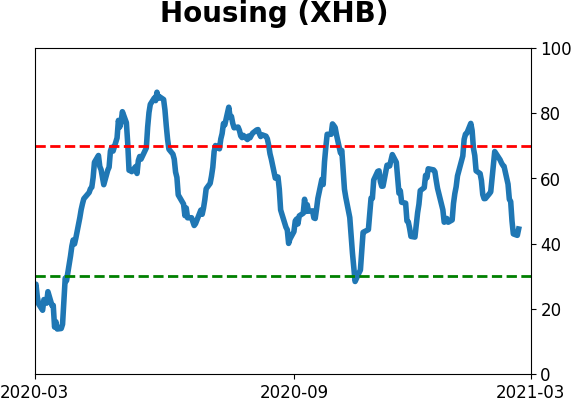

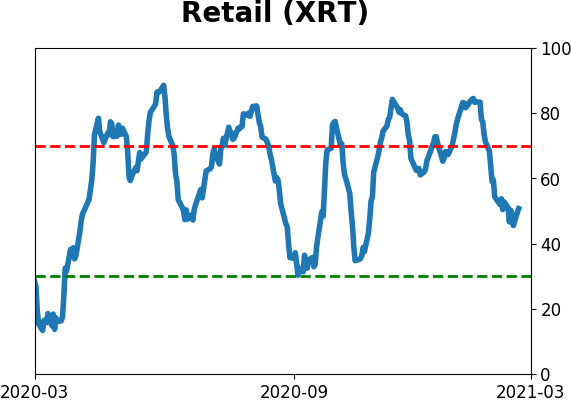

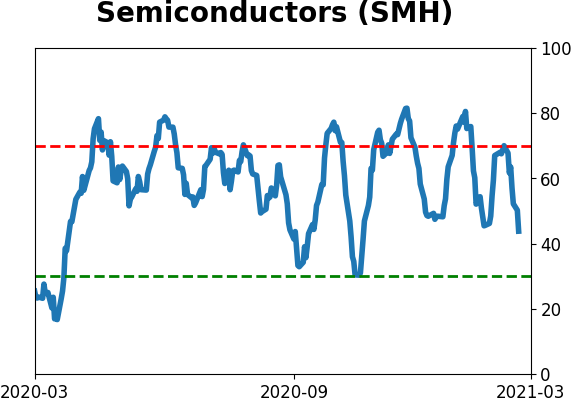

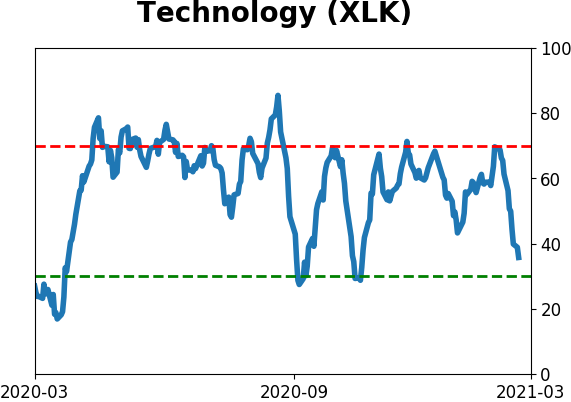

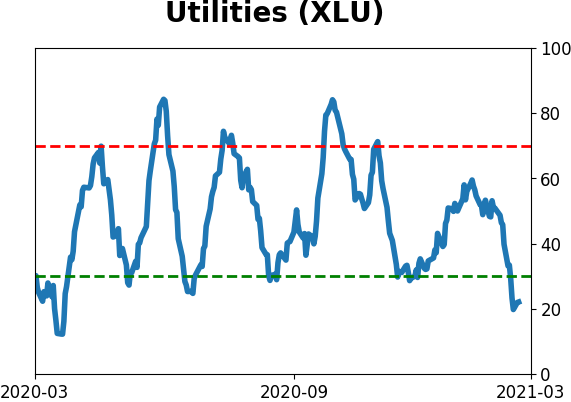

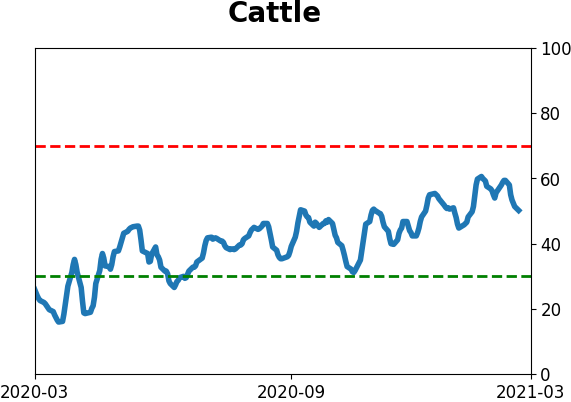

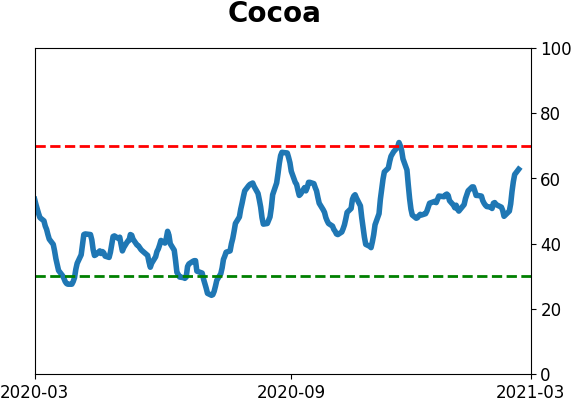

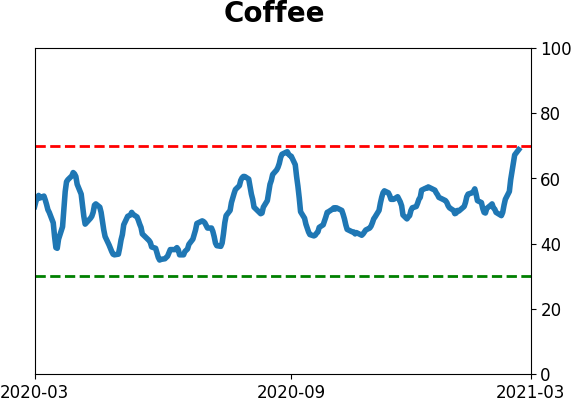

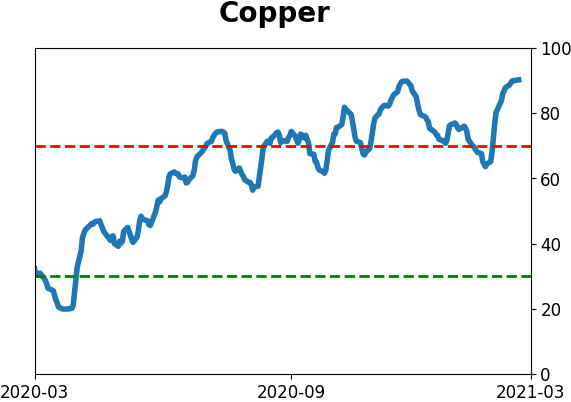

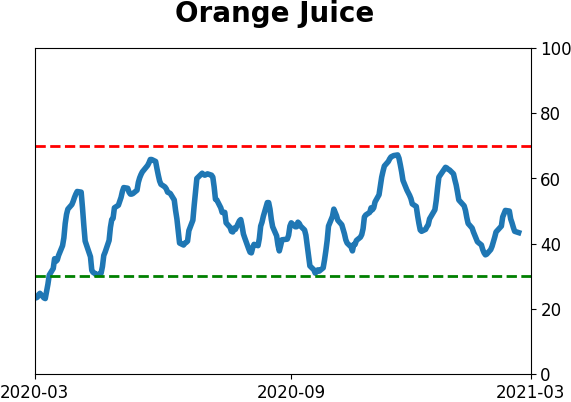

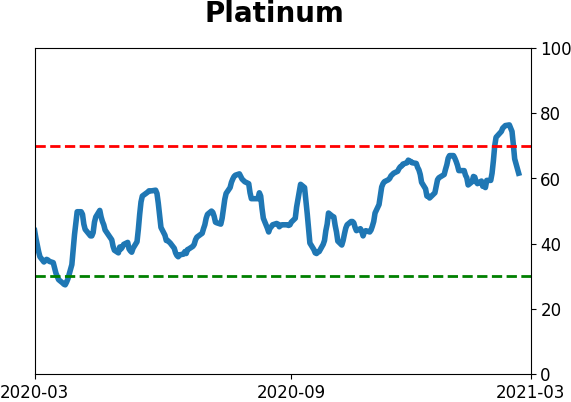

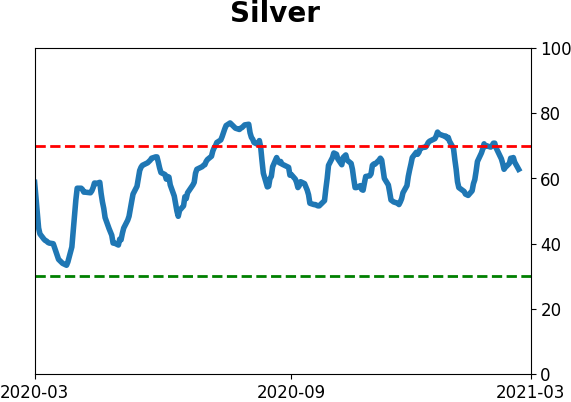

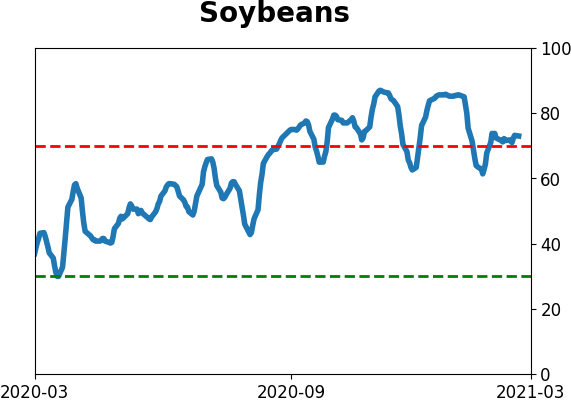

Optimism Index Thumbnails

|

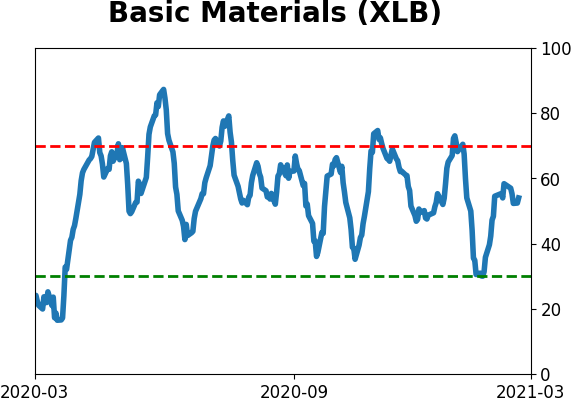

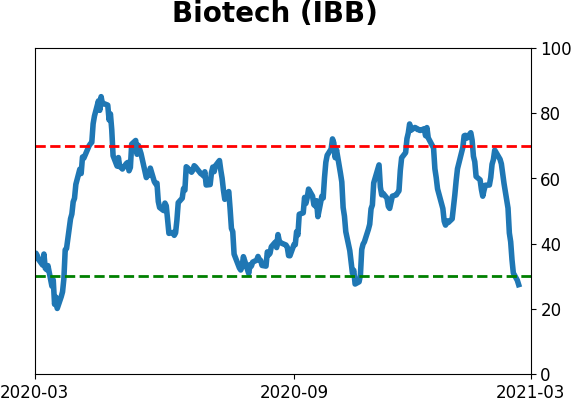

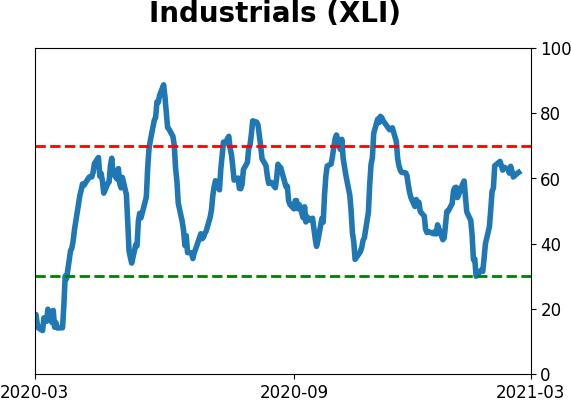

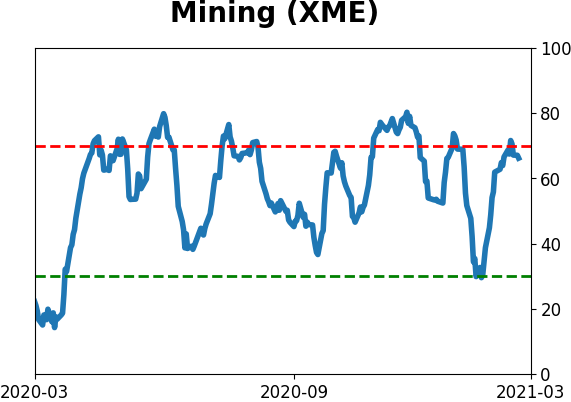

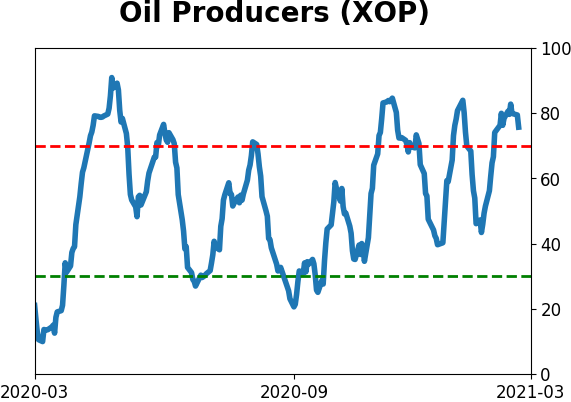

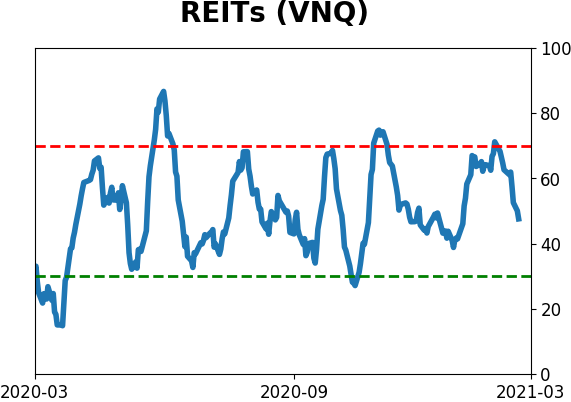

Sector ETF's - 10-Day Moving Average

|

|

|

Country ETF's - 10-Day Moving Average

|

|

|

Bond ETF's - 10-Day Moving Average

|

|

|

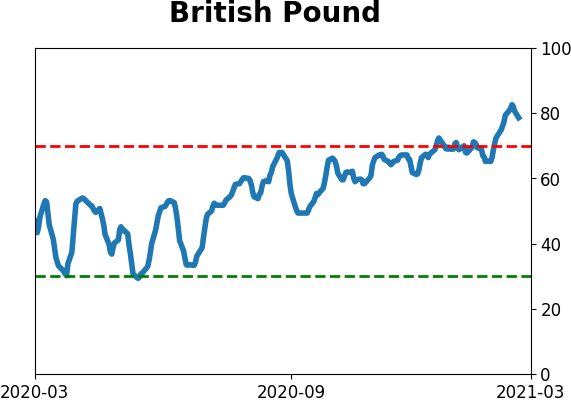

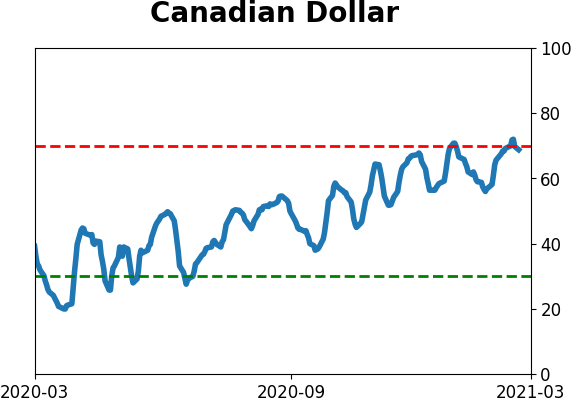

Currency ETF's - 5-Day Moving Average

|

|

|

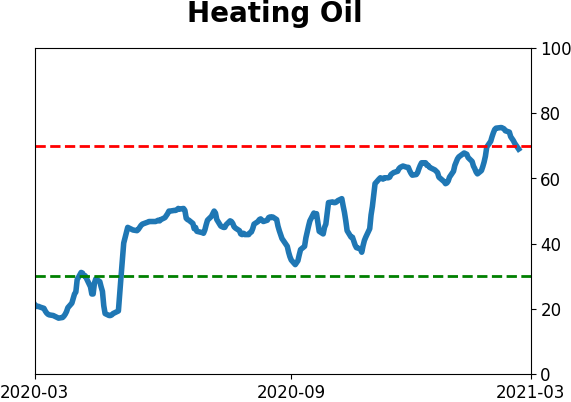

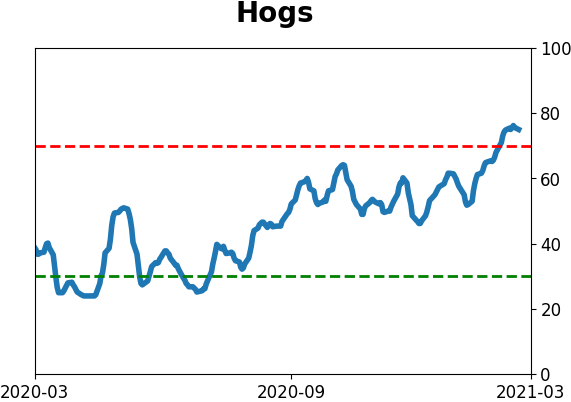

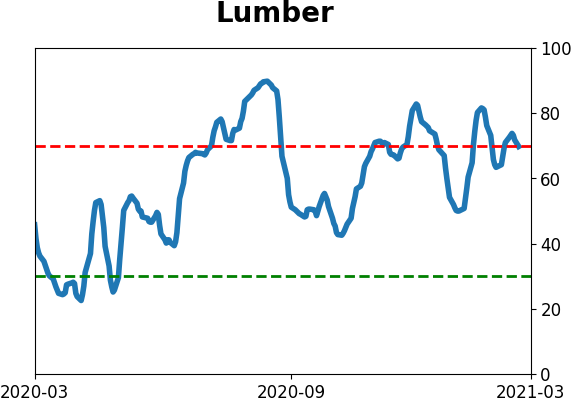

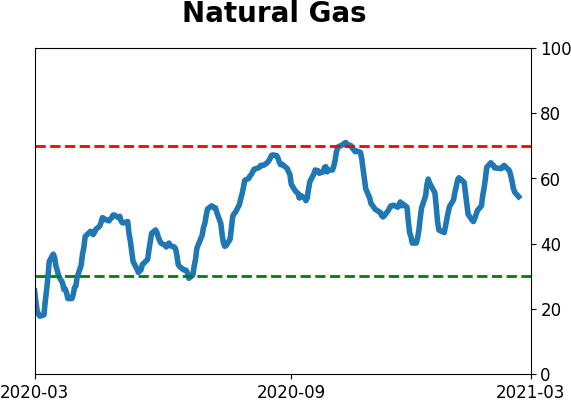

Commodity ETF's - 5-Day Moving Average

|

|