Headlines

|

|

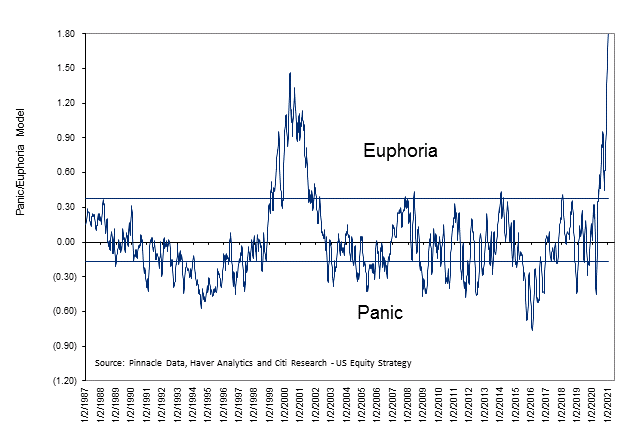

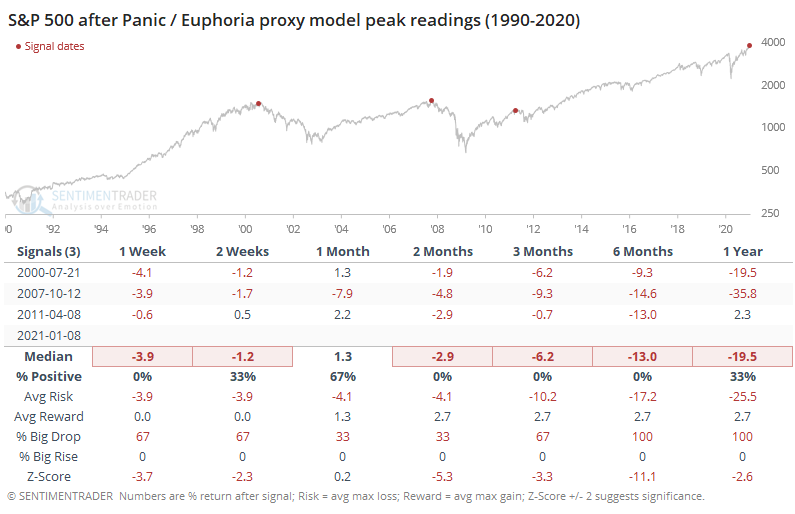

Moving beyond optimism to euphoria:

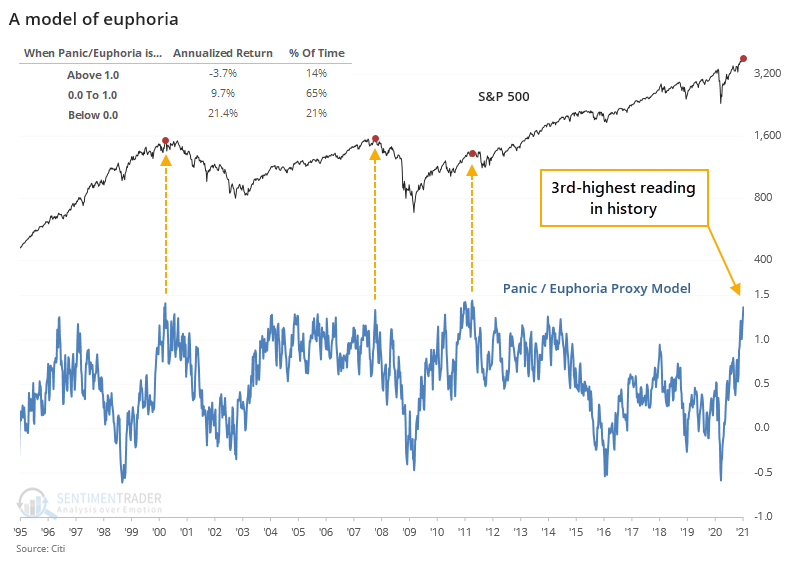

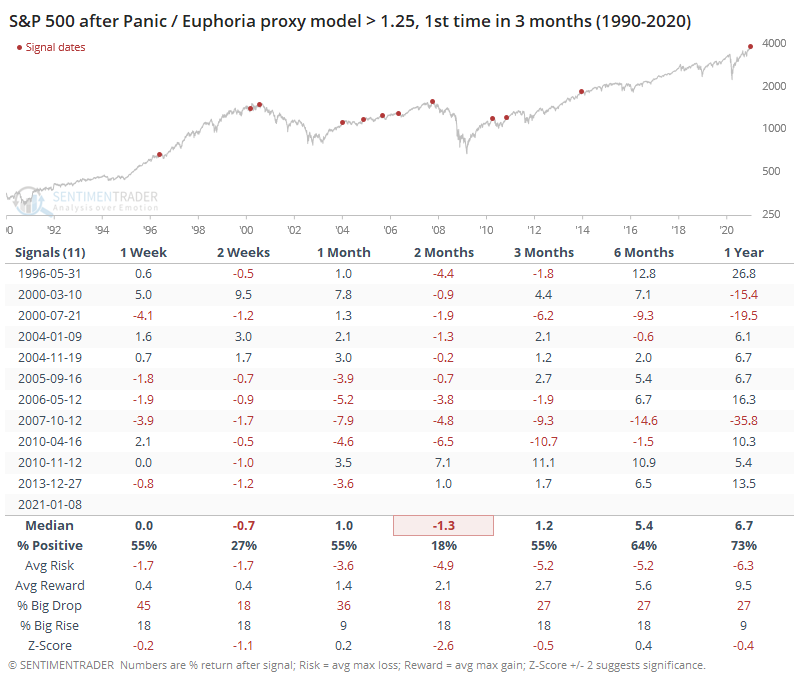

A model of panic and euphoria created by Citigroup has soared to a multi-decade high. Using proxy calculations, our estimate of the model just hit the 3rd highest reading in 30 years, with other high readings preceding poor returns for stocks.

Bottom Line:

- The market environment is pristine, with only sporadic signs of internal deterioration, but with near-historic optimism, gains tend to be muted, with a high probability of being reversed at some point over the ensuing weeks.

| Other Sectors and Assets |

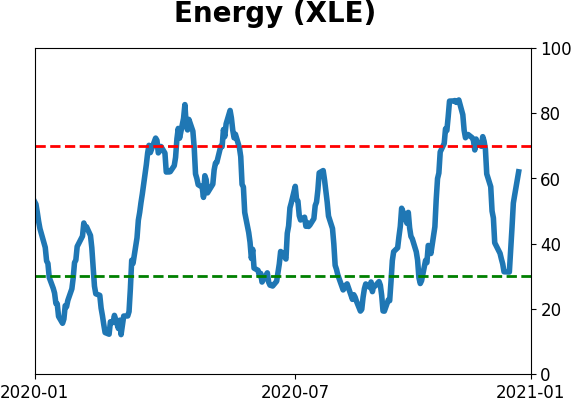

| | Positives | Negatives | | 1. Energy (here, here, and here) | 1. Skewed tech (here and here) |

|

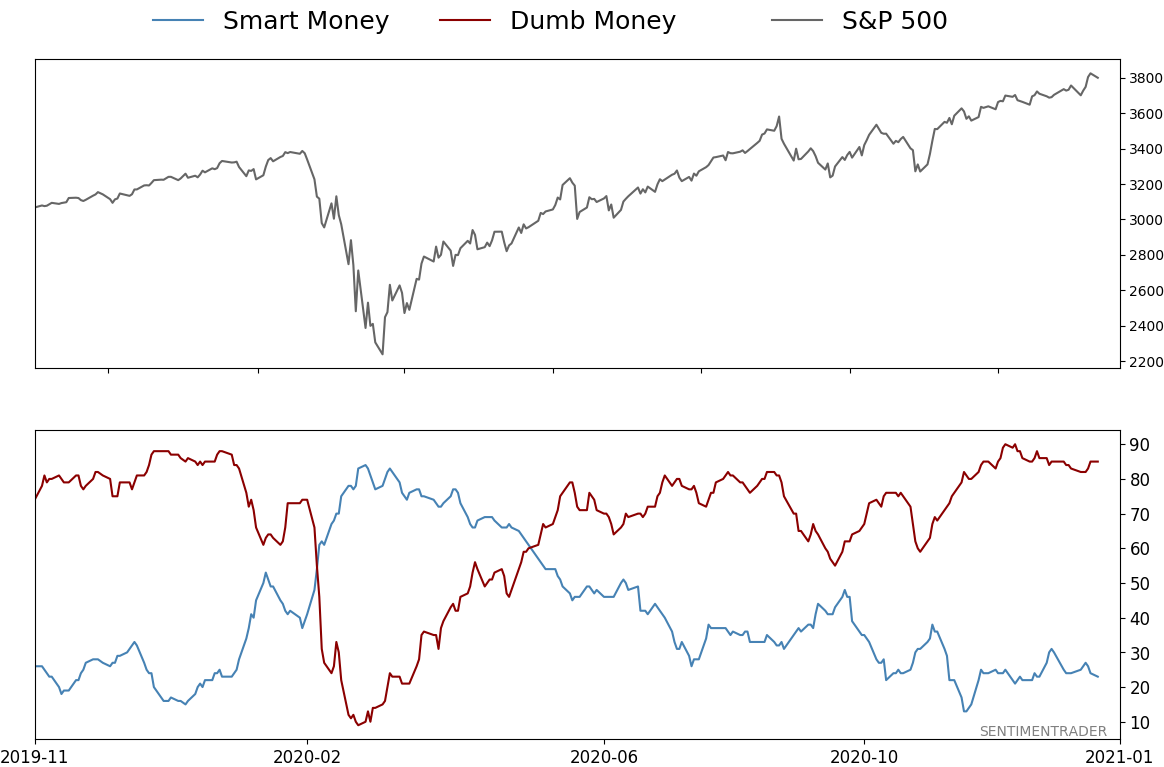

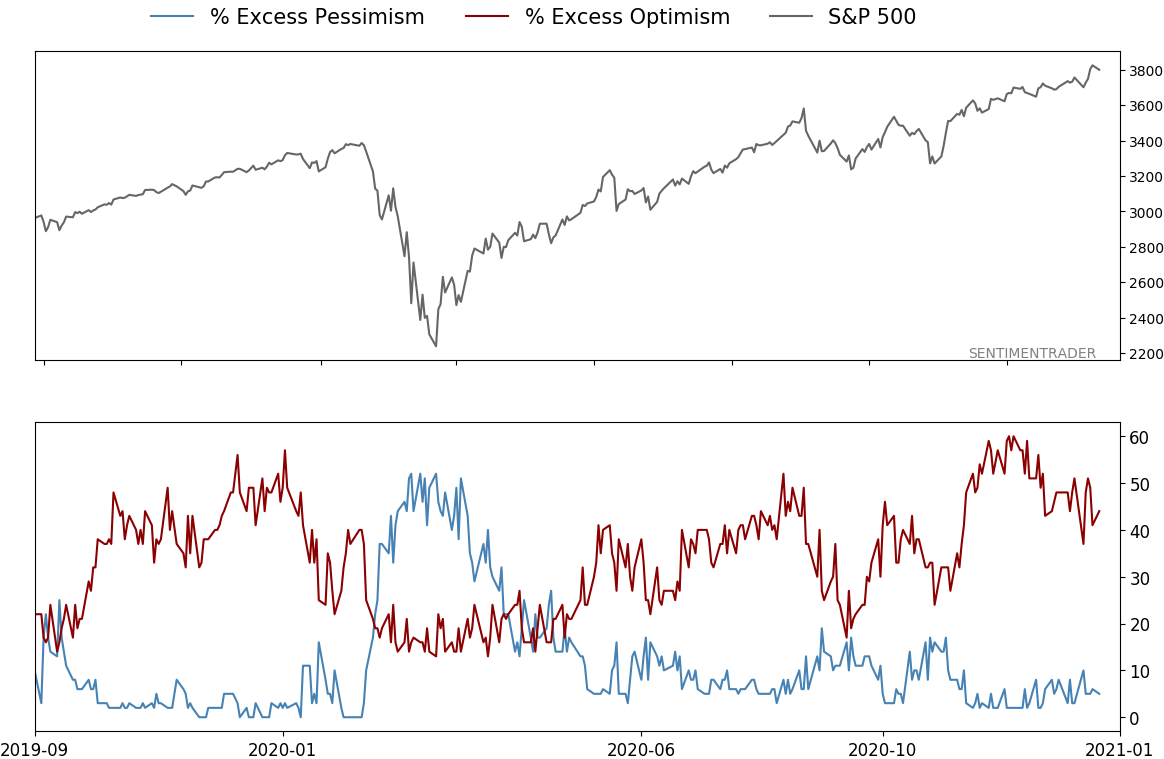

Smart / Dumb Money Confidence

|

Smart Money Confidence: 23%

Dumb Money Confidence: 85%

|

|

Risk Levels

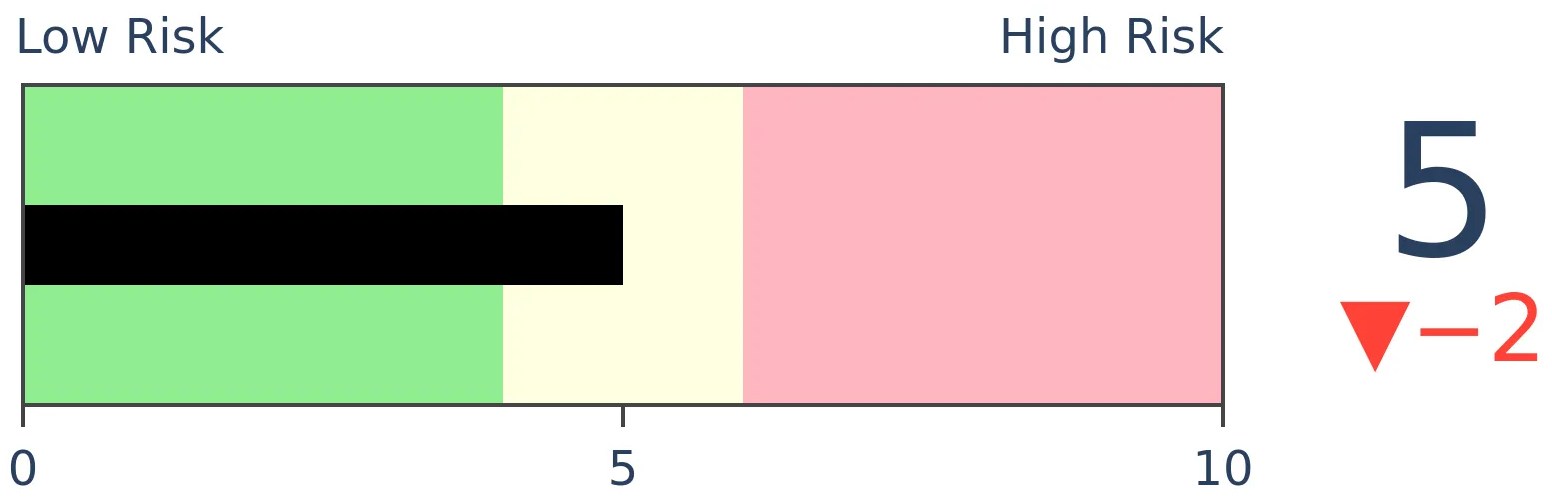

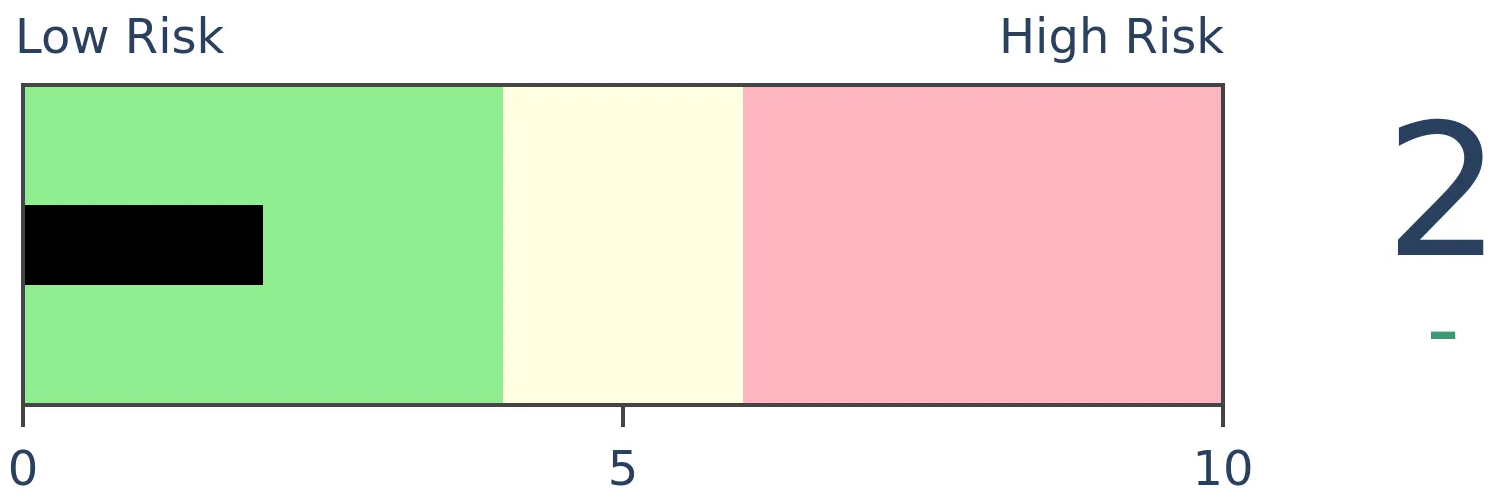

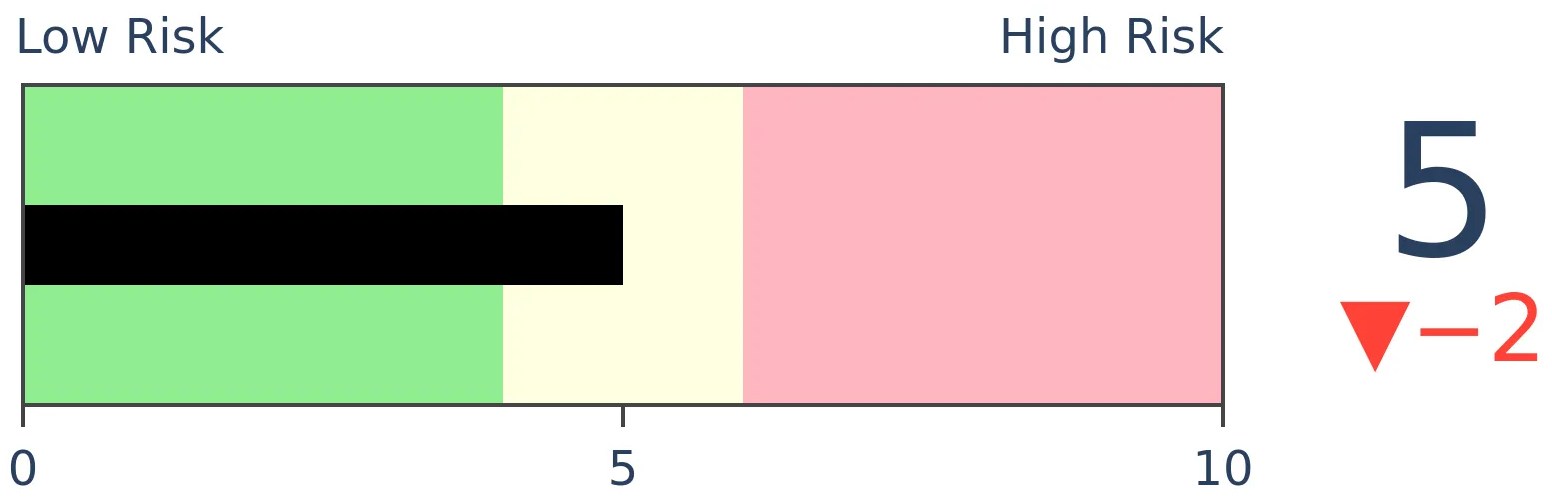

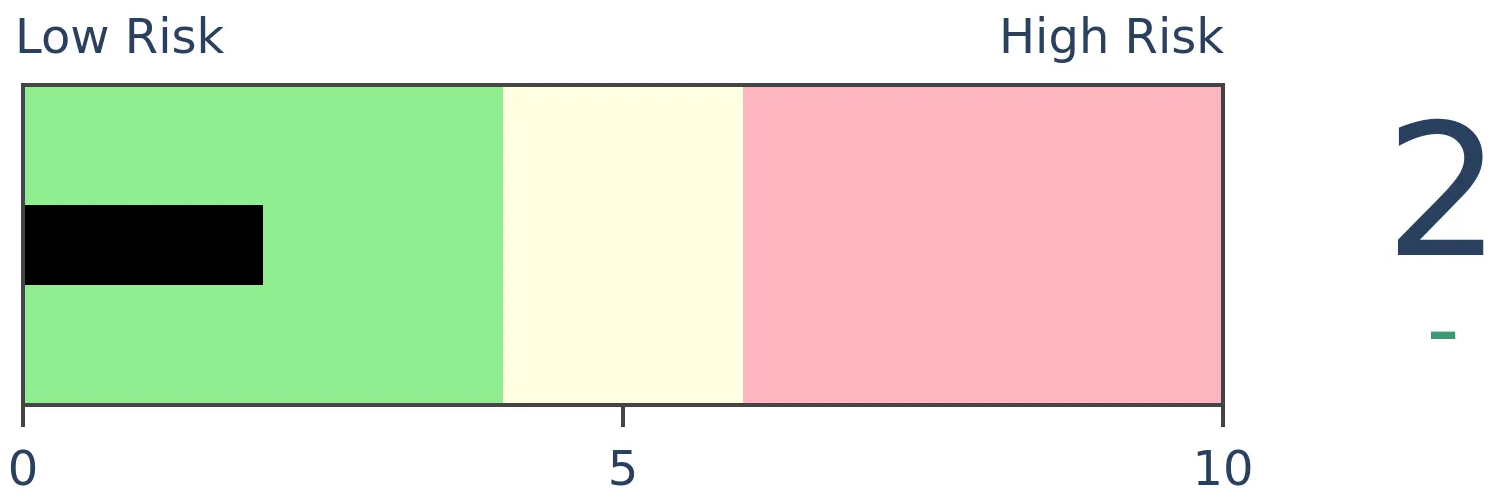

Stocks Short-Term

|

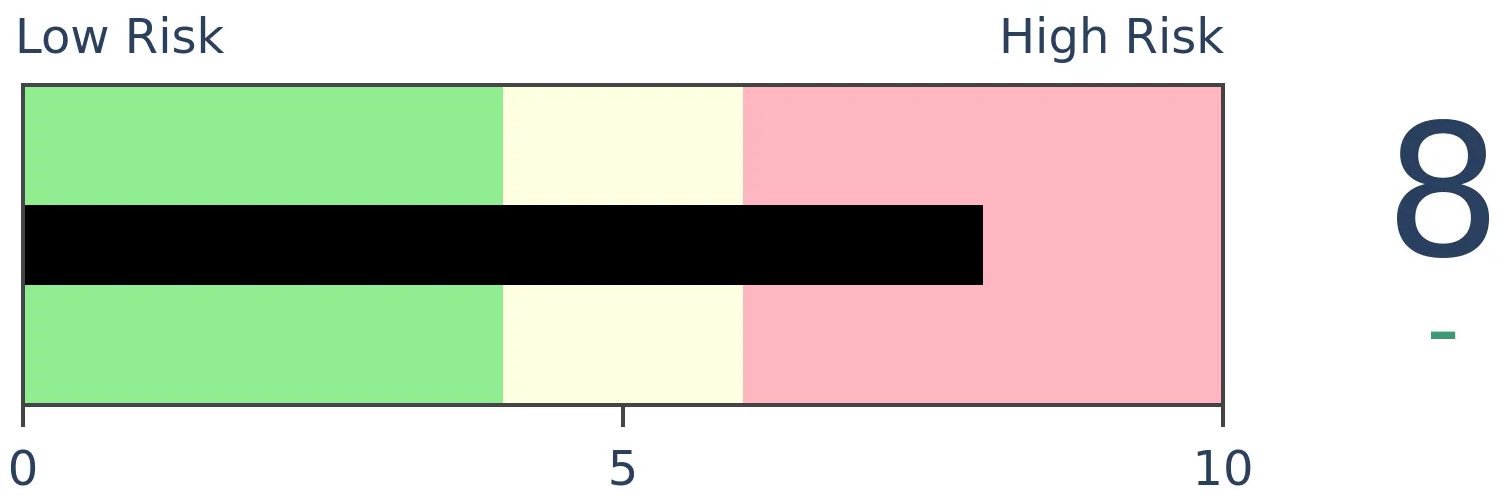

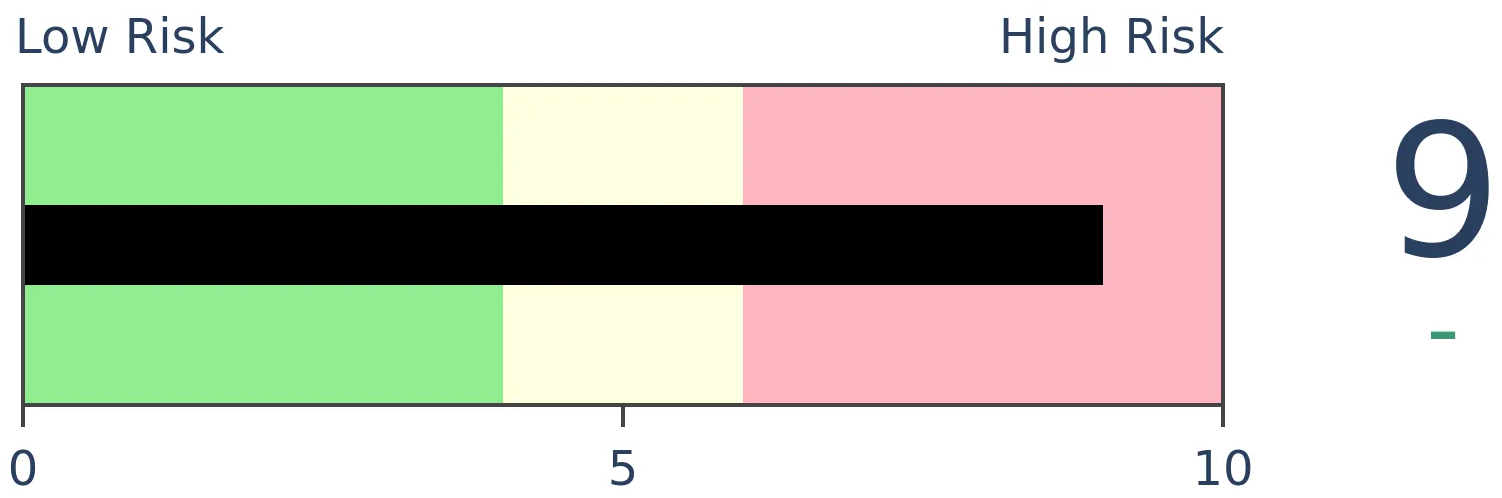

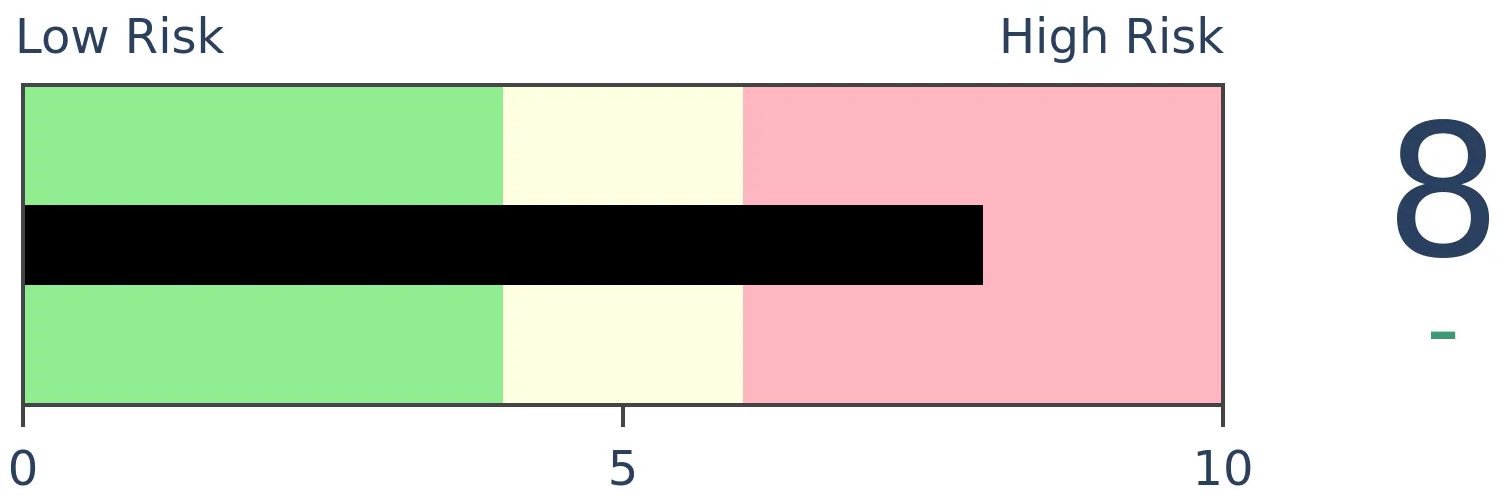

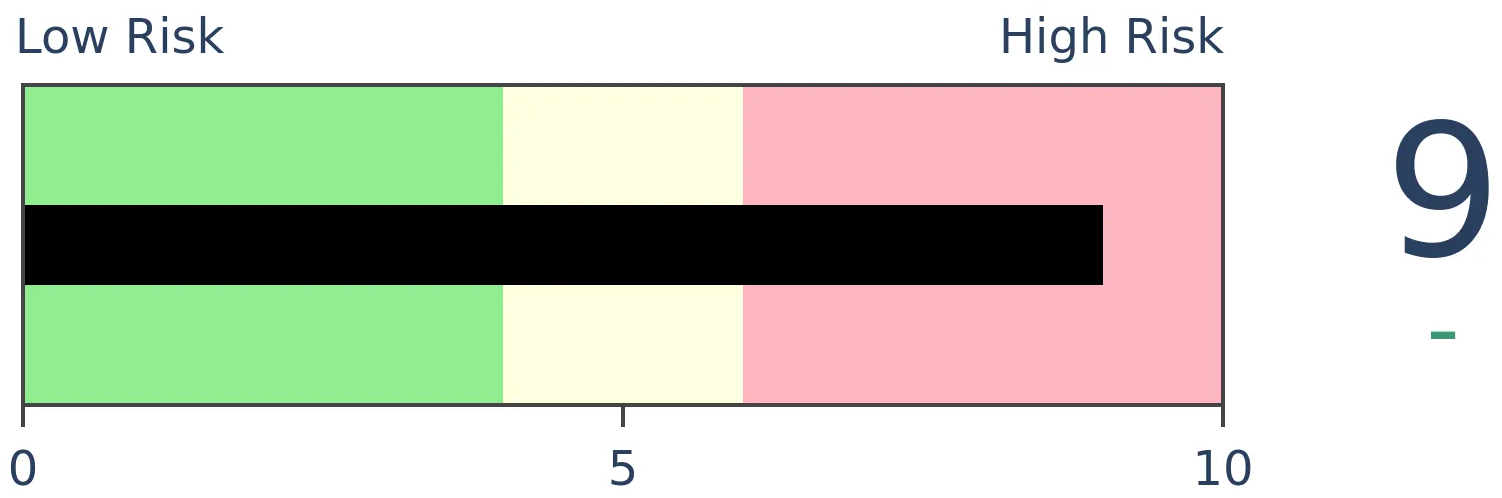

Stocks Medium-Term

|

|

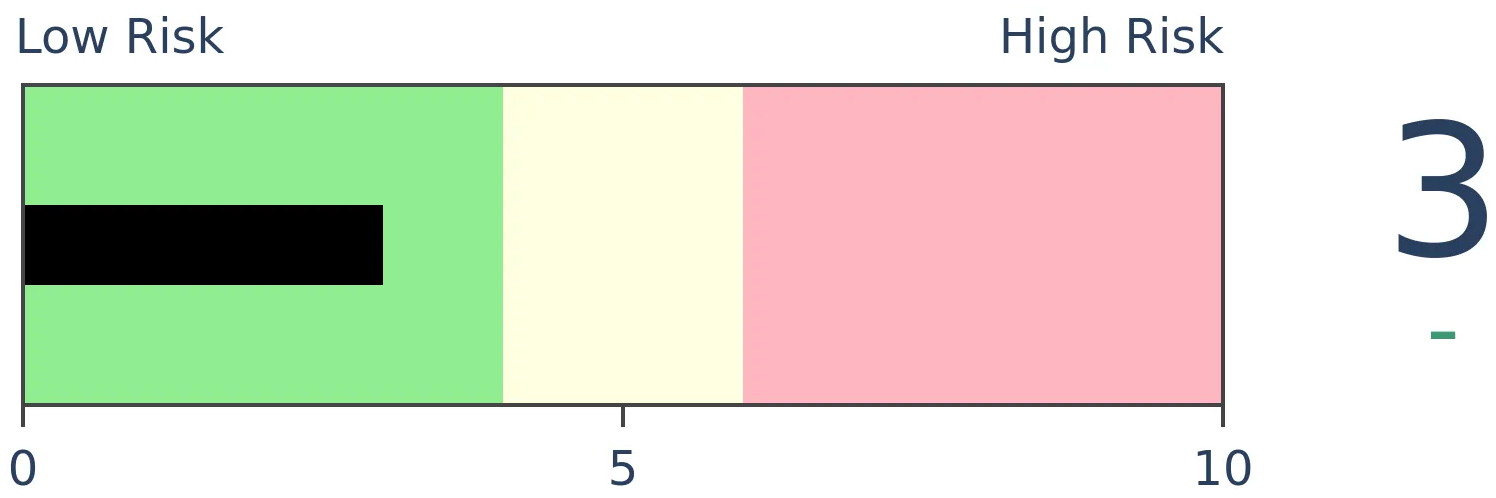

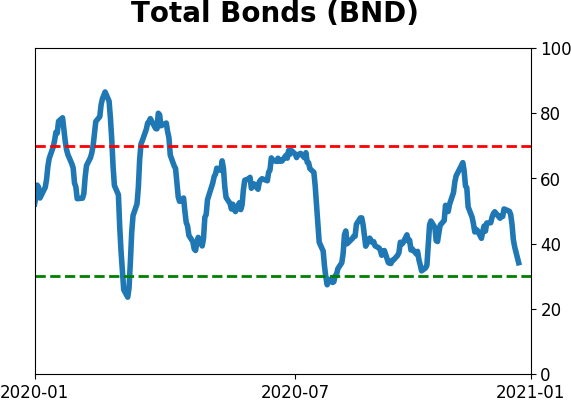

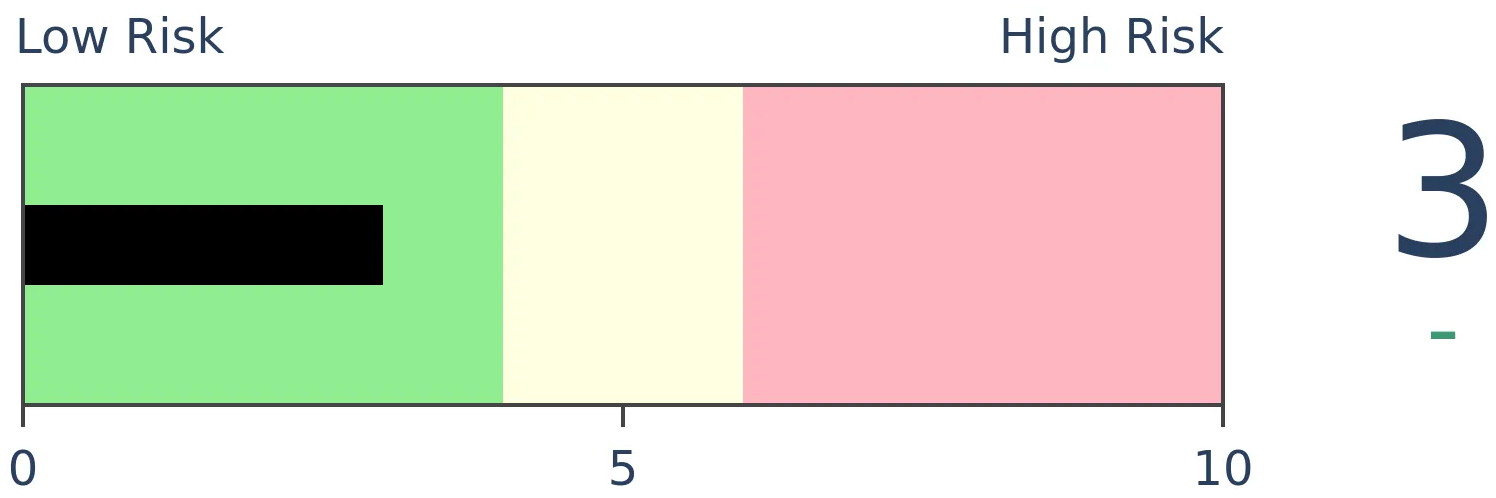

Bonds

|

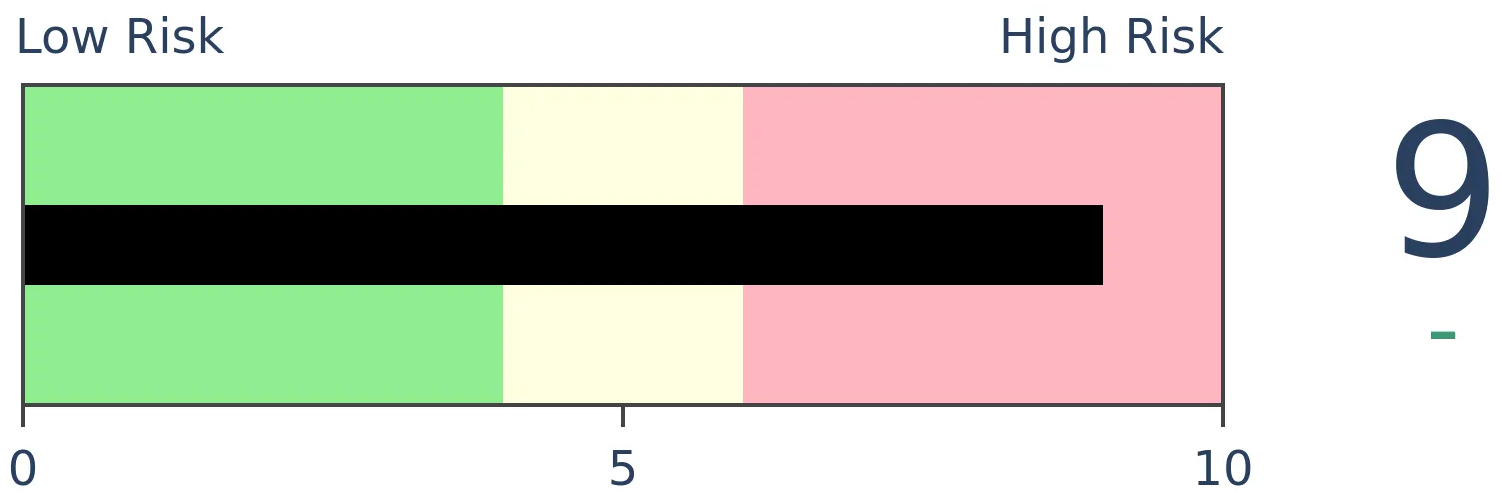

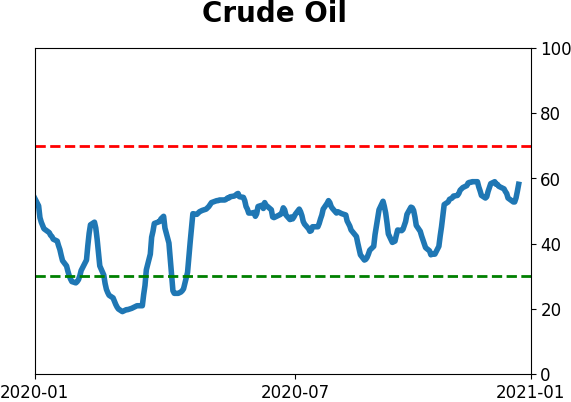

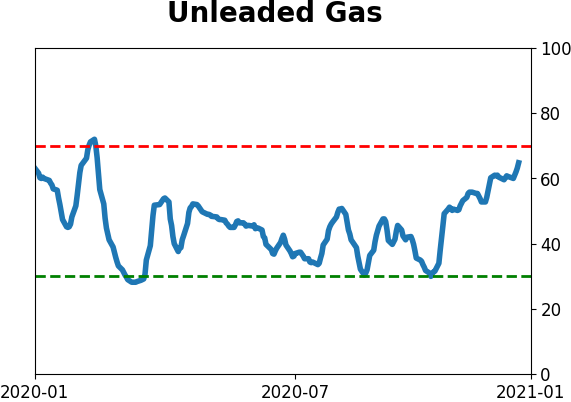

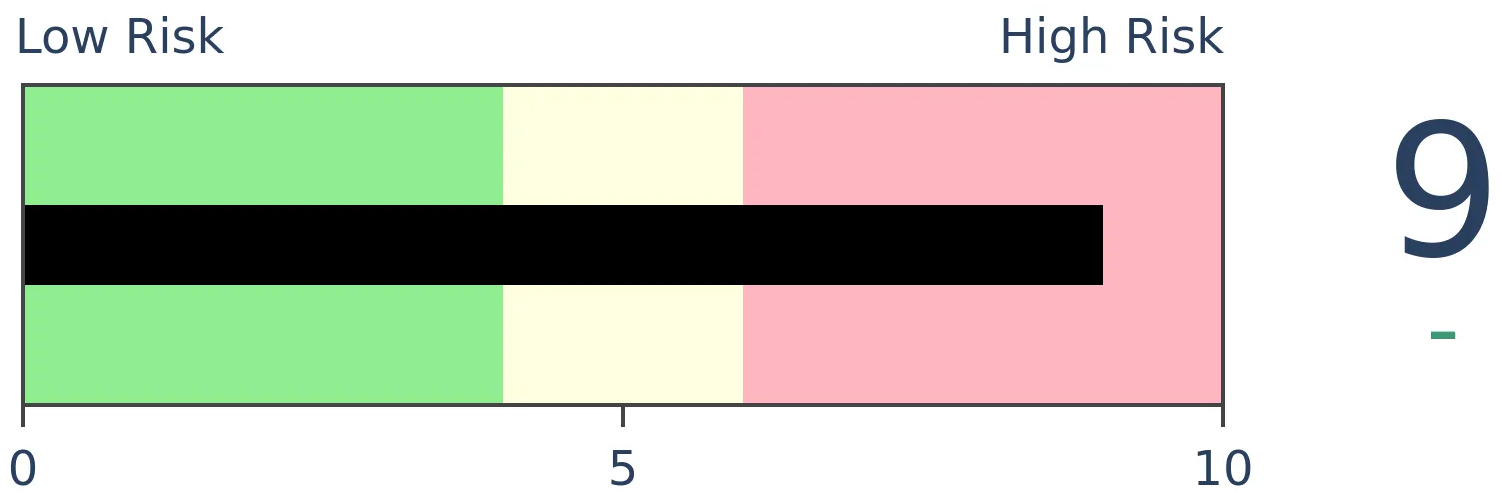

Crude Oil

|

|

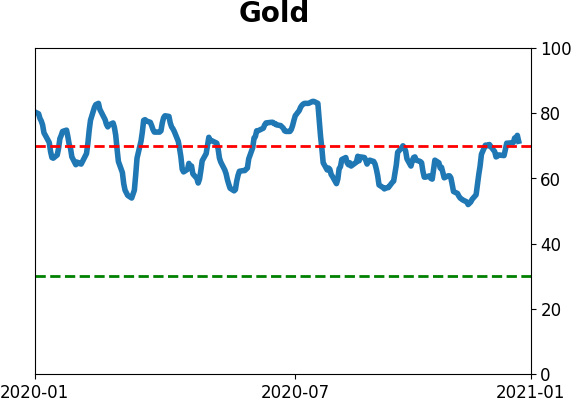

Gold

|

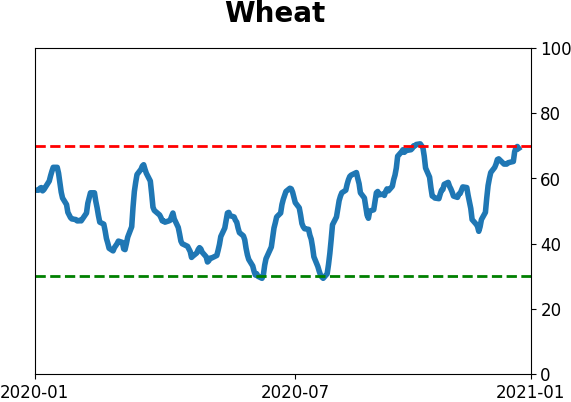

Agriculture

|

|

Research

BOTTOM LINE

A model of panic and euphoria created by Citigroup has soared to a multi-decade high. Using proxy calculations, our estimate of the model just hit the 3rd highest reading in 30 years, with other high readings preceding poor returns for stocks.

FORECAST / TIMEFRAME

None

|

If you're invested in one of the groups that has skyrocketed in the past couple of weeks, then it would only be human nature to feel a little giddy. Euphoric, even.

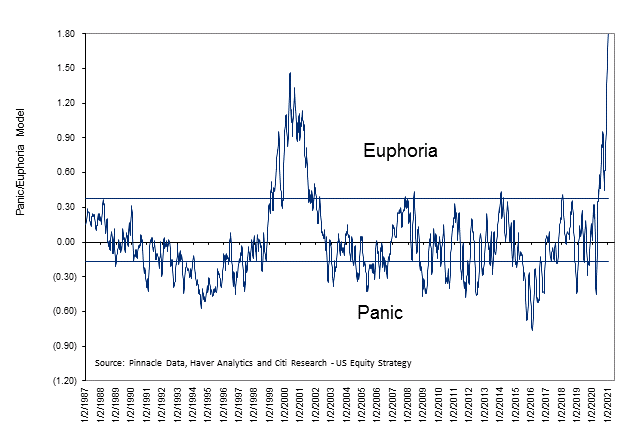

Based on a popular model, that's exactly how many investors are feeling at the moment, as the Citi Panic / Euphoria model has soared to a record high.

When we looked at this in June, we noted that based on publicly released data, the model's inputs are somewhat unusual. It includes:

- NYSE short interest

- Margin debt

- Nasdaq vs NYSE volume

- Investor's Intelligence survey

- AAII survey

- Retail money market funds

- Put/call ratios

- Commodities prices

- Gasoline prices

And that based on those criteria, we'd make assumptions that the following extremes would show euphoria:

- High optimism in the AAII and II surveys (investors think stocks will rise)

- Low put/call ratio (options traders betting on rising prices)

- Low short interest ratio (short-sellers covering bets against the market)

- High margin debt (investors pledging shares against loans)

- High Nasdaq volume relative to the NYSE (speculative fervor)

- Low retail money market fund assets (investors see no need for cash cushion)

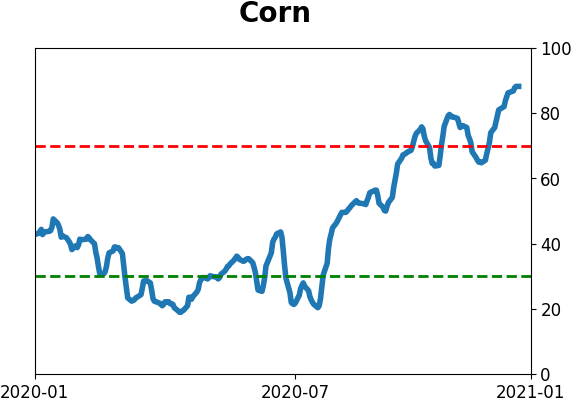

- High commodities prices (bets on economic growth)

- High gasoline prices (lots of mobility as the economy hums)

We adjusted the lookback we used to create the proxy model, and it follows the published one a bit better but is still not as extreme.

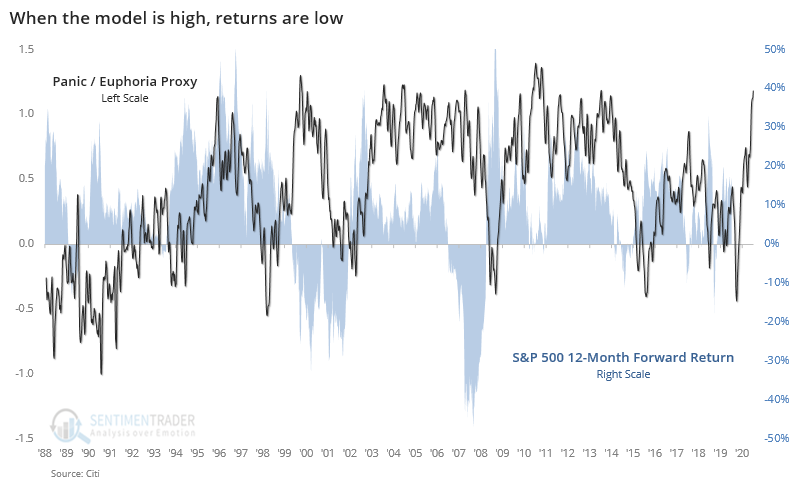

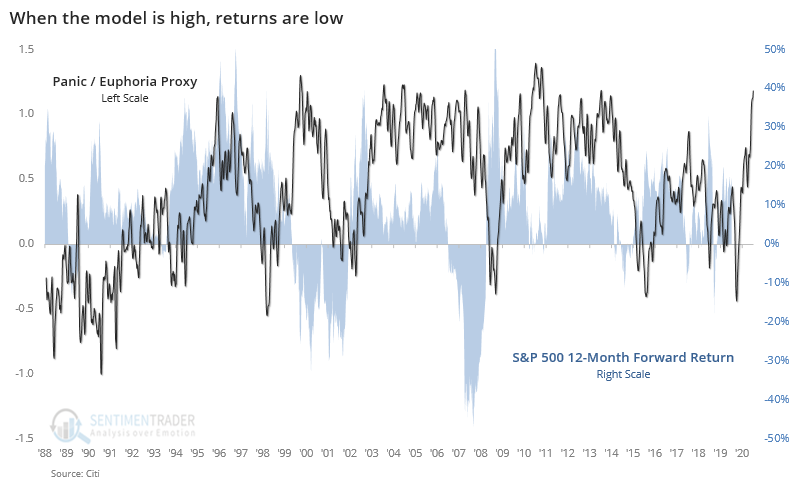

The chart below shows a fairly clear contrary nature to the model - when it's high, the S&P's returns over the next year tend to be low; when the model is low, the S&P's returns are high.

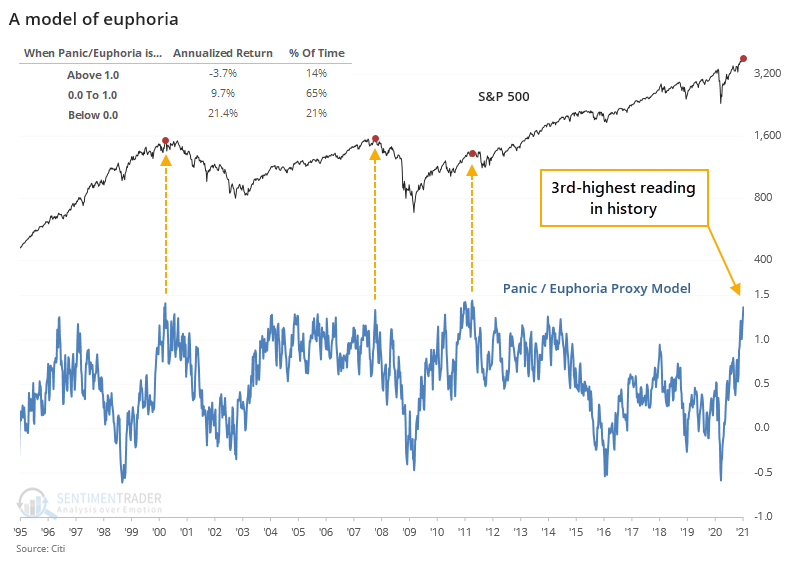

Whenever this proxy was above 1, occurring about 14% of the time since 1988, the S&P 500 returned an annualized -3.7%, compared to an impressive +21.4% when it was below zero.

Even though this proxy isn't as extreme as the one shown above, it did just record the 3rd-highest reading in 30 years.

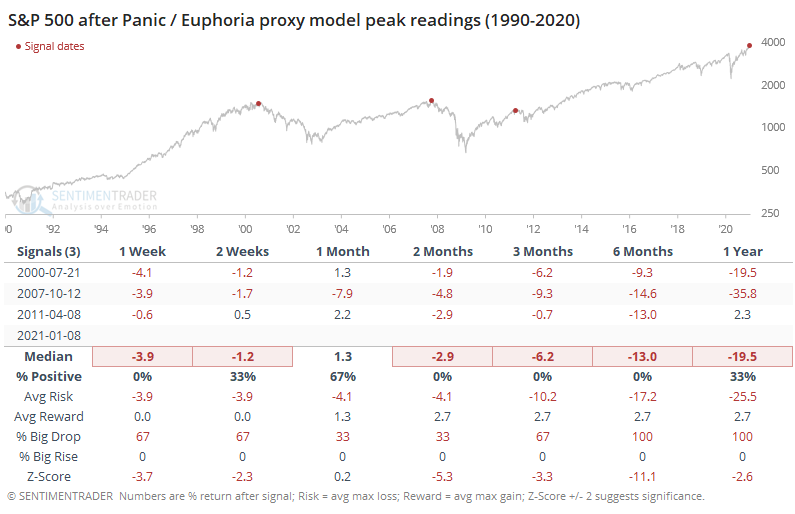

Not surprisingly, forward returns after those peak euphoria readings were stomach-turning.

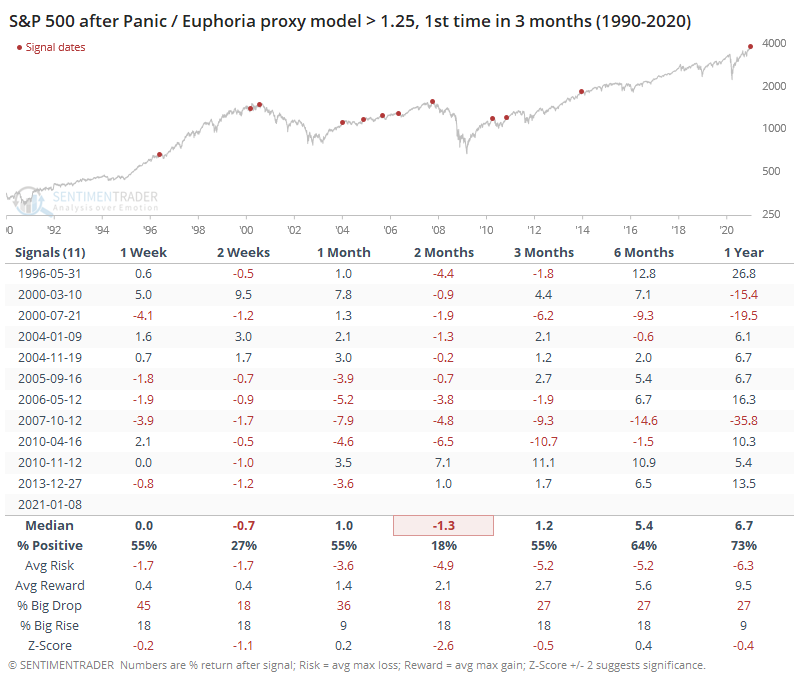

Even if we use lesser extremes, times when the average input was more than 1.25 standard deviations above its average, it preceded terrible returns over the next 2 months.

The biggest difference between now and most of those other signals is quality and momentum. As we saw on Friday, there have been tremendous thrusts underlying the market (though with some recent, isolated oddities that are troubling). As Dean pointed out, the S&P's recent new highs have been high-quality, not yet showing anywhere near the kind of deterioration we saw at other euphoric peaks.

The setup is ripe for a sustained pullback, and risk appears high relative to reward. We're just not quite seeing the kind of consistent internal weakness that preceded most of the sustained and deep corrections following other overly-optimistic-to-euphoric bouts of sentiment.

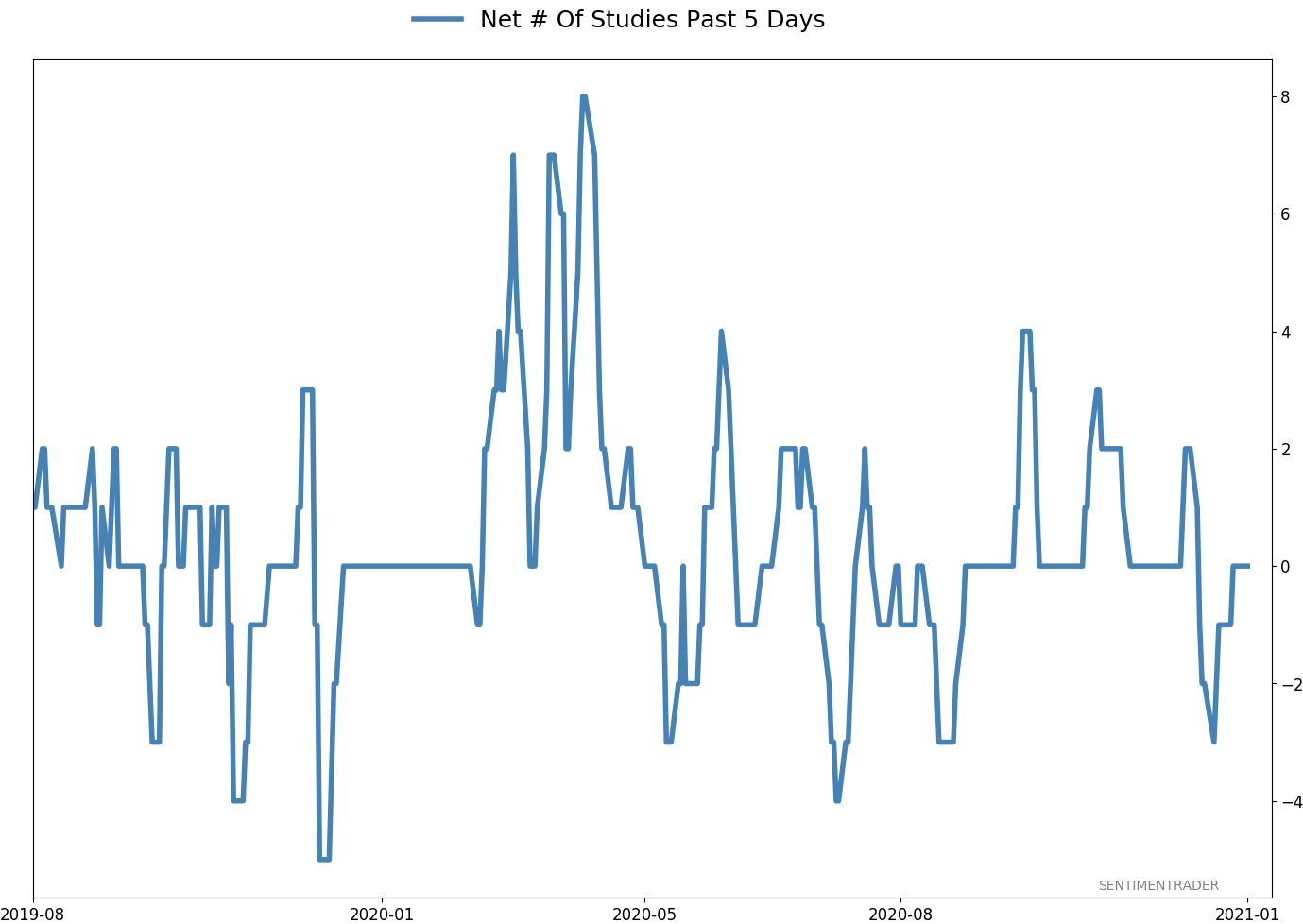

Active Studies

| Time Frame | Bullish | Bearish | | Short-Term | 0 | 0 | | Medium-Term | 2 | 1 | | Long-Term | 14 | 2 |

|

Indicators at Extremes

Portfolio

| Position | Description | Weight % | Added / Reduced | Date | | Stocks | 10.6% VWO, 10.1% XLE, 8.5% RSP, 8.3% PSCE | 37.5 | Added 3% | 2021-01-05 | | Bonds | 10% BND, 10% SCHP, 10% ANGL | 27.8 | Reduced 0.1% | 2020-10-02 | | Commodities | GCC | 2.3 | Reduced 2.1%

| 2020-09-04 | | Precious Metals | GDX | 9.8 | Added 4.8% | 2020-12-01 | | Special Situations | | 0.0 | Reduced 5% | 2020-10-02 | | Cash | | 22.6 | | |

|

Updates (Changes made today are underlined)

There hasn't been much that changed in recent weeks, with sky-high sentiment on many measures receding a bit, but that's not necessarily a good sign, just ask February 2020. We still have the lingering positives from all the breadth thrust last year, as late as October and November. Those have a very good historical record at preceding higher prices over a longer time frame. Of more immediate concern is the explosion in speculation in the most leveraged parts of the market. So far, that hasn't translated to price troubles, though there have been more oddities n the latter half of December than we'd seen since August, like the major indexes rising but on very poor breadth. I continue to avoid tech- and cap-heavy indexes, and don't see that changing any time soon. Energy stocks are doing what they should, and I added a bit more there. I'm not a momentum trader and do not focus on pyramiding positions in this account - it's more about protecting capital - but I like the setup on a long-term time frame. RETURN YTD: 2.7% 2020: 8.1%, 2019: 12.6%, 2018: 0.6%, 2017: 3.8%, 2016: 17.1%, 2015: 9.2%, 2014: 14.5%, 2013: 2.2%, 2012: 10.8%, 2011: 16.5%, 2010: 15.3%, 2009: 23.9%, 2008: 16.2%, 2007: 7.8%

|

|

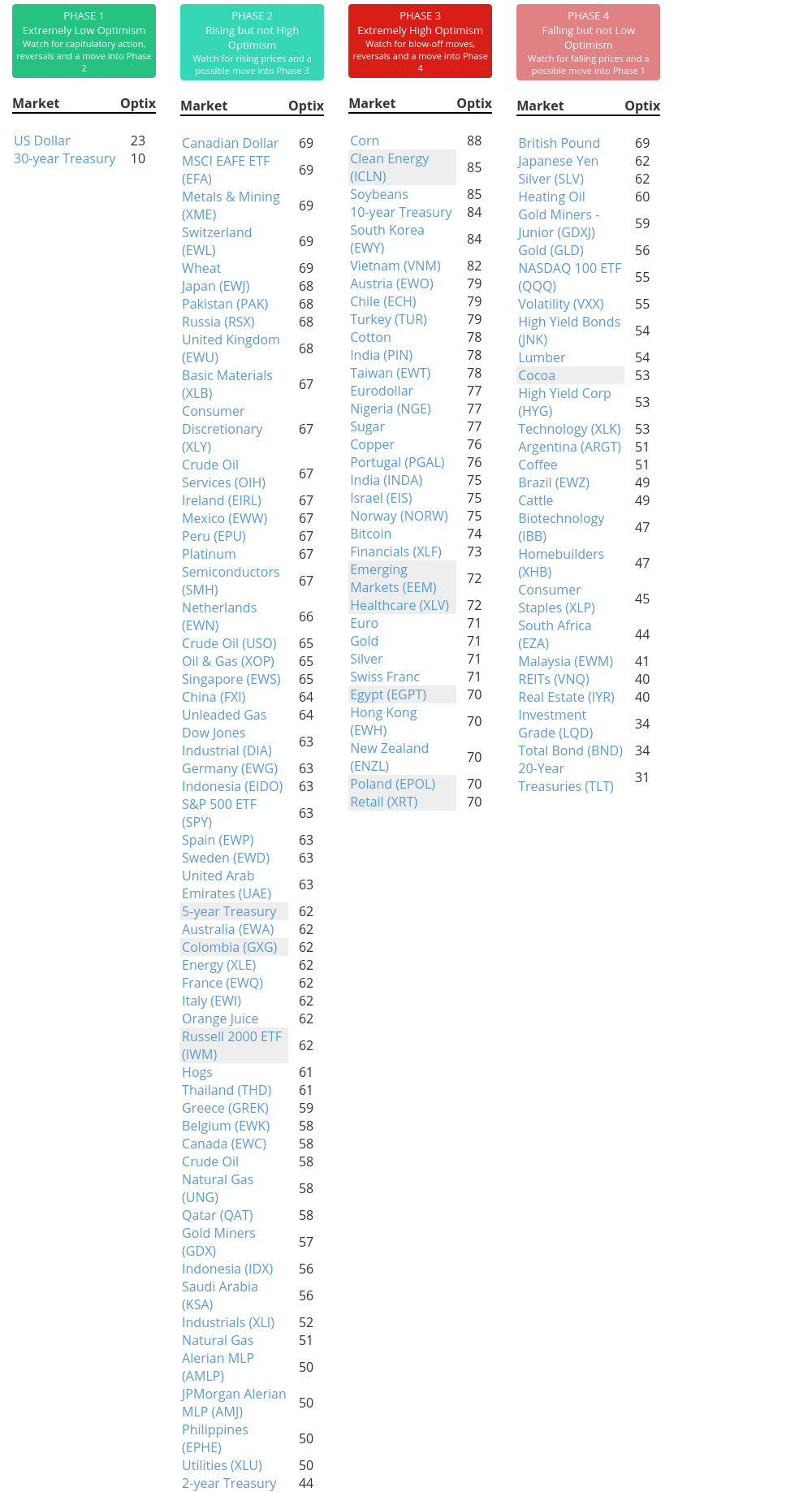

Phase Table

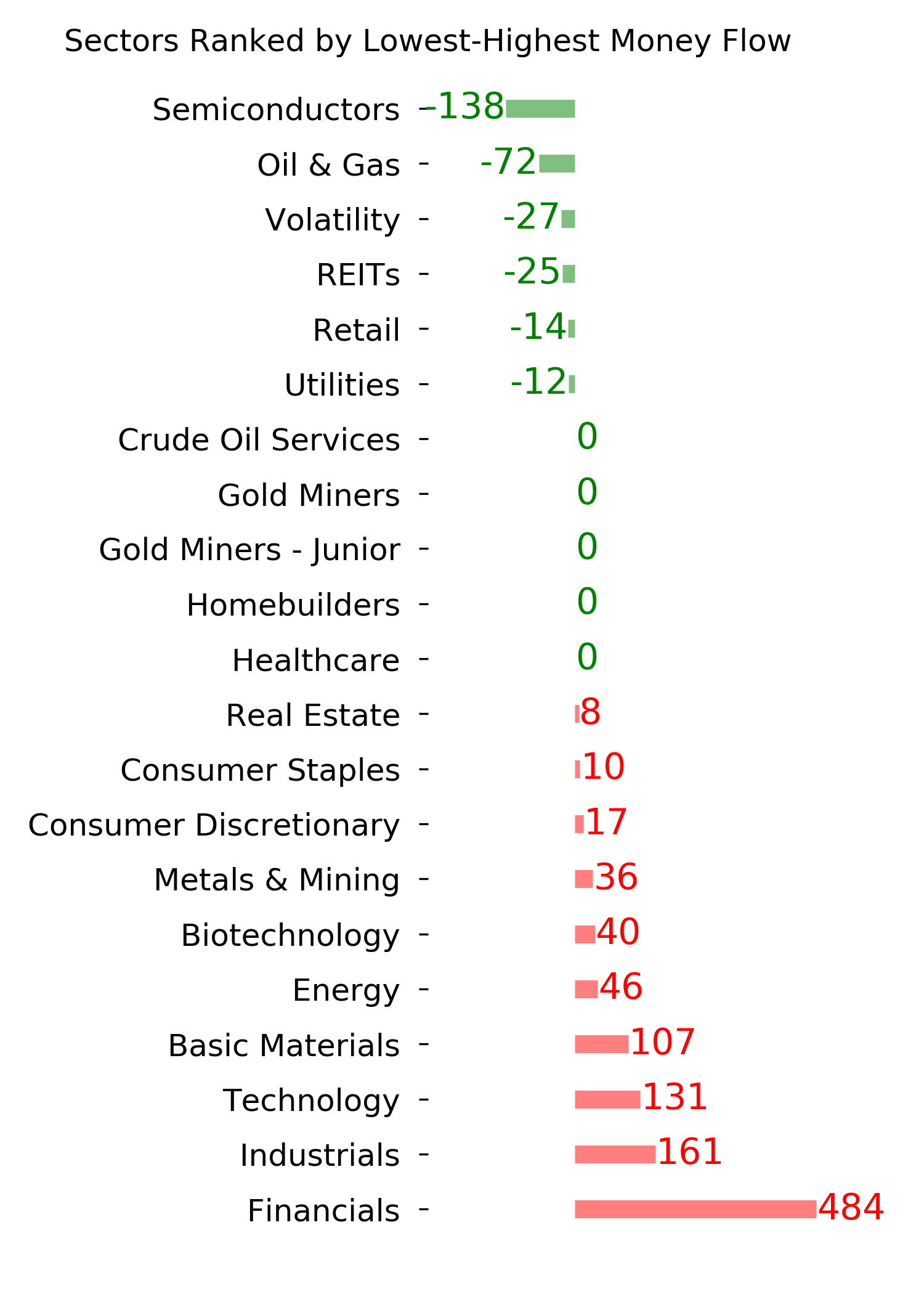

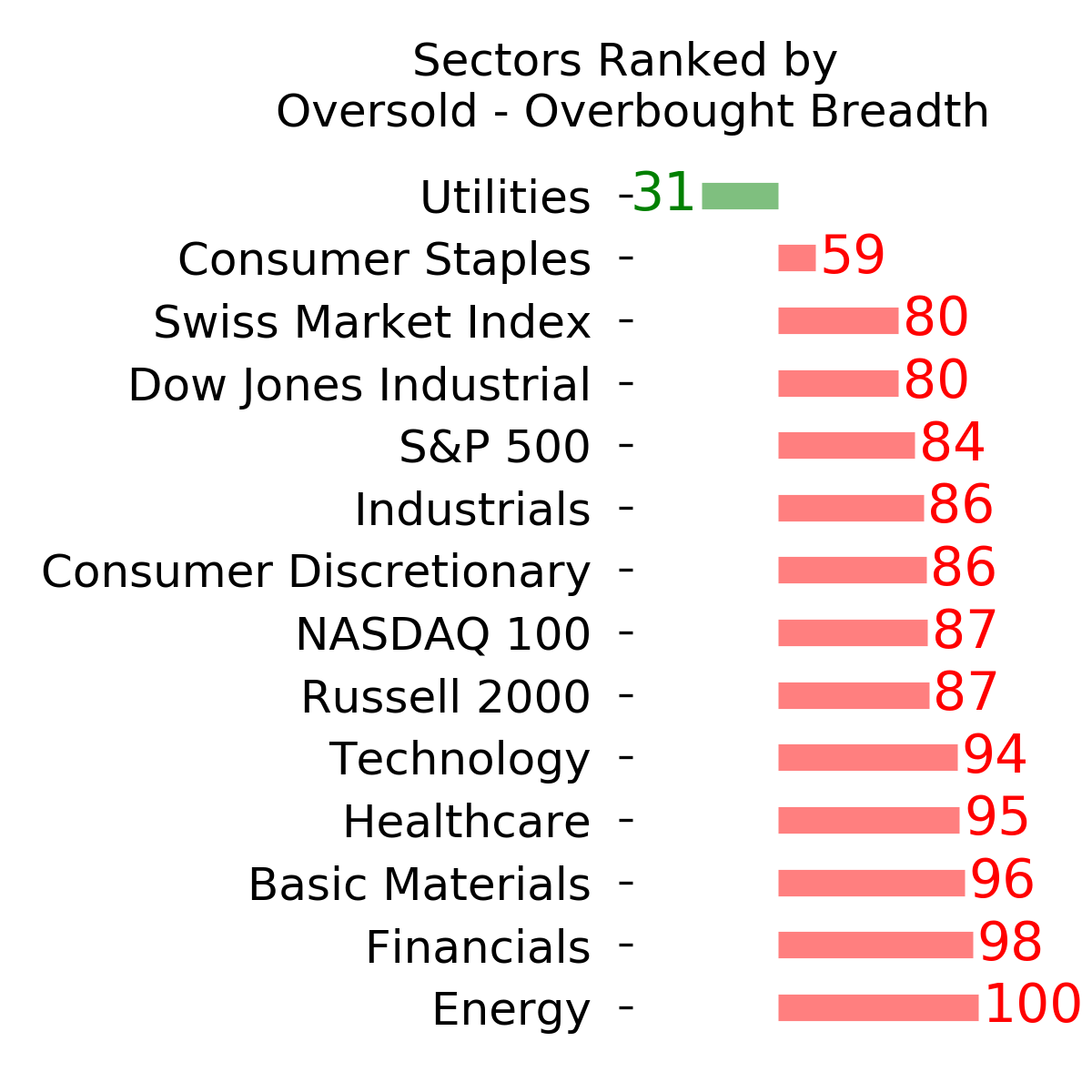

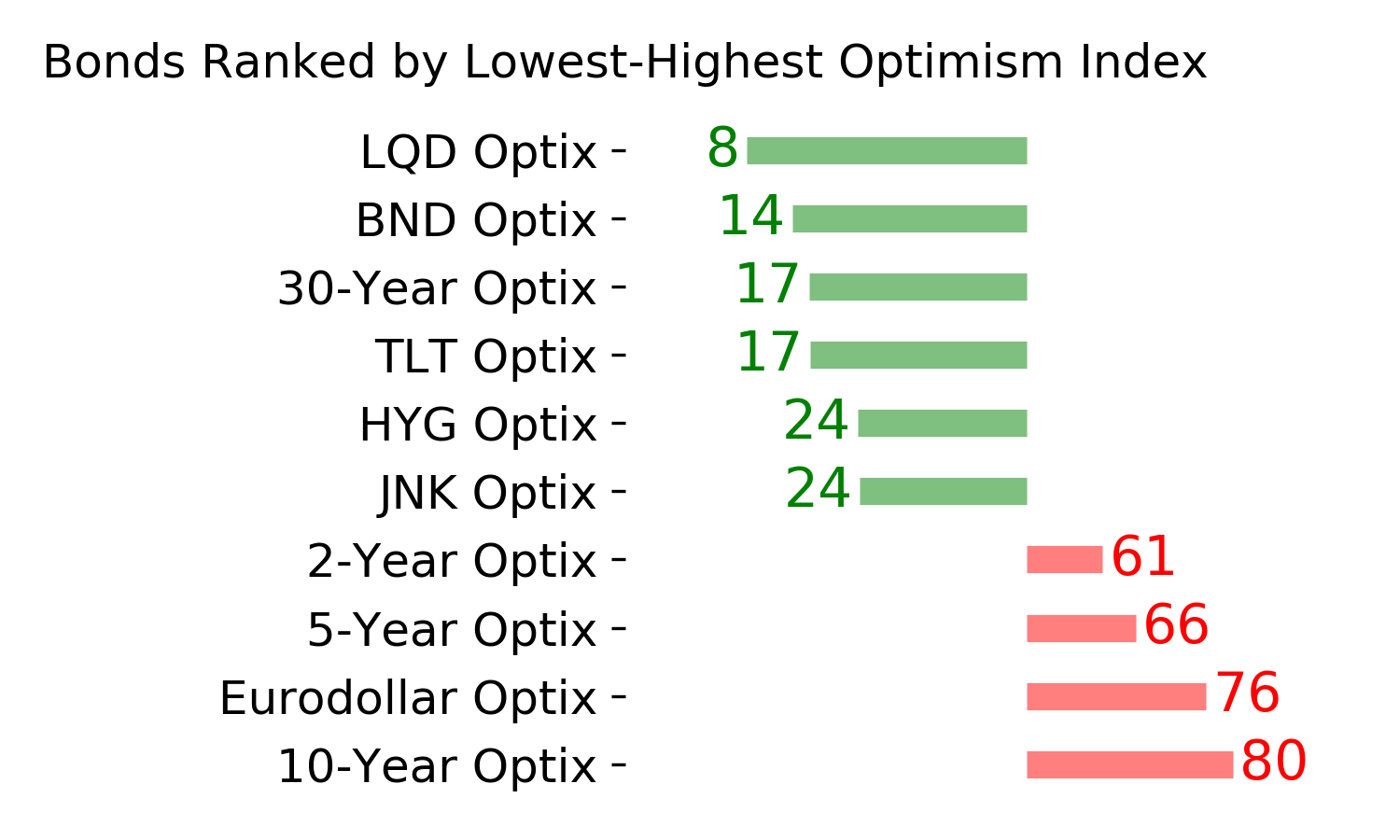

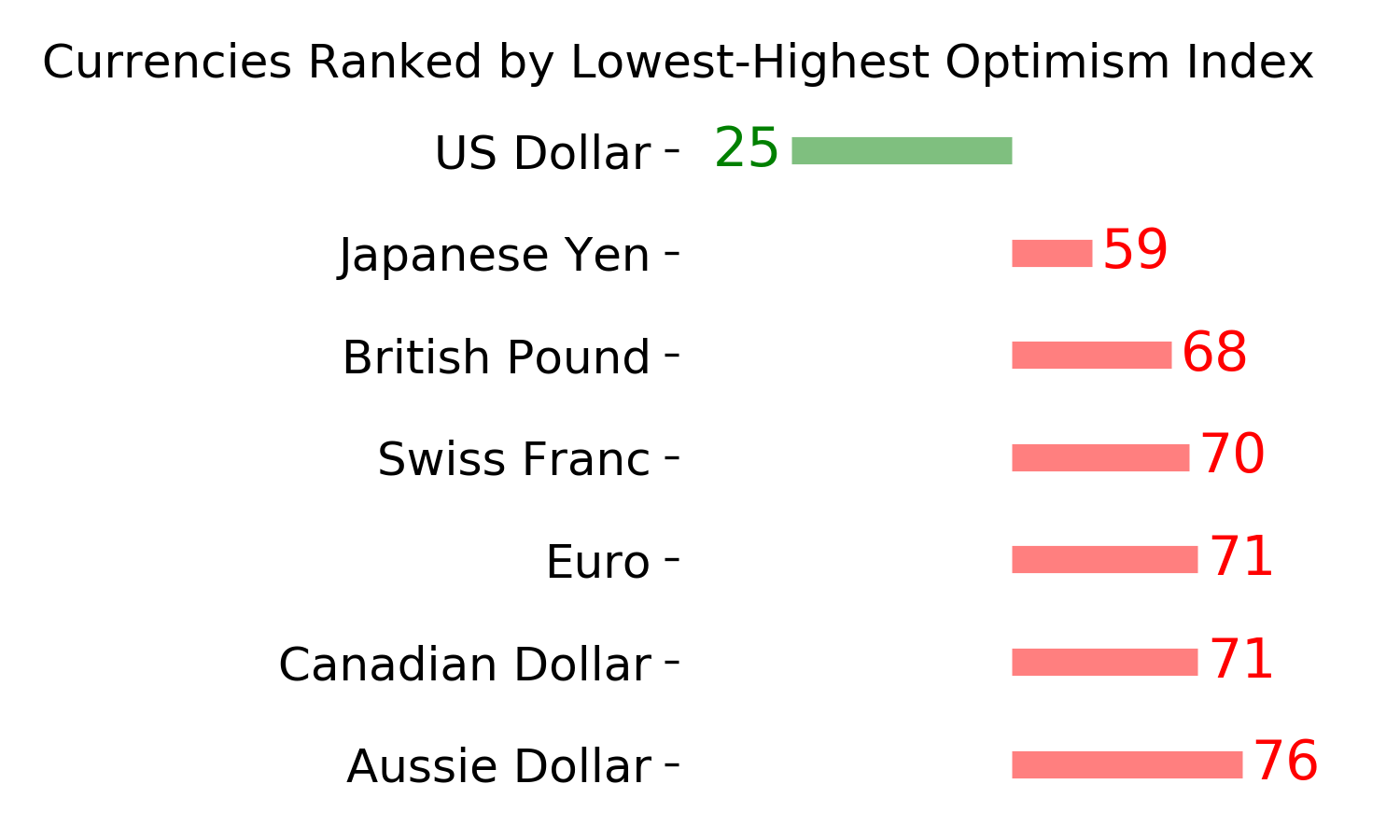

Ranks

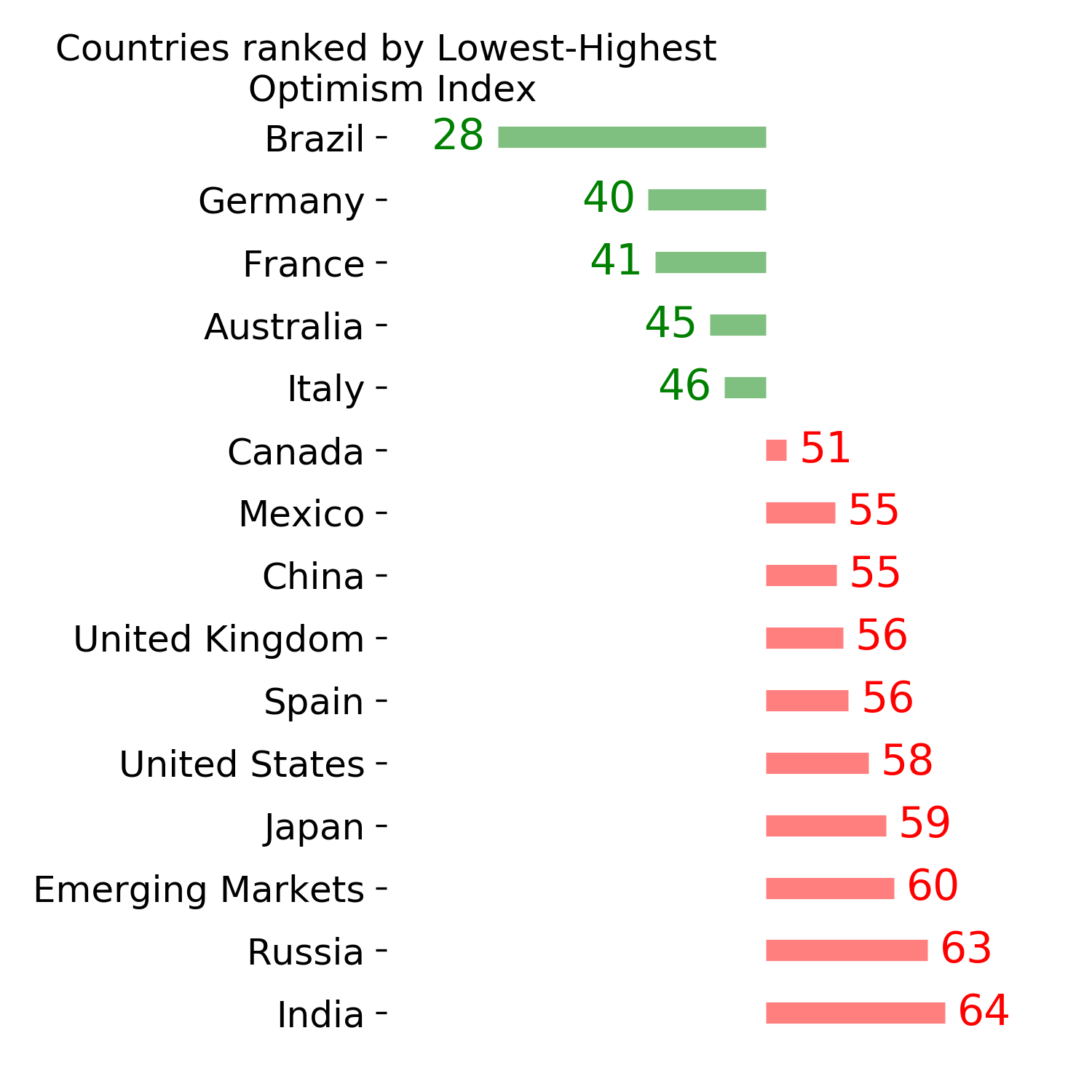

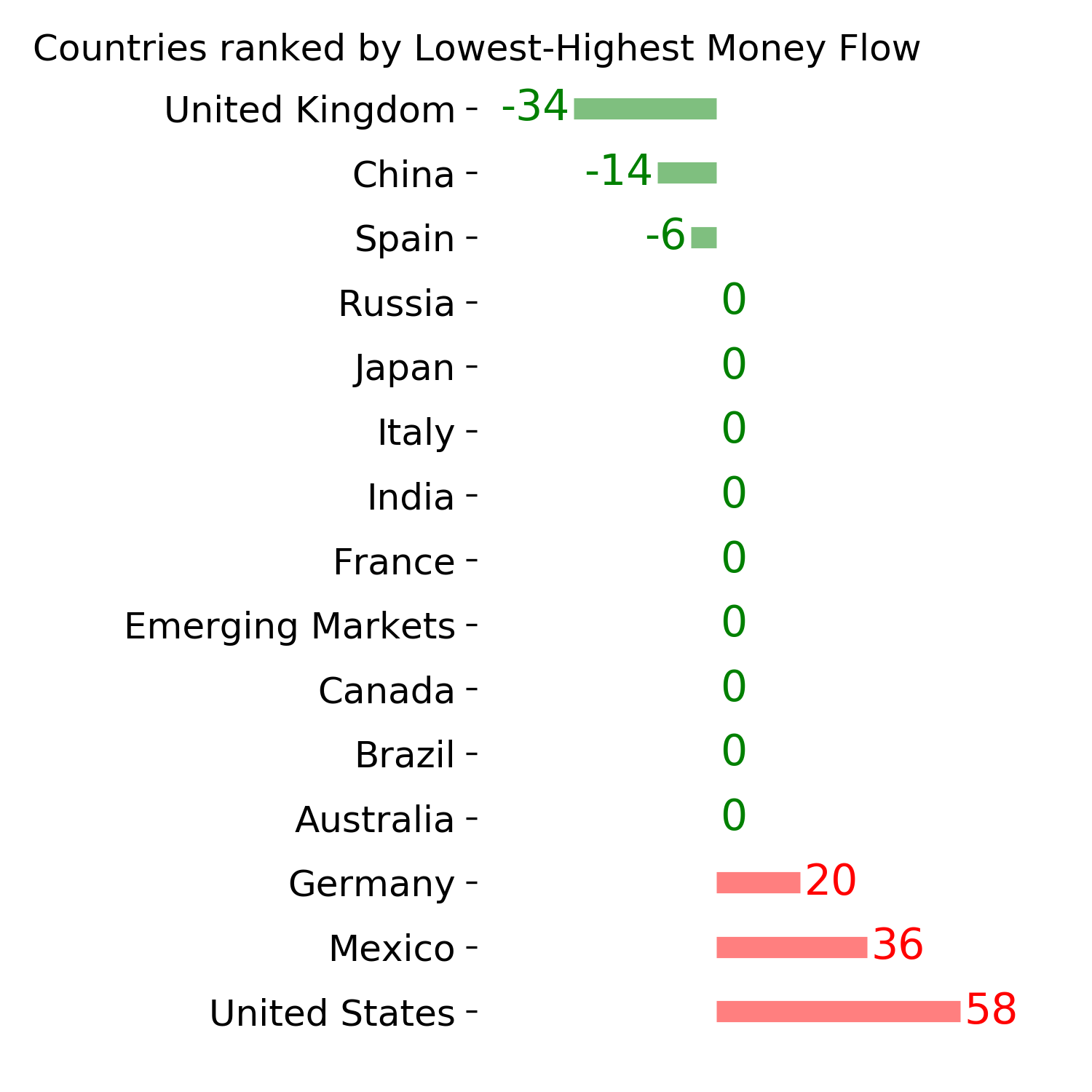

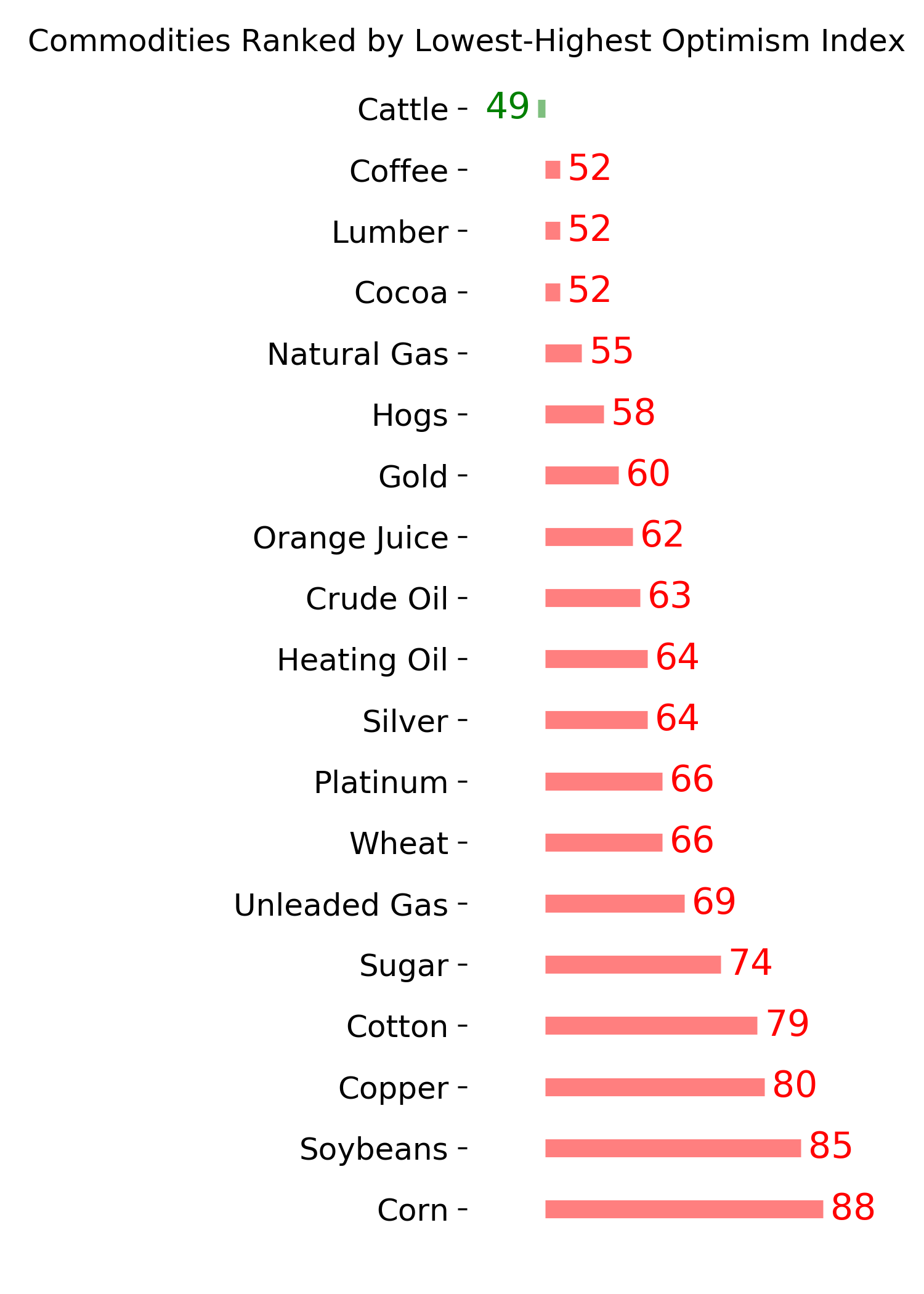

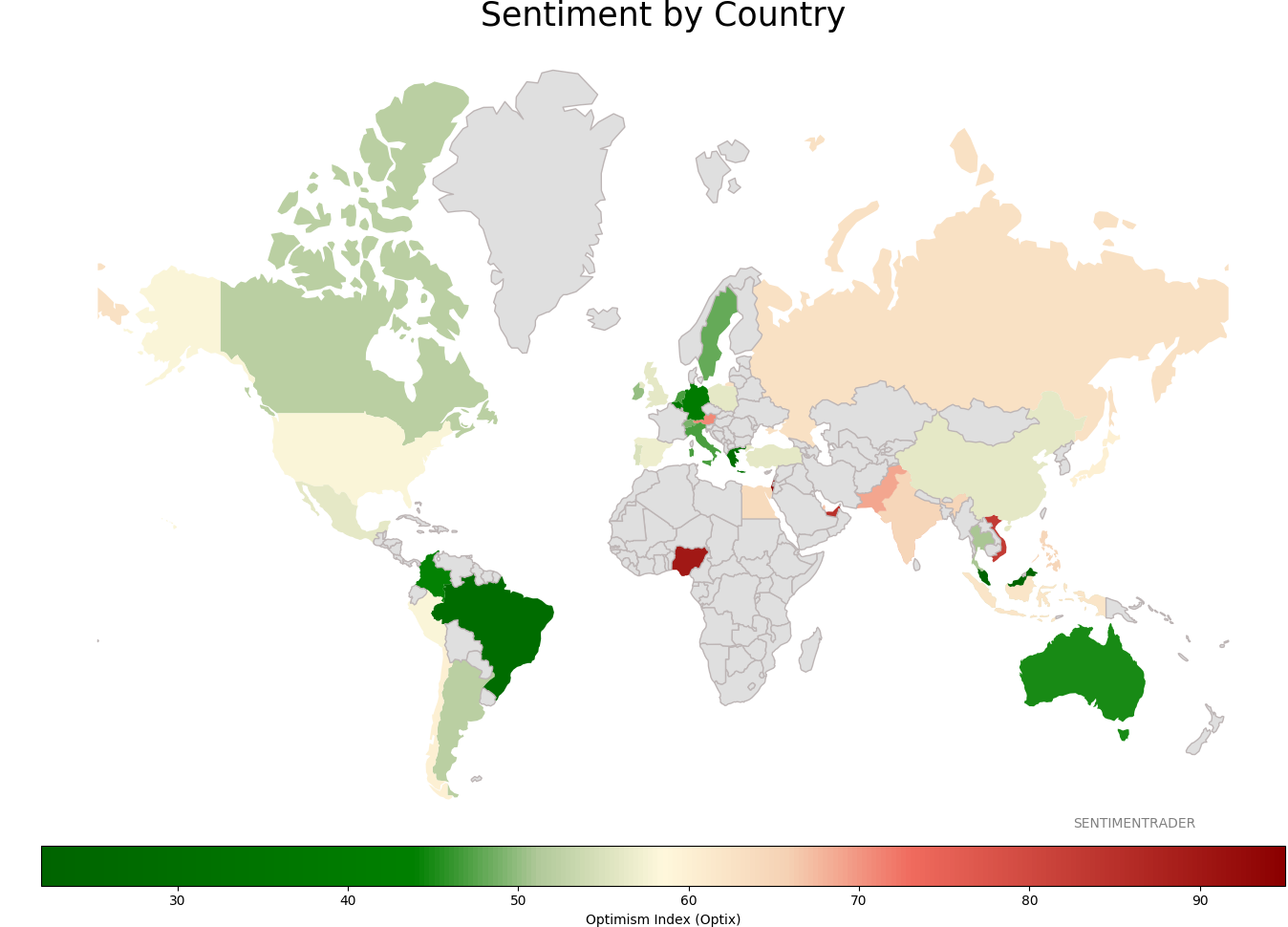

Sentiment Around The World

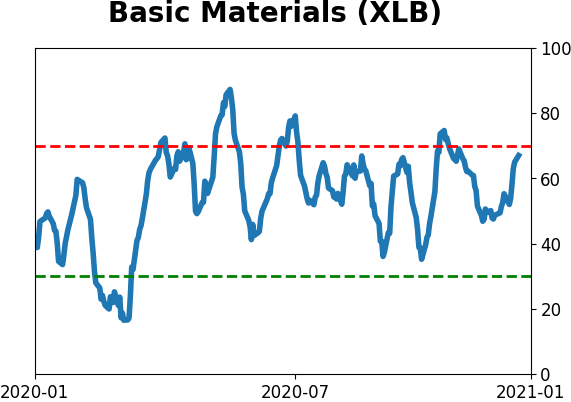

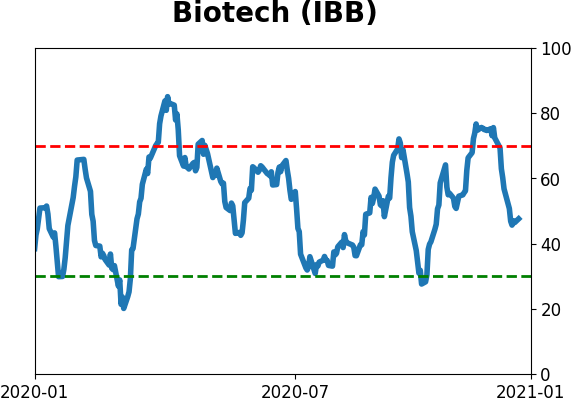

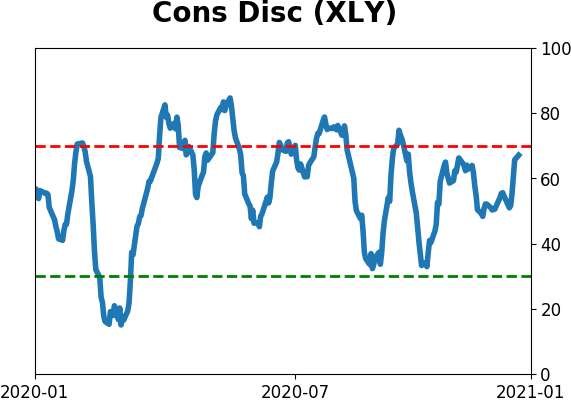

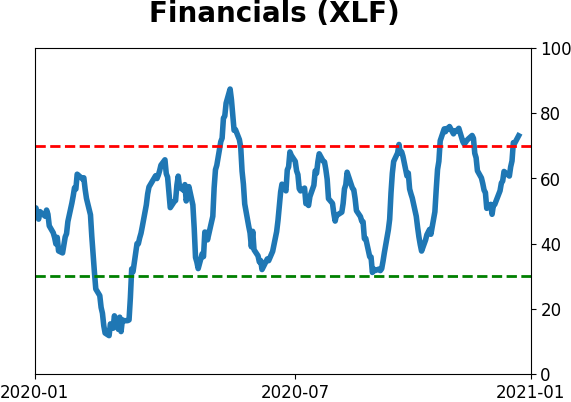

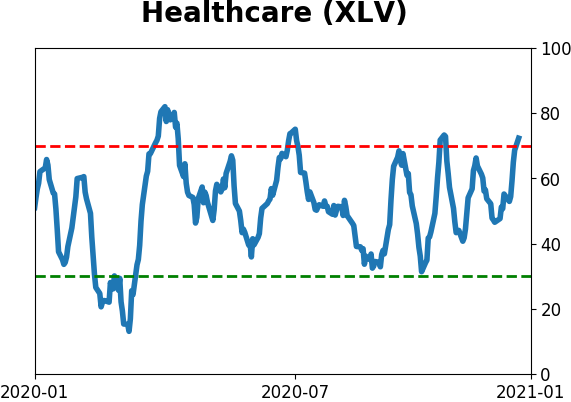

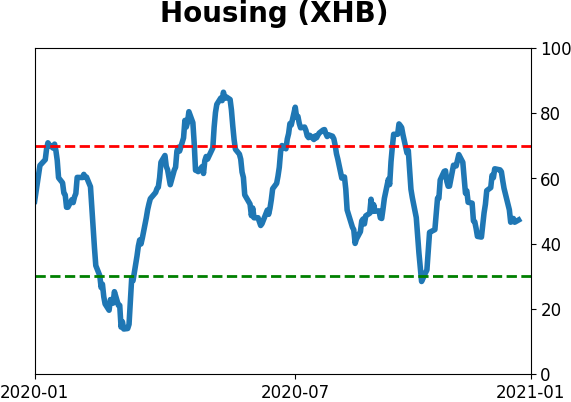

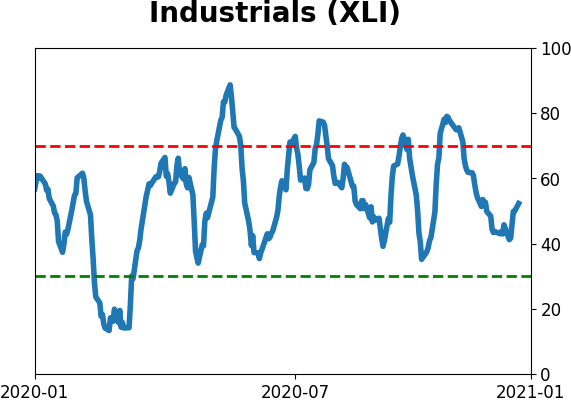

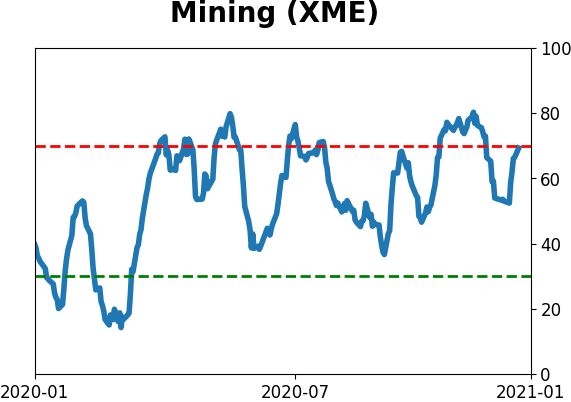

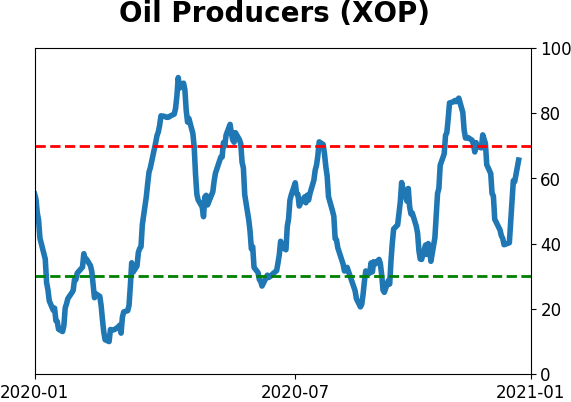

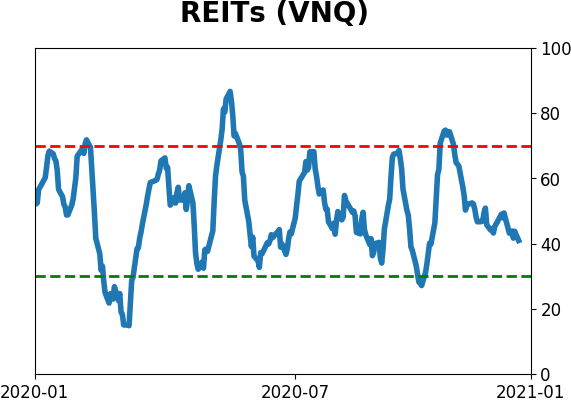

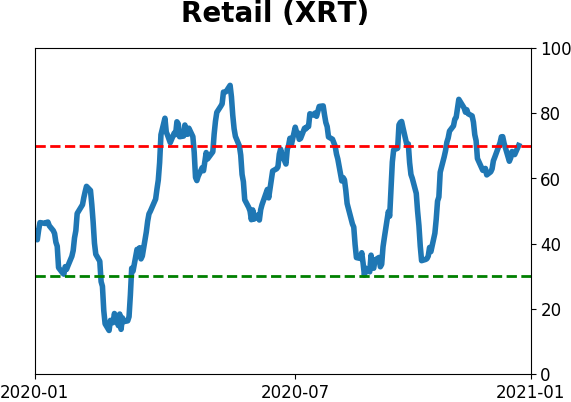

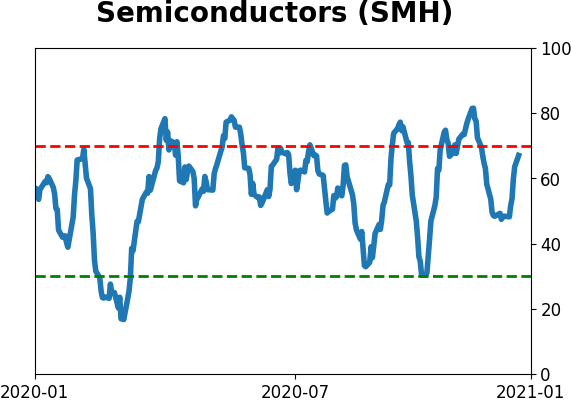

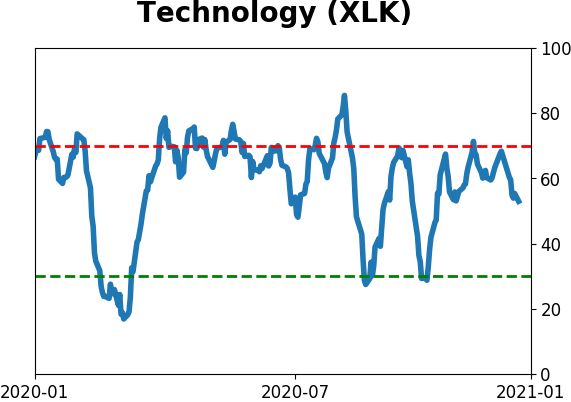

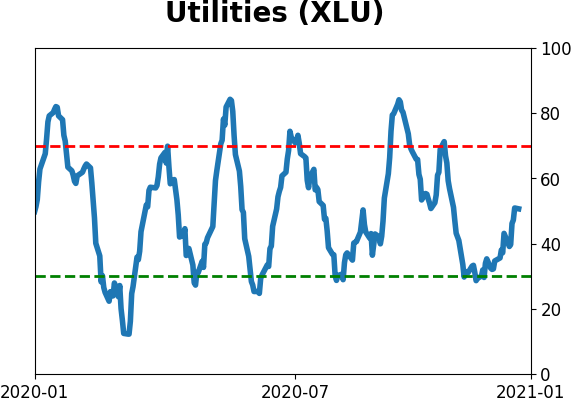

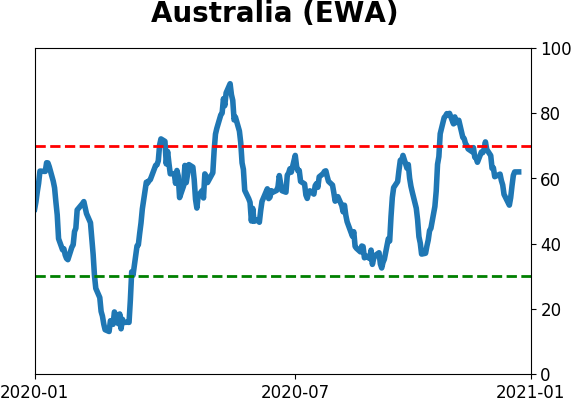

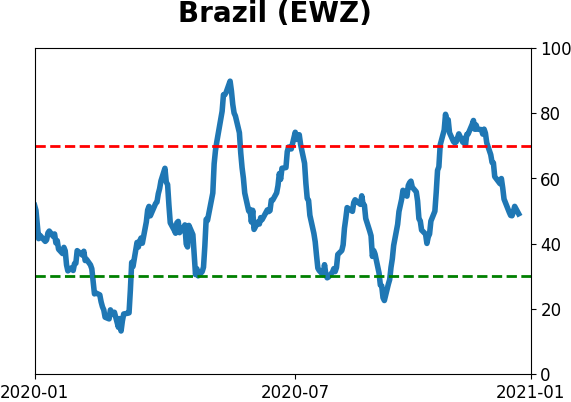

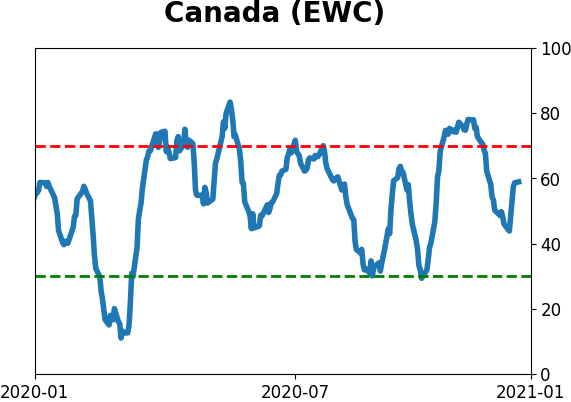

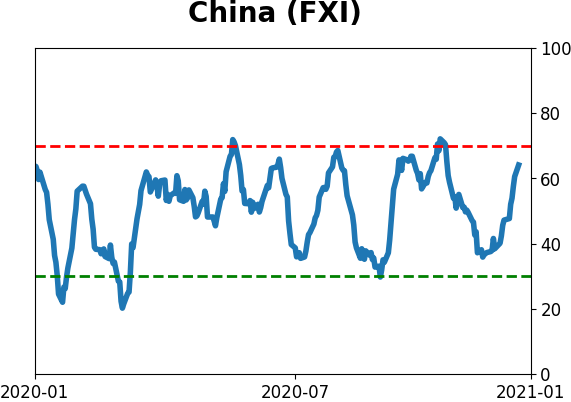

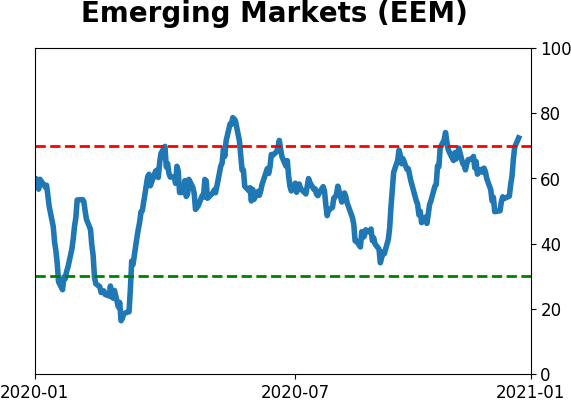

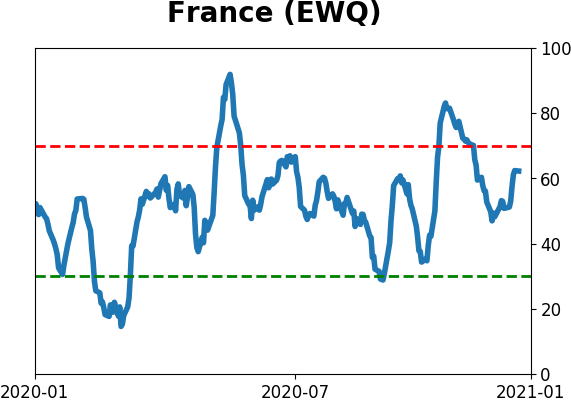

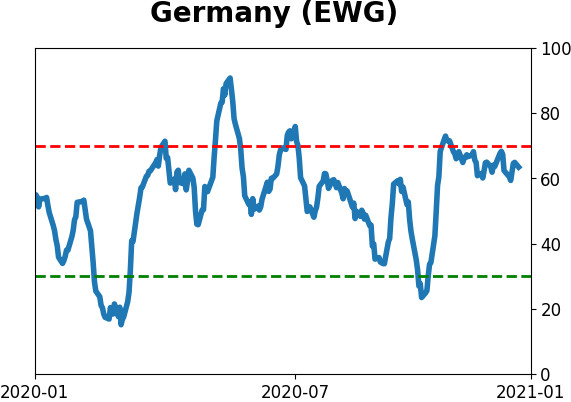

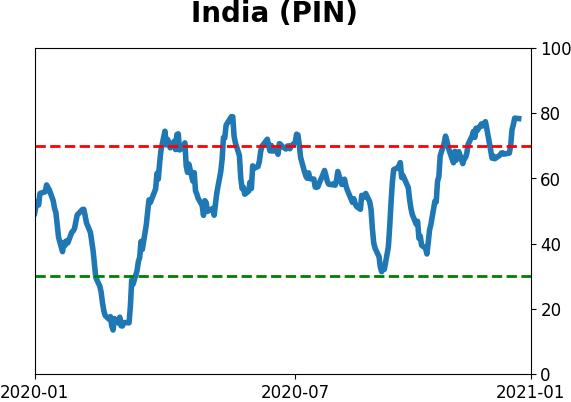

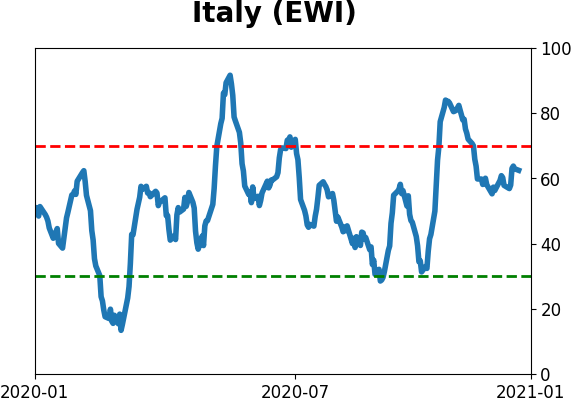

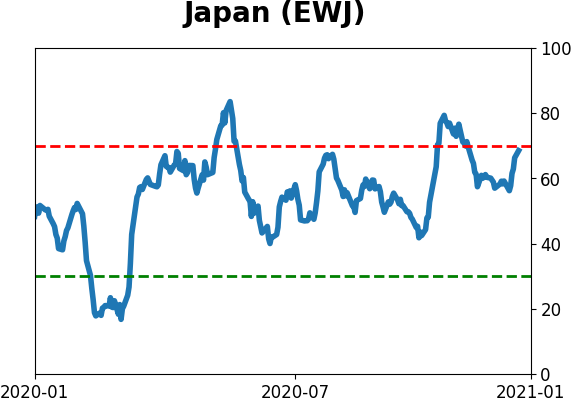

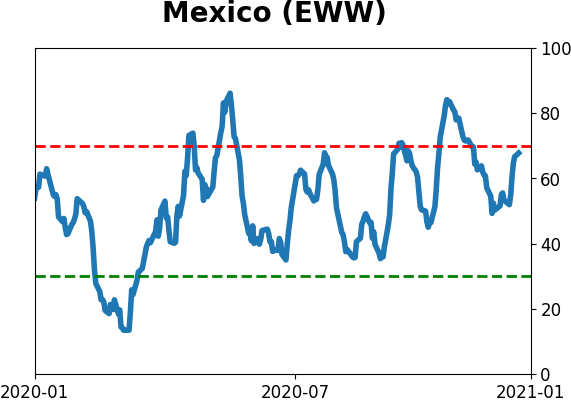

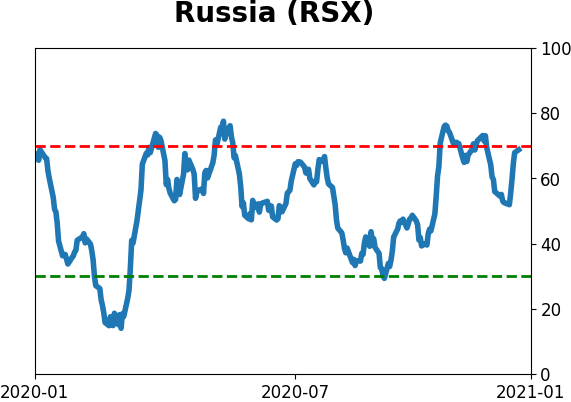

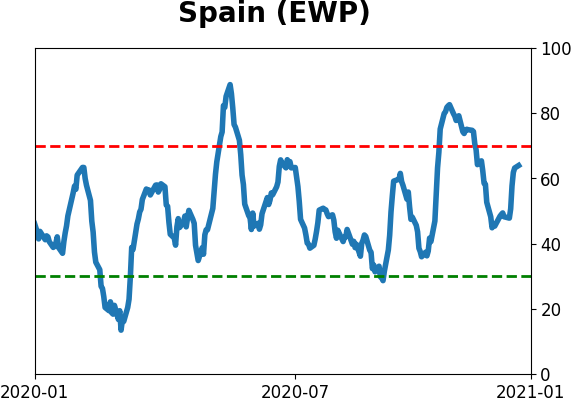

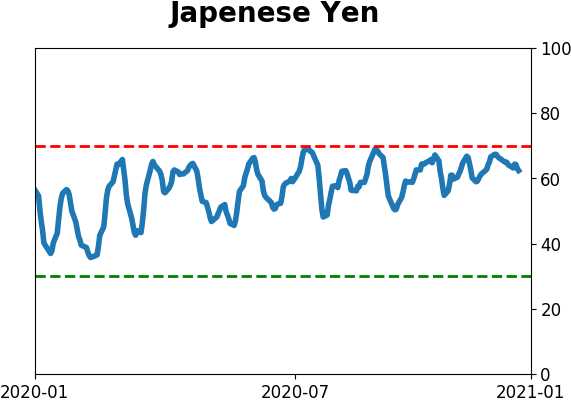

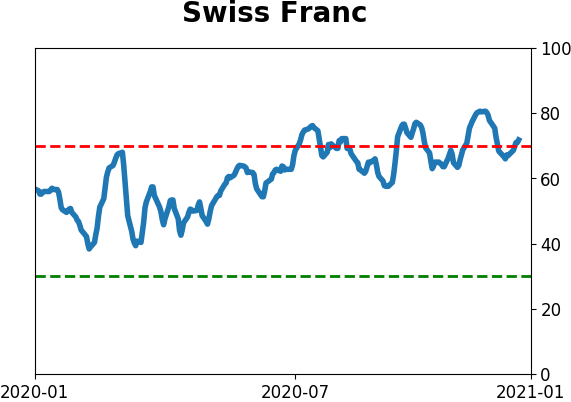

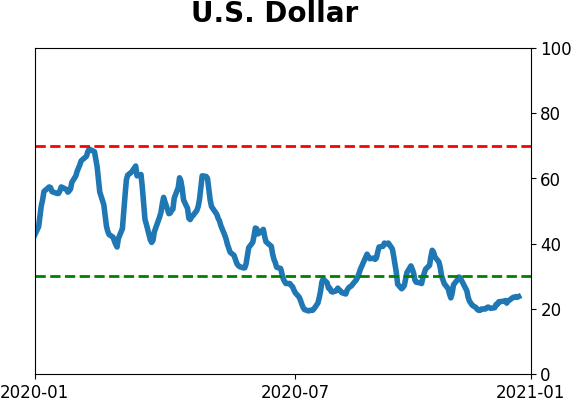

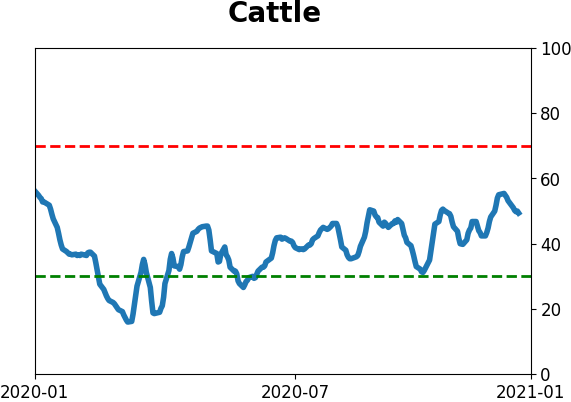

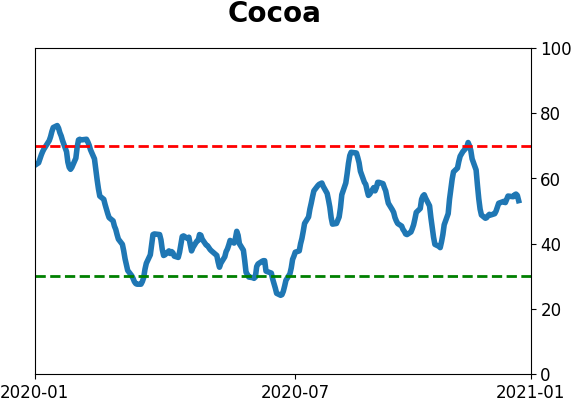

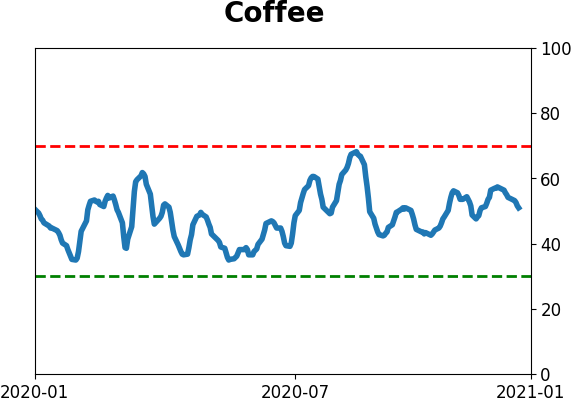

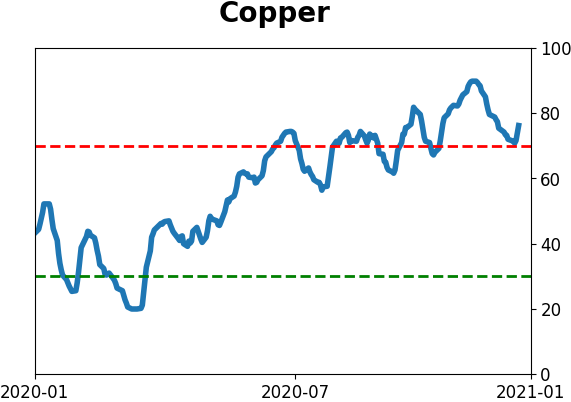

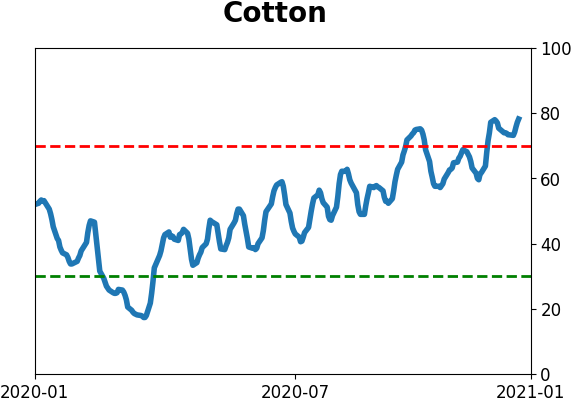

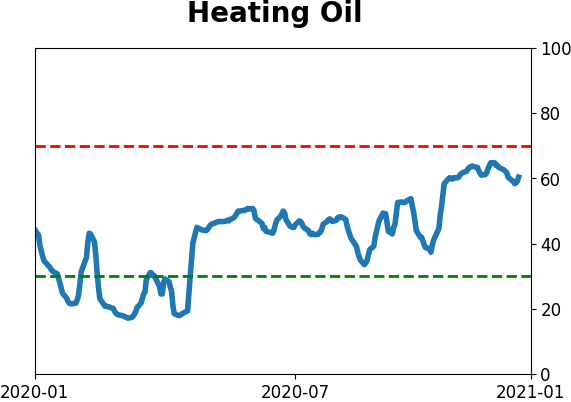

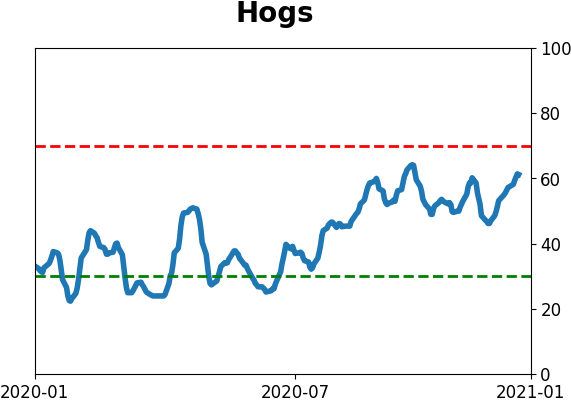

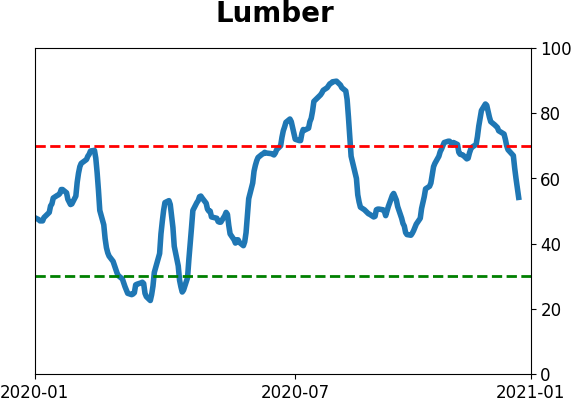

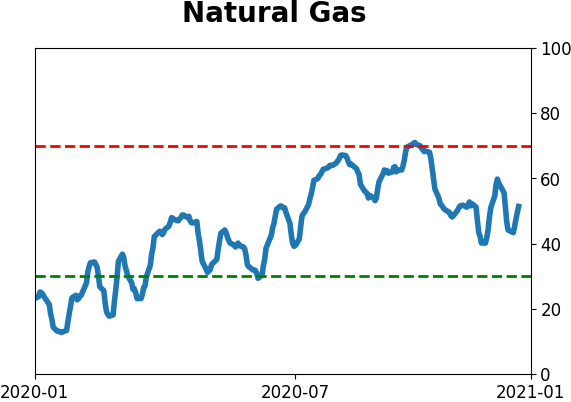

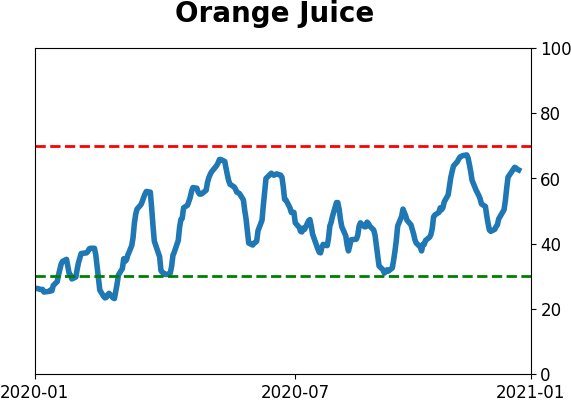

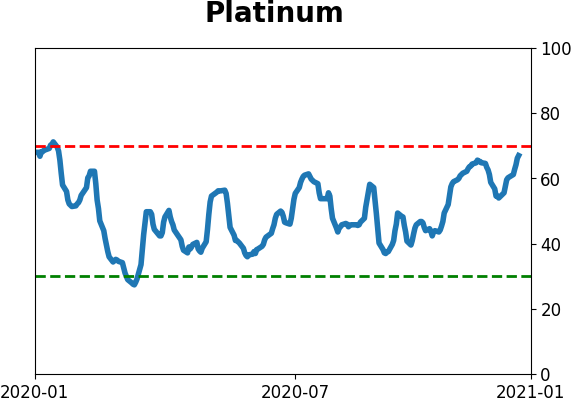

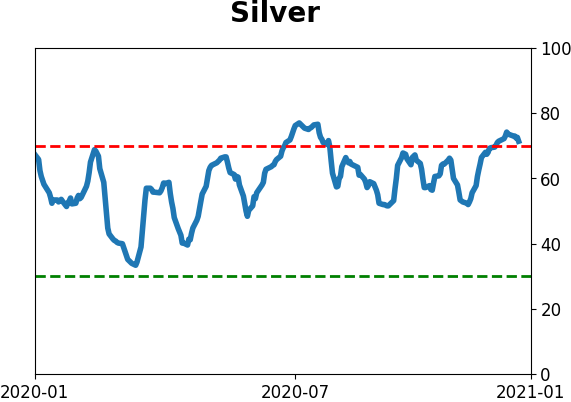

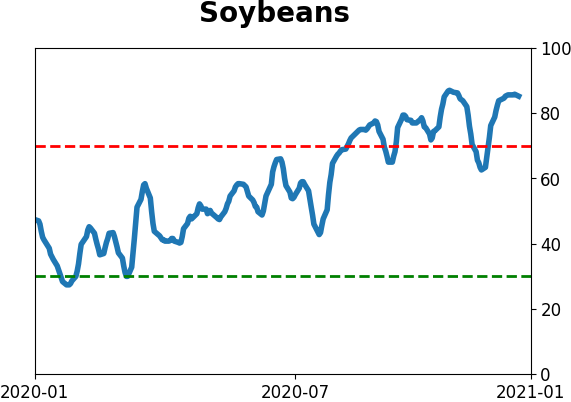

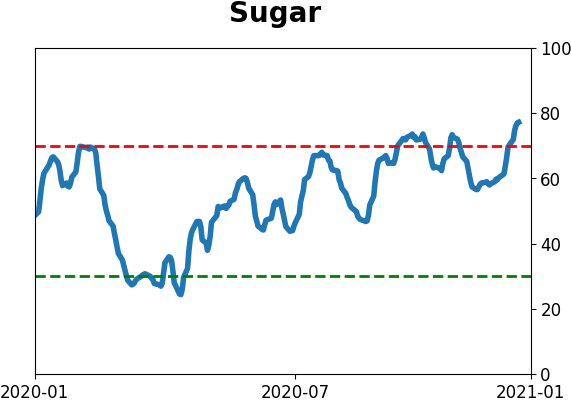

Optimism Index Thumbnails

|

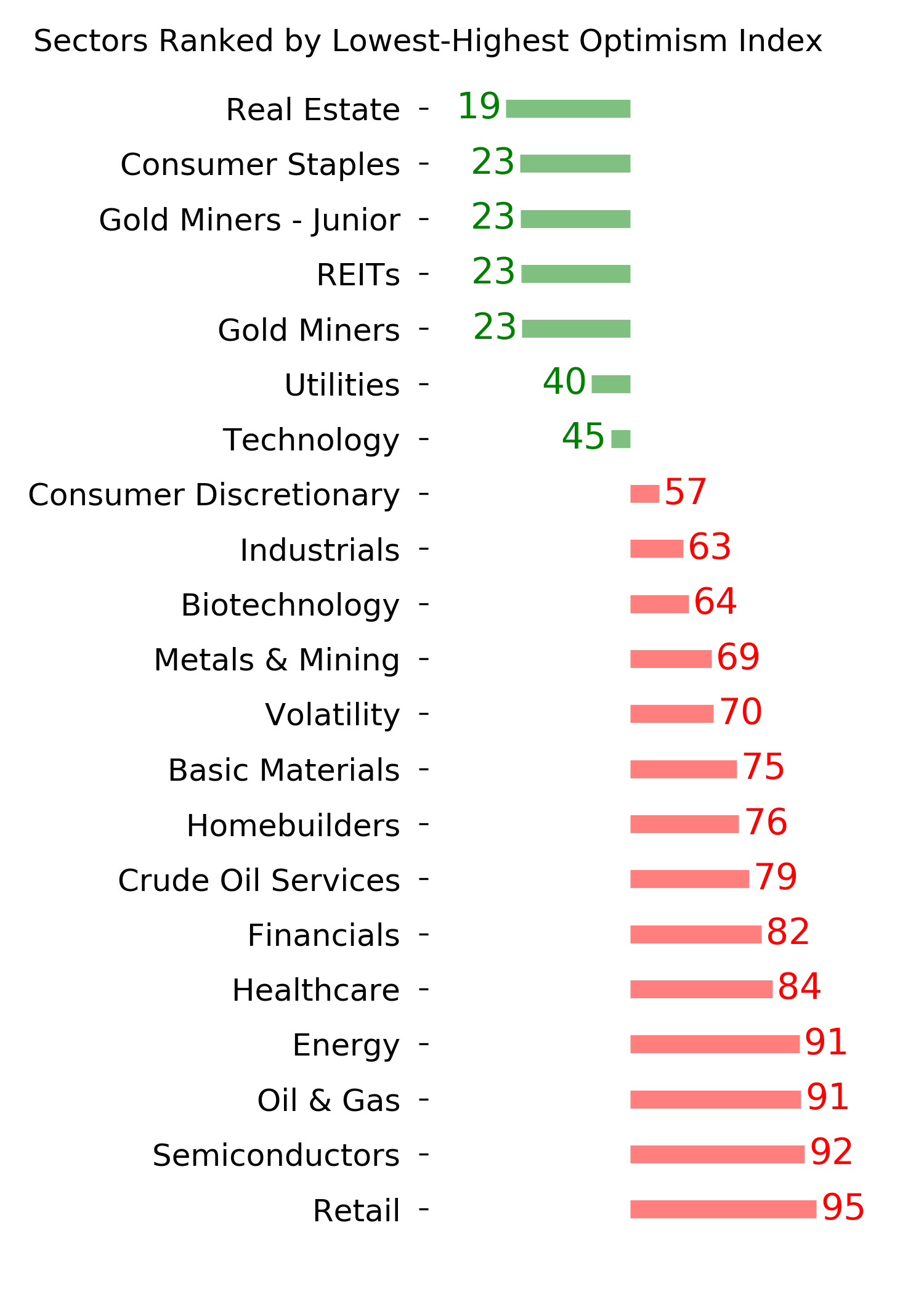

Sector ETF's - 10-Day Moving Average

|

|

|

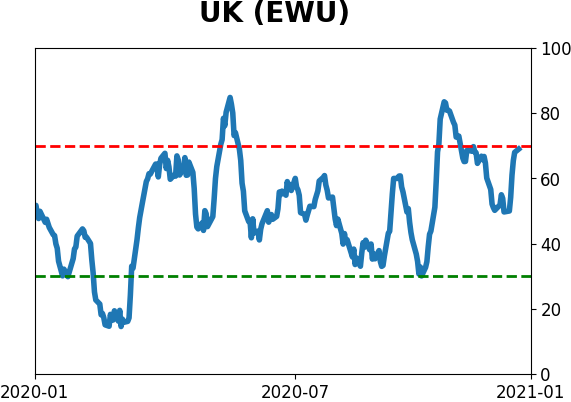

Country ETF's - 10-Day Moving Average

|

|

|

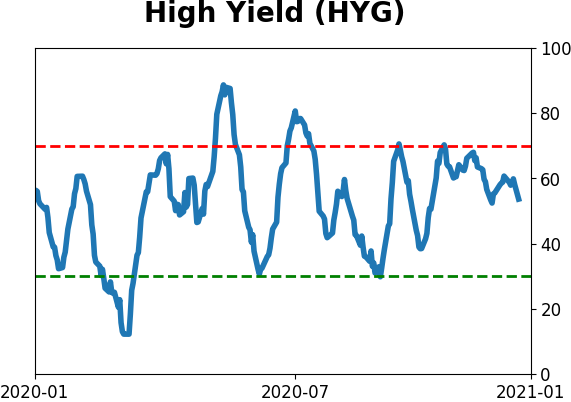

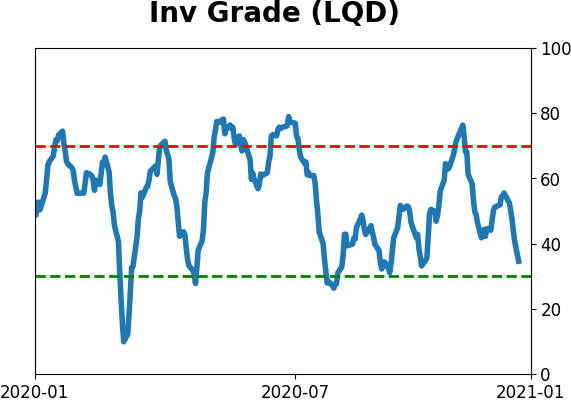

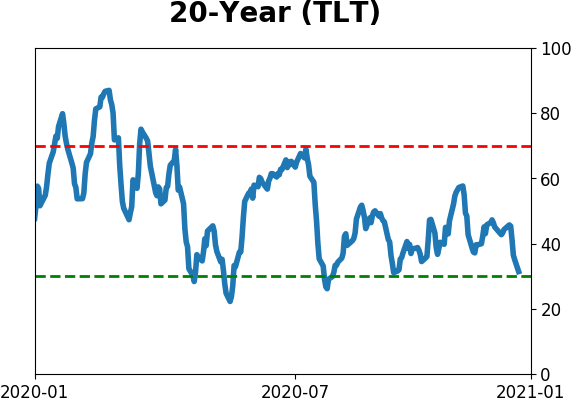

Bond ETF's - 10-Day Moving Average

|

|

|

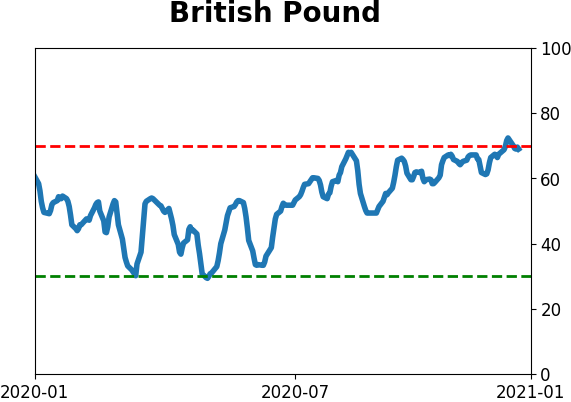

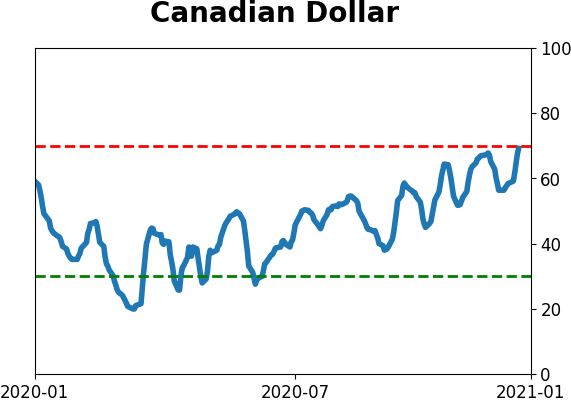

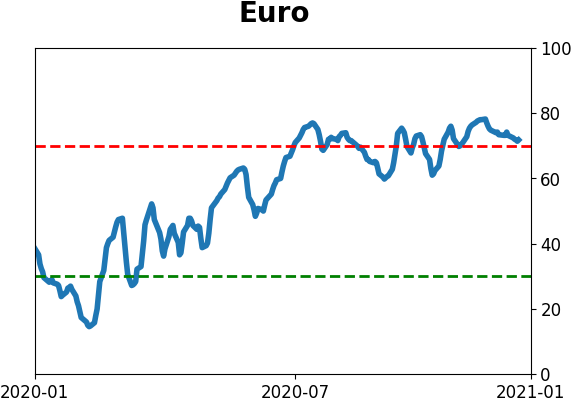

Currency ETF's - 5-Day Moving Average

|

|

|

Commodity ETF's - 5-Day Moving Average

|

|