Bullish Mom And Pop And Options Traders

This is an abridged version of our Daily Report.

Shades of 2000 for mom and pop

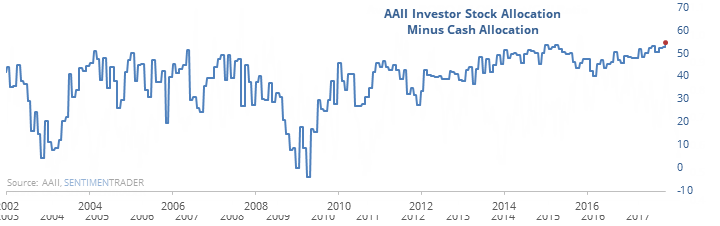

Individual investors haven’t had this small of a cash cushion since 2000. In November, their cash holdings dropped below the prior recent lows in 2015 and August of this year.

At the same time, they are heavily allocated to stocks. The difference between their stock and cash allocations is among the widest in 30 years.

Foreign buyers come back

There has been a big surge in foreign buyers of U.S. stocks. The latest month of inflows was among the largest in 30 years. But as a percentage of total market cap, it was relatively small and comes after months of outflows.

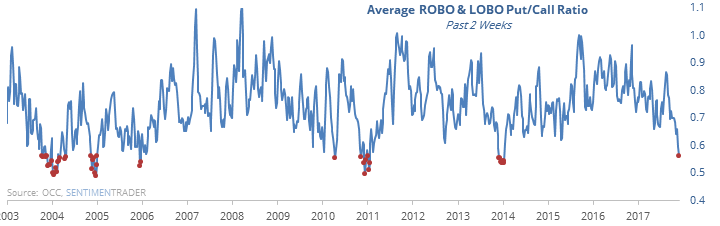

Options traders large and small are betting big

Small and large options traders alike are betting aggressively on the rally continuing. They haven’t had this much riding on bullish options strategies in almost four years, with an average of almost 2 bullish positions for every bearish one over the past two weeks.

Big reversal

Monday ranks as the largest negative reversal in S&P 500 futures since January 3, 2000. This is including times when they gapped up at least 0.5% at the open, traded to a new all-time high, then closed in negative territory.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.