Surging Dow, Positive Surprises

This is an abridged version of our Daily Report.

Can’t get enough of the Dow

The Dow Industrials enjoyed the best weekly gain in nearly a year. Even with Friday’s scare, it rallied nearly 3%, the most since last December. It also closed at a new all-time high, raising worries about a blow-off move this week. Similar moves since 1900 don’t support that worry.

Nothing but positive surprises

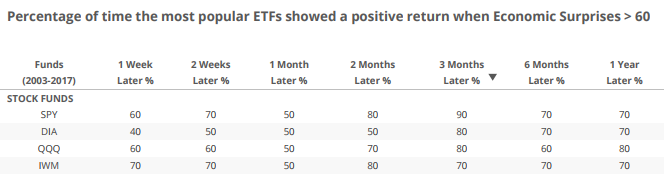

Economic surprises over the past three months have been consistently positive. The Citigroup Economic Surprise Index is nearing a maximum level since climbing above zero in September..

Among the most popular ETFs, bonds did okay, commodities were questionable, and energy and health care did well.

Industrials get the spotlight

Nearly half of Industrial stocks in the S&P 500 hit a 52-week high late this week, for mostly the same reasons the Dow had such a good week. Seeing more than 40% of Industrial stocks hit a 52-week high at the same time is among the highest readings in history.

A spike in fear, then…not

The VIX “fear gauge” spiked nearly 30% on Friday before reversing nearly all of that. That’s the 22nd time in 30 years that it has rallied at least 20% during the day and reversed more than -20% by the close.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.