Closing On Lows, Discretionary Streak

This is an abridged version of our Daily Report.

Closing on the lows (WHAT?!)

The S&P 500 fund, SPY, has closed near the day’s intraday low for the past two days, an unusual sight during this strong uptrend that has seen so many intraday dip-buyers. It hasn’t closed on the low on consecutive days in nearly two years. When stocks have been doing well, back-to-back closes near the low have been a good medium-term sign.

Consumer extrapolation

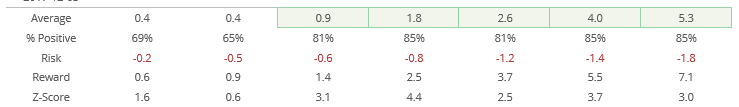

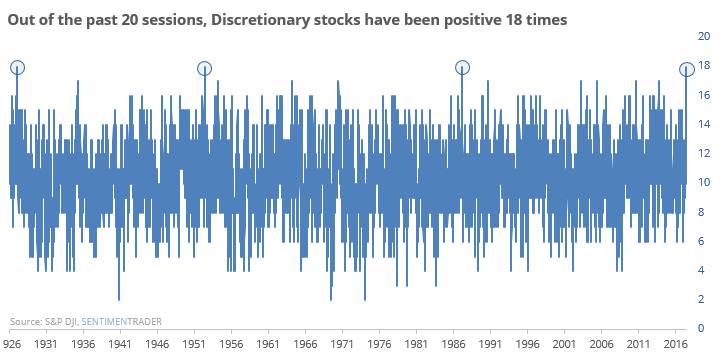

Investors seem to be projecting high consumer confidence to mean good sales of discretionary items. The Consumer Discretionary sector had been up 17 of the past 18 days, a streak not seen in 65 years.

Other bouts of persistent buying indicated some short-term exhaustion, but good long-term prospects.

Copper gone to pot

Copper suffered its largest loss in well over a year, but remains above its long-term 200-day average. Of the 13 other times it has suffered such a large relative loss in an uptrend, it went on to a further loss over the next two months 62% of the time.

Multiple losses

The S&P 500 has dropped for three sessions yet still remains above its 10-, 20-, 50- and 200-day averages. Prior to 1993, this led to rebounds over the next two weeks only 47% of the time and an average return of -0.2%. Since then, it has rebounded 72% of the time.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.