Bitcoin Blow-off, Sector Performance, SLV Pessimism

This is an abridged version of our Daily Report.

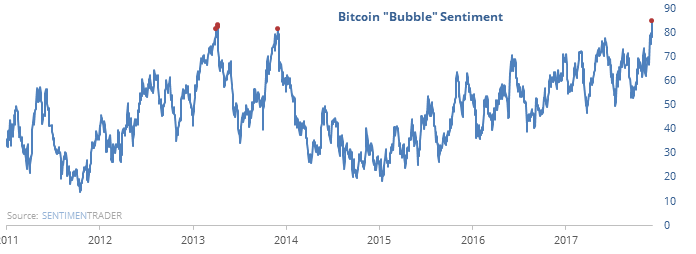

Bitcoin blow-off

Anecdotal evidence of a blow-off in Bitcoin has exploded over the last couple of days. That’s hard to incorporate, so using data related to price action and public interest, we see that a sentiment model has reached blow-off territory.

The few other times we’ve seen an extreme like this, further gains were erased in the week(s) ahead, especially once there was an initial sign that late buyers were getting scared.

Sector performance after plunge in correlation

Stocks have been at record highs then correlation among sectors plunged as we saw in Wednesday’s report. In general, stocks have performed poorly going forward, though among sectors, Tech and Health Care did fine.

Not so precious

The metals have been getting hit hard lately, and silver is starting to see signs of pessimism. The Optimism Index for SLV has averaged less than 20 over the last three days.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.