Cyclical stocks are outperforming again

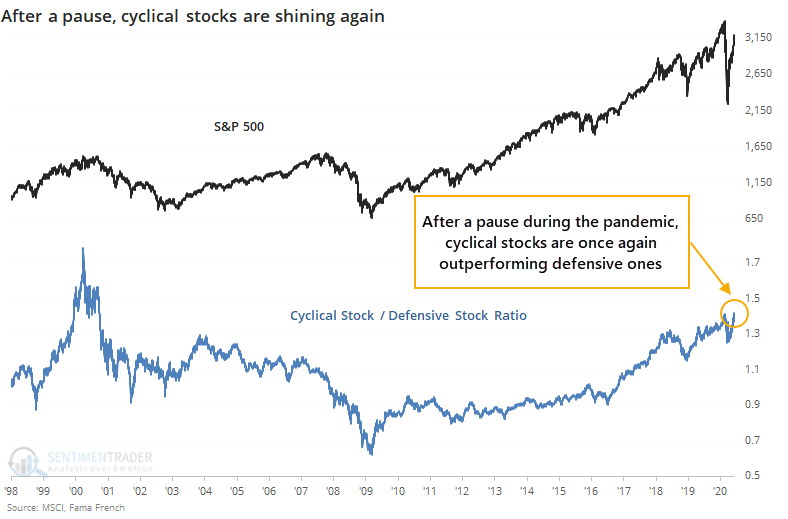

During the height of the pandemic panic, investors dumped stocks that were deemed most exposed to economic growth, favoring ones that are typically considered defensive.

Now that risk-on appetite is firmly in control, cyclical stocks are back in fashion. The ratio between them and defensive stocks just captured a new high for the first time in months.

Cyclical stocks are being driven by the usual culprits like Apple, Amazon, Microsoft, but also include JP Morgan, Visa, and Home Depot. Defensive stocks include Johnson & Johnson, Procter & Gamble, and UnitedHealth - companies making products that consumers tend to need no matter what the economy does.

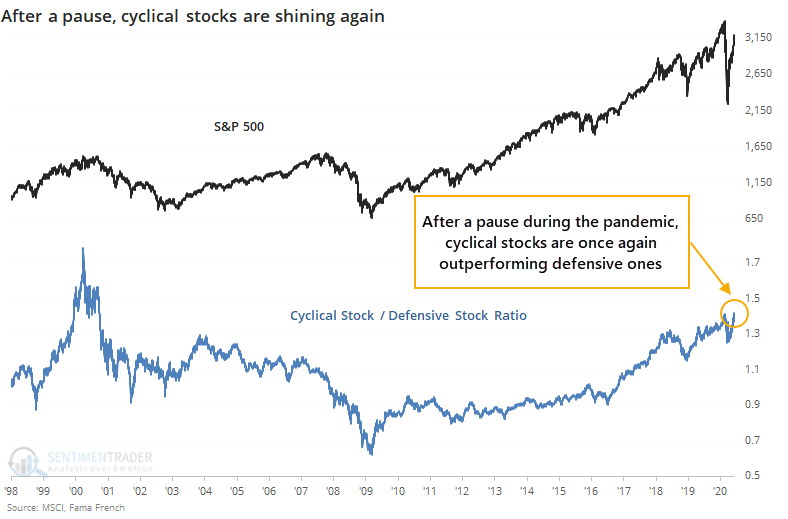

Over a very long time frame, the ratio has gone much further, but even now it could be considered high. Extreme levels in the ratio tended to coincide with peaks in the S&P 500.

The problem is identifying when those peaks actually occurred in real-time, but using something like a 200-day average of the ratio was a decent trend identifier. Regardless, it doesn't matter right now since the ratio just hit a decade-high, so clearly it hasn't rolled over yet.

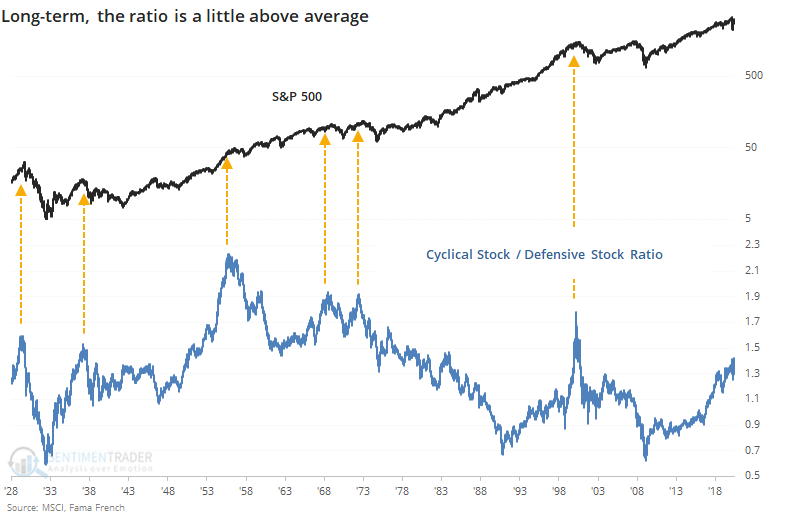

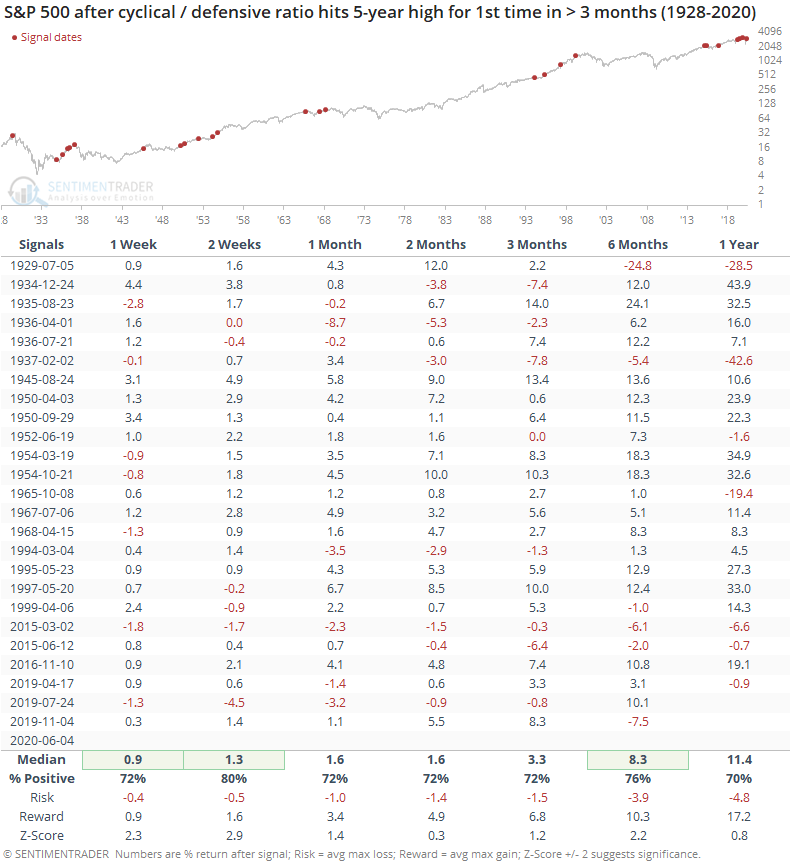

This evidence of risk-on behavior was mostly a good sign for the S&P.

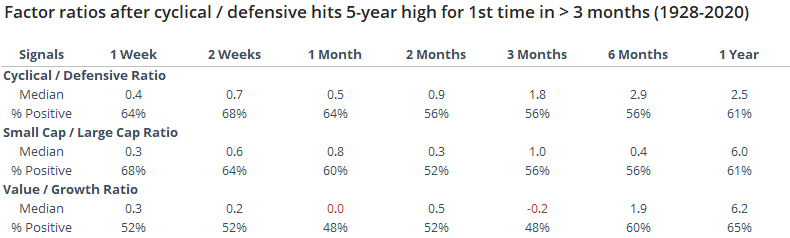

Returns over the short-term were good, medium-term were okay, and long-term were well above-average again. Over the next 6 months, there were few losses, and most of them were small. The risk/reward skew was more than 3-to-1 to the "reward" side, a rough gauge for what could be considered an edge.

For other factors, there was not a strong edge.

Because the ratio is already high, this breakout was not a good reason to expect cyclical stocks to continue to outperform defensive ones. Similarly, small-cap stocks did not consistently outperform large-cap ones, and value didn't consistently outperform growth.

Overall, the new relative high in cyclical stocks should be a modest positive for stock indexes like the S&P 500, but the ratio is high enough to be concerning and a turn lower in the ratio would likely signal a risk-off environment that's been tough for stocks to hold gains.