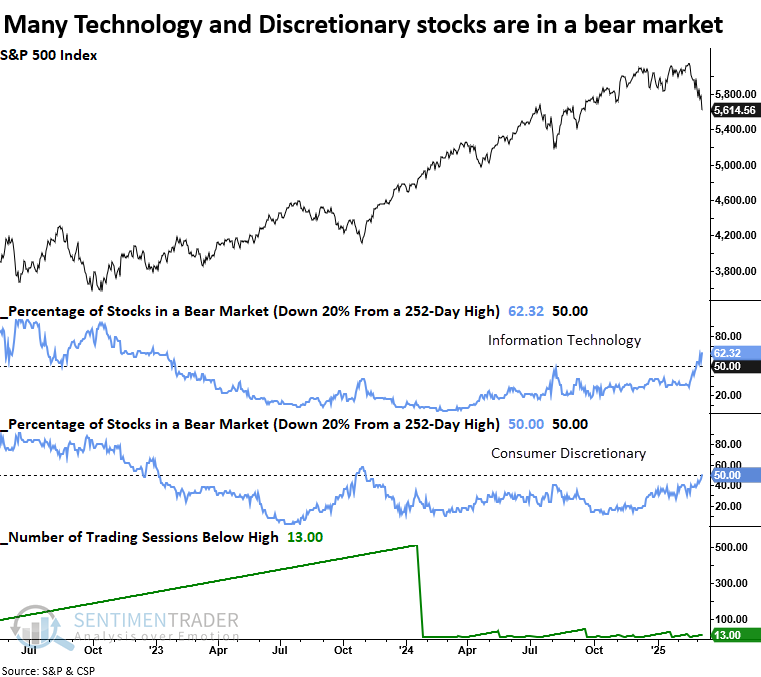

Cyclical growth stocks descend into bear market territory

Key points:

- 50% of Technology and Consumer Discretionary stocks have entered a bear market

- Similar precedents near a high suggest the S&P 500 could struggle over the subsequent six months

- Technology and Consumer Discretionary underperformed the broad market over a medium-term horizon

An uptick in growth stocks falling into bear market territory suggests more downside risk

Stock market pressure intensified on Monday as key indexes and sectors dropped between -2.7% and -4.25%, pushing more stocks into bear market territory - defined as a 20% decline from a 252-day high.

S&P 500 Technology and Consumer Discretionary, two critical growth-oriented sectors, now show 50% or more of their respective stocks in a bear market. Considering the S&P 500 is only 13 sessions from an all-time high, this is an alarming scenario.

The last signal appeared in January 2022, and although the S&P 500 rallied briefly, we all remember how that played out over the next nine months.

Technology holds the highest concentration of stocks in a bear market, while Consumer Discretionary ranks the fourth weakest. As expected, defensive sectors like Staples and Utilities have among the lowest levels of stocks in a bear phase.

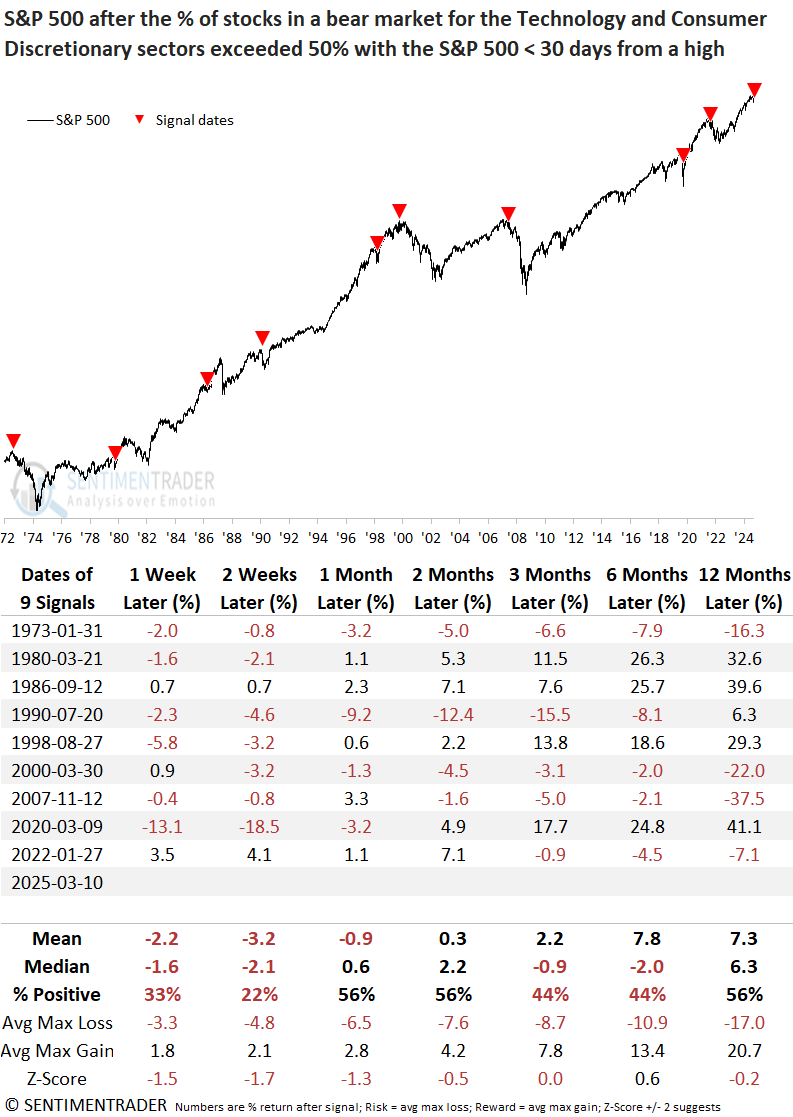

Comparable market breadth conditions indicate stocks may face headwinds

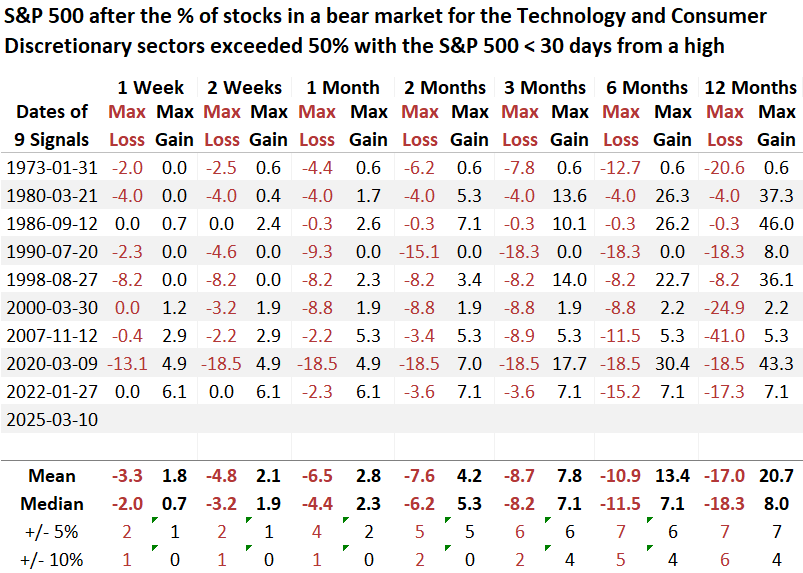

When 50% or more of stocks in the Technology and Consumer Discretionary sectors closed in bear market territory with the S&P 500 within 30 sessions or fewer from a multi-year high, the world's most benchmarked index exhibited unfavorable win rates and returns over the following six months.

At some point over the six-month horizon, the S&P 500 was lower in all but one case. Furthermore, six out of nine instances were associated with a significant market top.

The 1980 and 1986 signals occurred near a market low, but in the other cases, the S&P 500 fell by 8% or more over the subsequent six months.

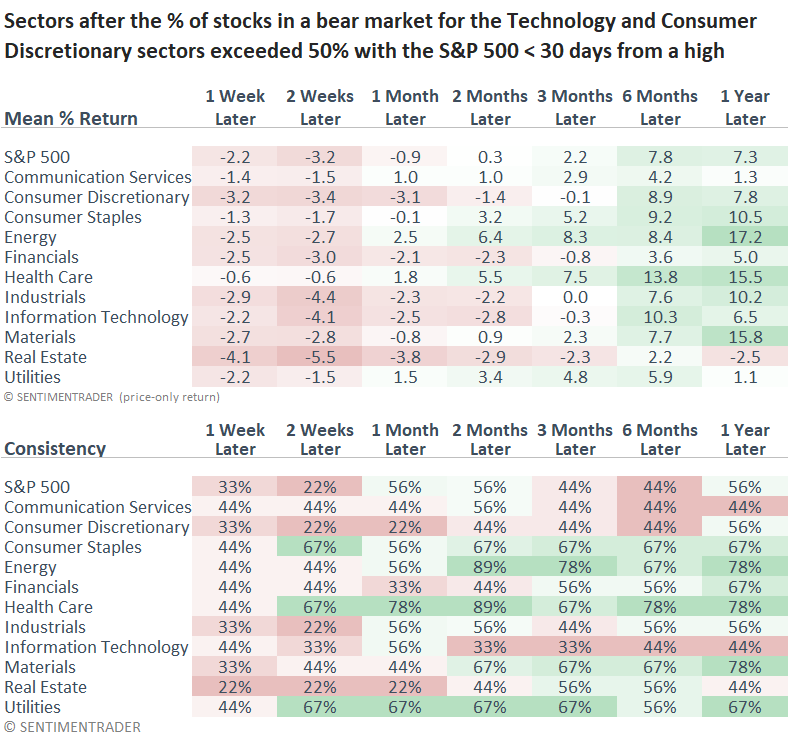

Technology and Consumer Discretionary lagged the S&P 500 in five out of seven horizons, with the bulk of the relative weakness concentrated in the first three months.

More evidence of a rotation away from growth

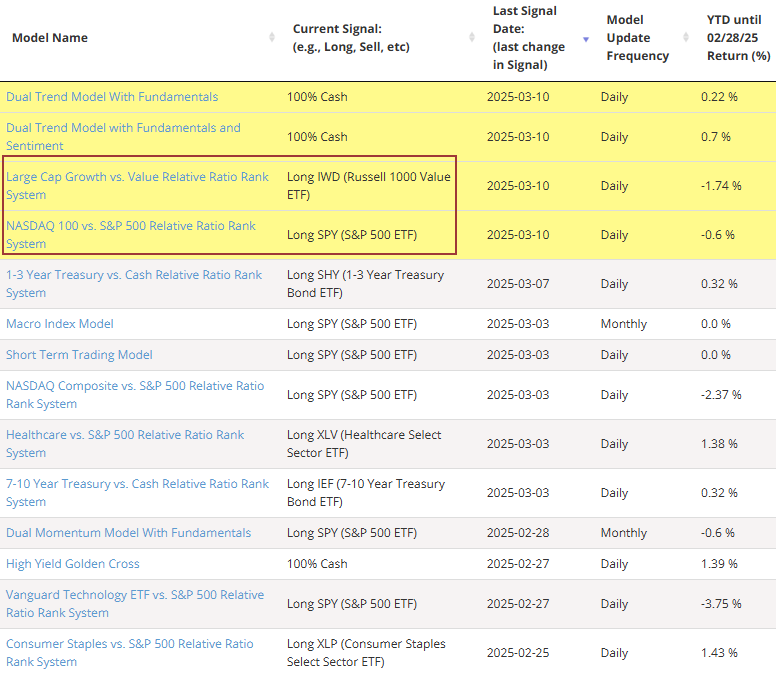

The relative strength timing systems on the website's strategies page exited more growth-oriented ETFs on Monday.

What the research tells us...

Two of the most pivotal growth sectors, Technology and Consumer Discretionary, have seen a significant portion of their stocks enter bear market territory even though the S&P 500 recently achieved a record high. Similar precedents suggest the world's most benchmarked index could see further downside in the next six months. Additionally, given that several of these signals occurred alongside notable market peaks, investors would be wise not to dismiss the possibility that this warning points to a more serious downturn than a garden variety correction. Even with a high percentage of stocks down 20% or more, the Technology and Consumer Discretionary sectors tended to underperform relative to the broader market.