Crude Sell-Off

We've touched on the so-bad-it-might-be-good sell-off in crude oil a few times over the past year. Usually it was good for a short-term reprieve at best.

Overall, that market has not responded, which is a good sign to stay away. Markets that don't do what they should are in great danger of doing more of what they shouldn't.

It's awfully tempting to look at these big down days and think, "This must be it, it can't possibly keep going like this." Sometimes that's the right line of thinking but it's not consistent enough to pay for the times it fails.

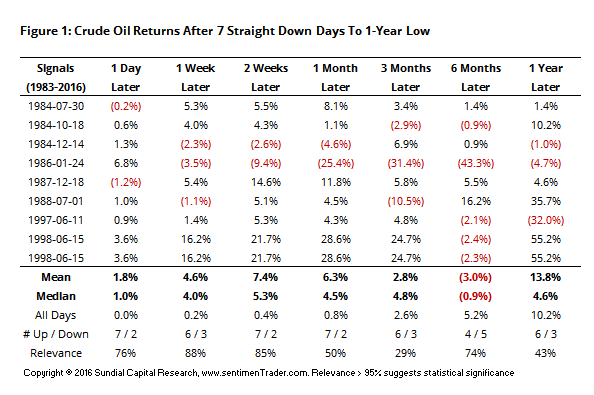

There are surely some compelling signs. Crude is on the cusp of falling for the 7th straight day, closing at a new low. Other instances have usually led to a short-term bounce (Figure 1).

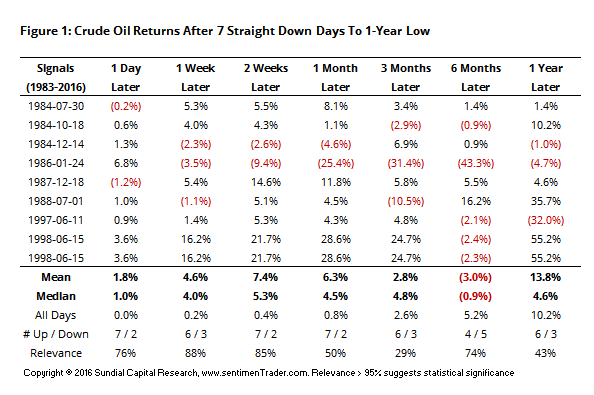

Same goes for when it suffers a 2% down day nearly every day for the past six sessions (Figure 2):

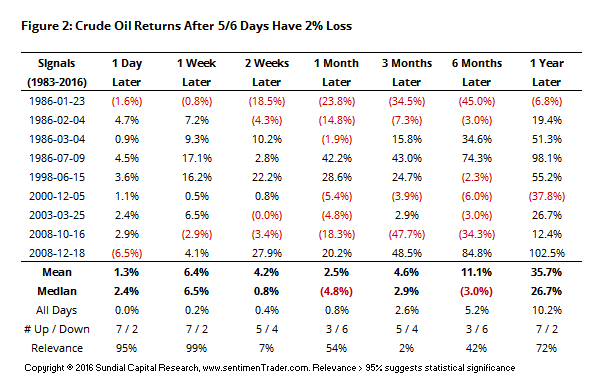

Money managers have been abandoning their long positions in oil futures:

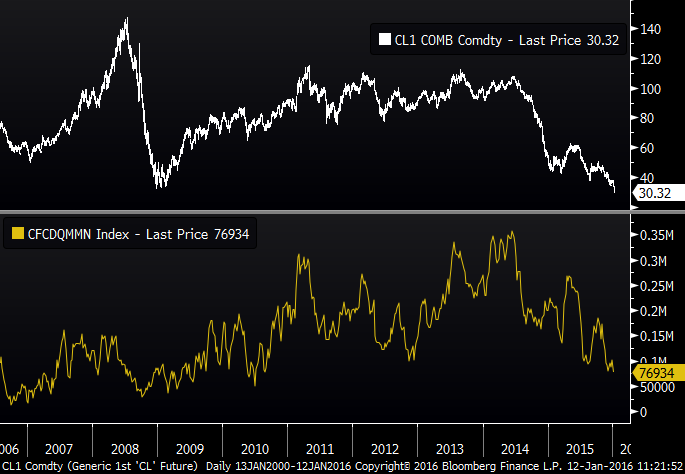

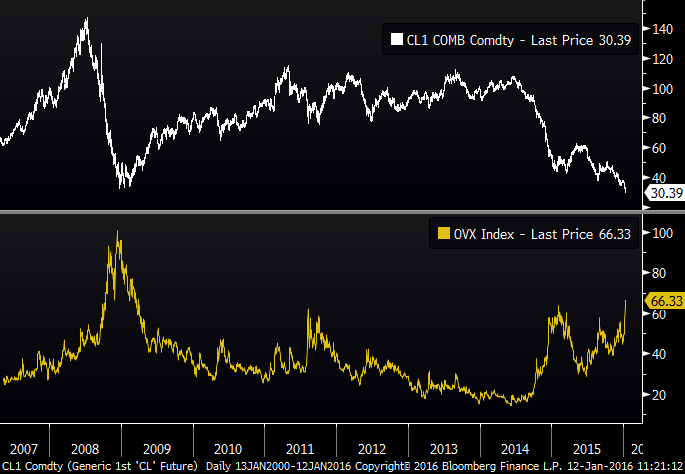

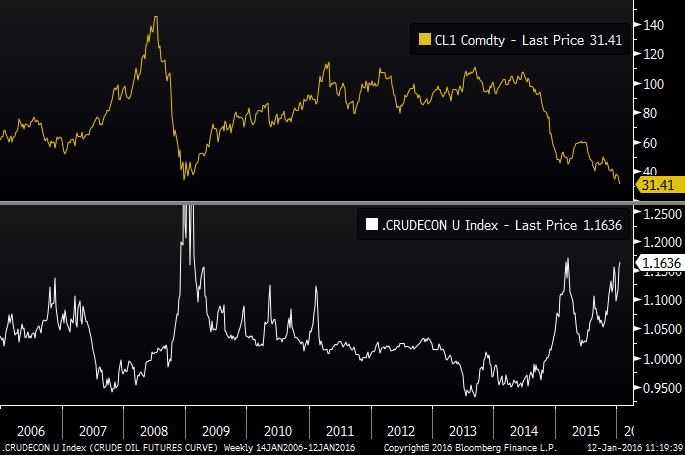

Which is helping to trigger one of the highest volatility readings in a decade:

Which is also causing one of the highest levels of contango we've ever seen (shorter-term futures trading at a discount to longer-term futures):

All of these point to higher prices, at least in the shorter-term. Whether this is "it" longer-term is a bad bet, at least in terms of sentiment and price patterns - we have no opinion on any fundamental or economic aspects.

The selling is clearly extreme but it has been for a while. The market is broken and that means there is low confidence in any medium- to long-term risk estimates.