Crude Oil's New Bear Market

Markets are mostly quiet (again), but not so much in the energy patch. Oil is getting hit again and is now down 20% from its most recent peak, arbitrarily considered a bear market at this point.

We saw in a recent report that although oil has lost 2% a week for the past few weeks, it hasn't been enough to signal selling exhaustion. Especially since most of the indicators we look at still are not showing excessive pessimism.

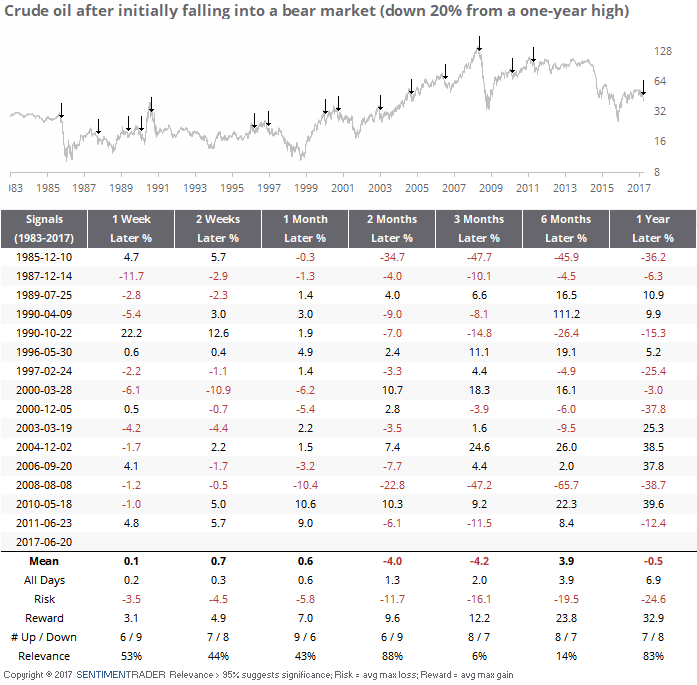

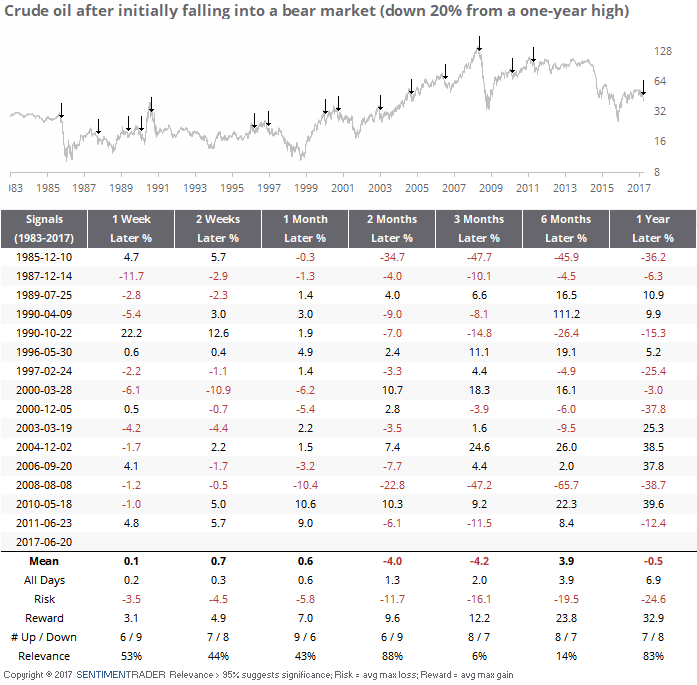

Let's take a look at times when oil initially fell into bear market territory and see if that was enough to provide some relief:

Not really. Oil continued to fall about as often as rebound. Two months later, it was actually down even more the majority of the time and had a terrible risk/reward ratio. Longer-term returns were extremely volatile, with average risk over the next year of nearly -25% versus reward of +33%. There's no edge there.

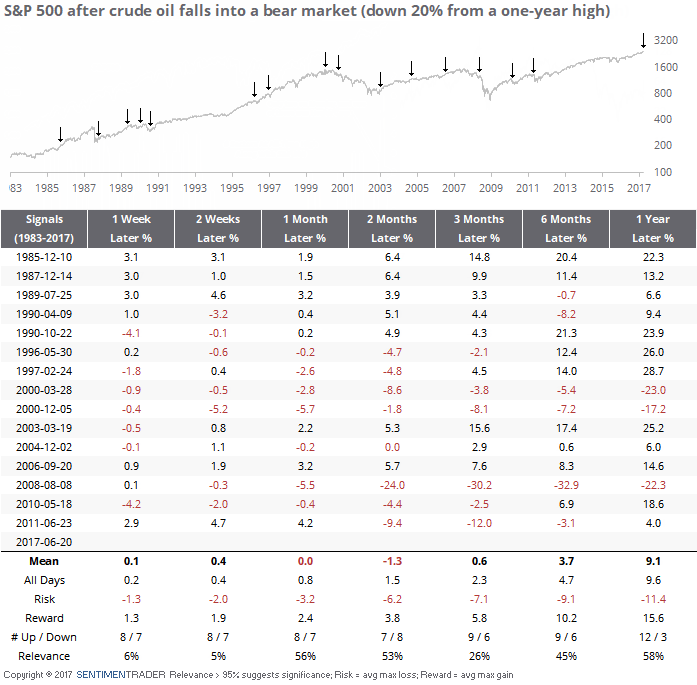

How about for stocks?

The S&P 500 index didn't respond all that well to new oil bear markets. Over the next couple of months, it rallied only 7 out of the 15 times, sported a negative average return and nearly 2-to-1 risk-to-reward ratio. Since 1996, it led to negative returns 8 out of 10 times over the next two months.

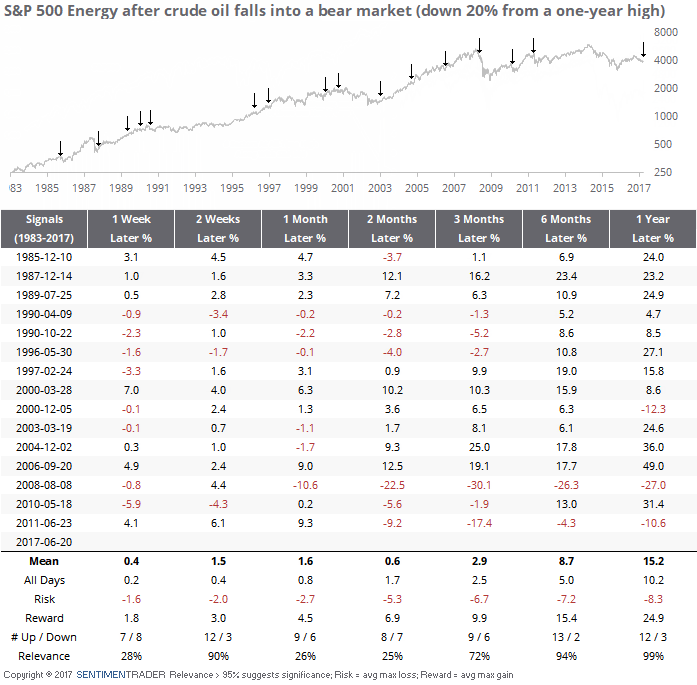

How about for energy stocks specifically?

Again, not great. Energy stocks within the S&P 500 did tend to rebound over the next two weeks, up 12 out of the 15 times, but over the medium-term it was mixed. Six months later, Energy stocks were up 13 times, with a good average return and risk/reward ratio, but the losses in 2008 and 2010 were large.

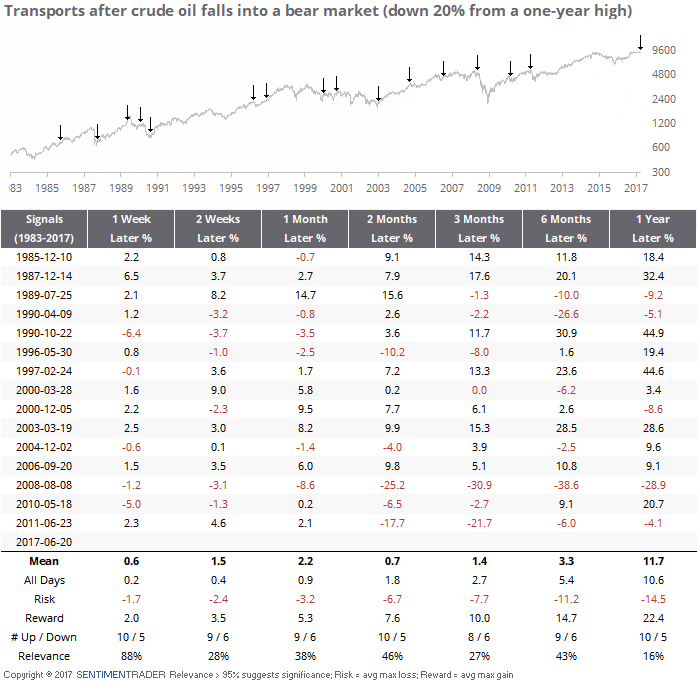

How about Transports? Oil is a cost input so perhaps trucking firms and airline stocks took advantage.

There isn't much evident of that here. The last three times all led to losses over the next 2-3 months. Transports' overall average returns were about in line with random, and the risk/reward skews were underwhelming. That was especially the case if Transports were near their highs at the time. So much for cost savings.

There's going to be an opportunity in this sector before long if the selling continues like this, but so far everything we've looked at has been inconclusive, especially on a short- to medium-term time frame. The fall is disturbing for stocks, which have suffered in recent years when oil dropped so much.