Crude Oil Term Structure Nears Record Extreme

With another drop in crude oil today, we've been asked to provide an update on the term structure for crude oil.

This is something we've discussed in years past, as a measure of how futures traders are pricing the various contracts in crude.

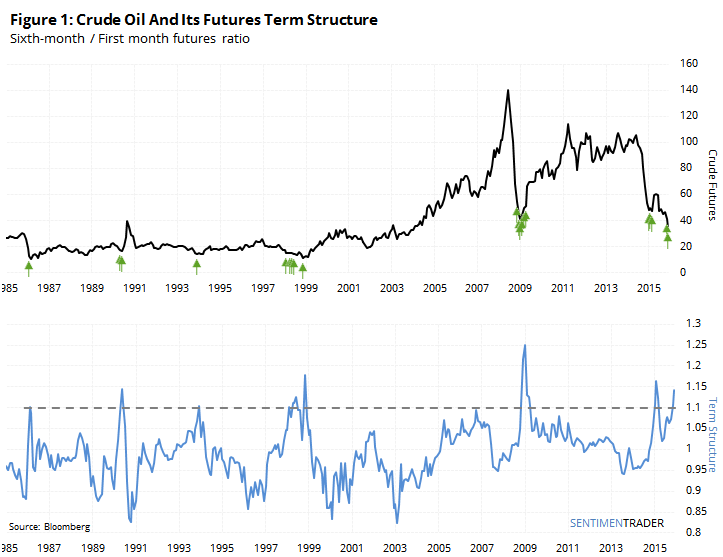

The ratio we've always used is the contract that expires in six months versus the one that expires in the next month. They move together, but the further-out contract will move more or less depending on traders' longer-term outlook.

As we approach the end of the year, the further-out contract is nearing its all-time high premium versus the nearer contract. There could very well be structural issues that explain this, and by no means whatsoever could we be considered experts, or even knowledgeable, in the fundamentals of the oil market, but that's not the point. The point is simply to show that the further-out contract is trading at a historically high premium (Figure 1).

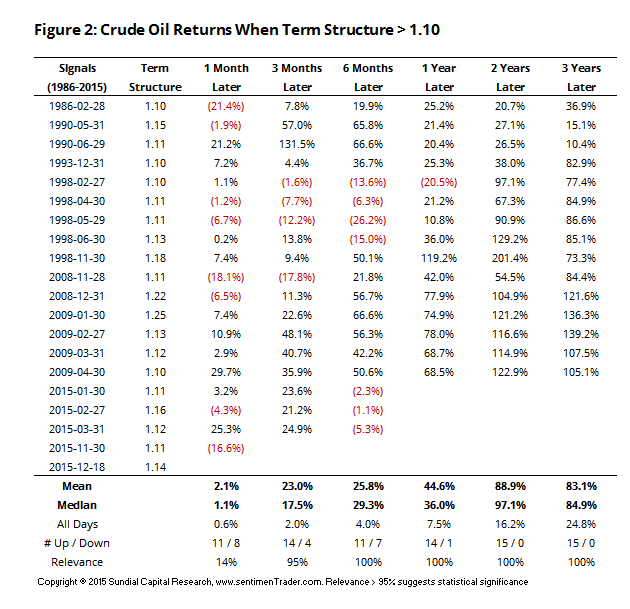

So what? That's what Figure 2 is for:

When the term structure has been this extreme, it has tended to occur near longer-term bottoms in oil. Granted, this only covers 30 years of history, and it has not been much of a factor this year as the market continues to crumble, but it's not a short-term indicator anyway. As traders sell the near-term contract heavily into year-end, it seems to be setting up a long-term opportunity according to the way the futures market is priced.