Crude Oil in April

Trading essentially involves:

- Analyzing markets

- Making trades

Successful trading also involves the extra step of assessing - and being preparing for - the types of risks that might arise along the way.

For example, one can state that "April is the best month for crude oil." At this point in time that is a factually correct statement. But does this mean that one can simply buy crude oil on April 1st and wait for the profits to roll in? Let's take a closer look.

Crude Oil in April

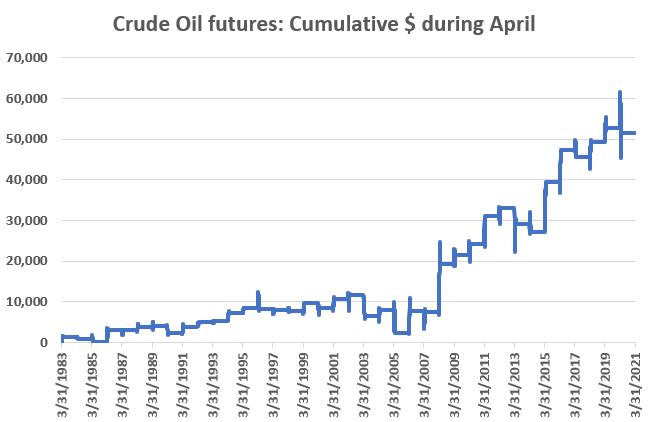

The chart below highlights the fact that April has ostensibly been the "best" month for crude oil.

For our purposes, we will use crude oil futures to measure performance. For a crude oil futures contract, a $1 move in the price of a barrel of oil translates into a $1,000 change in contract value.

NOTE: The data series that we will use rolls to the next contract month prior to "First Notice Date." A long futures position held after First Notice Date is subject to delivery. Unless you are a professional hedger and/or a user of the actual commodity you DO NOT want to hold a long futures position past First Notice Date. Crazy things can happen. To wit, last year an April crude oil futures contract held long until Last Trading Day actually went to -$37 a barrel due to a lack of storage space related to the abrupt curtailment of travel resulting from Covid lockdowns.

The chart below displays the hypothetical cumulative $ gain/loss achieved by holding a long 1-lot position in crude oil futures ONLY during the month of April every year since the contract started trading in the early 1980s.

The Good News is that the equity curve generally works its way up and to the right and as we saw above, it has been the most profitable month on a raw dollar basis.

So again we ask the question, does this mean that all we have to do is buy a crude oil futures contract every April 1st, hold for a month, and collect our profits? Eh, not exactly. Because trading - especially trading something as volatile as crude oil futures - involves risk. And a successful trader has to recognize the risk(s) that he or she is taking and be prepared to deal with those risks.

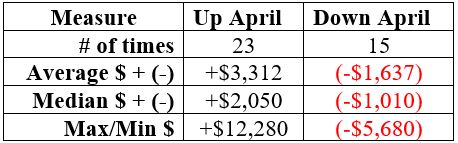

The table below displays year-by-year $ + (-) for April

The best month - but by absolutely no means a sure thing in any given year.

The table below summarizes the results for April.

As you can see, despite the fact that April is the best month for crude oil, the winning % is only 60.5% (up 23 of 38 years). The edge comes from the fact that the average and median winning trade is twice as big as the average and median losing trade.

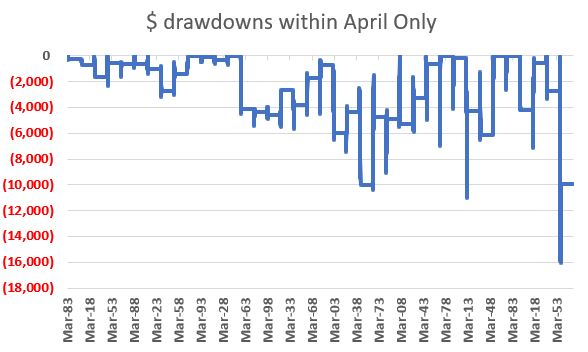

From a risk standpoint, the chart below displays the maximum drawdowns experienced while holding long a 1-lot of crude oil futures ONLY during April.

Clearly not for the faint of heart - nor the poorly capitalized.

Summary

Has crude oil been profitable during the month of April? Absolutely. Does this constitute "easy money?" Absolutely not.