Crap And Gap

Whenever there is volatility like that past two days, it's easy to pick and choose from a number of different extremes. There are so many that one can find something, anything, to support their view of either a bounce or more selling pressure.

The majority of what we looked at was inconclusive. There were some compelling suggestions for a short-term bounce, but it wasn't overwhelming, not like it was in February or at some of the other mini-panics like 2011 or 2015.

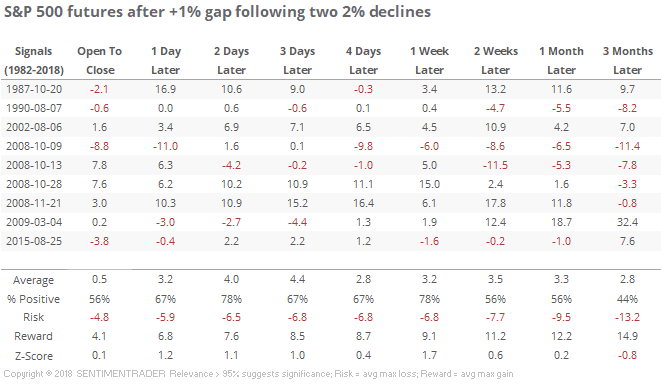

Regardless, futures are seeing a strong bounce with gains hovering about 1% above yesterday's close. Let's take a look at strong opens following multiple large down days.

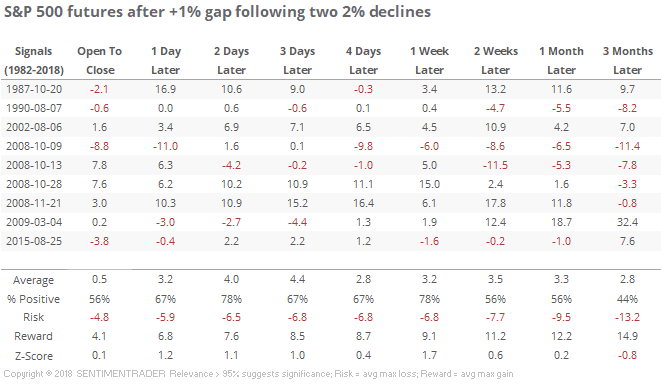

Even after accounting for the large gap up, returns over the next couple of sessions were strong. But if the gap starts to fade, like it did yesterday in the opposite direction, then the implications become a lot less compelling.

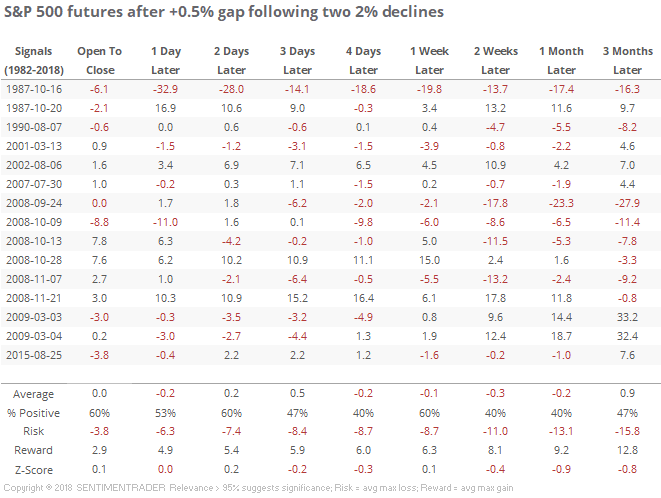

The suggestion is that if we see a large move down, and yet buyers are only marginally interested in buying the dip, then it's more likely to precede further selling pressure, as opposed to times when buyers are extremely interested in the dip.

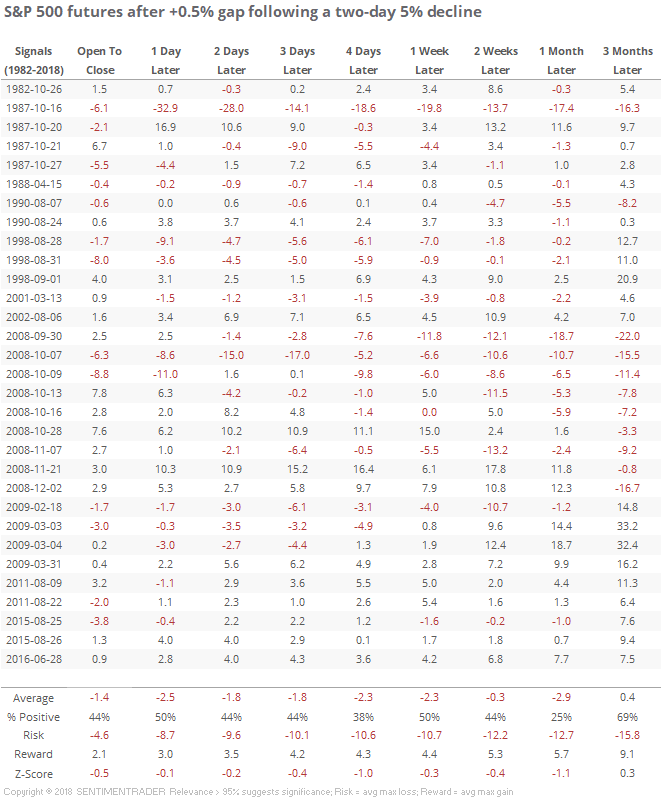

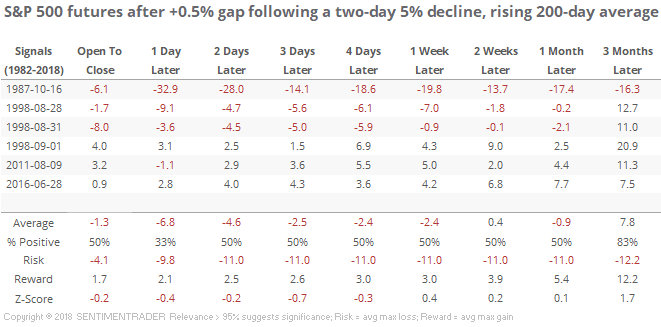

To get more signals, instead of requiring two 2% down days, let's just look at a two-day move of more than -5%, with at least a moderate gap-up open the next day (this morning in our current instance).

These were quite a bit more negative, with an outright negative expectation. The ones in October did not have a good record. They were also almost always triggered during a bear market. If we filter the table to only include times when the 200-day average on the S&P was rising, then it cuts down the sample size drastically.

Very mixed. It led to dramatic declines in '87 and '98, big bounces in '11 and '16.

Kind of like what we looked at yesterday, indicators and studies are mixed. It's easy to find something to support either a bounce, or not, and that's not a good edge. At the better knife-catching opportunities in past years, the evidence was much more overwhelming so I do not see good odds here either way. It's starting to tilt to the positive side over a medium-term time frame, but again it's still not heavily skewed unlike past lows.

And if you're not on Twitter, it's hard to ignore this.