Could the bull market run another three years?

Key points

- In a series of articles in April 2023 (see here, here, and here), we introduced the Benner Cycle, purportedly created by a man named Samuel Benner in 1875 - which consists of major cycles and minor cycles

- In the past 100 years, overall market performance has been uniformly positive during favorable periods for the minor Benner cycle

- A new favorable minor Benner cycle begins on January 1st and extends through December 2026

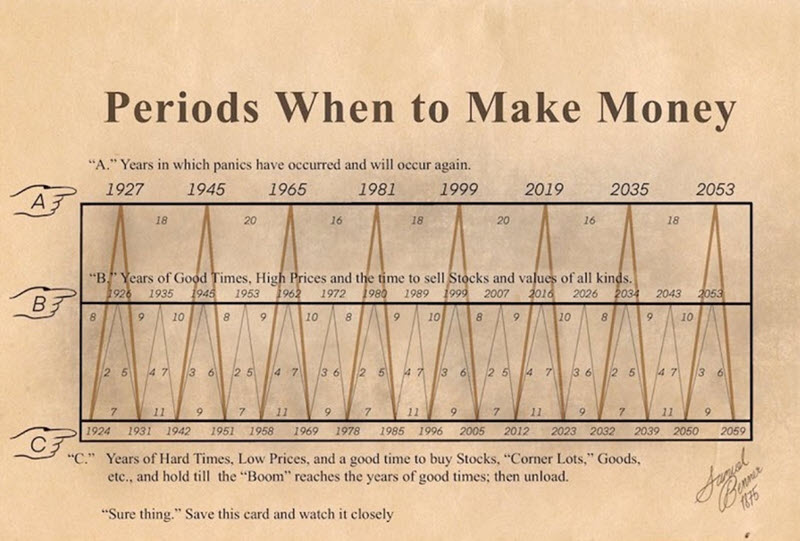

The "Benner Cycle" chart

The chart below was purportedly created by Samuel Benner in 1875.

The brownish/yellow lines in the chart above highlight "major" cycles, and the light gray line highlights "minor" cycles. At the close of trading for 2023, the major cycle will turn "neutral" until the end of 2032. On the other hand, the minor cycle will turn "favorable" until the end of 2026.

What might this mean for stock investors? Let's take a closer look.

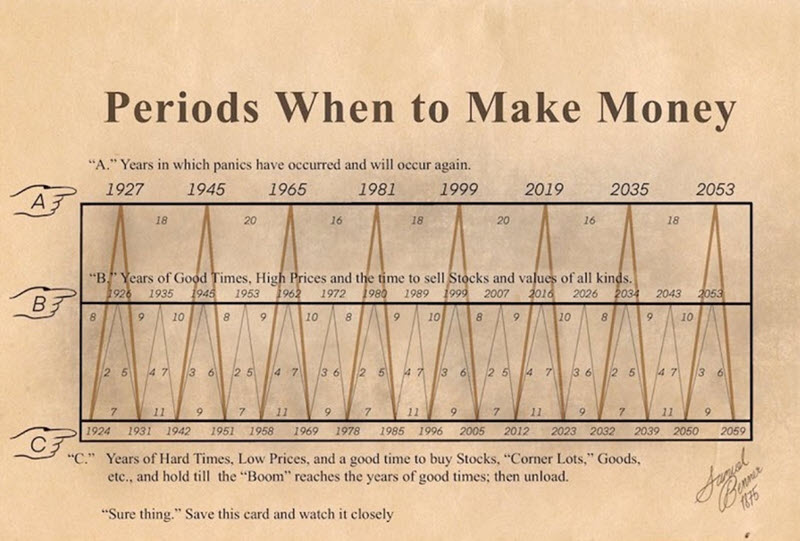

The minor Benner cycle pattern

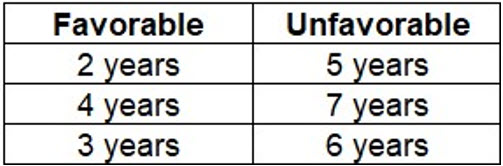

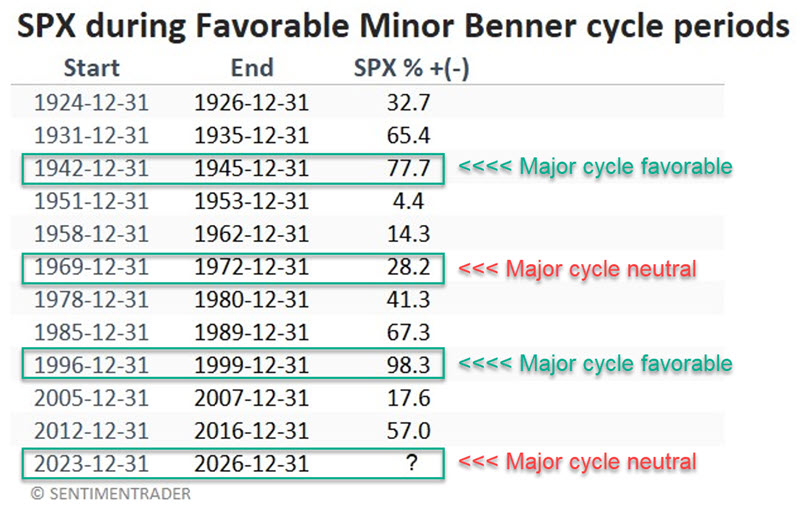

The "minor" cycle in the chart above (the light gray line) starts by rising from 1924 to 1926 (favorable), then declines from 1926 to 1931. It then rises for four years and declines for 7, then completes its pattern by increasing for three years, then falling for 6. From there (1951), the overall pattern repeats, as shown in the table below.

Favorable years within the minor Benner cycle

The list below contains all the "favorable" years the minor Benner cycle indicated. Note that for all tests, we start a new cycle period at the close on December 31st of the stated year and use monthly S&P 500 Index closing prices to track results.

The next minor cycle favorable period begins 2023-12-31 and extends through 2026-12-31.

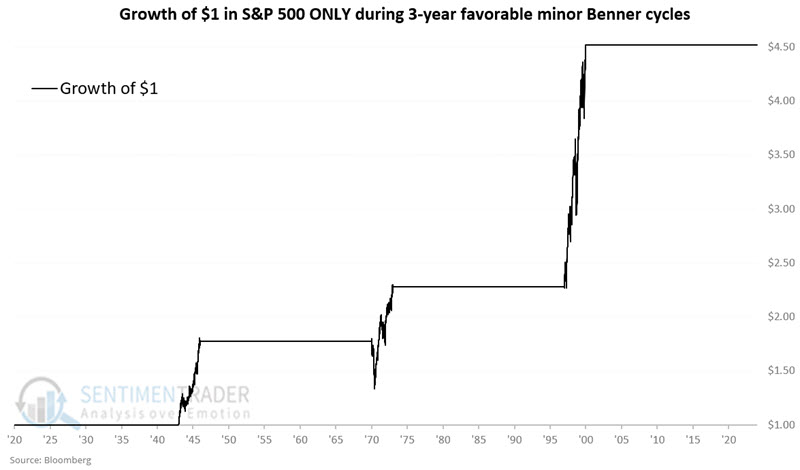

The chart below displays the growth of $1 invested only during the periods listed above (on a logarithmic scale) using monthly data. A hypothetical investment of $1 has grown to $51.33.

Focusing on minor 3-year cycles

In the earlier Benner cycle graphic, you can note that there have only been three favorable 3-year minor cycles - from 1942 to 1945, 1969 to 1972, and 1996 to 1999. The first and third occurrences happened for the record, while the major Benner cycle was favorable. The only previous time when the minor cycle was favorable and the major cycle was neutral was from 1969 to 1972. Even if we include all three, it is still too small of a sample size from which to draw conclusions. Nevertheless, for the sake of historical perspective, we will take a closer look at these three previous 3-year favorable minor cycle periods.

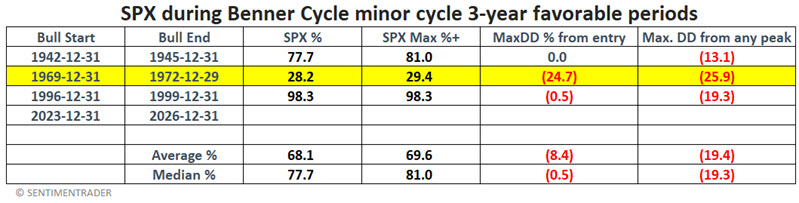

The table below displays the cycle-by-cycle results for all favorable minor cycles, with the three 3-year favorable periods highlighted.

The chart below displays the growth of $1 invested in the S&P 500 Index only during the three previous favorable 3-year minor cycles.

The table below displays:

- The period dates

- The cumulative S&P 500 % performance during the period

- The maximum gain achieved during the period

- The maximum % drawdown from the point of entry (i.e., the largest open loss experienced during this period)

- The maximum % drawdown from any peak within the 3-year period

As you can see, the single precedent for the "Major cycle neutral, minor cycle favorable for three years" configuration (highlighted in yellow) witnessed a gain of +28.2% (i.e., less than 10% per annum), and an investor who bought in on 1969-12-31 suffered a -24.7% loss before the market rebounded.

What the research tells us…

The reality is that there are few if any, concrete conclusions we can draw. On the one hand, to date, all favorable minor Benner cycle periods have witnessed a gain. This lends weight to the bullish case and argues that investors continue to give the bullish case the benefit of the doubt. On the other hand, while - again - it is not useful to try to draw conclusions from one precedent, the -24.7% drawdown during the only configuration precedent reminds us that volatility and risk are always factors that each individual investor must make plans to deal with.