Correlations Go Back To Normal Without A Breadth Thrust

This is an abridged version of our Daily Report.

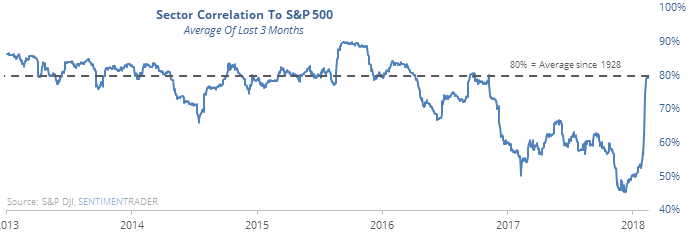

Correlations go back to normal

As stocks sold off, correlations between sectors rose as they usually do and are back at a normal level. That has reversed a period when correlations were almost at the lowest level in history, eclipsed only by the bubble in 2000.

When correlations rose from a low level, it led to medium-term positive returns, but some long-term trouble.

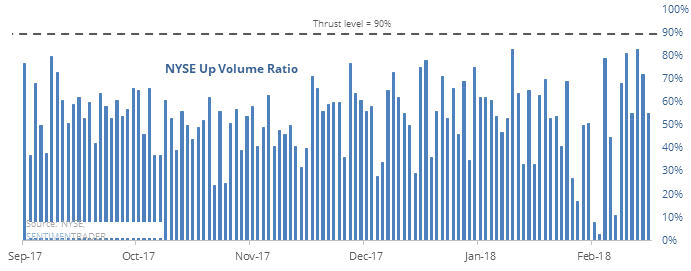

No thrust

During the 6-day rally off last week’s panic, there hasn’t been a buying thrust. The largest Up Volume Ratio was 83%, well below the usual threshold of 90% that would suggest eager buying.

It didn’t matter – future returns were about equal whether there was a thrust or not.

Quick change

Almost no S&P 500 stocks were above their 10-day averages last week, but now more than 80% are.

The latest Commitments of Traders report was released, covering positions through Tuesday

“Smart money” hedgers added aggressively to longs in 30-year Treasury futures, now holding more than 5% of the open interest.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.