Correction Roadmap As Leveraged ETF Bets Soar And Copper Flails

This is an abridged version of our Daily Report.

Correction roadmap

Nearing six months, the current correction is about in line with others since 2009. It most closely resembles 2015, which at this point was about to test its lows.

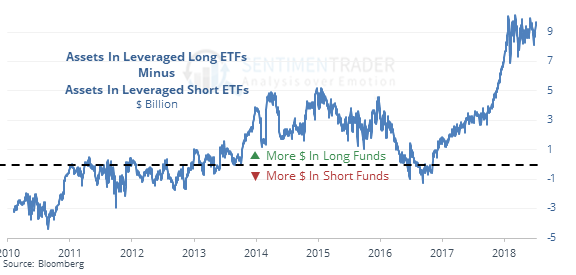

A big leveraged bet

Assets in leveraged ETFs betting on a rally have neared a record vs short funds, with nearly $10 billion betting on a market rise.

Investors have been comfortable buying dips since the market peaked in January.

Copper’s worst month ever

Copper futures have lost more than 17% since the peak only a month ago. They have declined 17 out of 21 days, tied for the record of most-clustered selling. The other two times it happened, copper rallied hard, but optimism was much less then than it is now.

No thanks, banks

Later in this report, we can see that the Financial ETF had the worst outflow on Tuesday, with nearly $350 million leaving the fund. According to the Backtest Engine, an outflow more than $345 million over the past 9 years has led to a rebound in XLF over the next week.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |