Correcting Oversold; Quick Change In Character; Every Dow Stock Rises

This is an abridged version of our Daily Report.

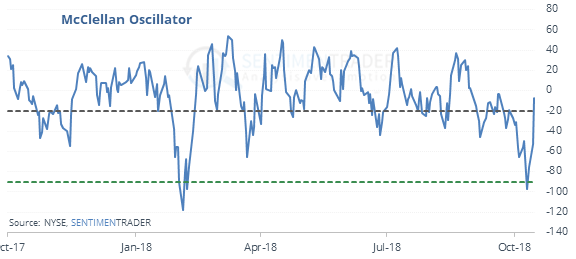

Correcting oversold

The McClellan Oscillator has gone from extremely oversold to neutral. It was below -90 just a few days ago and is now up to -10.

Such a rapid change in character has been a good sign during uptrends, and that context was important – during downtrends it led to much different outcomes.

Quick change in mood

The S&P 500 has gone from its worst 3-day return in months to its best. That kind of quick change has led to good returns, but once again only during uptrends. When this kind of volatility triggered while the S&P’s 200-day average was sloping down, future returns were horrid.

It’s good to be in the Dow

Every member of the major Dow indexes rose on Tuesday, as all 65 stocks in the Dow Industrials, Dow Transports, and Dow Utilities closed higher than they did on Monday. That’s the first time in almost 2 years.

Leaving the largest fund in the world

In the three sessions through Monday, shares outstanding in the S&P 500 tracking fund, SPY, declined by 4.6%. That’s the 3rd most since the start of 2016.