Corporate insiders drift away from their buying binge

Smart-money corporate insiders were heavy buyers in March, the data is pretty clear on that. Now they're either still buying, or selling heavily, depending on the source.

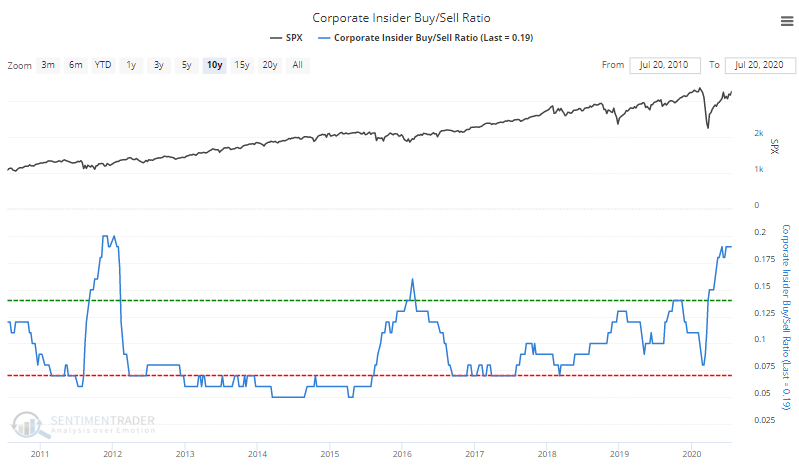

Insider transactions are one of those areas of sentiment that typically takes some finessing. Transactions are dependent on a lot of factors, and take many forms, most of them unrelated to sentiment. We prefer to use only open market transactions tracked by Bloomberg. When viewed that way, the Corporate Insider Buy/Sell Ratio for stocks within the S&P 500 is still quite positive.

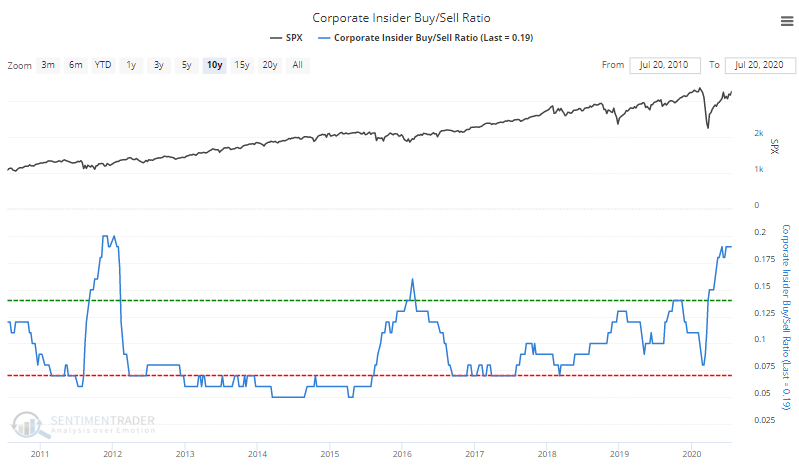

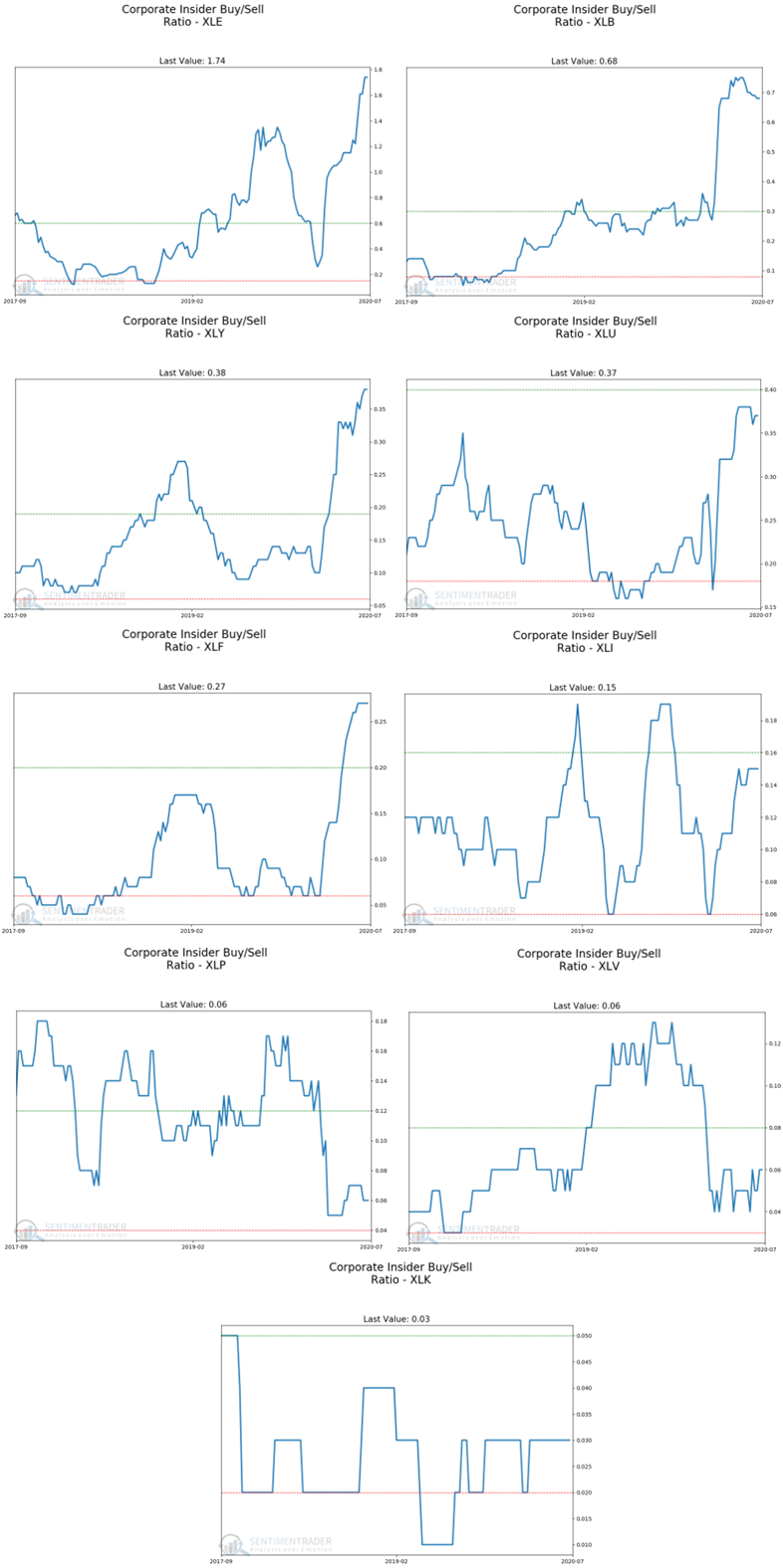

It's especially high for certain sectors like Energy.

Below, we can see each of their ratios relative to the range over the past nine months.

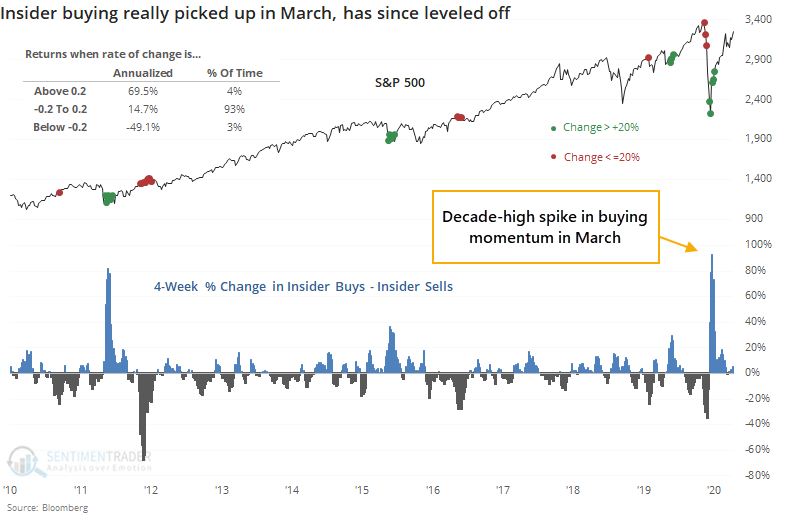

When we look at the 4-week rate of change in insider buys minus insider sells for all S&P 500 stocks, they showed decade-high eagerness to buy in March and have since leveled off. Extremely eager buying was an excellent signal for future returns in the S&P 500; eager selling led to poor returns, at least over the short- to medium-term.

While buying interest among insiders has tailed off in recent weeks, it's still net positive. That's been a good sign for months and shows no looming signs of being a negative.

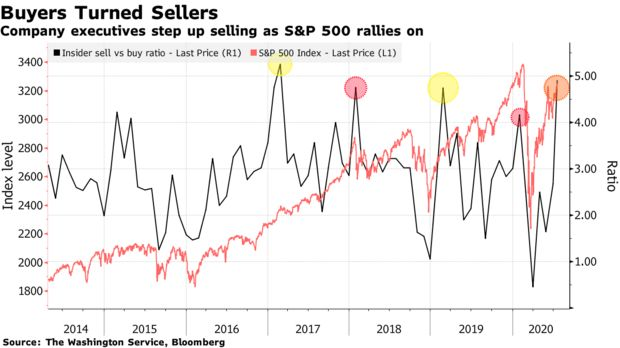

The only caveat is that other services are showing vastly different data. Bloomberg notes that according to the Washington Service, selling interest has picked up dramatically.

"Corporate insiders, whose buying correctly signaled the bottom in March, are now mostly sellers. Almost 1,000 corporate executives and officers have unloaded shares of their own companies this month, outpacing insider buyers by a ratio of 5-to-1, data compiled by the Washington Service showed. Only twice in the past three decades has the sell-buy ratio been higher than now."

Other times it got this high were mostly negative for stocks.

Parsing signal from noise in insider data takes specialized knowledge and good experience. There are dozens of services that focus on this data - most of them are decent, and most of them confirm what the others are saying. Unfortunately, the best ones are also only reserved for institutions, but it's not necessarily required to get a general handle on how corporate insiders are feeling about their stocks.

Right now, it's a confusing mix because various data providers aren't confirming each other as much as they usually do. About the best (or worst) we could say about these smart money transactions right now is that they've trailed off quite a bit from the buying binge in March. That might be enough to be a short- to medium-term headwind, but the massive buying this spring should continue to be a longer-term positive.