Corporate executives are "feeding the ducks"

The economy is cratering, corporate outlooks are the most uncertain in generations, and yet stocks have rallied hard. That's a perfect recipe for companies to issue more shares. They get cheap capital in a friendly environment.

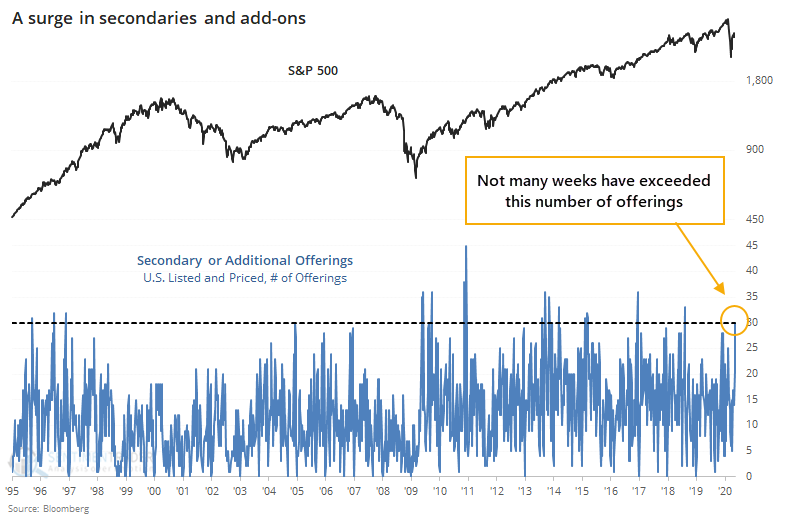

There is no doubt they're taking advantage and "feeding the ducks while they're quacking." Last week alone, there was more than $20 billion of secondary or additional offerings priced among U.S. listed companies.

In terms of the number of offerings, it's been relatively spread out, so it's not one giant company that accounts for the big spike in the dollar amount.

This data can be variable depending on what criteria are used, so other sources could come to different conclusions. But this is one of those things where a bearish argument makes a lot of sense, and it might be possible to torture the data in some way to make it confirm that suspicion. From the data we use, though, an objective look doesn't seem to support it as a negative influence.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- Looking at secondary and add-on offerings in terms of $ amount

- A look at country stock market and currency returns after negative interest rates

- The S&P 500's daily moves are finally calming down

- What happens after the S&P keeps recovering from > 1% intraday declines

- Consumer expectations have come down a lot, and fast

- There has been a surge in weekly options speculation