Corporate Bonds Struggle As Newsletter Writers Retrench

This is an abridged version of our Daily Report.

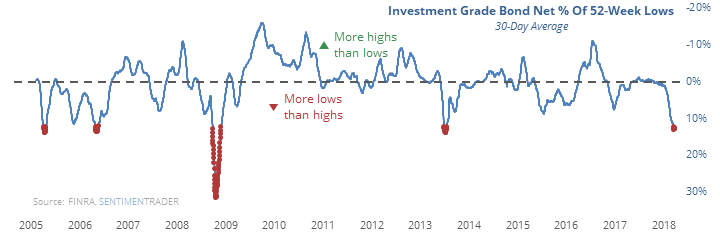

Corporate bond struggles

Over the past 30 days, investment-grade corporate bonds have had some of the worst breadth readings in 13 years. Fewer than 42% of bonds advanced, and more than 12% of them hit 52-week lows on average.

Forward returns after similar readings were excellent, especially in terms of risk versus reward.

Letters lose steam

Newsletter writers have become less optimistic about stocks after what had been a 30-year high in sentiment. The latest week showed fewer than 3 out of 4 letters being positive on stocks, a six-month low.

Just a matter of time

The S&P 500 keeps flirting with its 200-day average, a widely-watched metric for technical traders.

No cash

According to the Investment Company Institute, mutual fund managers were holding only 2.9% of their assets in cash at the end of February, a new record low dating back to 1954.

Tech tumbles

During the past week, an average of fewer than 8% of stocks in the Nasdaq 100 have managed to close above their 10-day average.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.