Corporate Bonds Diverge As Small Businesses See Record Optimism

This is an abridged version of our Daily Report.

Bond market battle

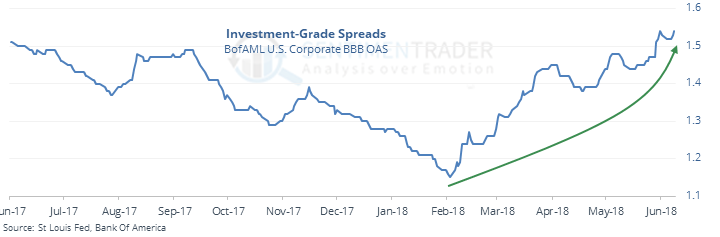

The spread on high-yield bonds has sunk to a multi-year low, while investment-grades are at a year high. That is exceptionally unusual, as corporate spreads typically move more or less together.

It seems like it should be a good sign, but the few prior instances led to a stumble in stocks.

Small business boom

The latest survey of small business shows record optimism, especially as a time to expand. The highest levels of optimism have led to mixed returns that favor small-cap Value over Growth. Micro-cap stocks also struggled, with negative returns over the next 1-2 years.

Optimistic momentum

We haven’t seen too many signs of momentum during the rally off the April low in stocks. Just a few here and there. One that’s starting to show is the Short-Term Optimism Index has been above 70 for 8 of the last 10 days, which hasn’t happened since last October.

Long-term pessimism

If you go to the Dashboard and click the Optix Heatmap under the Sentiment Indicator Summaries section, you can click the “50 Days” button, for example, and it will show most- and least-loved assets over the past 50 days.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |