Cornucopia Of Extremes

With the rapid moves and number of extremes, there are quite a few things that stick out beyond what we went over in the report on Monday. These are what we posted to the private Twitter feed, which you have access to if you're receiving this Note via email. Just request to follow @SenTrader_Prem and send an email to [email protected] with your username.

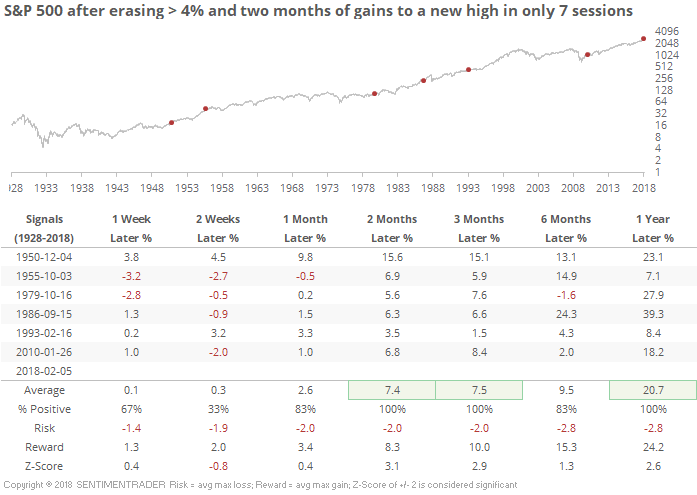

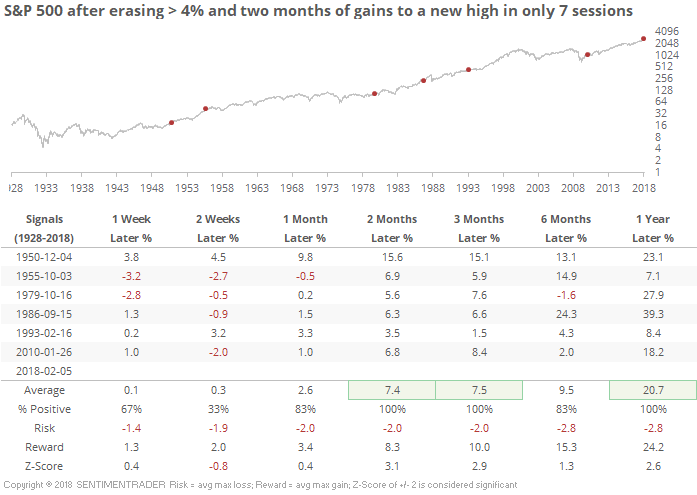

This has been the largest erasure of 2 months of gains that led to a 52-week high in the briefest amount of time.

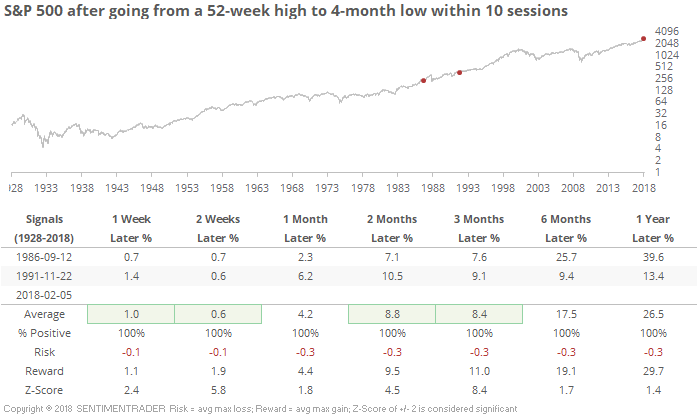

Depending on where we close, the S&P could go from a 52-week high to a 4-month low within two weeks of each other. Almost unprecedented.

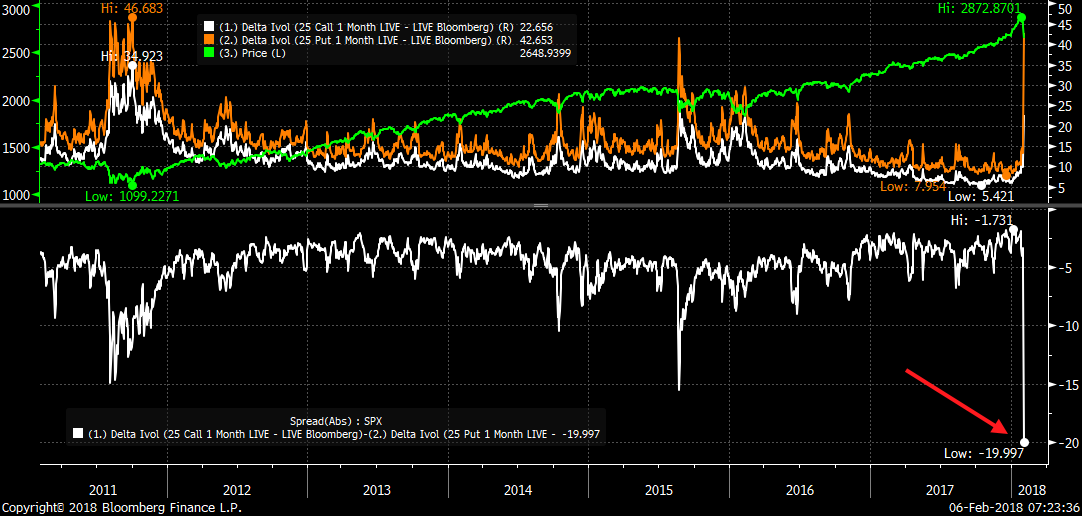

The kind of move we see on Monday triggers panic trading in options (no doubt helped along by volatility traders) and this was no exception. S&P puts the most expensive to calls in at least the past 7 years.

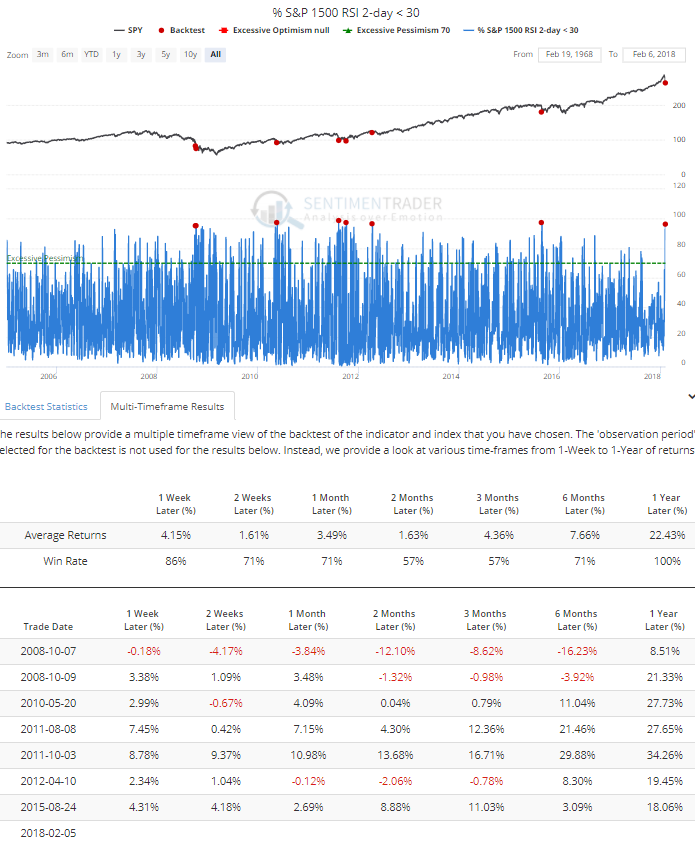

It's easy to panic when everything gets his. Among S&P 1500 stocks, almost all of them hit very short-term oversold levels, which doesn't happen often.

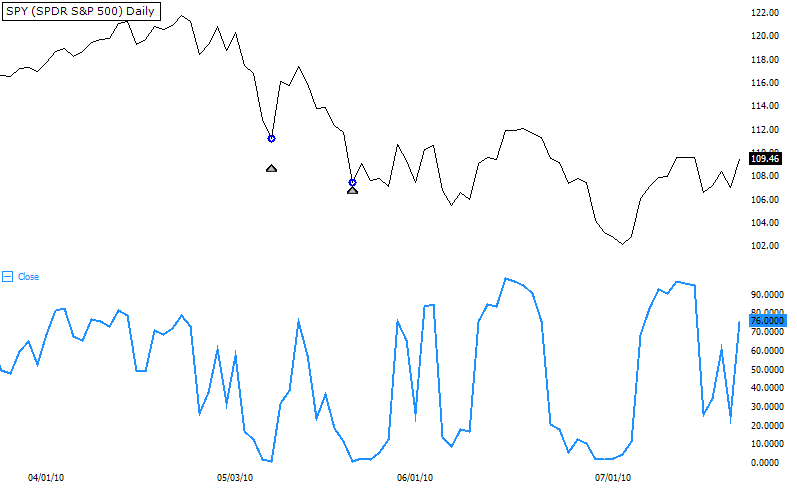

The fact that almost every stock in the S&P 500 dropped below its short-term 10-day moving average while the majority of them are still above their long-term 200-day averages is also rare. It has only happened twice before, both in May 2010.

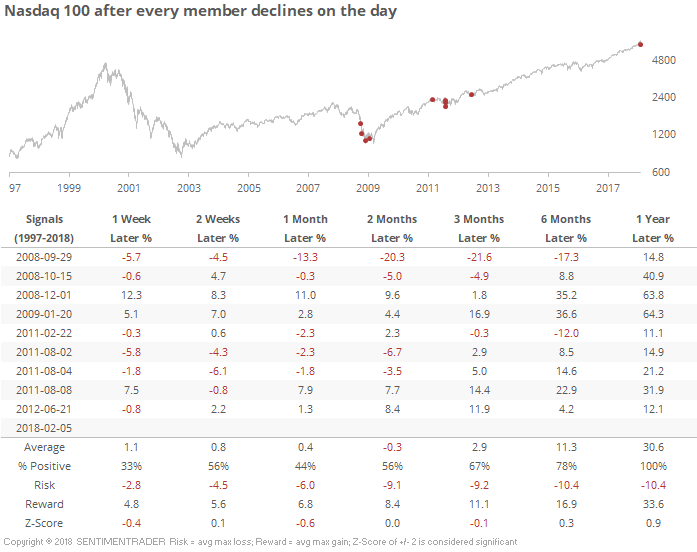

In tech stocks, it was even worse. Every member of the Nasdaq 100 declined on Monday.

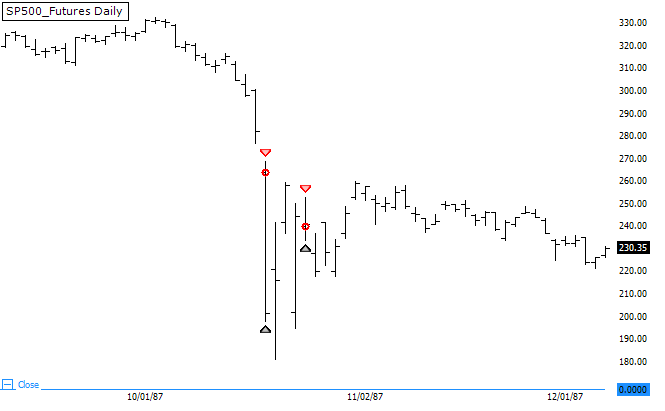

The futures are moving very fast this morning, and are currently indicated to open anywhere from 0.5% to 0.75% lower than Monday's close. This would be among the few times the futures have gapped at least 0.5% lower following a 4% down day.

The first times were during the 1987 crash.

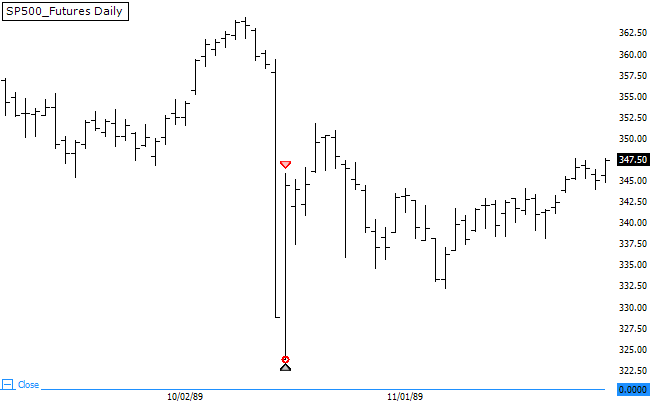

Then 1989.

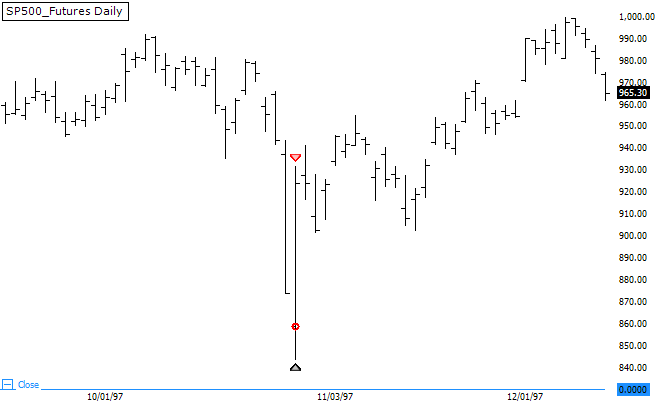

And 1997.

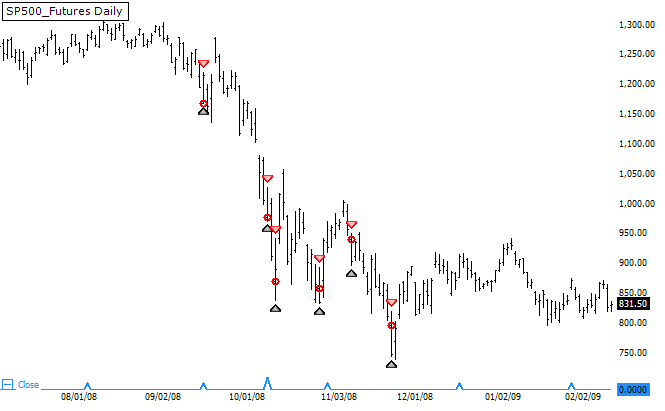

Finally, 2008.

The 1989 and 1997 instances are much closer to the type of activity we've seen lately and probably the best suggestions for what we might see going forward. Both times, the day of the gap down was a short-term capitulation.