Copper Drops To 200-Day Low As Value Lags And Gold Sinks

This is an abridged version of our Daily Report.

Copper slides to 200-day low

Copper closed at its lowest level since last July, a worry for believers in “Dr. Copper.”

Its record for stocks is mixed, but for copper itself, it wasn’t a good sign.

No value

Overseas investors have favored Momentum over Value to an extreme degree. By the time the difference has become this wide, it’s been time for Value to rise.

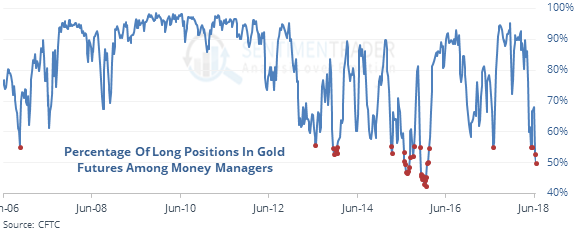

Good signs for gold

Several signals are showing up suggesting a good risk/reward for gold. Money managers are short, options traders have during a seasonally strong period.

Rush for the exit

According to Lipper, investors yanked $20 billion from equity funds in the last week. The Backtest Engine shows that the few other times that happened, stocks rallied every time over the next two weeks.

The latest Commitments of Traders report was released, covering positions through Tuesday

The 3-Year Min/Max Screen shows a few new extremes. “Smart money” hedgers are very nearly net long platinum futures, which would be the first time since July 2004.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |