Consumers Turn Bearish As Dow, Staples Decline

This is an abridged version of our Daily Report.

Consumers are buying…just not stocks

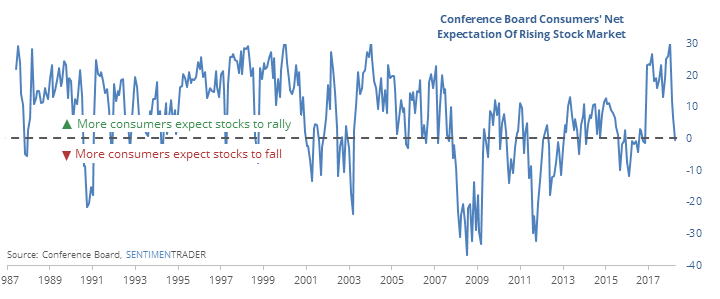

The latest Consumer Confidence survey shows more consumers expect stocks to decline than rally. That’s the first time since the November 2016 election that the U.S. consumer has been bearish on stocks.

Other times they went more than a year before becoming bearish led to higher stocks all but one time.

Big decline but not volume

The Dow lost more than 1.7% on Tuesday but volume flowing into declining stocks was nearly the lowest in history. Other times the Dow had a big decline with relatively positive Up Volume, it tended to rally in the weeks ahead

Four days of pain

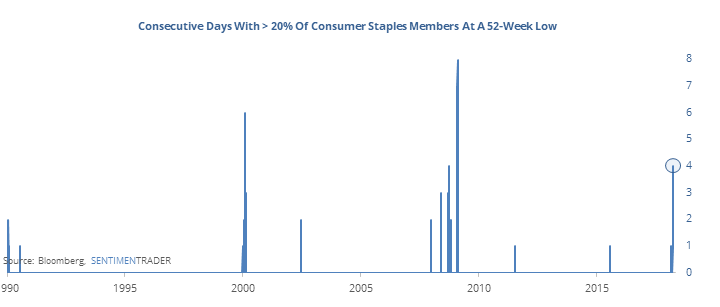

More than 20% of Consumer Staples have hit a 52-week low for four consecutive days.

The sector has suffered a streak like this only three other times before.

Distaste for the Dow

The Dow Industrials have lost ground for 5 straight days, with the last one being more than -1.5%. It’s still trading above its long-term 200-day average, though. Going back to 1900, it has suffered similar streaks 31 times.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |