Consumers negative for now, but hopeful for tomorrow

Consumers have been greatly impacted by the economic and psychological toll from the pandemic, and the depth of the impact is showing now in monthly surveys. We saw yesterday that consumer confidence suffered one of the biggest drops ever.

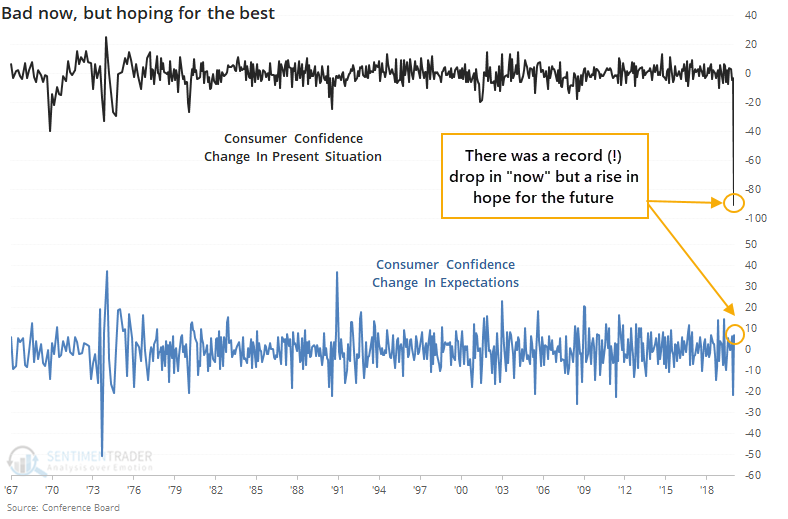

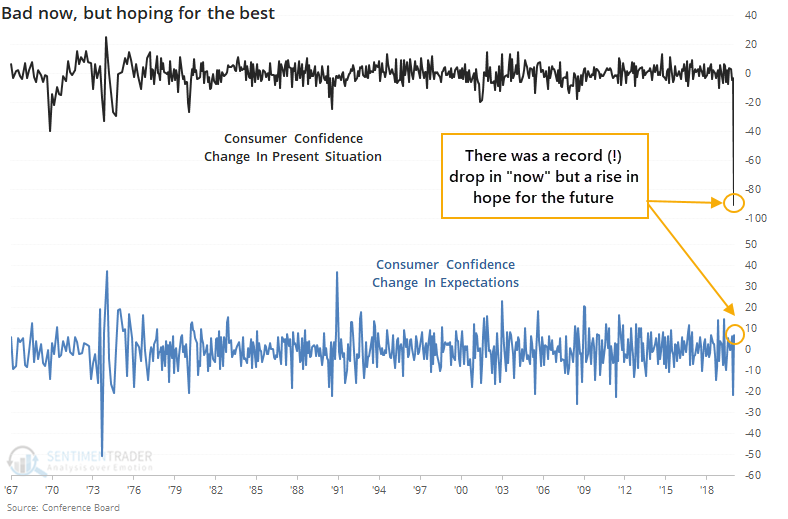

The "yeah, but" counter-argument to that drop could be that consumers only became more pessimistic about now, not the future. The Conference Board separates the survey into confidence about present conditions versus the future, and there was a massive difference between the two.

Confidence about the present dived 90 points, more than double any other month-to-month decline. Yet confidence about the future actually rose 7 points, likely helped by the rebound in stocks.

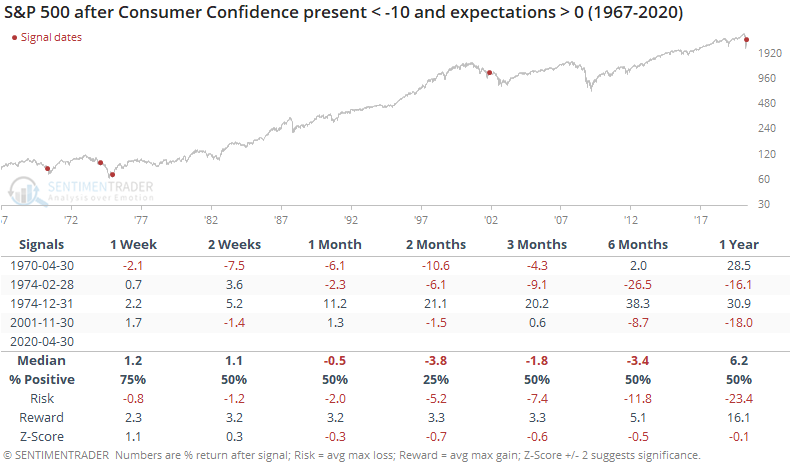

There have only been a few times when consumers' confidence in their present situation declined by more than 10 points while they became more optimistic about the future. Only one of those triggered in the past four decades.

This happened at the market bottom in 1974, but otherwise was early in de-risking phases in 1970, earlier in 1974, and 2001 following the 9/11 tragedy. Because of that, future returns were terrible three times and excellent once.

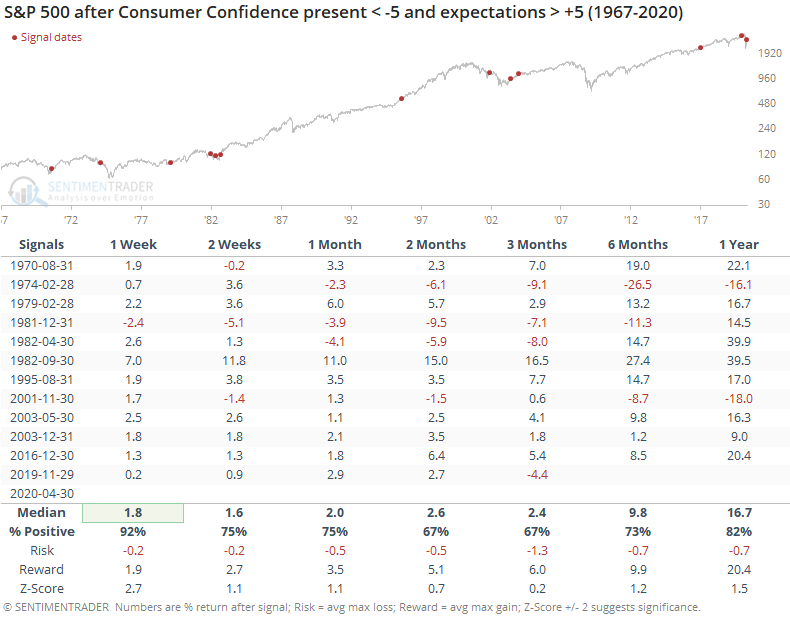

Such big drops in the present situation are unusual, so we have to relax the parameters if we want to get a larger sample size. If we look for times when present conditions dropped at least 5 points while expectations for the future rose at least 5 points, then we get the following.

In both studies, the very short-term was good, helped by a bullish seasonal pattern at the beginning of most months. Returns after that were a little better than random, with a mix of moderate gains and losses in the months ahead.

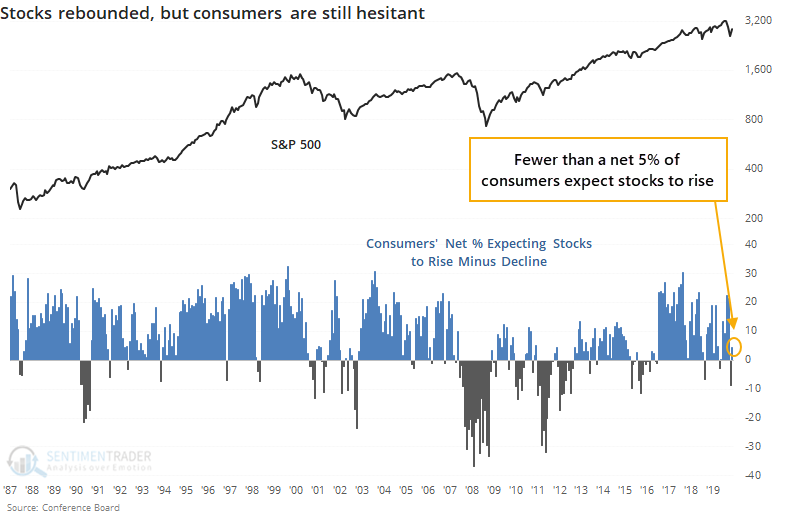

Even though stocks rebounded more than 10% in April, maybe they hadn't rallied enough for most consumers to notice during the study period. More of them became optimistic specifically about the stock market during the month, but still, only a net 4.6% of them expect stocks to keep rallying.

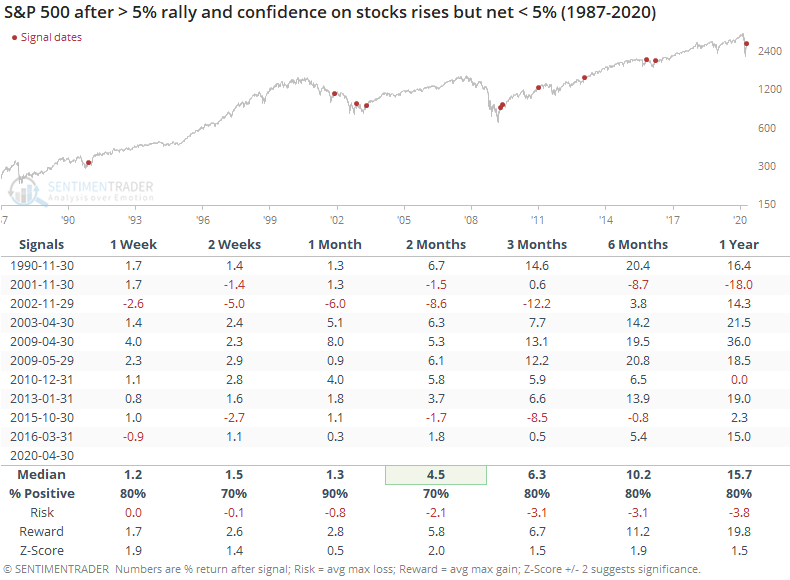

Below, we can see every month when stocks jumped at least 5%, and consumers became more optimistic, but fewer than a net 5% of them expected stocks to continue to rise.

This was a mostly positive thing, and returns were better than those months when more than a net 5% of consumers expected stocks to rise (in those cases, the 2-month forward return was -0.4%). Consumers jumped the gun by becoming more optimistic in 2001, 2002, and 2015, but otherwise, stocks did okay.

It's easy to be a knee-jerk contrarian and assume that because consumers didn't completely give up about the future in April, then they're not really pessimistic and we must have further to fall in order to wring out the optimism and allow stocks to recover. It hasn't really worked that way in the past, though. The current drop in present conditions is so many standard deviations from the norm that no historical precedent can serve as a template here, but from months that look at least passingly like the present, it might be a modest shorter-term positive.