Consumers keep fighting this uptrend

We've been seeing for months that consumers haven't really been buying into the idea of an immediate economic recovery. Four months later and more than 25% higher in many indexes, consumers still aren't buying it.

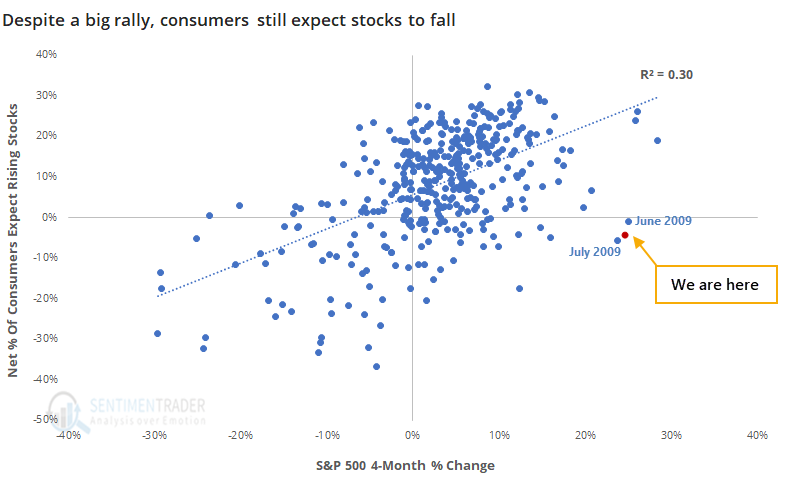

The latest survey from the Conference Board shows that more consumers expect stock prices to decrease over the coming months than increase. This is highly unusual - there is a strong positive relationship between the S&P 500's rate of change over the past four months and the net percentage of consumers who expect stocks to rise going forward.

Recency bias is a real thing. The only other months in more than 30 years of history when the S&P gained more than 20% and yet consumers, on balance, expected stocks to fall were June and July 2009.

There is no good way to reconcile this against other indicators that show highly speculative behavior from investors - there are rarely any times when every indicator agrees. It's just a matter of determining what matters most and using weight of the evidence.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A closer look at what happens when consumers fight the market's trend

- Margin debt is another indicator showing investor apathy

- Hedge funds are betting heavily against the U.S. dollar - what that's meant for the buck and gold

- The Nasdaq 100 is on the cusp of under-performing for the 1st time in 8 months